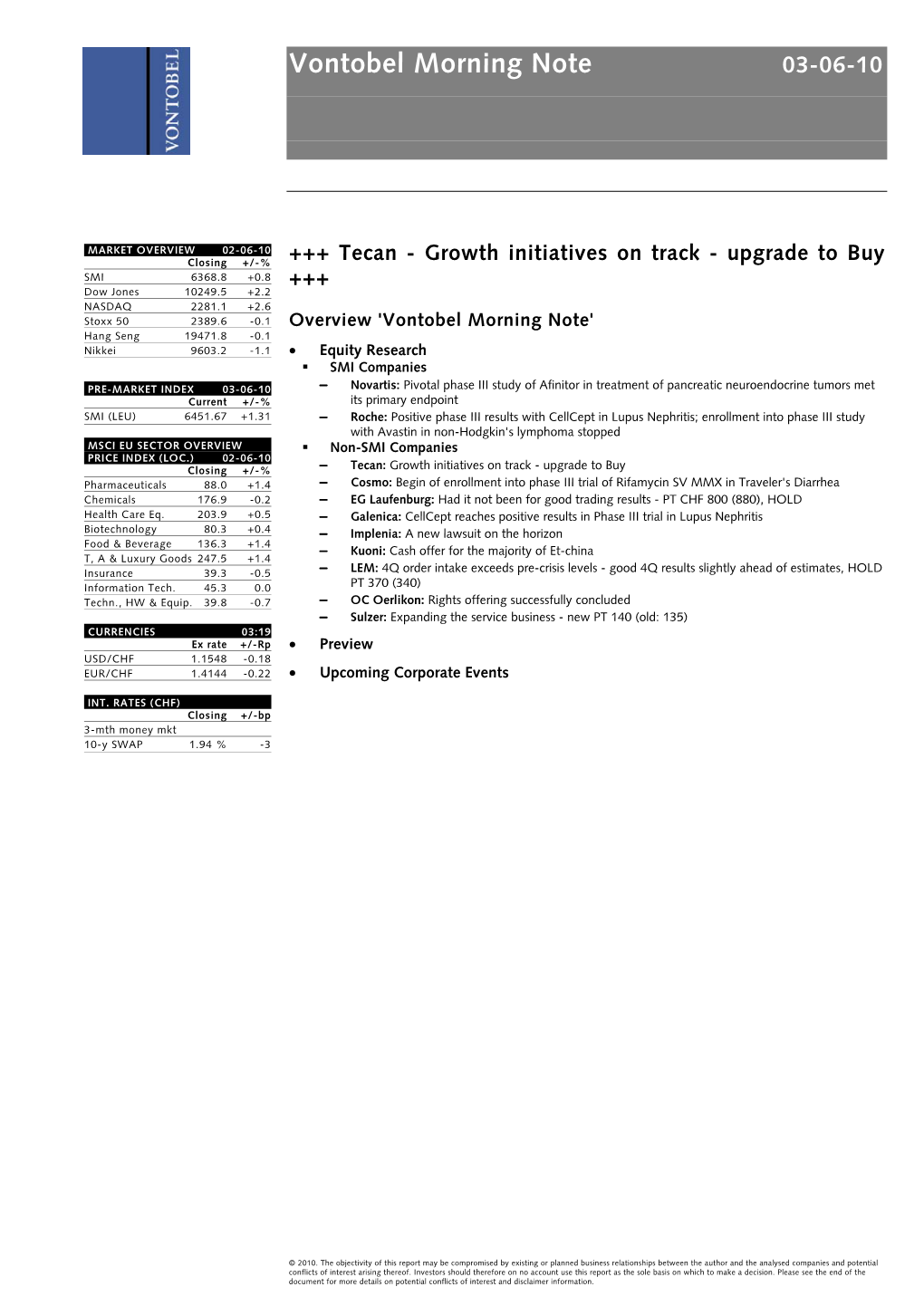

Vontobel Morning Note 03-06-10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Annual Report 2018 19 Table of Content

