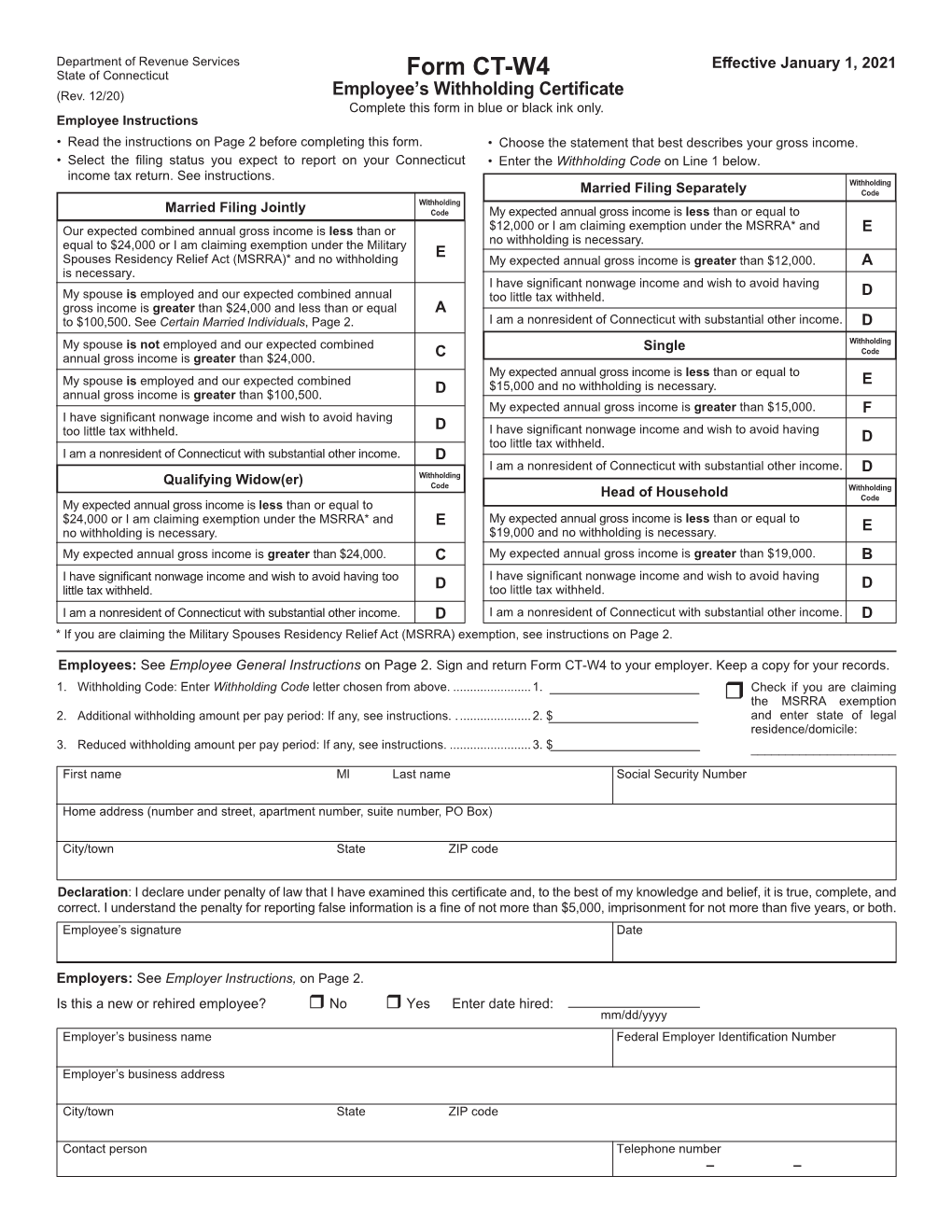

Connecticut State Tax Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tramway Renaissance

