Q2 Update: 57% of Italian NPL Securitisations Now Under-Performing

Total Page:16

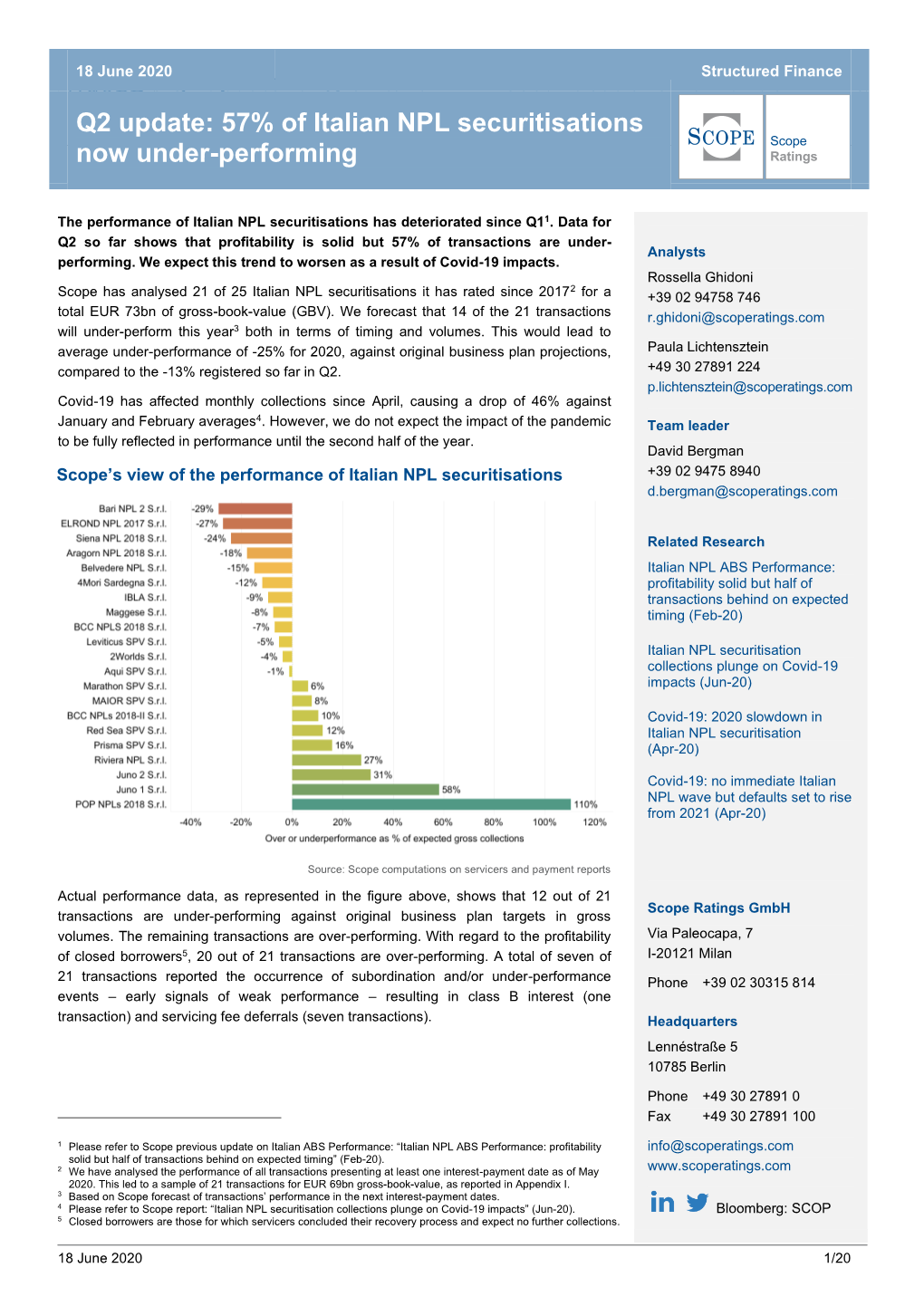

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CREDITO VALTELLINESE S.P.A

BASE PROSPECTUS CREDITO VALTELLINESE S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) €5,000,000,000 Euro Medium Term Note Programme Under the €5,000,000,000 Euro Medium Term Note Programme (the "Programme") described in this Base Prospectus, Credito Valtellinese S.p.A. ("Credito Valtellinese" or the "Issuer") may from time to time issue certain non-equity securities in bearer form, denominated in any currency and governed by English Law (the "English Law Notes") or by Italian Law (the "Italian Law Notes", and together with the English Law Notes, the "Notes"), as described in further detail herein. The terms and conditions for the English Law Notes are set out herein in “Terms and Conditions for the English Law Notes” and the terms and conditions for the Italian Law Notes are set out herein in “Terms and Conditions for the Italian Law Notes”. References to the “Notes” shall be to the English Law Notes and/or the Italian Law Notes, as appropriate and references to the “Terms and Conditions” or the “Conditions” shall be to the Terms and Conditions for the English Law Notes and/or the Terms and Conditions for the Italian Law Notes, as appropriate. For the avoidance of doubt, in “Terms and Conditions for the English Law Notes”, references to the “Notes” shall be to the English Law Notes, and in “Terms and Conditions for the Italian Law Notes”, references to the “Notes” shall be to the Italian Law Notes. This Base Prospectus has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") in its capacity as competent authority in Luxembourg as a base prospectus under article 8 of Regulation (EU) 2017/1129, as amended (the "Prospectus Regulation"). -

