Electric Vehicles Policy 2020-2025 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Franchise Business in Pakistan an Analytical

i FRANCHISE BUSINESS IN PAKISTAN─AN ANALYTICAL STUDY IN SHARIAH PERSPECTIVE RESEARCH THESIS FOR PhD ISLAMIC STUDIES 1439ھ/2017ء Submitted by Supervised by GHULAM MUSTAFA DR. MUHAMMAD SAAD SIDDIQUI Roll No PhD 01-14 Professor INSTITUTE OF ISLAMIC STUDIES UNIVERSITY OF THE PUNJAB LAHORE, PAKISTAN SESSION 2014-19 ii In the name of ALLAH The Compassionate, the Merciful iii ۡ ۡ ا ۡق َرأۡۡبۡ ٱ ۡس مۡۡ َرب َكۡٱلَّ ذيۡ َخ َل َق١ۡۡۡ َخ َل َقۡٱ ۡ ۡلن ََٰس َنۡۡ م ۡنۡ َع َل ٍق٢ۡۡۡٱ ۡق َرأۡۡ َو َربُّ َكۡٱ ۡۡلَ ۡك َر مۡۡ ۡ ٣ۡۡٱلَّ ذيۡ َعلَّ َمۡبۡ ٱل َق َل م٤ۡۡۡ َعلَّ َمۡۡٱ ۡ ۡلن ََٰس َنۡۡ َماۡ َل ۡمۡيَ ۡع َل ۡم٥ۡۡ ۡ 1. Read in the name of your Lord Who created. 2. He created man from a clot. 3. Read and your Lord is most Honorable, 4. Who taught (to write) with the pen? 5. Taught man what he knew not. iv DEDICATION This work is dedicated to my very kind, affectionate, very loving, courageous and beloved parents and teachers. May ALLAH Almighty live them long and blissful. Student Name: Ghulam Mustafa Roll No: 01-14 Institute of Islãmic Studies Session: 2014-19 v CERTIFICATE The thesis: “FRANCHISE BUSINESS IN PAKISTAN-AN ANALYTICAL STUDY IN SHAIRAH PERSPECTIVE” by Ghulam Mustafa is approved in its present form by the Institute of Islãmic Studies as satisfying the thesis requirement for the degree of PhD in Islãmic Studies and it also fulfils the respective requirement of University of the Punjab and HEC. Signature of Supervisor with stamp Dr. -

