Entertainment Content

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Programmprofile Von Das Erste, ZDF, RTL, VOX, Sat.1 Und Prosieben Von Torsten Maurer, Anne Beier Und Hans-Jürgen Weiß*

Media 246 Perspektiven 5/2020 Ergebnisse der ARD/ZDF-Programmanalyse 2019 – Teil 1 Programmprofile von Das Erste, ZDF, RTL, VOX, Sat.1 und ProSieben Von Torsten Maurer, Anne Beier und Hans-Jürgen Weiß* Neukonzeption Der vorliegende Beitrag knüpft an die Strukturana- Kurz und knapp der kontinuierlichen lysen von öffentlich-rechtlichen und privaten Fern- • Die Programmstrukturanalyse wird als Sekundäranalyse der Programmforschung sehprogrammen an, die seit vielen Jahren von Udo AGF Programmcodierung durchgeführt. im Jahr 2019 Michael Krüger an dieser Stelle publiziert wurden. (1) • 2019 wurden sechs Sender untersucht: Das Erste, ZDF, RTL, VOX, Sie sind Teil der kontinuierlichen Fernsehprogramm- Sat.1 und ProSieben. forschung, die seit 1985 im Auftrag von ARD und ZDF durchgeführt wird. Die Methode der Programm- • Der Anteil der Informationsangebote am Gesamtprogramm lag bei analyse, die für das Untersuchungsjahr 2019 neu Das Erste und ZDF bei über 40 Prozent, bei den Privaten zwischen konzipiert wurde, wird in einem weiteren Beitrag 12 und 24 Prozent. ausführlich erläutert. (2) Im Fall der Strukturanalyse • Die journalistische Information wird quantitativ stark von Magazin- wurden gegenüber den bisherigen Erhebungen ver- sendungen geprägt. gleichsweise wenige methodische Veränderungen • Die Vielfalt der Sendungsformate ist bei Das Erste und ZDF vorgenommen: am größten. – Sie wird nach wie vor als Sekundäranalyse der Programmprotokolle und Programmcodierung der AGF Videoforschung durchgeführt. Strukturelle und empirische Rahmen- – Die Zahl der analysierten Programme wurde von bedingungen des Programmvergleichs fünf auf sechs erweitert: Hinzugekommen ist VOX, Im Rahmen der Programmstrukturanalyse werden die Rahmenbedingungen so dass nun jeweils zwei private Fernsehvollpro- sechs untersuchten Programme aus der Perspektive für öffentlich- gramme der RTL-Gruppe (RTL und VOX) und der des linearen Fernsehens analysiert und miteinander recht liche und ProSiebenSat.1-Gruppe (Sat.1 und ProSieben) verglichen. -

Übersicht Der Kostenfreien TV-Sender

Übersicht der kostenfreien TV-Sender Die Sender sind alphabetisch sortiert. Die Nummerierung dient nur der Orientierung und entspricht nicht den Programmplätzen. 1. 1-2-3.tv 41. HSE24 EXTRA 81. QVC 2. 1-2-3.tv HD 42. HSE24 EXTRA HD 82. QVC Deutschland 3. 3sat 43. HSE24 HD 83. QVC HD 4. 3sat HD 44. HSE24 TREND 84. QVC Style 5. Al Jazeera Channel 45. Juwelo HD 85. QVC 2 6. Al Jazeera English 46. Juwelo TV 86. QVC 2 HD 7. ANIXE SD 47. kabel eins 87. Radio Bremen 8. ARD-alpha 48. kabel eins Doku 88. Radio Bremen TV 9. ARD-alpha HD 49. KiKA 89. rbb Berlin 10. arte 50. KiKA HD 90. rbb Berlin HD 11. arte HD 51. MDR Sachsen 91. rbb Brandenburg 12. AstroTV 52. MDR Sachsen HD 92. rbb Brandenburg HD 13. Baden TV 53. MDR S-Anhalt 93. rhein main tv 14. BBC World 54. MDR S-Anhalt HD 94. RTL Bayern 15. Bibel TV 55. MDR Thüringen 95. RTL HB NDS 16. Bibel TV HD 56. MDR Thüringen HD 96. RTL HH SH 17. Bloomberg 57. meinTVshop 97. RTL Regional NRW 18. BR Fernsehen Nord 58. Melodie TV NEU 98. RTL Television 19. BR Fernsehen Nord HD 59. MTV 99. RTLplus 20. BR Fernsehen Süd 60. N24 DOKU 100. RTL2 21. BR Fernsehen Süd HD 61. NDR FS HH 101. SAT.1 22. Canal Algérie 62. NDR FS HH HD 102. SAT.1 Bayern 23. Channel 21 Shop 63. NDR FS MV 103. SAT.1 Gold 24. CNN Int. 64. -

