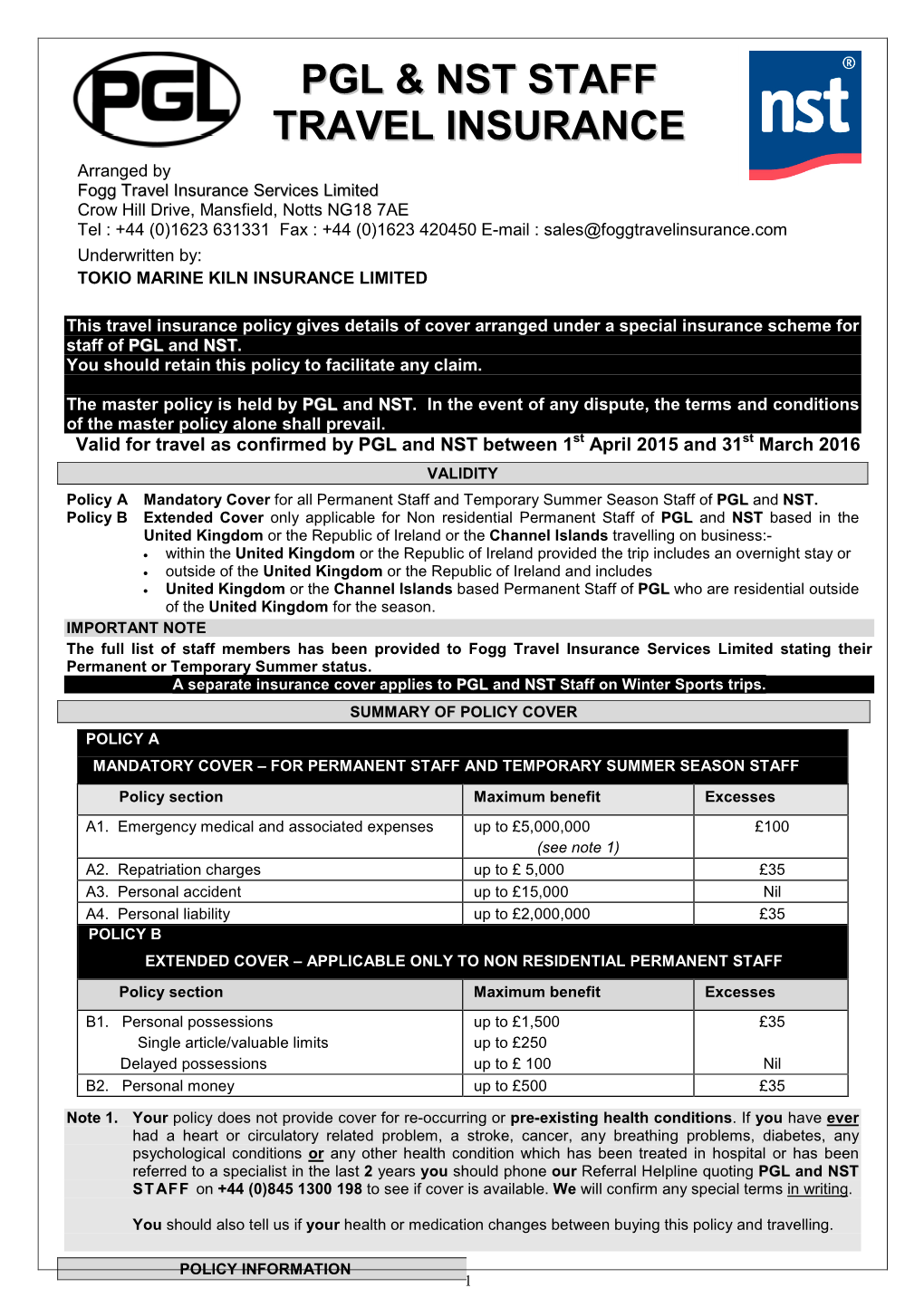

Pgl & Nst Staff Travel Insurance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Planning Statement

