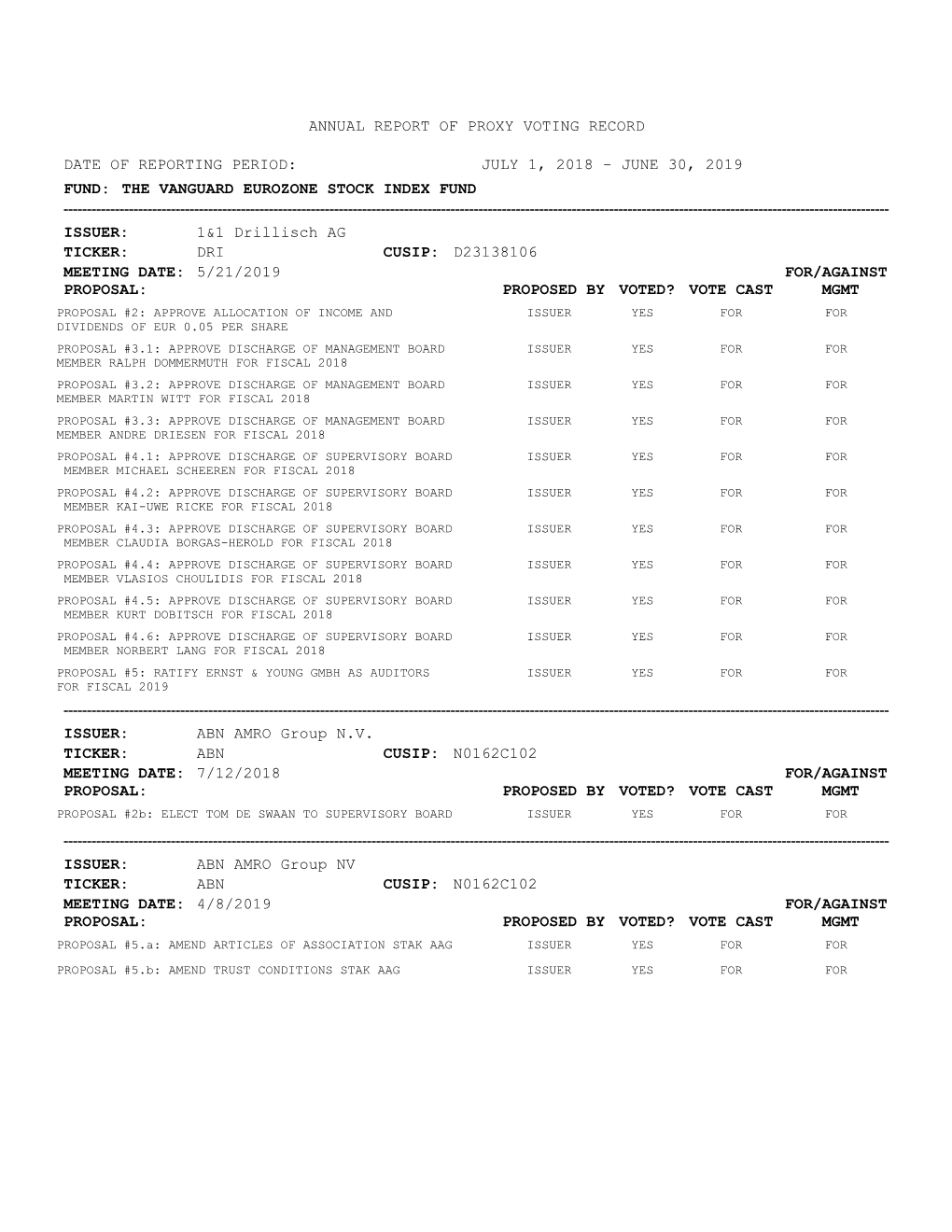

Annual Report of Proxy Voting Record Date Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2019

