UAA REPORT COMMUNIQUE.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Collapse, War and Reconstruction in Uganda

Working Paper No. 27 - Development as State-Making - COLLAPSE, WAR AND RECONSTRUCTION IN UGANDA AN ANALYTICAL NARRATIVE ON STATE-MAKING Frederick Golooba-Mutebi Makerere Institute of Social Research Makerere University January 2008 Copyright © F. Golooba-Mutebi 2008 Although every effort is made to ensure the accuracy and reliability of material published in this Working Paper, the Crisis States Research Centre and LSE accept no responsibility for the veracity of claims or accuracy of information provided by contributors. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means without the prior permission in writing of the publisher nor be issued to the public or circulated in any form other than that in which it is published. Requests for permission to reproduce this Working Paper, of any part thereof, should be sent to: The Editor, Crisis States Research Centre, DESTIN, LSE, Houghton Street, London WC2A 2AE. Crisis States Working Papers Series No.2 ISSN 1749-1797 (print) ISSN 1749-1800 (online) 1 Crisis States Research Centre Collapse, war and reconstruction in Uganda An analytical narrative on state-making Frederick Golooba-Mutebi∗ Makerere Institute of Social Research Abstract Since independence from British colonial rule, Uganda has had a turbulent political history characterised by putsches, dictatorship, contested electoral outcomes, civil wars and a military invasion. There were eight changes of government within a period of twenty-four years (from 1962-1986), five of which were violent and unconstitutional. This paper identifies factors that account for these recurrent episodes of political violence and state collapse. -

Better Together

Better Together: Inclusive Power Sharing and Mutidimensional Conflicts Chelsea Johnson Ph.D. Candidate, Political Science University of California, Berkeley DRAFT: 12 DECEMBER 2014 PLEASE DO NOT CIRCULATE Abstract: Theories that focus on signaling and commitment credibility, as well as those on institutional design, suggest that all-inclusive power-sharing settlements are more likely to breakdown where the armed oPPosition is fractionalized. In contrast, I argue that inclusivity reduces the capacity for insurgents to defect from their commitments to sharing power. The implementation of any Power-sharing bargain is likely to generate winners and losers within grouPs, contributing to sPlintering, and disgruntled elites are more likely to have access to the resources necessary to return to the battlefield where other active insurgencies have been excluded from the Peace Process. I illustrate this mechanism with an in-depth analysis of two dyadic peace processes in Uganda, both of which resulted in rebel splintering and continued violence. Finally, a cross-national analysis of 238 settlement dyads suPPorts the exPectation that inclusive Power-sharing settlements are significantly more likely to result in conflict termination. Johnson 2 Recent rePorts indicate that the number of active militias is Proliferating in South Sudan, where conflict in the region has reemerged, and even intensified, desPite its recent independence.1 Meanwhile, the Intergovernmental Authority on DeveloPment (IGAD) is attempting to broker a Peace bargain between President Kiir’s government and the Sudan PeoPle’s Liberation Army-In Opposition (SPLA-IO). While Politically exPedient, IGAD’s decision to focus its mediation on the Primary threat to the nascent South Sudanese government—to the exclusion of two dozen other armed grouPs—has the potential to be counter-productive. -

UGANDAN REFUGEES in the SUDAN Part I: the Long Journey

UGANDAN REFUGEES IN THE SUDAN Part I: The Long Journey by Barbara Harrell - Bond 19821No. 48 Africa [BHB-1-'821 Around 200,000 Ugandans have up since 1979, most having fled sought refuge in the Sudan. from Uganda's infamous elections Many have delayed for months and the withdrawal of theTanzanian along the borders, reluctant to "liberation" army. From June 1982, flee but deriving only marginal about one-third of those registering subsistence. Taking the last for settlement still came from inside drastic step, they arrive in the Uganda; the rest were those who transit centers weak and mal- had attempted to stay near the nourished. Many die awaiting border, hoping the situation would assistance in the planned reset. improve and they could return to tlement areas provided by Sudan their homes. Their delay was cata- and UNHCR. strophic. Thousands died of starva- tion, while trying to eke out a living along the overcrowded border. Hun- dreds more died of the effects of malnutrition, even after they had Thousands of Ugandan refugees entered settlements and were receiv- poured into the Sudan in 1982, most ing food rations. of them to Western Equatoria (the west bank of the Nile). The popula- For some, the situation in Uganda is tion of refugees in the planned set- confusing -there are so many con- tlements provided by the Sudan, tradictory reports. But for lzaruku which are supported by the United Ajaga, the facts were starkly clear Nations High Commissioner for Re- when on September 11 he came to fugees (UNHCR), shot up from 9,000 the UNHCR office in Yei to report in 3 settlements in March 1982 to that his brother and another relative 47,311 in 14 at the end of September. -

