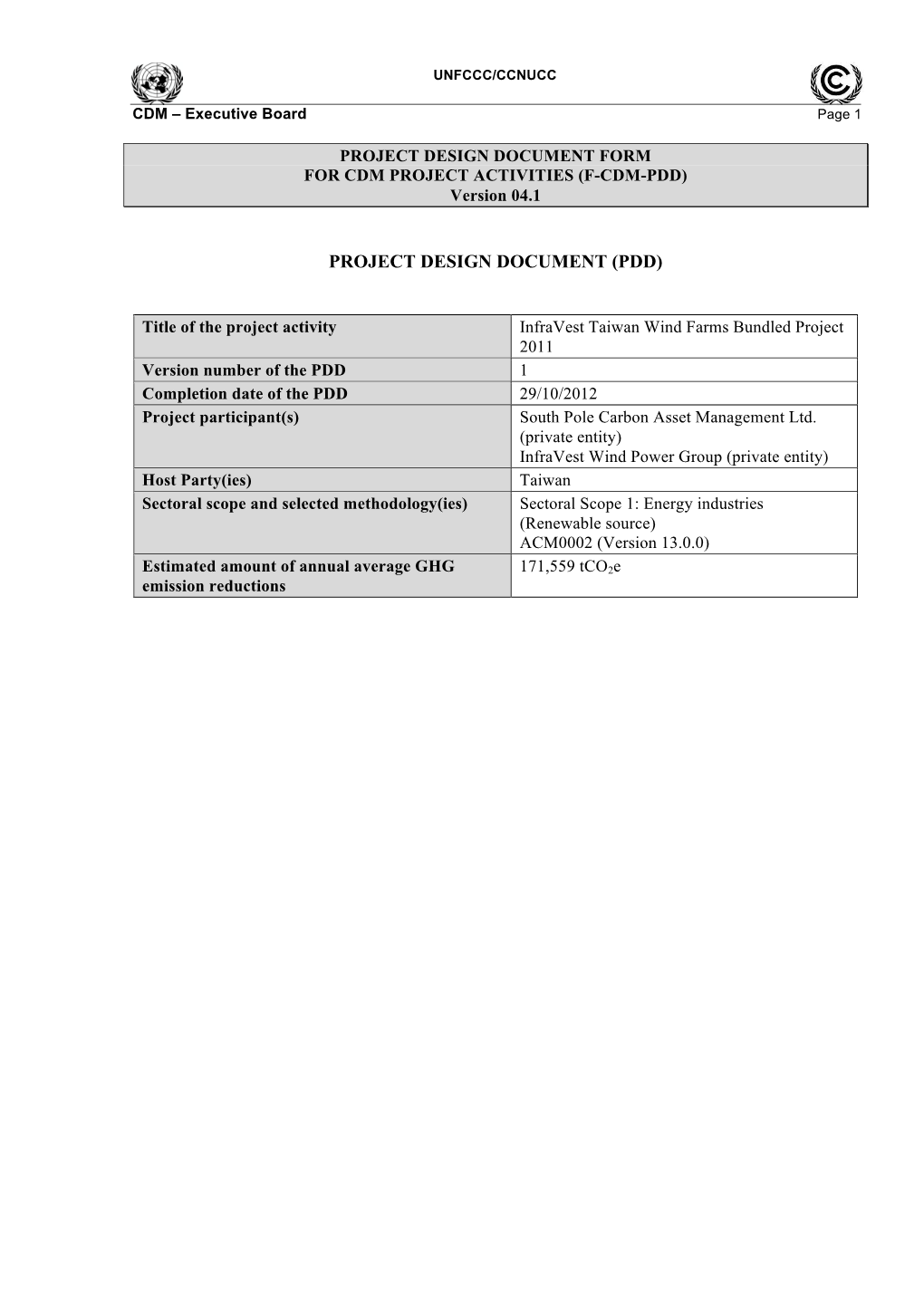

Infravest Wind Bundle 2011 PDD Form05 20130207

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

No. Area Post Office Name Zip Code Address Telephone No. Same Day

Zip No. Area Post Office Name Address Telephone No. Same Day Flight Cut Off Time * Code Pingtung Minsheng Rd. Post No. 250, Minsheng Rd., Pingtung 900-41, 1 Pingtung 900 (08)7323-310 (08)7330-222 11:30 Office Taiwan 2 Pingtung Pingtung Tancian Post Office 900 No. 350, Shengli Rd., Pingtung 900-68, Taiwan (08)7665-735 10:00 Pingtung Linsen Rd. Post 3 Pingtung 900 No. 30-5, Linsen Rd., Pingtung 900-47, Taiwan (08)7225-848 10:00 Office No. 3, Taitang St., Yisin Village, Pingtung 900- 4 Pingtung Pingtung Fusing Post Office 900 (08)7520-482 10:00 83, Taiwan Pingtung Beiping Rd. Post 5 Pingtung 900 No. 26, Beiping Rd., Pingtung 900-74, Taiwan (08)7326-608 10:00 Office No. 990, Guangdong Rd., Pingtung 900-66, 6 Pingtung Pingtung Chonglan Post Office 900 (08)7330-072 10:00 Taiwan 7 Pingtung Pingtung Dapu Post Office 900 No. 182-2, Minzu Rd., Pingtung 900-78, Taiwan (08)7326-609 10:00 No. 61-7, Minsheng Rd., Pingtung 900-49, 8 Pingtung Pingtung Gueilai Post Office 900 (08)7224-840 10:00 Taiwan 1 F, No. 57, Bangciou Rd., Pingtung 900-87, 9 Pingtung Pingtung Yong-an Post Office 900 (08)7535-942 10:00 Taiwan 10 Pingtung Pingtung Haifong Post Office 900 No. 36-4, Haifong St., Pingtung, 900-61, Taiwan (08)7367-224 Next-Day-Flight Service ** Pingtung Gongguan Post 11 Pingtung 900 No. 18, Longhua Rd., Pingtung 900-86, Taiwan (08)7522-521 10:00 Office Pingtung Jhongjheng Rd. Post No. 247, Jhongjheng Rd., Pingtung 900-74, 12 Pingtung 900 (08)7327-905 10:00 Office Taiwan Pingtung Guangdong Rd. -

Diagnosability and Description of a New Subspecies of Indo-Pacific

