CONSTRAINTS to FIBER PRODUCTION T. Townsend

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investigation of the Mechanical Properties of a Carbon Fibre-Reinforced Nylon Filament for 3D Printing

machines Article Investigation of the Mechanical Properties of a Carbon Fibre-Reinforced Nylon Filament for 3D Printing Flaviana Calignano 1,* , Massimo Lorusso 2 , Ignanio Roppolo 3 and Paolo Minetola 1 1 Department of Management and Production Engineering, Politecnico di Torino, Corso Duca degli Abruzzi 24, 10129 Turin, Italy; [email protected] 2 Istituto Italiano di Tecnologia, Center for Sustainable Future Technologies IIT@Polito, Corso Trento 21, 10129 Turin, Italy; [email protected] 3 Department of Applied Science and Technology, Politecnico di Torino, Corso Duca degli Abruzzi 24, 10129 Turin, Italy; [email protected] * Correspondence: fl[email protected]; Tel.: +39-011-090-7218 Received: 19 July 2020; Accepted: 2 September 2020; Published: 4 September 2020 Abstract: Additive manufacturing (i.e., 3D printing) has rapidly developed in recent years. In the recent past, many researchers have highlighted the development of in-house filaments for fused filament fabrication (FFF), which can extend the corresponding field of application. Due to the limited mechanical properties and deficient functionality of printed polymer parts, there is a need to develop printable polymer composites that exhibit high performance. This study analyses the actual mechanical characteristics of parts fabricated with a low-cost printer from a carbon fibre-reinforced nylon filament. The results show that the obtained values differ considerably from the values presented in the datasheets of various filament suppliers. Moreover, the hardness and tensile strength are influenced by the building direction, the infill percentage, and the thermal stresses, whereas the resilience is affected only by the building direction. Furthermore, the relationship between the mechanical properties and the filling factor is not linear. -

Appendix 1 Sources

APPENDIX 1 SOURCES UMIST: DEPARTMENT OF TEXTILES Most of the work described in this book comes from research in the Department of Textiles, UMIST, under the direction of Professor John Hearle. It started with the purchase of a scanning electron microscope with a grant from the Science Research Council in 1967, together with five-year funding for an experimental officer and a technician. Since 1972, the staff have been supported by general UMIST funds; a second grant from SERC enabled a replacement SEM to be bought in 1979; industrial sponsors, listed below, have contributed through membership of the Fibre Fracture Research Group; special research grants have been made by the Ministry of Defence (SCRDE, Colchester, and RAE, Farnborough) and jointly by the Wool Research Organization of New Zealand (WRONZ) and the Wool Foundation (IWS); and other research programmes and contract services have contributed indirectly to our knowledge. Pat Cross was the first SEM experimental officer and she was followed in 1969 by Brenda Lomas, who retired in 1990. Trevor Jones then took on responsibility for microscopy in the Department of Textiles in addition to photography. Over the years, many staff and students have contributed to the research. Their names are given below. Some have worked wholly on fibre fracture problems. Others have used fracture studies as an incidental element in their work. PERSONNEL The following people at UMIST have contributed to the research. Academic staff J.D. Berry Aspects of fibre breakage CP. Buckley Mechanics of tensile fracture, general direction C. Carr Fabric studies W.D. Cooke Pilling in knitwear, conservation studies G.E. -

Natural Fibers and Fiber-Based Materials in Biorefineries

Natural Fibers and Fiber-based Materials in Biorefineries Status Report 2018 This report was issued on behalf of IEA Bioenergy Task 42. It provides an overview of various fiber sources, their properties and their relevance in biorefineries. Their status in the scientific literature and market aspects are discussed. The report provides information for a broader audience about opportunities to sustainably add value to biorefineries by considerin g fiber applications as possible alternatives to other usage paths. IEA Bioenergy Task 42: December 2018 Natural Fibers and Fiber-based Materials in Biorefineries Status Report 2018 Report prepared by Julia Wenger, Tobias Stern, Josef-Peter Schöggl (University of Graz), René van Ree (Wageningen Food and Bio-based Research), Ugo De Corato, Isabella De Bari (ENEA), Geoff Bell (Microbiogen Australia Pty Ltd.), Heinz Stichnothe (Thünen Institute) With input from Jan van Dam, Martien van den Oever (Wageningen Food and Bio-based Research), Julia Graf (University of Graz), Henning Jørgensen (University of Copenhagen), Karin Fackler (Lenzing AG), Nicoletta Ravasio (CNR-ISTM), Michael Mandl (tbw research GesmbH), Borislava Kostova (formerly: U.S. Department of Energy) and many NTLs of IEA Bioenergy Task 42 in various discussions Disclaimer Whilst the information in this publication is derived from reliable sources, and reasonable care has been taken in its compilation, IEA Bioenergy, its Task42 Biorefinery and the authors of the publication cannot make any representation of warranty, expressed or implied, regarding the verity, accuracy, adequacy, or completeness of the information contained herein. IEA Bioenergy, its Task42 Biorefinery and the authors do not accept any liability towards the readers and users of the publication for any inaccuracy, error, or omission, regardless of the cause, or any damages resulting therefrom. -

