Chinese Nocs' Overseas Strategies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

14TH OGIF Participant List.Xlsx

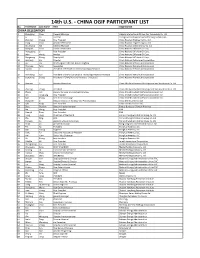

14th U.S. ‐ CHINA OGIF PARTICIPANT LIST No. First Name Last Name Title Organization CHINA DELEGATION 1 Zhangxing Chen General Manager Calgary International Oil and Gas Technology Co. Ltd 2 Li He Director Cheng Du Development and Reforming Commission 3 Zhaohui Cheng Vice President China Huadian Engineering Co. Ltd 4 Yong Zhao Assistant President China Huadian Engineering Co. Ltd 5 Chunwang Xie General Manager China Huadian Green Energy Co. Ltd 6 Xiaojuan Chen Liason Coordinator China National Offshore Oil Corp. 7 Rongguang Li Vice President China National Offshore Oil Corp. 8 Wen Wang Analyst China National Offshore Oil Corp. 9 Rongwang Zhang Deputy GM China National Offshore Oil Corp. 10 Weijiang Liu Director China National Petroleum Cooperation 11 Bo Cai Chief Engineer of CNPC RIPED‐Langfang China National Petroleum Corporation 12 Chenyue Feng researcher China National Petroleum Corporation 13 Shaolin Li President of PetroChina International (America) Inc. China National Petroleum Corporation 14 Xiansheng Sun President of CNPC Economics & Technology Research Institute China National Petroleum Corporation 15 Guozheng Zhang President of CNPC Research Institute(Houston) China National Petroleum Corporation 16 Xiaquan Li Assistant President China Shenhua Overseas Development and Investment Co. Ltd 17 Zhiming Zhang President China Shenhua Overseas Development and Investment Co. Ltd 18 Zhang Jian deputy manager of unconventional gas China United Coalbed Methane Corporation Ltd 19 Wu Jianguang Vice President China United Coalbed Methane Corporation Ltd 20 Jian Zhang Vice General Manager China United Coalbed Methane Corporation Ltd 21 Dongmei Li Deputy Director of Strategy and Planning Dept. China Zhenhua Oil Co. Ltd 22 Qifa Kang Vice President China Zhenhua Oil Co. -

Negativliste. Fossil Energi

Bilag 6. Negativliste. Fossil energi Maj 2017 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten. Rækkeetiketter Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Africa Oil Corp Africa Oil Corp Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine Development Co Black Mountain Resources LLC Bluff Spur Coal Corp Boone Energy Co Bull Mountain Mining Corp Central Penn Energy Co Inc Central West Virginia Energy Co Clear Fork Coal Co CoalSolv LLC Cobra Natural Resources LLC Crystal Fuels Co Cumberland Resources Corp Dehue Coal Co Delbarton Mining Co Douglas Pocahontas Coal Corp Duchess Coal Co Duncan Fork Coal Co Eagle Energy Inc/US Elk Run Coal Co Inc Exeter Coal Corp Foglesong Energy Co Foundation Coal -

A Comparison of Natural Gas Pricing Mechanisms of the End-User Markets in USA, Japan, Australia and China

A Comparison of Natural Gas Pricing Mechanisms of the end-user markets In USA, Japan, Australia and China China-Australia Natural Gas Technology Partnership Fund 2013 Leadership Imperative Li Yuying, SHDRC Li Jinsong, CNOOC Gas and Power Group Yu Zhou, Guangdong Dapeng LNG Co Ltd. Wang Zhang, Guangdong Dapeng LNG Co Ltd. August 6th, 2013 1 Table of Contents Acknowledgements..........................................................................................................6 Executive Summery .........................................................................................................7 01 Introduction .......................................................................................................................8 1.1 Background ...........................................................................................................8 1.2 Definition of Pricing Mechanism ...........................................................................9 1.3 Overall Purpose of this Project ...............................................................................9 1.4 Proposed Outcome ............................................................................................... 10 1.5 Structure of the Report ......................................................................................... 10 02 Gas Market & Pricing Mechanism in USA ...................................................................... 10 2.1 USA Natural Gas Demand .................................................................................. -