Wang et al. Zoological Studies (2015) 54:36 DOI 10.1186/s40555-015-0115-x RESEARCH Open Access Diagnosability and description of a new subspecies of Indo-Pacific humpback dolphin, Sousa chinensis (Osbeck, 1765), from the Taiwan Strait John Y Wang1,2,3*, Shih Chu Yang4 and Samuel K Hung5 Abstract Background: Subspecies recognition can affect how people (scientists and non-scientists alike) view organisms and thus has important implications for research on, as well as the conservation of, these entities. Recently, a small group of Indo-Pacific humpback dolphins was discovered inhabiting the waters off central western Taiwan. This geographically isolated population possesses pigmentation patterns that are subtly, but noticeably, different from their nearest conspecifics in the neighbouring waters of the Jiulong River Estuary and Pearl River Estuary of mainland China. Due to this population’s low and declining numbers and the numerous threats it faces, it was assessed as critically endangered by the Red List of Threatened Species of the International Union for Conservation of Nature. The purpose of this study is to examine the degree of differentiation of the Taiwanese population to determine if subspecies recognition is warranted. Results: Analysis of the degree of differentiation in pigmentation patterns revealed nearly non-overlapping distributions between dolphins from Taiwanese waters and those from the Jiulong River + Pearl River estuaries of mainland China (the nearest known populations). The Taiwanese dolphins were clearly diagnosable from those of the Jiulong River + Pearl River estuaries under the most commonly accepted ‘75% rule’ for subspecies delimitation (with 94% of one group being separable from 99+% of the other). -

