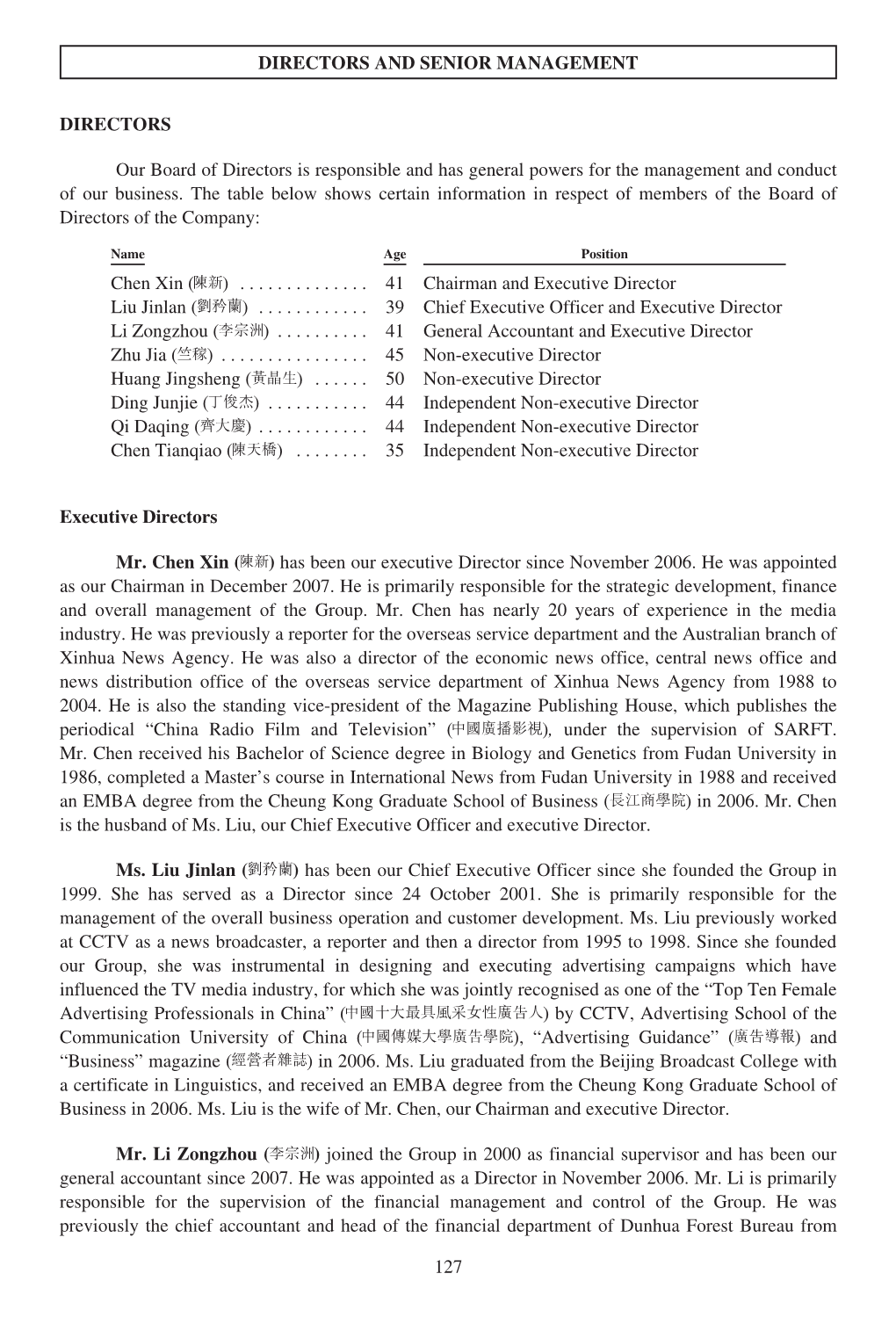

Directors and Senior Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WIC Template 13/9/16 11:52 Am Page IFC1

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

Coming Back Home After the Sun Rises: Returnee Entrepreneurs and Growth of High Tech Industries