05001499 007 BUP 1.Pdf

ࠗࡦ࠼ડᬺߩࠣࡠࡃ࡞ᚢ⇛ ᐕᣣ ᣣᧄ⾏ᤃᝄ⥝ᯏ᭴㧔ࠫࠚ࠻ࡠ㧕 ᶏᄖ⺞ᩏㇱ 1 ߪߓߦ ㄭᐕࠗࡦ࠼ડᬺߩࠢࡠࠬࡏ࠳M&A ߇ᵴ⊒ൻߒߡ߹ߔޕ2007 ᐕߩ࠲࠲ࠬ࠴࡞ ߦࠃࠆࠦࠬࠣ࡞ࡊ⾈ޔ2006 ᐕߩ࠼ࠢ࠲࠺ࠖࡏ࠻࠭ߦࠃࠆࡌ ࠲ࡈࠔࡓ⾈ߥߤ߇⸥ᙘߦᣂߒߣߎࠈߢߔޕߎࠇࠄߩࡔࠟ࠺ࠖ࡞એᄖߦ߽ήᢙߩ M&A ߇ⴕࠊࠇߡ߅ࠅޔࠗࡦ࠼ડᬺߪࠣࡠࡃ࡞ൻࠍㅴޔޟࠗࡦ࠼ᄙ࿖☋ડᬺޠߣߥࠅߟ ߟࠅ߹ߔޕߎࠇࠄࠗࡦ࠼ડᬺߪᦸߥࡄ࠻࠽ߦޔࠆߪᚻߏࠊ┹⋧ᚻߦߥࠅ ߃߹ߔޕᧄ⺞ᩏߩ⋡⊛ߪޔߎ߁ߒߚਥⷐࠗࡦ࠼ડᬺߩၮᧄᖱႎ߿ߘߩᶏᄖᚢ⇛ࠍᢛℂߔࠆ ߎߣߢޔᣣᧄડᬺߩෳ⠨ߣߥࠆ⾗ᢱࠍឭଏߔࠆߎߣߦࠅ߹ߔޕ ߹ߚޔࠫࠚ࠻ࡠߢߪޔㅜޔ☨࿖ડᬺߩࠗࡦ࠼ะߌࠝࡈ࡚ࠪࠕࡦࠣ⺞ᩏࠍታᣉߒߡ ߹ߔޕᧄ⺞ᩏߪޔߎࠇߣ㑐ㅪߒߡޔࠗࡦ࠼߳ߩࠝࡈ࡚ࠪࠕࡦࠣޔ․ߦ⍮⼂㓸⚂⊛ߥᬺോ ࠍኻ⽎ߣߔࠆ࠽࠶ࠫࡊࡠࠬࠕ࠙࠻࠰ࠪࡦࠣ㧔KPO㧕ࠍ⥄りߢታ〣ߒޔߘߩ⚿ᨐ ࠍࠝࡈ࡚ࠪࠕࡦࠣ⺞ᩏႎ๔ᦠߦᵴ߆ߔࠃ߁ߦ⸘↹ߒߚ߽ߩߢ߽ࠅ߹ߔޕౕ⊛ߦߪޔ ࠫࠚ࠻ࡠߪ⺞ᩏߩડ↹߅ࠃ߮ࡊࡠࠫࠚࠢ࠻ࡑࡀࠫࡔࡦ࠻ߩߺࠍⴕޔߢߩ⺞ᩏߪో 㕙⊛ߦࠗࡦ࠼ߩ⺞ᩏડᬺࠗࡃࡘࠨࡉߦࠕ࠙࠻࠰ࠬߒ߹ߒߚޕ ޟࠗࡦ࠼ડᬺߩᶏᄖᚢ⇛ޠ⺞ᩏࡊࡠࠫࠚࠢ࠻ߩ-21ࡢࠢࡈࡠ ട╩䊶ୃᱜ ᦨ⚳ႎ๔ᦠ䈱ฃข ᦨ⚳ႎ๔ᦠ䈱⚊ ᦨ⚳ ਇὐ䈱⏕ൻ ႎ๔ ᦨ⚳⏕ ⠡⸶ቢੌ ⋙⸶䇮⸶䈮䈧䈇䈩 ੑ㊀䉼䉢䉾䉪 䊐䉞䊷䊄䊋䉾䉪 ౝኈ䈱⏕ൻ ౝኈ䈱ਇὐ䉕⏕ ⠡⸶ ᣣᧄ⺆⠡⸶ ⠡⸶㐿ᆎ䉕ᜰ␜ ⠡⸶䉕㐿ᆎ 㐿ᆎ䉕ᜰ␜ ⧷ᢥ䈪䈱 ᦨ⚳ႎ๔ ⧷ᢥਛ㑆ႎ๔ ⧷ᢥ䈪䈱 䈱䊐䉞䊷䊄䊋䉾䉪䇮 ਛ㑆ႎ๔ ਇὐ䈱⏕ൻ ⺞ᩏ ታᣉ ⺞ᩏታᣉ 䊒䊨䉳䉢䉪䊃䊶 䊙䊈䊷䉳䊞䊷 ⺞ᩏ⸳⸘วᗧ 䊶⺞ᩏ⸳⸘䈱ឭ᩺ 䉝䊅䊥䉴䊃 䊶ⷐઙቯ⟵䈱⏕ ⸘↹ 䊶䊒䊨䉳䉢䉪䊃䊶䉼䊷䊛 䊶⺞ᩏડ↹┙᩺ 䇭䈱ㆬቯ 䊶ⷐઙቯ⟵ ⠡⸶ᜂᒰ 䉳䉢䊃䊨䋨᧲੩䋩 䉟䊋䊥䊠䉰䊷䊑㩿䊆䊠䊷䊂䊥䊷䋩 䉟䊋䊥䊠䉰䊷䊑䋨ᶏ䋩 2 