Note Tariff Was 5% Prior to February 14, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lens Material Transmittance

Visible Light Transmittance of Common Lens Materials All colors are simulated Photochromic Lens Materials Darkened Faded 0% 25% 50% 75% 100% 22% 85% P hotogray E xtra 1.523 25% 85% P hotobrown E xtra 1.523 16% 86% Photogray Thin &Dark ™ (1.5mm C.T.) 1.523 25% 85% Autumn Gold ™ 1.523 22% 83% Photosolar, 1.60, Gray 1.60 12% 89% Transitions ® G ray** 1.50 15% 89% Transitions ® Brown** 1.50 22% 87% Transitions ® High-X ™ , Gray** 1.55 28% 87% Transitions ® High-X ™ , Brown** 1.55 ® ™ 14% 80% Transitions Aris Gray 1.53 ® ™ 28% 80% Transitions Aris Brown 1.53 16% 40% Glass Polarized Thin & Dark ™ Gray 1.523 19% 38% Glass Polarized Photobrown Extra 1.523 15% 32% Glass Polarized Autumn Gold ™ 1.523 ® 12% 40% NXT Polarized Gray Fixed Tint Lens Materials Polarized Lens Materials 15% UVSG (Gray, UV Filtering Sunglass) 1.597 11% Glass Polar G-15 19% G-15 1.523 15% NXT Polar Gray 20% Gray 3 1.523 15% NXT Polar Brown 21% Tan 3 1.523 17% Glass Polar Brown 3 30% Gray 2 1.523 17% Glass Polar Gray 3 36% Green 3 1.523 19% Poly G-15 40% Gray 1 1.523 20% Poly Brown 3 51% Green 2 1.523 20% Plastic Polar Gray 3 64% Rose Didymium 1.523 20% Poly Polar Gray 3 67% Green 1 1.523 25% Plastic Polar Brown 3 82% Canary Yellow 1.523 38% Glass Polar Brown 1 82% Rose 2 1.523 41% Glass Polar Gray 1 85% 1.80/High Index Glass 1.801 41% Plastic Polar Gray 1 86% 1.70/High Index Glass 1.701 87% Polycarbonate 1.598 NXT® Lens Material 88% Aris™ 1.523 Photochromic Gray 88% High-X™ 1.670 Photochromic Brown 88% Rose 1 1.523 Photochromic Copper 89% Clear 16™ 1.601 Photochromic yellow to Gray 92% Clear Crown Glass 1.523 15% Gray-15, w/wo Silver Mirror 92% CR-39 Plastic Resin 1.498 15% Brown-15, w/wo Gold Mirror 92% High-X™ 1.554 15% Green-15 (G-15 Like Color) Note:All readings were taken at 77 degrees fahrenheit, at 2.0mm C.T. -

The Science and Technology of Prescribing Photochromics

The Science and Technology of Jenean Carlton BA, ABOC, NCLC Prescribing Photochromics 9 Protect patients from harmful UV (cataracts, aging 9President, Carlton & Associates, LLC – Carlton Jenean Carlton BA, ABOC, NCLC around eyes, pterygium …) and Associates, LLC provides communications and educational materials for the optical industry. 9 Provide glare protection – especially important for 9Contributing Editor for Refractive Eyecare Course #214 patients with glare issues or photophobia magazine and freelance writer to the industry. Monterey Symposium 9Communications Committee member OWA. 9 Are convenient – easier than keeping up with two or 9Has worked in the optical industry for more than more pairs of glasses 25 years with more than half of this time spent managing practices. 9 Are variable – they automatically adjust to light 9Vision Monday’s Most Influential Women Award in conditions in the environment Optical 2005 Source: Transitions Optical 1 2 3 Copyright Carlton & Associates, LLC 2012 9 Americans at risk increasing Men Experiencing Women Experiencing 9 Only 9% of Americans know UV can as baby-boomers age cause eye damage Dry eye 9% 15% 9 4 leading causes of blindness Trouble seeing 11% 22% Proportion Awareness/Action at night 9 Age-related macular degeneration 1 out of 4 Do not know there’s a treatment Light sensitivity 6% 11% 9 Glaucoma for glaucoma 9 Cataract 1 out of 3 Do not know there’s a treatment 9 Diabetic retinopathy for astigmatism 9 More women say headaches impact 9 2 out of 3 Do not know there’s a treatment vision, and are caused by glare Total annual cost of adult for presbyopia Basketball superstar eye diseases = $35.4 billion Lebron James only recently realized that he 9 All issues increased with age could correct his vision 9 Can be detected / treated through regular eye care to see distant objects. -