Kenting Tours Kenting Tour

KENTING TOURS KENTING TOUR THEME PLAN / 4-PEOPLE TOUR PRICE(SHUTTLE SERVICE NOT INCLUDED) PAGE (Jan.)Rice Planting in the Organic Paddies of Long-Shui Community $300 / per 8 (May)Harvesting Rice in the Organic Paddies of Long-Shui Community $300 / per 9 (May - Oct.)Nighttime Harbourside Crab Explore $350 / per 11 KENTING TOUR (July - Aug.) $350 / per 12 (SEASONAL LIMITED) (Oct.)Buzzards over Lanren $1,000 / per 13 (Oct.)Buzzards over Lanren $750 / per 13 $999 / per (LUNCH INCLUDED) $699 / per Manzhou Memories of Wind - Explore The Old Trail of Manzhou Tea 15 $700 / per (LUNCH INCLUDED) 400 / per Travelling the Lanren River $400 / per 16 Tea Picking at Gangkou $250 / per 17 KENTING TOUR Deer by Sunrise $350 / per 18 (YEAR-ROUND) Daytime Deers Adventures $350 / per 19 Daytime Adventures $250 / per 20 Nighttime Adventures $250 / per 21 THEME PLAN PRICE (SHUTTLE SERVICE NOT INCLUDED) PRICE (SHUTTLE SERVICE INCLUDED) PAGE Discover Scuba Diving - $2,500 up / per 24 Scuba Diving - $3,500 / per 25 OCEAN Yacht Chartering Tour $58,000 / 40 people - 26 ATTRACTIONS Sailing Tour - $2,200 / minimum 4 people 28 GLORIA MANOR KENTING TOUR | 2 Cancellations Cancellation Time Cancellation Fee Cancellation Policy Remark 1 Hour before Tour Tour and Shuttle Fee Irresistible Factors : $50 / per You may need to pay the cancellation fee by 24 Hours before Tour Tour Fee cash. Irresistible Factors : Free 72 Hours before Tour $50 / per GLORIA MANOR KENTING TOUR | 3 KENTING’S ECOLOGY AND CULTURE Collaboration Kenting Shirding Near to GLORIA MANOR, the only workstation in Taiwan which dedicated to helping Formosan Sika deer (Cervus nippon taiouanus) quantity recover. -

List of Insured Financial Institutions (PDF)

401 INSURED FINANCIAL INSTITUTIONS 2021/5/31 39 Insured Domestic Banks 5 Sanchong City Farmers' Association of New Taipei City 62 Hengshan District Farmers' Association of Hsinchu County 1 Bank of Taiwan 13 BNP Paribas 6 Banciao City Farmers' Association of New Taipei City 63 Sinfong Township Farmers' Association of Hsinchu County 2 Land Bank of Taiwan 14 Standard Chartered Bank 7 Danshuei Township Farmers' Association of New Taipei City 64 Miaoli City Farmers' Association of Miaoli County 3 Taiwan Cooperative Bank 15 Oversea-Chinese Banking Corporation 8 Shulin City Farmers' Association of New Taipei City 65 Jhunan Township Farmers' Association of Miaoli County 4 First Commercial Bank 16 Credit Agricole Corporate and Investment Bank 9 Yingge Township Farmers' Association of New Taipei City 66 Tongsiao Township Farmers' Association of Miaoli County 5 Hua Nan Commercial Bank 17 UBS AG 10 Sansia Township Farmers' Association of New Taipei City 67 Yuanli Township Farmers' Association of Miaoli County 6 Chang Hwa Commercial Bank 18 ING BANK, N. V. 11 Sinjhuang City Farmers' Association of New Taipei City 68 Houlong Township Farmers' Association of Miaoli County 7 Citibank Taiwan 19 Australia and New Zealand Bank 12 Sijhih City Farmers' Association of New Taipei City 69 Jhuolan Township Farmers' Association of Miaoli County 8 The Shanghai Commercial & Savings Bank 20 Wells Fargo Bank 13 Tucheng City Farmers' Association of New Taipei City 70 Sihu Township Farmers' Association of Miaoli County 9 Taipei Fubon Commercial Bank 21 MUFG Bank 14 -

![[カテゴリー]Location Type [スポット名]English Location Name [住所](https://docslib.b-cdn.net/cover/8080/location-type-english-location-name-1138080.webp)