ࠝࡈ࡚ࠪࠕࡦࠣታ〣ߩᚑᨐߪޔޟࠗࡦ࠼ࠝࡈ࡚ࠪࠕࡦࠣޠ㧔ࠫࠚ࠻ࡠೀ㧕ࠍߏⷩߊ ߛߐޕ߹ߚޔࠫࠚ࠻ࡠߩ࠙ࠚࡉࠨࠗ࠻㧔ർ☨ߩ⺞ᩏࡐ࠻㧦 http://www.jetro.go.jp/biz/world/n_america/reports/㧕ߦޔᧄ⺞ᩏߩ⧷⺆ ႎ๔ᦠࠍឝタߒߡ ߅ࠅ߹ߔޕ ᧄᦠߪޔࠗࡃࡘࠨࡉ␠߆ࠄฃ㗔ߒߚႎ๔ᦠߦޔࠫࠚ࠻ࡠߦߡട╩ୃᱜࠍട߃ߡ߅ࠅ ߹ߔ߇ޔౝኈߩᱜ⏕ᕈߦߟߡߪޔၮᧄ⊛ߦᆔ⸤ߒߚࠗࡦ࠼ߩ⺞ᩏડᬺࠗࡃࡘࠨࡉߩ ⺞ᩏ⢻ജߦଐߞߡ߹ߔޕ ߹ߚޔᧄᦠࠍߏⷩߚߛߊߦߚߞߡߪޔԘᧄᢥਛߢ↪ߒߡࠆ࠺࠲߿ታ㑐ଥߪ ା㗬ߢ߈ࠆߣᕁࠊࠇࠆฦ⒳ᖱႎߦၮߠߡࠆ߽ߩߩޔߘߩᱜ⏕ᕈޔቢోᕈߦߟߡޔࠫ ࠚ࠻ࡠޔࠗࡃࡘࠨࡉߣ߽⸽ࠍߔࠆ߽ߩߢߪߥߎߣޔԙࠫࠚ࠻ࡠߪᧄႎ๔ߩ⺰ᣦߣ ৻⥌ߒߥઁߩ⾗ᢱࠍ⊒ⴕߒߡࠆޔࠆߪᓟ⊒ⴕߔࠆ႐ว߽ࠆߎߣޔԚᧄႎ๔ߪ ⺒⠪ߩᣇޘ߳ߩᖱႎឭଏࠍ⋡⊛ߣߒߚ߽ߩߢࠅޔ․ቯߩᛩ⾗್ᢿࠍଦߔ߽ߩߢߪߥߊޔ ႎ๔ᦠߩౝኈࠍෳ⠨ߦߒߡⴕࠊࠇߚ⚻ᷣⴕὑߩ⚿ᨐߦኻߒߡࠫࠚ࠻ࡠ߅ࠃ߮ࠗࡃࡘࠨ ࡉߪ⽿છࠍ⽶ࠊߥߎߣޔߦߟߡޔߏੌ⸃߅㗿⥌ߒ߹ߔޕ ᧄᦠ߇⥝㓉ߒᆎߚࠗࡦ࠼ડᬺ߳ߩℂ⸃ࠍᷓࠃ߁ߣߐࠇࠆࡆࠫࡀࠬࡄࠬࡦࠍߪߓ ޔߏ㑐ᔃࠍ㗂ߚᣇߦޔዋߒߢ߽߅ᓎߦ┙ߡ߫ᐘߢߔޕ ᣣᧄ⾏ᤃᝄ⥝ᯏ᭴ ᶏᄖ⺞ᩏㇱ ࡊࡠࠫࠚࠢ࠻ᜂᒰ⠪৻ⷩ ᣣᧄ⾏ᤃᝄ⥝ᯏ᭴ ᶏᄖ⺞ᩏㇱ ർ☨⺖㧔ડ↹ో⛔㧕 ડ↹✬㓸㧦 ㋈ᧁ ᣣᧄࡊࡠࠫࠚࠢ࠻ࡑࡀࠫࡖ㧦 ↰ਛિ ⋙⸶㧦 㒙ㇱᄙᤋሶ ࠗࡃࡘࠨࡉ ࠗࡦ࠼࠴ࡓ㧔⺞ᩏᜂᒰ㧕 ࡊࠫࠚࠢ࠻⛔㧦 ࠕࠪࡘࠪࡘࠣࡊ࠲㧔Ashish Gupta㧕 ࠗࡦ࠼ࡊࡠࠫࠚࠢ࠻ࡑࡀࠫࡖ㧦 ࠕࠫࠚࠗࡧࠔࠪࡘ࠾㧔Ajay Varshney㧕 ⺞ᩏᜂᒰ㧦 ࠕࡆ࠽ࡉࡊࡠࡅ࠻㧔Abhinav Purohit㧕 ⺞ᩏᜂᒰ㧦 ࠕࠞࠪࡘࠢࡑ࡞ࠫࠚࠗࡦ㧔Akash Kumar Jain㧕 ⺞ᩏᜂᒰ㧦 ࠕࡒ࠲ࠞ࡞㧔Amita Kalra㧕 ਛ࿖࠴ࡓ 㧔⠡⸶ᜂᒰ㧕 ⠡⸶ᬺ⛔㧦ࠛ࠼ࡢ࠼Aࠕ࠳ࡓࠬࠠ㧔Edward A. -

