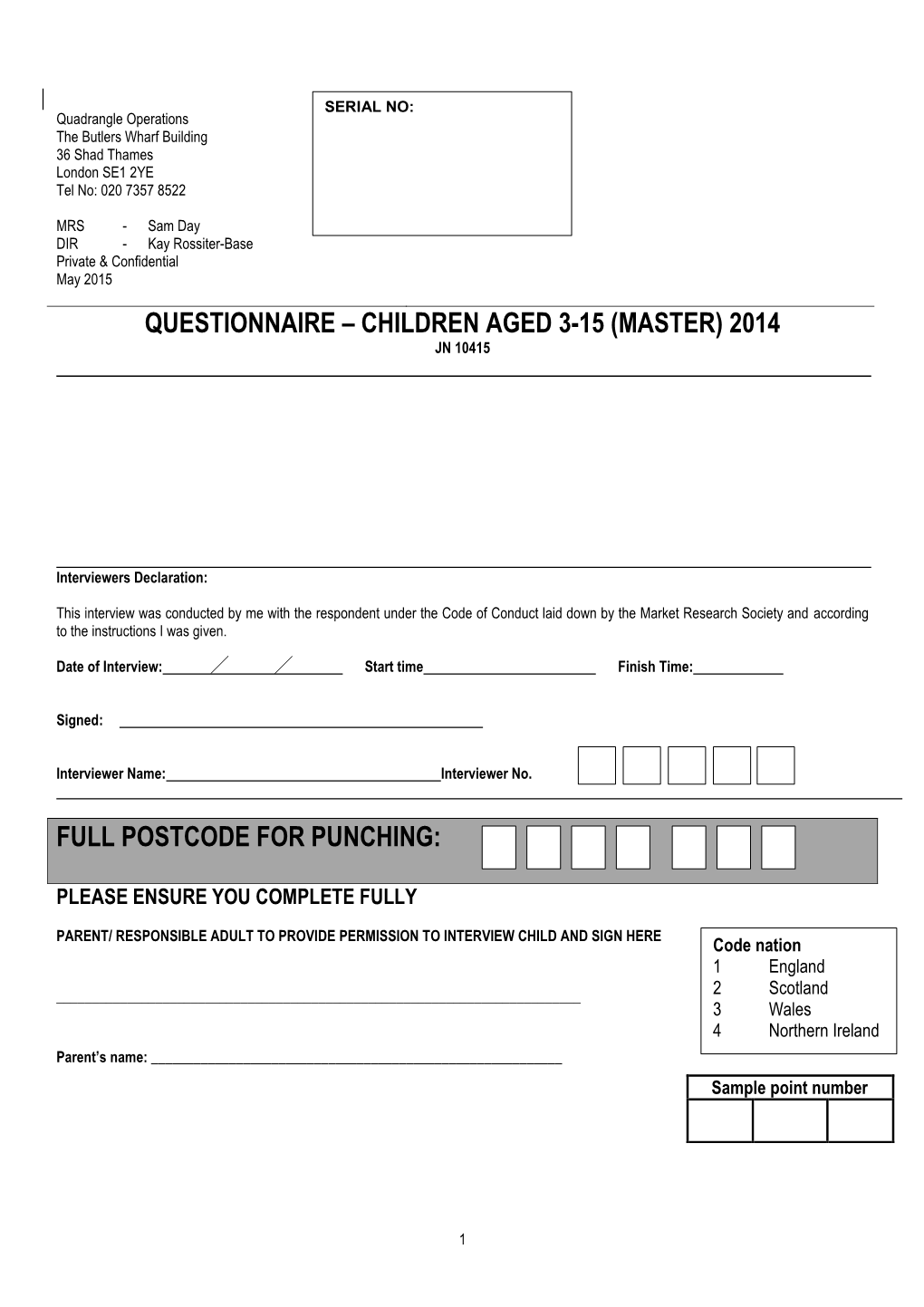

Questionnaire – Children Aged 3-15 (Master) 2014 Jn 10415

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nabet-Abc Master Agreement

NABET-CWA/ABC Inc. 2017-2021 Master Agreement MASTER AGREEMENT TABLE OF CONTENTS General Articles Article I. Recognition and Warranty ............................................................... 2 II. No Discrimination ........................................................................... 2 III. Employment ..................................................................................... 3 IV. Check-Off ........................................................................................ 7 V. No Strikes or Lockouts .................................................................... 9 VI. Transfer of Work ............................................................................. 9 VII. Program Origination ...................................................................... 10 VIII. Work Schedule, Overtime and Penalties ....................................... 15 IX. Meal Periods .................................................................................. 22 X. Night Shift Differential .................................................................. 22 XI. Seniority, Layoffs and Rehires ...................................................... 23 XII. Transfers, Training and Temporary Upgrading ............................. 31 XIII. Leave of Absence .......................................................................... 33 XIV. Discharges ...................................................................................... 35 XV. Severance Pay ............................................................................... -

