China Refinery Operating Analysis Monthly Report Methodology

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

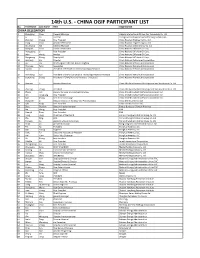

14TH OGIF Participant List.Xlsx

14th U.S. ‐ CHINA OGIF PARTICIPANT LIST No. First Name Last Name Title Organization CHINA DELEGATION 1 Zhangxing Chen General Manager Calgary International Oil and Gas Technology Co. Ltd 2 Li He Director Cheng Du Development and Reforming Commission 3 Zhaohui Cheng Vice President China Huadian Engineering Co. Ltd 4 Yong Zhao Assistant President China Huadian Engineering Co. Ltd 5 Chunwang Xie General Manager China Huadian Green Energy Co. Ltd 6 Xiaojuan Chen Liason Coordinator China National Offshore Oil Corp. 7 Rongguang Li Vice President China National Offshore Oil Corp. 8 Wen Wang Analyst China National Offshore Oil Corp. 9 Rongwang Zhang Deputy GM China National Offshore Oil Corp. 10 Weijiang Liu Director China National Petroleum Cooperation 11 Bo Cai Chief Engineer of CNPC RIPED‐Langfang China National Petroleum Corporation 12 Chenyue Feng researcher China National Petroleum Corporation 13 Shaolin Li President of PetroChina International (America) Inc. China National Petroleum Corporation 14 Xiansheng Sun President of CNPC Economics & Technology Research Institute China National Petroleum Corporation 15 Guozheng Zhang President of CNPC Research Institute(Houston) China National Petroleum Corporation 16 Xiaquan Li Assistant President China Shenhua Overseas Development and Investment Co. Ltd 17 Zhiming Zhang President China Shenhua Overseas Development and Investment Co. Ltd 18 Zhang Jian deputy manager of unconventional gas China United Coalbed Methane Corporation Ltd 19 Wu Jianguang Vice President China United Coalbed Methane Corporation Ltd 20 Jian Zhang Vice General Manager China United Coalbed Methane Corporation Ltd 21 Dongmei Li Deputy Director of Strategy and Planning Dept. China Zhenhua Oil Co. Ltd 22 Qifa Kang Vice President China Zhenhua Oil Co. -

Negativliste. Fossil Energi

Bilag 6. Negativliste. Fossil energi Maj 2017 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten. Rækkeetiketter Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Africa Oil Corp Africa Oil Corp Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine Development Co Black Mountain Resources LLC Bluff Spur Coal Corp Boone Energy Co Bull Mountain Mining Corp Central Penn Energy Co Inc Central West Virginia Energy Co Clear Fork Coal Co CoalSolv LLC Cobra Natural Resources LLC Crystal Fuels Co Cumberland Resources Corp Dehue Coal Co Delbarton Mining Co Douglas Pocahontas Coal Corp Duchess Coal Co Duncan Fork Coal Co Eagle Energy Inc/US Elk Run Coal Co Inc Exeter Coal Corp Foglesong Energy Co Foundation Coal -

A Comparison of Natural Gas Pricing Mechanisms of the End-User Markets in USA, Japan, Australia and China

A Comparison of Natural Gas Pricing Mechanisms of the end-user markets In USA, Japan, Australia and China China-Australia Natural Gas Technology Partnership Fund 2013 Leadership Imperative Li Yuying, SHDRC Li Jinsong, CNOOC Gas and Power Group Yu Zhou, Guangdong Dapeng LNG Co Ltd. Wang Zhang, Guangdong Dapeng LNG Co Ltd. August 6th, 2013 1 Table of Contents Acknowledgements..........................................................................................................6 Executive Summery .........................................................................................................7 01 Introduction .......................................................................................................................8 1.1 Background ...........................................................................................................8 1.2 Definition of Pricing Mechanism ...........................................................................9 1.3 Overall Purpose of this Project ...............................................................................9 1.4 Proposed Outcome ............................................................................................... 10 1.5 Structure of the Report ......................................................................................... 10 02 Gas Market & Pricing Mechanism in USA ...................................................................... 10 2.1 USA Natural Gas Demand .................................................................................. -