The World's Finest Driving Sunglass

THE WORLD’S FINEST DRIVING SUNGLASS 2012 Some take the road less travelled, HAVØYSUND LOFOTEN while others take HELGELANDSKYSTEN NORD a road no one ATLANTERHAVSVEGEN GEIRANGER-TROLLSTIGEN has travelled HARDANGER before. Exploring new territories has always been at the heart of Serengeti®. It’s this spirit of discovery and innovation that led us to pioneer photochromic lens technology. And it’s this same spirit that brought us to the land of Norway, so we could experience firsthand some of the world’s most spectacular driving and roads that few have ever experienced. Here, you’ll discover pristine rural countryside, stunning water vistas and rugged Featuring the San Remo mountainscapes — a landscape bathed in light that’s constantly changing from moment to moment and season to season. In every condition, Serengeti® photo- chromic lenses deliver an impressive view of the road ahead, and dramatic proof that ours is unmistakably the world’s finest driving sunglass. 3 Lens Technology 23 Classics 5 Photochromic Lens Technology 33 Cosmopolitan 7 Polarized Lens Technology 39 Serengeti Sport ® 9 Spectral Control Lens Technology 41 Polar PhD™ Lens 10 RX Prescription Programme 46 Merchandising 12 Infiniflex 48 Distributors 13 Frame Materials 49 Product index 15 Flex Series COVER: Featuring her in the Bella and him in the Levanto BACK COVER: Featuring the Piero EUROPE | Bushnell Outdoor Products 4, rue Diderot 92150 Suresnes France | Tel: 33.1.41.44.94.80 | Email: [email protected] | Fax: 33.1.41.44.06.09 | serengeti-eyewear.com This catalog is recyclable. Serengeti recycles unused catalogs and encourages you to do the same. -

