Manulife Investment Management Limited MANULIFE FUNDAMENTAL BALANCED CLASS August 3, 2021 Advisor Series

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fund Selection

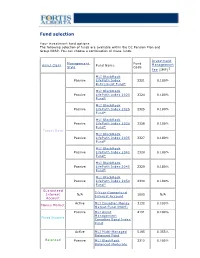

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

2018 Annual Report Fellow Shareholders, Governance and Shareholder Outreach

Manulife Financial Corporation Who Manulife Financial Corporation is Our five Portfolio Optimization we are a leading international financial strategic We are actively managing our priorities services group providing financial 1 legacy businesses to improve advice, insurance, as well as returns and cash generation while wealth and asset management reducing risk. solutions for individuals, groups, and institutions. We operate as John Hancock in the United States Expense Efficiency and Manulife elsewhere. We are getting our cost structure 2 into fighting shape and simplifying and digitizing our processes to position us for efficient growth. Accelerate Growth We are accelerating growth in our 3 highest-potential businesses. Our Digital, Customer Leader mission Decisions We are improving our customer 4 experiences, using digitization and made easierr. innovation to put customers first. Lives High-Performing Team made betterr. We are building a culture that 5 drives our priorities. Our Our Values represent how we Obsess Do the Values operate. They reflect our culture, about right thing inform our behaviours, and help define how we work together. customers Manulife Note: Growth in core earnings, assets under Core Earnings (C$ billions) management and administration (AUMA), and by the new business value are presented on a constant $5.6 billion exchange rate basis. numbers Total Company, Global Wealth and Asset Management (Global WAM), and Asia core earnings up 23%, 21%, and 20%, respectively, from 2017. 5.6 4.6 4.0 3.4 2.9 2014 2015 2016 2017 2018 Assets Under Management and Administration Net Income Attributed to Shareholders (C$ billions) (C$ billions) $1,084 billion $4.8 billion Over $1 trillion in AUMA. -

RBC LPIM Canadian Technical and Quantitative Total Return Securities

January 2020 RBC LPIM Canadian Technical And Quantitative Total Return Securities GLOBAL INVESTMENT SOLUTIONS FOR THE INFORMATION OF INVESTORS IN OUTSTANDING RBC LPIM CANADIAN TECHNICAL AND QUANTITATIVE TOTAL RETURN SECURITIES ONLY Investment Objective: EQUITY INVESTMENT – JANUARY 2020 The Debt Securities have been designed to provide As of December 31, 2019, the Portfolio was allocated 100% to an Equity Investment. Indicated dividend yield on the Underlying investors with “long” exposure to the Bank’s Equity Securities as of December 31, 2019 was 0.66%. proprietary 6-factor quantitative model (the Sector Symbol Company Weight Dividend Yield (%) Rank “Model”), with the ability to allocate to a Fixed Materials WDO Wesdome Gold Mines Ltd. 5.00% 0.00 5 ASR Alacer Gold Corp. 5.00% 0.00 6 Income Investment based on whether the stocks in DGC Detour Gold Corp. 5.00% 0.00 7 the S&P/TSX Composite Index (the “Index”) exhibit TXG Torex Gold Resources Inc. 5.00% 0.00 8 bearish trends to such an extent that the stocks of YRI Yamana Gold Inc. 5.00% 1.02 27 less than 20 issuers are eligible for notional inclusion Industrials BYD Boyd Group Services Inc. 5.00% 0.00 0 in the Equity Investment as determined by the AC Air Canada 5.00% 0.00 36 Model. The goal of this strategy is to be exposed to Consumer Discretionary DOO BRP Inc. 5.00% 0.68 13 Consumer Staples ATD.B Alimentation Couche-Tard Inc. 5.00% 0.61 21 the performance of the stocks selected by the Health Care BHC Bausch Health Cos Inc. -