Annual Report 2019 Advance Reading Copy Subject to Modification and Amendments At a Glance 2019 Key Figures (IFRS) in € millions 2019 2018 2017 2016 2015 Business Development Group revenues 18,023 17,673 17,190 16,950 17,141 Operating EBITDA 2,909 2,586 2,636 2,568 2,485 EBITDA margin in percent1) 16.1 14.6 15.3 15.2 14.5 Bertelsmann Value Added (BVA)2) 89 121 163 180 180 Group profit 1,091 1,104 1,198 1,137 1,108 Investments3) 1,270 1,434 1,103 1,240 1,259 Consolidated Balance Sheet Equity 10,445 9,838 9,127 9,895 9,434 Equity ratio in percent 38.2 38.8 38.5 41.6 41.2 Total assets 27,317 25,343 23,713 23,794 22,908 Net financial debt 3,364 3,932 3,479 2,625 2,765 Economic debt4) 6,511 6,619 6,213 5,913 5,609 Leverage factor 2.6 2.7 2.5 2.5 2.4 Dividends to Bertelsmann shareholders 180 180 180 180 180 Distribution on profit participation certificates 44 44 44 44 44 Employee profit sharing 96 116 105 105 95 As of January 1, 2019, the new financial reporting standard IFRS 16 Leases was applied for the first time. In accordance with the transitional provisions of IFRS 16, prior-year comparatives have not been adjusted. Further details are presented in the section “Impact of New Financial Reporting Standards.” The figures shown in the table are, in some cases, so-called Alternative Performance Measures (APM), which are neither defined nor described in IFRS. -

Speakers and Moderators

Speakers and Moderators 6th EIOPA Annual Conference Tuesday, 18 October 2016 Frankfurt am Main Gabriel Bernardino Gabriel Bernardino is Chairman of the European Insurance and Occupational Pensions Authority (EIOPA). He is responsible for the strategic direction of EIOPA and represents the Authority at the Council of the European Union, the European Commission and the European Parliament. Mr. Bernardino prepares the work of EIOPA's Board of Supervisors and also chairs the meetings of the Board of Supervisors and the Management Board. Mr. Bernardino is the first Chairperson of EIOPA. He was elected by the Board of Supervisors of EIOPA on 10 January, 2011. His nomination followed a pre-selection of the European Commission and was confirmed by the European Parliament after a public hearing held on 1 February, 2011. Mr. Bernardino assumed his responsibilities on 1 March, 2011. Prior to his current role, Mr. Bernardino was the Director General of the Directorate for Development and Institutional Relations at the Instituto de Seguros de Portugal (ISP). He has served in several positions of increasing responsibility since he joined the ISP in 1989 and represented EIOPA's preceding organisation, CEIOPS, as Chairman between October 2009 and December 2010. Melinda Crane Dr. Melinda Crane has given speeches and moderated events and discussions for a wide range of international organizations and firms. She is a frequent guest and commentator on German television and radio and regularly analyzes US policy for the news broadcaster n-tv. An experienced TV anchor, she is chief political correspondent at DW TV and also hosts the DW talk show “Quadriga”. -

Prospectus 2020 (March 24, 2020)

Debt Issuance Programme Prospectus dated 24 March 2020 This document constitutes the base prospectus for the purposes of Article 8(1) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017, (the "Prospectus Regulation") and the Luxembourg act relating to prospectuses for securities of 16 July 2019 (Loi du 16 juillet 2019 relative aux prospectus pour valeurs mobilières et portant mise en œuvre du règlement (UE) 2017/1129) (the "Luxembourg Law") of Bertelsmann SE & Co. KGaA in respect of non-equity securities within the meaning of Article 2(c) of the Prospectus Regulation ("Non-Equity Securities"), (the "Debt Issuance Programme Prospectus" or the "Prospectus"). Bertelsmann SE & Co. KGaA (Gütersloh, Federal Republic of Germany) as Issuer EUR 5,000,000,000 Debt Issuance Programme (the "Programme") This Prospectus has been approved by the Luxembourg Commission de Surveillance du Secteur Financier (the "Commission") as competent authority under the Prospectus Regulation. The Commission only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of the issuer or of the quality of the Notes that are the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the Notes. Application has been made to list Notes issued under the Programme on the official list of the Luxembourg Stock Exchange and to trade Notes on the Regulated Market or on the professional segment of the Regulated Market "Bourse de Luxembourg". The Luxembourg Stock Exchange's Regulated Market is a regulated market for the purposes of the Market in Financial Instruments Directive 2014/65/EU, as amended (the "Regulated Market"). -

No Politics Without Culture !

