Cutting the Profitability Gordian Knot

Total Page:16

File Type:pdf, Size:1020Kb

Load more

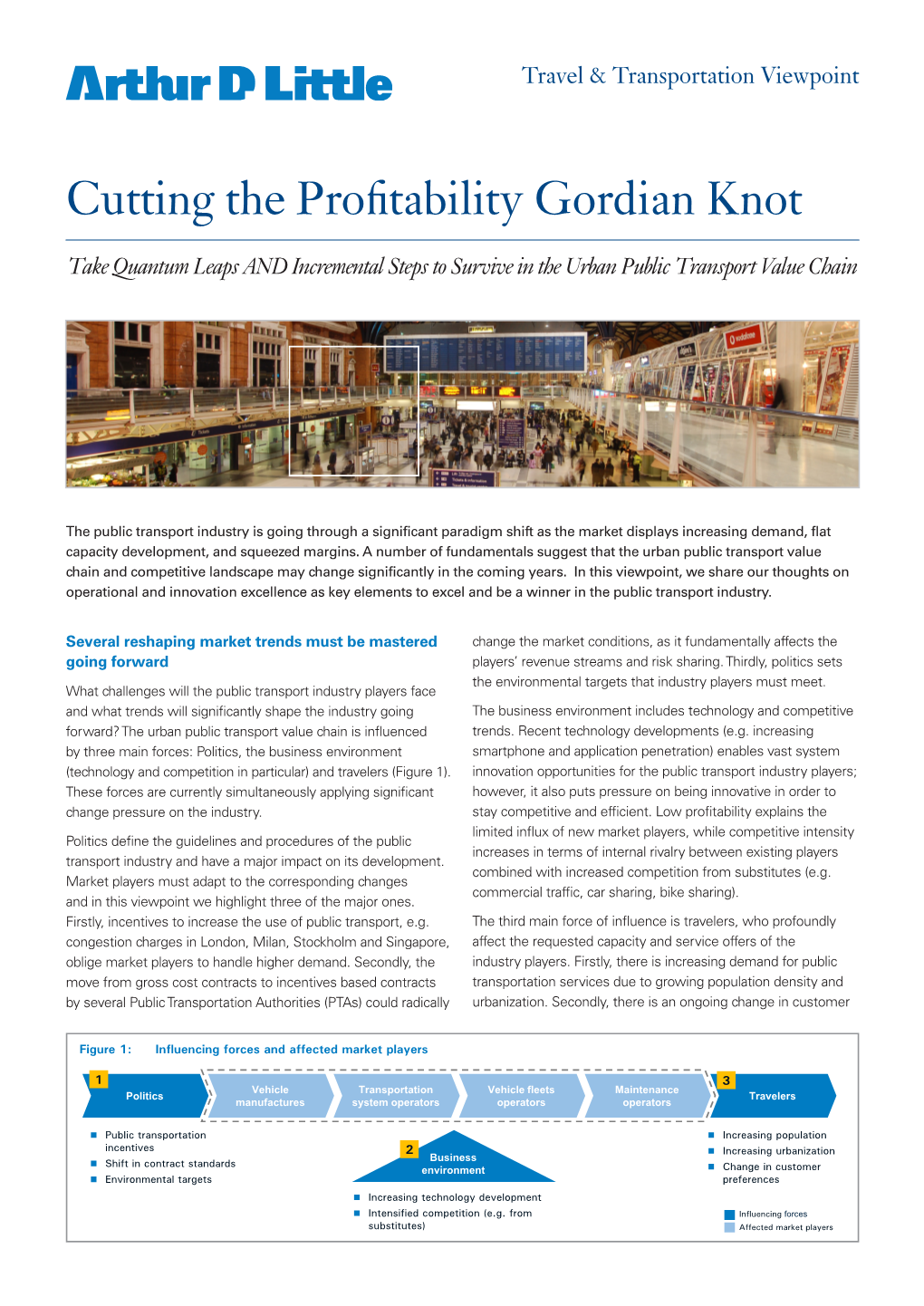

Recommended publications

-

Volvo 8900 – Den Grønnere Intercitybussen SAFETY THAT FITS ALL

OnKundemagasin fra VolvoThe Bus Corporation, nr 2 2010Move Vi presenterer Volvo 9500 – Allsidighet på veien Nye Volvo 8900 – den grønnere intercitybussen SAFETY THAT FITS ALL ALCOLOCKS ARE NOT ONLY AVAILABLE FROM THE ASSEMBLY LINE. NOW YOU CAN EXTEND THIS SAFETY MEASURE TO YOUR ENTIRE FLEET. Specifically engineered to withstand dust, vibration and extreme temperatures, ALCOLOCK is compatible with all vehicles. AVAILABLE THROUGH THE VOLVO DEALER NETWORK As a leading producer of alcohol interlocks and breath alcohol testers, Alcohol Countermeasure Systems offers technology of superior quality. These custom solutions are fully integrated and designed to communicate with other systems in your fleet, such as GPS, GSM and telematics. • CENELEC (EU) approved • Compatible with all vehicles To learn more on how to integrate alcohol interlock technology into your vehicles please visit our website: acs-corp.com Effektive og miljøvennlige transportløsninger 4. Volvo 8900 er en ny, lettere og mer drivstoffef Våre kunder står overfor store utfordringer i dag og i frem- fektiv samt mer ergonomisk tiden. Operatørene blir stilt overfor nye strenge, men viktige intercitybuss, laget av stål og miljøkrav samtidig som myndighetene krever mer for pen- aluminium. gene. Bedrifter som driver busselskapene er under press på grunn av høye drivstoffkostnader og hard konkurranse, noe som tvinger dem til å konstant forsøke å finne mer effektive løsninger. For oss hos Volvo Bus er det viktig å støtte busselska- pene ved å tilby miljømessig kompatible og effektive løs- ninger som tiltrekker flere passasjerer på grunn av et høyt kvalitetsnivå. 7. Volvo 8900 leveres med I forbindelse med IAA, den største bussutstillingen i en pakke av ettermarkedstje Tyskland, lanserer vi tre store produktnyheter som dekker nester som hjelper kundene å de strenge kravene som stilles til dagens busselskaper. -