Bezeichnungen Für Bekannte Personen Als Komponenten Deutscher Und Polnischer Eigennamen

STUDIA GERMANICA GEDANENSIA Gdańsk 2017, Nr. 37 Marcelina Kałasznik Universität Wrocław, Philologische Fakultät Bezeichnungen für bekannte Personen als Komponenten deutscher und polnischer Eigennamen Designations of known people in the function of proper name components in German and Polish. – Per- sonal designations form an important and open set of linguistic means by which people are called and char- acterized. At the heart of this article is a fragment of the inventory of personal identifications in German and Polish, namely names of famous people. The purpose of the article is to indicate the occurrence of names of known people in selected classes of proper names in Polish and German and to discuss the func- tion of their occurrences in particular onyms. Keywords: personal designations, designations of known people, proper names Bezeichnungen für bekannte Personen als Komponenten deutscher und polnischer Eigenna- men. – Personenbezeichnungen bilden einen wesentlichen und offenen Abschnitt des Wortschatzes. Mit Personenbezeichnungen wird der Mensch benannt und charakterisiert. Im Mittelpunkt des Beitrags steht das Inventar der Bezeichnungen für bekannte Personen im Deutschen und im Polnischen. Das Ziel der Studie besteht darin, auf das Vorhandensein der Bezeichnungen für bekannte Personen in bestimmten Klassen von Eigennamen in der deutschen und polnischen Sprache zu verweisen sowie ihre Funktionen in ausgewählten Typen von Onymen zu besprechen. Schlüßelwörter: Personenbezeichnungen, Bezeichnungen für bekannte Personen, Eigennamen. Określenia osób znanych w funkcji komponentów nazw własnych w języku niemieckim i polskim. – Określenia osobowe tworzą istotny i otwarty zbiór środków językowych, przy pomocy których nazywany i charakteryzowany jest człowiek. W centrum zainteresowania niniejszego artykułu znajduje się fragment inwentarza określeń osobowych w języku niemieckim i polskim, mianowicie określenia osób znanych. -

No. Channel Logo Features Comeback HD App TV

Features No. Channel Logo TV start TV comfort ComeBack HD App 1 SRF 1 HD 2 SRF zwei HD 3 Das Erste HD 4 ZDF HD 5 SAT.1 HD 6 ProSieben HD 7 RTL HD 8 3+ HD 9 4+ HD 10 RTL II HD 11 VOX HD 12 5+ HD 13 kabel eins HD 14 sixx HD 15 TV24 HD 16 S1 HD 17 ORF 1 HD 18 ORF 2 HD 19 ARTE HD 20 SRF info HD 21 TeleZüri 22 Nickelodeon CH HD 23 SUPER RTL HD 24 ServusTV HD 25 MTV CH HD 26 VIVA CH HD 27 RTL NITRO HD 28 Puls 8 HD 29 TV25 HD 30 ntv CH HD 31 Eurosport HD 33 Discovery Channel HD 34 Animal Planet HD 35 HISTORY HD 36 TNT Serie HD 37 TNT Film HD 38 AXN HD 39 MTV LIVE HD 40 FashionTV HD ftv 41 CHTV HD 42 3sat HD 43 KiKA HD 44 NDR HD 45 WDR Fernsehen HD 46 SWR HD 47 BR HD 48 ZDF Neo HD 49 ZDFinfo HD 50 PHOENIX HD 51 ANIXE HD 52 DMAX 53 TLC 54 ProSieben MAXX CH 55 SAT.1 Gold 56 TELE 5 57 gotv 58 DELUXE MUSIC 59 Schweiz 5 60 STAR TV HD 61 wetter.tv 62 Eurosport 63 SPORT1 64 Disney Channel 65 NATIONAL GEOGRAPHIC CHANNEL 66 TNT Serie 67 TNT Film 68 hr-fernsehen 69 MDR FERNSEHEN 70 rbb Fernsehen 71 ARD-alpha 72 tagesschau24 73 Einsfestival 74 N24 75 euronews 76 Deutsche Welle 77 Bloomberg TV 78 Bibel TV 79 HSE24 80 Teleclub Zoom 81 RTS Deux HD Features No. -

