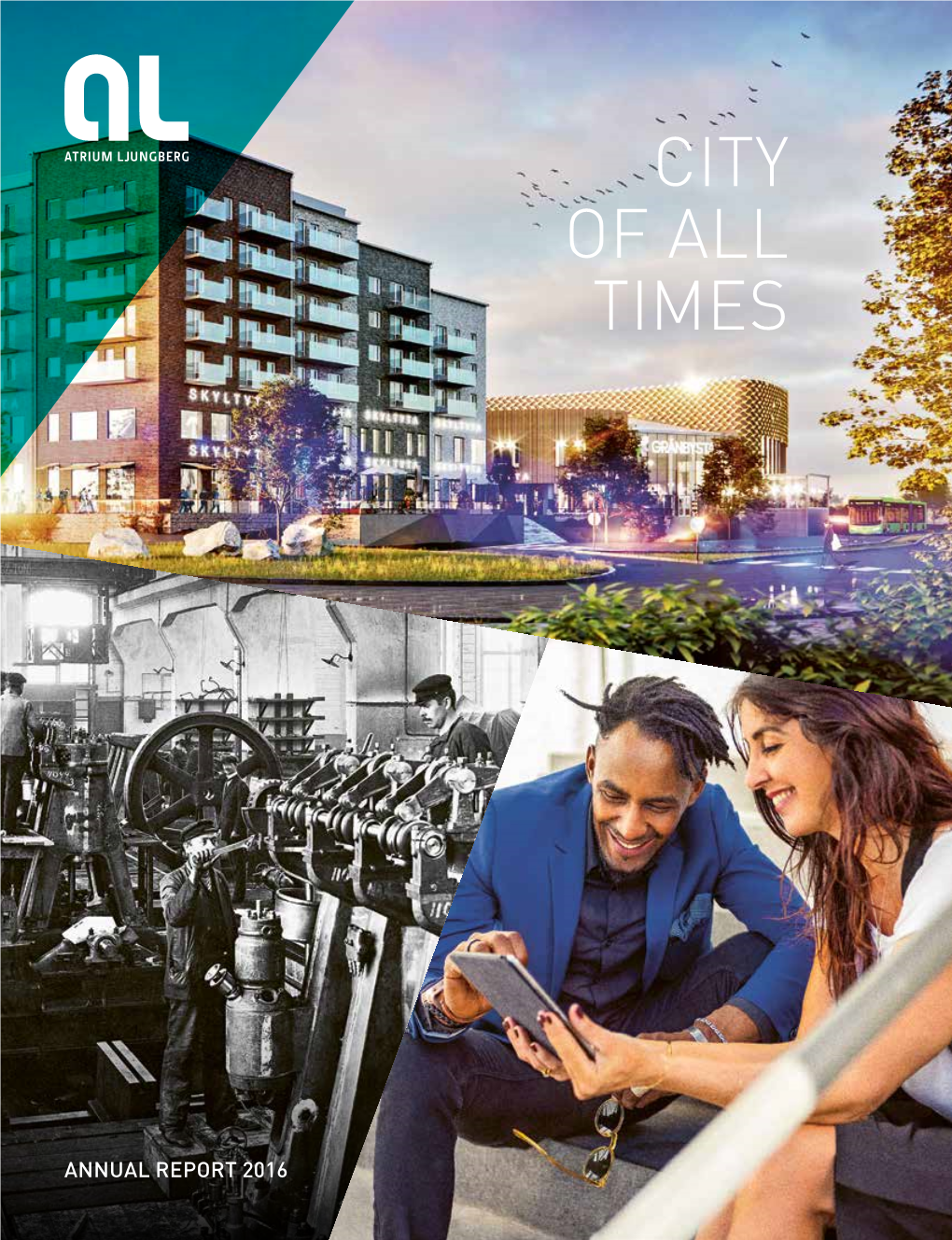

City of All Times

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Swedish Transport Administration Annual Report 2010 Contents