Bus Transportation Taking the High Road

Transportation Bus transportation Taking the High Road The massive upgradation of national highways and the construction of a network of expressways linking important cities have given a boost to the coach-building industry in India, as demand for luxury buses has gone up exponentially, says Annamma Oommen. 30 HEY are among the new crop of expressways that have come up in India, linking important cities. The Mumbai-Pune expressway Tand the Ahmedabad-Vadodara expressway – each nearly 100 km in length – are among the busiest roads in the country. Sleek air-conditioned coaches zoom across the fast lanes, hitting speeds of 100 to 120 kmph. Inside the coach, passen- gers can relax in luxurious pull-back seats, watching their favourite Bollywood flicks. Travelling along the new expressways, one experiences the sea-change that has occurred in the quality of surface trans- port. Sturdy luxury coaches, replete with air suspension, comfortable seats, ample COMFORTABLE RIDE: Holidayers are increasingly travelling by luxury coaches to destinations like Goa sitting space and enormous holds for baggage, zip across India’s leading cities, transporting millions of business travel- include Mumbai-Pune, Delhi-Chandi- lers, holidayers and students. garh, Delhi-Agra, Delhi-Jaipur, Bangalore- Many state transport undertakings With demand Chennai and Ahmedabad-Vadodara. have also acquired a fleet of fancy coaches, It takes an hour or two to reach an catering to the burgeoning demand from passengers airport – in Mumbai, Delhi or Bangalore from passengers, most of who do not soaring, transport – from the city centre; early check-in, mind paying a premium for travelling in security drills and delayed flights due to relative comfort. -

