James Farrar TITLE of PAPER: LEP Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Knaresborough

KING JAMES’S SCHOOL KNARESBOROUGH INFORMATION TO PARENTS 2015 - 2016 INDEX Applications for school entry as at September 2014 2 Visiting the school 2 Parental preference 3 Transport 3 Appeals 3 Out of Area students 3 Students in Year 8 and above 3 Facilities for Learning 4 Student Guidance 4 Careers Education and Guidance 5 Parents and School 6 Involving parents 6 Praise, Reward and Sanctions 6 Parents’ Evenings, Reports and Homework 6 School Routine – The School Day 7 School Calendar Dates 2015 - 2016 7 Academic Year 7 Who to contact at King James’s School 8 Attendance 8 Security 8 1 ParentPay 9 School Lunch 9 Lockers 9 School Fund 9 Medical Arrangements 10 Library 10 Aerosols 10 Assemblies 10 Access and Inclusion 10 Curriculum 11 Departmental Information 13 Learning Support Department 19 Open Mindsets and Challenges for All 19 Personal, Social, Health Citizenship and Economic Education 19 Additional Information 20 Anti-Bullying 20 Social mentoring and emotional support 20 Sex and Relationship Education 20 Exam Entry Policy 20 Internet Access 21 School Documents 21 Charging for School Activities 21 Complaints procedure 21 Child Protection 21 School Uniform 22 Valuable Items, Jewellery, Make-up, Hairstyles 23 Outdoor Clothing 23 Specialist Clothing 23 Physical Education Equipment 24 Staff List 2014/2015 25 School Governors 28 Destinations of School Leavers 29 Applications for School Entry as at September 2014 King James's School is a co-educational, comprehensive school which normally provides places for children aged 11-18 who live in the parishes of Knaresborough, Allerton Mauleverer with Hopperton, Brearton, Coneythorpe with Clareton, Farnham, Flaxby, Goldsborough, Kirk Deighton, Knaresborough Outer, Little Ribston, Nidd, North Deighton, Scotton, and Scriven. -

(Public Pack)Agenda Document for Local Government North Yorkshire

Public Document Pack Local Government North Yorkshire and York Notice of a public meeting of Local Government North Yorkshire and York To: Councillors Keith Aspden (City of York Council), Mr Jim Bailey (North York Moors National Park Authority), Richard Cooper (Harrogate Borough Council), Mark Crane (Selby District Council), Angie Dale (Richmondshire District Council), Keane Duncan (Ryedale District Council), Richard Foster (Craven District Council), Mr Neil Heseltine (Yorkshire Dales National Park Authority), Carl Les (North Yorkshire County Council), Mark Robson (Hambleton District Council) and Steve Siddons (Scarborough Borough Council). Date: Friday, 5 March 2021 Time: 2.30 pm Venue: Remote meeting held via Zoom AGENDA Anybody can watch this meeting live on YouTube via the following link https://youtu.be/9AxmIDHj_dE . After the meeting, a recording will be available via the link - www.northyorks.gov.uk/livemeetings Business 1. Substitutions and Apologies for Absence Councillor Liz Colling is substituting for Councillor Steve Siddons (Scarborough Borough Council). Louise Wood is substituting for Stacey Burlet (Ryedale District Council). Apology received from Tom Hind (North York Moors National Park Authority). 2. Election of Chair Suggested that Councillor Keith Aspden continues as Chair until LGNYY’s AGM to be held in July 2021. 3. Declarations of Interest Enquiries relating to this agenda please contact Ruth Gladstone Tel: 01609 532555 or email [email protected]. Agenda andPage papers 1 available via www.northyorks.gov.uk OFFICIAL 4. Minutes of the LGNYY meeting held on 6 March 2020 (Pages 3 - 6) 5. York and North Yorkshire LEP's Project Pipeline Report of James Farrar (Chief Operating Officer of the York and North Yorkshire Local Enterprise Partnership) Helen Simpson (Chair Elect) has been invited to attend this meeting. -