The Swedish Transport Administration Annual Report 2010 Contents A EVERYBODY ARRIVES SMOOTHLY, THE GREEN AND SAFE WAY Contents Contents Comments from the Director-General 4 B 1. The Swedish Transport Administration in brief 6 2. Transport developments 10 Traffic developments on roads and railways 11 Capacity and congestion 11 Traffic and weather 2010 12 3. The Swedish Transport Administration’s operations 2010 14 The Swedish Transport Administration’s efficiency measures 15 Planning for intermodal transports 16 Investments in roads and railways 17 Operation and maintenance of state roads and railways in accordance with the national plan 26 International work 36 Research and innovation 37 4. Transport policy goals 40 Functional objective Accessibility 42 Environment and health 50 Safe traffic 56 5. Employees 60 6. Other feedback 62 7. Financial report 66 Income and expenditure account 68 Balance sheet 69 Appropriation account 70 Statement of source and application of funds 72 Summary of key figures 73 Notes 74 8. Signing of the annual report 80 9. Auditors’ report 81 10. Board of directors 82 11. Management group 83 Comments from the Director-General Comments from the Director-General be solved in the future. When society chairman of the organisation committee changes, then the transport systems must and then elected as Director-General. The also change. This is why the initial focus was to guarantee ongoing Administration’s challenges are closely operations and to maintain contacts with linked to current developments in society. interested parties and the wider world. Climate changes will impact infra- Much effort was spent ensuring function- structure, at the same time as transports ality in the telecom and datacom system, impact the climate. -

From Boring Boxes to Beautiful Cost-Effective Houses a Study About Housing Development and Exterior Architectural Preferences

DEGREE PROJECT IN CIVIL ENGINEERING AND URBAN MANAGEMENT, REAL ESTATE AND CONSTRUCTION MANAGEMENT MASTER OF SCIENCE IN ENGINEERING, SECOND LEVEL, 30 CREDITS STOCKHOLM, SWEDEN 2017 From Boring Boxes to Beautiful Cost-Effective Houses A study about housing development and exterior architectural preferences Rebecca Granström and Sofia Wahlström KTH ROYAL INSTITUTE OF TECHNOLOGY DEPARTMENT OF REAL ESTATE AND CONSTRUCTION MANAGEMENT MASTER OF SCIENCE THESIS Title From Boring Boxes to Beautiful Cost-Effective Houses - A study about exterior architectural preferences and housing development Authors Rebecca Granström and Sofia Wahlström Department Real Estate and Construction Management Master Thesis Number TRITA-FOB-ByF-MASTER-2017:35 Archive Number 493 Supervisor Tina Karrbom Gustavsson Keywords exterior architecture, housing development, multifamily houses, aesthetics, environmental psychology, residential area ABSTRACT The last time Sweden did face a major housing shortage was during the 1960’s. As a solution to the housing shortage, The Million Homes Programme was initiated. The programme did manage to get rid of the housing shortage, but has received a lot of criticism concerning its architecture and environment since its completion. At the time for this study, Sweden is experiencing yet another housing crisis. In order to manage the housing shortage in a more successful way this time, it is important to not down- prioritise the exterior architecture. The exterior architecture plays an important role in creating both an aesthetical appealing and a social sustainable built environment. But the scarcity of housing makes it easy to sell the produced apartments, especially in the larger cities, which reduces the incentives for the developers to prioritise the aesthetics. -