[カテゴリー]Location Type [スポット名]English Location Name [住所

※IS12TではSSID"ilove4G"はご利用いただけません [カテゴリー]Location_Type [スポット名]English_Location_Name [住所]Location_Address1 [市区町村]English_Location_City [州/省/県名]Location_State_Province_Name [SSID]SSID_Open_Auth Misc Hi-Life-Jingrong Kaohsiung Store No.107 Zhenxing Rd. Qianzhen Dist. Kaohsiung City 806 Taiwan (R.O.C.) Kaohsiung CHT Wi-Fi(HiNet) Misc Family Mart-Yongle Ligang Store No.4 & No.6 Yongle Rd. Ligang Township Pingtung County 905 Taiwan (R.O.C.) Pingtung CHT Wi-Fi(HiNet) Misc CHT Fonglin Service Center No.62 Sec. 2 Zhongzheng Rd. Fenglin Township Hualien County Hualien CHT Wi-Fi(HiNet) Misc FamilyMart -Haishan Tucheng Store No. 294 Sec. 1 Xuefu Rd. Tucheng City Taipei County 236 Taiwan (R.O.C.) Taipei CHT Wi-Fi(HiNet) Misc 7-Eleven No.204 Sec. 2 Zhongshan Rd. Jiaoxi Township Yilan County 262 Taiwan (R.O.C.) Yilan CHT Wi-Fi(HiNet) Misc 7-Eleven No.231 Changle Rd. Luzhou Dist. New Taipei City 247 Taiwan (R.O.C.) Taipei CHT Wi-Fi(HiNet) Restaurant McDonald's 1F. No.68 Mincyuan W. Rd. Jhongshan District Taipei CHT Wi-Fi(HiNet) Restaurant Cobe coffee & beauty 1FNo.68 Sec. 1 Sanmin Rd.Banqiao City Taipei County Taipei CHT Wi-Fi(HiNet) Misc Hi-Life - Taoliang store 1F. No.649 Jhongsing Rd. Longtan Township Taoyuan County Taoyuan CHT Wi-Fi(HiNet) Misc CHT Public Phone Booth (Intersection of Sinyi R. and Hsinsheng South R.) No.173 Sec. 1 Xinsheng N. Rd. Dajan Dist. Taipei CHT Wi-Fi(HiNet) Misc Hi-Life-Chenhe New Taipei Store 1F. No.64 Yanhe Rd. Anhe Vil. Tucheng Dist. New Taipei City 236 Taiwan (R.O.C.) Taipei CHT Wi-Fi(HiNet) Misc 7-Eleven No.7 Datong Rd. -

The Development of COMCOT Storm Surge Model and the Applica on to 2013 Typhoon

The Development of COMCOT Storm Surge Model and the Applicaon to 2013 Typhoon Haiyan 2014/03/25 (二 ) Prof. Tso-Ren Wu (吳祚任) 蔡育霖、莊美惠、林君蔚 [email protected] Naonal Central University (Taiwan) 國立中央大學(台灣) Introduc:on of COMCOT (Cornell Mul:-grid Coupled Tsunami Model) • Solve shallow water equaons on both spherical and Cartesian coordinate systems • Explicit leapfrog Finite Difference Method for stable and high speed calculaon system • Mul:/Nested-grid system for mul:ple wave scales • Moving Boundary Scheme for inundaon (2). COMCOT has been used on many scien:fic papers At least 26 SCI papers were published during 2001~2011 (Including Science) 1. Title: Long waves through emergent coastal vegetaon 7. Title: An insitu borescopic quan:tave imaging profiler for the 12. Title: Analy:cal and numerical simulaon of tsunami Author(s): Mei Chiang C.; Chan I-Chi; Liu Philip L. -F.; et al. measurement of high concentraon sediment velocity mi:gaon by mangroves in Penang, Malaysia Source: JOURNAL OF FLUID MECHANICS Volume: 687 Pages: Author(s): Cowen Edwin A.; Dudley Russell D.; Liao Qian; et al. Author(s): Teh Su Yean; Koh Hock Lye; Liu Philip Li-Fan; et al. 461-491 DOI: 10.1017/jfm.2011.373 Published: NOV 2011 Source: EXPERIMENTS IN FLUIDS Volume: 49 Issue: 1 Special Source: JOURNAL OF ASIAN EARTH SCIENCES Volume: 36 Issue: SI Pages: 77-88 DOI: 10.1007/s00348-009-0801-8 Issue: 1 Pages: 38-46 DOI: 10.1016/j.jseaes.2008.09.007 2. Title: Insights on the 2009 South Pacific tsunami in Samoa Published: JUL 2010 Published: SEP 4 2009 and Tonga from field surveys and numerical simulaons Author(s): Fritz Hermann M.; Borrero Jose C.; Synolakis 8. -