Semi-Annual Italian NPL Performance Report: 60% Of

28 July 2021 Structured Finance Semi-annual Italian NPL performance report: sector will under-perform into the medium term Semi-annual Italian NPL performance report: sector will under-perform into the medium term Italian NPL collection volumes look to be stabilising at 25% below average pre-pandemic levels. Performance has deteriorated slightly Analysts since Scope’s last report: 60% of transactions were performing below servicers’ original expectations in the second quarter of 2021, Rossella Ghidoni against 56% previously (based on Q3 2020 data1). The outlook is weak and risks remain to the downside. +39 02 94758 746 Indeed, weakness in the underlying market is reflected by the NPL Performance Index. The NPI, which tracks cumulative collections against [email protected] servicers’ original projections, stands at 94 and Scope expects it to remain below the baseline of 100 into the medium term. Meanwhile, notes are Paula Lichtensztein expected to amortise in six to eight years, based on the Scope NPL Dynamic Coverage Index (SCI), which tracks the speed of note amortisation. +49 30 27891 224 [email protected] The share of positions closed by servicers remains low and on those positions that have closed, median profitability has been 87%, below Scope expectations at closing. Vittorio Maniscalco +39 02 94758 456 Scope believes the Italian NPL sector will continue to under-perform into the medium term as the consequences of the pandemic have not yet worked [email protected] themselves through the economy. By the fourth quarter of 2021, Scope estimates that the share of transactions with collection volumes lagging Antonio Casado servicers’ forecasts will align with second quarter 2021 figures. -