2013 CULTURE & POWER NO POLITICS WITHOUT CULTURE ! 2013 CULTURE & Contents POWER PRODUCE The Think tank 04 BROADCAST The International Meetings 06 Publications 08 Team 10 With a turnover of $2 700 billion world- wide, 6.1% of global GDP, 8 million jobs and 4% of GDP in Europe for culture and creative industries: can governments and companies prepare forward-looking strategies without culture? As budget drops have led governments to cut funding for culture across Europe, China has increased its spending by more than 23%. Digital technology is increasing access to artistic productions in India and across Africa. The Middle Eastern nations are investing more and more in culture across the board. Are we witnes- sing a global power shift in Culture? aurÉLIE FILIPpetti (France) Marjane Satrapi (Iran) NEELIE KROES (Netherlands) French Minister of Culture and Communication Cartoonist and Film Director Vice President digital strategy, European Commission " CULTURAL COMMITMENT IS TO BE TOTALLY Renaud CAPUÇON (France) RETHOUGHT " Violonist Axel Dauchez, President of Deezer - ArteTV JT, 2012 ELIE BARNAVI (Romania) Historian and Scientific Director of the Museum of Europe VIVIANNE REDING (Luxembourg) Vice President, European Commission MORE THAN " IF WE SUccEED christine albanel (France) Former French Minister of Culture and Communi- IN CONVINCING PUBLIC cation - Executive Vice President, Communication, 1000 Philanthropy, Content Strategy, Orange AUTHORITIES, FIRMS PARTICIPANTS PER YEAR AND CITIZENS THAT THESE STAKES ARE AT THE VERY HEART OF OUR ECONOMY, -

Entscheidungen Im August 2020 Und Ergebnisse Der 252. Sitzung Der KEK Zulassungen • Supreme Master TV / Supreme Master Ching Hai Deutschland E

KEK-Pressemitteilung 04/2020 • Berlin, 8. September 2020 Entscheidungen im August 2020 und Ergebnisse der 252. Sitzung der KEK Zulassungen • Supreme Master TV / Supreme Master Ching Hai Deutschland e. V. • TVR (Arbeitstitel) / Deutsches Musik Fernsehen GmbH & Co. KG Beteiligungsveränderungen • TM-TV GmbH • ProSiebenSat.1 Media SE • RTL Group S.A. • German Car TV Programm GmbH und MV Sendebetriebs- gesellschaft UG (haftungsbeschränkt) • sporttotal.tv GmbH • WeltN24 GmbH und Bild GmbH Die Kommission zur Ermittlung der Konzentration im Medienbereich (KEK) hat entschieden, dass den folgenden Zulassungen und Beteiligungsveränderungen keine Gründe der Sicherung der Meinungsvielfalt entgegenstehen: Zulassung Supreme Master TV / Supreme Master Ching Hai Deutschland e. V. Der Supreme Master Ching Hai Deutschland e.V. hat bei der Medienanstalt Berlin-Brandenburg (mabb) eine Zulassung für das bundesweite Fernsehspartenprogramm Supreme Master TV beantragt. Das Programm Supreme Master TV ist geprägt vom Leben und Wirken der Ching Hai, einer vietnamesischen Schriftstellerin, Unternehmerin und Meditationslehrerin, die in ihrem Umfeld als spirituelle Meisterin gilt. Themenschwerpunkte sind unter anderem Veganismus, Frieden, Kultur, Spiritualität, Umwelt und Gesundheit. Supreme Master TV wird bereits international über verschiedene Ausspielwege verbreitet. In Deutschland ist der Empfang über die sendereigene Website www.suprememastertv.com und über YouTube, Apple TV, Amazon Fire TV sowie Android-Smart-TV-Systeme und TikTok möglich. 1/8 Zulassung TVR (Arbeitstitel) / Deutsches Musik Fernsehen GmbH & Co. KG Die Deutsches Musik Fernsehen GmbH & Co. KG plant ein Unterhaltungsspartenprogramm unter dem Arbeitstitel TVR. Das Programm soll frei empfangbar über Satellit (Astra) und Kabel (PŸUR/Tele Columbus) erfolgen. Ein entsprechender Zulassungsantrag wurde bei der Bremischen Landesmedienanstalt (brema) gestellt. Die Deutsches Musik Fernsehen GmbH & Co. -