Fibers and Fabrics; TX335 .A1 U6 NO

KitlQRr Bureau of Standards Reference book' no' to ygjgtv |Oi Admin. Bldg. taken from the library, gmp STATES Ite.WMENT OF COMMERCE PUBLICATION A11ID3 Db3SbD All103063560 Blandford, Josephlne/FIbers and fabrics; TX335 .A1 U6 NO. 1, 1970 C.1 NBS-PUB-R 1 ^TES ‘‘•‘‘'/I'ti'i'.1'1' 1: BBB8 MB A Consumer’s Guide from the Mational Bureau of Standards NBS CIS 1 IIIIShSs Fibers and Fabrics by Josephine M. Blandford and Lois M. Gurel INFORMATION ABOUT NATURAL AND MAN-MADE FIBERS AND FABRICS TO MEET YOUR PARTICULAR NEEDS. NBS CONSUMER INFORMATION SERIES 1 Editor: James E. Payne Issued November 1970 U.S. DEPARTMENT OF COMMERCE Maurice H. Stans, Secretary Rocco C. Siciliano, Under Secretary Myron Tribus, Assistant Secretary for Science and Technology NATIONAL BUREAU OF STANDARDS A Consumer’s Lewis M. Branscomb, Director GUIDE FROM THE) NATIONAL BUREAU OF STANDARDS For sale by the Superintendent of Documents, U.S. Government Printing Office, U.S. DEPARTMENT Washington, D.C. 20402. OF COMMERCE Price 65 cents. NATIONAL BUREAU OF STANDARDS APR 1 0 1971 FOREWORD Technology is changing not only the products you buy, but the marketplace as well. Unfortunately, this is not an unmixed blessing. Products are constantly being improved, but designs are complicated, quality is vari¬ able, and good advice is hard to get. Modern stores and merchandising bring you a wide variety of products; but the large number of choices and the lack of dependable infor¬ mation often make shopping a confusing and frustrating experience. A generation ago the merchant was likely to be a friend of the family. -

Sockwear Recommendations for People with Diabetes

Clinical Decision Making Sockwear Recommendations for People With Diabetes Carol B. Feldman, MSN, RN, CDE, and Ellen D. Davis, MS, RN, CDE Case Presentation A.B., a 55-year-old man who had adequate blood glucose control. His monofilament testing confirmed that been diagnosed with type 2 diabetes 6 most recent HbA1c was 6.5%. foot sensation was intact. He had easi- months ago, was a new patient in the The skin on his feet was intact, ly palpable pedal pulses and no edema. foot clinic of the Durham VA without redness, and its texture was During routine discussion of foot- Medical Center. At the time of his smooth and soft. His nails were intact care precautions, he asked what kind first visit, he was taking metformin, without signs of onychomycosis. The of socks he should wear to prevent 500 mg twice a day, and maintained shape of his feet was normal, and problems. Discussion Good foot care practices are impor- physicians, podiatrists, staff nurses, Although they expressed concern that tant for people with diabetes. A large and certified diabetes educators socks should be comfortable, they percentage of diabetic patients under- (CDEs) from Duke University Medical were also likely to recommend specific go nontraumatic amputation after Center, the Durham VA Medical fabric types. Most of the nurses diabetic neuropathy renders them Center, and surrounding areas to thought people with diabetes should unable to feel festering foot injuries. explore providers’ sockwear recom- wear cotton or wool socks. But those What’s more, within 3 years of a first mendations and the reasoning behind recommending acrylic fabrics said amputation, up to half of these them. -

Production and Characterization of Cut Resistant Acrylic/Copolyaramid Fibers Via Bicomponent Wet Spinning Stephen Hipp Clemson University, [email protected]