G Model RESPOL-2772; No. of Pages 17 ARTICLE IN PRESS Research Policy xxx (2012) xxx–xxx Contents lists available at SciVerse ScienceDirect Research Policy jou rnal homepage: www.elsevier.com/locate/respol Coming back home after the sun rises: Returnee entrepreneurs and growth of high tech industries a,b c,∗ d Martin Kenney , Dan Breznitz , Michael Murphree a Department of Human and Community Development, University of California, Davis, United States b Berkeley Roundtable on the International Economy, United States c The Scheller College of Business, Georgia Institute of Technology, United States d Sam Nunn School of International Affairs, Georgia Institute of Technology, United States a r t i c l e i n f o a b s t r a c t Article history: Recently, the role of returnees in the economic development of various East Asian nations has received Received 6 November 2011 much attention. The early literature on the relocation of the most highly trained individuals from a devel- Received in revised form 30 July 2012 oping nation to a developed nation viewed the phenomena as a “brain drain.” Since the 1990s, a new Accepted 4 August 2012 strand of thinking has suggested that for developing nations this was actually a positive phenomenon; as Available online xxx these expatriates studied and then worked abroad, they absorbed technical expertise, managerial, and entrepreneurial skills. These theories stipulated that these expatriates then returned home, and ignited Keywords: a virtuous circle of technological entrepreneurship leading to rapid economic development. Much of this High skilled immigrants Innovation literature gives returnees a critical role in the home country’s take-off period of the local information and communications technology (ICT) industry. -

Socioterritorial Fractures in China: the Unachievable “Harmonious Society”?

China Perspectives 2007/3 | 2007 Creating a Harmonious Society Socioterritorial Fractures in China: The Unachievable “Harmonious Society”? Guillaume Giroir Édition électronique URL : http://journals.openedition.org/chinaperspectives/2073 DOI : 10.4000/chinaperspectives.2073 ISSN : 1996-4617 Éditeur Centre d'étude français sur la Chine contemporaine Édition imprimée Date de publication : 15 septembre 2007 ISSN : 2070-3449 Référence électronique Guillaume Giroir, « Socioterritorial Fractures in China: The Unachievable “Harmonious Society”? », China Perspectives [En ligne], 2007/3 | 2007, mis en ligne le 01 septembre 2010, consulté le 28 octobre 2019. URL : http://journals.openedition.org/chinaperspectives/2073 ; DOI : 10.4000/ chinaperspectives.2073 © All rights reserved Special feature s e Socioterritorial Fractures v i a t c n i in China: The Unachievable e h p s c “Harmonious Society”? r e p GUILLAUME GIROIR This article offers an inventory of the social and territorial fractures in Hu Jintao’s China. It shows the unarguable but ambiguous emergence of a middle class, the successes and failures in the battle against poverty and the spectacular enrichment of a wealthy few. It asks whether the Confucian ideal of a “harmonious society,” which the authorities have been promoting since the early 2000s, is compatible with a market economy. With an eye to the future, it outlines two possible scenarios on how socioterritorial fractures in China may evolve. he need for a “more harmonious society” was raised 1978, Chinese society has effectively ceased to be founded for the first time in 2002 at the Sixteenth Congress on egalitarianism; spatial disparities are to be seen on the T of the Communist Party of China (CPC). -

Generational Change in Chinese ICT Entrepreneurs and Their

IFEAMA SPSCP Vol.2 pp.17-24 IFEAMA All right reserved Generational Change in Chinese ICT Entrepreneurs and their Business Models: A Review of A. Saxenian’s Brain Circulation Model Ritsumeikan University, Kyoto, Japan Ryoji NAKAGAWA rnt20014@ir.ritsumei.ac.jp 1. Rapid Growth of Chinese ICT Industry When the Chinese government began its Reform and Opening Policy in 1978, Chinese GDP per capita was less than $400. In 1980, the number of telephone subscribers per 100 inhabitants in China was only 0.63, and in 1983 the development of machinery compatible with the IBM PC had only just started. Under a market-oriented and outward-looking policy, however, China achieved amazingly rapid and continuous economic development, so that its GDP per capita reached $3,678 in 2009. China has already become one of the biggest ICT manufacturing countries in the world. In 2008, of the world’s PCs, around 40%, or 136 million units, were made in China. As the PC factory of the world, China exported 80% of these, but 20% were sold to the Chinese market, which has also become one of the biggest markets in the world, around three times the size of the Japanese PC market. Lenovo, the top Chinese PC manufacturer, merged with IBM’s PC Division in 2005 and became the world’s third largest PC manufacturer (dropping to fourth, however, after the takeover of Gateway by Acer). As of June 2010, China has 805.3 million mobile phone subscribers, or around 16% of the world’s total and around eight times as many as Japan. -

