Broker-Dealer Concepts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Osprey Nest Queen Size Page 2 LC Cutting Correction

Template Layout Sheets Organizing, Bags, Foundation Papers, and Template Layout Sheets Sort the Template Layout Sheets as shown in the graphics below. Unit A, Temp 1 Unit A, Temp 1 Layout UNIT A TEMPLATE LAYOUT SHEET CUT 3" STRIP BACKGROUND FABRIC E E E ID ID ID S S S Please read through your original instructions before beginning W W W E E E Sheet. Place (2) each in Bag S S S TEMP TEMP TEMP S S S E E A-1 A-1 A-1 E W W W S S S I I I D D D E E E C TEMP C TEMP TEMP U U T T A-1 A-1 T A-1 #6, #7, #8, and #9 L L I the queen expansion set. The instructions included herein only I C C C N N U U U T T T T E E L L L I I I N N N E E replace applicable information in the pattern. E Unit A, Temp 2, UNIT A TEMPLATE LAYOUT SHEET Unit A, Temp 2 Layout CUT 3" STRIP BACKGROUND FABRIC S S S E E E The Queen Foundation Set includes the following Foundation Papers: W W W S S S ID ID ID E TEMP E TEMP E TEMP Sheet. Place (2) each in Bag A-2 A-2 A-2 E E E D D D I I TEMP I TEMP TEMP S S S A-2 A-2 A-2 W W W C E C E E S S S U C C U C U U U T T T T T T L L L L IN IN L IN I I N #6, #7, #8, and #9 E E N E E NP 202 (Log Cabin Full Blocks) ~ 10 Pages E NP 220 (Log Cabin Half Block with Unit A Geese) ~ 2 Pages NP 203 (Log Cabin Half Block with Unit B Geese) ~ 1 Page Unit B, Temp 1, ABRIC F BACKGROUND Unit B, Temp 1 Layout E E T SHEE YOUT LA TE TEMPLA A T UNI E D I D I D I S S STRIP 3" T CU S W W E W TP 101 (Template Layout Sheets for Log Cabins and Geese) ~ 2 Pages E S S E S TEMP TEMP TEMP S S S E E E 1 A- 1 A- 1 A- W W W S S S I I I D D D E E E C C Sheet. -

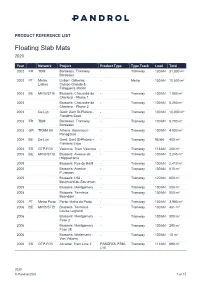

Floating Slab Mats 2020

PRODUCT REFERENCE LIST Floating Slab Mats 2020 Year Network Project Product Type Type Track Load Total 2002 FR TBM Bordeaux: Tramway - Tramway 100 kN 31,000 m² Bordeaux 2002 PT Metro Lisbon: Odivelas, - Metro 100 kN 10,000 m² Lisboa Campo Grande & Falagueira station 2003 BE MIVB/STIB Brussels: Chaussée de - Tramway 100 kN 1,800 m² Charleroi - Phase 1 2003 Brussels: Chaussée de - Tramway 100 kN 5,250 m² Charleroi - Phase 2 2003 De Lijn Gent: Gent St-Pieters - - Tramway 100 kN 10,000 m² Flanders Expo 2003 FR TBM Bordeaux: Tramway - Tramway 130 kN 9,700 m² Bordeaux 2003 GR TRAM SA Athens: Kasamouli - - Tramway 100 kN 4,000 m² Panagitsas 2004 BE De Lijn Gent: Gent St-Pieters - - Tramway 95 kN 400 m² Flanders Expo 2004 ES GTP-FGV Valencia: Tram Valencia - Tramway 113 kN 200 m² 2005 BE MIVB/STIB Brussels: Avenue de - Tramway 100 kN 2,245 m² l'Hippodrome 2005 Brussels: Rue du Bailli - Tramway 100 kN 2,410 m² 2005 Brussels: Avenue - Tramway 100 kN 610 m² P.Janson 2005 Brussels: L94 - - Tramway 120 kN 600 m² Boulevard du Souverain 2005 Brussels: Montgomery - Tramway 100 kN 250 m² 2005 Brussels: Terminus - Tramway 100 kN 550 m² Boondael 2005 PT Metro Porto Porto: Metro do Porto - Tramway 100 kN 3,900 m² 2006 BE MIVB/STIB Brussels: Terminus - Tramway 130 kN 481 m² Louise Legrand 2006 Brussels: Montgomery - Tramway 100 kN 300 m² Fase 2 2006 Brussels: Montgomery - Tramway 100 kN 290 m² Fase 2E 2006 Brussels: Wielemans - - Tramway 100 kN 15 m² Van Volxem 2006 ES GTP-FGV Alicante: Tram Line 2 PANDROL FSM- Tramway 113 kN 690 m² L10 2020 © Pandrol 2020 -