The Automotive Sector in Pakistan

Final Report THE AUTOMOTIVE SECTOR IN PAKISTAN TABLE OF CONTENTS LIST OF ACRONYMS 1 EXECUTIVE SUMMARY 4 CHAPTER 1: INTRODUCTION 9 1.1. Terms of Reference 9 1.2. History of the Sector 10 1.3. Review of Literature 12 CHAPTER 2: THE AUTOMOTIVE SECTOR 16 2.1. Coverage 16 2.2. Sizing of the Sector 16 2.3. Contribution To The Economy 26 2.4. Demand Analysis 32 CHAPTER 3: POLICY AND REGULATORY FRAMEWORK 34 3.1. TRIMS 34 3.2. Investment Policy 36 3.3. Trade Policies 38 3.4. Tariff Policy 39 3.5. Auto Industry Development Programme 43 3.6. Policy and Standards 44 CHAPTER 4: EXTENT OF EFFECTIVE PROTECTION 45 4.1. Methodology 45 4.2. Results 46 4.3. Recommendations on Tariff Reform 47 CHAPTER 5: ASSESSMENT OF COMPETITION IN THE SECTOR 52 5.1. Methodology for Assessing Degree of Competition 52 5.2. Measure of Extent of Competition 53 5.3. Assessment of Competition in the Automotive Sector 54 CHAPTER 6: PROFILE OF THE SAMPLE OF VENDORS 58 6.1. Objectives of the Survey 58 6.2. The Sample 58 6.3. Legal Status 61 ii 6.4. Membership of Associations 61 6.5. Investment and Capacity 62 6.6. Turnover 63 6.7. Employment 63 6.8. Cost Structure 64 6.9. Gross Profit and Value Added 64 CHAPTER 7: KEY ISSUES IN THE VENDING INDUSTRY 66 7.1. Impact of Tariff Protection 66 7.2. Extent of Competition 70 7.3. Degree of Competitiveness 71 7.4. Factors Influencing Growth 71 7.5. -