AXA Impact Fund – Climate & Biodiversity

For professional clients only December 2019 Impact Investing Case Study Private Markets Defining strategic impact objectives: AXA Impact Fund – Climate & Biodiversity Impact investment at AXA Investment Managers follows deepest and most diversified investment opportunity sets to a simple guiding principle—what we do should deliver generate outcomes that are intentional, measurable, and positive. impact “Addressing eroding biodiversity is a complex but This principle lies at the heart of the AXA Impact Fund - increasingly pressing challenge. Nature produces Climate & Biodiversity, our third impact fund and one elements essential to human activity and to our very focused on the ecosystems that will support our world survival, from food and shelter to medicines’ active into the future. ingredients. Moreover, diverse ecosystems are key to tackling climate change, as flourishing forests and well- preserved oceans absorb carbon emissions. Conversely, We believe that finance has a role in fostering a society that climate change accelerates biodiversity loss, creating a supports fairness and equity, as well as an environment that vicious circle. Our dependence on diverse ecosystems to can sustain our population and our investments over the long thrive, if not survive, is therefore not to be doubted.” — term. This is core to our identity, and is embedded in what Thomas Buberl – AXA Group CEO we do and in how we serve our clients. outcomes. This is why we established the AXA Impact Investing (Private The Climate & Biodiversity fund, launched in July 2019, was Equity) strategy in 2012. Our objective was to use our developed in response to increasing concerns about how institutional investing expertise to demonstrate that investors climate change threatens biodiversity. -

Paris EUROPLACE Is the Paris Financial Services-Led Body, in Charge of Developing and Promoting Paris As an International Financial Center

Welcome to Paris Your Hub to Europe 2021 Paris EUROPLACE is the Paris financial services-led body, in charge of developing and promoting Paris as an international financial center. Paris EUROPLACE is chaired by Augustin de ROMANET, Chairman and CEO, Aéroports de Paris (ADP). Paris EUROPLACE brings together all financial services industry Missions stakeholders and is the voice for its 400+ members, corporate issuers, investors, banks and financial intermediaries, professional associations, attorneys and accountants, consulting firms, etc., as well as the financial market authorities. Think tanks and Working groups: to enhance the New growing financial sectors: to act as a prominent Paris financial services business regulatory and global financial center in: environment, by supporting reforms and initiatives to improve the attractiveness of the Paris financial center. • Innovation / Fintech: the FINANCE INNOVATION Cluster guides the development of Fintechs in the most European contribution: to participate in European innovative fields: new payment solutions, Blockchain, working groups and consultations on European financial AI, risk management, asset management, insurtech,… markets and establish permanent relations with the European Commission and Parliament. • Sustainable Finance: the Finance for Tomorrow ini- tiative contributes to mobilizing the Paris market players International cooperation: to develop dialogue, close towards a sustainable and low carbon economy, in line ties and cooperation with emerging financial centers with the Paris Agreement. through the signature of MOUs and the organization of International Financial Forums. Financial research: the Institut Louis Bachelier promotes, shares and disseminates research in economics and finance. 2030 Institut Louis Bachelier (ILB) Global Strategy: www.institutlouisbachelier.org FINANCIAL RESEARCH To improve the Paris financial 1. -