Prospetto Informativo

PROSPETTO INFORMATIVO Relativo all’offerta in opzione agli azionisti di massimo n. 330.600 azioni ordinarie della Banca Popolare Sant’Angelo S.c.p.A. (con “Bonus Share”) e successiva offerta ai terzi delle eventuali azioni rimaste inoptate Emittente e soggetto incaricato della raccolta delle sottoscrizioni: Banca Popolare Sant’Angelo S.c.p.A. Prospetto informativo depositato presso la CONSOB in data 28/09/2009 in conformità alla nota di comunicazione dell’avvenuto rilascio dell’autorizzazione da parte della CONSOB stessa del giorno 22/09/2009 prot. n. 9083160 e messo a disposizione del pubblico presso: • la sede sociale della Banca Popolare Sant’Angelo S.c.p.A. in Corso Vittorio Emanuele 10, 92027 Licata; • tutti gli sportelli della Banca Popolare Sant’Angelo S.c.p.A.; • il sito Internet www.bancasantangelo.com. L’adempimento di pubblicazione del presente Prospetto Informativo non comporta alcun giudizio della CONSOB sull’opportunità dell’investimento proposto e sul merito dei dati e delle notizie allo stesso relativi. Prospetto Informativo Banca Popolare Sant’Angelo S.c.p.A. AVVERTENZA Le Azioni oggetto dell’Offerta presentano gli elementi di rischio propri di un investimento in strumenti finanziari non quotati in un mercato regolamentato, per i quali potrebbero insorgere difficoltà di disinvestimento. Per difficoltà di disinvestimento si intende che i sottoscrittori potrebbero avere difficoltà nel negoziare gli strumenti finanziari oggetto della presente Offerta, in quanto le richieste di vendita potrebbero non trovare adeguate contropartite. 1 Prospetto Informativo Banca Popolare Sant’Angelo S.c.p.A. INDICE GLOSSARIO DELLE PRINCIPALI DEFINIZIONI ........................................................................................ 7 NOTA DI SINTESI ......................................................................................................................................... 9 Avvertenze ................................................................................................................................................... 9 A. -

Credito Valtellinese Banking Group - Register of Banking Groups No

Condensed Interim Consolidated Report at 30 June 2019 Creval Società per Azioni Registered Offices in Piazza Quadrivio 8 - Sondrio, Italy Tax code and Sondrio Company Registration no. 00043260140 - Register of Banks no. 489 Parent of the Credito Valtellinese Banking Group - Register of Banking Groups no. 5216.7 Website: http://www.gruppocreval.com E-mail: [email protected] Data at 30 June 2019: Share Capital EUR 1,916,782,886.55 Member of the Interbank Guarantee Fund COMPANY OFFICERS OF CREDITO VALTELLINESE in office at 6 August 2019 BOARD OF DIRECTORS Chairman Alessandro Trotter Deputy Chairman Stefano Caselli Managing Director and General Manager Luigi Lovaglio Directors Livia Aliberti Amidani Elena Beccalli Paola Bruno Maria Giovanna Calloni Carlo Crosara Anna Doro Fausto Galmarini Serena Gatteschi Stefano Gatti Jacob F. Kalma Teresa Naddeo Massimiliano Scrocchi BOARD OF STATUTORY AUDITORS Chairman Francesca Michela Maurelli Standing Auditors Paolo Cevolani Alessandro Stradi Substitute Auditors Simonetta Bissoli Francesco Fallacara HEADS OF THE MAIN CORPORATE FUNCTIONS Deputy General Manager Vicar Umberto Colli Chief Risk Officer (CRO) Fabio Salis Chief Lending Officer (CLO) Vittorio Pellegatta Head of Compliance and Anti-money Laundering Department Enzo Rocca Manager in charge of financial reporting Simona Orietti Audit Company KPMG S.p.A. 2 Contents COMPANY OFFICERS OF CREDITO VALTELLINESE ........................................................................... 2 CONSOLIDATED HIGHLIGHTS AND ALTERNATIVE PERFORMANCE INDICATORS AT -