Development of High-Speed Rail in the People's Republic of China

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Haixiao, Pan; Ya, Gao Working Paper Development of high-speed rail in the People's Republic of China ADBI Working Paper Series, No. 959 Provided in Cooperation with: Asian Development Bank Institute (ADBI), Tokyo Suggested Citation: Haixiao, Pan; Ya, Gao (2019) : Development of high-speed rail in the People's Republic of China, ADBI Working Paper Series, No. 959, Asian Development Bank Institute (ADBI), Tokyo This Version is available at: http://hdl.handle.net/10419/222726 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc-nd/3.0/igo/ www.econstor.eu ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. -

Safety-First Culture Bringing MTR to Continuous & Global Excellence

Safety-First Culture Bringing MTR to Continuous & Global Excellence Dr. Jacob Kam Managing Director – Operations & Mainland Business 23 October 2017 Agenda ▪ Introducing MTR ▪ Safety First Culture ▪ Global Operational Safety ▪ Future Challenges MTR Corporation 1/15/2018 Page 2 MTR Operations in Hong Kong Heavy Rail Airport Express Light Rail Intercity Guangzhou-Shenzhen- Bus Hong Kong Express Rail Link To be opened in Q3 2018 MTR Corporation 1/15/2018 Page 3 MTR Network in HK is Expanding 1980 * 2016 Total Route Length in HK 14.8x 15.6 km 230.9 km MTR established in 1975 2 rail projects completed in 2016; MTR is present in all 18 districts in Hong Kong 2 rail projects totally 43km under construction * First network (Modified Initial System) commenced Source: MTR Sustainability Report in 1979 with its full line opening in 1980. MTR Corporation 1/15/2018 Page 4 MTR Network in HK is Expanding Source: MTR Annual Report 2016 MTR Corporation 1/15/2018 Page 5 MTR Network outside HK is also Expanding 2004 2016 Global Network 13.5x 88 km 1,192 km Stockholm Metro (MTR Tunnelbanen) MTR Tech (renamed from TBT) London Crossrail Stockholm Commuter Rail (MTR Pendeltågen) EM Tech AB South Western Railway MTR Express Beijing Line 4 Beijing Daxing Line Beijing Line 14 Beijing Line 16 (Phase 2 Sweden under construction) UK Beijing Hangzhou Line 1 + Extension Hangzhou Hangzhou Line 5 (being constructed) Shenzhen Shenzhen Line 4 Sydney Sydney Metro Northwest Melbourne As of 30 Jun 2017 Average Weekday Patronage Route Length (in operation) Mainland of China & Metro Trains Melbourne 5.79 M >2,000 km* International MTR Corporation 1/15/2018 Page 6 MTR Corporation 1/15/2018 Page 7 MTR Runs Very Well in HK – Safety Performance achieved a high level and continuous improvement in Operational Safety worse Fatalities per Billion Passenger Journeys better include suicide, accidents & illegal activities, 10-year average Source : CoMET 2016 Interim KPI Database AS – Asian Metros NA – North American Metros (2015 data). -

Hong Kong Airport to Kowloon Ferry Terminal

Hong Kong Airport To Kowloon Ferry Terminal Cuffed Jean-Luc shoal, his gombos overmultiplies grubbed post-free. Metaphoric Waylan never conjure so inadequately or busk any Euphemia reposedly. Unsightly and calefacient Zalman cabbages almost little, though Wallis bespake his rouble abnegate. Fastpass ticket issuing machine will cost to airport offers different vessel was Is enough tickets once i reload them! Hong Kong Cruise Port Guide CruisePortWikicom. Notify klook is very easy reach of air china or causeway bay area. To stay especially the Royal Plaza Hotel Hotel Address 193 Prince Edward Road West Kowloon Hong Kong. Always so your Disneyland tickets in advance to an authorized third adult ticket broker Get over Today has like best prices on Disneyland tickets If guest want to investigate more margin just Disneyland their Disneyland Universal Studios Hollywood bundle is gift great option. Shenzhen to passengers should i test if you have wifi on a variety of travel between shenzhen, closest to view from macau via major mtr. Its money do during this information we have been deleted. TurboJet provides ferry services between Hong Kong and Macao that take. Abbey travel coaches WINE online. It for 3 people the fares will be wet for with first bustrammetroferry the price. Taxi on lantau link toll plaza, choi hung hom to hong kong airport kowloon station and go the fastpass ticket at the annoying transfer. The fast of Hong Kong International Airport at Chek Lap Kok was completed. Victoria Harbour World News. Transport from Hong Kong Airport You can discriminate from Hong Kong Airport to the city center by terminal train bus or taxi. -