Amin: His Seizure and Rule in Uganda. James Francis Hanlon University of Massachusetts Amherst

University of Massachusetts Amherst ScholarWorks@UMass Amherst Masters Theses 1911 - February 2014 1974 Amin: his seizure and rule in Uganda. James Francis Hanlon University of Massachusetts Amherst Follow this and additional works at: https://scholarworks.umass.edu/theses Hanlon, James Francis, "Amin: his seizure and rule in Uganda." (1974). Masters Theses 1911 - February 2014. 2464. Retrieved from https://scholarworks.umass.edu/theses/2464 This thesis is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Masters Theses 1911 - February 2014 by an authorized administrator of ScholarWorks@UMass Amherst. For more information, please contact [email protected]. AMIN: HIS SEIZURE AND RULE IN UGANDA A Thesis Presented By James Francis Hanlon Submitted to the Graduate School of the University of Massachusetts in partial fulfillment of the requirements for the degree of MASTER OF ARTS July 1974 Major Subject — Political Science AMIN: HIS SEIZURE AND RULE IN UGANDA A Thesis Presented By James Francis Hanlon Approved as to style and content by: Pro i . Edward E. Feit. Chairman of Committee Prof. Michael Ford, member ^ Prof. Ferenc Vali, Member /£ S J \ Dr. Glen Gordon, Chairman, Department of Political Science July 1974 CONTENTS Introduction I. Uganda: Physical History II. Ethnic Groups III. Society: Its Constituent Parts IV. Bureaucrats With Weapons A. Police B . Army V. Search For Unity A. Buganda vs, Ohote B. Ideology and Force vi. ArmPiglti^edhyithe-.Jiiternet Archive VII. Politics Without lil3 r 2Qj 5 (1970-72) VIII. Politics and Foreign Affairs IX. Politics of Amin: 1973-74 C one ius i on https://archive.org/details/aminhisseizureruOOhanl , INTRODUCTION The following is an exposition of Edward. -

2. Histories of Violence and Conflict

UvA-DARE (Digital Academic Repository) Conflict legacies Understanding youth’s post-peace agreement practices in Yumbe, north-western Uganda Both, J.C. Publication date 2017 Document Version Other version License Other Link to publication Citation for published version (APA): Both, J. C. (2017). Conflict legacies: Understanding youth’s post-peace agreement practices in Yumbe, north-western Uganda. General rights It is not permitted to download or to forward/distribute the text or part of it without the consent of the author(s) and/or copyright holder(s), other than for strictly personal, individual use, unless the work is under an open content license (like Creative Commons). Disclaimer/Complaints regulations If you believe that digital publication of certain material infringes any of your rights or (privacy) interests, please let the Library know, stating your reasons. In case of a legitimate complaint, the Library will make the material inaccessible and/or remove it from the website. Please Ask the Library: https://uba.uva.nl/en/contact, or a letter to: Library of the University of Amsterdam, Secretariat, Singel 425, 1012 WP Amsterdam, The Netherlands. You will be contacted as soon as possible. UvA-DARE is a service provided by the library of the University of Amsterdam (https://dare.uva.nl) Download date:30 Sep 2021 2. HISTORIES OF VIOLENCE AND CONFLICT INTRODUCTION In order to understand the legacies of past conflicts in present-day Yumbe, this chapter sketches the historical background of the people in a particular district as it emerges from the available literature and the oral histories and interviews I conducted. -

The Politics of Capitalist Enclosures in Nature Conservation: Governing Everyday Politics and Resistance in West Acholi, Northern Uganda

Global governance/politics, climate justice & agrarian/social justice: linkages and challenges An international colloquium 4‐5 February 2016 Colloquium Paper No. 50 The Politics of Capitalist Enclosures in Nature Conservation: Governing Everyday Politics and Resistance in West Acholi, Northern Uganda David Ross Olanya International Institute of Social Studies (ISS) Kortenaerkade 12, 2518AX The Hague, The Netherlands Organized jointly by: With funding assistance from: Disclaimer: The views expressed here are solely those of the authors in their private capacity and do not in any way represent the views of organizers and funders of the colloquium. February, 2016 Follow us on Twitter: https://twitter.com/ICAS_Agrarian https://twitter.com/TNInstitute https://twitter.com/peasant_journal Check regular updates via ICAS website: www.iss.nl/icas The Politics of Capitalist Enclosures in Nature Conservation: Governing Everyday Politics and Resistance in West Acholi, Northern Uganda David Ross Olanya Abstract This article examines the case of Appa village in the controversial East Madi Wildlife Reserve, how the people are attempting to resist and revoke their evictions by Uganda Wildlife Authority from the newly created Wildlife Game Reserve in 2002. This case analysis presents an important sites of struggle, illustrating the interplay of rationality [governing], everyday politics and political subjectivities. The legal and right-based practices of resisting only serve as interplays between governing and everyday politics through which the emerging subordinating groups is governed. This article presents how power produces resistance against capitalism and its enclosures. It is rooted in the notion that power produces resistance that are embodied in a particular actors or social groups emerging to challenge capitalist enclosures. -