Werbeforschung Zum Produkt Switchin

ADDRESSABLE TV Aktueller Stand aus der Werbeforschung (März 2019) Agenda 1 Reine SwitchIn XXL-Kampagnen 2 Incremental Reach und Erhöhung der Kontaktdosis 3 Kontaktklassenoptimierung via SwitchIn XXL 4 Grundlagenstudie 2 REINE SWITCHIN XXL-KAMPAGNEN SwitchIn XXL als alleiniges Werbemittel 3 Beispiel: Peugeot Rifter Steckbrief Peugeot Rifter Durchführung SevenOne Media / Advertising Research Erhebungsform SmartTV-Onlinebefragung über Connected TV anhand eines strukturierten Fragebogens Grundgesamtheit Nutzer des Connected TV-Angebots von ProSieben, Sat.1, kabel eins und sixx Auswahlverfahren Einladung via SwitchIn Classic Datum 24. August bis 30. September 2018 Stichprobe Ohne Kontakt zu ATV: n = 858; mit Kontakt zu ATV: n = 849 (1-2 Kontakte: n = 324, 3+ Kontakte: n = 525) Inhalt Gestützte Bekanntheit, Gestützte Werbeerinnerung, Relevant Set, Aussagen Peugeot Rifter 5 Steigerung der Bekanntheit mit ATV-Kontakt um 53 Prozent Gestützte Bekanntheit Peugeot Rifter - Kontakt Gestützte Bekanntheit Peugeot Rifter - Kontaktklassen Angaben in Prozent Angaben in Prozent 50 50 40 40 30 30 +53% 21 20 18 20 15 12 10 10 0 0 Ohne Kontakt Mit Kontakt 1-2 Kontakte 3 Kontakte und mehr Im Folgenden geht es um Automodelle. Welche der folgenden Automodelle kennen Sie, wenn auch nur dem Namen nach? 6 Basis: Nutzer des Connected TV-Angebots von ProSieben, Sat.1, kabel eins und sixx Quelle: SevenOne Media Schon wenige Kontakte mit gutem Effekt Relevant Set Peugeot Rifter - Kontakt Relevant Set Peugeot Rifter - Kontaktklassen Angaben in Prozent (ja, auf jeden Fall -