IX Edizione Di Invito Banca Antonveneta Cariprato a Palazzo

Associazione Bancaria Italiana BNL - Gruppo BNP Paribas Sono lieto di dare il benvenuto a quanti hanno scelto di visitare i palazzi delle banche aperti al pubblico in occasione della IX edizione di Invito Banca Antonveneta Cariprato a Palazzo. Questa iniziativa, ben consolidata nel calendario degli eventi Banca Carige Carisbo culturali, serve a far conoscere meglio il patrimonio culturale e i documenti della vita civile del nostro Paese che le banche conservano e valorizzano. Banca CR Firenze Cassa dei Risparmi di Forlì e della Romagna La manifestazione, promossa dall’ABI e realizzata con le banche che Banca dell’Adriadico aderiscono al progetto, apre per l’intera giornata di sabato 2 ottobre i Cassa di Risparmio Banca di Imola palazzi degli istituti di credito, normalmente chiusi al pubblico perché del Friuli Venezia Giulia luoghi in cui si svolge quotidianamente l’attività bancaria. Il pubblico può Banca di Piacenza Cassa di Risparmio del Veneto così fruire liberamente, almeno una volta l’anno, di un patrimonio culturale Banca di Romagna significativamente diffuso in tutti i centri del nostro Paese. Cassa di Risparmio Banca di Trento e Bolzano di Ascoli Piceno L’aver saputo mostrare attraverso i palazzi delle ‘cento città italiane’ i caratteri costitutivi della civiltà, dei costumi, del modo di essere degli Banca Etruria Cassa di Risparmio di Asti Italiani è la ragione dell’ampio successo di pubblico e dell’adesione di Banca Federico Del Vecchio Cassa di Risparmio di Cento tutti i mezzi d’informazione alla nostra manifestazione. ‘Il palazzo’, al di là della metafora pasoliniana, rappresenta ancora nella realtà attuale i Banca Finnat Euramerica Cassa di Risparmio di Cesena cardini dell’evoluzione civile ed economica del Paese, oltre che l’eccezionale tradizione architettonica e artistica di quel policentrismo culturale che Banca Monte dei Paschi di Siena Cassa di Risparmio spiega e tuttora caratterizza la storia di questo Paese. -

Floating) Dated April 5, 2013 Dated March 26, 2014

FINAL TERMS BASE PROSPECTUS FINAL TERMS NO. 6543 (floating) Dated April 5, 2013 Dated March 26, 2014 SUPPLEMENTARY PROSPECTUSES Dated May 3, 2013, May 10, 2013, June 3, 2013, June 14, 2013, June 28, 2013, August 2, 2013, September 18, 2013, November 8, 2013, November 20, 2013, February 3, 2014 and March 4, 2014 GENERAL ELECTRIC CAPITAL CORPORATION ISSUE OF EURO MEDIUM-TERM NOTES U.S.$ Floating Rate Notes Due 2020 Any person making or intending to make an offer of the Notes may only do so: (i) in the Public Offer Jurisdiction mentioned in Part B below, provided such person is of a kind specified in that paragraph and that the offer is made during the Offer Period specified in that paragraph; or (ii) otherwise in circumstances in which no obligation arises for the Issuer or any Manager to publish a prospectus pursuant to Article 3 of the Prospectus Directive or to supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to such offer. Neither the Issuer nor any Manager has authorized, nor do they authorize, the making of any offer of Notes in any other circumstances. The expression "Prospectus Directive" means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State) and includes any relevant implementing measure in the Relevant Member State and the expression "2010 PD Amending Directive" means Directive 2010/73/EU. PART A CONTRACTUAL TERMS Terms used herein shall be deemed to be defined as such for the purposes of the Conditions set forth in the above referenced Base Prospectus and the supplemental Prospectuses dated May 3, 2013, May 10, 2013, June 3, 2013, June 14, 2013, June 28, 2013, August 2, 2013, September 18, 2013, November 8, 2013, November 20, 2013, February 3, 2014 and March 4, 2014 which together constitute a base prospectus for the purposes of the Prospectus Directive (the "Base Prospectus"). -