Planning Design & Access Statement Amendments to extant planning permission (RR/2007/397/P as amended by later permissions) for a kitchen extension to approved conference centre, extension to existing accommodation block, amended design and location for approved accommodation blocks, toilet/shower block and tenting area, relocate approved car park, new coach passing places, provision of a range of outdoor activities including a new activity lake, creation of bunds with fencing and landscaping. PGL Pestalozzi, Ladybird Lane, Sedlescombe, Battle, TN33 0UF June 2019 Client: PGL Travel Ltd Report Title: Planning Statement Contents 1. Introduction .................................................................................................................................................................... 1 2. Need for the Proposal .................................................................................................................................................. 4 3. Site Description and Context ...................................................................................................................................... 6 4. Planning History .............................................................................................................................................................. 9 5. Proposal ........................................................................................................................................................................ 14 6. Consultation ................................................................................................................................................................ -

Disappoints on Debt Repayment

25 MAY 2016 Quarterly Update COX & KINGS BUY MIDCAPS Target Price: Rs 286 Disappoints on debt repayment Cox & Kings’s (C&K) FY16 revenue at Rs 24 bn (up 6% YoY) and CMP : Rs 150 EBITDA at Rs 8.2 bn (up 1% YoY) were broadly in line with our Potential Upside : 91% expectations. PAT at Rs 539 mn (our est. Rs 2.8 bn) was affected due to goodwill write-off as a result of sale of subsidiary. However, what disappointed us was debt repayment guidance of Rs 3-5 bn not panning MARKET DATA out (due to higher capex/working capital). FY16 net debt came down to No. of Shares : 169mn Free Float : 51% Rs 22.5 bn primarily due to cash from sale of subsidiary. Market Cap : Rs25bn Management does not see deterioration in working capital but expects 52-week High / Low : Rs317 / Rs141 capex to be higher at Rs 3 bn in FY17 led by PGL expansion Avg. Daily vol. (6mth) : 497,006 shares (Rs 1.1bn); India capex at Rs 0.8 bn (largely on account of SAP Bloomberg Code : COXK IB Equity implementation); and Rs 0.7 bn towards Meininger expansion. Promoters Holding : 49% FII / DII : 34% / 3% Management guided cash of Rs 4 bn from sale of subsidiaries coupled with operating cash flow will be used to reduce debt. Q4 highlights: In a seasonally weak quarter (Q4 contributes ~10% of yearly EBITDA),C&K reported 4% decline in revenue to Rs 4.7 bn. Despite higher ad spends in domestic leisure and impact of terror attack, EBITDA (adj. -

A Successful Journey of Transformation

73rd Annual Report 2012-13 A Successful Journey of Transformation Cox & Kings Limited PDF processed with CutePDF evaluation edition www.CutePDF.com A Successful Business Transformation for Sustainable Growth Cox & Kings has a strong legacy of delivering value for over 250 years. In our pursuit to build a business that can stand the test of time, we have been maintaining our focus on growth, profitability and sustainability, thus creating value for our stakeholders along the way. We have consistently and Contents strategically deepened our business model, which will enable us to grow faster, and sustain a longer journey. The acquisition of Holidaybreak (HBR), a ! A Successful Business Transformation for leading European Education activity and Leisure specialist travel company, Sustainable Growth 01 has brought along deep synergies in the form of our expanded market ! Making travel an all season business 02 ! Making travel integral to living 04 reach, cross selling opportunities and a more resilient business model. The ! Making travel an all region business 06 acquisition also brings in a unique mix of fast growing & defensive business ! Chairman's Message 08 segments like leisure & education. For Cox & Kings Group, we now have a ! Board of Directors 10 great mix of fast growing markets like India, Australia, New Zealand & ! Financial Highlights of Consolidated Accounts 12 Middle East alongside mature markets of Europe. ! Corporate Information 13 ! Management Discussion & Analysis 14 HBR's leadership position in niche travel segments, such as education travel ! Directors' Report 24 and camping business, have a transformational impact on our business. The ! Report on Corporate Governance 31 Education landscape, in each of our focused markets, is undergoing a rapid ! Corporate Social Responsibility Report 45 shift and has seen considerable investment from both government and ! Independent Auditor's Report 49 private players despite the macro-economic challenges. -