Appendix 3: Summary of the Baseline Position

Appendix 3: Summary of the Baseline Position 1. Quality housing available to everyone........................................................................................................................................................................ 78 2. Conditions and services to engender good health ..................................................................................................................................................... 81 3. Safety and security for people and property .............................................................................................................................................................. 84 4. Vibrant communities which participate in decision making ....................................................................................................................................... 85 5. Culture, leisure and recreation activities available to all ............................................................................................................................................ 88 6. Local needs met locally ............................................................................................................................................................................................... 90 7. Education and training opportunities which build the skills and capacity of the population .................................................................................... 94 8. Biodiversity and attractive natural environments ..................................................................................................................................................... -

Year 11 Careers Newsletter Post-16 Option Planning We Hope That You Have Settled Into Year 11 and Are Ready for the Challenges That Lie Ahead

Year 11 Careers Newsletter Post-16 Option Planning We hope that you have settled into Year 11 and are ready for the challenges that lie ahead. The Careers Department are on hand to support you as begin to turn your thoughts to your post-16 plans through an individual 30-minute career guidance meeting which will be scheduled for you sometime between the October and February half terms. Before this takes place however we hope that the following information will help you to consider your options and make realistic and informed decisions about your future plans. You are legally obliged to remain in education or training until you are 18. This means that you must be enrolled with one of the following: • A Sixth Form School • A College of Further Education • Employment with Training such as an Apprenticeship or Traineeship 1. The Associated Sixth Form Studying A Levels and Level 3 Applied Courses in the Associated Sixth From enables you to continue your GCSE subjects in greater depth and/or discover new subjects that are only offered after Year 11. You will choose to study 3 subjects and it is important to consider subjects that: • You enjoy • You believe you can do well in • You may need to enable you to access opportunities in the future To ensure that each student has the best opportunity to succeed in his or her chosen curriculum the Associate Sixth Form has general entry criteria and individual subjects also have their own specific requirements for each course. Please refer to the Associated Sixth Form prospectus for more information. -

Gold Award Winner Connor Coupland Is a Student at Leeds College of Building and Works for Aone+ Where He Is Heavily Involved with Managing Their GIS Database

BTEC Apprentice 16 –18 of the Year 2019 This summer’s 9th annual BTEC Awards were all about celebrating exceptional BTEC learners and apprentices – and we had a record number of nominations. In the BTEC Apprentice 16-18 of the Year category, we had a total of 4 winners: 3 Bronze and 1 Gold. Find out who they are: Gold Award Winner Connor Coupland is a student at Leeds College of Building and works for AOne+ where he is heavily involved with managing their GIS database. His largest project to date is the ‘Integrated Area Programme’, which is looking to save tens-of-thousands of public sector money. Bronze Award Winners Name School/College Country Daniel Huxtable Exeter College United Kingdom Jean Tams Newcastle College United Kingdom Louis Andrews Louis Andrews United Kingdom BTEC Apprentice 19+ of the Year 2019 This summer’s 9th annual BTEC Awards were all about celebrating exceptional BTEC learners and apprentices - and we had a record number of nominations. In the BTEC Apprentice 19+ of the Year category, we had a total of 4 winners: 2 Bronze; 1 Silver and 1 Gold. Find out who they are: Gold Award Winner After completing a successful work placement at Jacobs, Christopher Meredith was offered an Apprenticeship with them. Christopher then completed progressed to a Higher Level Apprenticeship and will be starting his Degree Apprenticeship later on this year. Silver Award Winners Name School/College Country Lee Woodward Training 2000 United Kingdom Bronze Award Winners Name School/College Country Lee Curry Pearson TQ United Kingdom Lee Woodward Pearson TQ United Kingdom BTEC Apprenticeship Provider of the Year 2019 This summer’s 9th annual BTEC Awards were all about celebrating the amazing apprenticeship providers that provide and deliver high-quality BTEC qualifications to learners – and we had a record number of nominations. -

