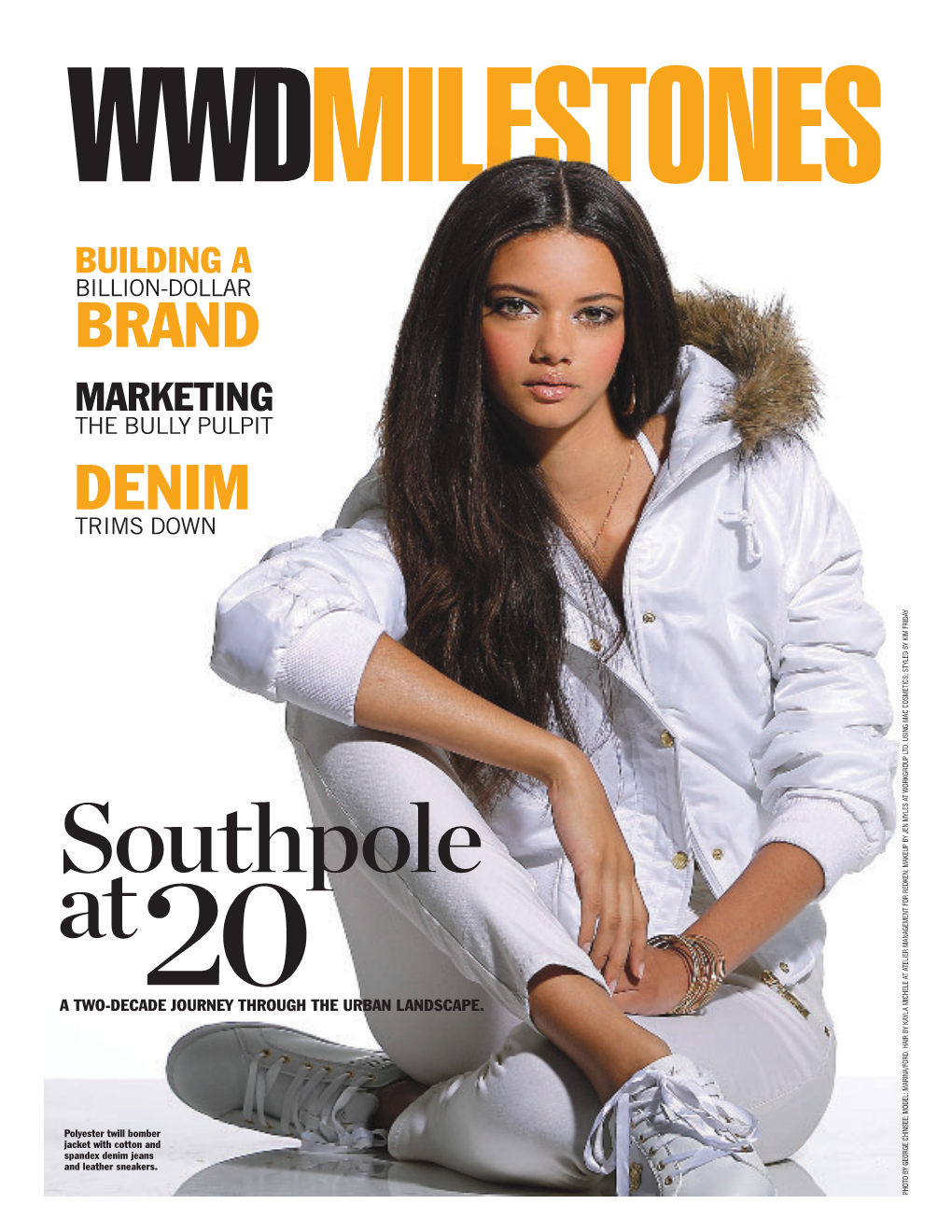

Southpole At

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scaling-Up Climate Change Mitigation Efforts and Prospects for Namas in the Waste Sector