Delivering a Strategy

Delivering a Strategy Kings Limited Cox & 74th Annual Report 2013-14 Delivering a Strategy Business Overview 01 The parlance of business remains full with many impactful variables – economic growth, Financial Highlights 08 ts industry-specific trends, regulations, consumer behavior, input cost, competitive pricing Chairman's Letter 10 power and so on. Shortfalls or moderation in business performances often get attributed Board of Directors 12 The World of Cox & Kings 14 to adversities emanating from these macro environments. en Corporate Information 18 t Mature businesses deploy their knowledge, experience, insights and foresight in Management Discussion & Analysis 19 developing robust strategies, tools, processes and safeguards in order to contain the Statutory Reports impact of these external variables and stay predictable in their performance. As one of the on Directors' Report 30 oldest global travel company with interest in holiday business and education travel, we Report on Corporate Governance 37 have honed our insights, foresight and control over many decades of business operations C Corporate Social Responsibility Report 54 in 26 countries spanning 4 continents. Financial Statements Standalone With a clear focus on strengthening our business fundamentals, we started our journey of Auditor’s Report 58 business transformation in 2009 and developed a strategic plan enumerating certain Financial Statements 62 deliverables to be achieved within set timeframes. We made certain promises to our own Significant Accounting Policies 66 self and to our stakeholders towards actualizing these set goals. At the close of fiscal year Notes 68 2013-14, we are happy to return measurable deliveries across many counts. In our Annual Financial Information of Subsidiary Companies 93 Report 2013-14, we take pleasure in highlighting the deliverables. -

The Difference We Made in 2018

THE DIFFERENCE WE MADE IN 2018 The Family Holiday Association is the leading national charity dedicated to providing breaks and days out for children and their families coping with some of the toughest challenges life can bring. 3,820 Families received a short break or day out % 97 of families created happy % memories 6,181 8,612 39 We worked of families had Adults Children with referrers in a break together 93% of all local for the first time authority areas across the UK I couldn’t believe that some people are so kind to fund holidays and I will be grateful for the rest of my life that I had the opportunity to show my kids that there is life outside of our town. What families tell us For families who don’t get the chance for a break or day out the difference can be Before the break I had been through transformational. Families told us that they a really difficult period when my son was experienced the following outcomes after not in my care. I do not know how to say their break or day out (either on their own how much it meant - I felt more confident or as part of a group trip). - proud of managing to go away on my own with my son. I am now able to visit family on the train which I couldn’t do before. Outcomes Family who had a short break in Skegness % % We were able to spend time together 90 91 Get on better Could cope as a family. -

Tourism Action Plan August 2016

Tourism Action Plan August 2016 1 Tourism Action Plan Prime Minister Theresa May Tourism is vitally important to the UK. The industry provides 1.6 million jobs across the country. In 2015, we saw the greatest number of overseas visits to the UK on record, bringing £22.1 billion into our economy. Domestic overnight spend also hit a record high of £19.6 billion in England. In short, the sector goes from strength to strength. But many overseas visitors never venture beyond London, so over 50% of their spending is in the capital. While we want tourist numbers to remain high, we also want the benefits of growth to be felt across the whole of the UK. This is a beautiful country, offering so much to see and do throughout, and we must do everything we can to make sure that visitors are encouraged to explore beyond the capital. Progress is already being made. The South East, South West, West Midlands and North East have all seen visitor rates grow faster than London over the past year. The £40 million Discover England Fund will strengthen regional tourism even further. But there is still work to be done in promoting the whole of the UK. We must ensure that the benefits of tourism are shared across cities, regions and nations up and down the United Kingdom. The British people’s decision to leave the European Union creates many great opportunities for growth, such as cutting red tape and forging partnerships in new and developing markets. Our stunning scenery hasn’t changed, nor our centuries-old monuments and cultural traditions. -