Directors and Officers of Credito Valtellinese Board of Directors

Directors and Officers of Credito Valtellinese Board of Directors Chairman *Francesco Guicciardi Deputy Chairmen *Salvatore Vitali Vincenzo Merlino Managing Director *Giovanni De Censi Directors Bassano Baroni Franco Bettini *Michele Colombo *Mario Cotelli Pier Domenico De Filippis Emilio Rigamonti Marco Santi Giuliano Zuccoli *Members of the Executive Committee Board of Statutory Auditors Chairman Angelo Palma Acting Auditors Roberto Campidori Fabiano Garbellini Alternate Auditors Aldo Cottica Alfonso Rapella Board of Arbitrators Acting Arbitrators Emilio Berbenni Francesco Bertini Italo Vittorio Lambertenghi Alternate Auditors Ettore Negri Fedele Pozzoli General Management General Manager Renato Bartesaghi Deputy General Manager Miro Fiordi Deputy General Manager Franco Sala Independent Auditing Firm Reconta Ernst & Young S.p.A. CONSOLIDATED BALANCE SHEET (in thousands of Euro) Assets 30/06/2002 31/12/2001 30/06/2001 10 Cash and deposits with central banks and post offices 70.913 67.608 46.490 20 Treasury bills and similar securities eligible for refinancing with central banks 456.818 478.838 566.798 30 Due from banks: 319.519 537.741 421.075 a) repayable on demand 60.340 125.667 135.569 b) other 259.179 412.074 285.506 40 Loans to customers 6.059.244 5.830.174 5.374.274 including: - loan using public funds administered 82 86 99 50 Bonds and other debt securities: 975.210 1.058.092 1.095.058 a) issued by public bodies 786.389 759.592 828.862 b) issued by banks: 131.319 261.977 228.005 including: - own securities 11.988 11.395 21.410 -

Member States

EUR million Member States Belgium 1 755,0 Gas storage, transport and transmission throughout Belgium Fluxys 120,0 Construction of two combined cycle gas-fired units in Lelystadt-Flevoland (Netherlands), combined cycle gas-fired unit in Amercoeur-Hainaut and blast furnace residue gas-fired unit at Arcelor plant in Ghent Electrabel SA 25,0 (Belgium) Construction and operation of first phase of Belgium's second large offshore wind farm Special purpose entity/fund 300,0 Financing of small and medium-scale renewable energy projects Dexia Banque Belgique 150,0 Construction and rehabilitation of regional wastewater treatment facilities in Flemish region Aquafin NV 100,0 Construction and modernisation of sewerage networks in Flemish region, comprising East and West Aquafin NV 200,0 Flanders, Antwerp, Flemish Brabant and Limburg Compagnie Upgrading of drinking water supply networks in Greater Liège Intercommunale Liégeoise 120,0 des Eaux Urban regeneration comprising demolition, upgrading and repair of social housing and associated social Société Wallonne du 250,0 and urban infrastructure in Walloon region Logement Vlaamse Maatschappij voor Modernisation, refurbishment and reconstruction of 7 500 rented social housing units 200,0 Sociaal Wonen NV RDI in fields of cancer diagnosis and therapy on various sites Ion Beam Applications S.A. 50,0 R&D in field of hardware and software for virtual simulation, prototyping and testing technologies in LMS International NV 15,0 Leuven (Belgium), Brasov (Romania) and Lyon (France) Financing of small and medium-scale projects carried out by SMEs ING Bank N.V. 75,0 Fortis Banque SA 150,0 Bulgaria 173,5 Rehabilitation of three major junctions in Sofia's road network Sofia Municipality 43,5 Financing of small and medium-scale projects carried out by SMEs Erste Group Bank AG 5,0 Eurobank EFG Bulgaria AD 50,0 Piraeus Bank Bulgaria AD 40,0 Bulgarian Development 25,0 Bank AD Alpha Bank AE 10,0 Czech Republic 1 860,5 Upgrading and extension of electricity distribution network across large part of Czech Republic ČEZ Distribuce, a.s. -