TV-Formate Richtung Geprägt

Erschienen in: Thomas Hecken und Marcus Kleiner (Hg.): Handbuch Popkultur. Stuttgart: Metzler, 2017. - S. 159–163. D Fernsehen 29 TV-Formate richtung geprägt. Hierin unterscheidet sich das For- mat vom übergeordneten Begriff des >Genres< (vgl. Der >Format<-Begriff rangiert als Typus zwischen Hickethier 2010,152 f.). >Sendung< (singuläres Produkt) und >Genre< (überge- Ein Fernsehformat ist durch fixe optische und ordneter Typus). Ein Genre ist durch etablierte For- akustische Gestaltungsmerkmale (z. B. Logo, Titelme- men des Erzählens und der fernsehästhetischen Dar- lodie) und durch eine unveränderte Dramaturgie be- stellung gekennzeichnet. In Bezug auf gesellschaftli- ziehungsweise einen konstanten Sendungsablauf ge- che Erwartungen stellt ein Fernsehgenre eine Form kennzeichnet. Die gleichbleibenden ästhetischen der kulturellen Praxis dar, durch die eine Orientierung Merkmale und Strukturen dienen als Grundlage der zwischen Programmausrichtung, Sendungsinhalt und jeweiligen Episoden oder Shows (vgl. Mikos 2015, Zuschauererwartung geboten wird. Fernsehgenres 255 ff.). Zusätzlich haben Formate oftmals einen fest werden im deutschsprachigen Raum zunächst nach vorgesehenen Sendeplatz im Fernsehprogramm (z. B. Informationssendung, Unterhaltungssendung oder Samstag-Abend-Show, Vorabend-Serie) (vgl. Lünen- fiktionaler Sendung unterschieden (vgl. Faulstich borg 2013, 94). 2008, 33 ff.). Aufgrund der nationalen Adaptionen kommt Fern- Für das Fernsehen spielt der Formatbegriff eine be- sehformaten in der non-fiktionalen Unterhaltung deutsame Rolle, weil er auf die ökonomische Dimensi- (z. B. Reality-Shows) eine größere Bedeutung als in der on des Fernsehmarkts verweist. Der Formatbegriff fiktionalen Unterhaltung (z. B. Serien) zu. Vor allem gründet in der Optimierung der (internationalen) die Subgenres der Spielshow, der Quizshow und des Vermarktung von Unterhaltungssendungen und in Reality-TV bringen populäre und international erfolg- der Ausrichtung des Fernsehens auf Einschaltquoten. -

Sandra Rieger

Sandra Rieger together casting UG Katja Steininger Phone: +49 89 520 32905 Email: [email protected] Website: www.together-casting.de © ️ Ronald Hansch Information Acting age 20 - 29 years Nationality German Year of birth 1993 (28 years) Languages German: native-language Height (cm) 179 English: fluent Eye color green brown Dialects Bairisch Hair color Brown Swabian Hair length Medium Berlin German Place of residence München Münchnerisch Housing options Berlin, Hamburg, Rusyn Leipzig, New York City, Accents Russian: only when required Stuttgart American: only when required Instruments Guitar: basic Keyboard/Synthesizer: basic Sport Rockclimbing, Bouldering, Soccer, Inline skating, Canoe/Kayak, Kickboxing, Climb, Longboard, Ice skating, Swim, Alpine skiing, Surfing Dance Salsa: basic Ballet: basic Hip hop: medium Standard: medium Freestyle dance: medium Jazz Dance: medium Street Dance: medium Modern Dance: medium Expressionist dance: medium Contemporary dance: basic Latin American dances: medium Profession Actor Singing Rock/Pop: basic Soul/RnB: basic Pitch Mezzo-soprano Other licenses Fitness trainer B license Vita Sandra Rieger by www.castupload.com — As of: 2021-09-18 Page 1 of 4 Professional background Die Schauspielfabrik Berlin - Intensiv Schauspielkurs Other Education & Training 2021 Gesehen & Werden Coaching in Film 2019 –… Zinner Studio Vollzeit Schauspielunterricht und Training + Kamera Workshop 2021 Gabrielle Odinis Schauspiel Coaching 2016 –… Junges Resi Unterricht in Tanz, Gesang und Schauspiel 2017 –… Junges Resi -

Programmprofile Von Das Erste, ZDF, RTL, VOX, Sat.1 Und Prosieben Von Torsten Maurer, Matthias Wagner Und Hans-Jürgen Weiß*