Research Themes F Or Tourism

Research Themes for Tourism This page intentionally left blank Research Themes for Tourism Edited by Peter Robinson University of Wolverhampton, UK Sine Heitmann University of Wolverhampton, UK and Dr Peter Dieke George Mason University, USA CABI is a trading name of CAB International CABI Head Offi ce CABI North American Offi ce Nosworthy Way 875 Massachusetts Avenue Wallingford 7th Floor Oxfordshire OX10 8DE Cambridge, MA 02139 UK USA Tel: +44 (0)1491 832111 Tel: +1 617 395 4056 Fax: +44 (0)1491 833508 Fax: +1 617 354 6875 E-mail: [email protected] E-mail: [email protected] Website: www.cabi.org © CAB International 2011. All rights reserved. No part of this publication may be reproduced in any form or by any means, electronically, mechanically, by photocopying, recording or otherwise, without the prior permission of the copyright owners. A catalogue record for this book is available from the British Library, London, UK. Library of Congress Cataloging-in-Publication Data Research themes for tourism / [edited by] Peter Robinson, Sine Heitmann, Dr. Peter Dieke. p. cm. Includes bibliographical references and index. ISBN 978-1-84593-684-6 (alk. paper) 1. Tourism--Research. 2. Heritage tourism--Research. I. Robinson, Peter, 1979- II. Heitmann, Sine. III. Dieke, Peter U.C. IV. Title. G155.A1R474 2010 338.4’791072--dc22 2010020954 ISBN-13: 978 1 84593 684 6 Commissioning editor: Sarah Hulbert Production editor: Kate Hill Typeset by Columns Design, Reading, UK Printed and bound in the UK by MPG Books Group Contents Contributors vii Introduction xi 1 From Mass Tourism to Niche Tourism 1 Duncan Marson 2 Aspects of Tourism Development 16 Dr Peter U.C. -

Level 2 Award/Certificate/Diploma in Travel and Tourism (4876)

Level 2 Award/Certificate/Diploma in Travel and Tourism (4876) www.cityandguilds.com Qualification handbook for centres June 2011 (September 2014) Version 2.1 About City & Guilds City & Guilds is the UK’s leading provider of vocational qualifications, offering over 500 awards across a wide range of industries, and progressing from entry level to the highest levels of professional achievement. With over 8500 centres in 100 countries, City & Guilds is recognised by employers worldwide for providing qualifications that offer proof of the skills they need to get the job done. City & Guilds Group The City & Guilds Group includes City & Guilds, ILM (the Institute of Leadership & Management, which provides management qualifications, learning materials and membership services), City & Guilds NPTC (which offers land-based qualifications and membership services), City & Guilds HAB (the Hospitality Awarding Body), and City & Guilds Centre for Skills Development. City & Guilds also manages the Engineering Council Examinations on behalf of the Engineering Council. Equal opportunities City & Guilds fully supports the principle of equal opportunities and we are committed to satisfying this principle in all our activities and published material. A copy of our equal opportunities policy statement is available on our website. Copyright The content of this document is, unless otherwise indicated, © The City and Guilds of London Institute and may not be copied, reproduced or distributed without prior written consent. However, approved City & Guilds centres -

Annual Report 2015/16

National Trust Annual Report 2015/16 National Trust Annual Report 2015/16 1 The National Trust in brief What is the National Trust? We are a charity founded in 1895 by three people who saw the importance of our nation’s heritage and open spaces, and wanted to protect them for everyone to enjoy. More than 120 years later, these values are still at the heart of everything we do. We look after special places throughout England, Wales and Northern Ireland for ever, for everyone. We look after coastline, forests, woods, fens, beaches, farmland, moorland, islands, archaeological remains, nature reserves, villages, historic houses, gardens, mills and pubs. We restore them, protect them and open them up to everyone. For the Trust, conservation has always gone hand-in-hand with public access. We welcome everyone to explore: • 775 miles of coastline • Over 248,000 hectares of land • Over 500 historic houses, castles, ancient monuments gardens and parks and nature reserves Many of our properties are unable to fund their own permanent preservation. The cost of caring for them is high: our overall conservation project expenditure was £107.1 million in 2015/16. Most of our property is held inalienably, so it can never be sold or developed against our wishes without the consent of Parliament. We rely on the support of our members, donors and volunteers, as well as income from grant-making bodies and commercial activities such as retail and catering, to look after the places in our care. This Annual Report can also be viewed online at www.nationaltrustannualreport.org.uk A 2015/16 Impact Review is also available at www.nationaltrustannualreport.org.uk. -