EU Public Procurement

EU Public procurement Ulf Gustafsson Strong global position 1. Evobus 2. - 3. Yutong 4. Tata 5. Ashok Leyland 6. MAN 7. Irisbus 8. Scania 9. King Long Sales 2010 Volvo Buses 2 Volvo Buses global sales N. America Total 8 559 Volvo 3 652 Europe MS 23,2% Total 23 679 Volvo 2 910 MS 11,4% International S. America Total 113 640 Volvo 4 130 (incl JV) Total 20 823 Volvo 3 652 MS 5,1% MS 17,6% Global Bus Market 2011 > 12 tons NA excl. school buses. SA and Mexico >15 tons Volvo Buses 3 2/3 of our sales in Europe Distribution of sales is purchased under the Public Procurement rules. Rules that enable free trade Europe is a prerequisite, especially for 20% a company with a small home Sweden (home market. market) 3% Other 77% Volvo Buses Departement, Name, Document name, Security Class 4 Date Comments on the modernization of the EU public procurement framework VBC can support: • New award criteria based on MEAT in support of common societal goals (Linked to Europe 2020 Strategy) • Innovation partnerships to give incentives to develop innovative solutions • Establishment of national oversight bodies in charge of monitoring and controlling implementation activities • Simplification • Lifecycle cost concept (Sector specific “Green Vehicle Directive”) Volvo Buses Department, Name, Document name, Security Class 5 Date Main areas of concern ü Appeals of taken decisions. • The use of appeals has diminished lately, hopefully is this trend continuing. ü The implementation of Green Vehicle Directive • The monetized option is rarely used as part of the procurement. -

Export Financing

VOLVOEXPORT BUSES FINANCING – AN EXCELLENT TOOL FOR A SWEDISH EXPORTER 8TH NORDIC REGION TRADE & EXPORT FINANCE FORUM Tore Bäckström Senior Vice President & Executive Advisor November 25, 2015 Volvo Buses VOLVO BUSES PART OF THE VOLVO GROUPThe Volvo Group is one of the world’s leading manufacturers of trucks, buses, construction equipment, marine and industrial engines The Volvo Group employs about 110,000 people, has production facilities in 18 countries and sales of products in more than 190 markets Volvo Buses 2 November 2015 Volvo Group Organization Group Trucks Group Trucks Sales Group Trucks Operations Group Trucks Technology Business Areas Construction Governmental Volvo Financial Buses Volvo Penta Equipment Sales Services Volvo Buses 3 November 2015 THE VOLVO BRAND High quality buses, coaches, chassis and services BUSES COACHES CHASSIS SERVICE • Green Efficiency • Low Lifecycle Cost • Preferred body • Fuel efficiency • Low Lifecycle Cost • Safety builders • Availability and • Strong after-market • Strong aftermarket • Low Lifecycle Cost Uptime support support • Strong after-market • Workshop integration support Volvo Buses 4 November 2015 Volvo Bus Corporation VBC 2010 2011 2012 2013 2014 2015-YTD No units sold 11 100 13 600 11 400 9 700 9 600 7 600 Net Sales BSEK 20,5 22,3 20,3 16,7 18,7 16,7 Op Income MSEK 780 1 036 50 -190 98 596 America 2010 2011 2012 2013 2014 2015-YTD No units sold 3 500 5 700 4 500 4 300 4 700 3 000 Net Sales BSEK 8,9 10,3 9,5 7,9 9,5 10,7 Op income MSEK 401 613 129 -105 131 501 Volvo Buses 5 November -

New York November 8, 2006

New York November 8, 2006 Leif Johansson, President and CEO 1 Volvo Group Third Quarter Highlights Third Quarter In Focus Going Forward z Business environment z Manage product- and production - European market stronger than expected change-over - Prebuy effect in North America z Capitalize on new products z Sales increased by 9% z Manage downturn in US truck market z Another quarter with strong profitability - Adjusted operating income up 24% to SEK 4,972 - Adjusted operating margin at 8.7% - Return on equity at 19.3% z EPS up 34% to SEK 9.70 z Increased ownership in Nissan Diesel and a 70% equity investment in Lingong z New financial targets AB Volvo 2006-11-08 LJo 2 Volvo Group Heavy Duty Truck Market Europe (EU members + Switzerland and Norway) Forecast 2006: ~290,000 Units, Thousands (heavy trucks) 2007: in line with 2006 300 Modification of definition In 1991 (East Germany) and in 2000 (new member states) 277 250 256 230 200 188 171 179 150 122 100 116 50 0 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 '00 '01 '02 '03 '04 '05 AB Volvo 2006-11-08 LJo 3 Volvo Group Strategic focus for the Volvo Group 2007… → Building a competitive Volvo Group → Profitable growth – Through acquisitions – Geographic expansion – Asia – Eastern Europe – Soft offers AB Volvo 2006-11-08 LJo 4 Volvo Group The Volvo Group Vision To be valued as the world’s leading provider of commercial transport solutions Wanted position ¾ Number one in image and customer satisfaction ¾ Sustainable profitability above average ¾ Number one or two in size or superior growth rate AB Volvo 2006-11-08 LJo 5 Volvo Group Maintaining Strong Positions DCX Evobus* Caterpillar Volvo Group Volvo Buses Komatsu Paccar Scania Deere Dongfeng Irisbus Hitachi *Mercedes, Setra & Orion Interna’l > 16 ton Neoman > 12 ton Volvo CE Volvo Aero Brunswick VolvoVolvo GroupGroup y World leading in development, Volvo Penta DCX production and aftermarket services Yanmar Caterpillar of selected engine components. -