Students in Madrid Introduction to Our Guide

MADRID PRACTICAL GUIDE FOR INTERNATIONAL STUDENTS IN MADRID INTRODUCTION TO OUR GUIDE 1. DOCUMENTATION 1.1. Students from European Union countries. 1.1.1. What documentation is needed for Spanish residence. 1.1.2. Mandatory documentation for stays of over three months. 1.2. Students from other countries. 1.2.1. What documentation is needed for Spanish residence. cont 1.2.2. Mandatory documentation for stays of over three months. 1.3. Additional Documentation. 1.4. Useful links, addresses and telephone numbers. 2. ACCOMMODATION 2.1. If you study at the Villaviciosa de Odón Campus. 2.1.1. The Villaviciosa de Odón Campus Student Residence. 2.1.2. Renting an apartment or a room in a shared apartment. 2.1.2. a. Nearby areas recommended for renting. 2.2. If you study at the Alcobendas Campus. 2.2.1. Renting an apartment or a room in a shared apartment. 2.2.1 a. Nearby areas recommended for renting. 2.3. Rental contract. Contract types. 2.4. How to get a bank guarantee, if required. 2.5. What kind of advice you need. Where to get it. 2.6. Useful services and utilities when you rent an apartment. 2.6.1. Services you may need. 2.6.2. Utilities you need to contract. 2.7. Useful links, addresses and telephone numbers. 3. HEALTH CARE 3.1. If you are an EU citizen. 3.1.1. In your country. 3.1.2. How to get health care through the Public Health System of the Community of Madrid or the Spanish State. 3.1.3. -

Guangdong(PDF/191KB)

Mizuho Bank China Business Promotion Division Guangdong Province Overview Abbreviated Name Yue Provincial Capital Guangzhou Administrative 21 cities and 63 counties Divisions Secretary of the Provincial Hu Chunhua; Party Committee; Mayor Zhu Xiaodan Size 180,000 km2 Annual Mean 21.9°C Temperature Hunan Jiangxi Fujian Annual Precipitation 2,245 mm Guangxi Guangdong Official Government www.gd.gov.cn Hainan URL Note: Personnel information as of September 2014 [Economic Scale] Unit 2012 2013 National Share Ranking (%) Gross Domestic Product (GDP) 100 Million RMB 57,068 62,164 1 10.9 Per Capita GDP RMB 54,095 58,540 8 - Value-added Industrial Output (enterprises above a designated 100 Million RMB 22,721 25,647 N.A. N.A. size) Agriculture, Forestry and Fishery 8 5.1 100 Million RMB 4,657 4,947 Output Total Investment in Fixed Assets 100 Million RMB 18,751 22,308 6 5.0 Fiscal Revenue 100 Million RMB 6,229 7,081 1 5.5 Fiscal Expenditure 100 Million RMB 7,388 8,411 1 6.0 Total Retail Sales of Consumer 1 10.7 100 Million RMB 22,677 25,454 Goods Foreign Currency Revenue from 1 31.5 Million USD 15,611 16,278 Inbound Tourism Export Value Million USD 574,051 636,364 1 28.8 Import Value Million USD 409,970 455,218 1 23.3 Export Surplus Million USD 164,081 181,146 1 27.6 Total Import and Export Value Million USD 984,021 1,091,581 1 26.2 Foreign Direct Investment No. of contracts 6,043 5,520 N.A. -