Financial Analysis of Toyota Indus Motor Company

Financial Analysis of Toyota Indus Motor Company 2017 Financial Analysis of Toyota Indus Motor Company Financial Year 2011-2016 Ayesha Majid Lahore School of economics 5/1/2017 Financial Analysis of Toyota Indus Motor Company i Table of Contents Preamble .................................................................................................................... 1 Categories of Financial Ratios Analysed ................................................................ 1 Limitations .............................................................................................................. 2 Toyota Indus Motors................................................................................................... 3 Company Profile ..................................................................................................... 3 Financial Profile ...................................................................................................... 3 Introduction ............................................................................................................. 4 Mission Statement ............................................................................................... 5 Vision Statement ................................................................................................. 5 Slogan ................................................................................................................. 5 Quote Summary as on 1st May 2017 .......................................................................... 6 -

Annual 2012.Pdf

A View of Baluchistan Wheels Limited Vision Mission To Produce Automotive Wheels and Allied Products of International Quality Standard of ISO 9002 and contribute towards national economy by import substitution, exports, taxation, employment and consistently compensate the stake holders through stable returns. BALUCHISTAN WHEELS LIMITED Table of Contents Corporate Information 04 Notice of the Meeting 06 Our Leadership Team 08 Directors Report to the Shareholders 10 Pattern of Shareholding 16 Breakup of Shareholding 17 Statement of Compliance with the Code of 19 Corporate Governance Statement of Compliance with the 21 Best Practices on Transfer Pricing Review Report to the Members on Statement 22 of Compliance with the Best Practices of the Code of Corporate Governance Auditors Report 23 Balance Sheet 24 Profit and Loss Account 25 Statement of Comprehensive Income 26 Cash Flow Statement 27 Statement of Changes in Equity 28 Notes to the Financial Statements 29 Six years at a Glance 53 Form of Proxy New Induction of CO2 Welding New Induction of Automobile Disc profile Forming Machine by Spinning Process BALUCHISTAN WHEELS LIMITED Corporate Information Mr. Muhammad Siddique Misri Mr. Razak H. M. Bengali Mr. Muhammad Irfan Ghani Chairman Chief Executive Chief Operating Officer BOARD OF DIRECTORS Mr.Muhammad Siddique Misri Chairman(Executive Director) Mr.Razak H.M.Bengali Chief Executive(Executive Director) Mr. Muhammad Irfan Ghani Chief Operating Officer(Executive Director) Syed Haroon Rashid Director (Nominee - NIT)(Non Executive Director) Syed Zubair Ahmed Shah Director (Nominee - NIT)(Non Executive Director) Mr.Muhammad Javed Director(Executive Director) Mr.Irfan Ahmed Qureshi Director(Executive Director) COMPANY SECRETARY Mr.Irfan Ahmed Qureshi BOARD AUDIT COMMITTEE Syed Haroon Rashid - Chairman Director Syed Zubair Ahmed Shah- Member Director Mr. -