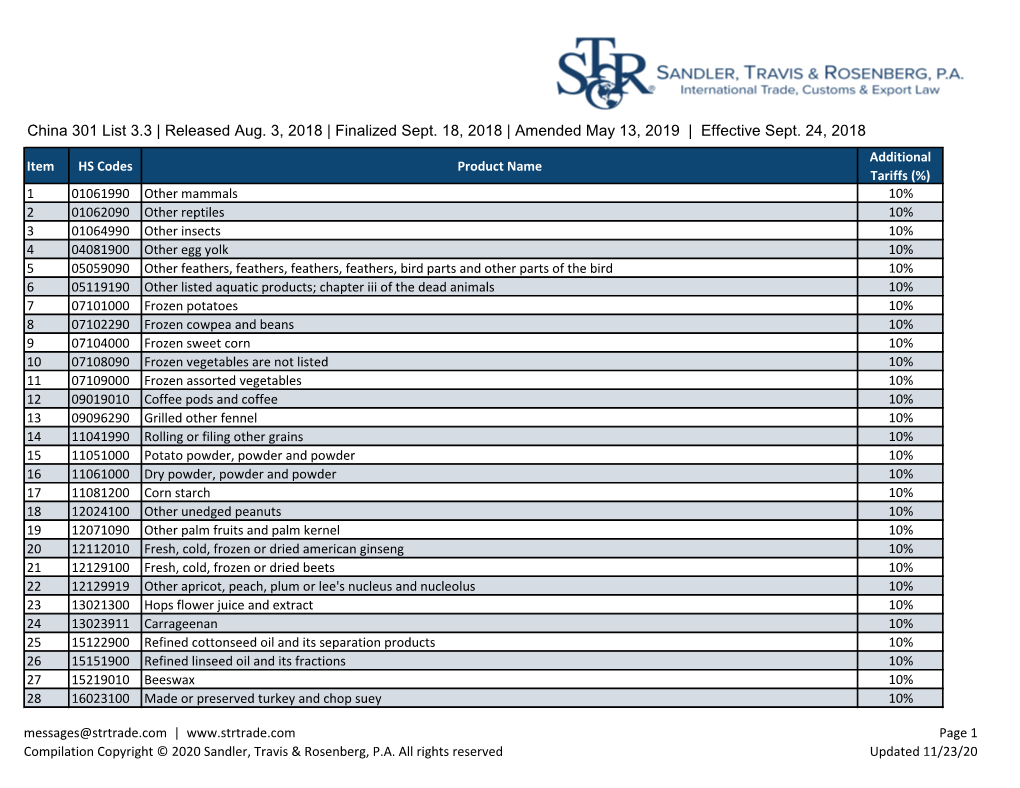

List 3.3 ($60 Billion)

CHINA RETALIATORY TARIFFS List 3.3 ($60 billion) Released: August 3, 2018 Revised: May 13, 2019 Effective: September 24, 2018 Additional Tariffs HTSUS # Product Description (%) 1061990 Other mammals 10% 1062090 Other reptiles 10% 1064990 Other insects 10% 4081900 Other egg yolk 10% 5059090 Other feathers, feathers, feathers, feathers, bird parts and other parts of the bird 10% 5119190 Other listed aquatic products; chapter iii of the dead animals 10% 7101000 Frozen potatoes 10% 7102290 Frozen cowpea and beans 10% 7104000 Frozen sweet corn 10% 7108090 Frozen vegetables are not listed 10% 7109000 Frozen assorted vegetables 10% 9019010 Coffee pods and coffee 10% 9096290 Grilled other fennel 10% 11041990 Rolling or filing other grains 10% 11051000 Potato powder, powder and powder 10% 11061000 Dry powder, powder and powder 10% 11081200 Corn starch 10% 12024100 Other unedged peanuts 10% 12071090 Other palm fruits and palm kernel 10% 12112010 Fresh, cold, frozen or dried american ginseng 10% 12129100 Fresh, cold, frozen or dried beets 10% 12129919 Other apricot, peach, plum or lee's nucleus and nucleolus 10% 13021300 Hops flower juice and extract 10% 13023911 Carrageenan 10% 15122900 Refined cottonseed oil and its separation products 10% 15151900 Refined linseed oil and its fractions 10% 15219010 Beeswax 10% 16023100 Made or preserved turkey and chop suey 10% 16023291 Other methods of making or preserving chicken breasts 10% 17019100 Sugar added flavoring or coloring agents of 10% 17021100 Anhydrous lactose 10% 17021900 Milk and other lactose -

CHINA RETALIATORY TARIFFS List 4B

CHINA RETALIATORY TARIFFS List 4B Released: August 23, 2019 Effective: December 15, 2019 Additional Tariffs HTSUS # Product Description (%) 9012100 Coffee, roasted: Not decaffeinated Suspended 9012200 Roasted coffee that has been soaked in caffeine Suspended 9021010 Each flower tea with a net weight of ≤3kg Suspended 9021090 Other green teas with a net weight of ≤3kg Suspended 9022090 Other green teas with a net weight > 3kg Suspended 9023010 Oolong tea with a net weight of ≤3kg Suspended 9023090 Other fermented, semi-fermented black tea with a net weight of ≤3kg Suspended 9024090 Other black tea (fermented) and semi-fermented tea with a net weight of >3kg Suspended 9041100 Unground pepper Suspended 9041200 Ground pepper Suspended 9042200 Ground pepper Suspended 9061900 Other unground cinnamon and cinnamon flowers Suspended 9093200 Has been smashed Suspended 9101200 Grated ginger Suspended 9109100 Mixed seasoning Suspended 9109900 Other flavorings Suspended 10011100 Durum wheat Suspended 10011900 Other durum wheat Suspended 10019100 Other wheat and mixed wheat Suspended 10019900 Other wheat and mixed wheat Suspended 10051000 Corn Suspended 10059000 Other corn Suspended 10079000 Other stilts Suspended 11029090 Other cereal fine powder Suspended 11042200 Other processed oats Suspended 11052000 Potato powder, granules and pellets Suspended 11063000 Fine powder, coarse powder and powder of fruits and nuts Suspended 12024100 groundnuts, in shell (excl. seed for sowing, roasted or otherwise cooked) Suspended 12093000 Herb Flower Plant Seeds -