International Energy Executive Forum 2018 12-13 December 2017 | Beijing, China

Co-hosts: International Energy Executive Forum 2018 12-13 December 2017 | Beijing, China PARTNERSHIP PROSPECTUS IEEF FORUM SUMMARY PARTICIPANTS To help energy industry participants identify critical Over 300 delegates from across the globe, including senior corporate trends in global energy and to assess the impact that executives, government officials, as well as industry experts and thought these trends may have on companies and governments, leaders. Executive functions of participants include strategic planning, research & development, technologies, finance, operations sales & marketing, as well as CNPC Economics & Technology Research Institute (ETRI) business development. and IHS Markit are jointly hosting the International Energy Executive Forum in Beijing. SPEAKERS Speakers include top Chinese energy officials, Chinese state company Now in its fifth year, this year’s Forum will be held executives, international energy company executives, leaders from service providers such as oilfield services, equipment and engineering, legal and on 12-13 December 2017, with the theme “Energy finance, and leading think tanks. at Crossroads: Seeking New Balance”. In this year’s expanded focus from ‘Oil and Gas’ to ‘Energy’, we look to address the many fuels and technologies – both old and new – outside the oil and gas business that will likely become increasingly important for industry participants. © 2017 IHS Markit IEEF FORUM SUMMARY Bai Changbo, Vice President, BP China RECENT SPEAKERS: Nobuo Tanaka, Global Associate, Institute Daniel Yergin, -

Final Cover 2010-E

The Secretary General's 37 The Secretary Organization of Arab Petroleum Exporting Countries (OAPEC) th Annual Report A.H. 1430 - 1431 / A.D. 2010 A.H. 1430 - 1431 / The Secretary General's 37th Annual Report Organization of Arab Petroleum Exporting Countries (OAPEC) ORGANIZATION OF ARAB PETROLEUM EXPORTING COUNTRIES (OAPEC) All rights reserved. The Organization of Arab Petroleum Exporting Countries (OAPEC), 2010. ORGANIZATION OF ARAB PETROLEUM EXPORTING COUNTRIES (OAPEC) P.O. Box 20501Safat, 13066 kuwait Kuwait Tel.: (00965) 24959000 - Faxmaill: (00965) 24959755 E.mail: [email protected] www.oapecorg.org ORGANIZATION OF ARAB PETROLEUM EXPORTING COUNTRIES (OAPEC) The Ministerial Council H.E. Youcef Yousfi(1) People’s Democratic Republic of Algeria H.E. Dr. Abdul Hussein bin Ali Mirza Kingdom of Bahrain H.E. Eng. Samih Samir Fahmy Arab Republic of Egypt H.E. Abdul-Kareem Luaibi Bahedh(2) Republic of Iraq H.E. Shaikh Ahmad Al Abdullah Al-Ahmad Al-Sabah State of Kuwait H.E. Dr. Shokri Mohammad Ghanim Libya H.E. Abdullah bin Hamad Al-Attiyah State of Qatar H.E. Eng. Ali bin Ibrahim Al-Naimi Kingdom of Saudi Arabia H.E. Eng. Sufian Al-Alaw Syrian Arab Republic H.E. Mohammad Bin Dhaen Al-Hamly United Arab Emirates (1) Succeeded H.E. Dr. Chakib Khelil in May 2010 (2) Succeeded H.E. Dr. Hussein Al-Sharhastani in December 2010 ORGANIZATION OF ARAB PETROLEUM EXPORTING COUNTRIES (OAPEC) The Executive Bureau Mr. Mohamed Ras Al Kaf People’s Democratic Republic of Algeria Mr. Ali Abdul Jabar Al-Sawad Kingdom of Bahrain Mr. Eng. Ahmad Saeed Al Ashmawi Arab Republic of Egypt Mr. -