Media 240 Perspektiven 4/2021 Ergebnisse der ARD/ZDF-Programmanalyse 2020 – Teil 1 Programmprofile von Das Erste, ZDF, RTL, VOX, Sat.1 und ProSieben Von Torsten Maurer, Matthias Wagner und Hans-Jürgen Weiß* Mit dem vorliegenden Beitrag wird die 2019 neu gorien dieser Strukturanalyse sind vor allem Pro- konzipierte ARD/ZDF-Programmanalyse für das Un- grammsparten und Sendungsformate, mit deren tersuchungsjahr 2020 fortgeschrieben. (1) In der seit Hilfe die Angebote der sechs Fernsehprogramme 1985 durchgeführten Langzeitstudie wurden von beschrieben und miteinander verglichen werden Anfang an die Programmstrukturen und mit zuneh- können. mender Differenzierung die Informationsangebote der Fernsehprogramme analysiert, die in Deutschland die Kurz und knapp größten Zuschauerreichweiten erzielen. Seit etwa 20 Jahren werden zwei separate Teilstudien zu die- • Der erste Teil der Programmanalyse 2020 belegt weitgehende sen beiden Forschungsschwerpunkten durchgeführt: Kontinuität bei den Strukturen der Fernsehprogramme. Die Programmstrukturen zunächst von fünf und seit • Auch die Coronakrise zeigt – auf das gesamte Jahr bezogen – nur 2019 von sechs Sendern werden im Rahmen einer geringe Effekte auf die Zusammensetzung der sechs untersuchten Jahresvollerhebung anhand der Programmprotokolle Programme. und Programmcodierung der AGF Videoforschung • Das deutliche Übergewicht der Informationsangebote in den untersucht (Teilstudie 1). Zusätzlich werden im Rah- öffentlich-rechtlichen Programmen gegenüber den privaten bleibt men einer vier Programmwochen umfassenden bestehen. Stichprobenerhebung Umfang, Struktur und Inhalte • Auffällig ist die Zunahme an aktuellen Sondersendungen in allen der Informationsangebote in vier Fernsehprogram- Programmen. men anhand von TV-Aufzeichnungen analysiert (Teil- • Die Analyse der Angebote nach Tagesabschnitten zeigt Unterschiede studie 2). Im Folgenden werden die Befunde der in der Programmpolitik der Sender. ersten Teilstudie zum Untersuchungsjahr 2020 vor- gelegt. -

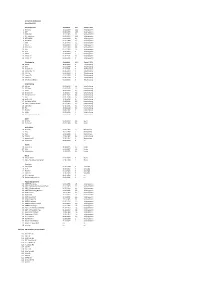

Tailwind® 500/550 with RDU TV Programming for Europe

Tailwind® 500/550 with RDU TV programming for Europe European Programming 23 CNBC Europe E 57 WDR Köln G 91 N24 Austria G 125 EinsPlus G ® for Tailwind 500/550 with RDU 24 Sonlife Broadcasting Network E 58 WDR Bielefeld G 92 rbb Berlin G 126 PHOENIX G A Arabic G German P Portuguese 25 Russia Today E 59 WDR Dortmund G 93 rbb Brandenburg G 127 SIXX G D Deutch K Korean S Spanish 26 GOD Channel E 60 WDR Düsseldorf G 94 NDR FS MV G 128 sixx Austria G E English M Multi T Turkish F French Po Polish 27 BVN TV D 61 WDR Essen G 95 NDR FS HH G 129 TELE 5 G 28 TV Record SD P 62 WDR Münster G 96 NDR FS NDS G 130 DMAX G Standard Definition Free-to-Air channel 29 TELESUR S 63 WDR Siegen G 97 NDR FS SH G 131 DMAX Austria G 30 TVGA S 64 Das Erste G 98 MDR Sachsen G 132 SPORT1 G The following channel list is effective April 21, 2016. Channels listed are subject to change 31 TBN Espana S 65 hr-fernsehen G 99 MDR S-Anhalt G 133 Eurosport 1 Deutschland G without notice. 32 TVE INTERNACIONAL EUROPA S 66 Bayerisches FS Nord G 100 MDR Thüringen G 134 Schau TV G Astra 33 CANAL 24 HORAS S 67 Bayerisches FS Süd G 101 SWR Fernsehen RP G 135 Folx TV G 34 Cubavision Internacional S 68 ARD-alpha G 102 SWR Fernsehen BW G 136 SOPHIA TV G 1 France 24 (in English) E 35 RT Esp S 69 ZDF G 103 DELUXE MUSIC G 137 Die Neue Zeit TV G 2 France 24 (en Français) F 36 Canal Algerie F 70 ZDFinfo G 104 n-tv G 138 K-TV G 3 Al Jazeera English E 37 Algerie 3 A 71 zdf_neo G 105 RTL Television G 139 a.tv G 4 NHK World TV E 38 Al Jazeera Channel A 72 zdf.kultur G 106 RTL FS G 140 TVA-OTV -