An Overview of Trends in the Automotive Sector and the Policy Framework

Working paper An Overview of Trends in the Automotive Sector and the Policy Framework Automotive Sector in Pakistan Phase I Report Hafiz Pasha Zafar Ismail January 2012 TABLE OF CONTENTS LIST OF ACRONYMS 1 CHAPTER 1: INTRODUCTION 3 1.1. Terms of Reference 3 1.2. History of the Sector 3 1.3. Review of Literature 6 CHAPTER 2: THE AUTOMOTIVE SECTOR 11 2.1. CoverAge 11 2.2. Sizing of the Sector 11 2.3. Contribution To The Economy 21 2.4. DemAnd AnAlysis 27 CHAPTER 3: POLICY AND REGULATORY FRAMEWORK 29 3.1. TRIMS 29 3.2. Investment Policy 31 3.3. TrAde Policies 33 3.4. Tariff Policy 34 3.5. Auto Industry DeveloPment ProgrAmme 38 3.6. Policy and StAndArds 39 CHAPTER 4: EXTENT OF EFFECTIVE PROTECTION 40 4.1. Methodology 40 4.2. Results 41 4.3. RecommendAtions on TAriff Reform 42 CHAPTER 5: COMPETITIVENESS ASSESSMENT OF THE SECTOR 47 5.1. Methodology for Assessing Degree of ComPetition 47 5.2. MeAsure of ComPetitiveness 48 5.3. Assessment of ComPetitiveness of the Automotive Sector 49 REFERENCES 54 APPENDICES ApPendix – ChaPter 1 9 ii LIST OF TABLES Table 2.1: Indicators of Size of the Automotive Sector from the CMI of 2005-06 12 Table 2.2: Number of Units in 2011 According to AssociAtions 13 Table 2.3: RePorted CAPAcity of OEMs And RAtes of UtilisAtion 13 Table 2.4: EstimAted Levels of Production of Different TyPes of Vehicles, 2000-01 to 2010-11 16 Table 2.5: InternAtionAl CompArison of Production of Vehicles 17 Table 2.6: Recent Trends in Prices of CArs, 2008 to 2012 18 Table 2.7: EstimAted Turnover in 2009-10 in different Sub-sectors 19 Table -

Overview Association Major Players

Brief on Automotive Sector Overview The auto sector is considered the sixth largest manufacturing sector in Pakistan and is therefore of prime importance to the economy of Pakistan. Pakistan’s automotive industry started with an automobile plant set up by General Motors in 1949. To achieve 75 per cent local content levels, auto manufacturers started to look for local sourcing. They also started to provide auto parts manufacturers with technical assistance to ensure quality and uninterrupted supply, which led to the development of the auto vending industry. Pakistan automobile industry is the sixth largest manufacturing sub‐sector with annual contribution of 2.8 percent in GDP. Automotive sector still thrives to make significant contribution to the domestic economy in form of foreign investments, foreign exchange earnings, employment, and revenue generation. Association • Pakistan Automotive Manufacturers Association (PAMA) • Pakistan Association of Automotive Parts & Accessories Manufacturers (PAAPAM) Major Players Pak Suzuki Co. Ltd Atlas Honda Ltd. Indus Motor Co. Ltd. Plum Qingqi Motors Ltd. Honda Atlas Cars (Pakistan) Ltd. Fateh Motors Ltd. Sigma Motors Ltd. Ravi Automobile Pvt. Ltd. Ghandhara Industries Ltd. Sazgar Engineering Works Ltd. Ghandhara Nissan Ltd. Orient Automotive Industries Pvt. Ltd. Master Motor Corporation Ltd. Eiffel Industries Ltd. Millat Tractors Ltd. Yamaha Motor Pakistan Pvt. Ltd. Al-Ghazi Tractors Ltd. United Auto Industries Pvt. Ltd. Hyundai Nishat Motor Pvt. Ltd. Hinopak Motors Limited Ghandhara DF (Pvt) Ltd. Fuso Master Motor Pvt Ltd. Afzal Motors Pvt Ltd PM Auto Industries Daewoo Pak Motors (Pvt) Ltd. Al Haj FAW Motors (Pvt) Ltd. Al-Ghazi Tractors Ltd MTW Pak Assembling Industries (Pvt) Ltd. -

Engineering Development Board Electric Vehicle

ENGINEERING DEVELOPMENT BOARD Ministry of Industries and Production Government of Pakistan ELECTRIC VEHICLE & NEW TECHNOLOGY POLICY 2020-2025 (DRAFT) April 2020 Electric Vehicles Policy 2020-2025 2020 Table of Contents 1.0 Executive Summary.................................................................................................................................................. 4 2.0 Background to EV Policy ........................................................................................................................................ 7 3.0 Scope of EV Policy ..................................................................................................................................................... 8 3.1 Policy Objectives ................................................................................................................................................... 8 4.0 Synopsis of Automotive Sector in Pakistan .................................................................................................... 9 4.1 Performance of the Sector .............................................................................................................................. 10 5.0 Limitations of Policy .............................................................................................................................................. 14 6.0 Tariff Incentives for Electric & Hybrid Vehicles ........................................................................................ 15 6.1 Tariff Incentive for New Model -