York, North Yorkshire, East Riding and Hull Area Review Final Report

York, North Yorkshire, East Riding and Hull Area Review Final Report August 2017 Contents Background 4 The needs of the York, North Yorkshire, East Riding and Hull area 5 Demographics and the economy 5 Patterns of employment and future growth 7 LEP priorities 10 Feedback from LEPs, employers, local authorities, students and staff 13 The quantity and quality of current provision 18 Performance of schools at Key Stage 4 19 Schools with sixth-forms 19 The further education and sixth-form colleges 20 The current offer in the colleges 22 Quality of provision and financial sustainability of colleges 23 Higher education in further education 25 Provision for students with special educational needs and disability (SEND) and high needs 25 Apprenticeships and apprenticeship providers 26 Land based provision 26 The need for change 28 The key areas for change 28 Initial options raised during visits to colleges 28 Criteria for evaluating options and use of sector benchmarks 30 Assessment criteria 30 FE sector benchmarks 30 Recommendations agreed by the steering group 32 Askham Bryan College 33 Bishop Burton College 34 Craven College 35 East Riding College 36 Hull College Group 37 2 Scarborough Sixth Form College 38 Scarborough TEC (formerly Yorkshire Coast College) 39 Selby College 40 Wilberforce and Wyke Sixth- Form Colleges 42 York College 43 Conclusions from this review 48 Next steps 50 3 Background In July 2015, the government announced a rolling programme of around 40 local area reviews, to be completed by March 2017, covering all general further education and sixth- form colleges in England. The reviews are designed to ensure that colleges are financially stable into the longer-term, that they are run efficiently, and are well positioned to meet the present and future needs of individual students and the demands of employers. -

2014 Admissions Cycle

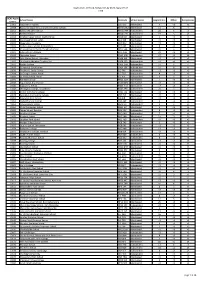

Applications, Offers & Acceptances by UCAS Apply Centre 2014 UCAS Apply School Name Postcode School Sector Applications Offers Acceptances Centre 10002 Ysgol David Hughes LL59 5SS Maintained 4 <3 <3 10008 Redborne Upper School and Community College MK45 2NU Maintained 11 5 4 10011 Bedford Modern School MK41 7NT Independent 20 5 3 10012 Bedford School MK40 2TU Independent 19 3 <3 10018 Stratton Upper School, Bedfordshire SG18 8JB Maintained 3 <3 <3 10020 Manshead School, Luton LU1 4BB Maintained <3 <3 <3 10022 Queensbury Academy LU6 3BU Maintained <3 <3 <3 10024 Cedars Upper School, Bedfordshire LU7 2AE Maintained 4 <3 <3 10026 St Marylebone Church of England School W1U 5BA Maintained 20 6 5 10027 Luton VI Form College LU2 7EW Maintained 21 <3 <3 10029 Abingdon School OX14 1DE Independent 27 13 13 10030 John Mason School, Abingdon OX14 1JB Maintained <3 <3 <3 10031 Our Lady's Abingdon Trustees Ltd OX14 3PS Independent <3 <3 <3 10032 Radley College OX14 2HR Independent 10 4 4 10033 St Helen & St Katharine OX14 1BE Independent 14 8 8 10036 The Marist Senior School SL5 7PS Independent <3 <3 <3 10038 St Georges School, Ascot SL5 7DZ Independent 4 <3 <3 10039 St Marys School, Ascot SL5 9JF Independent 6 3 3 10041 Ranelagh School RG12 9DA Maintained 7 <3 <3 10043 Ysgol Gyfun Bro Myrddin SA32 8DN Maintained <3 <3 <3 10044 Edgbarrow School RG45 7HZ Maintained <3 <3 <3 10045 Wellington College, Crowthorne RG45 7PU Independent 20 6 6 10046 Didcot Sixth Form College OX11 7AJ Maintained <3 <3 <3 10048 Faringdon Community College SN7 7LB Maintained -

