Factsheet BGF Swiss Small & Midcap Opportunities Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Annual Report 2018 19 Table of Content

FINANCIAL REPORT Annual Report 2018 19 Table of content Letter to shareholders 2 Our product and service offering 6 Strategy and businesses 10 Corporate governance 36 Compensation report 60 Financial review 96 5 year key figures 104 Consolidated financial statements 105 Financial statements of Sonova Holding AG 175 Investor information 188 Corporate Responsibility Report 190 Letter to shareholders Dear shareholders, 2018/19 marked another year of solid financial performance, posting further record levels of sales and profits to which all three businesses contributed. Moreover – and as expected – growth accelerated from the first half-year to the second, driven by the launch of a number of innovative products and solutions. Sonova affirmed its leading position in audiological performance with the release of the Marvel™ technology platform. Marvel takes full advantage of the unique connectivity enabled by our SWORD™ (Sonova Wireless One Radio Digital) chip and combines it with the proven convenience of our rechargeable solutions. We also made significant progress in our retail business, which we have renamed “audiological care” for one simple reason: care is what we deliver. The expert service We have made significant provided by our hearing care professionals adds key value for the consumer. progress in implementing our strategy. Our cochlear implants business launched a series of innovative new products to strengthen its leading position in this expanding market. Robert Spoerry You will find details of these and other strategic initiatives in the “strategy and businesses” section of this report. The global market in which we operate is poised for further growth, as developed countries see increasing demand from the “baby boomer” generation and developing countries begin to bridge the gap in hearing care provision. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

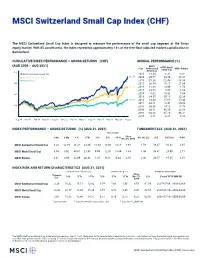

MSCI Switzerland Small Cap Index (CHF) (GROSS)

MSCI Switzerland Small Cap Index (CHF) The MSCI Switzerland Small Cap Index is designed to measure the performance of the small cap segment of the Swiss equity market. With 85 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in Switzerland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (CHF) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year Switzerland MSCI World MSCI Europe Small Cap Small Cap 400 MSCI Switzerland Small Cap 2020 13.34 6.32 -3.31 MSCI World Small Cap 361.59 2019 29.77 24.54 22.38 MSCI Europe 2018 -25.26 -12.48 -13.33 300 2017 36.54 18.11 21.04 271.92 2016 11.60 14.99 1.76 2015 13.70 0.86 -1.62 200 2014 8.62 14.32 5.38 2013 34.55 29.15 22.38 152.39 2012 14.34 15.65 17.40 2011 -24.11 -8.41 -10.22 100 2010 30.39 14.12 -5.79 2009 30.61 40.59 32.88 2008 -43.62 -45.10 -49.31 0 2007 8.61 -6.21 6.10 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI Switzerland Small Cap 3.20 10.19 36.21 23.49 11.64 13.96 14.06 8.93 1.56 59.37 30.08 2.95 MSCI World Small Cap 3.56 3.92 44.61 21.40 9.99 12.41 13.89 7.33 1.46 34.31 20.09 2.17 MSCI Europe 2.61 3.93 32.09 20.32 8.35 9.21 9.44 2.58 2.44 20.57 15.85 2.18 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI Switzerland Small Cap 3.38 18.32 15.11 13.82 0.74 1.00 1.06 0.55 61.59 2007-07-04—2009-03-09 MSCI World Small Cap 13.33 22.77 18.29 15.39 0.57 0.78 0.96 0.46 62.67 2007-06-19—2009-03-09 MSCI Europe 2.07 18.23 15.46 14.17 0.57 0.70 0.75 0.22 62.95 2007-07-16—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The MSCI Switzerland Small Cap Index was launched on Jan 01, 2001. -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

![SO AR 11 12 EN WEB[1].Pdf](https://docslib.b-cdn.net/cover/0315/so-ar-11-12-en-web-1-pdf-2150315.webp)

SO AR 11 12 EN WEB[1].Pdf

That’s the mandate for Sonova’s two main businesses – hearing instruments and hearing implants. We pursue innovation in its broadest brand sense: innovation in products and processes, right across all our activities; innovation in what we make; inno portfolio vation in how we make it – and how Unitron Phonak Advanced Bionics we sell it. At the core of our innovation strategy is a rich pipeline of new products. hearing instruments hearing instruments cochlear implants Our goal is to give our customers and endusers enhanced, tangible bene Unitron is a global organization Built with the highest techno- Putting the patient first, Advan- built on strong, personal relation- logical standards, providing ced Bionics brings continuous fits. This is achieved by combining our ships with hearing care pro- optimum speech comprehen- innovation to the remarkable fessionals to improve the lives sibility in a wide range of cochlear implant technology, of people with hearing loss. sound conditions. Phonak also delivering the promise of clear, knowhow with continuous feedback Distributing a full line of hearing provides wireless commu- high-resolution sound and instruments to customers in nication systems for audiological optimal speech understanding from the users of our hearing solutions, over 60 countries, Unitron has and other applications, as to children and adults with a proven track record of de- well as hearing protection sys- significant hearing loss. veloping technological innova- tems. The product range now as well as the hearing care profes tions that provide natural includes the Lyric brand: the sound with exceptional speech world’s first and only extended- understanding, and a relent- wear hearing instrument, sionals who serve them. -