THE LOW EMISSION BUS GUIDE Interactive Version

THE LOW EMISSION BUS GUIDE Interactive version H This report is published by The Low Carbon Vehicle Partnership Low Carbon Vehicle Partnership 3 Birdcage Walk, London, SW1H 9JJ Tel: +44 (0)20 7304 6880 E-mail: [email protected] Project Team: Gloria Esposito, Daniel Hayes Author: Gloria Esposito, Head of Projects Reviewed by: Andy Eastlake, Managing Director Date of Report: 1st November 2016 Acknowledgments The production of the Low Emission Bus Guide has been sponsored by the following organisations: LowCVP would like to thank members of their Bus Working Group for providing technical information and case study material pertaining to the guide - Argent Energy, BOC, BYD, First Bus JouleVert, Roadgas, Scania, Stagecoach, Transport for London, Volvo, Nottingham City Council, Reading Buses, York City Council. 4 Low Emission Bus Guide Low Emission Bus Guide 5 Executive Summary Introduction The Low Emission Bus (LEB) Guide aims to provide bus operators greenhouse gas emissions. Road transport is currently responsible representative bus test cycle such as the LowCVP UK LUB cycle. There are presently 3,760 LCEBs in operation across England, and local authorities with an overview of the benefits of a range of for around quarter of greenhouse gas emissions (GHG) in the UK, Consideration of local policies such as Clean Air Zones or Low Wales and Scotland covering hybrid, electric, plug-in hybrid, low emission fuels and technologies that reduce both air pollution of which 4% is attributable to buses¹ . A range of policies have Emission Zones, which specify emission performance standards, electrified ancillaries, biomethane and hydrogen fuel cell buses. and greenhouse gas emissions. -

The Volvo Group Annual and Sustainability Report 2016

THE VOLVO GROUP ANNUAL AND SUSTAINABILITY REPORT DRIVING PROSPERITY THROUGH TRANSPORT SOLUTIONS CONTENT A GLOBAL GROUP OVERVIEW This is Volvo Group . 2 CEO comments . 4 OUR MISSION IS TO DRIVE PROSPERITY STRATEGY The Volvo Group journey continues . 8 THROUGH TRANSPORT Mission . .10 SOLUTIONS. Vision . 12 Aspirations . 14 Values . 15 Global context and overall trends . 16 Strategy . 19 Financial targets . 23 Materiality issues . .26 OUR VISION IS TO BE BUSINESS MODEL THE MOST DESIRED AND Value chain . 30 SUCCESSFUL Customers . 32 TRANSPORT SOLUTION Product development . 38 PROVIDER IN THE Purchasing . 48 WORLD. Production & Logistics . 50 Retail & Services . .54 Reuse . 56 Our people behind it . .58 Our role in society . 64 GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2016 OUR ASPIRATIONS Global strength . 76 ARE THE GUIDE ON Significant events published in quarterly reports . 78 Financial performance . .80 OUR JOURNEY. Financial position . 83 Cash flow statement . 86 Trucks . .88 Construction Equipment . 92 Buses. 95 Volvo Penta . 97 Financial Services . 99 BUILDING A PERFOR- Financial management . .101 MANCE CULTURE. Changes in consolidated shareholders’ equity . 102 OUR COMPANY CULTURE The share. 103 IS HOW WE INTERACT Risks and uncertainties . 106 WITH EACH OTHER, WITH OUR CUSTOMERS NOTES Notes to financial statements . .112 AND WITH SOCIETY Parent Company AB Volvo . 160 AS A WHOLE. CORPORATE GOVERNANCE Corporate Governance Report 2016 . 170 Board of Directors . 178 Group Executive Board . 184 OTHER INFORMATION Proposed Remuneration Policy . 188 Proposed Disposition of Unappropriated Earnings . 189 Audit report for AB Volvo (publ) . 190 Eleven-year Summary . 193 Explanation to adjusted operating income . 202 Definitions . 204 Annual General Meeting . 205 Preliminary publication dates . -