Announcement

Announcement 100 articles, 2016-09-17 00:00 1 Fußball - Köln besingt 3:0 gegen Freiburg Köln (dpa) - Nach einer rauschenden Fußball-Nacht ist der 1. FC Köln erstmals seit mehr als 20 Jahren wieder die Nummer 1 in der (4.39/5) Bundesliga. Die Mannschaft von 2016-09-16 22:42 4KB www.t-online.de 2 EU-Gipfel in der Slowakei: Der Geist von Bratislava scheint zu wirken In der slowakischen Hauptstadt Bratislava trafen sich die EU- (3.21/5) Regierungschefs, um über den künftigen Kurs der Union zu beraten. Im Zentrum der Debatten standen der Brexit und die Flüchtlingskrise. 2016-09-16 21:38 5KB www.rp-online.de 3 Nach Zusammenstößen in Bautzen: Linke greift Polizei an Mit Blick auf die jüngsten gewaltsamen Zusammenstöße zwischen (3.12/5) Rechtsextremen und jungen Flüchtlingen in Bautzen hat die sächsische Linke die Polizei scharf 2016-09-16 21:19 1KB www.t- online.de 4 Mecklenburg-Vorpommern: SPD beschließt Koalitionsverhandlungen mit CDU Die SPD im Nordosten setzt auf Kontinuität und kündigt (2.04/5) Koalitionsverhandlungen mit den Christdemokraten an. Die Linke geht damit in die Opposition. 2016-09-16 20:26 3KB www.zeit.de 5 EU-Gipfel: Merkel begrüßt "flexible Solidarität" Nach dem Brexit-Schock versucht die EU einen Neustart. Die (1.11/5) Vertreter osteuropäischer Staaten machen aber deutlich, dass sie in der Flüchtlingskrise nicht einlenken wollen. 2016-09-16 21:26 3KB www.sueddeutsche.de 6 Finale im Promi-Haus: Mario Basler landet auf Platz 3 Finale bei Promi Big Brother 2016: Am Freitagabend entschieden (1.02/5) die Zuschauer, wer die zweiwöchige Container-Show gewinnt. -

