Acquisition by British Sky Broadcasting Group Plc of a 17.9 Per Cent Stake in ITV Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CP-ITV3-D300 3-Axis ITV Control Panel

CP-ITV3-D300 3-Axis ITV Control Panel Telemetrics Control Panel for the Sony EVI-D30, EVI-D70, EVI-D100, EVI-HD3V, BRC-300, BRC-700 and Elmo PTC-100 Pan/Tilt Video Cameras enhances function and value for Teleconferencing, Educational, and Security Applications. P/N 92 55418 002 – 11 REV. - Page 1 6 Leighton Place Mahwah, New Jersey 07430 P: 201•848•9818 F: 201•848•9819 CP-ITV3-D300 OPERATING INSTRUCTIONS System with Daisy Chain Wiring Interconnect Cable Interconnect Cable Interconnect Cable 15’ CA-ITV-S15 15’ CA-ITV-S15 15’ CA-ITV-S15 25’ CA-ITV-S25 25’ CA-ITV-S25 25’ CA-ITV-S25 50’ CA-ITV-S50 50’ CA-ITV-S50 50’ CA-ITV-S50 Control Cable 6’ CA-ITV-DIN-6 25’ CA-ITV-DIN-25 *Extension Cable (Optional) 25’ CA-ITV-D-25 300’ CA-ITV-D-300 50’ CA-ITV-D-50 400’ CA-ITV-D-400 100’ CA-ITV-D-100 500’ CA-ITV-D-500 Video Switcher 200’ CA-ITV-D-200 Cables > 500’ use Rs422 kit Comprehensive CVG-SW61CS Control Cable Remote Panel POR T 1 PORT 3 Remote Control 10’ CA-ITV-V10 CAMERA CAMERA Cable * Remote Panel only PRES ET 25’ CA-ITV-P25 PR ES E T available with daisy PO R T 4 PORT 4 chain configuration CP-ITV3-EVI/BRC CP-ITV3-EVI/BRC * For Plenum cables, use part number CA-ITV-DP-XXX (where XXX=feet). PORT DESCRIPTION 1 SONY EVI-D100 CAMERA 2 NOT USED 3 VIDEO SWITCHER (CVG-SW61CS) 4 REMOTE PORT • Connect power, camera data, and video switcher cables to rear panel. -

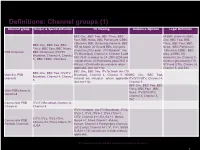

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

€600,000,000 2.125 Per Cent. Notes Due 21 September 2022

PROSPECTUS ITV PLC (incorporated with limited liability under the laws of England and Wales with registered number 04967001) €600,000,000 2.125 per cent. Notes due 21 September 2022 ITV plc ("ITV" or the "Issuer") is issuing €600,000,000 2.125 per cent. Notes due 21 September 2022 (the "Notes"). The issue price of the Notes is 99.135 per cent. of their principal amount. Unless previously redeemed or cancelled, the Notes will be redeemed at their principal amount on 21 September 2022. The Notes are subject to early redemption (i) in whole but not in part, at the option of the Issuer at any time at the Relevant Early Redemption Amount (as defined below), (ii) in whole but not in part, at the option of the Issuer at any time in the event of certain changes affecting taxes of the United Kingdom ("UK") at their principal amount together with accrued interest and (iii) at the option of Noteholders if a Put Event (as defined below) shall occur at their principal amount together with accrued interest. See "Terms and Conditions of the Notes—Redemption and Purchase". The Notes will bear interest from 21 September 2015 at the rate of 2.125 per cent. per annum payable annually in arrear on 21 September in each year commencing on 21 September 2016. Such rate will be subject to change in the case of a Step Up Rating Change or Step Down Rating Change (both as defined below) as further described in Condition 4 (Interest). Payments on the Notes will be made in euro without deduction for or on account of taxes imposed or levied by the UK to the extent described under "Terms and Conditions of the Notes—Taxation". -

Quick Reference Guide To: How to Deliver Content to ITV Your Programme Has Been Commissioned and You Have Been Asked by ITV to Deliver a Piece of Content

July 2020 Quick Reference Guide To: How to Deliver Content to ITV Your programme has been commissioned and you have been asked by ITV to deliver a piece of content. What do you need to do and who are the contacts along the journey?..... Firstly, you will need to know who your Compliance Advisor is. If you’ve not been provided with a contact then email [email protected]. Your Advisor will be able to provide you with legal advice along the journey and will be able to provide you with lots of key information such as your unique Production Number. Another key contact is your Commissioner. They may require some deliverables from you so it’s best to have that discussion directly with them. Within this guide you will find a list of frequently asked questions with links to more detailed documents. 1. My programme will be transmitted live. Does this make a difference? 2. My programme isn’t live; so what exactly am I delivering? 3. Where do I get my Production/Clock Numbers from? 4. Where can I get my tech spec to file deliver? 5. Where do I deliver my DPP AS-11 file to? 6. I need to ensure that my programme has the ITV ‘Look & Feel’. How do I make this happen? 7. Can I make amendments to my programme after I’ve delivered it to Content Delivery? 8. Where do I send my Post Productions Scripts to? 9. What do I do if I have queries around part durations and the total runtime of my programme? 10. -