30-Jun-2018 01-Jan-2018 Va

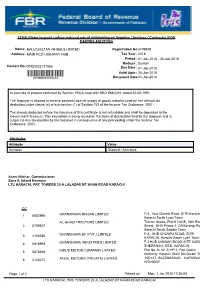

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts) (FOR PARTIES ADDITION) Name: BALUCHISTAN WHEELS LIMITED Registration No 0709848 Address: MAIN RCD HIGHWAY HUB Tax Year : 2018 Period : 01-Jan-2018 - 30-Jun-2018 Medium : System Contact No: 00923332131656 Due Date : 01-Jan-2018 Valid Upto : 30-Jun-2018 Document Date 01-Jan-2018 In exercise of powers conferred by Section 153(4) read with SRO 586(I)/91 ,dated 30-06-1991. The taxpayer is allowed to receive payment against supply of goods manufactured by him without tax deduction under clause (a) of sub-section (1) of Section 153 of the Income Tax Ordinance, 2001. Tax already deducted before the issuance of this certificate is not refundable and shall be deposited in the Government Treasury. This exemption is being issued on the basis of declaration filed by the taxpayer and is subject to any tax-payable by the taxpayer in consequence of any proceeding under the Income Tax Ordinance, 2001. Attributes Attribute Value Decision Granted / Accepted Asem Iftikhar, Commissioner Zone-II, Inland Revenue LTU KARACHI, PRC TOWERS 32-A LALAZAR MT KHAN ROAD KARACHI CC F-3,, Hub Chowki Road, SITE Karachi, 1 0802990 GHANDHARA NISSAN LIMITED Karachi South Lyari Town AL-GHAZI TRACTORS LIMITED Tractor House, Plot # 102-B, 16th East 2 0709507 Street,, DHA Phase 1, Off Korangi Road, Karachi South Saddar Town F-3,, HUB CHOWKI ROAD, SITE 3 4166685 GHANDHARA DF (PVT.) LIMITED KARACHI, Karachi South Lyari Town F 3 HUB CHOWKI ROAD SITE KARACHI 4 0816963 GHANDHARA INDUSTRIES LIMITED SHERSHAH, SITE, KARACHI. -

What's More.. Pakwheels Exclusives Ajay's 1965 Low-Rider Chevrolet Im

Issue 3, October 2006 Monthly Magazine Pakistan Rs. 50 India Rs. 50 U.A.E. AED 5 International US$ 5 Ajay’sChevrolet 1965 Low-Rider Impala What’s more.. - Four Stroke Cycle - FWD vs RWD - DIY Car Wash - Driving Ethics - Classifieds - News & Gossips - Month in Review - Pricelist PakWheels Exclusives & much more -INI0AJERO2EVIEW 0ROTON,AUNCH 3POTTED #ONCEPT#ARS www.pakwheels.com October 2006 www.pakwheels.com October 2006 www.pakwheels.com October 2006 Editors Note WHY DIDN’T SUPERMAN EVER WRITE A BOOK? Because he spent all of his time being an excellent Superman. Yes once again the wheel is turning and each of us is trying to get better at what we do best, back again with the latest issue of PW! Often the best way to tell if your boat leaks is to put it in water! If you were given a ‘sinking’ feeling by this pearl of wisdom, allow me to explain. What I mean is that you have to get out in people’s faces to get them to notice much of anything these days. Hence it explains our “Oh so informative” articles on Washing Cars Properly and arguing over FWD and RWD’s!!! Maybe you’ve noticed most of us don’t buy our new cars off the internet. If that were the case, dealerships would be open Monday through Friday nine- to-five - just like everyone else. Thanks to our portal, we give you the chance to put it in a picture that speaks a thousand words! The perople and cars once seemed made for each other, but now they are headed in different directions. -

