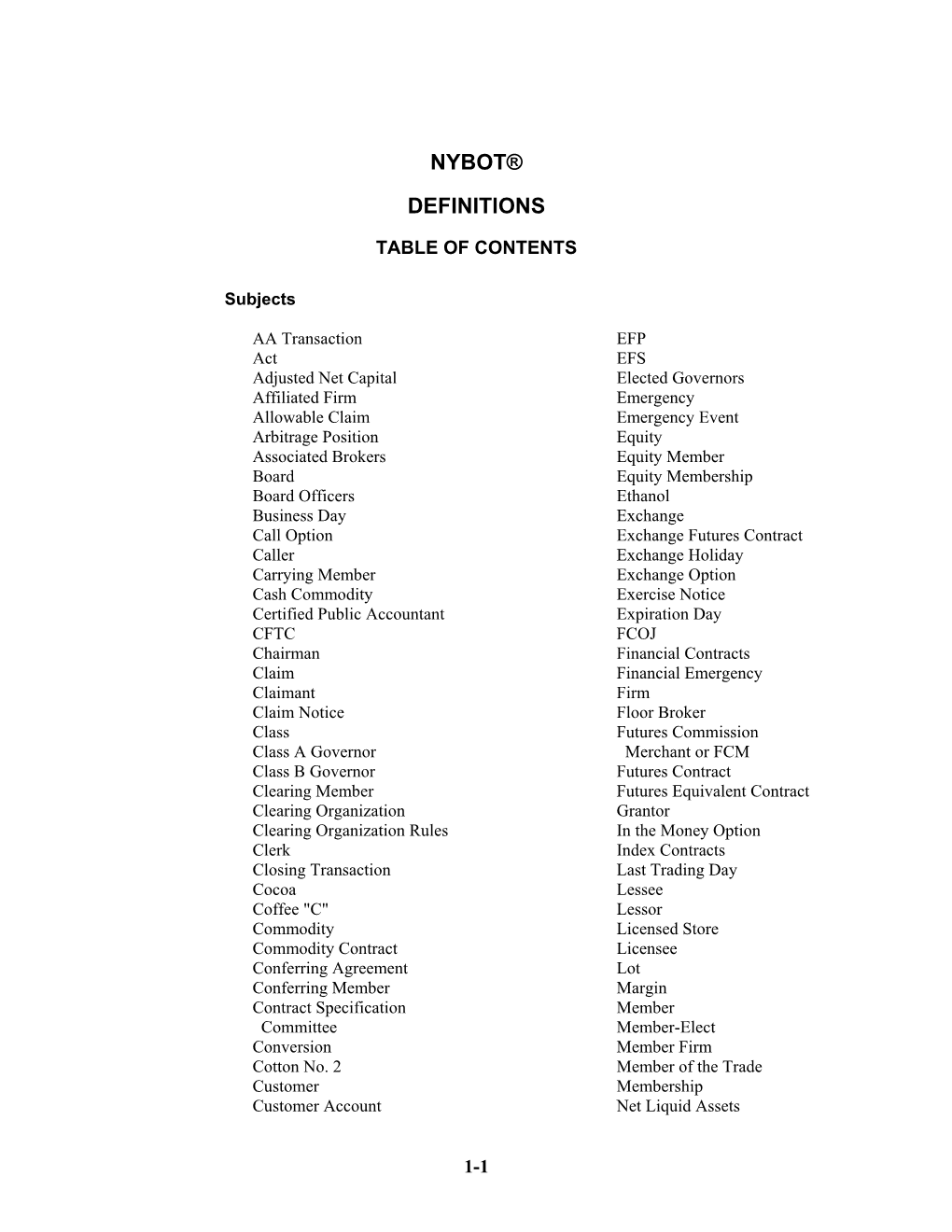

Nybot® Definitions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Data Services New York Board of Trade (NYBOT)