Analysis of Changes in Basic Cable TV Programming Costs

Analysis of Changes in Basic Cable TV Programming Costs Prepared by: Robert Gessner President Massillon Cable TV, Inc. Massillon, OH Phone: 330-833-5509 Email: [email protected] November 5, 2013 1 Analysis of Changes in Basic Cable TV Programming Costs It is important to note that all of this information is specific to MCTV. Our costs are unique to the extent that we offer our customers a set of networks and channels that differs from others. We also may have different costs for program content due to different outcomes of negotiations. However, I am confident you will find that the facts presented are an accurate representation of the current costs of Basic Cable TV programming, the increase in costs expected in 2014 and the rest of this decade for any independent cable TV company in the US. I believe any other cable TV company will report similar increases in cost, contract terms and conditions, and expectations for the future. 2 Analysis of Changes in Basic Cable TV Programming Costs Contents Executive Summary ........................................................................................................ 4 Expect Large Increases ............................................................................................... 4 There Are No “Local” TV Stations in NE Ohio ............................................................. 4 Seven Major Media Companies Control US TV ........................................................... 4 Contracts Are Becoming More Restrictive .................................................................. -

ANNEX 2 – List of Service Providers Required to Respond Together with Service Name(S)

ANNEX 2 – List of service providers required to respond together with service name(s). Those who did not respond are indicated in red. 1. 2WEBMEDIA LIMITED (wankitnow.com) 2. 965 TV Ltd (Studio66 TV) 3. AETN UK (A&E Networks – History / Bio / C1) 4. Amazon Instant Video Limited (Amazon Instant Video) 5. AMC Networks International Broadcasting Ltd (AMC/ MGM / Extreme Sport Channels) 6. AMC Networks Programme Services Ltd (AMC Channel) 7. Arsenal Broadband Limited (Arsenal Player) 8. Bay TV Liverpool Ltd (Bay TV Liverpool) 9. BBC Worldwide Ltd (BBC Worldwide / BBC Store) 10. British Film Institute (BFI Player) 11. British Sign Language Broadcasting Trust (BSL Zone Player) 12. British Telecommunications PLC t/a BT Vision (BT TV / BT Vision / BT Sport) 13. Broadcasting (Gaia) Ltd (Amateur Girlfriends/100% Babes/Barley Legal TV/Hustler XXX Movies) 14. CBS AMC Networks EMEA Channels Partnership (CBS Reality, Drama, Action, Europa) 15. CBS AMC Networks UK Channels Partnership (CBS Reality, Drama, Action, Horror Channel) 16. Channel 4 Television Corporation and 4Ventures Ltd (All 4 / 4oD) 17. Columbia Pictures Corporation Ltd (Sony Pictures Television) 18. Channel 5 Broadcasting Ltd (Demand 5) 19. Chelsea Football Club Ltd (Chelsea TV Online) 20. Chrominance Television (Chrominance TV inc Cinematio) 21. Cirkus Limited (Cirkus Sweden) 22. Classical TV Ltd (Classical TV) 23. Community Channel (Community Channel) 24. Curzon Cinemas Limited (Curzon Home Cinema) 25. Digital Theatre.com Ltd (www.digitaltheatre.com) 26. Discovery Communications Europe Ltd (Discovery Networks Northern Europe Play inc. Animal Planet, TLC) 27. Discovery Networks Northern Europe Limited (Discovery Networks VOD) 28. E! Entertainment UK Limited (E! Entertainment) 29. -