ITV2 Limited

ITV2 Limited Strategic Report for the Year Ended 31 December 2019 The Directors present their strategic report for the year ended 31 December 2019. Principal activity ITV2 Limited (the "Company") is licensed by Ofcom to broadcast digital programme services in the United Kingdom. The company holds the broadcast licences for the ITV2, ITV4 and ITVBe channels. Fair review of the business The results for the Company show a profit for the year of £86,523,000 (2018: profit of £86,395,000) against sales of £323,513,000 (2018: sales of £322,096,000). KPIs The Directors of the ITV plc Group manage the Group’s operations on a divisional basis with this Company being included within the Broadcast & Online division. For this reason, the Company’s Directors use the ITV plc Group Broadcast & Online division’s operating and performance review in managing and understanding the development, performance and position of the Company. The operating and performance review is included on pages 37 to 43 of ITV plc’s 2019 annual report. Further to the divisional key performance indicators, the Directors would consider the key financial performance indicators of the Company during the year to include: • Revenues, which were up 0.4%, with an increase of 1.2% in Total advertising revenue (TAR). This is ahead of overall ITV Family TAR (down 1.5%) driven by good performance around Love Island. The strong performance relating to TAR offset declines in the Company across Direct to consumer and other revenues. • Share of viewing (SOV) ITV2 SOV was down slightly in the year. -

The Speakers and Chairs 2016

WEDNESDAY 24 FESTIVAL AT A GLANCE 09:30-09:45 10:00-11:00 BREAK BREAK 11:45-12:45 BREAK 13:45-14:45 BREAK 15:30-16:30 BREAK 18:00-19:00 19:00-21:30 20:50-21:45 THE SPEAKERS AND CHAIRS 2016 SA The Rolling BT “Feed The 11:00-11:20 11:00-11:45 P Edinburgh 12:45-13:45 P Meet the 14:45-15:30 P Meet the MK London 2012 16:30-17:00 The MacTaggart ITV Opening Night FH People Hills Chorus Beast” Welcome F Revealed: The T Breakout Does… T Breakout Controller: T Creative Diversity Controller: to Rio 2016: SA Margaritas Lecture: Drinks Reception Just Do Nothing Joanna Abeyie David Brindley Craig Doyle Sara Geater Louise Holmes Alison Kirkham Antony Mayfield Craig Orr Peter Salmon Alan Tyler Breakfast Hottest Trends session: An App Taskmaster session: Charlotte Moore, Network Drinks: Jay Hunt, The Superhumans’ and music Shane Smith The Balmoral screening with Thursday 14.20 - 14.55 Wednesday 15:30-16:30 Thursday 15:00-16:00 Thursday 11:00-11:30 Thursday 09:45-10:45 Wednesday 15:30-16:30 Wednesday 12:50-13:40 Thursday 09:45-10:45 Thursday 10:45-11:30 Wednesday 11:45-12:45 The Tinto The Moorfoot/Kilsyth The Fintry The Tinto The Sidlaw The Fintry The Tinto The Sidlaw The Networking Lounge 10:00-11:30 in TV Formats for Success: Why Branded Content BBC A Little Less Channel 4 Struggle For The Edinburgh Hotel talent Q&A The Pentland Digital is Key in – Big Cash but Conversation, Equality Playhouse F Have I Got F Winning in F Confessions of FH Porridge Adam Abramson Dan Brooke Christiana Ebohon-Green Sam Glynne Alex Horne Thursday 11:30-12:30 Anne Mensah Cathy -