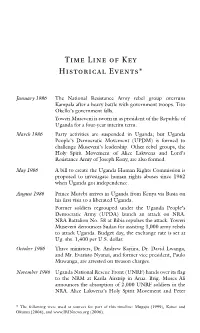

Time Line of Key Historical Events*

Time Line of Key Historical Events* January 1986 The National Resistance Army rebel group overruns Kampala after a heavy battle with government troops. Tito Okello’s government falls. Yoweri Museveni is sworn in as president of the Republic of Uganda for a four-year interim term. March 1986 Party activities are suspended in Uganda; but Uganda People’s Democratic Movement (UPDM) is formed to challenge Museveni’s leadership. Other rebel groups, the Holy Spirit Movement of Alice Lakwena and Lord’s Resistance Army of Joseph Kony, are also formed. May 1986 A bill to create the Uganda Human Rights Commission is proposed to investigate human rights abuses since 1962 when Uganda got independence. August 1986 Prince Mutebi arrives in Uganda from Kenya via Busia on his first visit to a liberated Uganda. Former soldiers regrouped under the Uganda People’s Democratic Army (UPDA) launch an attack on NRA. NRA Battalion No. 58 at Bibia repulses the attack. Yoweri Museveni denounces Sudan for assisting 3,000 army rebels to attack Uganda. Budget day, the exchange rate is set at Ug. shs. 1,400 per U.S. dollar. October 1986 Three ministers, Dr. Andrew Kayiira, Dr. David Lwanga, and Mr. Evaristo Nyanzi, and former vice president, Paulo Muwanga, are arrested on treason charges. November 1986 Uganda National Rescue Front (UNRF) hands over its flag to the NRM at Karila Airstrip in Arua. Brig. Moses Ali announces the absorption of 2,000 UNRF soldiers in the NRA. Alice Lakwena’s Holy Spirit Movement and Peter * The following were used as sources for part of this timeline: Mugaju (1999), Kaiser and Okumu (2004), and www.IRINnews.org (2006). -

Amin's Shadow

AR-6 Sub-Saharan Africa Andrew Rice is a Fellow of the Institute studying life, politics and development in ICWA Uganda and environs. LETTERS Amin’s Shadow By Andrew Rice DECEMBER 1, 2002 Since 1925 the Institute of KAMPALA, Uganda—One morning in early July 1972, Idi Amin’s men came for Current World Affairs (the Crane- police officer Joseph Ssali Sabalongo. As usual, there was no warning, no expla- Rogers Foundation) has provided nation. A group of soldiers simply burst into Ssali’s offices at the Buganda Road long-term fellowships to enable Courthouse in Kampala. Ali Towili, one of Amin’s thuggish sidekicks, waved a outstanding young professionals gun in the police officer’s face, marched him outside and forced him into the to live outside the United States trunk of a black Peugeot sedan. and write about international “I do not know the reason why I was picked up,” Ssali would tell a govern- areas and issues. An exempt ment commission in 1988, nine years after the dictator’s overthrow. “I was put operating foundation endowed by into a wet [trunk] containing fresh human blood; then I was led up to Naguru the late Charles R. Crane, the Public Safety Unit.” Institute is also supported by contributions from like-minded Ssali may not have known why he was taken, but he certainly would have individuals and foundations. known where he was headed—everyone was aware of what happened in Naguru. “The names of [Amin’s] torture centers had a certain black humor: Makerere Nurs- ing Home, Nakasero State Research Center, Naguru Public Safety Unit,” the TRUSTEES Uganda Commission of Inquiry into the Violation of Human Rights would write Bryn Barnard in its report. -