American Optical History

American Optical History Click mouse for each slide Copyright 2008 - the Optical Heritage Museum 1826 • William Beecher arrives in Southbridge and opens a Jewelry and Watch Shop on Main St.; below photo is of Beecher trunk (Optical Heritage Museum collection) 1833 • AO’s “Birth” – Beecher and 3 apprentices make silver eyeglass frames in rooms above Jewelry Shop 1839 • Beecher moves to 2 Story building on corner of Chestnut and Main St. • Referred to as “Old Spec Shop” • Later became Hyde Tools building when AO moved to Mechanic St. 1843 • First steel Spectacles made in America were produced by machinery invented by Beecher 1848 • First gold frames made in America 1850 • Gold frames (14K-18K) sell for $7.50/pair 1853 • Frame sales nationwide total 14,919 pair 1853 • Old Spec Shop switches from Cohasse Brook power to steam power 1864 • 17 year old George Wells hired by Beecher • George & Brother, Hiram, hired by company now called R. H. Cole & Co., both are fired short time later • George W. Wells (age 17) arrives in Southbridge with $100 in his pocket 1865 • George Wells rehired by R. H. Cole Daniel Wells Schreck, Direct descendant of George W. Wells (Portrait) in Southhbridge (2004) 1869 – Feb 26th • American Optical Company formed • Gross business of $50,000 • R. H. Cole offers 22 year old G. W. Wells partnership in business 1871 • First 3 story Wooden Structure on AO Main Plant site; drawing below shows 1872 view • Cost to build = $35,000 • 20,700 square feet 1872 • G. W. Wells becomes General Supervisor of new plant 1874 • AO introduces first Rimless Spectacles 1883 • AO plans to make its own spectacle lenses in Southbridge 1884 • First AO spherical lenses made • Production started when Import tarriffs were imposed. -

Chinese Retaliatory Tariffs: List 3.3

Chinese Retaliatory Tariffs: List 3.3 HTSUS Product Description Subheading 1061990 Other mammals 1062090 Other reptiles 1064990 Other insects 4081900 Other egg yolk 5059090 Other feathers, feathers, feathers, feathers, bird parts and other parts of the bird 5119190 Other listed aquatic products; chapter iii of the dead animals 7101000 Frozen potatoes 7102290 Frozen cowpea and beans 7104000 Frozen sweet corn 7108090 Frozen vegetables are not listed 7109000 Frozen assorted vegetables 9019010 Coffee pods and coffee 9096290 Grilled other fennel 11041990 Rolling or filing other grains 11051000 Potato powder, powder and powder 11061000 Dry powder, powder and powder 11081200 Corn starch 12024100 Other unedged peanuts 12071090 Other palm fruits and palm kernel 12112010 Fresh, cold, frozen or dried American ginseng 12129100 Fresh, cold, frozen or dried beets 12129919 Other apricot, peach, plum or lee's nucleus and nucleolus 13021300 Hops flower juice and extract 13023911 Carrageenan 15122900 Refined cottonseed oil and its separation products 15151900 Refined linseed oil and its fractions 15219010 Beeswax 16023100 Made or preserved turkey and chop suey 16023291 Other methods of making or preserving chicken breasts 17019100 Sugar added flavoring or coloring agents of 17021100 Anhydrous lactose 17021900 Milk and other lactose syrup 18061000 Sugar or other sweetening matter cocoa powder 19011090 Other retail packaged foods for infants and young children eat 19023010 Dry rice noodles 19043000 Bulgur 20029011 Weighing no more than 5kg of canned tomato -