Localisations of Logistics Centres in Greater Stockholm

Department of Real Estate and Construction Management Thesis no. 182 Real Estate Economics and Financial Services Master of Science, 30 credits Real Estate Economics MSs Localisations of Logistics Centres in Greater Stockholm Author: Supervisor: Gunnar Larsson Stockholm 2012 Hans Lind Master of Science thesis Title: Localisations of Logistics Centres in Greater Stockholm Author: Gunnar Larsson Department Department of Real Estate and Construction Management Master Thesis number 182 Supervisor Hans Lind Keywords Logistics, Stockholm, location, localisation factors, warehouse, terminal, logistics centres, logistics parks, future, scenario. Abstract This study examines how and on what basis logistics centres are located in Greater Stockholm. Its purpose is to formulate a possible future scenario regarding localisations of logistics centres in Greater Stockholm in 10-15 years. Goods transports, distribution, property characteristics, market trends, investment decisions, localisation factors, potential challenges, public plans, transport infrastructure and logistics locations have been investigated in order to form a conclusion. There is a wide range of previous research on most fields mentioned above. Yet there is a gap regarding a picture of them from a market perspective applied to Stockholm’s future. The research method is qualitative, involving 31 interviews (34 respondents) representing logistics companies, goods holders, property developers, investors, consultants and municipalities; as they are making the decisions of tomorrow, i.e. “choose” the locations. The qualitative approach has been complemented with descriptions of infrastructure, regional plans and reports in order to consolidate and complement facts and opinions from the interviews. Together they provide the basis for a final analysis and discussion followed by a possible future scenario of Greater Stockholm’s major logistics locations. -

FRÅN RUM TILL RUM Gestaltning Av Ett Stadsstråk I Sundbyberg

Institutionen för stad och land FRÅN RUM TILL RUM Gestaltning av ett stadsstråk i Sundbyberg ANNA GRONOW AVDELNINGEN FÖR LANDSKAPSARKITEKTUR EXAMENSARBETE VID LANDSKAPSARKITEKTPROGRAMMET UPPSALA 2016 Sveriges lantbruksuniversitet Fakulteten för naturresurser och jordbruksvetenskap Institutionen för stad och land, avdelningen för landskapsarkitektur, Uppsala Examensarbete för yrkesexamen på landskapsarkitektprogrammet EX0504 Självständigt arbete i landskapsarkitektur, 30 hp Nivå: Avancerad A2E © 2016 Anna Gronow, e-post: [email protected] Titel på svenska: Från rum till rum - Gestaltning av ett stadsstråk i Sundbyberg Title in English: From room to room - a design proposal for a city street in Sundbyberg Handledare: Ulla Myhr, institutionen för stad och land, SLU Examinator: Lars Johansson, institutionen för stad och land, SLU Biträdande examinator: Maria Wisselgren, institutionen för stad och land, SLU Övriga foton och illustrationer: Av författaren om inget annat anges. Samtliga bilder/foton/illustrationer/kartor i examensarbetet publiceras med tillstånd från upphovsman. Nyckelord: aktivitetspark, centrala Sundbyberg, design, esplanad, gestaltning, torg, överdäckning. Online publication of this work: http://epsilon.slu.se FÖRORD Under våren 2015 var jag med i en idétävling för unga skapad av Sundbybergs kommun. Tävlingen gick ut på att komma med en nyskapande idé för vad man kan göra på den plats som blir tillgänglig i staden när järnvägen läggs i en tunnel. Kommunen ville ha ungas idéer eftersom de var nyfkna på vad unga ville ha i sin kommun och vad som kunde få dem att fytta till Sundbyberg i framtiden. Jag kom på andraplats i idétävlingen med mitt förslag ”Uppe bland molnen”. När jag sedan skulle bestämma ett ämne för mitt examensarbete kändes det inspirarande att fortsätta med en gestaltning för samma plats. -

Government Communication 2011/12:56 a Coordinated Long-Term Strategy for Roma Skr