FINANCIAL REPORT Annual Report 2018 19 Table of content Letter to shareholders 2 Our product and service offering 6 Strategy and businesses 10 Corporate governance 36 Compensation report 60 Financial review 96 5 year key figures 104 Consolidated financial statements 105 Financial statements of Sonova Holding AG 175 Investor information 188 Corporate Responsibility Report 190 Letter to shareholders Dear shareholders, 2018/19 marked another year of solid financial performance, posting further record levels of sales and profits to which all three businesses contributed. Moreover – and as expected – growth accelerated from the first half-year to the second, driven by the launch of a number of innovative products and solutions. Sonova affirmed its leading position in audiological performance with the release of the Marvel™ technology platform. Marvel takes full advantage of the unique connectivity enabled by our SWORD™ (Sonova Wireless One Radio Digital) chip and combines it with the proven convenience of our rechargeable solutions. We also made significant progress in our retail business, which we have renamed “audiological care” for one simple reason: care is what we deliver. The expert service We have made significant provided by our hearing care professionals adds key value for the consumer. progress in implementing our strategy. Our cochlear implants business launched a series of innovative new products to strengthen its leading position in this expanding market. Robert Spoerry You will find details of these and other strategic initiatives in the “strategy and businesses” section of this report. The global market in which we operate is poised for further growth, as developed countries see increasing demand from the “baby boomer” generation and developing countries begin to bridge the gap in hearing care provision. -

Ntqlrethih1it6katsuy79yjfy6.Pdf

Global Research 16 March 2021 Aryzta AG Equities Improved business model set up - upgrade to Buy Switzerland Food Products 12-month rating Buy * Upgrade to Buy after key corporate actions Prior: Neutral Aryzta has gone through challenging times but we believe new management actions 12m price target CHF1.50 unlock value prospects. We upgrade the stock to Buy from Neutral and raise our price Prior: CHF0.65 target to CHF1.5. In our view, the announced divestment of the underperforming Price (15 Mar 2021) CHF1.04 region North America with related proceeds (c€700m – transaction multiple c10.5x FY 20) used to de-lever the balance sheet is a game changer. Aryzta can now focus on the RIC: ARYN.S BBG: ARYN SW key value driver Europe. The improving balance sheet allows growth investments. With Trading data and key metrics c60% exposure to street traffic, we also think Aryzta should benefit from easing 52-wk range CHF1.04-0.29 COVID-19 mobility restrictions. We expect a strong net profit recovery to €81m by FY Market cap. CHF1.03bn/US$1.10bn 23E (FY 21E -€61m). The stock has EFCF run rate prospects of €70-100m medium term Shares o/s 990m (REG ) resulting in an attractive yield to market cap of 7-10% (Swiss mid cap food companies Free float 100% trade at 2-4%). Avg. daily volume ('000) 6,794 Restructuring on track and attractive exposure to consumer street traffic Avg. daily value (m) CHF5.4 To optimise the business model set up in Europe, Aryzta is de-layering management, Common s/h equity (07/21E) €0.19bn resulting in cost savings of c€20-30m (UBSe), but at the same time it is strengthening P/BV (07/21E) 4.9x local responsibility and client relations. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2011 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the simplified prospectus, or the “key investor information”, as soon as it is available, in conjunction with the latest annual report and the latest semi-annual report if published thereafter. The articles of association, the valid prospectus and the simplified prospectus, the annual and semi-annual reports (or the “key investor information”, as soon as it is available), as well as the information based on the SFA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Swiss & Global Asset Management AG, Hardstraße 201, CH - 8005 Zurich (new address from 19 September 2011) Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, Postfach, CH - 8010 Zurich Paying and information agent in Germany (until 31 December 2010): Bank Julius Bär Europe AG, An der Welle 1, Postfach 15 02 52, D - 60062 Frankfurt am Main Paying agent in Germany (since 1 January 2011): Deka Bank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt am Main Information agent in Germany (since 1 January 2011): Swiss & Global Asset Management Kapital AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Representative and paying agent in Liechtenstein: LGT Bank in Liechtenstein AG, Herrengasse 12, FL - 9490 Vaduz Trade and Companies Register number: R.C.S. -