Product Spotlight – Sunsensors New Photochromic Lens Technology

Product Spotlight – SunSensors New Photochromic Lens Technology - Expanding Material –Casting –Coating Options Mark Mattison-Shupnick, ABOM, Deborah Kotob, ABOM Ophthalmic Level 2 Course Description Manufacturers are always searching for ways to improve the patient visual experience. This means pushing the limits of technology to discover new and better chemistry to produce the best material solutions for lenses including photochromic lens technology. Each photochromic technological advancement is born from either a material or coating solution improvement. This course describes the latest improvement for photochromic casting technology for in-mass and informs us of the new patented CrystalChrome, the newest thermal cured hard coat coating photochromic technology. This course is intended to help you better understand the MR series of SunSensors lenses with In- mass technology and it will also introduce you to CrystalChrome photochromic technology. Better technology means better products and satisfied customer. It is a Win, Win for the patient and the practice! Objectives 1. Learn a short overview of photochromic lens improvements. 2. Understand in-mass photochromic lens chemistry and how the distribution of dye molecules throughout the lens monomer 3. Learn the essentials for communicating the complementary patient benefits of high index, photochromic and new lens designs have on the patient satisfaction. WHY PHOTOCHROMICS? If money were no object, patients would want every lens enhancement and only the best materials used in the making of their eyewear. Todays informed consumer weighs the value of the lens options. Therefore, each benefits must be made clear to the customer hence each benefit must be clear to the optician. It is imperative that you know the details of ‘how and why’ new photochromic will improve optical performance convenience and make the life of the consumer better. -

Acrylic Lenses Tb Other Addition to Their Visual Advantages

More Than Meets The Eye The Stories Behind the Development of Plastic Lenses About the Author Joseph L. Bruneni is the author of "LOOKING BACK, an illustrated history of the American Ophthalmic Indusl1}', II a hard cover book pub lished in 1994 and still in print. He is a frequent contributor to most of the major optical trade publications and writes regularly-appearing colunUls in a number of them. He serves as a special consultant to the Optical Laboratories Association (OLA) and is a member of the Ocular Heritage Society. He currently serves as an assis tant professor teaching ophthalmic optics at the Southern California College of Optometry. On the Cover The cover illustrates key elements in the development of ophthalmic lenses. Upper rigbt: Tltis is the first known painting to show someone wearing eyeglasses. It was painted in the year 1252. Directly below: Pince-nez glasses were in vogue around the turn of the century. They often featured a chain or ribbon to catch them when they fell off the nose. At left: Frank Strain was one of the two inventive chemists at PPG who developed and patented allyl diglycol carbonate (CR-39® monomer) in 1940. Due to the war, ule patent was not issued until 1945. Center: Amodel of the atomic structure of CR-39 monomer. Bottom left: Tltis energy-efficient landmark glass tower in Pittsburgh, Pa., serves as international headquarters for PPG Industries, a global manufac turer of coatings, glass, fiber glass, and industrial and specialty chemicals. - (Ue Beginning under the rna erial s batch name "CR-39.' In By the time World War II began, the future year , more than 180 different plastics revolution was already well underway. -