Informational Materials

This is the ‘decisive decade’ to fight climate change — and insurers need NSD/FARA Registration Unit 08/09/2021 3:54:36 PM B Sign in URL: https://money.yahoo.com/how-insmers-can-combat-climate-change-152416073.html Coronavirus Articles &'Tutorials News Career Planning yahoo/financeYahoo Finance This is the ‘decisive decade’ to fight climate change — and insurers need to play a key role Read full article Sting Thomas Buberl Retirement June 11, 2021 -5 min read https://money.yahoo.com/how-insurers-can-combat-climate-change-l524Registration Unit 08/09/2021 3:54:36 PM This is the ‘decisive decade’ to fight climate change — and insurers need NSD/FARA Registration Unit 08/09/2021 3:54:36 PM U.S. Special Presidential Envoy for Climate John Kerry greets Transportation Secretary Pete Buttigieg, not pictured, ahead of a virtual Climate Summit with world leaders in the EaSt Room at the White House in Washington, U.S., April 23, 2021. REUTERS/Tom Brenner More This is an opinion piece by Thomas Buberl, the CEO ofAXA, a Paris-based international insurance company with operations in 54 countries around the world. As a European CEO of a global company long committed to combating climate change, I have always been convinced the United States has a decisive part to play in meeting the ambitious objectives of the Paris climate agreement. The emissions pledges at the recent White House "Climate Summit of World Leaders" by President Biden and many other world leaders illustrate that these goals are now shared on both sides of the Atlantic, ahead of the key COP 26 climate negotiations in Glasgow, Scotland this November. -

Paris EUROPLACE Is the Paris Financial Services-Led Body, in Charge of Developing and Promoting Paris As an International Financial Center

Welcome to Paris Your Hub to the Eurozone 2019 Paris EUROPLACE is the Paris financial services-led body, in charge of developing and promoting Paris as an international financial center. Paris EUROPLACE is chaired by Augustin de ROMANET, Chairman and CEO, Aéroports de Paris (ADP). Paris EUROPLACE brings together all financial services industry Missions stakeholders and is the voice for its 400+ members, corporate issuers, investors, banks and financial intermediaries, professional associations, attorneys and accountants, consulting firms, etc., as well as the financial market authorities. Think tanks and Working groups: to enhance the New growing financial sectors: to act as a prominent Paris financial services business regulatory and global financial center in: environment, by supporting reforms and initiatives to improve the attractiveness of the Paris financial center. • Innovation / Fintech: the FINANCE INNOVATION Cluster guides the development of Fintechs in the most European contribution: to participate in European innovative fields: new payment solutions, Blockchain, working groups and consultations on European financial AI, risk management, asset management, insurtech,… markets and establish permanent relations with the European Commission and Parliament. • Sustainable Finance: the Finance for Tomorrow ini- tiative contributes to mobilizing the Paris market players International cooperation: to develop dialogue, close towards a sustainable and low carbon economy, in line ties and cooperation with emerging financial centers with the Paris Agreement. through the signature of MOUs and the organization of International Financial Forums. Financial research: the Institut Louis Bachelier promotes, shares and disseminates research in economics and finance. 2030 Institut Louis Bachelier (ILB) Global Strategy: www.institutlouisbachelier.org FINANCIAL RESEARCH To improve the Paris financial 1. -

Notice of Meeting COMBINED SHAREHOLDERS' MEETING 2021 Friday May 28, 2021 at 10:00 Am As a Closed Session at the Company's Registered Office

Notice of meeting COMBINED SHAREHOLDERS' MEETING 2021 Friday May 28, 2021 at 10:00 am As a closed session at the Company's registered office Documents covered by Article R. 225-81 of the French Commercial Code SUMMARY 3 MESSAGE from the Chairman and CEO 4 AGENDA of the Combined Shareholders' Meeting 5 How to VOTE 9 2020 RESULTS Key figures and outlook 14 COMPOSITION of the Board of Directors of TOTAL SE 16 Board of Directors’ report on the proposed RESOLUTIONS 29 Proposed RESOLUTIONS 02 I TOTAL Combined Shareholders’ Meeting 2021 MESSAGE from the Chairman and CEO Dear Madam/Sir, Dear Shareholders, For the second year running, your Annual Shareholders’ Meeting will be held in a closed session at the Company headquarters on Friday, May 28, 2021 at 10 am. We have no other choice, given that the emergency health situation owing to the Covid-19 pandemic has been extended until June 01, and that the ultimate priorities are to ensure that you are not exposed to any health risks, and to guarantee everyone equal access to the Shareholders’ Meeting. In 2020, your commitment to supporting the resolutions approved by your Board of Directors and your high level of participation (over 500 questions asked ahead of the Shareholders’ Meeting and live), proved that shareholder democracy thrives in your Company. Once again this year, we are doing our utmost to make remote attendance easy for you: Ý Ahead of the Shareholders’ Meeting, we invite you to vote either via Internet using the simple and secure system, or via postal mail. -