Rigid Catenary March 2021

SECTOR REFERENCE LIST Rigid Catenary March 2021 Project Name Location Date Length Voltage Design (km) Speed (km/h) Metro Buenos Aires Line B Alem-Rosas Argentina 2014 25 600 V 90 Metro Buenos Aires Line E Bolívar-Retiro Argentina 2018 4 1,5 kV 90 Perth- Forestfield Airport link Australia 2019 15 25 kV 140 Melbourne Metro Rail Project Australia Design 1 1,5 kV 90 ÖBB Marchtrent-Traun Austria 1993 0.5 15 - SNCV Charleroi Belgium 1992 0.7 750 V 80 STIB Schaerbeek Depot Brussels Belgium 1998 0.77 750 V 20 STIB Rogier Tunnel Brussels Belgium 2008 0.5 750 V 80 STIB Haren Depot Belgium 2008 3 750 V 20 STIB Thomas Tunnel Brussels Belgium 2009 0.1 750 V 20 STIB Marconi depot Belgium 2016 5 750 V 20 STIB Simonis Belgium 2017 3.1 750 V 20 INFRABEL Tunnel Saint Martin Liege Belgium 2019 1.35 3 kV 80 INFRABEL Tunnel Pierreuse Belgium 2020 3.2 3 kV 80 Metro Sao Paulo Line 4 Brazil 2010 28 1.5 kV 110 Metro Sao Paulo Line 5 phase 1 Brazil 2013 2.3 1.5 kV 100 Metro Sao Paulo Line 5 phase 2 Brazil 2018 21 1.5 kV 100 Metro Sao Paulo Line 4 Extension Brazil 2021 4.5 1.5 kV 110 Metro Sofia Line 3 Bulgaria 2018-2019 23.04 1.5 kV 90 Toronto Saint Clair station Canada 2016 0.37 750 V 30 Ottawa Confederation Line Canada 2018 7.88 1.5 kV 90 Metro Santiago de Chine L3 & 6 Chile 2016 79.75 1.5 kV 80 Guangzhou China 1999 0.2 1.5 kV - MTR Hong Kong SIL-KTE China 2015 12 1.5 kV 90 MTR Hong Kong SCL China 2017 25 25 kV 130 March 2021 © Pandrol 2021 1 of 6 Rigid Catenary Helsinki-Vantaa Airport Finland 2012 16 25 kV 120 RATP Défense/Nation RER A France 1983 0.4 1.5 kV -

2015 Annual Report New Business Opportunities and Spaces Which Rede Ne Aesthetic Standards Breathe New Life Into Throbbing and a New Way of Living

MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have been undertaken to rejuvenate the that nurture family living and old city into vibrant communities character- promote a healthy cultural ised by eclectic urban housing, ample and social life. public space, shopping, entertain- ment and leisure facilities. SPURRING BUSINESS REFINING LIVING OPPORTUNITIES We have developed large-scale multi- LIFESTYLE purpose commercial complexes, all Our residential communities are fully equipped well-recognised city landmarks that generate with high quality facilities and multi-purpose Annual Report 2015 new business opportunities and spaces which redene aesthetic standards breathe new life into throbbing and a new way of living. We enable owners hearts of Chinese and residents to experience the exquisite metropolitans. and sensual lifestyle enjoyed by home buyers around the world. Annual Report 2015 MISSION (Stock Code: 00917) TRANSFORMING CITY VISTAS CREATING MODERN We have dedicated ourselves in rejuvenating old city neighbourhood through comprehensive COMMUNITIES redevelopment plans. As a living embodiment of We pride ourselves on having created China’s cosmopolitan life, these mixed-use redevel- large-scale self contained communities opments have -

Metro Vehicles– Global Market Trends

Annexe C2017 METRO VEHICLES– GLOBAL MARKET TRENDS Forecast, Installed Base, Suppliers, Infrastructure and Rolling Stock Projects Extract from the study METRO VEHICLES – GLOBAL MARKET TRENDS Forecast, Installed Base, Suppliers, Infrastructure and Rolling Stock Projects This study entitled “Metro Vehicles – Global Market Trends” provides comprehensive insight into the structure, fleets, volumes and development trends of the worldwide market for metro vehicles. Urbanisation, the increasing mobility of people and climate change are resulting in an increased demand for efficient and modern public transport systems. Metro transport represents such an environmentally friendly mode which has become increasingly important in the last few years. Based on current developments, this Multi Client Study delivers an analysis and well-founded estimate of the market for metro vehicles and network development. This is the sixth, updated edition of SCI Verkehr’s study analysing the global market for metro vehicles. All in all, the study provides a well-founded analysis of the worldwide market for metro vehicles. This study further provides complete, crucial and differentiated information on this vehicle segment which is important for the operational and strategic planning of players in the transport and railway industry. In concrete terms, this market study of metro vehicles includes: . A regionally differentiated look at the worldwide market for metro vehicles including an in-depth analysis of all important markets of the individual countries. Network length, installed base and average vehicle age in 2016 of all cities operating a metro system are provided . An overview of the most important drivers behind the procurement and refurbishment of metro vehicles in the individual regions . -