Non Binding Translation for Convenience Only

Non binding translation 6.4 SceneryFor and convenience leisure only Scenic beauty and leisure environment surveys for this project were carried out in August 2016 and May 2017. The survey results were similar and there was not much change in the overall environment. Photos of scenic spots from the two surveys are shown in Figure 6.4-1. Provincial Highway 61 at the estuary of Provincial Highway 61 at the estuary of Old Huwei River (2016.08.18) Old Huwei River (2017.05.06) Santiaolun Fishing Harbor (2016.08.18) Santiaolun Fishing Harbor (2017.05.06) Shoal south of Santiaolun Fishing Harbor Shoal south of Santiaolun Fishing Harbor (2016.08.18) (2016.05.06) Figure 6.4-1 Photos of the project's scenic spots taken during surveys in 2016 and 2017 6-312 Non binding translation For convenience only Observation platform on the western Observation platform on the western embankment of Gangxi Village embankment of Gangxi Village (2016.08.18) (2017.05.06) On the Aogu Wetland embankment On the Aogu Wetland embankment (2016.08.18) (2017.05.06) Dongshih Fisherman's Wharf (2016.08.18) Dongshih Fisherman's Wharf (2017.05.06) Figure 6.4-1 Photos of the project's scenic spots taken during surveys in 2016 and 2017 (continued) 6.4.1 Environmental scenic beauty I. Survey and analysis of the current development site scenic beauty status The wind farm is located off the coasts of Sihu Township and Kouhu Township, Yunlin County. Provincial Highways 17 and 61 (Western Coast Expressway) and County Roadways 155, 160, 164, and 166 are the main traffic access ways along the coast of Yunlin and Chiayi. -

Taiwan in Brief

MATSU TAIPEI ISLANDS KEELUNG ISLAND Taroko Music Festival Taiwan Hot Spring October KINMEN Season ISLANDS October-November This festival’s organisers wanted Taiwan TAOYUAN CITY GUISHAN to combine the visual splendor of The gradual arrival of winter formally ISLAND Taroko Gorge, arguably Taiwan’s announces that Taiwan’s peak hot most attractive scenic and natural spring season has begun. Hot spring YILAN CITY wonder, with the beauty of music. areas throughout the country hold in brief Over the years, different locations a series of events introducing their attractions Taiwan have been chosen for the music scenic beauty. During this period, TAICHUNG CITY Tourist Shuttle take performances, including the grassy hot spring areas throughout the Area Taroko passengers to the main area beside the Taroko National Park country hold a series of hot spring/ 36,000 sq km National Park tourist attractions in Taiwan. Visitor Center, the bed of the Liwu fine-cuisine events and pull together taiwantourbus.com.tw HUALIEN River near the Eternal Spring Shrine, hundreds of county Population taiwantrip.com.tw While outdoor events in Taiwan are not as large in scale or the grassy terraces at Buluowan, and municipal 23 million as well known internationally as the biggest happenings Taiwan East Coast and even a beach near the coastal companies, Taxis abroad – there are in fact plenty to chose from. Land Arts Festival Qingshui Cliff. introducing Languages Taxis here are well-marked the scenic Mandarin, Taiwanese, Hakka yellow vehicles easily recognised Taroko National Park, Hualien County beauty of the & Indigenous languages by visitors. The two largest ones There is something special about Trees covering the mountains and facebook.com/tarokomusic springs, the PENGHU Yushan ISLANDS National Park are Taiwan Taxi, often referred to being out in nature, whether it be for fields used to be an important cash local cultural Time zone as 55688, which is also their soaking in the scenery, watching birds crop for the Hakka tribe. -