Prepared Statement of Jack Sabo Vice President – Market Data Services New York Board of Trade (NYBOT) Before the Senate Subcommittee on Federal Financial Management, Government Information, and International Security Field Hearing on “Ensuring Protection of American Intellectual Property Rights for American Industries in China.” November 21, 2005 Chairman Coburn, I appreciate the opportunity to appear before you today to discuss the challenges faced by the U.S. financial community – and, in particular, the New York Board of Trade -- due to piracy of real time market data in China. While the issue of piracy in China is often dominated by high profile industries such as motion pictures, recordings, software and publishing, Chinese piracy also affects the financial industry by robbing exchanges of fees from the sale of market data and by robbing customers from licensed market data vendors, such as Bloomberg, e-Signal, and others. Market data provided by derivative exchanges is vital information used by the global financial industry which includes brokerage houses, banks, fund managers, cotton, coffee, sugar, cattle, corn, orange juice brokers, and many more. They depend on reliable information, whose integrity can be undermined through unauthorized access and piracy of this data. Revenue from market data fees can be as much as 25% of total exchange revenue. As New York’s original futures exchange, the New York Board of Trade (commonly referred to as “NYBOT”) is an historic part of the financial community. It is a traditional futures exchange where traders buy and sell futures on Coffee, Sugar, Cocoa, Cotton, Orange Juice, wood pulp and a variety of financial instruments such as the US Dollar Index. -

Market Information – Glossary of Terms Centrifuge. a Perforated

Market Information – Glossary of Terms Centrifuge. A perforated appliance which spins inside a casing to separate sugar crystals from molasses. Sugar that has come through a centrifuge is centrifugal sugar. Chicago Board of Trade (CBOT). Established in 1848, it is the oldest financial futures and options exchange in the world and situated in Chicago, Illinois. In 2007, the Chicago Board of Trade merged with the Chicago Mercantile Exchange to form the CME Group. Some its commodity futures prices (such as wheat, soya beans and maize) form the principal world price benchmarks. Contract expiry. The date at which trading a particular futures contract ends and becomes either physically or cash settled. For the New York No. 11 raw sugar contract this is the last trading day of the month prior to the delivery month. For the London No. 5 white sugar contract it is sixteen calendar days before the first day of the delivery month. Free on Board (FOB). A term requiring the seller to deliver goods on board a vessel designated by the buyer. The seller fulfils their obligation to deliver when the goods have passed over the ship's rail. Generally, a seller has an obligation to deliver goods, and assume the costs of delivery to a named place for transfer to a carrier, such as a ship. EU sugar regime. In 2006 a major reform achieved simplification and greater market orientation of the EU's sugar policy. The total EU production quota of 13.5 million tonnes of sugar is divided between nineteen Member States, of which the UK’s share is 1.056mt. -

After a Five-Year Rally, the Commodities Market Has Turned Ugly. As Prices

Blo o m b e r g M a r ke t s COMMODITIES 120 November 2006 CRUNCH By Edward Robinson ‚At 7:55 a.m., five minutes before the opening bell, An- thony Compagnino and Michael Ragazzo huddle in their office on the New York Board of Trade floor—a booth with a dozen telephones and no chairs—to plot their next move in the cocoa pit. “I should have picked a less stressful job, like bomb defusing,” says Ragazzo, a com- modities broker at East Coast Options Services. After five years, the rally in commodity prices has hit a wall. For two days, Ragazzo and Compagnino, his boss, have been selling cocoa futures as prices have plummet- ed 15 percent. Hedge funds that have been riding the richest commodities boom in a generation have dumped cocoa en masse, upending the market. Now, on July 19, the guys at East Cost Options agree that the worst is over. Compagnino, 46, wearing a blue and gold trader’s jacket, hustles to the top rung of the cocoa pit, the tiered ring where trading takes place. Ragazzo, 48, in a matching coat, takes up a position nearby, a phone to each ear. The bell sounds—and all hell breaks loose. One floor broker barks a bid to buy cocoa for September delivery for $1,517 a metric ton. Another hollers an offer to sell at $1,507. The traders down in the pit can’t settle on a price. Compagnino starts selling. “Thirty Seps at 18! Thirty Seps at 18!” Compagnino thunders, offering to sell 30 September contracts on cocoa for $1,518 per ton. -

From 9/11 to 8/29: Post-Disaster Recovery and Rebuilding in New York and New Orleans