Programmliste Netcologne

Senderliste NetCologne Stand Mai 2016 Vollprogramme Sendestart MA Genre lt. KEK 1 Das Erste 25.12.1954 12,5 Vollprogramm 2 ZDF 01.04.1963 13,3 Vollprogramm 3 WDR Köln 17.12.1965 2,4 Vollprogramm 4 RTL Television 02.01.1984 10,3 Vollprogramm 5 SAT.1 NRW 01.01.1984 8,1 Vollprogramm 6 ProSieben 01.01.1989 5,5 Vollprogramm 7 VOX 25.01.1993 5,2 Vollprogramm 8 RTL 2 06.03.1993 3,9 Vollprogramm 9 kabel eins 29.02.1992 3,8 Vollprogramm 10 3Sat 01.12.1984 1,1 Vollprogramm 11 arte 30.05.1992 1 Vollprogramm 12 DMAX 01.09.2006 1 Vollprogramm 13 Servus TV 01.01.2011 0,2 Vollprogramm 14 Family TV 04.01.2009 0 Vollprogramm Teleshopping Sendestart MA Genre lt. KEK 18 HSE24 16.10.1995 0 Teleshopping 19 QVC 01.12.1996 0 Teleshopping 20 Channel 21 01.03.2001 0 Teleshopping 21 sonnenklar.TV 01.03.2003 0 Teleshopping 22 1-2-3.tv 01.10.2004 0 Teleshopping 23 Juwelo TV 01.10.2006 0 Teleshopping 24 QVC Plus 01.09.2010 0 Teleshopping 25 QVC Beauty&Style 01.03.2012 0 Teleshopping Unterhaltung 30 ZDFneo 01.11.2009 1,3 Unterhaltung 31 RTL Nitro 01.04.2012 1,3 Unterhaltung 32 Tele 5 28.04.2002 0,9 Unterhaltung 33 Einsfestival 30.08.1997 0,8 Unterhaltung 34 Disney Channel 07.01.2014 0,8 Unterhaltung 35 sixx 07.05.2010 0,7 Unterhaltung 36 Sat.1 Gold 17.01.2013 0,7 Unterhaltung 37 ProSieben MAXX 03.09.2013 0,5 Unterhaltung 38 VIVA / Comedy Central 01.12.1993 0,3 Unterhaltung 39 ZDFkultur 07.05.2011 0,3 Unterhaltung 40 TLC 10.04.2014 0,1 Unterhaltung 41 EinsPlus 29.08.1997 0 Unterhaltung 42 ANIXE 01.01.2008 0 Unterhaltung 43 (MTV gibt es nur in HD) 01.01.2011 0 Unterhaltung -

TV Channel Monitoring

TV Channel Monitoring The channels below are monitored in real- time, 24/7. United States 247 channels NATIONAL A&E Comedy Central Fuse ABC CW FX ABC Family Destination America GAC AHC Discovery Galavision (GALA) AMC Discovery Fit & Health Golf Channel Animal Planet Discovery ID GSN BBC America Disney Channel Hallmark Channel BET DIY HGTV Big Ten Network E! History Channel Biography Channel ESPN HLN Bloomberg News ESPN 2 HSN BRAVO ESPN Classic IFC Cartoon Network ESPN News ION CBS ESPN U Lifetime CBS Sports Food Network LOGO Cinemax East Fox 5 MLB CMT Fox Business MSG Network CNBC Fox News MSNBC CNBC World Fox Sports 1 MTV CNN Fox Sports 2 MTV2 My9 Science Channel Travel Channel National Geographic ShowTime East truTV NBA Spike TV TV1 NBC SyFy TV Guide NBC Sports (Versus) TBN TV Land NFL TBS Univision NHL TCM USA Nickelodeon Telemundo VH1 Nicktoons Tennis Channel VH1 Classic OLN The Cooking VICELAND Oprah Winfrey Net. Channel WE Ovation The Hub WGN America Oxygen Time Warner Cable WLIW QVC TLC YES REELZ TNT New York ABC (WABC) Fox (WNYW) Univision (WXTV) CBS (WCBS) MyNetworkTV (WWOR) CW (WPIX) NBC (WNBC) Los Angeles ABC (KABC) CW (KTLA) NBC (KNBC) CBS (KCBS) FOX (KTTV) Univision (KMEX) Baltimore ABC (WMAR-DT) Fox (WBFF-DT) NBC (WBAL-DT CBS (WJZ-DT) MyNetworkTV CW (WNUV-DT) (WUTB-DT) Chicago ABC (WLS-DT) Fox (WFLD-DT) Univision (WGBO- CBS (WBBM-DT) NBC (WMAQ-DT) DT) CW (WGN-DT) San Diego ABC (KGTV) FOX (KSWB) The CW (KFMB) CBS (KFMB) NBC (KNSD) Univision (KBNT) The United Kingdom 74 Channels 4Music Home Nick Toons 5 star Horror Channel