PETROBRAS-CHINA RELATIONS: TRADE, INVESTMENTS, INFRASTRUCTURE PROJECTS and LOANS1 Pedro Henrique Batista Barbosa2

PETROBRAS-CHINA RELATIONS: TRADE, INVESTMENTS, INFRASTRUCTURE PROJECTS AND LOANS1 Pedro Henrique Batista Barbosa2 Petrobras’ expansion over the last years is linked to one foreign country: China. After the discovery of the pre-salt oil, the company’s relation with Chinese players has evolved rapidly in four directions: trade, investments, infrastructure projects, and loans. Chinese actors have become relevant crude importers, production partners, service providers, and funding options. China became Petrobras’ main export destination and the origin of the majority of its external loans, which have helped it to expand production and honor its financial commitments. From China’s perspective, Petrobras is a reliable crude supplier, besides being an increasingly relevant destination of investments and technical, operational, and financial services. In each of the four pillars, the progress of bilateral relations was based upon complementary circumstances, such as China’s skyrocketing imports and Petrobras’ burgeoning exports. However, beyond complementarity, Petrobras-China oil cooperation has significant challenges. Keywords: China; Petrobras; oil; trade; FDI; infrastructure projects; loans. AS RELAÇÕES PETROBRAS-CHINA: COMÉRCIO, INVESTIMENTOS, PROJETOS DE INFRAESTRUTURA E EMPRÉSTIMOS A expansão da Petrobras nos últimos anos está ligada a um país estrangeiro: China. Após a descoberta do petróleo do pré-sal, a relação da empresa com os atores chineses evoluiu rapidamente em quatro direções: comércio, investimentos, projetos de infraestrutura e empréstimos. Empresas e bancos chineses tornaram-se importantes importadores de petróleo, parceiros em extração, provedores de serviços e opções de financiamento. A China passou a ser o principal destino das exportações da Petrobras e a origem da maioria dos seus empréstimos externos, o que a ajudou a expandir sua produção e equilibrar seus compromissos financeiros. -

Chinese Nocs' Overseas Strategies

THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY RICE UNIVERSITY CHINESE NOCS’ OVERSEAS STRATEGIES: BACKGROUND, COMPARISON AND REMARKS BY XIAOJIE XU CNPC RESEARCH ACADEMY OF ECONOMICS AND TECHNOLOGY PREPARED IN CONJUNCTION WITH AN ENERGY STUDY SPONSORED BY THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY AND JAPAN PETROLEUM ENERGY CENTER RICE UNIVERSITY – MARCH 2007 THIS PAPER WAS WRITTEN BY A RESEARCHER (OR RESEARCHERS) WHO PARTICIPATED IN THE JOINT BAKER INSTITUTE/JAPAN PETROLEUM ENERGY CENTER POLICY REPORT, THE CHANGING ROLE OF NATIONAL OIL COMPANIES IN INTERNATIONAL ENERGY MARKETS. WHEREVER FEASIBLE, THIS PAPER HAS BEEN REVIEWED BY OUTSIDE EXPERTS BEFORE RELEASE. HOWEVER, THE RESEARCH AND THE VIEWS EXPRESSED WITHIN ARE THOSE OF THE INDIVIDUAL RESEARCHER(S) AND DO NOT NECESSARILY REPRESENT THE VIEWS OF THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY NOR THOSE OF THE JAPAN PETROLEUM ENERGY CENTER. © 2007 BY THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY OF RICE UNIVERSITY THIS MATERIAL MAY BE QUOTED OR REPRODUCED WITHOUT PRIOR PERMISSION, PROVIDED APPROPRIATE CREDIT IS GIVEN TO THE AUTHOR AND THE JAMES A. BAKER III INSTITUTE FOR PUBLIC POLICY ABOUT THE POLICY REPORT THE CHANGING ROLE OF NATIONAL OIL COMPANIES IN INTERNATIONAL ENERGY MARKETS Of world proven oil reserves of 1,148 billion barrels, approximately 77% of these resources are under the control of national oil companies (NOCs) with no equity participation by foreign, international oil companies. The Western international oil companies now control less than 10% of the world’s oil and gas resource base. In terms of current world oil production, NOCs also dominate. -