From 9/11 to 8/29: Post-Disaster Recovery and Rebuilding in New York and New Orleans Kevin Fox Gotham Miriam Greenberg Social Forces, Volume 87, Number 2, December 2008, pp. 1039-1062 (Article) Published by The University of North Carolina Press DOI: 10.1353/sof.0.0131 For additional information about this article http://muse.jhu.edu/journals/sof/summary/v087/87.2.gotham.html Access Provided by Tulane University at 04/20/11 3:40PM GMT From 9/11 to 8/29: Post-Disaster Recovery and Rebuilding in New York and New Orleans Kevin Fox Gotham, Tulane University Miriam Greenberg, University of California, Santa Cruz This article examines the process of post-disaster recovery and rebuilding in New York City since 9/11 and in New Orleans since the Hurricane Katrina disaster (8/29). As destabilizing events, 9/11 and 8/29 forced a rethinking of the major categories, concepts and theories that long dominated disaster research. We analyze the form, trajectory and problems of reconstruction in the two cities with special emphasis on the implementation of the Community Development Block Grant program, the Liberty Zone and the Gulf Opportunity Zone, and tax-exempt private activity bonds to finance and promote reinvestment. Drawing on a variety of data sources, we show that New York and New Orleans have become important laboratories for entrepreneurial city and state governments seeking to use post-disaster rebuilding as an opportunity to push through far-reaching neoliberal policy reforms. The emphasis on using market-centered approaches for urban recovery and rebuilding in New York and New Orleans should be seen not as coherent or sustainable responses to urban disaster but rather as deeply contradictory restructuring strategies that are intensifying the problems they seek to remedy. -

Execution Venues Equities and Fixed Income

UBS AG London Branch 5 Broadgate London EC2M 2QS United Kingdom UBS Europe SE OpernTurm Bockenheimer Landstraße 2-4 60306 Frankfurt am Main Germany www.ubs.com/ibterms Execution venues Equities and fixed income Version: December 2020 For information about our investment bank entities, visit www.ubs.com/ibterms Execution venues This is a non-exhaustive list of the main execution venues that we use outside UBS and our own systematic internalisers. We will review and update it from time to time in accordance with our UK and EEA MiFID Order Handling & Execution Policy. We may use other execution venues where appropriate. Equities Cash Equities Direct access Aquis Exchange Europe Aquis Exchange PlcAthens Stock Exchange BATS Europe, a CBOE Company Borsa Italiana CBOE NL CBOE UK Citadel Securities (Europe) Limited SI Deutsche Börse Group - Xetra Euronext Amsterdam Stock Exchange Euronext Brussels Stock Exchange Euronext Lisbon Stock Exchange Euronext Paris Stock Exchange Instinet Blockmatch Euronext DublinITG Posit London Stock Exchange Madrid Stock Exchange Nasdaq Copenhagen Nasdaq Helsinki Nasdaq Stockholm Oslo Bors Sigma X Europe Sigma X MTFTower Research Capital Europe Limited SI Turquoise Europe TurquoiseUBS Investment Bank UBS MTF Vienna Stock Exchange Virtu Financial Ireland Limited Warsaw Stock Exchange Via intermediate broker Budapest Stock Exchange Cairo & Alexandria Stock Exchange Deutsche Börse - Frankfurt Stock Exchange Istanbul Stock Exchange Johannesburg Stock Exchange Moscow Exchange Prague Stock Exchange SIX Swiss Exchange Tel Aviv Stock Exchange Structured Products Direct access Börse Frankfurt (Zertifikate Premium) Börse Stuttgart (EUWAX) Xetra SIX Swiss Exchange SeDeX Milan Euronext Amsterdam London Stock Exchange Madrid Stock Exchange NASDAQ OMX Stockholm JSE Johannesburg Stock Exchange OTC matching CATS-OS Fixed Income Cash bonds Via Bond Port Bloomberg EuroTLX Euronext ICE (KCG) BondPoint Market Axess MOT MTS BondsPro 1 © UBS 2020. -

Download Cotton Market Information

Cotton No.2 Intercontinental Exchange® (ICE®) became the center of global trading in “soft” commodities with its acquisition of the New York Board of Trade (NYBOT) in 2007. Now known as ICE Futures U.S.®, the exchange offers futures and options on futures on soft commodities including coffee, cocoa, frozen concentrated orange juice, sugar and cotton. Cotton futures have traded in New York since 1870, first on the New York Cotton Exchange, then on the New York Board of Trade and now on ICE Futures U.S. Options on cotton futures were introduced in 1984. Futures and options on futures are used by both the domestic and global cotton industries to price and hedge transactions. Because cotton is at the center of the global textiles industry, it is a preferred contract among commodity trading advisors and hedge funds. ICE Futures U.S. is the exclusive global market for Cotton No. 2 futures and options. A BRIEF HISTORY OF COTTON IN COMMERCE the economy in the American south, the perpetuation of slavery and Cotton is grown widely around the world and has been used for ultimately the American Civil War. at least 7,000 years. While the oldest archaeological fragments have been found in Mexico, the Indus valley in modern Pakistan Cotton was so critical to British and French industries at the time was the first commercial cotton-growing center. Alexander the that both countries contemplated intervening on behalf of the Great brought cotton back from the Indus Valley into the Hellenistic Confederacy during the Civil War, their opposition to slavery world. -