UK CMR Context

The Communications Market 2015 1 1 The market in context 19 Contents 1.1 Introduction and structure 21 1.2 Fast facts 23 1.3 Key market trends 25 1.4 Changes in TV viewing habits 37 1.5 Developments in viewing beyond traditional television 49 1.6 A smartphone society 63 1.7 Communication with friends and family 85 1.8 Social media developments 95 1.9 Digital music and photograph collections 109 1.10 Media literacy: the past decade 119 1.11 Developments in the nations 131 20 1.1 Introduction and structure 1.1.1 Introduction This introductory section of the Communications Market Report 2015 is divided into six sections: • Key market trends (Section 1.3, page 25) This section summarises developments in the UK’s communications sectors during 2014 and 2015. It focuses on service availability, take-up, and industry revenues, as well as covering consumers’ use of devices and household spending on communications services. • Changes in TV viewing habits (Section 1.4 , page 37) This section of the report analyses the decline in broadcast TV viewing on the TV set, as measured by BARB. We begin with an examination of the decline and then move on to consider some of the potential explanatory factors for the decline. • Developments in viewing beyond traditional television (Section 1.5, page 49) In this section, we explore changes in audio-visual content and delivery in recent years, to provide context to the changing viewing habits described in the previous section. • A smartphone society (Section 1.6, page 63) This section explores the popularity and take-up of smartphones and their ever- increasing role in connecting consumers. -

UK CMR Context Charts

CMR 2015: Market in context Key Market Trends Figure 1.2 Communications industry revenue – telecoms, TV, radio, post £billion Annual 5 year 80 change CAGR Total -0.5% -0.5% 60 57.6 57.4 57.5 57.3 56.4 56.1 4.1 4.1 4.1 4.2 1.1 1.1 1.2 1.2 1.24.2 1.24.3 Post 0.4% 0.7% 11.1 11.8 12.4 12.5 12.8 13.2 40 Radio 3.6% 2.1% TV 3.1% 3.6% 20 41.3 40.4 39.9 39.4 38.1 37.4 Telecoms -2.0% -2.0% 0 2009 2010 2011 2012 2013 2014 Source: Ofcom/ operators Note: Includes licence fee allocation for radio and TV, figures are in nominal terms. Post is addressed letter mail. 2 Figure 1.3 Average household spend on communications services £ per month (2014 prices) 6% Post 5.3% 5.1% 5.2% 5.1% 4.8% 150 4.7% 5% Radio 122.07 121.68 120.80 119.68 117.52 117.71 4% Television 100 29.58 30.41 31.02 30.60 30.77 31.10 3% Fixed internet 10.84 11.18 11.63 12.26 12.90 14.74 2% Mobile voice & 50 50.71 50.01 data 49.29 48.77 45.98 44.37 Fixed voice 1% 25.65 25.31 23.71 22.98 22.52 22.18 % of total spend 0 0% 2009 2010 2011 2012 2013 2014 Source: Ofcom / operators/ ONS Notes: Adjusted for CPI; historic telecoms figures have been re-stated, so are not comparable to those published in previous reports. -

CMR 2015: Full Chart Pack

CMR 2015: Full chart pack 6th August 2015 CMR 2015: Market in context Key Market Trends Figure 1.2 Communications industry revenue – telecoms, TV, radio, post £billion Annual 5 year 80 change CAGR Total -0.5% -0.5% 60 57.6 57.4 57.5 57.3 56.4 56.1 4.1 4.1 4.1 4.2 1.1 1.1 1.2 1.2 4.21.2 1.24.3 Post 0.4% 0.7% 11.1 11.8 12.4 12.5 12.8 13.2 40 Radio 3.6% 2.1% TV 3.1% 3.6% 20 41.3 40.4 39.9 39.4 38.1 37.4 Telecoms -2.0% -2.0% 0 2009 2010 2011 2012 2013 2014 Source: Ofcom/ operators Note: Includes licence fee allocation for radio and TV, figures are in nominal terms. Post is addressed letter mail. 3 Figure 1.3 Average household spend on communications services £ per month (2014 prices) 6% Post 5.3% 5.1% 5.2% 5.1% 4.8% 150 4.7% 5% Radio 122.07 121.68 120.80 119.68 117.52 117.71 4% Television 100 29.58 30.41 31.02 30.60 30.77 31.10 3% Fixed internet 10.84 11.18 11.63 12.26 12.90 14.74 2% Mobile voice & 50 50.71 50.01 data 49.29 48.77 45.98 44.37 Fixed voice 1% 25.65 25.31 23.71 22.98 22.52 22.18 % of total spend 0 0% 2009 2010 2011 2012 2013 2014 Source: Ofcom / operators/ ONS Notes: Adjusted for CPI; historic telecoms figures have been re-stated, so are not comparable to those published in previous reports. -

NSI Annual REPORT 2010/11 Nsi Board of Directors “NSI Is Committed to Training Storytellers Because...”