Establishing a National Oil Company in Lebanon

ا rلeمtركnزe اCل لبeنsانneي aلbلeدرLا eساThت LCPS for Policy Studies r e 6 p 1 0 Establishing a National Oil a 2 r P e b m Company in Lebanon y e t c p e i S l Valérie Marcel o P Founded in 1989, the Lebanese Center for Policy Studies is a Beirut-based independent, non-partisan think tank whose mission is to produce and advocate policies that improve good governance in fields such as oil and gas, economic development, public finance, and decentralization. This research was funded by the International Development Research Center Copyright© 2016 The Lebanese Center for Policy Studies Designed by Polypod Executed by Dolly Harouny Sadat Tower, Tenth Floor P.O.B 55-215, Leon Street, Ras Beirut, Lebanon T: + 961 1 79 93 01 F: + 961 1 79 93 02 [email protected] www.lcps-lebanon.org Establishing a National Oil Company in Lebanon Dr Valérie Marcel Valérie Marcel is an associate fellow at Chatham House and has extensive experience in the field of oil and gas and international relations. As an expert on national oil companies, petroleum sector governance, and emerging oil and gas producers, she led energy research at Chatham House from 2002 to 2007 and authored the book Oil Titans: National Oil Companies in the Middle East as well as the recent paper ‘The Cost of an Emerging National Oil Company’. Dr. Marcel also advises governments on energy sector governance, as a member of KPMG’s Global National Oil Companies (NOC) team. She previously taught international relations at Sciences Po Paris (Institut d’études politiques de Paris) and the University of Cairo. -

Petroleum Politics: China and Its National Oil Companies

MASTER IN ADVANCED EUROPEAN AND INTERNATIONAL STUDIES ANGLOPHONE BRANCH - Academic year 2012/2013 Master Thesis Petroleum Politics: China and Its National Oil Companies By Ellennor Grace M. FRANCISCO 26 June 2013 Supervised by: Dr. Laurent BAECHLER Deputy Director MAEIS To Whom I owe my willing and my running CONTENTS List of Tables and Figures v List of Abbreviations vi Chapter 1. Introduction 1 1.1 Literature Review 2 1.2 Methodologies 4 1.3 Objectives and Scope 4 Chapter 2. Historical Evolution of Chinese National Oil Companies 6 2.1 The Central Government and “Self-Reliance” (1950- 1977) 6 2.2 Breakdown and Corporatization: First Reform (1978- 1991) 7 2.3 Decentralization: Second Reform (1992- 2003) 11 2.4 Government Institutions and NOCs: A Move to Recentralization? (2003- 2010) 13 2.5 Corporate Governance, Ownership and Marketization 15 2.5.1 International Market 16 2.5.2 Domestic Market 17 Chapter 3. Chinese Politics and NOC Governance 19 3.1 CCP’s Controlling Mechanisms 19 3.1.1 State Assets Supervision and Administration Commission (SASAC) 19 3.1.2 Central Organization Department 21 3.2 Transference Between Government and Corporate Positions 23 3.3 Traditional Connections and the Guanxi 26 3.4 Convergence of NOC Politics 29 Chapter 4. The “Big Four”: Overview of the Chinese Banking Sector 30 Preferential Treatment 33 Chapter 5. Oil Security and The Going Out Policy 36 5.1 The Policy Driver: Equity Oil 36 5.2 The Going Out Policy (zou chu qu) 37 5.2.1 The Development of OFDI and NOCs 37 5.2.2 Trends of Outward Foreign Investments 39 5.3 State Financing: The Chinese Policy Banks 42 5.4 Loans for Oil 44 Chapter 6. -

Massive and Misunderstood Data-Driven Insights Into National Oil Companies

Massive and Misunderstood Data-Driven Insights into National Oil Companies Patrick R. P. Heller and David Mihalyi APRIL 2019 Contents EXECUTIVE SUMMARY ............................................................................................................................... 1 I. UNDER-ANALYZED BEHEMOTHS ......................................................................................................... 6 II. THE NATIONAL OIL COMPANY DATABASE .....................................................................................10 III. SIZE AND IMPACT OF NATIONAL OIL COMPANIES .....................................................................15 IV. BENCHMARKING NATIONAL OIL COMPANIES BY VALUE ADDITION .....................................29 V. TRANSPARENCY AND NATIONAL OIL COMPANY REPORTING .................................................54 VI. CONCLUSIONS AND STEPS FOR FURTHER RESEARCH ............................................................61 APPENDIX 1. NOCs IN NRGI’S NATIONAL OIL COMPANY DATABASE ..........................................62 APPENDIX 2. CHANGES IN NOC ECONOMIC DATA AS REVENUES CHANGED..........................66 Key messages • National oil companies (NOCs) produce the majority of the world’s oil and gas. They dominate the production landscape in some of the world’s most oil-rich countries, including Saudi Arabia, Mexico, Venezuela and Iran, and play a central role in the oil and gas sector in many emerging producers. In 2017, NOCs that published data on their assets reported combined assets of $3.1 trillion. -