Clemson University TigerPrints All Dissertations Dissertations 12-2015 Production and Characterization of Cut Resistant Acrylic/Copolyaramid Fibers Via Bicomponent Wet Spinning Stephen Hipp Clemson University, [email protected] Follow this and additional works at: https://tigerprints.clemson.edu/all_dissertations Part of the Polymer Chemistry Commons Recommended Citation Hipp, Stephen, "Production and Characterization of Cut Resistant Acrylic/Copolyaramid Fibers Via Bicomponent Wet Spinning" (2015). All Dissertations. 1587. https://tigerprints.clemson.edu/all_dissertations/1587 This Dissertation is brought to you for free and open access by the Dissertations at TigerPrints. It has been accepted for inclusion in All Dissertations by an authorized administrator of TigerPrints. For more information, please contact [email protected]. PRODUCTION AND CHARACTERIZATION OF CUT RESISTANT ACRYLIC/COPOLYARAMID FIBERS VIA BICOMPONENT WET SPINNING A Dissertation Presented to the Graduate School of Clemson University In Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy Polymer and Fiber Science by Stephen James Hipp December 2015 Accepted by: Dr. Philip Brown, Committee Chair Dr. Gary Lickfield Dr. Olin Mefford Dr. Julia Sharp Abstract A composite fiber system consisting of a sheath core bicomponent polymer fiber loaded with hard ceramic particles was developed and characterized for use in cut protective clothing. The core component was comprised of a copolyaramid in order to provide high base cut resistance. An acrylic-copolyaramid polymer blend was used for the sheath component to improve processability and provide potential benefits such as dyeability. Lastly, aluminum oxide particles were incorporated into the fiber core to deflect and deform the cutting edge, further improving cut resistance. A series of designed experiments was used to explore the effects of the wet spinning and heat treatment processes on the structure and properties of the bicomponent fiber. -

Evaluation of Physical Properties of Errandi-Acrylic Union Fabrics

Journal of Applied and Natural Science 10 (3): 925 - 930 (2018) ISSN : 0974-9411 (Print), 2231-5209 (Online) journals.ansfoundation.org Evaluation of physical properties of Errandi-acrylic union fabrics Sunita Boruah* Article Info Assistat Professor, Department of Fashion Design and Technology, Assam Women’s DOI:10.31018/jans.v10i3.1816 University, Jorhat-785004 (Assam), India Received: June 30, 2018 B. Baishya Kalita Revised: July 16, 2018 Professor, Department of Textiles and Apparel designing, College of Community Science, Accepted: July 30, 2018 Assam Agricultural University, Jorhat-785013 (Assam), India *Corresponding author. E-Mail: [email protected] How to Cite Abstract: Boruah, S. et al. (2018). Errandi silk has a potential of emerging as “A silk of the new millennium”. The experi- Evaluation of physical mental finding provides information on physical properties as well as subjective evalua- properties of Errandi- tions of Errandi silk -Acrylic union fabrics with twill and herringbone weave. The count and acrylic union fabrics. diameter of errandi silk fibre were higher than acrylic fibre and in case of woven fabrics, Journal of Applied and herringbone weave were found to have maximum value in cloth covers, weight and thick- Natural Science, 10(3): ness. A comparative subjective evaluation was done based on fabric quality by the panel 925 - 930 of 100 respondents. 100 per cent respondent opined that all the woven samples have good appearance, soft in hand and smooth in texture. It was observed that cent percent of respondents found errandi-acrylic blended union fabrics with twill and herringbone weaves were high in lustre. The costs of blended yarns and the cost of union fabrics of different proportion were got reduced in comparison to that of 100 per cent errandi-silk yarn (Rs.3000.00/kg) and controlled errandi silk fabrics (Rs.985.00/mt.). -