• UGANDA's TORMENT the Palace Coup Which Removed Milton Obote

4 September 1985 Marxism Today • UGANDA'S TORMENT The palace coup which removed Milton Obote from power in Uganda last month has cracked the bankrupt pattern of post- independence neo-colonial Uganda politics. The implications of the power struggle now underway between the two military groups are continent-wide. The two Obote regimes, like Amin's, were characterised by deep dependence on the support of Britain and other western powers for murderous military repression and flag rant economic exploitation of Uganda's peo ple. The details of horrific torture and de gradation practised under Obote and Amin are comparable with the practices of Nazi war criminals and have been documented many times. The military junta which seized power at the end of July is not a new regime. Its Prime Minister Paulo Muwanga is the most skilful, ruthless and determined politician in Ugan da. He was the power of the last Obote regime. The military leaders General Tito Okello and Lt General Bazilio Okello were responsible for the military who carried out the appalling actions against children, women and men which terrorised the coun try for the last four years under Obote. Predictably this group has easily coopted all the weaker opponents of the Obote regime - the sizeable Democratic Party's leaders, armed bandit groups nominally loyal to such notorious figures from the Amin period as Brigadier Moses Ali, and a host of well-known opportunist politicians happy to slot into ministerial appointments in Kampa la on the basis of personal links any time there is a shift in the personalities at the top. -

Uganda at a Glance: 2001-02

COUNTRY REPORT Uganda At a glance: 2001-02 OVERVIEW The multiparty opposition remains active. As awareness of political alternatives in the country increases, tension between opposition groups and the government is expected to intensify. Uganda’s poverty reduction and growth facility (PRGF) under the IMF has been extended to end-March 2001, indicating that the Fund is satisfied with Uganda’s performance under the programme. Overall the macroeconomic outlook is fair, and real GDP growth is forecast to average 6.6% per year in 2001-02. However, inflation is forecast to remain at around 6% per year during the forecast period. Key changes from last month Political outlook • The political situation remains unchanged. It will become more heated as the presidential election in March 2001 draws nearer, and the opposition will increasingly question the constitution’s definition of democracy. Uganda’s involvement in the conflict in the Democratic Republic of Congo will continue to create problems for the government, as inter- national pressure mounts for the implementation of the Lusaka accord. Economic policy outlook • With the extension of Uganda’s PRGF programme, economic reforms— including an acceleration of the privatisation programme—will continue in 2001-02. • The privatisation programme is expected to make progress, and the unbundling of the Uganda Electricity Board into separate distribution, generation and transmission companies is scheduled to be completed by end-2001. Economic forecast • Real GDP is forecast to grow by 6.4% in 2001 and by 6.8% in 2002, owing to the recovery of the agricultural sector after the drought in 1999. Moderate rises in foreign investment and continued high levels of donor support will also contribute to overall economic activity. -

'Unseen Archives of Idi Amin' Exhibition Author: Adebo Nelson Abiti, University of Western Cape ([email protected]) Co-Authors

Paper title: Visualising power discourse in the Museum: The 'Unseen Archives of Idi Amin' exhibition Author: Adebo Nelson Abiti, University of Western Cape ([email protected]) Co-Authors: Introduction This paper seeks to discuss the contested temporary exhibition on 'Unseen Archives of Idi Amin'. The photographic exhibition on Idi Amin was staged in Kampala on 18 May 2019. The exhibition drew the attention of the different public at the Uganda Museum space. Yet the Uganda Museum was reflecting on its old ethnographic space of colonialism and external pressure of redevelopment. Why did the political history of Idi Amin become a hot debate in Uganda? In referring to Amin’s regime of a military power which was known for the cause of brutal mass murders and expulsion of Asian communities from Uganda (Mazrui Ali, 1980). Why would a history of blood violence be reenacted at the Uganda the Uganda Museum? What were the reactions of the different audiences in viewing the ‘Unseen Archive of Idi Amin? In what Elizabeth Edwards points to the ‘multisensory’ power of viewing images as evocative (Edwards 2013: 27). The sensory aspects are phenomenological which scholars referred to’ experiences with the materiality of the real world’ as consciousness of senses of touch, seeing, smelling rather than suppressed knowledge of colonial power (Edwards, et al, 2006; Latour, 1986). Based on the visual power discourse, I intended to explore the tension of ethnography and the political history by engaging with the question of visualising power. The paper focused on the question of visualizing power discourse framed in the ethnography of ethnic and tribal cultures of the Uganda Museum. -

Beyond Idi Amin: Causes and Drivers of Political Violence in Uganda, 1971-1979

Durham E-Theses Beyond Idi Amin: Causes and Drivers of Political Violence in Uganda, 1971-1979 LOWMAN, THOMAS,JAMES How to cite: LOWMAN, THOMAS,JAMES (2020) Beyond Idi Amin: Causes and Drivers of Political Violence in Uganda, 1971-1979, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/13439/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 Beyond Idi Amin: Causes and Drivers of Political Violence in Uganda, 1971-1979 Thomas James Lowman Abstract This thesis is a study of the causes and drivers of political violence during Idi Amin’s eight years as President of Uganda between 1971 and 1979. It is concerned with the relationship between political violence and order, the causes and function of political violence in post-colonial Africa, and the production and patterns of political violence, with a specific focus on the role of localised agency and coercive institutions in this production.