Tv Uk Freesat

Tv uk freesat loading Skip to content Freesat Logo TV Guide Menu. What is Freesat · Channels · Get Freesat · THE APP · WHAT'S ON · Help. Login / Register. My Freesat ID. With over channels - and 13 in high definition - it's not hard to find unbelievably good TV. With Freesat's smart TV Recorders you can watch BBC iPlayer, ITV Hub*, All 4, Demand 5 and YouTube on your TV. Tune into our stellar line-up of digital radio channels and get up to date Get Freesat · What's on · Sport. If you're getting a new TV, choose one with Freesat built in and you can connect directly to your satellite dish with no need for a separate box. You can now even. With a Freesat Smart TV Recorder you can enjoy the UK's favourite Catch Up services: BBC iPlayer, ITV Hub*, All 4 & Demand 5, plus videos on YouTube. Freesat TV Listings. What's on TV now and next. Full grid view can be viewed at Freesat is a free-to-air digital satellite television joint venture between the BBC and ITV plc, . 4oD launched on Freesat's Freetime receivers on 27 June , making Freesat the first UK TV platform to host the HTML5 version of 4oD. Demand Owner: BBC and ITV plc. Freesat, the satellite TV service from the BBC and ITV, offers hundreds of TV and radio channels to watch Lifestyle: Food Network UK, Showcase TV, FilmOn. FREESAT CHANNEL LIST - TV. The UK IPTV receiver now works on both wired internet and WiFi which , BET Black Entertainment TV, Entertainment. -

TUESDAY 19TH FEBRUARY 06:00 Breakfast 09:15 Countryfile Winter

TUESDAY 19TH FEBRUARY All programme timings UK 06:00 Good Morning Britain All programme timings UK All programme timings UK 06:00 Breakfast 08:30 Lorraine 09:50 Combat Ships 06:00 Forces News Replay 09:15 Countryfile Winter Diaries 09:25 The Jeremy Kyle Show 10:40 The Yorkshire Vet Casebook 06:30 The Forces Sports Show 10:00 Homes Under the Hammer 10:30 This Morning 11:30 Nightmare Tenants, Slum Landlords 07:00 Battle of Britain 11:00 Wanted Down Under Revisited 12:30 Loose Women 12:20 Counting Cars 08:00 Battle of Britain 11:45 Claimed and Shamed 13:30 ITV Lunchtime News 12:45 The Mentalist 09:00 Never The Twain 12:15 Bargain Hunt 13:55 Regional News and Weather 13:30 The Middle 09:30 Never The Twain 13:00 BBC News at One 14:00 James Martin's Great British Adventure 13:50 The Fresh Prince of Bel Air 09:55 Hogan's Heroes 13:30 BBC London News 15:00 Tenable 14:15 Malcolm in the Middle 10:30 Hogan's Heroes 13:45 Doctors 14:40 Scrubs 11:00 Hogan's Heroes 14:10 A Place to Call Home 15:05 Shipwrecked 11:30 Hogan's Heroes 15:00 Escape to the Country 15:55 MacGyver 12:00 RATED: Games and Movies 15:45 The Best House in Town 16:45 NCIS: Los Angeles 12:30 Forces News 16:30 Flog It! 17:30 Forces News 13:00 Battle of Britain 17:15 Pointless 18:00 Hollyoaks 14:00 Battle of Britain 18:00 BBC News at Six 18:25 Last Man Standing 15:00 R Lee Ermey's Mail Call 18:30 BBC London News 18:50 How to Lose Weight Well 15:30 R Lee Ermey's Mail Call 19:00 The One Show 19:45 Police Interceptors 16:00 The Aviators 19:30 EastEnders 20:35 The Legend of Tarzan 16:30 The Aviators The residents of Walford pay their final 22:20 Mad Max Fury Road 17:00 RATED: Games and Movies respects to Doctor Legg. -

Media Plurality

---------------------------------------------------------------------------------------------------------------------------------- Final decisions by the Secretary of State for Business, Enterprise & Regulatory Reform on British Sky Broadcasting Group’s acquisition of a 17.9% shareholding in ITV plc dated 29 January 2008. _______________________________________________________________ PARTIES 1. British Sky Broadcasting Group plc (BSkyB) is a holding company for subsidiaries whose principal activities relate to television broadcasting and retailing in the UK and Ireland. BSkyB operates the direct-to-home satellite platform and other digital subscriber line networks and mobile networks. BSkyB also distributes a number of its channels on a wholesale basis to cable (and other) operators who act as retailers to its UK and Irish customers. 2. News Corporation (News Corp) holds 39.14% of the shares in BSkyB (through its subsidiary News UK Nominees Limited). Of the thirteen directors on the Board of BSkyB, three are also directors of News Corp. 3. ITV plc (ITV) was formed in 2004 by the merger of Carlton Communications plc and Granada plc and it is active in a number of sectors primarily related to television production and broadcasting. ITV’s in-house content arm (Granada Productions, renamed ITV Productions) principally produces a range of light entertainment and drama TV programming with mainstream audience appeal in the UK. 4. ITV distributes its own third party content via a wide range of wholly owned free to air television channels broadcast on a range of platforms, and sells advertising on behalf of all 15 Channel 3 regional licencees in the UK, 11 of which it controls. ITV also holds a controlling 75 per cent share in GMTV, (which holds the national Channel 3 licence for breakfast television); a 40% stake in the news provider Independent Television News (ITN) and interests in two of the six digital terrestrial television multiplex platforms. -