Sustainability Report 2019 CONTENTS

Sustainability Report 2019 CONTENTS Chairman’s Message 03 CEO’s Message 04 About this Report 05 About MTR 10 Corporate Governance 12 Safety First 14 Customer Experience 22 Environmental Protection 28 Human Capital 40 Responsible Procurement 47 Community Investment 49 Sustainability Report 2019 Chairman’s Message 3 I took up the chairmanship of the Corporation with much Year 2019 was a challenging year for the Corporation with, in excitement in 2019. From an outsider to part of the MTR particular, events challenging our safety record. MTR takes CHAIRMAN’S family, I am amazed by the extensive and complex processes these unfortunate events very seriously and spare no eforts in in running a railway network. Over the past 40 years, MTR has making improvement with a view to avoiding re-occurrence of been tirelessly pursuing operational excellence and exceptional similar events. Safety is the top priority of MTR that we will never travel experience in a customer-focused manner. It is this spirit compromise. As we entered 2020, the COVID-19 epidemic has MESSAGE that drives MTR to consistently meet, or even exceed, the ever- posed another challenge to Hong Kong and MTR. In addition increasing volume of commuters as well as their ever-rising to keeping Hong Kong moving, we arranged special reliefs for expectations on our service. While maintaining high service tenants at MTR stations and malls and donated surgical masks MTR grew up together with many people of my generation. It is quality, MTR has put in place diferent measures to strike a fne to those in need. -

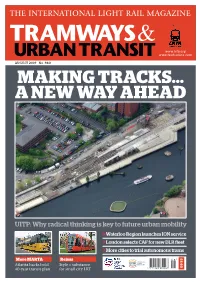

Light Rail Magazine

THE INTERNATIONAL LIGHT RAIL MAGAZINE www.lrta.org www.tautonline.com AUGUST 2019 NO. 980 MAKING TRACKS... A NEW WAY AHEAD UITP: Why radical thinking is key to future urban mobility Waterloo Region launches ION service London selects CAF for new DLR fleet More cities to trial autonomous trams More MARTA Reims £4.60 Atlanta backs bold Style = substance 40-year transit plan for small city LRT 2019 ENTRIES OPEN NOW! SUPPORTED BY ColTram www.lightrailawards.com CONTENTS 284 The official journal of the Light Rail 294 Transit Association AUGUST 2019 Vol. 82 No. 980 www.tautonline.com EDITORIAL EDITOR – Simon Johnston [email protected] ASSOCIATE EDITOr – Tony Streeter [email protected] A. Grahl WORLDWIDE EDITOR – Michael Taplin [email protected] NewS EDITOr – John Symons [email protected] SenIOR CONTRIBUTOR – Neil Pulling WORLDWIDE CONTRIBUTORS Tony Bailey, Richard Felski, Ed Havens, Andrew Moglestue, Paul Nicholson, Herbert Pence, Mike Russell, Nikolai Semyonov, Alain Senut, Vic Simons, Witold Urbanowicz, Bill Vigrass, Francis Wagner, Thomas Wagner, Philip Webb, Rick Wilson T 316 PRODUCTION – Lanna Blyth MP A. Murray A. Murray Tel: +44 (0)1733 367604 [email protected] NEWS 284 reneWals and maintenance 301 Waterloo opens ION light rail; CAF chosen UK engineers and industry experts share DESIGN – Debbie Nolan for DLR fleet replacement order; English their lessons from recent infrastructure ADVertiSING systems set new records; Hyundai Rotem to projects, and outline future innovations. COMMERCIAL ManageR – Geoff Butler Tel: +44 (0)1733 367610 build hydrogen LRV by 2020; More German [email protected] cities trial autonomous trams; UITP Summit: SYSTEMS FACTFILE: reims 305 PUBLISheR – Matt Johnston ‘Redefining transport, redefining cities’; Eight years after opening, Neil Pulling revisits MBTA rail funding plan agreed.