Sugar No. 1 1® and Sugar No

Sugar No. 1 1 ® and Sugar No. 16® IntercontinentalExchange® (ICE®) became the center of global trading in “soft” commodities with its acquisition of the New York Board of Trade (NYBOT) in 2007. Now known as ICE Futures U.S.®, the exchange offers futures and options on futures on soft commodities including coffee, cocoa, frozen concentrated orange juice, cotton and sugar, including the benchmark for global price discovery, the Sugar No. 11® contract. Sugar futures have traded in New York since 1914, beginning with the predecessors of ICE Futures U.S.: the Coffee, Sugar and Cocoa Exchange and the New York Board of Trade. Options on sugar futures were introduced in 1982. Futures and options on futures are used by the global sugar industry to price and hedge transactions. In addition, sugar’s role in ethanol production increasingly makes it both an energy commodity and a food commodity, and no exchange is positioned better to take advantage of this dual role than ICE Futures U.S. Finally, the deep and liquid nature of the sugar market has made it a favorite of commodity trading advisors and hedge funds. THE SUGAR MARKET for corn. This efficiency derives from a biochemical quirk involving Nearly all sugar in world commerce today is sucrose derived from the photosynthetic arrangement of four carbon atoms (instead of either sugar cane or sugar beets, accounting for about 70% and 30% three), and allows the sugar cane to pull vast quantities of carbon of world production, respectively. The resulting sugar is the same dioxide out of the air. The ability of the sugar cane plant to capture regardless of source. -

An Investigation Into the Impact of Financial Investment on Coffee Price Behaviour

Working Paper No 2009/7 MARCH 2009 The New Price Makers: An investigation into the impact of financial investment on coffee price behaviour Susan Newman * ABSTRACT The collapse of the international commodity agreements in the 1980s, together with the liberalisation of marketing systems in commodity exporting developing countries under structural adjustment programs have removed the role of the state in the pricing of commodities. The logic of liberalisation was to remove impediments to the efficient market discovery of commodities prices where state intervention was seen as the main culprit. Mainstream economics has also promoted the role of derivatives exchanges in efficient price discovery on physical markets in international commodity markets with globally fragmented production. By rapidly exploiting opportunities to profit from price deviations between futures and spot markets, rational and informed speculators are seen to drive any price deviations in the market quickly to the equilibrium price that reflect international supply and demand realities. Such a view, however, fails to consider the role of differentiated market participants on international exchanges in driving commodity prices, by assuming that all trading activities are efficiency enhancing irrespective of the motives behind them. There has been much media interest in the role of speculation on commodity prices, in particular food commodities, over the recent months. There has, however, been very little systematic evidence gathered on the extent to which speculative activities affect prices of exchange traded commodities. Using the example of international prices for coffee, this paper shows that increases in trading activities by non-physical market actors for the purposes of financial investment have led to a dislocation between prices on international exchanges and supply and demand realities. -

Agricultural Commodity Futures Contract Specifications

Agricultural Commodity Futures Contract Specifications his guide provides information about commodity example, corn is traded in full contracts (5,000 bushels) exchange markets and contract specifications for and mini-contracts (1,000 bushels) both on the CME selectedT agricultural commodities common to Missouri. Group’s CBOT trading floor and through their As an agricultural producer or agribusiness person, you electronic exchange system, GLOBEX. You should be need to have a clear understanding of the operation of the aware of the difference in trading volume, or number exchange market and to know the exact specifications of of futures contracts traded during a given period of the commodity contract you are about to enter into. time, between these contracts. Lack of adequate trading volume can cause difficulty when entering or exiting the market; however, mini-contracts can be useful to those Agricultural exchange information lacking finances or the production quantity necessary to Commodity exchanges can make extensive buy or sell a full contract. information resources available to you. The Chicago Table 1 shows contract specifications for various Board of Trade (CBOT) and Chicago Mercantile agricultural commodities. The Futures column heading Exchange (CME), merged as the CME Group, have represents the commodity being traded. Contract size many free publications that explain topics ranging from refers to the size of the contract being traded. Price quote the duties of a floor trader to understanding and using refers to the units in which the price is quoted. basis information. Much of this information is available on the websites of the various commodity exchanges. Deliverable vs. -