ePISODic series feature film social meDia narrative marketing shorts gaming story transmeDia journalism no matter how you look at it, we train storytellers national screen institute 2010-11 annual report No matter how you look at it, NSI traINS StorytellerS for a dIgItal ecoNomy. We are the national SCREEN institute. our students come to us with stories and ideas and we give them the tools to finesse and mold those projects for the TV screen, silver screen, mobile screen and more. We are market-driven. We evolve our programs to deliver what the industry demands. We provide relevant programs. We are designing new programs for the digital age. We are working with the industry to develop partnerships for innovative programs. throughout these pages you’ll meet our board, staff, alumni, participants and faculty. they all believe in the power of storytelling across different platforms. You’ll read about what inspires them, what seemingly insignificant events led to a script idea and the value in letting a story speak through a quiet moment. It all comes down to a good story. And NSI helps to bring it to the right screen. NSi – traiNiNg nsi Mission taBle oF contents NSI delivers professional, market-driven, StorytellerS SiNce 1986 innovative and cutting-edge programming NSi – traiNiNg StorytellerS SiNce 1986 ................................ 1 that meets the needs, direction and future the national screen institute (NSI) is canada’s national training school trends of the canadian and global media message from the co-chairS; NSi Board .............................. 2 for screen professionals. We are headquartered in Winnipeg, Manitoba. marketplace leading participants message from the NSi hoNorary chair ............................... -

Channel 4'S 25 Year Anniversary

Channel 4’s 25 year Anniversary CHANNEL 4 AUTUMN HIGHLIGHTS Programmes surrounding Channel 4’s anniversary on 2nd November 2007 include: BRITZ (October) A two-part thriller written and directed by Peter Kosminsky, this powerful and provocative drama is set in post 7/7 Britain, and features two young and British-born Muslim siblings, played by Riz Ahmed (The Road to Guantanamo) and Manjinder Virk (Bradford Riots), who find the new terror laws have set their altered lives on a collision course. LOST FOR WORDS (October) Channel 4 presents a season of films addressing the unacceptable illiteracy rates among children in the UK. At the heart of the season is a series following one dynamic headmistress on a mission to wipe out illiteracy in her primary school. A special edition of Dispatches (Why Our Children Can’t Read) will focus on the effectiveness of the various methods currently employed to teach children to read, as well as exploring the wider societal impact of poor literacy rates. Daytime hosts Richard and Judy will aim to get children reading with an hour-long peak time special, Richard & Judy’s Best Kids’ Books Ever. BRITAIN’S DEADLIEST ADDICTIONS (October) Britain’s Deadliest Addictions follows three addicts round the clock as they try to kick their habits at a leading detox clinic. Presented by Krishnan Guru-Murphy and addiction psychologist, Dr John Marsden, the series will highlight the realities of addiction to a variety of drugs, as well as alcohol, with treatment under the supervision of addiction experts. COMEDY SHOWCASE (October) Channel 4 is celebrating 25 years of original British comedy with six brand new 30-minute specials starring some of the UK’s best established and up and coming comedic talent. -

Analysis of the Florida Film and Entertainment Industry

Analysis of the Florida Film and Entertainment Industry Prepared for: The Governor’s Office of Film & Entertainment Lucia Fishburne, State Film Commissioner Principal Investigator: Dr. Rick Harper, Director Haas Center for Business Research and Economic Development University of West Florida Pensacola, Florida 850‐474‐2657 Prepared by: Phyllis K. Pooley, MBA, JD, Associate Director Haas Center for Business Research and Economic Development University of West Florida Pensacola, Florida Date Submitted: February, 2009 Acknowledgements We thank the Governor’s Office of Film & Entertainment for administrative and funding support for this project. We would particularly like to thank Lucia Fishburne, Susan Simms and Niki Welge for their efforts in reviewing this material and providing valuable information and feedback. We would also like to thank the local film liaisons for providing data for this project, as well as the many individuals who took time out from very busy schedules to answer our survey questions and provide tremendous insights into the operation of the indigenous Film and Entertainment Industry. Data Limitations Much of the data reported in this study were acquired from secondary data sources and were not collected by the Haas Center. While the Haas Center believes that these sources are generally accurate, we have no way of independently ascertaining the reliability of the data collected or the collection methods used. Readers of this report should bear this in mind when using this material. State incentive information is current as of December, 2008. Interview and survey information were collected using contact information developed from the 2007‐08 Film Florida Production Guide. Given the random nature and length of time allotted for the survey interview process, those with the most knowledge of the Florida industry may not have been contacted or available for inclusion. -

