Annual Report 2018 19 Table of Content

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DWS (CH) II Small and Mid Caps Switzerland

Marketing Material DWS (CH) II Small and Mid Caps Switzerland Equity Funds - Europe - Regions/Countries August 2021 As at 31/08/2021 Fund Data Performance Investment Policy Performance - Share Class FD (in %) The goal of the sub-fund is primarily to achieve long-term growth in Swiss Francs through investment in a portfolio of stocks from Swiss issuers that are listed in a representative Swiss equities index of small and medium enterprises or the small and mid- cap subindex of a Swiss equities index (“the benchmark”). The investment strategy is based on a transparent and comprehensible investment process, focuses on stock selection. Fund Benchmark (since 09/08/2006): SPI EXTRA Total Return (RI) Past performance is no indication of current or future performance, and the performance data do not take account of the commissions and costs Fund Management's Comment incurred on the issue and redemption of units. For detailed comments on the fund and its corresponding markets please see the annual report. Cumulative performance (in %) - share class FD 1 m 1 y 3 y 5 y s. Inception YTD 3 y avg 5 y avg 2017 2018 2019 2020 CHF 3.0 42.7 36.1 77.7 421.8 29.6 10.8 12.2 29.9 -21.6 29.3 1.8 EUR 2.7 42.0 42.2 80.2 650.5 30.2 12.5 12.5 19.4 -18.6 33.7 2.2 BM IN CHF 2.5 34.9 39.1 90.5 284.2 23.7 11.6 13.8 29.7 -17.2 30.4 8.1 Further Characteristics (3 years) / VAR (1 year) - share class FD Volatility 18.36% Maximum Drawdown -21.26% VAR (99%/10 days) 7.23% Sharpe Ratio -- Information Ratio -0.16 Correlation Coefficient 0.97 Alpha -1.26% Beta 1.05 Tracking Error -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Corporate Governance

Business report Corporate governance Transparency is one of the key elements of good corporate governance, to which Sonova is committed. Good corporate governance is essential for Sonova and we strive for high standards in this field. What “good corporate governance” means is an evolving matter and we constantly monitor the latest changes to the requirements. Compliance is an integral element of our corporate culture and embedded in our core values. We therefore continued to strengthen the Sonova Group compliance program during the 2017/18 financial year, putting particular emphasis on integrating our acquired businesses into our compliance culture, designing new global compliance training, and updating our antibribery policy. Our continuing compliance efforts help us to live our values of ethical behavior and unquestionable integrity. At Sonova, corporate governance is based upon, and structured to conform with, relevant standards and practices. The company fulfils its legal duties under the Swiss Code of Obligations, the SIX Swiss Exchange Directive on Information relating to Corporate Governance, and the standards defined in the Swiss Code of Best Practice for Corporate Governance. This report describes the principles of corporate governance for the Sonova Group and provides background information on the Group’s executive officers and bodies as of March 31, 2018. All relevant documents can be accessed at the corporate governance section of the Sonova website: www.sonova.com/en/commitments/corporategovernance. For clarity and transparency, the compensation report is presented as a separate chapter of the annual report. Sonova Annual Report 2017/18 37 CORPORATE GOVERNANCE Group structure Operational group structure The Sonova Group is headquartered in Stäfa, Switzerland, and is active in over 100 countries. -

FACTSHEET - AS of 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR

FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR HISTORICAL PERFORMANCE 6,000 5,000 4,000 3,000 2,000 1,000 Jan-2000 Jan-2005 Jan-2010 Jan-2015 Jan-2020 Solactive Switzerland 40 Equal Weight Index TR CHARACTERISTICS ISIN / WKN DE000SLA98V4 / SLA98V Base Value / Base Date 1000 Points / 03.03.1999 Bloomberg / Reuters SOCH40ET Index / .SOCH40ET Last Price 5520.10 Index Calculator Solactive AG Dividends Included Index Type Total Return Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency CHF History Available daily back to 03.03.1999 Index Members 40 FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.87% -1.29% 6.88% 26.84% 16.30% 452.01% Performance (p.a.) - - - - - 7.86% Volatility (p.a.) 14.33% 11.91% 11.14% 12.42% 11.49% 18.86% High 5927.07 5927.07 5927.07 5927.07 5927.07 5927.07 Low 5498.67 5498.67 5111.72 4101.40 4734.43 549.01 Sharpe Ratio -4.04 -0.43 1.30 2.20 1.96 0.42 Max. Drawdown -7.23% -7.23% -7.23% -8.17% -7.23% -68.82% VaR 95 \ 99 -22.5% \ -33.9% -29.8% \ -57.3% CVaR 95 \ 99 -29.9% \ -44.8% -47.2% \ -78.4% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES CH 97.6% CHF 100.0% AT 2.4% TOP COMPONENTS AS OF 29-Sep-2021 Company Ticker Country Currency Index Weight (%) DUFRY AG DUFN SE Equity CH CHF 2.80% SWISSCOM AG SCMN SE Equity CH CHF 2.69% ALCON INC ALC SE Equity CH CHF 2.67% SONOVA HOLDING AG SOON SE Equity CH CHF 2.64% UBS GROUP AG UBSG SE Equity CH CHF 2.63% JULIUS BAER GRUPPE AG BAER SE Equity CH CHF 2.61% KUEHNE & NAGEL INTERNATIONAL AG KNIN SE Equity CH CHF 2.60% NESTLE SA NESN SE Equity CH CHF 2.60% SWISS LIFE HOLDING AG SLHN SE Equity CH CHF 2.60% CHOCOLADEFABRIKEN LINDT & SPRUENGLI AG LISP SE Equity CH CHF 2.60% FACTSHEET - AS OF 29-Sep-2021 Solactive Switzerland 40 Equal Weight Index TR DISCLAIMER © Solactive AG, 2021. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