THE INTERNATIONAL LIGHT RAIL MAGAZINE www.lrta.org www.tautonline.com OCTOBER 2018 NO. 970 FLORENCE CONTINUES ITS TRAMWAY RENAISSANCE InnoTrans 2018: Looking into light rail’s future Brussels, Suzhou and Aarhus openings Gmunden line linked to Traunseebahn Funding agreed for Vancouver projects LRT automation Bydgoszcz 10> £4.60 How much can and Growth in Poland’s should we aim for? tram-building capital 9 771460 832067 London, 3 October 2018 Join the world’s light and urban rail sectors in recognising excellence and innovation BOOK YOUR PLACE TODAY! HEADLINE SUPPORTER ColTram www.lightrailawards.com CONTENTS 364 The official journal of the Light Rail Transit Association OCTOBER 2018 Vol. 81 No. 970 www.tautonline.com EDITORIAL EDITOR – Simon Johnston [email protected] ASSOCIATE EDITOr – Tony Streeter [email protected] WORLDWIDE EDITOR – Michael Taplin 374 [email protected] NewS EDITOr – John Symons [email protected] SenIOR CONTRIBUTOR – Neil Pulling WORLDWIDE CONTRIBUTORS Tony Bailey, Richard Felski, Ed Havens, Andrew Moglestue, Paul Nicholson, Herbert Pence, Mike Russell, Nikolai Semyonov, Alain Senut, Vic Simons, Witold Urbanowicz, Bill Vigrass, Francis Wagner, Thomas Wagner, 379 Philip Webb, Rick Wilson PRODUCTION – Lanna Blyth NEWS 364 SYSTEMS FACTFILE: bydgosZCZ 384 Tel: +44 (0)1733 367604 [email protected] New tramlines in Brussels and Suzhou; Neil Pulling explores the recent expansion Gmunden joins the StadtRegioTram; Portland in what is now Poland’s main rolling stock DESIGN – Debbie Nolan and Washington prepare new rolling stock manufacturing centre. ADVertiSING plans; Federal and provincial funding COMMERCIAL ManageR – Geoff Butler Tel: +44 (0)1733 367610 agreed for two new Vancouver LRT projects. -

Modern Tram and Public Transit Integration in Chinese Cities A

Modern Tram and Public Transit Integration in Chinese Cities A Case Study of Suzhou Discussion Paper No. 2017-xx Prepared for the Roundtable on [Integrated and Sustainable Urban Transport] (24-25 April 2017, Tokyo) Chia-Lin Chen Department of Urban Planning and Design, Xian Jiaotong-Liverpool University, Suzhou, China Disclaimer: This paper has been submitted by the author for discussion at an ITF Roundtable. Content and format have not been reviewed or edited by ITF and are the sole responsibility of the author. The paper is made available as a courtesy to Roundtable participants to foster discussion and scientific exchange. A revised version will be published in the ITF Discussion Papers series after the Roundtable. The International Transport Forum The International Transport Forum is an intergovernmental organisation with 57 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre-negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. -

A Case Study of Suzhou

Economics of Transportation xxx (2017) 1–16 Contents lists available at ScienceDirect Economics of Transportation journal homepage: www.elsevier.com/locate/ecotra Tram development and urban transport integration in Chinese cities: A case study of Suzhou Chia-Lin Chen Department of Urban Planning and Design, Xi'an Jiaotong-Liverpool University, Room EB510, Built Environment Cluster, 111 Renai Road, Dushu Lake Higher Education Town, Suzhou Industrial Park, Jiangsu Province, 215123, PR China ARTICLE INFO ABSTRACT JEL classification: This paper explores a new phenomenon of tram development in Chinese cities where tram is used as an alternative H7 transport system to drive urban development. The Suzhou National High-tech District tram was investigated as a J6 case study. Two key findings are highlighted. Firstly, the new tramway was routed along the “path of least resis- P2 tance”–avoiding dense urban areas, to reduce conflict with cars. Secondly, regarding urban transport integration, R3 four perspectives were evaluated, namely planning and design, service operation, transport governance and user R4 experience. Findings show insufficient integration in the following aspects, namely tram and bus routes and services, O2 fares on multi-modal journeys, tram station distribution, service intervals, and luggage auxiliary support. The paper Keywords: argues there is a need for a critical review of the role of tram and for context-based innovative policy reform and Tram governance that could possibly facilitate a successful introduction and integration of tram into a city. Urban development Urban transport integration Suzhou China 1. Introduction so instead began planning tram networks. There has been relatively little research examining how new trams have been introduced into cities and The past decade has seen rapid development of urban rail systems in whether these tramways provide an effective alternative to private car use. -