Colaris Digital Textile Printing

ZIMMER AUSTRIA | DIGITAL PRINTING SYSTEMS COLARIS DIGITAL TEXTILE PRINTING HOME TEXTILES APPAREL DECORATION AUTOMOTIVE FLAGS & BANNERS www.zimmer-austria.com 2020.01.15 page 1 CONTENT 1. INNOVATION IS IN OUR DNA 1.1. HISTORIC MILESTONES 3 2. INK CLASSES 2.1. TYPES | PRODUCTS | PROCESS | REQUIREMENTS 4 2.2. TYPES | PRODUCTS | PROCESS | REQUIREMENTS 5 3. PRINT TECHNOLOGY 3.1. PROCESSING DIAGRAM 6 3.2. PROCESS EQUIPMENT 7 4. REACTIVE PRINTING 4.1. GENERAL INFORMATION 8 4.2. EXAMPLE: TERRY TOWEL PRINT PRODUCTION 9 5. ACID PRINTING 5.1. GENERAL INFORMATION 10 5.2. EXAMPLE: UPHOLSTERY PRINT LINE 11 6. DISPERSE / SUBLIMATION PRINTING 6.1. GENERAL INFORMATION 12 6.2. EXAMPLE: PES BLANKET PRINT LINE 13 7. VAT INDANTHRENE® PRINTING 7.1. GENERAL INFORMATION 14 7.2. APPLICATION DIVERSITY 15 8. PIGMENT PRINTING 8.1. GENERAL INFORMATION 16 8.2. APPLICATION DIVERSITY 17 9. CATIONIC PRINTING 9.1. GENERAL INFORMATION 18 10. COLARIS - CHARACTERISTICS AND FEATURES 10.1. COLARIS MODELS 19 11. COLARIS FEATURES AND COMPONENTS 11.1. INTEGRATED MACHINE COMPONENTS 20 11.2. INTEGRATED MACHINE COMPONENTS 21 12. PROCESS EQUIPMENT 12.1. INLINE COMPONENTS 22 12.2. OFFLINE COMPONENTS 23 13. PRINT HEAD 13.1. TECHNOLOGY 24 13.2. RECONDITION CENTER 25 14. ZIMMER TECHNOLOGY & APPLICATION CENTER 14.1. GENERAL INFORMATION 26 14.2. EQUIPMENT & FACILITIES 27 www.zimmer-austria.com 2020.01.15 page 2 1. INNOVATION IS IN OUR DNA 1.1. HISTORIC MILESTONES Vertical Duplex blanket printer from 1951 First commercial rotary screen printer 1958 The broad digital competence of ZIMMER AUSTRIA is based on an innovation introduced more than 4 decades ago. -

All About Fibers

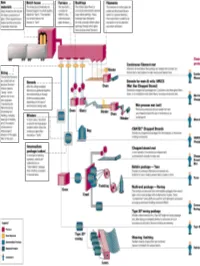

RawRaw MaterialsMaterials ¾ More than half the mix is silica sand, the basic building block of any glass. ¾ Other ingredients are borates and trace amounts of specialty chemicals. Return © 2003, P. Joyce BatchBatch HouseHouse && FurnaceFurnace ¾ The materials are blended together in a bulk quantity, called the "batch." ¾ The blended mix is then fed into the furnace or "tank." ¾ The temperature is so high that the sand and other ingredients dissolve into molten glass. Return © 2003, P. Joyce BushingsBushings ¾The molten glass flows to numerous high heat-resistant platinum trays which have thousands of small, precisely drilled tubular openings, called "bushings." Return © 2003, P. Joyce FilamentsFilaments ¾This thin stream of molten glass is pulled and attenuated (drawn down) to a precise diameter, then quenched or cooled by air and water to fix this diameter and create a filament. Return © 2003, P. Joyce SizingSizing ¾The hair-like filaments are coated with an aqueous chemical mixture called a "sizing," which serves two main purposes: 1) protecting the filaments from each other during processing and handling, and 2) ensuring good adhesion of the glass fiber to the resin. Return © 2003, P. Joyce WindersWinders ¾ In most cases, the strand is wound onto high-speed winders which collect the continuous fiber glass into balls or "doffs.“ Single end roving ¾ Most of these packages are shipped directly to customers for such processes as pultrusion and filament winding. ¾ Doffs are heated in an oven to dry the chemical sizing. Return © 2003, P. Joyce IntermediateIntermediate PackagePackage ¾ In one type of winding operation, strands are collected into an "intermediate" package that is further processed in one of several ways. -