Government communication 2011/12:56 A coordinated long-term strategy for Roma Skr. inclusion 2012–2032 2011/12:56 The Government hereby submits this communication to the Riksdag. Stockholm, 16 February 2012 Fredrik Reinfeldt Erik Ullenhag (Ministry of Employment) Key contents of the communication This communication presents a coordinated and long-term strategy for Roma inclusion for the period 2012–2032. The strategy includes investment in development work from 2012–2015, particularly in the areas of education and employment, for which the Government has earmarked funding (Govt. Bill. 2011/12:1, Report 2011/12:KU1, Riksdag Communication 2011/12:62). The twenty-year strategy forms part of the minority policy strategy (prop. 2008/09:158) and is to be regarded as a strengthening of this minority policy (Govt. Bill 1998/99:143). The target group is above all those Roma who are living in social and economic exclusion and are subjected to discrimination. The whole implementation of the strategy should be characterised by Roma participation and Roma influence, focusing on enhancing and continuously monitoring Roma access to human rights at the local, regional and national level. The overall goal of the twenty-year strategy is for a Roma who turns 20 years old in 2032 to have the same opportunities in life as a non-Roma. The rights of Roma who are then twenty should be safeguarded within regular structures and areas of activity to the same extent as are the rights for twenty-year-olds in the rest of the population. This communication broadly follows proposals from the Delegation for Roma Issues in its report ‘Roma rights — a strategy for Roma in Sweden’ (SOU 2010:55), and is therefore also based on various rights laid down in international agreements on human rights, i.e. -

Urban Mobility Strategy

Urban Mobility Strategy English version stockholm.se/trafiken Urban Mobility Strategy 1 © 2012 City of Stockholm, the City of Stockholm Traffic Administration The City of Stockholm Traffic Administration Tekniska Nämndhuset, Fleminggatan 4 Box 8311, SE-104 20 Stockholm, Sweden Telephone: +46 (0) 8 508 27 200 www.stockholm.se/trafikkontoret Reg. No.: T2008-310-02378 Author: Daniel Firth, Traffic Administration Contents Introduction ................................................................................................................................................... 3 Overall strategy .............................................................................................................................................9 Objectives for world-class city streets ....................................................................................................17 Planning Aim A: Capacity .........................................................................................................................19 Objective A1: Transport capacity ........................................................................................................23 Objective A2: Public transport ............................................................................................................25 Objective A3: Cycling .............................................................................................................................27 Objective A4: Business users ................................................................................................................29 -

Ancillary Services 4.0: a Top-To-Bottom Control-Based Approach for Solving Ancillary Services Problems in Smart Grids

Received December 19, 2017, accepted January 31, 2018. Date of publication xxxx 00, 0000, date of current version xxxx 00, 0000. Digital Object Identifier 10.1109/ACCESS.2018.2805330 Ancillary Services 4.0: A Top-to-Bottom Control-Based Approach for Solving Ancillary Services Problems in Smart Grids GIULIA DE ZOTTI 1, S. ALI POURMOUSAVI2, (Member, IEEE), HENRIK MADSEN1, (Senior Member, IEEE), AND NIELS KJØLSTAD POULSEN1, (Senior Member, IEEE) 1Institut for Matematik og Computer Science, Danmarks Tekniske Universitet, 2800 Kongens Lyngby, Denmark 2Global Change Institute, The University of Queensland, Brisbane, QLD 4072, Australia Corresponding author: Giulia De Zotti ([email protected]) This work was supported in part by CITIES project under Grant DSF-1305-0027B and in part by the European Union's Horizon 2020 Smart-Net project under Grant 691405. ABSTRACT Power systems are experiencing a large amount of renewable generation with highly stochastic and partly unpredictable characteristics. This change in energy production implies significant consequences related to the provision of ancillary services (AS). Current markets dedicated to the provision of AS are not able to benefit from the flexible energy resources. They also cannot cope with the new level of stochasticity, non-linearity, and dynamics of generation and flexibility. To overcome such issues and exploit the potential of flexibility resources, a new strategy is required. In this paper, by capitalizing on flexibility resources' potential, AS 4.0 approach is proposed, which offers a comprehensive solution for the AS provision in the smart grid era. INDEX TERMS Ancillary services 4.0, flexible retail electricity price, smart grid, power system operation, peer-to-peer, control-based approach. -

Smart Territorial Mapping for Enhanced Multilevel Governance of S3: Inputs for Inter-Regional Learning Policy Learning Document