Demutualization Details

Demutualization Details 1. American Mutual Life – AmerUs- Indianapolis Life Insurance Company - Central Life Assurance - Central Life Assurance merged with American Mutual in 1994. American Mutual Life was renamed AmerUs Life Insurance Company in 1995. On September 20, 2000, it demutualized to become AmerUs Group. In 2001, the company merged with Indianapolis Life, which had also undergone a demutualization. Approximately 300,000 policyholders and heirs became entitled to receive $452 million in AmerUs Group common stock and $340 million in cash and policy credits. Distribution began on July 31, 2001. Eligible policyholders received a fixed component of 20 AmerUS common shares, as well as a variable component based on policy value. Those who elected to receive cash were compensate $26 per share entitlement. In the first year after the initial public offering, the price of an AmerUS common share increased 99%. The current value of AmerUS Group stock is approximately $45 per share. 2. Anthem Insurance - On July 31, 2002 Anthem Insurance Companies, Inc. completed its conversion from a mutual insurance company to a stock company, and became a wholly owned subsidiary of Anthem, Inc. Eligible policyholders and heirs became entitled to approximately 48 million shares of Anthem, Inc. common stock and cash totaling $2.06 billion. Compensation consisted of a fixed component of 21 Anthem common shares, as well as a variable component based on policy value. The shares were offered to the public at $36. In the first year after the initial public offering, the price of an Anthem common share increased 54%. 3. Equitable Life – Axa - In 1992 the Equitable Life Assurance Society of the United States demutualized and a new parent holding company, the Equitable Companies, was listed on the New York Stock Exchange. -

Canadian Equity Value Corporate Class OF

Canadian Equity Value Corporate Class Class OF CAD FUND OVERVIEW PERFORMANCE1 As at 2021-08-31 This fund invests primarily in equity and equity-related Growth of $10,000 (since performance inception date) securities of Canadian companies. This fund may invest up to 30% of its assets in foreign securities. 25k $22,337 FUND DETAILS 20k Inception date October 2007 15k Total net assets ($CAD) $748.1 million 10k As at 2021-08-31 5k NAVPS $15.8216 08 09 10 11 12 13 14 15 16 17 18 19 20 21 As at 2021-09-22 MER (%) 1.87 As at 2021-03-31 Calendar year performance Management fee (%) 1.50 50 Asset class Canadian Equity 27.70 25.59 Currency CAD 25 15.23 7.19 6.62 6.85 4.83 Minimum investment $100 initial / $25 centage additional er 0 Distribution frequency Quarterly % P -7.34 -11.88 -10.27 Last distribution $0.3929 -25 11 12 13 14 15 16 17 18 19 20 Risk rating2 Average annual compound returns Low to Medium to Low Medium High medium high YTD 1 Mo 3 Mo 6 Mo 1 Y 3 Y 5 Y 10 Y Inception* 19.50% 2.20% 7.70% 18.10% 29.10% 11.30% 10.10% 8.20% 5.90% FUND CODES *Since performance inception date T8 DISTRIBUTION HISTORY3 MANAGEMENT TEAM OF 17356 A ISC 17656 Payable date Total Payable date Total DSC 17856 2021-03-26 0.3929 2019-12-13 0.1504 LL 17556 IDSC 17756 2020-12-18 0.1169 2019-09-27 0.1335 CI Global Asset Management (CI GAM) is an integrated 2020-09-25 0.1190 2019-06-21 0.1351 E ISC 15656 ISC 13156 global investment asset manager with a strong lineup of DSC 15856 DSC 13356 2020-06-26 0.0982 2018-12-14 0.0642 relevant investment solutions that will help today’s LL 15556 LL 13056 investors meet their financial goals. -