BICOM Briefing | UK-China Relations and the Changing Middle East

BICOM Briefing | UK-China relations and the changing Middle East NOVEMBER 2019 Executive Summary largest trading partner with Iran with trade read- ing $37.14bn. In 2008, China surpassed Russia as In April 2019, the UK Foreign Affairs Select Com- Iran’s largest arms supplier, and has been a key mittee (FASC) argued that UK strategy vis-à-vis partner in Iran’s military modernisation and nucle- China is not based on the reality of “a more am- ar development, as well as supporting the devel- bitious, more confident, and more assertive” opment of Iran’s own domestic military production foreign policy by the Chinese Communist Party capabilities. under President Xi Jinping. Subsequently, the FASC called for the Government to develop a sin- The UK and China are on opposing sides in the gle, detailed, public document defining the UK’s Syrian civil war. The UK has been at the forefront China strategy by the end of 2020. of calls for Syrian President Bashar al-Assad to leave office as part of a transition to a new gov- The FASC report noted that Chinese investment ernment. China has adopted the Russian narra- in the Middle East need not inherently conflict tive that the Assad regime is a bulwark against with British interests. However, China’s econom- Islamic extremism in the region, and Beijing has ic footprint in the region has increased substan- justified Russia’s military role as “part of interna- tially over the last decade and it is believed that, tional counterterrorism efforts”. at some point, China’s political engagement (and possibly military activity) in the region will have China remains a human rights ‘priority coun- to increase in order for it to protect its economic try’ for the UK with the primary concern the gov- interests. -

Oil, Gas & Energy Law Intelligence

Oil, Gas & Energy Law Intelligence www.gasandoil.com/ogel/ China's Overseas Oil and Gas Investment: ISSN : 1875-418X Motivations, Strategies, and Global Impact Issue : Vol. 6 - issue 1 Published : March 2008 by K. Wu This article is part of the special feature on China's Energy and Environmental challenges edited for Oil, Gas & Energy Law by: Ms Xin Ma CEPMLP, University of Dundee E-mail: [email protected] About OGEL OGEL (Oil, Gas & Energy Law Intelligence): Focusing on recent developments in the area of oil-gas-energy law, regulation, treaties, judicial and arbitral cases, voluntary guidelines, tax and contracting, including the oil-gas-energy geopolitics. For full Terms & Conditions and subscription rates, please visit our website at www.gasandoil.com/ogel/. Editor-in-Chief Open to all to read and to contribute Thomas W. Wälde [email protected] Our aim is for OGEL to become the hub of a global Professor & Jean-Monnet Chair professional and academic network. Therefore we invite all CEPMLP/Dundee those with an interest in oil-gas-energy law and regulation to Essex Court Chambers, London contribute. We are looking mainly for short comments on recent developments of broad interest. We would like where Terms & Conditions possible for such comments to be backed-up by provision of Registered OGEL users are authorised to download and print in-depth notes and articles (which we will be published in our one copy of the articles in the OGEL Website for personal, 'knowledge bank') and primary legal and regulatory non-commercial use provided all printouts clearly include the materials. -

International Energy Executive Forum 2019 Creating a New Landscape: Global Energy and 40 Years of Reform and Opening in China 12-13 December 2018 | Beijing, China