Geneva, May 15, 2017 MSCI GLOBAL STANDARD INDEXES The

Geneva, May 15, 2017 MSCI GLOBAL STANDARD INDEXES The following are changes in constituents for the MSCI Global Standard Indexes which will take place as of the close of May 31, 2017. SUMMARY PER COUNTRY and PER REGION: Nb of Nb of Securities Securities Region Country Added Deleted Asia Pacific AUSTRALIA 1 1 JAPAN 3 2 HONG KONG 0 1 MALAYSIA 0 2 TAIWAN 2 1 KOREA 3 0 INDIA 2 1 PAKISTAN 6 0 CHINA 5 3 Nb of Nb of Securities Securities Region Country Added Deleted Europe, Middle East and Africa UNITED ARAB EMIRATES1 0 SWITZERLAND 1 1 DENMARK 1 0 SPAIN 1 2 FRANCE 1 1 ITALY 1 0 UNITED KINGDOM 1 1 TURKEY 1 0 SOUTH AFRICA 0 1 RUSSIA 1 0 EGYPT 1 1 Nb of Nb of Securities Securities Region Country Added Deleted Americas USA 22 7 CANADA 1 1 BRAZIL 1 1 COLOMBIA 1 1 ASIA PACIFIC MSCI AUSTRALIA INDEX Additions Deletions BLUESCOPE STEEL VOCUS GROUP MSCI JAPAN INDEX Additions Deletions DISCO CORP HOKURIKU ELECTRIC POWER KYUSHU RAILWAY CO MITSUBISHI LOGISTICS TOSOH CORP MSCI HONG KONG INDEX Additions Deletions None CATHAY PACIFIC AIRWAYS MSCI MALAYSIA INDEX Additions Deletions Page 1 MSCI Global Standard Indexes - May 15, 2017 © MSCI 2017, All rights reserved None BERJAYA SPORTS TOTO LAFARGE MALAYSIA MSCI TAIWAN INDEX Additions Deletions GLOBALWAFERS CASETEK HOLDINGS TAIWAN HIGH SPEED RAIL MSCI KOREA INDEX Additions Deletions DOOSAN BOBCAT None MEDY-TOX PANOCEAN MSCI INDIA INDEX Additions Deletions INDIAN OIL CORP DIVI'S LABORATORIES RURAL ELECTRIFICATION CO MSCI PAKISTAN INDEX Additions Deletions ENGRO CORPORATION None HABIB BANK LUCKY CEMENT MCB BANK OIL -

MSCI Switzerland Small Cap Index (CHF) (GROSS)

MSCI Switzerland Small Cap Index (CHF) The MSCI Switzerland Small Cap Index is designed to measure the performance of the small cap segment of the Swiss equity market. With 85 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in Switzerland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (CHF) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year Switzerland MSCI World MSCI Europe Small Cap Small Cap 400 MSCI Switzerland Small Cap 2020 13.34 6.32 -3.31 MSCI World Small Cap 361.59 2019 29.77 24.54 22.38 MSCI Europe 2018 -25.26 -12.48 -13.33 300 2017 36.54 18.11 21.04 271.92 2016 11.60 14.99 1.76 2015 13.70 0.86 -1.62 200 2014 8.62 14.32 5.38 2013 34.55 29.15 22.38 152.39 2012 14.34 15.65 17.40 2011 -24.11 -8.41 -10.22 100 2010 30.39 14.12 -5.79 2009 30.61 40.59 32.88 2008 -43.62 -45.10 -49.31 0 2007 8.61 -6.21 6.10 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI Switzerland Small Cap 3.20 10.19 36.21 23.49 11.64 13.96 14.06 8.93 1.56 59.37 30.08 2.95 MSCI World Small Cap 3.56 3.92 44.61 21.40 9.99 12.41 13.89 7.33 1.46 34.31 20.09 2.17 MSCI Europe 2.61 3.93 32.09 20.32 8.35 9.21 9.44 2.58 2.44 20.57 15.85 2.18 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI Switzerland Small Cap 3.38 18.32 15.11 13.82 0.74 1.00 1.06 0.55 61.59 2007-07-04—2009-03-09 MSCI World Small Cap 13.33 22.77 18.29 15.39 0.57 0.78 0.96 0.46 62.67 2007-06-19—2009-03-09 MSCI Europe 2.07 18.23 15.46 14.17 0.57 0.70 0.75 0.22 62.95 2007-07-16—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Switzerland Small Cap Index was launched on Jan 01, 2001. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

2018 Compensation Report to a Principles Applicable to Performance-Related Pay and to the Consultative Vote at the 2019 Annual General Meeting