Charles Zhang

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

Annual Report 2009 5

股份編號 SinoMedia Holding Limited (the “Company” or “SinoMedia”) and its subsidiaries (the “Group”) is a leading media advertising operator in China. We enter into underwriting agreements with TV stations and provide nationwide TV advertising coverage for our clients, including advertisers and advertising agencies. SinoMedia is one of the largest underwriters of TV advertisement time for China Central Television Station (“CCTV”). We have long-standing business cooperation with CCTV dating back to our inception in 1999. 作為中國領先的傳媒廣告營運商,中視金橋國際傳媒控股有限公司(「本公司」或「中視金 橋」)及其子公司(「本集團」)與多家電視台簽訂代理合約,向包括廣告主及廣告代理商在 內的客戶提供全國性電視廣告宣傳服務。 中視金橋是中國中央電視台(「央視」)最大的廣告時間買斷代理商之一,自一九九九年成 立以來,與央視已建立了緊密的合作關係。 Financial Summary 2 Contents Corporate Information 3 2009 Year in Review 4 Awards and Recognition 7 Chairman’s Statement 10 Management Discussion and Analysis 14 Directors and Senior Management 24 Corporate Governance Report 32 Directors’ Report 37 Independent Auditor’s Report 45 Consolidated Income Statement 47 Consolidated Statement of Comprehensive Income 48 Consolidated Balance Sheet 49 Balance Sheet 51 Consolidated Statement of Changes in Equity 52 Consolidated Cash Flow Statement 53 Notes to the Financial Statements 55 Five Year Summary 112 Financial Summary RMB’000 For the For the year ended year ended 31 December 31 December 2009 2008 Change (%) Revenue 766,804 558,356 +37.3% Profi t from operations 120,907 159,712 –24.3% Profi t attributable to owners of the Company 97,245 120,800 –19.5% Earnings per share (RMB) — Basic 0.172 0.243 –29.2% — Diluted 0.172 0.243 -

Pivot to Internet Plus: Molding China's Digital Economy for Economic

International Journal of Communication 11(2017), 1486–1506 1932–8036/20170005 Pivot to Internet Plus: Molding China’s Digital Economy for Economic Restructuring? YU HONG1 University of Southern California, USA Under the Internet Plus policy, China’s Internet and digital economy become unprecedentedly important during the post-2008 economic restructuring. Using the Internet as a metaphor to represent the broader Web-oriented communications commodity chains that encompass access devices, networks, and services and applications, and by examining three state–corporate disputes involving Foxconn, Qualcomm, and Alibaba, this article historicizes the political economy of China’s digital economy, especially the liberalized and quasiliberalized sections, and then characterizes the nature of the state’s interventions under the auspices of economic restructuring. It argues that the state’s ability to make effective policy for change in this critical field is incoherent. The combination of state-power decentralization and the externally oriented commodity chain for the Web economy is likely to turn Internet Plus into a risky strategy, but the cyber business section of China’s digital capitalism is most likely to benefit. Keywords: the state, digital capitalism, global economic crises, the Internet, transnational capital, state–corporate relations Prelude: Pivot to Internet Plus China and communications are two major engines generating decisive dynamics in the global market economy. This is palpable especially during a worrisome global economic situation from 2008. Led by disruptive innovation centering on digital networks, digital devices, and digitized information services, the communications ecosystem has created a few high-growth outlets in the overall sluggish economy. In China, meanwhile, the corporate-run cyberspace is building a global impact—as the country has the world’s largest number of Internet users and is nurturing a few Internet conglomerates. -

California Insɵtute of Technology Division of Biology and Biological Engineering Annual Report 2017