Swiss Small and Mid-Cap Equities – Consistent Value Creation

Swiss Small and Mid-Cap Equities – Consistent value creation White Paper For professional investors in Switzerland or professional investors as defined by the relevant laws Asset Management | November 2020 Performance of major equity markets (%) Key points 100 ■ The Swiss economy has once again proven its 80 resilience during the Covid-19 pandemic, as 60 reflected by year-to-date outperformance in the 40 Swiss equity market and also its small and mid- 20 cap segment. 0 ■ Several Swiss companies across all market-cap -20 segments have benefited from the disruption -40 caused by the pandemic, since they have CHF CHF USD USD USD EUR EUR EUR GBP exposure to underlying long-term trends that SPI SPI MSCI S&P S&P MSCI MSCI DAX FTSE Extra AC 500 MidcapEurope Europe Mid 250 have been accelerated by the crisis. World 400 Small Cap ■ However, the strongest argument for exposure to Cap Swiss equities within a diversified equity YTD 5Y portfolio remains the consistent long-term Sources: UBP and, Bloomberg Finance LP. Data as of September 2020. Past performance is not a guide to current or outperformance of Swiss equities, driven by their future results. superior value-creation and ESG profiles. ■ An active investment approach, driven by The 2020 EPS growth estimate for global equities has fundamentals and supported by extensive remained steady at around -19% over the past few expertise and knowledge of the market, has led months, while the 2021 estimate now stands at almost to an impressive track record and substantial +30%. Expected regional earnings growth rates for 2020 AuM growth for UBP’s Swiss equity franchise range from +0% for China to -39% for the UK and the over the last 14 years. -

Notice N19 2019

UBS MTF Market Notice Swiss Market Removal 28 June 2019 Dear Member, Following the announcement of the Swiss Federal Department of Finance on June 24 (FDF prepared to activate measure to protect Swiss stock exchange infrastructure), and further to our notice of the same date, UBS MTF will remove all instruments issued by companies with registered offices in Switzerland which are listed on Swiss trading venues. This update will take effect from 1 July. Our daily Stock Universe file, published on our website at https://www.ubs.com/global/en/investment- bank/ib/multilateral-trading-facility/reference-data.html and by SFTP, will reflect the removal of these instruments as of this date. Instruments not subject to the Swiss measure are unaffected; a list of affected instruments is attached to this notice. If you have any queries regarding this notice please contact the UBS MTF Supervisors at +44 207 568 2052 or [email protected]. UBS MTF Management Notice N19 2019 UBS MTF Notices and documentation are available at https://www.ubs.com/mtf. If you have any queries regarding this notice, or comments on the above, please contact the UBS MTF Supervisors at +44 20 7568 2052 or [email protected]. UBS MTF is operated by UBS AGLB which is authorised by the Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and Prudential Regulation Authority. UBS AG is a public company incorporated with limited liability in Switzerland domiciled in the Canton of Basel-City and the Canton of Zurich respectively registered at the Commercial Registry offices in those Cantons with Identification No: CHE-101.329.561 as from 18 December 2013 (and prior to 18 December 2013 with Identification No: CH-270.3.004.646-4) and having respective head offices at Aeschenvorstadt 1, 4051 Basel and Bahnhofstrasse 45, 8001 Zurich, Switzerland and is authorised and regulated by the Financial Market Supervisory Authority in Switzerland. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe ex UK ex 19 August 2021 Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.02 GERMANY BMW 0.41 GERMANY Engie 0.27 FRANCE A P Moller - Maersk A 0.14 DENMARK BMW AG Pref 0.06 GERMANY Eni 0.37 ITALY A P Moller - Maersk B 0.2 DENMARK BNP Paribas 0.81 FRANCE Epiroc A 0.17 SWEDEN A2A 0.04 ITALY Boliden 0.13 SWEDEN Epiroc B 0.09 SWEDEN Aalberts NV 0.06 NETHERLANDS Bollore 0.06 FRANCE EQT Partners AB 0.1 SWEDEN ABB 0.69 SWITZERLAND Bouygues 0.09 FRANCE Equinor ASA 0.24 NORWAY ABN AMRO Bank NV 0.06 NETHERLANDS Brenntag AG 0.17 GERMANY Ericsson A 0.01 SWEDEN Acciona S.A. 0.04 SPAIN Bureau Veritas S.A. 0.11 FRANCE Ericsson B 0.45 SWEDEN Accor 0.08 FRANCE Buzzi Unicem 0.03 ITALY Erste Group Bank 0.12 AUSTRIA Ackermans & Van Haaren 0.04 BELGIUM CaixaBank 0.16 SPAIN EssilorLuxottica 0.65 FRANCE ACS Actividades Cons y Serv 0.08 SPAIN Campari 0.08 ITALY Essity Aktiebolag B 0.24 SWEDEN Adecco Group AG 0.12 SWITZERLAND Capgemini SE 0.36 FRANCE Eurazeo 0.05 FRANCE Adevinta 0.05 NORWAY Carl Zeiss Meditec 0.08 GERMANY Eurofins Scienti 0.17 FRANCE Adidas 0.85 GERMANY Carlsberg (B) 0.22 DENMARK Euronext 0.11 FRANCE Adyen 0.84 NETHERLANDS Carrefour 0.14 FRANCE Evolution AB 0.3 SWEDEN Aegon NV 0.09 NETHERLANDS Casino Guichard Perrachon 0.02 FRANCE Evonik Industries AG 0.08 GERMANY Aena SME SA 0.14 SPAIN Castellum 0.08 SWEDEN Evotec 0.08 GERMANY Aeroports de Paris 0.04 FRANCE CD Projekt SA 0.04 POLAND Exor NV 0.1 ITALY Ageas 0.12 BELGIUM Cellnex Telecom SAU 0.46 SPAIN Fastighets AB Balder B 0.08 SWEDEN Ahold Delhaize 0.35 NETHERLANDS Chr. -