Planning Your Future Post-16 2020-21 Updated May 2021

2020-21 Planning your future post-16 A guide for parents, carers and young people Planning for your future | 2020-21 1 It all begins here Year 11 can be both a very exciting time and a very stressful time for young people. On top of finishing coursework and taking exams, your son or daughter will have to make important choices about what they want to do next year. It is also an important time for you as a parent or carer. Your help and support is vital and you need to ensure that you have all the information you need to help them make their decisions. Due to the Covid-19 pandemic, most students were not able to attend school from the end of March to the end of the summer term. Added to this, at the time of writing, arrangements for GCSE and other examinations in 2021 have not yet been confirmed, although a three week delay to the usual timetable has been announced. This means that our young people find themselves in an uncertain situation – we want to support them through this difficult period as well as possible so that they can progress successfully to their next stage. This booklet sets out: • The right starting point • Making choices • Staying on in full-time education: Courses and qualifications, Providers in York and Other options and financial support • Apprenticeships and Traineeships • What about the future? Employment and the job market • What about the future? Thinking about Higher Education? • General education / in-year provision • Institute of Technology • Doing more, going further: Volunteering • Further help and advice: Where to look, who to talk to • Lifelong learning • Get in touch in York York has a wide range of high quality options available for all young people, at all levels. -

Post 16 Provisions • Post 16 Special Schools. the Nearest Specialist

Post 16 Provisions Post 16 special schools. The nearest specialist school for most families would be Springhead school in Scarborough which offers a Post 16 curriculum. More information on the provision they offer can be found on www.sprinhead.n-yorks.sch.uk or you can contact the school on 01723 367829. Springhead Post 16 provision, from September 2017, will be based at Lady Edith’s Drive in Scarborough. Welburn Hall school in Kirbymoorside offer Post 16 provision on both a daily and boarding basis (although boarding is limited by space). More information on the provision they offer can be found on www.welburn-hall.n-yorks.sch.uk or you can contact the school on 01751 431218. More information on special schools can be found on the North Yorkshire Website www.northyorks.gov.uk/send-lovcal-offer. You must also contact the Assessment and Reviewing officer regarding special school provision. The contact email is [email protected]. Askham Bryan College York, offer a range of courses at entry level based around animal care, for horticulture and land based skills. The website address is www.askham-brayn.ac.uk. Bishop Burton College, Beverley offers a range of courses starting at the entry level based around animal care, horticultures and land based skills. The website address is www.bishopburton.ac.uk. Future Works based at The Street offer courses for those not yet ready for employment or further education. The course is called Improve My Prospects and runs for 2 days a week. The contact number is 01723 449616. Gateshead College offer a programme called ‘Project Choice’ which is based at The Street in Scarborough, to support young people with learning difficulties and/or disabilities into work. -

Printlink Exhibition Profiles Work of Craven Artists 14Th Nov-13Th Dec 2009

PRINTLINK EXHIBITION PROFILES WORK OF CRAVEN ARTISTS 14TH NOVEMBER-13TH DECEMBER 2009 MUSEUM OF NORTH CRAVEN LIFE, THE FOLLY, IN SETTLE Opening times: Tuesday, Friday, Saturday and Sunday 11.30am-4.30pm A new exhibition, called Printlink, at the Museum of North Craven Life in Settle will feature the work of five printmakers, all living and working in the Craven District of North Yorkshire. The exhibition is inspired by the geographical connections between the Printlink artists from Skipton, to Ribblehead , Middleton to Appletreewick. The physical links between these locations, including the Pennine Way and the railways and canals with their heritage and history, are all reflected in the show. The Printlink collective have exhibited together for over six years. Over this time the group have worked to raise awareness and understanding of the many different printmaking processes. They are also keen to encourage people to get involved in printmaking as a form of self-expression and run regular workshops to help develop new skills. Artist Philippa Troutman, a member of the Prinklink collective, said: “The friendships that have developed and the professional support that we offer to each other strengthens the group and makes exhibiting together an exciting and pleasurable activity. As printmakers we bring an interest and understanding of each others working methods. We are committed to promoting printmaking in the region and often run activities together.” Printmaking is an art form that includes a variety of processes involving the making of a plate from which an image is produced. These processes include screen printing, linocut, woodcut and etching. -