California InsƟtute of Technology Division of Biology and Biological Engineering Annual Report 2017 Introduction Annual Report | Biology and Biological Engineering | 2017 Introduction The annual report for Caltech's Division of Biology and Biological Engineering (BBE) presents major research accomplishments of faculty, students, and staff during the previous academic year. This report covers October 1, 2016 to September 30, 2017. Front Cover Illustration Vector-assisted spectral tracing (VAST) in the cerebellum of an adult mouse A movie highlighting the multi-color vector-assisted spectral tracing (VAST) system in the cerebellum of an adult mouse. Due to the stochastic uptake of AAV-PHP viruses encoding either a blue, green or red fluorescent protein, cells are labeled with a wide range of hues. This approach can be used to differentiate neighboring neurons for morphology and tracing studies. Credit: Ben Deverman et al., Gradinaru Lab Back Cover Illustration Engineered adeno-associated viruses efficiently cross the blood-brain-barrier for enhanced brain transduction in adult mice. Representative images of virally-delivered nuclear GFP fluorescence (green) and Calbindin immunohistochemistry (magenta) in the cerebellum. Credit: Chan et al., Gradinaru Lab 1 News, Events, and People Annual Report | Biology and Biological Engineering | 2017 Press Releases 5 Annual Retreat 14 Ferguson Prize 16 Ferguson Prize 17 Professorial Awards and Honors 18 Seminars 19 Named Lectures 25 2 News, Events, and People Annual Report | Biology and Biological Engineering -

Capital Profile Prasarttong-Osoth Family

7 NOVEMBER 2014 Prasarttong-Osoth Family — Bangkok Dusit Medical Services, Bangkok Airways Founding family and controlling shareholder of Thailand-listed Bangkok Dusit Medical Services and Bangkok Airways Bangkok Dusit Medical Services merged with Wichai Thongtang's Phyathai Hospital Group in 2011. Wichai Thongtang was Thaksin Shinawatra's lawyer in the former Thai PM's asset-concealment case in 2001 and is a close friend of Thaksin's brother-in-law Somchai Wongsawat. Bangkok Airways owns and operates four Thai airports: the Suvarnabhumi International Ilya Garger Airport, Samui Airport, Sukothai Airport and Trat Airport Editor in Chief Bangkok Airways' joint venture WFS-PG Cargo has reportedly been investigated for Su- [email protected] varnabhumi International Airport projects awarded during Thaksin's reign Sze Toh Yuin Munn Research Editor Capital Profile covers 12 family members and 21 companies [email protected] David Wu INTRODUCTION Researcher [email protected] The Prasert Prasarttong-Osoth family is be- of THB 25 per share, which crowned it hind SET-listed hospital operator Bangkok Thailand’s largest IPO of 2014, as of early Felix Tjandra Dusit Medical Services Group, one of the big- November. Research Analyst gest private medical services operator in Asia [email protected] Prasert Prasarttong-Osoth had a net worth of with a market capitalization of around THB USD 2.3bn as of June 2014, according to Jacob Li 78.4 billion in assets as of June 2014. The Forbes, which ranked him the eighth richest Analyst family also owns media businesses English- man in Thailand. [email protected] language cable TV channel THN Network (In Channel) and Bangkok Media and Broadcast Origin and Background Jessica Kurnia Co Ltd, which launched digital TV channel Researcher Prasert Prasarttong-Osoth was a surgeon by PPTV. -

Copyrighted Material

INDEX A/B testing, defi ned, 55 Borgos dos Santos, Sidnei, 176–178 Accel Partners, 59 Brain Platinum, 93–94 Acher, Eric, 164 Brazil: Ackerman, Bob, 38 business opportunities, 172–180 Advanced Research Projects Agency. See ARPA crime and safety issues, 166–169, 179 Africa, challenges of, 219–221. See also Rwanda culture and economics, 159–163 Agassi, Shai, 52–53, 62 entrepreneurship in, 19 Airtel, 125, 137, 151 exemplars of innovation, 169–178 Alex. Brown investments, 36–37 Marco Gomes story, 1–6, 163–166 Alibaba Group, 16, 96, 98, 100 Breslin, Abigail, 62 Almeida, Alberto, 233n1 (chap. 8) BRIC countries, 8, 161 Amazon.com: Brin, Sergey, 27 Jeff Bezos, 34 BS Construtora, 174–178, 180 Kindle, 14, 35 Buffett, Warren, 84 powerhouse, 89–90, 96 Bug, 173–174, 180 Zappos purchase, 24 Bureau of Labor Statistics, 12 AmDocs, 47 BuscaPe, 228 Animation Lab, 61 Bush, George W., 116 AOL, 53 BYD, 83–85, 128 Apple: as competitor, 39, 100 Cardoso, Fernando Henrique, 161 as innovator, 7, 34, 35 Carret & Co. Equity Research, 96 as technology icon, 84 Casares, Wences, 167, 179, 229 vis-à-vis Tencent, 97 Casey, Liam, 76–78, 80 ARPA, 33–34 Catholicism, legacy of, 3, 160 Asian fi nancial crisis, 93, 185 Chady, Mario, 170–171 Asian Godfathers (Studwell), 185 Chandra, Pankaj, 130 Assis, Rogerio, 169–170http://www.pbookshop.comChang, Leslie, 79 Assis, Zica, 169–170 Charles River Ventures, 58 Atlantic Monthly, The, 76 Chase, 167 AT&T, 34 Checkpoint, 47 Chen Tianqiao, 94 Baidu, 96, 97, 98, 101 China: Bakshi, Naren, 115 business culture, 67–71 Bakuramutsa, NkubitoCOPYRIGHTED -