The Tramway, Aka LRT

The Tramway, aka LRT An efficient, esthetic, durable mass transport resource for medium-sized cities Marc le Tourneur (former director of the Montpellier Public Transport Company) France Chile , july 2013 CHILE – Santiago , Antofagasta Marc le Tourneur 1 SUMMARY 1. The tram, a transport mode between BRT and metro 2. The tram (re)birth in France, a success story France: Public Transport organization 28 new tram networks in 30 years New trams, a revolution for Public Transport Three causes for the tram success 3. The case of Montpellier: an exemple of a successful choice for tram A rapidly growing city in Europe Sustainable mobility: a global approach Strong ties between city planning and Public Transport Paid parking: first step in congestion charge Pedestrian only zone in all historical center The creation of a 4 tram lines network in 15 years Integrated and intermodal Public Transport network 4. The Tramway/bus/BRT compared economic analysis in Montpellier ANNEXES 1-Urban growth and public transport development 2-Tram line description 3-Figures 4-The case of Strasbourg 5-Examples of European trams CHILE – Santiago , Antofagasta Marc le Tourneur 1. THE TRAMWAY BETWEEN BRT AND METRO In the world's major cities, mass transport comes down to a choice between metro (Mass Rapid Transit) and BRT (Bus Rapid Transit). New York's subway Bogota's TransMilenio The tramway, whose revival dates from only the 1980s, appears as a mode of transport that is: . Touristy and historic for the cities that have kept their old tramways (San Francisco, Rio de Janeiro, New Orleans, etc.) . Esthetic and costly for the new tramways built generally in the richest Rio de Janeiro's Bonde de Santa countries Teresa CHILE – Santiago , Antofagasta Marc le Tourneur 3 The modern tramway (or Light Rail, or VLT, or light metro) holds its place between the BRT and the metro The capacity of the vehicles places the tram between buses and metros: . -

ACCIDENTOLOGY of TRAMWAYS Analysis of Reported Events

Service Technique des Remontées Mécaniques et des Transports Guidés REPORT MEDDTL DGITM Technical Department for Mechanical Lifts and Guided Transport Systems systems TramWay Division December 2010 ACCIDENTOLOGY OF TRAMWAYS Analysis of reported events year 2009 evolution 2003 2009 Ministry of Ecology, Sustainable Development, Transport and Housing wwwdeveloppementdurable.gouv.fr Service Technique des Remontées Mécaniques et des Transports Guidés Tramway accident report 2009 – December 2010 Page 2 of 28 Service Technique des Remontées Mécaniques et des Transports Guidés History of document versions Version Date Remarks 0.1 23 December 2010 Version 1 0.2 7 January 2011 Corrections following latest update of database information 0.3 1 February 2011 Minor corrections Case Controller Michel ARRAS STRMTG Tel: 04.76.63.78.78. / Fax: 04.76.42.39.33. Email: michel.arras@developpementdurable.gouv.fr Author Michel ARRAS – TramWay Division Verifier Laetitia MENETRIEUX – TramWay Division Tramway accident report 2009 – December 2010 Page 3 of 28 Tramway accident report 2009 – December 2010 Page 4 of 28 Contents 1. REMINDER ON THE SUBJECT OF THE DATABASE........................................................................8 1.1 THE FIELDS IN THE DATABASE ..............................................................................................................8 1.2 THE CODIFICATION OF TRAMWAY LINES ...............................................................................................8 1.3 DATA .....................................................................................................................................................8 -