Elenco Banche Convenzionate

OFFERTA XPAY: ELENCO BANCHE 1015 Banco di Sardegna SpA 1030 Banca Monte dei Paschi di Siena SpA 3011 Hypo Alpe Adria Bank 3019 Credito Siciliano 3032 Credito Emiliano SpA 3047 Banca Capasso 3048 Banca del Piemonte SpA 3062 Banca Mediolanum SpA 3083 Ubi Banca Private Investment SpA 3087 Banca Finnat 3084 Banca Cesare Ponti 3104 Deutsche Bank SpA 3111 Unione di Banche Italiane SpA 3124 Banca del Fucino SpA 3127 UGF Banca SpA 3138 Banca Reale 3141 Banca di Treviso 3158 Banca Sistema SpA 3165 IW Bank SpA 3177 Banca Sai SpA 3185 Banca Ifigest 3204 Banca di Legnano 3229 Banca Modenese Spa 3242 Banco di Lucca 3253 Banca Federico Del Vecchio 3259 Nordest Banca 3262 Asset Banca 3265 Banca Promos SpA 3287 Banca Sammarinese d’Investimenti 3301 Carimilo - Cassa dei Risparmi di Milano e della Lombardia 3310 Eticredito Banca Etica Adriatica 3317 Banca della Provincia di Macerata 3323 GBM Banca 3332 Banca Passadore & C. SpA 3336 Credito Bergamasco Offerta XPay: Elenco Banche 1 di 4 3338 Banca Serfina 3353 Banca del Sud 3399 Extra Banca 3403 Imprebanca 3425 Banco di Credito P. Azzoaglio SpA 3426 Credito Peloritano 3440 Banco di Desio e della Brianza 3488 Cassa Lombarda 3493 Cassa Centrale Raiffeisen dell’Alto Adige SpA 3512 Credito Artigiano 3566 Citibank National Associaton 3589 Allianz Bank 3599 Cassa Centrale Banca - Cred. Coop. del Nord Est SpA 5000 Istituto Centrale Banche Popolare Italiane 5018 Banca Popolare Etica 5023 Banca Regionale Sviluppo 5030 Credito Salernitano 5034 Banco Popolare Soc. Coop. 5035 Veneto Banca Holding SpA 5036 Banca Agricola -

New Bank Financing for 33 Million Euros

SIFI: new bank financing for 33 million Euros Catania, 29 June 2016 - SIFI is pleased to announce the closing of a medium/long term financing agreement of up to 33 million euro, aimed at refinancing its outstanding debt and supporting its growth strategy. The consortium of lenders includes Banca Popolare di Milano, Intesa Sanpaolo, Banca del Mezzogiorno Mediocredito Centrale, Credito Valtellinese and Credito Siciliano. Banca Popolare di Milano and Banca IMI acted as arrangers and bookrunners ; BancaPopolare di Milano also acted as agent and depository bank . Essentia acted as financial advisor and Carbonetti e Associati as legal advisor to the company, while Simmons & Simmons acted as legal advisor to the banks. The main objective of the deal is to fund SIFI Group’s business plan, whose main targets are international expansion, also through acquisitions in selected European markets, and consolidation of its leadership position in Italy, through the implementation of a new marketing strategy and the launch of new products. "We are very pleased with the execution of this strategic deal - said Fabrizio Chines, SIFI Executive Chairman – which will allow us to further invest in overseas growth opportunities and new technologies. Thanks to new credit lines and the definitive overcoming of the previous bank debts rescheduling agreement , SIFI obtains the financial and business flexibility required to pursue its vision of becoming a leading player in the European EyeCare market. We also expect an immediate economic benefit from the capability -