Switzerland Fund A-Chf 31 August 2021

MPR.en.xx.20210831.LU0054754816.pdf For Investment Professionals Only FIDELITY FUNDS MONTHLY PERFORMANCE REVIEW SWITZERLAND FUND A-CHF 31 AUGUST 2021 Portfolio manager: Andrea Fornoni, Alberto Chiandetti Performance over month in CHF (%) Performance for 12 month periods in CHF (%) Fund 1.5 Market index 2.3 MSCI Switzerland Index (Net) Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: nav-nav with income reinvested, in CHF, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment European equity markets continued to rise in August, driven by strong quarterly earnings and optimism over an economic recovery, supported by high rates of vaccination. At the annual Jackson Hole Symposium, US Federal Reserve Chair Jerome Powell indicated that the central bank is in no rush to tighten its monetary policy. However, gains were capped as data showed that inflation surged to a 10-year high in August, and that further rises were likely, challenging the European Central Bank's (ECB) benign view on price growth. Consumer prices saw an increase of 3% this month (2.2% in July), well above the ECB’s target of 2%, fuelled by rising costs of energy, food and industrial goods. However, the ECB argues that the majority of the inflation increase can be attributed to supply chain constraints and should ease by early next year. There were increased uncertainties surrounding the ECB’s next steps regarding the future of its asset purchase programme, as differences over when to relax stimulus measures grew within the governing council. -

Schedule of Investments International Equity Portfolio^ (Unaudited) September 30, 2020

Schedule of Investments International Equity Portfolio^ (Unaudited) September 30, 2020 NUMBER OF NUMBER OF SHARES VALUE SHARES VALUE 108,300 Sanwa Holdings Corp. $ 1,148,343 Common Stocks 96.9% 11,400 SCSK Corp. 637,818 Austria 1.2% (a) 9,400 Shionogi & Co. Ltd. 503,128 25,905 BAWAG Group AG $ 936,585 8,700 TechnoPro Holdings, Inc. 544,720 Belgium 0.7% 17,700 Terumo Corp. 704,720 11,337 KBC Group NV 568,506 15,100 Tokio Marine Holdings, Inc. 660,694 Canada 0.8% 16,100 Toyota Motor Corp. 1,068,557 4,458 Kinaxis, Inc. 656,237* 8,971,615 China 1.2% Luxembourg 0.4% 25,272 Alibaba Group Holding Ltd. 927,763* 7,570 Befesa SA 303,705(a) France 7.3% Netherlands 6.6% 3,942 Air Liquide SA 624,845 4,488 ASML Holding NV 1,657,746 (b) 3,372 Arkema SA 357,514 11,265 Heineken NV 1,002,887 (a) 8,232 Pernod-Ricard SA 1,312,476 28,494 Intertrust NV 485,031 * 8,941 Schneider Electric SE 1,111,356 23,067 Koninklijke Philips NV 1,089,203 5,393 Teleperformance 1,662,672 7,280 NXP Semiconductors NV 908,617 (b) 16,748 TOTAL SE 575,169 5,143,484 5,644,032 Norway 0.7% *(a) Germany 11.4% 73,154 Sbanken ASA 528,710 * 2,683 adidas AG 866,453 Singapore 0.8% 16,232 Brenntag AG 1,032,060 * 44,000 DBS Group Holdings Ltd. 646,859 14,354 CTS Eventim AG & Co.