National Oil Companies... 16/17 November 2005

Global Energy, Utilities & Mining Conference National Oil Companies... 16/17 November 2005 PwC Introducing the NOCs… 8 slides, 15 minutes The resource position… The players… The trends… The challenges and issues… 2005 Global Energy, Utilities & Mining Conference Page 2 PricewaterhouseCoopers 16/ 17 November 2005 2004 Oil Reserves…who controls them? Not the 30 countries of the Organization for Economic Co-operation and Development OECD 7% State and National Oil Companies 93% From Oil & Gas Journal 2005 Global Energy, Utilities & Mining Conference Page 3 PricewaterhouseCoopers 16/ 17 November 2005 2004 Oil Reserves of Top 20 Companies… Representing nearly 90% of the world’s proven reserves ExxonMobil 1%, ChevronTexaco 1%, BP 1% Kazakhstan 1% Sonangol 1% Sonatrach 1% Yukos 1% PetroBras 1% Qatar Petroleum 1.5% Pemex 1.5% Lukoil 2% Chinese National Petroleum Corp 2% Nigerian National Petroleum Corp 4% Saudi Aramco 26% National Oil Company of Libya 4% PdVSA 8% National Iranian Oil Company 13% Abu Dhabi National Oil Company 9% Kuwait Petroleum Corporation 10% Iraq National Oil Company 11% From Oil and Gas Journal, BP Statistical Review of World Energy, OPEC Annual Statistical Bulletin 2005 Global Energy, Utilities & Mining Conference Page 4 PricewaterhouseCoopers 16/ 17 November 2005 2004 Figures for Reserves and Production… Supermajors share…oil 3%, gas 2% production 20% # Oil Reserves Gas Reserves Oil Production Billions bbls Tcf Millions bbls/yr 1 Saudi Arabia 262 Gazprom 1008 Saudi Arabia 3247 2 Iran 132 Iran 976 Iran 1399 3 Iraq 115 Qatar -

Country Analysis Executive Summary: Azerbaijan Last Updated: September 13, 2021

Country Analysis Executive Summary: Azerbaijan Last Updated: September 13, 2021 Overview • Azerbaijan is a net energy exporter; crude oil and natural gas production and exports are central to Azerbaijan's economy and government revenues. • Natural gas accounts for over two-thirds of Azerbaijan's total domestic energy consumption. Oil supplies less than one-third of total energy consumption (Figure 1). 1 • In 2018, the five countries bordering the Caspian Sea met regarding a decades-old delimitation dispute over the maritime and seabed boundaries of the Caspian. In early 2021, the foreign ministers of Turkmenistan and Azerbaijan signed a memo of understanding, which signified collaboration for joint exploration in the previously contested deep-water block along the Caspian maritime borders for both countries. The agreement is likely to attract foreign 2 investment for exploratory drilling and development in the Dostluk field. U.S. Energy Information Administration 1 Figure 1. Azerbaijan's total primary energy consumption, 2020 hydro-electricity 2% petroleum 29% natural gas 69% Source: Graph by EIA based on data from BP Statistical Review of World Energy 2021. Note: Chart does not include traditional biomass and w aste, such as burning firew ood and w aste. Petroleum and other liquids • Azerbaijan's proved crude oil reserves were estimated at 7 billion barrels in January 2021, according to the Oil & Gas Journal (OGJ). 3 Sector organization • The State Oil Fund of the Republic of Azerbaijan (SOFAZ) manages currency and assets from oil and natural gas activities, and it had $43.564 billion in managed assets at the start of January 2021, an increase of over 5% from the beginning of 2020 ($41.349 billion). -

Oil and Gas in Latin America South America Hydrocarbon Provinces

Oil and Gas in Latin America South America Hydrocarbon provinces U. S. Geological Survey Open-File Report 97-470D Map of Central and South America • Assessed provinces (red areas), province boundaries (red), and country boundaries (black). U.S.Geological Survey World Energy Assessment Team (USGS), 2000 Mesoamerica and Caribbean Main Oil Provinces Petroleum field location Province boundary line Latin America Production of Crude Oil, Natural Gas Plant Liquids, and Other Hydrocarbons, 2001 (Thousand Barrels per Day) Country 2001 State oil Company Mexico* 3,590 Pemex, monopoly Venezuela* 3,080 PdVSA nationalized 1976 Brazil* 1,561 Petrobras joint Argentina* 829 YPF Privatized-sold Colombia* 614 Ecopetrol monopoly Ecuador* 421 PetroEcuador open Trinidad&Tobago 125 Peru 95 Cuba 50 Bolivia 44 Guatemala 21 Chile 14 Suriname 10 Barbados 1 Total Latin 10,456 America World Total 75,461 from *We will discuss these http://www.eia.doe.gov/emeu/international/petroleu.html#IntlProduction Mexico Oil and Gas Basins • Majority in the Gulf of Mexico Hydrocarbon Productive Regions, 2000 (% of total production) http://www.energia.gob.mx/ Gulf of Mexico Basins 5301 Tampico-Misantla Basin 5302 Veracruz Basin 5304 Saline-Comalcalco Basin 5307 Campeche-Sigsbe Salt Basin 5308 Yucatan 5310 Sierra Madre de Chiapas-Peten Golden Lane Mexico, Oil Exports • OIL Mexico has the fourth largest proven crude oil reserves in the Western Hemisphere after Canada, Venezuela, and the United States at 12.6 billion barrels. During the first 10 months of 2002, Mexico produced about 3.6 million barrels per day (bbl/d) of oil. Mexico consumed approximately 1.9 million bbl/d of oil in 2002, resulting in net exports of roughly 1.7 million bbl/d. -