Information to Users

INFORMATION TO USERS This manuscript has been reproduced from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be from any type of computer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely affect reproduction. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand corner and continuing from left to right in equal sections with small overlaps. Each original is also photographed in one exposure and is included in reduced form at the back of the book. Photographs included in the original manuscript have been reproduced xerographically in this copy. Higher quality 6" x 9" black and white photographic prints are available for any photographs or illustrations appearing in this copy for an additional charge. Contact UMI directly to order. University Microfilms International A Bell & Howell Information C om pany 300 North Zeeb Road. Ann Arbor. Ml 48106-1346 USA 313/761-4700 800/521-0600 Order Number 9307740 The performance of folly in plays by O’Neill, Williams, and S hepard Conklin, Robert Brian, Ph.D. The Ohio State University, 1992 UMI 300 N. -

February 2015 T Is for THOUSANDS! Lucky Andrea Goodheart Took Delivery of a £5,000 Cash Prize Just Before Christmas… All Thanks to Compers News and Compers Update

FAIR PLAY FOR COMPERS Comping Crusader MEMBER-ONLY PRIZES! MEMBER OFFER The Comping Crusader True Comper Awards Compers Update Est. If you’ve got a comping problem, Hurry, our first prize category 28-day Trial Offer! our Crusader is here to help – is closing very soon – Available today – see page 7 see pages 2 & 3 see pages 8 & 9 CN Join us at CompersNews.com Britain’s Biggest Competitions Magazine February 2015 T is for THOUSANDS! Lucky Andrea Goodheart took delivery of a £5,000 cash prize just before Christmas… all thanks to Compers News and Compers Update. One piece of advice we always give here at Compers much longer than expected to sort everything out. News is: always try to get your entries in early. So Fingers crossed we’ll be able to announce the winners you can’t blame your editor for muttering under his in next month’s issue though, so watch this space! breath over the Christmas and New Year break as his Thanks to everyone for all your entries. The enormous Inbox strained under literally HUNDREDS of last- popularity of the competition took us all completely minute entries for our A-Z of Prizes competition. by surprise and it’s been fantastic seeing and reading We had hoped to bring you the results of our A-Z about your thousands and thousands of A-Z wins. quest in this month’s issue, but we received so many One last-minute entry that caught our eye came entries – THOUSANDS in all – that it’s taking us from Andrea Goodheart… her prize of thousands of pounds matched the thousands of entries we received, so it seems a fitting photo for this month’s PICK OF THE MONTH front cover. -

ANNEX 3 – Subtitle Provision by Service* and by Platform As a Percentage of Total Programming Hours 1

ANNEX 3 – Subtitle provision by service* and by platform as a percentage of total programming hours 1 Total programming hours available on given platform: Less than 1000 hours 1000-5000 hours More than 5000 hours Service not available on this platform Figures show the percentage of programming hours carrying subtitles – where no figure is given, no subtitles were available via this platform WEBSITE YOUTUBE YOUVIEW VIRGIN SKY SKY SKY GAMES MOBILE CONNECTED OTHER TIVO GO (PUSH) (PULL) CONSOLE APP TV APP A&E Networks – History / Bio / C1 Amazon Instant Video 56% 56% 56% 56% AMC / MGM / Extreme % unspecified Sports Channels AMC Channel Arsenal Player Bay TV Liverpool BBC Worldwide / BBC Store BFI Player 29% 29% 29% BSL Zone Player 100% 100% BT TV / BT Vision / BT Sport CBS Reality, Drama, % unspecified Action & Europa CBS Reality, Drama, Action, Horror Channel Channel 4 - All 4 / 4oD 77% *Please note that the list of services here does not include adult VOD services ANNEX 3 – Subtitle provision by service* and by platform as a percentage of total programming hours 2 Total programming hours available on given platform: Less than 1000 hours 1000-5000 hours More than 5000 hours Service not available on this platform Figures show the percentage of programming hours carrying subtitles – where no figure is given, no subtitles were available via this platform WEBSITE YOUTUBE YOUVIEW VIRGIN SKY SKY SKY GAMES MOBILE CONNECTED OTHER TIVO GO (PUSH) (PULL) CONSOLE APP TV APP Channel 5 – Demand 5 73% 73% PS3 71% Windows Panasonic Roku / EETV / PS4 73% / iOS / 70% Freesat 73% Xbox 73% Android Fire TV 74% 73% Channel 7 Chelsea TV Online Chiswickbuzz.net Chrominance TV (inc.