Regional Workshop on Nationally Appropriate Mitigation Actions in Asia and the Pacific: Scaling-up climate change mitigation efforts and prospects for NAMAs in the waste sector 18 and 19 March 2014, Bangkok, Thailand BACKGROUND PAPER Disclaimer The designations employed and the presentation of the material in this report do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or its authorities, or concerning the delimitation of its frontiers or boundaries. The content and views expressed in this publication are those of the authors and not necessarily reflect the views or policies, or carry the endorsement of the United Nations. Reference to a commercial entity or product in this publication does not imply endorsement. Trademark names and symbols are used in an editorial fashion with no intention on infringement on trademark and copyright laws. The publishing organization does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any consequence of their use. This paper was prepared without formal editing and for the sole purpose of providing background information and facilitating discussions at the Regional Workshop. 1 I. Introduction and context The Regional Workshop on “Nationally Appropriate Mitigation Actions in Asia and the Pacific: Scaling-up climate change mitigation efforts and prospects for NAMAs in the waste sector” is organized in the context of the project “Pro-poor and sustainable solid waste management in secondary cities and small towns”, implemented by ESCAP in partnership with Waste Concern. -

PERSONAL INFORMATION Sina Wartmann Sina

PERSONAL INFORMATION Sina Wartmann Sina (Silke Christina) Wartmann Ltd., 201 Avonvale Rd., Bristol, BS59SR, United Kingdom (0044) 07565 183 163 [email protected] Sex: Female | Nationality: German PROFILE Sina Wartmann is an international expert in the fields of emission monitoring, reporting and verification (MRV) / Transparency with 17 years international of work experience in this area. She holds a Diploma in Industrial Engineering from the Technical University of Karlsruhe. Sina has excellent insight into the set-up and enhancement of MRV systems for GHG emissions, mitigation actions and support. She is currently supporting Kenya in setting up its national MRV system (GNIplus) and three Mexican States with their GHG inventory and mitigation MRV, she also supported Lebanon in setting up an MRV of support system under Clima South. She heavily contributed to the development of the MRV requirements under the EU-Emission Trading System between 2002-2012. Sina also has an excellent understanding of GHG inventory compilation, including based on the IPCC 2006 Guidelines and the IPCC Software. She has supported a number of countries in enhancing their national GHG inventories, e.g. Lebanon, Palestine, Chile, the Dominican Republic, Bangladesh, Vietnam, Perú. She also supports cities with GHG inventory compilation using the GPC Standard. She regularly attends the international climate negotiations under the UNFCCC, including as part of country delegations. This gives her an excellent insight into requirements related to the existing MRV framework and its transition to the future reporting requirements under the Paris Agreement’s Enhanced Transparency Framework (ETF) and its Modalities, Processes and Guidelines (MPGs), which are still under discussion. -

Calm Down NEW YORK — East Met West at Tiffany on Sunday Morning in a Smart, Chic Collection by Behnaz Sarafpour

WINSTON MINES GROWTH/10 GUCCI’S GIANNINI TALKS TEAM/22 WWDWomen’s Wear Daily • The Retailers’MONDAY Daily Newspaper • September 13, 2004 • $2.00 Accessories/Innerwear/Legwear Calm Down NEW YORK — East met West at Tiffany on Sunday morning in a smart, chic collection by Behnaz Sarafpour. And in the midst of the cross-cultural current inspired by the designer’s recent trip to Japan, she gave ample play to the new calm percolating through fashion, one likely to gain momentum as the season progresses. Here, Sarafpour’s sleek dress secured with an obi sash. For more on the season, see pages 12 to 18. Hip-Hop’s Rising Heat: As Firms Chase Deals, Is Rocawear in Play? By Lauren DeCarlo NEW YORK — The bling-bling world of hip- hop is clearly more than a flash in the pan, with more conglomerates than ever eager to get a piece of it. The latest brand J.Lo Plans Show for Sweetface, Sells $15,000 Of Fragrance at Macy’s Appearance. Page 2. said to be entertaining suitors is none other than one that helped pioneer the sector: Rocawear. Sources said Rocawear may be ready to consider offers for a sale of the company, which is said to generate more than $125 million in wholesale volume. See Rocawear, Page4 PHOTO BY GEORGE CHINSEE PHOTO BY 2 WWD, MONDAY, SEPTEMBER 13, 2004 WWW.WWD.COM WWDMONDAY J.Lo Talks Scents, Shows at Macy’s Accessories/Innerwear/Legwear By Julie Naughton and Pete Born FASHION The spring collections kicked into high gear over the weekend with shows Jennifer Lopez in Jennifer Lopez in from Behnaz Sarafpour, DKNY, Baby Phat and Zac Posen. -