Discover the Secret

Collection 2016-2017 DISCOVER THE SECRET 1 We live in a world of unseen and undiscovered beauty: majestic textures, vibrant tones, elusive shadows, and dramatic highlights. All perfectly arranged, like a symphony of colour on a live canvas. And only Serengeti® sunglasses reveal it. The moment you put them on, everything is naturally enhanced. You discover a world that wasn’t there before. It’s this experience that drives us to constantly push to improve our technology — always looking for new materials, processes, and possibilities. Together, fashion and technology come together DISCOVER in perfect harmony. The best way to see the Serengeti difference is to discover it for yourself. THE SECRET Serengeti. Discover the Secret. 2 3 OUR PASSION FOR TECHNOLOGY HAS BECOME A TRADITION OF EXCELLENCE DISCOVER. PERFECT. REPEAT. At Serengeti® we’re not just concerned with what’s in front of the eye, we are intensely focused on the eye itself. Helping people see more clearly is what drives all our innovation. By doing this, we’ve revolutionized the way the world looks at, and through, sunglasses. We are driven by vision, and have been since the beginning. Our evolution over the past century follows an unparalleled path of achievements in technology, design, and performance from Corning®, which led to the advanced sunglass-lens technology of today’s Serengeti Eyewear. OVER 140 YEARS OF INNOVATION IN EVERY LENS 1908 Corning’s optical laboratory was founded, 1964 The first true Photochromic borosilicate 1982 Serengeti was born, and we introduced the 1988 Serengeti sunglasses were recognized by one of the U.S. -

Dispensing Photochromic Lenses Transitions Optical Introduced and Commercialized Plastic Photochromic Lenses in 1991

Dispensing Photochromic Lenses Transitions Optical introduced and commercialized plastic photochromic lenses in 1991. Through its Laurie Pierce, LDO, ABOM patented imbibing process, photochromic dye was applied to the front surface of the lens and then From café variables to photochromics … we’ve processed so that it penetrated into the plastic. This new come a long way (baby). Once used for the technology opened the doors for plastic photochromic practical purposes of one pair only, today’s lenses, as the speed of the darkening/lightening process variable tinted lenses fit in with lifestyle dispensing was improved, and the lenses became darker than the and multiple pairs. Who wouldn’t want eyewear early plastic photochromics. Throughout the 1990s and that provides both practical function and fashion today, additional optical companies have introduced fun? Because of current technologies available to plastic photochromic lenses. These include clear, us, our clients can have a clear-to-gray/brown sunwear and fun color options, e.g., pink to purple and option for comfort and protection and pink-to- blue to green. purple lenses for style on the go. This improved photochromic technology enhances vision. But how do we get this good news to the The first photochromics were introduced in the mid general public? Sometimes our clientele resists 1960s with the invention of purchasing changeable plastic lenses Corning’s PhotoGray lenses. because they remember early technology This was a major breakthrough Today’s photochromic that did not work as well. This could in lens technology and gained technology increases lead to making decisions in regard to popularity very quickly. -

ANSI/ISEA Z87.1-2010 Revision of ANSI Z87.1-2003

A N S I / I S E A Z87.1-2010 American National Standard for Occupational and Educational Personal Eye and Face Protection Devices ANSI/ISEA Z87.1-2010 Revision of ANSI Z87.1-2003 American National Standard Occupational and Educational Personal Eye and Face Protection Devices Secretariat International Safety Equipment Association Approved April 13, 2010 American National Standards Institute, Inc. American An American National Standard implies a consensus of those substantially concerned with its scope and provisions. An American National Standard is intended as a guide to aid the manufac- National turer, the consumer, and the general public. The existence of an American National Standard does Standard not in any respect preclude anyone, whether they have approved the standard or not, from manu- facturing, marketing, purchasing, or using products, processes, or procedures not conforming to the standard. American National Standards are subject to periodic review and users are cautioned to obtain the latest editions. The American National Standards Institute does not develop standards and will in no circums- tances give an interpretation of any American National Standard. Moreover, no persons shall have the right or authority to issue an interpretation of an American National Standard in the name of the American National Standards Institute. CAUTION NOTICE: This American National Standard may be revised or withdrawn at any time. The procedures of the American National Standards Institute require that action be taken to reaf- firm, revise, or withdraw this standard no later than five years from the date of publication. Pur- chasers of American National Standards may receive current information on all standards by call- ing or writing the American National Standards Institute.