Iveco Afriway - Dawn of a New Era

????????? 95.00 R FEBRUARY 2016 | ON TRANSPORT AND LOGISTICS FOCUSONTRANSPORT.CO.ZA IVECO AFRIWAY - dawn of a new era HIRING NEW DRIVERS? Are you sure they can drive? HOW NEW EU TRUCKS take a brake ALTERNATIVE FUELS: what’s the difference? UD BUSES FOR RHD markets? Real-time fleet data BIG TIME SAVINGS FUEL BRAKES CLUTCH Does your monthly Are brake pads, Do you spend fuel bill exceed drums and discs R100 000 or more on costing you in R 1 million? clutch replacements excess of a month? R250 000 per month? We can reduce We can reduce We can reduce your monthly fuel the wear on these your clutch consumption by items by an replacements on an average of average of average by 14% 30% 60% R140 000 R70 000 R60 000 per month * per month * per month * * Results may vary Call us to SAVE Join fleet owners in 35 countries on 5 continents who save with this advanced eco-drive system, focusing on fleet efficiency; mechanical and predictive diagnostics; safety and driver technical skills analysis. www.questektelematics.co.za | [email protected] | +27 11 706 0405 FEBRUARY 2016 CONTENTS PAGE PAGE PAGE PAGE 6 12 16 24 A TRULY TERRIFYING LOVE AND CARE FROM FUEL, GLORIOUS FUEL STOP ON SIGHT TEST THE INSIDE OUT Supply of fossil fuels is finite Since November 2015, new Employing a new truck or bus As the rand continues to – it will run out. We fire up European trucks with a gross driver, without first testing that weaken, it becomes more some info on alternative fuels. -

OCCASION This Publication Has Been Made Available to the Public on The

OCCASION This publication has been made available to the public on the occasion of the 50th anniversary of the United Nations Industrial Development Organisation. DISCLAIMER This document has been produced without formal United Nations editing. The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization (UNIDO) concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries, or its economic system or degree of development. Designations such as “developed”, “industrialized” and “developing” are intended for statistical convenience and do not necessarily express a judgment about the stage reached by a particular country or area in the development process. Mention of firm names or commercial products does not constitute an endorsement by UNIDO. FAIR USE POLICY Any part of this publication may be quoted and referenced for educational and research purposes without additional permission from UNIDO. However, those who make use of quoting and referencing this publication are requested to follow the Fair Use Policy of giving due credit to UNIDO. CONTACT Please contact [email protected] for further information concerning UNIDO publications. For more information about UNIDO, please visit us at www.unido.org UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna International Centre, P.O. Box 300, 1400 Vienna, Austria Tel: (+43-1) 26026-0 · www.unido.org · [email protected] Sources of Competitiveness in the Automotive Industry of the Republic of Belarus UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Sources of Competitiveness in the Automotive Industry of the Republic of Belarus UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna, 2011 ©2011 UNIDO December 2011 DISCLAIMER ACKNOWLEDGEMENTS This document has been produced without formal United Mr. -

VOLVO 9700 Superb Performance

VOLVO 9700 Superb performance. Striking style. PASSENGER SATISFACTION A business decision that’s thoughtfully designed You need efficient tools to run a profitable operation. Tools that contribute to increased income and lower costs to help you achieve higher productivity, while keeping quality-conscious passengers safe and comfortable. With those requirements in mind—plus the need to meet the latest EPA emissions standards—there’s one coach that does it all. Today more than ever, the Volvo 9700 is the best way to stay ahead in a highly competitive transportation marketplace. With superb performance, a striking modern design, and Volvo-unique safety, the 9700 is built to increase your profits with every mile you drive. A first impression that lasts Climate control The Volvo 9700 makes quite an impression. The sleek exterior is matched by an elegant The on-board environment stays pleasant thanks to a high-capacity ventilation system, interior featuring soft, gentle shapes and well-designed trim. The luggage racks, handles, excellent air circulation, and individually adjustable air vents for each seat. The vehicle’s fittings and ceiling panel are all designed to reinforce a spacious feeling. Choose from roof-mounted, fully automatic air conditioning and heating system also features separate three color themes in which the roof lining, walls, modesty panel and seat covers all match. computerized climate controls for the driver. The sensation of comfort High-quality entertainment Electronically controlled air suspension and a rigid frame ensure a confident, reassuring Volvo 9700 coaches feature Proline III audio systems, offering the latest user-friendly ride. A low interior noise level and comfortable seats add enjoyment to the journey, and technology that delivers information and entertainment from a single source. -