International Energy Executive Forum 2019 Creating a New Landscape: Global Energy and 40 Years of Reform and Opening in China 12-13 December 2018 | Beijing, China Partnership prospectus Confidential. © 2018 IHS MarkitTM. All Rights Reserved. 2 EVENT SUMMARY PARTICIPANTS To help energy industry participants identify critical Over 400 delegates from across the globe, including senior corporate trends in global energy and to assess the impact that executives, government officials, as well as industry experts and thought leaders. Executive functions of participants include strategic planning, these trends may have on companies and research & development, technologies, finance, operations sales & marketing, governments, CNPC Economics & Technology as well as business development. Research Institute (ETRI) and IHS Markit are jointly hosting the International Energy Executive Forum in SPEAKERS Beijing. Speakers include top Chinese energy officials, Chinese state company executives, international energy company executives, leaders from service Now in its sixth year, this year’s Forum will be held providers such as oilfield services, equipment and engineering, legal and on 12-13 December 2018, with the theme “Creating a finance, and leading research institutes. New Landscape: Global Energy and 40 Years of Reform and Opening in China” and will address a wide range of topics concerning global energy development with top executives, government officials, and thought leaders. This year also marks the 40th anniversary of China’s “Reform & Opening Up” policy that has transformed the Chinese economy and nation. Energy has been an indispensable part of this growth story and continues to be a critical sector as China embarks on the next phase of its economic and social development. -

The U.A.E. Oil & Gas Sector

The U.A.E. Oil & Gas Sector Recent Updates January 2019 The U.S.-U.A.E. Business Council is the premier business organization dedicated to advancing bilateral commercial relations. By leveraging its extensive networks in the U.S. and in the region, the U.S.- U.A.E. Business Council provides unparalleled access to senior decision makers in business and government with the aim of deepening bilateral trade and investment. U.S.-U.A.E. Business Council 505 Ninth Street, NW Suite 6010 Washington D.C. +202.863.7285 [email protected] www.usuaebusiness.org EXECUTIVE SUMMARY The United Arab Emirates (U.A.E.), a member of the Organization of the Petroleum Exporting Countries (OPEC) and the Gas Exporting Countries Forum (GECF), has long been an important actor in international oil & gas (O&G) markets. Having consolidated its position in the global hydrocarbon sector, Emirati policymakers are now actively pursuing wide-ranging social, economic, and regulatory reforms with demonstrable impacts on the domestic O&G sector and key international markets. U.A.E. policymakers have explicitly stated that the Emirates, particularly Abu Dhabi, will undertake major strategic investments in midstream and downstream infrastructure to bring domestic producers in line with the U.A.E.’s 2021 national development goals, and the contemporary global hydrocarbon pricing environment, through greater emphasis on high value-added refined and petrochemical products, rather than crude oil exports.1 In support, the Government of Abu Dhabi has already strategically reoriented its national oil company, the Abu Dhabi National Oil Company (ADNOC), to allow the firm’s leadership to augment activities across the hydrocarbon value-chain through the optimization of its organizational structure, a more robust utilization of external funding, significant investments in new and preexisting assets, and the expansion of the company’s strategic partnership frameworks. -

Trends in Asian National Oil Company Investment Abroad: an Update

Trends in Asian National Oil Company Investment Abroad: An update A Working Paper by Glada Lahn November 2007 Trends in National Oil Company Investment Abroad: An update, Chatham House Working Paper: November 2007. © Royal Institute of International Affairs 2007 This material is offered free of charge for personal and non-commercial use, provided the source is acknowledged. For commercial or any other use, prior written permission must be obtained from the Royal Institute of International Affairs. In no case may this material be altered, sold or rented. Chatham House (the Royal Institute of International Affairs) is an independent body which promotes the rigorous study of international questions and does not express opinion of its own. The opinions expressed in this publication are the responsibility of the authors. Chatham House, 10 St James’s Square, London, SW1Y 4LE T: +44 (0) 20 7957 5700 F: +44 (0) 20 7957 5710 www.chathamhouse.org.uk Charity Registration No. 208 223 Glada Lahn is Junior Research Fellow at the Energy, Environment and Development Programme at Chatham House. She specialises in issues of oil sector governance and related development in oil and gas producing countries. The author is grateful to Juliet Kerr for her research assistance and to colleagues and associates involved in the Asian National Oil Company Investments Abroad project. 2 Trends in National Oil Company Investment Abroad: An update, Chatham House Working Paper: November 2007. Table of contents Introduction..........................................................................................................