Form 2441, Child and Dependent Care Expenses

Child and Dependent Care Expenses 1040 OMB No. 1545-0074 Form 2441 1040-SR ◀ . ▶ Attach to Form 1040, 1040-SR, or 1040-NR. 1040-NR 2020 Department of the Treasury ▶ Go to www.irs.gov/Form2441 for instructions and the 2441 Attachment Internal Revenue Service (99) latest information. Sequence No. 21 Name(s) shown on return Your social security number You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed in the instructions under “Married Persons Filing Separately.” If you meet these requirements, check this box. Part I Persons or Organizations Who Provided the Care—You must complete this part. (If you have more than two care providers, see the instructions.) 1 (a) Care provider’s (b) Address (c) Identifying number (d) Amount paid name (number, street, apt. no., city, state, and ZIP code) (SSN or EIN) (see instructions) Did you receive No ▶ Complete only Part II below. dependent care benefits? Yes ▶ Complete Part III on the back next. Caution: If the care was provided in your home, you may owe employment taxes. For details, see the instructions for Schedule 2 (Form 1040), line 7a. Part II Credit for Child and Dependent Care Expenses 2 Information about your qualifying person(s). If you have more than two qualifying persons, see the instructions. (c) Qualified expenses you (a) Qualifying person’s name (b) Qualifying person’s social security number incurred and paid in 2020 for the First Last person listed in column (a) 3 Add the amounts in column (c) of line 2. -

Influence of Guangzhou Metro Line 6 on Transit Accessibility in Xunfengzhou District, Guangzhou

International Journal of Emerging Engineering Research and Technology Volume 4, Issue 9, September 2016, PP 26-36 ISSN 2349-4395 (Print) & ISSN 2349-4409 (Online) Influence of Guangzhou Metro Line 6 on Transit Accessibility in Xunfengzhou District, Guangzhou Ji-hua HU1, Li-xiao GAO2, Jia-xian LIANG3 1Research Centre of Intelligent Transportation System, School of Engineering, Sun Yat-sen University Guangzhou 510006, China; Guangdong Provincial Key Laboratory of ITS, Guangzhou, China 2Research Centre of Intelligent Transportation System, School of Engineering, Sun Yat-sen University Guangzhou 510006, China; Guangdong Provincial Key Laboratory of ITS, Guangzhou, China 3Research Centre of Intelligent Transportation System, School of Engineering, Sun Yat-sen University Guangzhou 510006, China; Guangdong Provincial Key Laboratory of ITS, Guangzhou, China ABSTRACT The great changes of transit accessibility have taken place in Xunfengzhou district after the operating of Guangzhou metro line 6. Apply the travel time to measure the accessibility from the Xunfengzhou district to Gongyuanqian station before and after the metro line 6 operated. Analyze the changes of public transit accessibility and its reasons after metro line 6 operated by comparison. Completely explore the influence of subway operating on public transit system. Then infer the departure time in morning commute in Xunfengzhou district and portray the departure time isochrones map based on the isochrones measure to provide the guidance for the residents in Xunfengzhou district. The results show that the transit accessibility improved a great extent in Xunfengzhou district due to the operating of metro line 6. The subway operating is beneficial to improve the accessibility of public transit system. Keywords: accessibility, isochrones, departure time, Xunfengzhou, travel time INTRODUCTION With the continuous expansion of city and the rapid increase of population, the conventional public transport system cannot meet the travel needs of urban residents in Guangzhou. -