HGS-Sixth-Form-Prospectus-2019-Website.Pdf

PROSPECTUS 2019 HARROGATE GRAMMAR SCHOOL Contents Welcome 3 Progression Map 10 Sixth Form Student Leadership Team 4 Scholars’ Programme 10 General Information 5 Entry Requirements 11 Advanced Level Subjects 6 Courses 12 Extended Project Qualification 7 Application Process 13 Mathematical Studies (Core Maths) 7 Opportunities for Leadership & Enrichment 14 Packages 8 Leading on Learning 16 Progression 9 A Centre of Excellence for Language Provision 17 Bursaries & Transportation 18 Courses & Further Information Extended Project Qualification (EPQ) 35 MATHEMATICS FACULTY ART, DESIGN & IT FACULTY Mathematical Studies (Core Maths) 45 Art & Design A Level 21 Mathematics AS Level 46 Art & Design: Fine Art A Level 22 Mathematics A Level 47 Art & Design: Textiles A Level 23 Mathematics (Further) A Level 48 Computer Science A Level 28 PE & SPORT FACULTY Digital Media OCR Level 3 Cambridge Sport BTEC Level 3 National Extended Certificate 60 Technical Extended Certificate 29 PERFORMING ARTS FACULTY Graphics A Level 41 Drama & Theatre Studies A Level 30 Photography A Level 53 Music A Level 49 Product Design A Level 55 Music Level 3 Subsidiary Diploma (BTEC) 50 ENGLISH FACULTY Performing Arts (Acting) English Language A Level 32 Level 3 Extended Certificate (BTEC) 51 English Literature A Level 33 SCIENCE FACULTY HUMANITIES FACULTY Biology A Level 24 Geography A Level 38 Chemistry A Level 26 Government & Politics A Level 40 Physics A Level 54 History A Level 42 SOCIAL SCIENCES FACULTY Religious Studies A Level 57 Business A Level 25 LANGUAGES FACULTY Economics A Level 31 Chinese GCSE 27 Psychology A Level 56 French A Level 37 Sociology A Level 58 German A Level 39 FURTHER INFORMATION Italian A Level 43 Student Destinations 2018 63 Spanish A Level 59 Year 13 Examination Results 2018 68 Welcome We are very proud of the Sixth Form at Harrogate Grammar School and the outstanding achievements of our students. -

Useful Websites Job Application and Apprenticeship Further Education

Useful Websites To identify skill areas and broad suggestions for careers which may match these: www.truity.com and select ‘Holland Code Career Test’. This uses a like/dislike response approach to identify skills areas and suggest careers linked to these. For more information on particular careers look at Job Profiles on: www.prospects.ac.uk/job-profiles www.nationalcareersservice.direct.gov/job-profiles Job Application and Apprenticeship For information on where to find jobs and apprenticeships and make applications: www.findanapprenticeshipservice.gov.uk www.indeed.co.uk Please use both websites as the ‘Indeed’ website tends to have apprenticeships including ‘higher’ and ‘degree’ which are not necessarily on the ‘apprenticeship.gov’ website. There are plenty of other websites but these are possibly the easiest to use Leeds Pathways-Careers Information Advice and Guidance including job search: www.leeds.gov.uk/leedspathways /#LeedsNextSteps2018/ Select ‘visit a drop in centre near you’ and find the names of two Leeds Pathways advisers: Gayle Ferris - mob: 07891 275026 and Ian Grant - mob: 07891 274524. NB You may well need to leave voice mail or better still a text if they are not available Further Education help Further Education Colleges Please note that most FE colleges offer a range of apprenticeships as well as full time courses and in both cases you can apply on- line. Below are some of the colleges. If you live outside York and North Yorkshire eg, you will have to check local colleges. Check websites for details but for apprenticeships