Fund Risk Management

FUND RISK MANAGEMENT Monthly Report Umbrella Cosmos Lux International Net Asset Value 11,496,391.95 Sub-fund CHF Currency CHF August 2019 Portfolio date 26/08/2019 FUND ID Fund name Cosmos Lux International TNA end of period 11,496,391.95 NAV end of period 117.48 Sub-fund name CHF TNA start of period 11,830,504.83 NAV start of period 120.89 ISIN LU0989373237 TNA Variation -2.82% NAV Variation -2.82% Currency CHF Benchmark SWISS MARKET INDEX Subscriptions 0.00 FUND RISK PROFILE Low Redemptions 0.00 RISK MANAGEMENT COMMENTS Stale price overview No stale price. Operational risk No material NAV error occurred during the period. No massive redemption occurred during the period. Risk Metrics: Scorecard reporting 4Cs (based on NAV date) Leverage Counterparty risk Concentration risk Liquidity risk . <100% NAV <5% or 10% <10% >90% liquid day Investment Compliance dashboard Type of breach Description Origin Start date Close Date Active/Passive Impact Regulator reporting UCITS 50 (2) (a) Persistent overdraft Start of warning period 14/01/2019 21/01/2019 WARNING N/A N/A Investment Compliance specific NA Total Expense Ratio - Internal limit 3% As of 28/06/2019 (Quarterly): Without transaction fees B CAP: 2.78% Portfolio Turnover As of 28/06/2019 (Quarterly): 26.02% Please note that PTR displayed is calculated on an annual basis as specified in the CSSF circular 03/122. VaR - Leverage NA Liquidity Risk No issue to report. Investment Manager comments 1 FUND RISK MANAGEMENT Monthly Report Umbrella Cosmos Lux International Net Asset Value 11,496,391.95 Sub-fund CHF Currency CHF August 2019 Portfolio date 26/08/2019 Regulatory main limit checks Check result Indicator Check result Indicator Issuer Exposure < 10% NAV 5.48% Cash Counterparty Exposure < 20% NAV 1.55% OECD Govt Bond Exposure < 35% NAV NA OTC Counterparty Exposure NA 5/40 Rule 10.55% Aggregated Group Exposure 5.48% Borrowing limit < 10% NAV NA Cover Rule (liquid assets vs. -

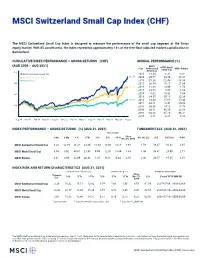

MSCI Switzerland Small Cap Index (CHF) (GROSS)

MSCI Switzerland Small Cap Index (CHF) The MSCI Switzerland Small Cap Index is designed to measure the performance of the small cap segment of the Swiss equity market. With 85 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in Switzerland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (CHF) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year Switzerland MSCI World MSCI Europe Small Cap Small Cap 400 MSCI Switzerland Small Cap 2020 13.34 6.32 -3.31 MSCI World Small Cap 361.59 2019 29.77 24.54 22.38 MSCI Europe 2018 -25.26 -12.48 -13.33 300 2017 36.54 18.11 21.04 271.92 2016 11.60 14.99 1.76 2015 13.70 0.86 -1.62 200 2014 8.62 14.32 5.38 2013 34.55 29.15 22.38 152.39 2012 14.34 15.65 17.40 2011 -24.11 -8.41 -10.22 100 2010 30.39 14.12 -5.79 2009 30.61 40.59 32.88 2008 -43.62 -45.10 -49.31 0 2007 8.61 -6.21 6.10 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI Switzerland Small Cap 3.20 10.19 36.21 23.49 11.64 13.96 14.06 8.93 1.56 59.37 30.08 2.95 MSCI World Small Cap 3.56 3.92 44.61 21.40 9.99 12.41 13.89 7.33 1.46 34.31 20.09 2.17 MSCI Europe 2.61 3.93 32.09 20.32 8.35 9.21 9.44 2.58 2.44 20.57 15.85 2.18 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI Switzerland Small Cap 3.38 18.32 15.11 13.82 0.74 1.00 1.06 0.55 61.59 2007-07-04—2009-03-09 MSCI World Small Cap 13.33 22.77 18.29 15.39 0.57 0.78 0.96 0.46 62.67 2007-06-19—2009-03-09 MSCI Europe 2.07 18.23 15.46 14.17 0.57 0.70 0.75 0.22 62.95 2007-07-16—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Switzerland Small Cap Index was launched on Jan 01, 2001. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