Intercontinental Exchange Investor Day June 2, 2017

INTERCONTINENTAL EXCHANGE INVESTOR DAY JUNE 2, 2017 1 Transparent Financial Strategic Framework Connecting the Modernizing Data Virtuous Cycle: Trading, NYSE: Leading Global Strategic Growth Speaker Bios & Welcome & Overview Sales Transformation Framework for M&A / Integration Financial Landscape Solutions Clearing, Information Equity Markets & Data Through Innovation Appendix WELCOME & OVERVIEW Kelly Loeffler SVP, Corporate Communications, Marketing and Investor Relations 2 INTERCONTINENTAL EXCHANGE Transparent Financial Strategic Framework Connecting the Modernizing Data Virtuous Cycle: Trading, NYSE: Leading Global Strategic Growth Speaker Bios & Welcome & Overview Sales Transformation Framework for M&A / Integration Financial Landscape Solutions Clearing, Information Equity Markets & Data Through Innovation Appendix AGENDA Time Topic 1:30 Welcome and Overview 1:35 Transparent Financial Framework 1:50 Strategic Framework for M&A and Integration: Connecting the Financial Landscape 2:15 Modernizing Data Solutions; Sales Transformation 2:40 Break 2:50 Virtuous Cycle: Trading, Clearing, Information 3:10 NYSE: Leading Global Equity Markets and Data 3:25 Strategic Growth Through Innovation 3:45 Q&A 4:30 Closing Remarks 3 INTERCONTINENTAL EXCHANGE Transparent Financial Strategic Framework Connecting the Modernizing Data Virtuous Cycle: Trading, NYSE: Leading Global Strategic Growth Speaker Bios & Welcome & Overview Sales Transformation Framework for M&A / Integration Financial Landscape Solutions Clearing, Information Equity Markets & Data Through Innovation Appendix FORWARD-LOOKING STATEMENT AND LEGENDS CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS This presentation may contain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements regarding ICE’s business that are not historical facts are forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. -

ICE Coffee Markets Price Discovery Using Global Futures Markets

ICE Coffee Markets Price discovery using global futures markets David Farrell Chief Operating Officer, ICE Futures U.S. November 2019 We began by transforming energy markets and expanded through innovation into new markets 2018 ICE adds BondPoint Coffee “C”, Cocoa and TMC to 2014 Sugar 11, FCOJ comprehensive ICE acquires majority stake bond trading offering and Cotton #2 in continental European clearing house, now ICE Clear 2016 2001 2009 Acquires Chicago Stock Netherlands; spins out Euronext ICE acquires Standard ICE expands into ICE acquires former Exchange, now NYSE & Poor’s Securities 2017 energy futures, Board of Trade Chicago 2007 Expands in Asia with Singapore Evaluations, Inc. ICE adds the Bank of acquiring the Clearing Corp; ICE acquires futures exchange and clearing & Credit Market America Merrill Lynch International launches 2 Launches Bakkt to bring New York Board of house Analysis. Global Research Petroleum Exchange, CDS clearing houses, trust and utility to digital Trade, now ICE division’s index now ICE Futures quickly becoming assets Futures US Adds SuperDerivatives, provider of Secures majority stake business to global Europe global leader analytics, valuation and data in MERSCORP index platform Acquires remaining Holdings stake in MERSCORP 2000 2002 2008 2010 2013 2015 2016 2017 2019 ICE forms from ICE introduces ICE enters credit ICE expands reach in ICE acquires NYSE ICE acquires Interactive ICE launches expanded ICE acquires ICE adds to predecessor industry’s first market acquiring emissions markets Euronext Data Corporation, -

Report of the Commodity Futures Trading Commission on the Futures Industry Response to September 11Th

Report of the Commodity Futures Trading Commission on the Futures Industry Response to September 11th March 11, 2002 Table of Contents Introduction.........................................................................................................................................1 The Role of the Futures Markets ...................................................................................................1 The Role of the CFTC....................................................................................................................2 Impact of the Terrorist Attacks ......................................................................................................3 Preparedness Efforts.......................................................................................................................4 I. Reopening the Futures Markets...........................................................................7 A. Tuesday, September 11th ........................................................................................................7 1. The New York Board of Trade..........................................................................................7 2. The New York Mercantile Exchange................................................................................8 3. Other Commodity Futures Exchanges............................................................................ 10 4. The Regulators - Communication and Coordination..................................................... 10 B. Wednesday, September