Carbon Fiber Supply and Demand

Carbon Fiber Supply and Demand Supply of PAN based carbon fiber New players could make all the difference San Diego, California, USA October 23 2007 The ongoing shortage of PAN based carbon fibers has seen the planning, development and realization of new carbon fiber manufacturing capacity in new countries. The start up of new plant faces many hurdles, especially in the face of competition that has been in the business for many decades. However these hurdles have been overcome and this process will enable carbon fiber to become truly a commodity product, available to the vast range of current and new composite applications. Latest News (Press releases in the last 4 weeks) Supply October 11, 2007 Capacity Expansion of Carbon Fiber “TENAX®” Toho Tenax Co., Ltd. (Head Office: Bunkyo-ku, Tokyo, President: Yoshikuni Utsunomiya), which is engaged in the business of carbon fibers within the Teijin Group, has decided to add a new carbon fiber production line at Toho Tenax Europe GmbH (located at Wuppertal, Germany. October 05, 2007 SGL Group plans to triple carbon fiber capacities SGL Group plans to triple carbon fiber capacities Capacity increase up to 12,000 metric tons by 2012 Demand September 27, 2007 British Airways Green light for aircraft orders British Airways has today placed an order for 12 Airbus A380 and 24 Boeing 787 aircraft with options for a further seven Airbus A380s and18 Boeing 787s. The British Airways Order The new aircraft will replace 34 of the airline's long haul fleet and will be delivered between 2010 and 2014. The order, including options, will give the airline the ability to grow its capacity by up to four per cent per year and the flexibility to tailor its future capacity growth in line with market conditions. -

Natural Fiber Composites for Space Applications

Natural fiber composites for space applications Clean Space industrial days, 25.10.2017 Julien Rion, CTO Bcomp Ltd 1700 Fribourg Switzerland ABOUT BCOMP . Founded 2011, 12 Employees . Several innovation- and start-up awards, including Swiss Economic Award 2016 . Broad customer basis in Sports & Leisure and Luxury industries (e.g. K2, Black Diamond, Nordica, Stöckli, Starboard) . Lightweighting development projects with leading Automotive OEMs . International academic/research network 07.11.2017 2 OUR VALUE PROPOSITION We deliver lightweight, high-performance materials in a renewable package . Weight reduction of up to 40% . Material cost reduction of up to 30% Flax fibres Structural part Bcomp reinforcement 07.11.2017 3 BCOMP PRODUCT PORTFOLIO bCores® ampliTex® powerRibs Services 07.11.2017 4 Why using natural fibers? . High specific stiffness . Good vibration damping properties . Probably demisable . Radio-transparent . Sustainable fibers State of the art for space applications Are natural fibers applicable for space? . Tensiles tests between -50 and 150°C . DMA tests from -150°C to 150°C . TMA tests . Outgasing tests . Moisture tests Tensile tests . High specific stiffness at low temperature . Bilinear behaviour . Loss of stiffness with temperature increase Stiffness 48 12 E1 44 11 E2 40 ET 10 36 9 32 8 28 7 24 6 20 5 16 4 [GPa] ET E1 , E2 [GPa] E1 , 12 3 8 2 4 1 0 0 -100 -50 0 50 100 150 200 T [°C] DMA tests Test on L specimens: . Constant decrease of E with T increase . Damping quite constant DMA tests 80 E-modulus: 70 . Constant decrease of E 60 with T increase 50 40 . -

Basic of Textiles

BASIC OF TEXTILES BFA(F) 202 CC 5 Directorate of Distance Education SWAMI VIVEKANAND SUBHARTI UNIVERSITY MEERUT 250005 UTTAR PRADESH SIM MOUDLE DEVELOPED BY: Reviewed by the study Material Assessment Committed Comprising: 1. Dr. N.K.Ahuja, Vice Chancellor Copyright © Publishers Grid No part of this publication which is material protected by this copyright notice may be reproduce or transmitted or utilized or store in any form or by any means now know or here in after invented, electronic, digital or mechanical. Including, photocopying, scanning, recording or by any informa- tion storage or retrieval system, without prior permission from the publisher. Information contained in this book has been published by Publishers Grid and Publishers. and has been obtained by its author from sources believed to be reliable and are correct to the best of their knowledge. However, the publisher and author shall in no event be liable for any errors, omission or damages arising out of this information and specially disclaim and implied warranties or merchantability or fitness for any particular use. Published by: Publishers Grid 4857/24, Ansari Road, Darya ganj, New Delhi-110002. Tel: 9899459633, 7982859204 E-mail: [email protected], [email protected] Printed by: A3 Digital Press Edition : 2021 CONTENTS 1. Fiber Study 5-64 2. Fiber and its Classification 65-175 3. Yarn and its Types 176-213 4. Fabric Manufacturing Techniques 214-260 5. Knitted 261-302 UNIT Fiber Study 1 NOTES FIBER STUDY STRUCTURE 1.1 Learning Objective 1.2 Introduction 1.3 Monomer, Polymer, Degree of polymerization 1.4 Student Activity 1.5 Properties of Fiber: Primary & Secondary 1.6 Summary 1.7 Glossary 1.8 Review Questions 1.1 LEARNING OBJECTIVE After studying this unit you should be able to: ● Describe the Natural Fiber.