Integrating the territorial dimension for cohesive S3 Smart territorial mapping for enhanced multilevel governance of S3: Inputs for inter-regional learning Policy learning document October 2020 Prepared by Ainhoa Arrona, Miren Estensoro, Miren Larrea and James R. Wilson (Orkestra – Basque Institute of Competitiveness) Table of Content 1. Introduction 2 2. Background and aim of the Smart territorial mapping exercise 4 3. Smart territorial mapping: steps 9 3.1. Mapping multilevel specialization and governance 9 3.2. Assessment 10 4. Summary of results of smart territorial mapping exercise in Cohes3ion 12 4.1. The mapping: territorial levels, specialization capabilities, innovation actors and governance spaces 12 4.2. Assessment: strengths and areas of improvement 15 5. Summary 24 Appendixes 25 Appendix 1. Smart territorial map matrix 26 Appendix 2. Smart territorial map Assesment document 27 Appendix 3. Summary of conclusions by partner region 29 Appendix 4. Areas of improvement identified through Smart territorial map exercise in each region grouped by challenge 34 Appendix 5. Smart territorial map: Bizkaia 37 Appendix 6. Smart territorial map: Calabria 47 Appendix 7. Smart territorial map: Mazovia 60 Appendix 8. Smart territorial map: North West Romania 76 Appendix 9. Smart territorial map: Ruhr Metropolis 88 Appendix 10. Smart territorial map: Southern Region Ireland 100 Appendix 11. Smart territorial map: Region Stockholm 119 Appendix 12. Smart territorial map: Wales 133 Smart territorial mapping 1 1. Introduction Regional and national governments play a entrepreneurs) into discovery processes main role as managing authorities of smart supporting more effective policy. While regional specialization strategies (S3) in the European and national governments have a certain Union (EU). -

Annual Report 2019 Wallenstam AB

Contents This is This is Wallenstam 1 Strategic Direction Wallenstam This is how we create value 2 Business plan 2019–2023 4 Guiding principle Customer 6 Guiding principle Employee 7 Guiding principle Environment 8 Comments by the CEO 9 Vision Comments by the Chairman 12 Wallenstam shall be the natural choice of Board of Directors 14 people and companies for housing and Group Management 16 premises. The Wallenstam share 18 Investing in Wallenstam 22 Financial strategy 24 Business concept Responsible enterprise 27 We develop and manage people’s homes Risks that generate opportunities 34 and workplaces based on a high level of service and long-term sustainability in Operations and Markets selected metropolitan areas. Organization and employees 40 Market outlook 43 Property management 48 Goal Value of the properties 53 To achieve an increase in net asset value Value-creating construction 56 of SEK 40 per share through 2023. We are building here 62 Five-year summary 64 Core values Financial Reports Progress, respect, commitment. How to read our income statement 66 Administration report 67 Consolidated accounts 72 Group accounting principles and notes 76 Parent company accounts 112 Parent company accounting principles and notes 116 Auditor’s report 129 Corporate governance report 132 Property List Stockholm Business Area 138 Gothenburg Business Area 140 Completed new construction, acquisitions and sales 145 Wind power 145 Other Wallenstam’s GRI reporting 146 Annual General Meeting 2020 149 Glossary 149 Definitions see cover Calendar see cover Wallenstam’s statutory sustainability report is found on the following pages: business model pages 2–4, environmental questions pages 8, 27–33, 39 and 146–148, social conditions and personnel-related ques- tions pages 7, 27–35, 40–42 and 146–148, respect for human rights pages 27–33 and 147–148, anti-corruption pages 27–30, 32–33, 36 and 148 as well as diversity in the Board pages 42 and 133. -