Broadcasting in Transition

House of Commons Culture, Media and Sport Committee Broadcasting in transition Third Report of Session 2003–04 Report, together with formal minutes, oral and written evidence Ordered by The House of Commons to be printed 24 February 2004 HC 380 [incorporating HC101-i and HC132-i] Published on 4 March 2004 by authority of the House of Commons London: The Stationery Office Limited £15.50 The Culture, Media and Sport Committee The Culture, Media and Sport Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department for Culture, Media and Sport and its associated public bodies. Current membership Mr Gerald Kaufman MP (Labour, Manchester Gorton) (Chairman) Mr Chris Bryant MP (Labour, Rhondda) Mr Frank Doran MP (Labour, Aberdeen Central) Michael Fabricant MP (Conservative, Lichfield) Mr Adrian Flook MP (Conservative, Taunton) Mr Charles Hendry MP (Conservative, Wealden) Alan Keen MP (Labour, Feltham and Heston) Rosemary McKenna MP (Labour, Cumbernauld and Kilsyth) Ms Debra Shipley (Labour, Stourbridge) John Thurso MP (Liberal Democrat, Caithness, Sutherland and Easter Ross) Derek Wyatt MP (Labour, Sittingbourne and Sheppey) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at http://www.parliament.uk/parliamentary_committees/culture__media_and_sport. cfm Committee staff The current staff of the Committee are Fergus Reid (Clerk), Olivia Davidson (Second Clerk), Grahame Danby (Inquiry Manager), Anita Fuki (Committee Assistant) and Louise Thomas (Secretary). -

AIRTIME CONTRACT TERMS Introduction

ITV CUSTOMER RELATIONS LIMITEDBRAND AND COMMERCIAL GLOSSARY -Of- AIRTIME CONTRACT TERMS Introduction: The terms defined in this Glossary of Contract Terms ("Glossary") shall be deemed incorporated into the Deal Arrangements, the Deal Conditions at the following URL: http://www.itvmedia.co.uk/deal_conditions_2008.2009.pdf and the Broadcasters Terms and Conditions at the following URL: http://www.itvmedia.co.uk/broadcasters_terms_and_conditions_2008.2009.pdf. All demographic grouping abbreviations (ABC1, HWCH etc.) shall have the meaning applied to them by BARB. Such definitions are hereby incorporated into this Glossary and the agreements and terms and conditions referred to above for airtime sales entered into by ITV Customer RelationsBrand and Commercial or a Broadcaster. Defined Terms: Aberdeen: means the north geographical transmission Part Area of STV North designated “aberdeen”; Act: means the Broadcasting Acts 1990 and 1996, the Communications Act 2003 and any amendments thereto or any superseding legislation; Actual Delivery: means the actual TVRs delivered by the relevant Broadcasters under a Booking Agreement as reported by BARB; Adjudicator: means the adjudicator appointed pursuant to the Undertakings; Advance Booking Deadline or ABD: means the relevant date from the list of dates published by ITV Customer RelationsBrand and Commercial from time to time on its website at www.itvmedia.co.uk, (or such other deadline as is agreed between an Advertiser or Agency on the one hand and a Broadcaster on the other hand), by which the -

Sky Drx890-Z Spec

Sky drx890-z spec Continue Sky HDOwnerSky plcParentSky plcLaunch date22 May 2006; 14 years ago (2006-05-22)DissolvedOctober 2016Official websitewww.sky.com/products/ways-to-watch/sky-plus-hd/Replaced bySky Sky HD was the hdTV service brand launched by Sky plc on May 22, 2006 in the UK and Ireland to allow high definition channels on Sky to be considered. For the first 2 years after launch, the service was branded Sky HD. The service requires the user to have a Sky HD Digibox and HD ready-made TV. A subscription to the original HD package carries an additional fee of 10.25 pounds (17.00 euros in Ireland) per month in addition to the standard Sky subscription, allowing customers to view HD channels corresponding to the packages of channels to which they are subscribed. Additional Pay-Per-View events on Sky Box Office HD are not available to customers unless they subscribe to the Sky HD package. As of June 2014, the number of sky-HD subscriptions was more than 5.2 million, which is 4.8 million more than a year earlier. Since October 2016, Sky HD is no longer offered since it was replaced by Sky s. Existing customers can continue their subscription with Sky HD. The story launched in May 2006, Sky HD brought high definition television to the consumer market, originally consisting of nine HD channels. The launch prices have been announced as 299 pounds for HD set-top boxes, with an additional HD subscription for 10 pounds per month on top of any existing packages.