Development of High-Speed Rail in the People's Republic of China

ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. 959 May 2019 Asian Development Bank Institute Pan Haixiao is a professor at the Department of Urban Planning of Tongji University. Gao Ya is a PhD candidate at the Department of Urban Planning of Tongji University. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. Some working papers may develop into other forms of publication. Suggested citation: Haixiao, P. and G. Ya. 2019. Development of High-Speed Rail in the People’s Republic of China. ADBI Working Paper 959. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/development-high-speed-rail-prc Please contact the authors for information about this paper. Email: [email protected] Asian Development Bank Institute Kasumigaseki Building, 8th Floor 3-2-5 Kasumigaseki, Chiyoda-ku Tokyo 100-6008, Japan Tel: +81-3-3593-5500 Fax: +81-3-3593-5571 URL: www.adbi.org E-mail: [email protected] © 2019 Asian Development Bank Institute ADBI Working Paper 959 Haixiao and Ya Abstract High-speed rail (HSR) construction is continuing at a rapid pace in the People’s Republic of China (PRC) to improve rail’s competitiveness in the passenger market and facilitate inter-city accessibility. -

Railway Reference List

Railway Reference List Product/Solution: Mass-Spring System Client/Project Country Year Monbijoustraße, Bern Switzerland 2021 Tramway Reinighaus, Graz Austria 2021 Tramway Stettin-Szczecin, Part 6,7,8 Poland 2021 ul. Wiejskiej na Rzadz PLP40, Grudziadz Poland 2021 Gaziray - Gaziantep, HSL Turkey 2021 Refurbishment railway track Breitenrain Switzerland 2021 Münzgrabenstraße, Line 6, Graz Austria 2021 Koralmbahn, Tunnel Mittlern-Althofen Austria 2021 U2-22 City Hall, Vienna Austria 2021 U5-2 Frankhplatz, Vienna Austria 2021 Metro Tunnel Melbourne Australia 2021 U2-U23, Vienna Austria 2021 GETAFE - ADIF Tunnel, Madrid Spain 2021 Limmattalbahn, Etappe 2 Switzerland 2021 Tramway Gorzow Wielpolski, ul. Chrobrego Mieszka Poland 2020 — 2021 Rösselsbrünnle, Karlsruhe Germany 2020 Main Station Munich North Germany 2020 Tramway Angers, Ligne B France 2020 Linz Linien - Traun Austria 2020 Limmattalbahn Switzerland 2020 Baselland Transport - Section L19 Switzerland 2020 La Sagrera train station, Barcelona Spain 2020 COOP Depot, Vufflens-La-Ville Switzerland 2020 Tramway SmartCity Austria 2020 Kriegsstraße, Karlsruhe Germany 2019 Lusail Tram Qatar 2019 ulica Karmelicka, Krakow Poland 2019 Trasa Łagiewnicka, Krakow Poland 2019 Reconstruction Ostring, Bern Switzerland 2019 Tramway Reininghaus Austria 2019 Chêne Bougerie Ligne 12 Switzerland 2019 Chêne Bougerie Tram du Goulet Switzerland 2019 Tramway Dabrowa Gornica, ulicy Kasprzaka Poland 2019 Tramway ul. Kujawska, Bydgoszcz Poland 2019 Eppenberg Tunnel Switzerland 2019 ul. Podchorążych, Krakow Poland 2019 Railway Reference List Client/Project Country Year Tramway Basel - frame contract Switzerland 2018 — 2023 Tram Magdeburg (Raiffeisenstraße - Warschauer Straße) Germany 2018 Riyadh Metro line 3 Saudi Arabia 2018 Gare de Montbovon Switzerland 2018 ul. Dabrowskiego II, Lodz Poland 2018 Tram Lyon T6 France 2018 KST III Krowodrza Górka — Azory, Krakau Poland 2018 Tramway Caen France 2018 Suin Line South Korea 2018 Tramway Toulouse France 2018 Hanam Line South Korea 2018 Tramway St. -