Banca Carige Banca Carige Italia Banca Caripe Banca

BANCA CARIGE BANCA CARIGE ITALIA BANCA CARIPE BANCA CESARE PONTI BANCA DEL FUCINO BANCA DEL MONTE DI LUCCA BANCA DEL SUD BANCA DELL'ADRIATICO BANCA DI VITERBO CREDITO COOPERATIVO BANCA DI CREDITO COOP. DI CAMBIANO BANCA DI CREDITO COOP. CASTAGNETO CARDUCCI BANCA DI CREDITO POPOLARE BANCA DI IMOLA BANCA DI PIACENZA BANCA DI PISA E FORNACETTE CREDITO COOPERATIVO BANCA DI SASSARI BANCA EUROMOBILIARE BANCA FIDEURAM BANCA FININT BANCA GENERALI BANCA IFIGEST BANCA IFIS BANCA MEDIOLANUM BANCA PASSADORE BANCA POPOLARE DI LANCIANO E SULMONA BANCA POPOLARE DEL CASSINATE BANCA POPOLARE DEL FRUSINATE BANCA POPOLARE DEL LAZIO BANCA POPOLARE DELL'ALTO ADIGE - VOLKSBANK BANCA POPOLARE DELL'EMILIA ROMAGNA BANCA POPOLARE DI APRILIA BANCA POPOLARE DI BARI BANCA POPOLARE DI MANTOVA BANCA POPOLARE DI MILANO BANCA POPOLARE DI PUGLIA E BASILICATA BANCA POPOLARE DI SPOLETO BANCA POPOLARE PUGLIESE BANCA POPOLARE SANT'ANGELO BANCA POPOLARE VALCONCA BANCA PROSSIMA BANCA SISTEMA BANCA TERCAS BANCA VALSABBINA BANCO DI DESIO E DELLA BRIANZA BANCO DI LUCCA BANCO DI NAPOLI BANCO DI SARDEGNA BANCO POPOLARE CABEL CASSA DEI RISPARMI DI FORLI' E DELLA ROMAGNA CASSA CENTRALE BANCA - CREDITO COOP. DEL NORD EST CASSA CENTRALE RAIFFEISEN DELL'ALTO ADIGE CASSA DI RISPARMIO DELLA PROV. DELL'AQUILA CASSA DI RISPARMIO DEL FRIULI V. GIULIA CASSA DI RISPARMIO DEL VENETO CASSA DI RISPARMIO DI ASTI CASSA DI RISPARMIO DI BIELLA E VERCELLI CASSA DI RISPARMIO DI BOLOGNA CASSA DI RISPARMIO DI BOLZANO - SPARKASSE CASSA DI RISPARMIO DI CARRARA CASSA DI RISPARMIO DI CESENA CASSA DI RISPARMIO DI FIRENZE CASSA DI RISPARMIO DI ORVIETO CASSA DI RISPARMIO DI PISTOIA E LUCCHESIA CASSA DI RISPARMIO DI RAVENNA CASSA DI RISPARMIO DI S. -

A. List of Significant Supervised Entities

List of supervised entities Cut-off date for significance decisions: 01 January 2016 Number of significant supervised entities: 129 A. List of significant supervised entities Belgium Name Country of Grounds for establishment significance of the group entities Investeringsmaatschappij Argenta nv Size (total assets EUR 30 - 50 bn) Argenta Bank- en Verzekeringsgroep nv Belgium Argenta Spaarbank NV Belgium AXA Bank Europe SA Size (total assets EUR 30-50 bn) AXA Bank Europe SCF France Banque Degroof Petercam SA Significant cross-border assets Banque Degroof Petercam France S.A. France Banque Degroof Luxembourg S.A. Luxembourg Privat Bank Degroof, S.A.U. Spain Belfius Banque S.A. Size (total assets EUR 150-300 bn) Dexia NV Size (total assets EUR 150-300 bn) Dexia Crédit Local France Dexia Flobail France Dexia CLF Banque France Dexia CLF Régions Bail France Dexia Kommunalbank Deutschland AG Germany Dexia Crediop S.p.A. Italy Dexia Sabadell, S.A. Spain KBC Group N.V. Size (total assets EUR 150-300 bn) KBC Bank N.V. Belgium CBC Banque Belgium KBC Bank Ireland plc Ireland Československá obchodná banka, a.s. Slovakia ČSOB stavebná sporiteľňa, a.s. Slovakia The Bank of New York Mellon S.A. Size (total assets EUR 50-75 bn) Germany Name Country of Grounds for establishment significance of the group entities Aareal Bank AG Size (total assets EUR 50-75 bn) Westdeutsche ImmobilienBank AG Germany Bayerische Landesbank Size (total assets EUR 150-300 bn) Deutsche Kreditbank Aktiengesellschaft Germany COMMERZBANK Aktiengesellschaft Size (total assets EUR 500-1,000 bn) European Bank for Financial Services GmbH (ebase) Germany Hypothekenbank Frankfurt AG Germany comdirect bank AG Germany Commerzbank International S.A.