Sustainable Campus in Taiwan

Challenge 2008 Taiwan National Development Plan Sustainable Campus ◎ S u in Taiwan Taipei s t a i n a b l e C A movement from「HEART」 a m ◎ p A march toward a u s [sustainable Taiwan] ◎ Tainan H. Jenny Su, ScD Professor of Environmental Health Sciences National Cheng Kung University, Tainan, Taiwan Taiwan Council Member National Council for Sustainable Development Campus: the basic unit of Taiwan’s new “green island initiative”, 2000 A reflection from “Earthquake 921”, 1999 Establishing green industries – local service Network information Shaping community image sharing Promoting green industries and the coexisting network – international join venture • Campus as a Community information Environment preservation/ S deliverance u Industry simulation for Local s rescue center? t species a Cultural i Information n Green and Center Community a -Safety b ecological Network Traveling l e Center Solar and wind corridors Center C -Community generated power a m Sustaining Rainwater storage p Ecology Resource and u -Education original Center s Sustainable ecology Energy cycling -Ecology Campus Center Community Community Cultural Activity Center Local culture General Center Sports and activity preservation education facilities Center Performing Community/District arts exhibits gatherings Middle and Adult and 1999.09.21 Executive Secretary for Environmental Protection elementary school community and Education, Ministry of Education, TAIWAN education institutions Sustainable Campus Eco-City Eco-County Community Eco-Country S u s t a i n a b l e C a m Execution and Supervision p u s Green Island Sustainable Taiwan 1 Building a Sustainable Campus Funding items Sustainable site mediation for hardware renovation Top soil improvement 1. -

To Meet Same-Day Flight Cut-Off Time and Cut-Off Time for Fax-In Customs Clearance Documents

Zip Same Day Flight No. Area Post Office Name Telephone Number Address Code Cut-off time* (03)5215-984 1 Hsinchu/ Miaoli Hsinchu Wuchang St. Post Office 300 No. 81, Wuchang St., East District, Hsinchu 300-41, Taiwan (R.O.C.) 14:30 (03)5250-760 2 Hsinchu/ Miaoli Hsinchu Dongmen Post Office 300 (03)5229-044 No. 56, Dongmen St., East District, Hsinchu 300-41, Taiwan (R.O.C.) 13:10 National Tsinghua University Post 3 Hsinchu/ Miaoli 300 (03)5717-086 No. 99, Sec. 2, Guangfu Rd., East District, Hsinchu 300-71, Taiwan (R.O.C.) 14:00 Office 4 Hsinchu/ Miaoli Hsinchu Fujhongli Post Office 300 (03)5330-441 No. 452-1, Sec. 1, Jingguo Rd., East District, Hsinchu 300-59, Taiwan (R.O.C.) 13:30 5 Hsinchu/ Miaoli Hsinchu Guanghua St. Post Office 300 (03)5330-945 No. 87, Guanghua N. St., N. District, Hsinchu 300-53, Taiwan (R.O.C.) 13:10 6 Hsinchu/ Miaoli Hsinchu Neihu Rd. Post Office 300 (03)5374-709 No.68, Neihu Rd., Xiangshan Dist., Hsinchu City 300-94, Taiwan (R.O.C.) 09:10 7 Hsinchu/ Miaoli Hsinchu Yingming St. Post Office 300 (03)5238-365 No. 10, Yingming St., N. District, Hsinchu 300-42, Taiwan (R.O.C.) 13:10 8 Hsinchu/ Miaoli Hsinchu Guandong Bridge Post Office 300 (03)5772-024 No. 313, Sec. 1, Guangfu Rd., East District, Hsinchu 300-74, Taiwan (R.O.C.) 14:00 9 Hsinchu/ Miaoli Hsinchu Shulintou Post Office 300 (03)5310-204 No. 449, Sec. 2, Dongda Rd., N. -

Liv Round-The-Island Fun / from Taipei (10 Days & 9 Nights)