Autoparts Study 2007

The Automotive Parts Sector in Pakistan — Export performance and potential — Implications of the WTO Agreements September 2007 This publication has been produced with the assistance of the European Union (EU) as part of an EU-funded Trade Related Technical Assistance (TRTA) programme with the Government of Pakistan. The International Trade Centre (ITC) is implementing the programme. The content of this publication is the sole responsibility of the consultants. Facts and figures set forth in this publication are the responsibility of the consultants and should not be considered as reflecting the views or carrying the endorsement of the EC, ITC, UNCTAD, or WTO. The factual details and in-country resources in the publication have been researched and compiled by the consultants. ITC has not formally edited this report. © International Trade Centre (UNCTAD/WTO) Palais des Nations, 1211 Geneva 10, Switzerland Email: [email protected] http://www.intracen.org Distribution: UNRESTRICTED September 2007 ITC: Your Development Partner in Export Success ITC Mission ITC enables small business export success in developing countries by providing, with partners, trade development solutions to the private sector, trade support institutions and policy-makers. ITC strategic objectives f Enterprises – Strengthen the international competitiveness of enterprises. f Trade support institutions – Develop the capacity of trade service providers to support businesses. f Policy-makers – Support policy-makers in integrating the business sector into the global economy. -

Modernizing the Trucking Sector of Pakistan February 13, 2007 at Serena Hotel, Islamabad

Annexure-XII WORKSHOP ON “MODERNIZING THE TRUCKING SECTOR OF PAKISTAN FEBRUARY 13, 2007 AT SERENA HOTEL, ISLAMABAD LIST OF PARTICIPANTS Sr. No. Name, Designation Name of Company Address City 1. Mr. Zulfiqar Dilawar, Tyre Consulting & Services 615-Clifton Centre, Block-5, Karachi (SMC-Private) Limited, Kehkashan Clifton, 2. S.H. Zaman Najmi, Siemens Pakistan Karachi Director (Business Dev.) 3. Mr Mohammad Kazim Idris NTRC Sector H-8/2, Islamabad Chief, 4. Khizer Javaid, NTRC 5. Mr. Hasan Mahmood, VP Raaziq International, Address : 27-D-1, Sir Syed Lahore. Road , Gulberg 6. Lt. Col (R) Syed Irshad Hussain SIGMA Motors (Pvt) Ltd. 28-Kaghan Road, Islamabad Shah, Sector F-8/4, Senior Manager Parts, 7. Mr. Rauf Ijaz, Muslim Commercial Bank Islamabad 8. Rana Asim Shakoor, Shakoor & Co. F-354, S.I.T.E., Karachi Managing Partner, 9. Mr. Asim Saeed, Small and Medium 6th Floor, LDA Plaza, Lahore- Manager (Policy & Planning), Enterprises Development Egerton Road, 54000 Authority, 10. Mr. Qasim Rastgar, Rastgar Engineering Islamabad 11. Rana Ahmad, Azad Hakim Karachi Azad Hakim 12. Mr. Aleem-ur-Rehman, Security Packers Islamabad Director Operation, 13. Mr. Saleem Asghar Mian, Indus Motors Islamabad Resident Director 14. Mr. Manzoor Rehman, A.D.B. Islamabad 15. Malik Abdul Majeed Nawaz, M.R. Enterprises Goods 43 Sabzazar Truck Stand, Lahore Director, Transport Co. (Regd) Bund Road, 16. Mr. Tahir Khan, M.R. Enterprises Lahore M.R. Enterprises 17. Mr. Fasih Haider, Ark Transport Co. Plot No32, New Truck Lahore CEO, Stand, Sabzazar Scheme, 18. Syed Asghar Hussain Rizvi, Peoples Steel Mills Ltd., Manghopir, Karachi Deputy General Manager (Marketing) 19.