84 Givaudan – 2018 Integrated Annual Report 85 Compensation report In this section 86 Compensation governance 87 Compensation principles 88 Compensation of Givaudan executives 93 Compensation of the Executive Committee 94 Compensation of the Board of Directors 96 Share ownership guidelines 96 Ownership of Givaudan securities 97 Report of the statutory auditor Givaudan – 2018 Integrated Annual Report 86 Compensation report Compensation report Attract, motivate and retain performance targets and related payouts under the annual incentives and share-based long-term incentives, while the Givaudan aims to attract, applicable performance criteria are set by the Board. motivate and retain a diverse The Compensation Committee is also responsible for pool of highly talented people to reviewing and approving individual compensation and benefits of each Executive Committee member as well as sustain its leadership position recommending compensation for the Board. within the flavour and fragrance The Compensation Committee consists of three independent industry. The Company’s members of the Board and is currently chaired by Prof. Dr-Ing. Werner Bauer. The Chief Executive Officer is regularly invited to compensation policies are an Compensation Committee meetings. The Head of Global Human Resources acts as secretary of the Compensation Committee. essential component of this The Chairman of the Compensation Committee may invite other strategy, and as such a key driver executives as appropriate. However, executives do not participate in discussions regarding their own compensation. of organisational performance. The Compensation Committee meets three to five times a year Our compensation programmes are aligned to our strategy and and informs the Board of its deliberations, recommendations and reflect the performance of the business and of individuals. -

Dividend and Compensation Payments in Light of Covid-19 Pandemic

DIVIDEND AND COMPENSATION PAYMENTS IN LIGHT OF COVID-19 PANDEMIC Information as of 18 November 2020 Annual General Meeting 2019 dividend Company Index Short-time work Board compensation Executive compensation (2020) (paid 2020) ABB SMI unchanged (26.03.2020) unchanged CHF 0.80 - 10% reduction of board compensation for the duration of the 10% reduction of salary for the duration of the crisis crisis Adecco SMI unchanged (16.04.2020) unchanged CHF 2.50 yes - - Aevis Other unchanged (30.04.2020) cancelled - - - Alcon SMI unchanged (06.05.2020) postponed to 2021 - - - Also Other unchanged (24.03.2020) unchanged CHF 3.25 - - - ams SMIM unchanged (03.06.2020) - - - - APG/SGA Other unchanged (14.05.2020) cancelled (from CHF 11.00) yes - 20% reduction of base salary Aryzta Other postponed to 15.12.2020 postponed yes 30% reduction of fees for 3 months 30% reduction salary reduction for 3 months (15% for wider leadership team) Autoneum Other unchanged (25.03.2020) cancelled yes - 10% reduction of base salary Baloise SMIM unchanged (24.04.2020) unchanged CHF 6.40 - - - Barry Callebaut SMIM unchanged (09.12.2020) - - - - BB Biotech SMIM unchanged (19.03.2020) unchanged CHF 3.40 - - - Bobst Other unchanged (07.04.2020) unchanged CHF 1.50 - - - Bossard Other unchanged (08.04.2020) reduced by 50% to CHF 2.00 4% reduction of compensation 4% salary reduction Bucher Industries SMIM unchanged (24.04.2020) unchanged CHF 8.00 yes (mainly FR and IT) - - BVZ Other unchanged (16.04.2020) reduced to CHF 7.50 - - - Calida Group Other brought forward to cancelled -

Voting Report 2020

Exercising of Shareholder Rights – Information December 2020 As a result of the adoption of the “Popular Initiative against Fat-Cat Salaries” in 2014, pension funds have an obligation to exercise shareholder rights in the interests of the insured persons and to disclose how the pension funds voted. This regulation applies for public limited companies with registered office in Switzerland and whose shares are listed on a domestic or foreign stock exchange. The Foundation Board of the PensFlex Collective Foundation has incorporated the corresponding regulations into the Art. 3.5 of the Organisational Rules or Art. 4 of the Rules on Investment. A list of the voting record of the PensFlex Collective Foundation in the year 2020 is shown below. Voting Report for PensFlex Sammelstiftung Kauffmannweg 16 6003 Luzern This report summarizes voting behaviour according to the following specifications: Time period: 01.01.2020 - 31.12.2020 Agenda items: Summary of all items on the agenda, i.e. not only the items requiring a vote according to Art. 22 para. 1 ORAb. The voting rights were exercised for the following companies: Perrot Duval 06.02.2020 Kardex 14.04.2020 Novartis 28.02.2020 Tornos 15.04.2020 Dätwyler 11.03.2020 Georg Fischer 15.04.2020 Roche 17.03.2020 Sulzer 15.04.2020 BB Biotech 19.03.2020 Evolva 15.04.2020 Schindler 19.03.2020 Mikron 15.04.2020 Swiss Prime Site 24.03.2020 Ascom 15.04.2020 Implenia 24.03.2020 Kudelski 15.04.2020 Bellevue 24.03.2020 Adecco 16.04.2020 SGS 24.03.2020 Rieter 16.04.2020 ALSO 24.03.2020 Cembra Money Bank 16.04.2020