Liv Round-the-Island Fun / From Taipei (10 days & 9 nights) A cycling tour that only belongs to females… Time and speed, we decide Comprehensive tour choices, to realize the dream of cycling around Taiwan Hop on the bike and enjoy! 【Total Trip Distance: 912 KM Average Speed Per Hour: Approx. 20-25 KM】 Taipei→Hsinchu ~ Taipei LIV Shop-Sanxia-Daxi-Shimen Xindian-Daxi-Guanxi-Hsinchu Provincial Highway No. 9 + County Highway Distance 100 KM No. 110 + Provincial Highway No. 3 【Pick-up Location】7:00 a.m. Taipei Liv Shop 【No.309, Dunhua N. Rd., Songshan Dist., Taipei City】 Leaving the hustle and bustle west, we ride on the tracks in the woods to avoid the busy traffic. Today we challenge ourselves with Provincial Highway No. 3. Without much slope, we still need to ride with a bit caution. The persistence would pay off when we enjoy the nice views. Today we visit Daxi Old Street, and experience the joy brought by seniors’ wisdom. Day1 Daxi Old Street: It’s the hometown of dry bean curd, with Highlights hand-made traditional taste. Made with whole hearted efforts, it’s so delicious that you can’t miss. There’s also a great street artist here, performing traditional whipping top. Only fortunate visitors could get the chance to see it. Hsinchu City God Temple: The Temple, located at Hsinchu City, is classified as a third-class historic site. In 1891, Master Chang in Qing Dynasty predicted a major catastrophe, and the City God Temple was suggested to be the worship ceremony location by local celebrity. -

Intermittent Supply by District (Drought Monitoring Red Signal) Frequently Asked Questions and Answers (Q&A) I

Intermittent Supply by District (Drought Monitoring Red Signal) Frequently Asked Questions and Answers (Q&A) I. Water rationing times, measures, and scope Q1 What are the objects and implemented measures of intermittent supply by district in Miaoli, Taichung, and Northern Changhua? (That is, the regions and water cut-off times of intermittent supply by district) A1 I.The Mioali region is divided into Areas A and B: (I)The scope of Area A: 1. 29 Villages in Toufen City: Xiaxing, Shangxing, Luzhu, Tianliau, Minsheng, Minquan, Minzu, Heping, Xinyi, Ren'ai, Shangpu, Tuniu, Shanxia, Wenhua, Douhuan, Hexing, Chenggong, Ziqiang, Zhongxiao, Dongzhuang, Jianguo, Houzhuang, Liudong, Shanhu, Xinhua, Xinglong, Toufen, Pantau, Zhongxing. 2. 4 Villages in Zhunan Township: Xinnan, Dingpu, Dapu (Wufu Street, Wufu New Residential Quarter), Gongyi (Luchukeng, Kouqiangwei, Kougongguan, Dadizhiai, the odd number side from Lane 1497 to No. 2429 of Gongyi Road). 3. Zhunan Science Park, Kuan-Yuan Science and Technology Park. 4. Zhong'ai Village in Xiangshan District of Hsinchu City (South of Zhong'ai Bridge), Nangang Village (Nangang Street). 5. Baudou Village in Baoshan Township of Hsinchu County (Xinshan Road, Xinshan 1st Road). (II.) The scope of Area B: 1. 23 Villages in Zhunan Township: Gongguan, Dacuo, Gangqian, Haikou, Zhongmei, Zhongying, Zhonggang, Zhonghua, Kaiyuan, Zhengnan, Zhunan, Zhaonan, Zhuxing, Yingpan, Shanjia, Longshan, Tianwen, Longfeng, Jiaxing, Shengfu, Qiding, Dapu (except for Wufu Street, Wufu New Residential Quarter), Gongyi (except for Luchukeng, Kouqiangwei, Kougongguan, Dadizhiai, the odd number side from Lane 1497 to No. 2429 of Gongyi Road). 2. 4 Villages in Toufen City: Jianshan, Jianxia, Guangxing, Lankeng. 1 3. Zhunan Industrial Park, Toufen Industrial Park.