Housing Supply for the Group Outside the Ordinary Housing Market

Master of Science in Spatial Planning June 2020 Housing Supply for the Group Outside the Ordinary Housing Market An analysis of the regional and the municipal planning in Sweden Harry Brar Faculty of Engineering, Blekinge Institute of Technology, 371 79 Karlskrona, Sweden This thesis is submitted to the Faculty of Engineering at Blekinge Institute of Technology in partial fulfilment of the requirements for the degree of Master of Science. Main field of study is Spatial Planning. The thesis is equivalent to 10 weeks of full time studies. The authors declare that they are the sole authors of this thesis and that they have not used any sources other than those listed in the bibliography and identified as references. They further declare that they have not submitted this thesis at any other institution to obtain a degree. Contact Information: Author: Harry Brar University advisor: Jimmie Andersén Department of Spatial Planning Faculty of Engineering Internet : www.bth.se Blekinge Institute of Technology Phone : +46 455 38 50 00 SE-371 79 Karlskrona, Sweden Fax : +46 455 38 50 57 ii Faculty of Engineering, Blekinge Institute of Technology, 371 79 Karlskrona, Sweden 3 Table of Contents ABBREVIATIONS .................................................................................................................................6 1 INTRODUCTION ..........................................................................................................................8 1.1 THE HOUSING SUPPLY ...............................................................................................................8 -

Urban Form and Sustainability Comparison Between Low-Rise "Garden Cities" and High-Rise "Compact Cities" of Suburban Areas

DEGREE PROJECT IN ENVIRONMENTAL ENGINEERING, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2019 Urban form and sustainability Comparison between low-rise "garden cities" and high-rise "compact cities" of suburban areas EFSTATHIA VLASSOPOULOU KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ARCHITECTURE AND THE BUILT ENVIRONMENT TRITA TRITA-ABE-MBT-19672 www.kth.se Urban form and sustainability Keywords: garden cities, compact cities, sustainability, density, life-cycle assessment, sustainability performance indicators Degree project course: Strategies for sustainable development, Second Cycle AL250X, 30 credits Author: Efstathia Vlassopoulou Supervisors: Tove Malmqvist (KTH) Gustaf Edgren (TMF) Examiner: Sara Borgström Department of Sustainable Development, Environmental Science and Engineering School of Architecture and the Built Environment KTH Royal Institute of Technology Abstract Urbanization and climate change are two of the most important issues of our days. Many attempts have been made to define the most sustainable way to organise cities in order to cope with the increased population, while simultaneously being climate friendly, socially acceptable and economically viable. This master thesis focuses on the comparison of the sustainability performance of two particular theoretically planned urban forms, located in the suburban area of Stockholm – a “compact city”-like neighborhood and a “garden-city”-like neighbourhood. It was decided that the focus would be on the carbon footprint of the representative residences of each urban form, with -

Socially Sustainable Planning for Ursvik's Development and Integration

DEGREE PROJECT IN THE BUILT ENVIRONMENT, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2018 Socially Sustainable Planning for Ursvik’s Development and Integration KRISTEN VERONICA KOEHLER KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ARCHITECTURE AND THE BUILT ENVIRONMENT TRITA TRITA-ABE-MBT-18277 www.kth.se Socially Sustainable Planning for Ursvik’s Development and Integration Kristen Koehler Socialt hållbar planering för Ursviks utveckling och integration Degree Project in Urban and Regional Planning, Second Cycle, AG212X, 30 credits Supervisor: Stefan Lundberg Examiner: Hans Westlund Department of Urban Planning and Environment. Division of Urban and Regional Studies. School of Architecture and the Built Environment. KTH Royal Institute of Technology Abstract As the City of Stockholm continues to grow, there is a looming fear that there will not be enough housing for a growing population. Municipalities within Stockholm County are building up their housing stock to contribute solutions to the infamous housing crisis that is on the rise. With this increase of built development, there is also a faint shadow of the Million Homes Project problems that daunts new projects. The last time the city of Stockholm had built up so much new development, some of the Million Homes Project neighborhoods descended into segregated and vulnerable areas. This project looks at how Riksbyggen, a housing developer, can build housing developments that align with social sustainability practices for integrated neighborhoods, in order to avoid the process of segregation. The research focuses on the study area of Ursvik, a residential neighborhood that has plans to grow by 15,000 new residents in the next 10-15 years.