The Rise of the National Oil Company

The rise of the national oil company The rapid rise of national oil companies is driving international oil companies to rethink strategies for achieving high performance. By Alexandre M Oliveira, senior executive, global upstream lead; Melissa Stark, senior executive, strategy; and Claire Lawrie, senior manager, strategy, Accenture Record profits among international oil companies (IOCs) would suggest they are hitting their stride as highperformance businesses. Are these good times here to stay? No company is counting on it. An unexpected challenge has arisen: the rapid rise of national oil companies (NOCs) to the global stage. As the dominant players in today’s oil markets, IOCs strive for high performance. Historically, they have been the partner of choice for many major resource holders, undertaking large, complex or groundbreaking oil and gas projects. However, times are changing. Technology ownership has shifted dramatically from operators towards the oil services sector over the last decade, while the capabilities of many NOCs have grown. In parallel, a wave of aggressive international acquisition activity by certain NOCs has raised eyebrows across the industry. Add to this the creation of NOC consortia and some creative deal making by previously conservative NOCs and suddenly the role of IOCs in the industry is coming under close scrutiny. The new relationship As part of Accenture’s High Performance Business initiative, we identified key elements that differentiated highperformance independents from their peer group. One is that they have a growthoriented strategy. This also is the overriding metric for IOCs – the ability to replace and grow reserves typically drives business strategies and shareholder value. -

Oil Fiscal Regimes and National Oil Companies: a Comparison Between Pemex And

Oil fiscal regimes and national oil companies: a comparison between Pemex and Petrobras Juan M. Ramírez-Cendrero, Complutense University of Madrid ([email protected]) (corresponding author) María J. Paz, Complutense University of Madrid ([email protected]) ABSTRACT Analysis of the determinants of the performance of national oil companies (NOCs) is and has always been among the most discussed topics in specialized literature. In this context, the uneven path experienced by two major Latin American NOCs -- Petrobras and Pemex -- is striking. Our work seeks to explain the uneven performance, focusing on the productive aspects. In particular, we analyze the oil fiscal regimes in Brazil and Mexico as a very crucial aspect – though not the only one -- within oil-rich countries that may shed light on the disparities between Petrobras and Pemex. The contribution of our work to the existing literature derives from the relationship that we establish between the characteristics of the respective oil fiscal regimes and the productive performance of the two NOCs, with special consideration paid to the ways in which a fiscal regime contributes, or not, to promoting and guiding the investment efforts of companies. We compare investment, production, and reserve indicators of Pemex and Petrobras and conclude that the Mexican and Brazilian oil fiscal regimes can largely explain the productive and investor performance of both NOCs. KEYWORDS National oil company, oil fiscal regime, Petrobras, Pemex 1.- Introduction Latin America has historically had cases of industrialization and modernization from natural resources, particularly from oil. Among the most relevant experiences in the region are certainly the cases of Brazil and Mexico. -

Introduction 3/6/06 2:28 PM Page 1

01-7473-6 Introduction 3/6/06 2:28 PM Page 1 Introduction In most important oil-producing regions of the world, the oil industry has been nationalized. Ninety percent of the world’s oil reserves are entrusted to state-owned companies. The five national oil companies (NOCs) that are the focus of this book together produce one quarter of the world’s oil and hold one half of the world’s oil and gas reserves. What do we know about these oil titans? Do we understand how they operate and what drives them? Do they emphasize politics over profits? Do they have the technical and business skills to develop responsibly the immense petroleum resources entrusted to them? In spite of the dependence of importing countries’ economic fortunes on the performance of the NOCs of the Middle East and North Africa, outsiders know very little about these organizations. Their opacity has discouraged most analysis so far. However, after explaining my project, I was invited to meet with the managers of Saudi Aramco, the Kuwait Petroleum Corporation (KPC), the National Iranian Oil Company (NIOC), Sonatrach (Algeria) and the Abu Dhabi National Oil Company (ADNOC). They allowed extensive interviews to be conducted, demonstrating their interest in discussing both their past accomplishments and future challenges. These were fascinating dis- cussions, and this book will tell those companies’ stories. From the oil industry’s perspective, it is an important time to be studying NOCs. Many of them are emerging on the international scene, no longer con- fined to filling the shoes of the oil majors, which left when the host countries nationalized their oil sector.