California Earthquake Insurance Unpopularity: the Issue Is the Price, Not the Risk Perception Adrien Pothon, Philippe Gueguen, Sylvain Buisine, Pierre-Yves Bard

California earthquake insurance unpopularity: the issue is the price, not the risk perception Adrien Pothon, Philippe Gueguen, Sylvain Buisine, Pierre-Yves Bard To cite this version: Adrien Pothon, Philippe Gueguen, Sylvain Buisine, Pierre-Yves Bard. California earthquake insurance unpopularity: the issue is the price, not the risk perception. Natural Hazards and Earth System Sci- ences, Copernicus Publ. / European Geosciences Union, 2019, 19 (8), pp.1909-1924. 10.5194/nhess- 19-1909-2019. hal-03035556 HAL Id: hal-03035556 https://hal.archives-ouvertes.fr/hal-03035556 Submitted on 15 Jan 2021 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Nat. Hazards Earth Syst. Sci., 19, 1909–1924, 2019 https://doi.org/10.5194/nhess-19-1909-2019 © Author(s) 2019. This work is distributed under the Creative Commons Attribution 4.0 License. California earthquake insurance unpopularity: the issue is the price, not the risk perception Adrien Pothon1,2, Philippe Gueguen1, Sylvain Buisine2, and Pierre-Yves Bard1 1ISTerre, Université de Grenoble-Alpes/Université de Savoie Mont Blanc/CNRS/IRD/IFSTTAR, Grenoble, France 2AXA Group Risk Management, Paris, France Correspondence: Adrien Pothon ([email protected]) Received: 1 February 2019 – Discussion started: 8 February 2019 Revised: 1 August 2019 – Accepted: 2 August 2019 – Published: 29 August 2019 Abstract. -

NOTICE of MEETING Combined Shareholders’ Meeting Ordinary and Extraordinary

2016NOTICE OF MEETING Combined Shareholders’ Meeting Ordinary and Extraordinary Paris, 18 March 2016 Dear fellow Shareholder, The Combined Shareholders’ Meeting (Ordinary and Extraordinary) of Peugeot S.A. shareholders will be held on Wednesday, 27 April 2016 at 10:00 a.m. at the Company’s headquarters. The Meeting will be chaired by Louis Gallois, Chairman of the Supervisory Board. For you as a shareholder, the Meeting offers an opportunity WEDNESDAY, 27 APRIL 2016 to learn about PSA’s business during the year and most importantly, to express your opinion before the vote on at 10:00 a.m. the proposed resolutions. The Shareholders’ Meeting is a special occasion to find out more about your Company at Company’s headquarters and to exchange views with management. We value the participation of all our shareholders. You 75 avenue de la Grande-Armée will find below all of the information you need to take part in the voting. I would like to thank you in advance 75116 Paris – France for paying careful attention to the resolutions submitted for your approval. Sincerely yours, Carlos Tavares Chairman of the Managing Board CONTENTS REPORT OF THE SUPERVISORY BOARD 3 PARTICIPATING IN THE SHAREHOLDERS’ MEETING 4 AGENDA 9 REPORT OF THE MANAGING BOARD ON THE RESOLUTIONS PRESENTED AT THE COMBINED SHAREHOLDERS’ MEETING 11 TEXT OF THE PROPOSED RESOLUTIONS 25 CORPORATE GOVERNANCE 32 NOMINATIONS SUBMITTED 33 2015 BUSINESS REVIEW 46 AUDITORS’ REPORT 51 REQUEST FOR DOCUMENTS AND INFORMATION 63 For more information concerning Peugeot S.A. or how to participate in the Shareholders’ Meeting, please contact INVESTOR RELATIONS: PHONE +33 (0) 1 40 66 37 60 MAIL PEUGEOT S.A.