2018 Compensation Report to a Principles Applicable to Performance-Related Pay and to the Consultative Vote at the 2019 Annual General Meeting

84 Givaudan – 2018 Integrated Annual Report 85 Compensation report In this section 86 Compensation governance 87 Compensation principles 88 Compensation of Givaudan executives 93 Compensation of the Executive Committee 94 Compensation of the Board of Directors 96 Share ownership guidelines 96 Ownership of Givaudan securities 97 Report of the statutory auditor Givaudan – 2018 Integrated Annual Report 86 Compensation report Compensation report Attract, motivate and retain performance targets and related payouts under the annual incentives and share-based long-term incentives, while the Givaudan aims to attract, applicable performance criteria are set by the Board. motivate and retain a diverse The Compensation Committee is also responsible for pool of highly talented people to reviewing and approving individual compensation and benefits of each Executive Committee member as well as sustain its leadership position recommending compensation for the Board. within the flavour and fragrance The Compensation Committee consists of three independent industry. The Company’s members of the Board and is currently chaired by Prof. Dr-Ing. Werner Bauer. The Chief Executive Officer is regularly invited to compensation policies are an Compensation Committee meetings. The Head of Global Human Resources acts as secretary of the Compensation Committee. essential component of this The Chairman of the Compensation Committee may invite other strategy, and as such a key driver executives as appropriate. However, executives do not participate in discussions regarding their own compensation. of organisational performance. The Compensation Committee meets three to five times a year Our compensation programmes are aligned to our strategy and and informs the Board of its deliberations, recommendations and reflect the performance of the business and of individuals. -

Proposed Spin-Off of Alcon

PROPOSED SPIN-OFF OF ALCON | A Proposed Spin-off of Alcon Shareholder Information Brochure General Meeting of Shareholders of Novartis AG February 28, 2019 Brochure dated as of January 30, 2019 B | PROPOSED SPIN-OFF OF ALCON Important Information This information brochure has been prepared exclusively for the We urge future holders of Alcon Shares to read the Form 20-F on shareholders of Novartis AG and holders of Novartis American file with the SEC or the SIX listing prospectus, once available, and Depositary Receipts (“ADRs”) in connection with the spin-off of Alcon familiarize themselves with the entire content, including the risk factors. proposed to the annual general meeting of Novartis shareholders to be held on February 28, 2019 (the “General Meeting”). The information set out herein and in any related materials is subject to updating, completion, revision, verification and/or amendment. This brochure is not an offer to sell or a solicitation of offers to Neither Novartis AG nor Alcon Inc. nor any of their affiliates or their purchase or subscribe for shares in Novartis AG or Alcon Inc. nor respective bodies, executives, employees and advisers are under any shall it or any part of it nor the fact of its distribution form the basis obligation to update or keep current the information contained in this of, or be relied on in connection with, any contract therefor. This brochure or to correct any inaccuracies except to the extent it would brochure does not constitute a listing prospectus as defined in the be required under applicable law or regulation. -

![SO AR 11 12 EN WEB[1].Pdf](https://docslib.b-cdn.net/cover/0315/so-ar-11-12-en-web-1-pdf-2150315.webp)

SO AR 11 12 EN WEB[1].Pdf

That’s the mandate for Sonova’s two main businesses – hearing instruments and hearing implants. We pursue innovation in its broadest brand sense: innovation in products and processes, right across all our activities; innovation in what we make; inno portfolio vation in how we make it – and how Unitron Phonak Advanced Bionics we sell it. At the core of our innovation strategy is a rich pipeline of new products. hearing instruments hearing instruments cochlear implants Our goal is to give our customers and endusers enhanced, tangible bene Unitron is a global organization Built with the highest techno- Putting the patient first, Advan- built on strong, personal relation- logical standards, providing ced Bionics brings continuous fits. This is achieved by combining our ships with hearing care pro- optimum speech comprehen- innovation to the remarkable fessionals to improve the lives sibility in a wide range of cochlear implant technology, of people with hearing loss. sound conditions. Phonak also delivering the promise of clear, knowhow with continuous feedback Distributing a full line of hearing provides wireless commu- high-resolution sound and instruments to customers in nication systems for audiological optimal speech understanding from the users of our hearing solutions, over 60 countries, Unitron has and other applications, as to children and adults with a proven track record of de- well as hearing protection sys- significant hearing loss. veloping technological innova- tems. The product range now as well as the hearing care profes tions that provide natural includes the Lyric brand: the sound with exceptional speech world’s first and only extended- understanding, and a relent- wear hearing instrument, sionals who serve them.