Tailormade Tour Guide

CHINA tailormade tour guide contents China brief Introduction & Climate map & Traditional Festival Explore China Top 10 Recommended Destinations Major Airport in China Top Airlines in China Train station in Major cities Type of train in China Top 10 Recommended Historic Attractions Top 10 Recommended Natural Beauties Top 10 Recommended beautiful Towns Top Minority Cities Most Popular Chinese Dishes China Currency and Exchange Info Electricity and Voltage Helpful Numbers Visa for China Flexible, Time-saving, Fast & Easy Tailor-making Procedure Novaland Tours Clients’ Photos China Brief Introduction China, officially the People's Republic of China (PRC), is a unitary sovereign state in East Asia and the world's most populous country, with a population of over 1.381 billion.Covering approximately 9.6 million square kilometers (3.7 million square miles), it is the world's second-largest state by land area and third- or fourth-largest by total area. Governed by the Communist Party of China, it exer- cises jurisdiction over 22 provinces, five autonomous regions,four direct-controlled municipalities (Beijing, Tianjin, Shanghai, and Chongqing) and the Special Administrative Regions Hong Kong and Macau, also claiming sovereignty over Taiwan. China is a great power and a major regional power within Asia, and has been characterized as a potential superpower. China emerged as one of the world's earliest civilizations in the fertile basin of the Yellow River in the North China Plain. For millennia, China's political system was based on hereditary monarchies, or dynasties, beginning with the semi-legendary Xia dynasty. Since then, China has then expanded, fractured, and re-unified numerous times. -

Innovative Technologies for Light Rail and Tram: a European Reference Resource

Innovative Technologies for Light Rail and Tram: A European reference resource Briefing Paper 5 Hybrid Battery/Supercapacitor - Hybrid Electric and Rapid Accumulator Systems September 2015 Sustainable transport for North-West Europe’s periphery Sintropher is a five-year €23m transnational cooperation project with the aim of enhancing local and regional transport provision to, from and withing five peripheral regions in North-West Europe. INTERREG IVB INTERREG IVB North-West Europe is a financial instrument of the European Union’s Cohesion Policy. It funds projects which support transnational cooperation. Innovative technologies for light rail and tram Working in association with the POLIS European transport network, who are kindly hosting these briefing papers on their website. Report produced by University College London Lead Partner of Sintropher project Authors: Charles King, Giacomo Vecia, Imogen Thompson, Bartlett School of Planning, University College London. The paper reflects the views of the authors and should not be taken to be the formal view of UCL or Sintropher project. 4 Innovative technologies for light rail and tram Table of Contents Background .................................................................................................................................................. 6 Innovative technologies for light rail and tram – developing opportunities ................................................... 6 Super-capacitor/Hybrid Trams .................................................................................................................... -

2020 Schedule C (Form 1040) 2020 Page 2 Part III Cost of Goods Sold (See Instructions)

SCHEDULE C Profit or Loss From Business OMB No. 1545-0074 (Form 1040) (Sole Proprietorship) ▶ Go to www.irs.gov/ScheduleC for instructions and the latest information. 2020 Department of the Treasury Attachment Internal Revenue Service (99) ▶ Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) A Principal business or profession, including product or service (see instructions) B Enter code from instructions ▶ C Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) E Business address (including suite or room no.) ▶ City, town or post office, state, and ZIP code F Accounting method: (1) Cash (2) Accrual (3) Other (specify) ▶ G Did you “materially participate” in the operation of this business during 2020? If “No,” see instructions for limit on losses . Yes No H If you started or acquired this business during 2020, check here . ▶ I Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions . Yes No J If “Yes,” did you or will you file required Form(s) 1099? . Yes No Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the “Statutory employee” box on that form was checked . ▶ 1 2 Returns and allowances . 2 3 Subtract line 2 from line 1 . 3 4 Cost of goods sold (from line 42) . 4 5 Gross profit. Subtract line 4 from line 3 .