Manulife's Investor Day 2017 in Hong Kong-Slides-Day 1

June 21, 2017 Hong Kong Agenda Time Speaker Presentation 9:05 am Donald Guloien Delivering on commitments, driving shareholder value & preparing for the future 9:20 am Roy Gori A compelling opportunity and clear priorities to win 9:40 am Steve Roder Commitment to shareholder value creation 10:10 am Q&A Session 10:45 am Roy Gori & Phil Witherington Executing on our Asia opportunity 11:30 am Q&A Session 11:55 am Various Labs 12:25 pm Lunch with Guest Speaker 1:40 pm Linda Mantia Driving Customer Centricity and Innovation 2:10 pm Q&A Session 2:25 pm Various Labs 3:05 pm Kai Sotorp A global wealth and asset management platform with solid growth momentum 3:35 pm Q&A Session 3:50 pm Various Labs Caution regarding forward-looking statements From time to time, MFC makes written and/or oral forward-looking statements, including in this presentation. In addition, our representatives may make forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbour” provisions of Canadian provincial securities laws and the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this presentation include, but are not limited to, statements with respect to demographic and market trends and their expected benefit, core ROE expansion over the medium term and the drivers of such expansion, our expected dividend payout ratio, annual core earnings per share growth over the medium term and dividend growth over time. The forward-looking statements in this presentation -

Bestweek World's Largest Insurers

www.bestweek.com BESTWEEK BESTWEEKWeekly Insurance Newsletter January 2012 Weekly Insurance Newsletter Top Insurers Ranked by Assets, Net Premiums Aegon N.V. Chairman and Chief Executive: World’s Largest Insurers Alex Wynaendts Ranked by Non-Banking Assets Aegon is a public company specializing 2010 in life insurance, pensions and long- Total Non- term savings and investment products. Country of Banking Assets % It has 28,000 employees serving 40 AMB Company Name Domicile USD (000) Change* million clients in 20 countries. 1 Japan Post Insurance Co. Ltd. Japan 1,089,463,948 -5.26 www.aegon.com Wynaendts 2 Axa S.A. France 920,476,513 3.27 3 Allianz SE Germany 807,486,736 8.23 Allianz Societas Europae 4 MetLife Inc. US 730,906,000 35.53 Chairman and Chief Executive: 5 American International Group Inc. US 683,443,000 -19.37 Michael Diekmann 6 Aviva plc UK 572,208,859 4.45 Allianz is a public company specializing 7 Assicurazioni Generali S.p.A. Italy 559,858,937 -0.33 in property/casualty and life/health 8 Prudential Financial Inc. US 539,854,000 12.42 insurance, asset management and Nippon Life Insurance Co. Japan 527,095,201 6.20 banking. It has approximately 151,000 9 employees serving more than 76 mil- 10 Legal & General Group plc UK 501,063,918 9.03 lion clients in about 70 countries. Diekmann 11 National Mut Ins Fed of Agricultural Co-ops Japan 488,175,304 3.30 Rating: A.M. Best currently rates the financial strength of 12 Aegon N.V. -

Dave Hunter DATE: September 18, 2020 SUBJECT: SIB Meeti

Executive Summary - Informational TO: State Investment Board FROM: Dave Hunter DATE: September 18, 2020 SUBJECT: SIB Meeting Materials – September 25, 2020 Our September board meeting will focus on Callan’s annual investment performance review of SIB client returns as of June 30, 2020. RIO will also share board education and manager research on in-state investment programs administered by other state plans, invite BND to provide an investment update & highlight recent legislative committee presentations. 1. Asset and Performance Overview – RIO will refresh the Asset and Performance Overview shared with the Board last month noting that 94% of our SIB clients generated net returns which exceeded their approved policy benchmarks for the 5 years ended June 30, 2020. All SIB Pension Pool clients generated net returns which exceeded their respective policy benchmarks for the 1, 3 and 5 year periods ended June 30, 2020. The Pension Pool, which includes PERS and TFFR, generated a net return of 8.4% for the 10 years ended June 30, 2020, exceeding its Policy Benchmark of 7.94% and their actuarial long-term return assumptions (of 7.00% to 7.25%). The NDSIB Pension Pool was also ranked in the top 25% of Callan’s Public Fund Sponsor Database for the 10-years ended June 30, 2020. 2. Callan Annual Investment Review – The SIB engages Callan to provide quarterly and annual investment performance reviews which include a reconciliation of RIO’s reported investment returns and asset valuations with those reported by Northern Trust, noting that Northern Trust serves as our primary custodian and record keeper for SIB client investments. -