Volvo 9900 Brochure Format PDF Size 8 MB

Volvo 9900 For your ultimate journey DESIGN A new design – beyond styling The moment you meet the Volvo 9900 you feel this coach is special. The elegance and the attractive details really catch the eye. The distinctive Z-shaped window lines along its sides add a sense of speed and motion. The angle of the lines also resembles the vehicle’s inner gradient theatre floor which gives every passenger excellent visibility. Designed for Part of the relaxing ambiance for an enjoyable journey. More than meets the eye Outstanding aerodynamics Designed for driver performance A holistic design philosophy is the secret behind the The new front of the Volvo 9900 has a distinct and Our design fundamentals are also clearly visible in the distinctive personality of the new Volvo 9000 range. powerful expression. But every single line and surface driver’s environment. A pleasently curved dashboard Luxury and comfort The Volvo 9900 is designed to express comfort and is part of an aerodynamic masterpeice. An undisturbed where everything is in the right place creates a calm and luxury, but functionality and performance are never flow with a minimum of turbulence results in reduced clean space. Together with the new stylish steering wheel The all-new Volvo 9900 is all about luxury. Your passengers compromised. The obvious elegance comes from noise, increased stability and a fuel-saving reduction and a premium driver’s seat it creates a perfect workplace. will enjoy travelling in the highest comfort and style, while you the fact that everything you see is there for a reason. in air resistance. -

Håkan Karlsson

Håkan Karlsson President & CEO Volvo Bus Corporation Volvo Investment trip, Wroclaw, May 14-15, 2007 Units/MSEK 20000 2000 Shanghai Volume 2004 1998 100% of MASA Sales Prévost Units closed Nova BUS or divested 16000 Carrus Vienna 1999 1995 Prévost Irvine 2000 12000 1994 Helsinki 2001 Drögmöller Aabenraa South Africa 2001 1981 Xian Prevost and Nova 8000 50% consolidated 2001 Säffle 1990 1988 Steyr Roswell 2002 1979 Leyland Brazil Aabenraa 2004 4000 Heilbronn 2005 0 1970 1975 1980 1985 1990 1995 2000 2005 Nordic Chassis European Acquisition phase Consolidation Company growth & Complete buses phase Volvo Bus Corporation Volvo Investment trip, Wroclaw, May 14-15, 2007 Volvo Buses consolidation Complete Bus Strategy Chassis platform One industrial system consolidation Partner Complete vehicles Chassis Body C NASA Europe International /Shells Builders/ O Converters M P L E Cost efficient modules & components T Marketing, development & E production of complete buses O VdB VBoF Asian hub F 12 6 F Price competitive chassis E Soft Offers R External Bodybuilders Aftermarket Volvo Powertrain System integration Poland Borås/Gbg Säffle Finland Mexico Acrivia Curitiba Prevost Nova Silver Sunwin KOLA GPS CA/SAP BM/FM ST GOS CATIA V5 MyPlace Not implemented Partly implemented Implemented Volvo Bus Corporation Volvo Investment trip, Wroclaw, May 14-15, 2007 COACHES INTERCITY BUSES CITY BUSES Volvo Bus Corporation Volvo Investment trip, Wroclaw, May 14-15, 2007 Sales Operating Income MSEK MSEK 16589 16859 633 14035 470 12722 11978 185 -94 -397 2002 2003 2004 2005 2006 2002 2003 2004 2005 2006 No. of invoiced vehicles 10675 10360 9059 7817 8232 2002 2003 2004 2005 2006 Volvo Bus Corporation Volvo Investment trip, Wroclaw, May 14-15, 2007 Bus World Market 2006 >12 tons 13,4 % 18,5 % Europe North America Total:24,313 Total: 8,938 Volvo: 3,255 Volvo: 1,655 6,5 % International Total: 65,590 7,8 % Volvo: 4,231 South America Total: 15,273 Volvo: 1,187 NA: excl.