Focus, Consolidation, Dominance

FOCUS, CONSOLIDATION, DOMINANCE Over the past three decades, Cox & Kings has transformed itself from being a simple air ticketing agent and inbound tour operator into a multi-national travel enterprise. We have consolidated operations by buying businesses that added value and shedding businesses that had a brighter future elsewhere. 2015-16 can best be described as the year in which we further entrenched our leadership in our respective domains both by way of volumes as well as At PGL, we are pioneers in out-of-classroom learning margins. COX & KINGS OPERATES IN 23 COUNTRIES ACROSS FOUR DISTINCT BUSINESS VERTICALS. Annual Report 2015-16 | 01 NST - Leader in secondary school tours C&K’s regionally branded tours are very popular Meininger Frankfurt 02 | Cox & Kings Limited BUSINESS OVERVIEW MANAGEMENT DISCUSSION & ANALYSIS STATUTORY REPORTS FINANCIAL STATEMENT Cox & Kings is a diversified, multinational enterprise focused on the travel sector. Consumers both young and old are increasingly using travel to satisfy their hunger for personal growth, and we are in pole position to deliver precisely that - in myriad ways, at scale, across the planet. Cox & Kings is unique in ŸWe operate low-price hybrid many ways; hotels in Europe, but even COX & KINGS IS ŸWe are an Indian company, CEOs and movie stars travel FOCUSED ON THE but we operate in 23 with us all over the world TRAVEL SECTOR countries We are a multi-national ŸWe have several disparate company, but India is our business divisions, but travel proud heart is our only domain ŸIn 2015-16 we journeyed millions of Indians, travelled >500,000 children in the UK and hosted 2.0 million bed nights in our European hybrid hotels ŸWe are known as an Indian tour operator, but our biggest earner is educational travel in the U.K. -

The Class of 2012 I the KORN/FERRY INSTITUTE

The Korn/Ferry Institute The Class of 2012 New NEDs in the FTSE 350 The Class of 2012 i THE KORN/FERRY INSTITUTE The Class of 2012 THE KORN/FERRY INSTITUTE Contents Page Foreword .................................................. i Executive summary ....................................... 1 The Class of 2012 .......................................... 3 Turnover is low on FTSE 350 boards ...................... 4 Primary career discipline ............................... 5 Gender balance ....................................... 7 Nationality and international experience .................. 9 Case study 1 ......................................... 10 NEDs 2.0? ........................................... 11 Case study 2 ......................................... 12 Career experience .................................... 13 Case study 3 ......................................... 15 Motivation to take a FTSE 350 NED role ................... 16 Case study 4 ......................................... 17 Induction processes ................................... 18 Expectations ......................................... 19 Conclusion .......................................... 20 The Class of 2012 biographies .............................. 22 THE CLASS OF 2012 i Foreword UK corporate governance is often something of an echo chamber, with articles from management and talent consultancies following one- another in procession, often saying much the same thing. As such, it is always interesting to come across something a little different, and credit to Korn/Ferry -

Specification

Specification BTEC Firsts Edexcel BTEC Level 2 Certificate, BTEC Level 2 Extended Certificate and BTEC Level 2 Diploma in Travel and Tourism (QCF) First teaching September 2010 Issue 4 Edexcel, a Pearson company, is the UK’s largest awarding body, offering academic and vocational qualifications and testing to more than 25,000 schools, colleges, employers and other places of learning in the UK and in over 100 countries worldwide. Qualifications include GCSE, AS and A Level, NVQ and our BTEC suite of vocational qualifications from entry level to BTEC Higher National Diplomas, recognised by employers and higher education institutions worldwide. We deliver 9.4 million exam scripts each year, with more than 90% of exam papers marked onscreen annually. As part of Pearson, Edexcel continues to invest in cutting-edge technology that has revolutionised the examinations and assessment system. This includes the ability to provide detailed performance data to teachers and students which helps to raise attainment. This specification is Issue 4. Key changes are sidelined. We will inform centres of any changes to this issue. The latest issue can be found on the Edexcel website: www.edexcel.com References to third party material made in this specification are made in good faith. Edexcel does not endorse, approve or accept responsibility for the content of materials, which may be subject to change, or any opinions expressed therein. (Material may include textbooks, journals, magazines and other publications and websites.) Authorised by Roger Beard Prepared