Billionaire's Gamble on Distressed US Firm Reflects Growing Confidence

As Published In Billionaire’s Gamble on Distressed US Firm Reflects Growing Confidence of Chinese Investors DAK Group’s Sheon Karol asked to comment. Written by Jodi Xu Klien how Chinese investors are stepping up in an unprece- Chen Tianqiao has placed one of the biggest wagers of his dented way to seek returns by helping to run businesses. life. And it may finally be starting to pay off.Chen, through For some US deal makers, Shanda’s approach reflects Chi- his Singapore investment firm Shanda Asset Management nese investors’ growing acumen in overseas investing. Holdings Limited, has accumulated a large stake in the struggling Tennessee company Community Health Sys- tems. Between early 2016 when Chen first bought shares of the operator of acute care hospitals, and January of this year, the share price plummeted more than 80 per cent, from US$20 a share to below US$4. The Chinese billionaire is betting he can catch outsize re- turns on his investment in the distressed US health care provider when its share price improves. To make sure that happens, his investment firm stated last March it intended “to engage with (Community’s) management team regard- ing (its) business and operations and the status of the on- going turnaround strategy.” This month, Community Health’s shares have staged a 37 per cent recovery, hitting US$5.50 this week. If the turna- “They [Chinese investors] are becoming round eventually comes to fruition as planned, Shanda, more confident about investing in so- whose 24 per cent stake in Community Health makes it the phisticated economies” Sheon Karol, company’s largest shareholder, stands to gain the most. -

Annual Report 2008

Stock code 股份編號: 623 Annual Report 2008 年 報 Annual Report 年報 2008 SinoMedia Holding Limited (the “Company” or “SinoMedia”) and its subsidiaries (the “Group”) is a leading media advertising operator in China. We enter into underwriting agreements with TV stations and provide nationwide TV advertising coverage for our clients, including advertisers and advertising agencies. SinoMedia is one of the largest underwriters of TV advertisement time for China Central Television Station (“CCTV”). We have long-standing business cooperation with CCTV dating back to our inception in 1999. 作為中國領先的傳媒廣告營運商,中視金橋國際傳媒控股有限公司(「本公 司」或「中視金橋」)及其子公司(「本集團」)與多家電視台簽訂代理合約,向包 括廣告主及廣告代理商在內的客戶提供全國性電視廣告服務。 中視金橋是中國中央電視台(「央視」)最大的廣告時間買斷代理商之一,自 一九九九年成立以來,與央視已建立了緊密的合作關係。 2 Financial Summary 2 Contents Corporate Information 3 2008 Year in Review 4 Awards and Recognition 6 Chairman’s Statement 10 Management Discussion and Analysis 12 Directors and Senior Management 20 Corporate Governance Report 24 Directors’ Report 30 Independent Auditor’s Report 40 Consolidated Income Statement 41 Consolidated Balance Sheet 42 Balance Sheet 44 Consolidated Statement of Changes in Equity 45 Consolidated Cash Flow Statement 46 Notes to the Financial Statements 48 Five Year Summary 112 3 Financial Summary RMB’000 For the For the year ended year ended 31 December 31 December 2008 2007 Change (%) Revenue 558,356 364,702 +53.1% Profi t from operations 159,712 79,630 +100.6% Profi t attributable to equity shareholders of the Company 120,800 42,316 +1.9 times Earnings per share (RMB) — Basic 0.243