Manulife Japan Company Profile English Version

About Manulife History Manulife Financial Corporation is a Canada-based leading international financial services group established in 1887. Starts life insurance business as Manulife Century Insurance Company with the transfer of 1999 ● goodwill from Daihyaku Mutual Life Insurance Company. Introduces a unique consulting system called "PlanRight". 2000 ● Completes the collective transfer of the policies and related assets of Daihyaku Mutual ● 2001 Life Insurance Company to Manulife. Changes name to Manulife Life Insurance Company. ● Press Conference in 1999 Manulife becomes the first Japanese insurance company to adopt the "Company Adopting ● 2003 Commitees System". (Now also known as “Company with Nomination Committee) Establishes Manulife Asset Management (Japan) Limited (formerly MFC Global Investment ● 2004 Management Japan Co., Ltd.) as a subsidiary. Establishes Manulife Investments Japan Limited as a subsidiary. Corporate Profile of Manulife Financial Corporation 2007 ● Manulife Financial Corporation provides a variety of products and services tailored to each Donates the rst and the second "Manulife Waku Waku Rooms," which are special playrooms ● fi market in order to respond to the changing needs of our customers. 2008 designed to improve the quality of life of children undergoing hospital treatment. Becomes the 2010 sponsor of the Pacific Baseball League. 2010 ● Manulife Waku Waku Rooms at Osaka Company Name Manulife Financial Corporation General Medical Center Introduces Japan's rst non-smoker rate for medical coverage as "ManuFlex" and "ManuMed". ● fi Head Office Toronto, Ontario, Canada (Excluding cancer-related special contracts. As of January 1, 2015; research conducted by Manulife Japan.) Year Established 1887 CORPORATE Becomes the main sponsor of the final tournament of the National High School Financial Quiz. -

IG Mackenzie Dividend Growth Fund

IG Mackenzie Canadian Equity Fund Summary of Investment Portfolio As at the Quarter ended June 30, 2021 (unaudited) The largest positions of the Fund (up to 25) at the end of the period, and the major asset classes in which the Fund was invested, are indicated below. This summary of investment portfolio may change due to ongoing portfolio transactions. The Management Report of Fund Performance, Prospectus, Financial Statements and other information for IG Wealth Management mutual funds in which the Fund invests are available upon request, and at no cost, by calling 1-888-746-6344 (1-800-661-4578 if you live in Quebec) or by writing to us at 447 Portage Avenue, Winnipeg, Manitoba, R3B 3H5 (2001, boulevard Robert-Bourassa, bureau 2000, Montreal, Quebec, H3A 2A6 if you live in Quebec), or by visiting our website at www.investorsgroup.com or SEDAR at www.sedar.com. Summary of Top 25 Long Positions Summary of Composition of the Portfolio % of net assets % of net assets Royal Bank of Canada 5.7 PORTFOLIO ALLOCATION The Toronto-Dominion Bank 5.0 Equities 94.5 The Bank of Nova Scotia 3.8 Mutual Funds 2.8 Canadian Pacific Railway Ltd. 3.2 1 Exchange Traded Funds 1.4 Mackenzie – IG U.S. Equity Pool Series P 2.8 Commodities 0.4 Brookfield Asset Management Inc. Class A limited voting 2.8 Cash and cash equivalents 0.7 Shopify Inc. Class A 2.6 Other net assets (liabilities) 0.2 Bank of Montreal 2.4 Total 100.0 Canadian Imperial Bank of Commerce 2.3 Manulife Financial Corp.