Climate Chatter

Climate Chatter Carbon Credits & Carbon Pricing in Asia Pacific 27 May 2020 Welcome to our Climate Chatter - Carbon Credits & Carbon Pricing in Asia Pacific ● Default audio setting: mute on joining ● Questions via the Question box are welcome at any time ○ Technical support: we will aim to resolve ASAP ○ Topic-related questions for the discussion: Q&A at the end. If we cannot answer your question in the Q&A we will get in touch via email ● Many of us are broadcasting from our homes. Please bear with us in case of technical issues 2 3 Who We Are South Pole helps clients address climate change impacts, while mitigating risk and creating value on their sustainability journey Innovative Diverse Project Solutions Expertise Developer Across 19 offices, An award winning, our team of 350+ Largest developer 14-year history of sustainability of emission providing advisors, scientists, reduction projects sustainability and engineers are globally solutions leading experts in their fields 4 Your Panel Host Leah Wieczorek Business Development Manager - Asia South Pole Speakers John Davis Jeff Swartz Peter Zaman Commercial Director - Asia Pacific Director Climate Policy Partner South Pole and Carbon Pricing Reed Smith South Pole 5 Climate Ambition and Voluntary Carbon Market Trends in Asia Pacific John Davis Commitments by country in Asia Carbon reduction goals Japan India 26% cut in Malaysia 33–35% cut in emissions emissions based on based on 2013 45% cut in 2005 levels by 2030 levels by 2030 emissions based on 2005 levels by 2030 China Singapore Indonesia -

2004 Outstanding 50 Asian Americans in Business Awards

Organizer: Sponsors: IBM . The New York Times . Verizon 2004 Outstanding Con Edison . McGraw-Hill . Fleet bank . Time Warner Colgate-Palmolive . BDO Siedman 50 Asian Americans in Planning Committee Chairman* and Members: Business Awards *Savio S. Chan, President & CEO, US China Partners, Inc. Mahesh Krishnamurti, Former Publisher/CFO, Worth Media James Y. Wohn, Senior Vice President, Fleet Bank June Jee, Director of Manhattan Community Affairs, Verizon Communications Walter Shay, Manager, Strategic Partnership, Con Edison John Kyriakides, Partner, BDO Seidman Jennifer Pauley, Assistant Director, Community Affairs, The New York Times V.M. Gandhi, President, New York Gold Company Thomas Chin, President, Accolade Technologies, LLC Govind Srivastava, CEO, Knowledge Resources, Inc. Message from the Event Chairman The Third Annual Outstanding 50 Asian Americans in Business Award Dinner provides a unique opportunity to pay tribute to those Asian American Entrepreneurs and professionals who demonstrate a commitment to making a difference in our community. Each year the Asian American Business Development Center takes this opportunity to honor outstanding, dedicated and well-deserving leaders in the New York tri-states areas. For 2004, some of the New York‘s best-known and well-respected executives are being recognized for their contributions. This year’s Pinnacle Award will be presented to Mr. Ted Teng, President and COO of Wyndham International. Mr. Teng has a distinguished career and is one of the SAVIO CHAN highest-ranking Asian executives from a publicly-traded company in the United Event Chairman States. He is recognized for his support and advocacy for the Asian community and has given his valuable time back to the community by serving on the various boards in many not-for-profit organizations. -

IR World Map.Mxd

180° W 150° W 120° W 90° W 60° W 30° W 0° 30° E 60° E 90° E 120° E 150° E 180° E 90° N 90° N NORTH POLE ARCTIC OCEAN INTERNATIONAL GREENLAND SVALBARD D A T JAN E L MAYEN I N E PRIME MERIDIAN ARCTIC CIRCLE ARCTIC CIRCLE FAROE ICELAND ISLANDS SWEDEN FINLAND RUSSIA NORWAY 60° N 60° N NORTH ESTONIA LATVIA DENMARK CANADA UNITED LITHUANIA ATLANTIC IRELAND KINGDOM NETHERLANDS BELARUS POLAND I N T E R ISLE OF MAN BELGIUM GERMANY N A CZECH REP T UKRAINE I O OCEAN GUERNSEY N LIECHTENSTEIN SLOVAKIA A LUXEMBOURG L AUSTRIA HUNGARY MOLDOVA KAZAKHSTAN JERSEY DATE LINE FRANCE SWITZERLAND SLOVENIA ROMANIA MONGOLIA SAN MARINO CROATIA ANDORRA SERBIA & ST. PIERRE & BOSNIA & MONTENEGRO MIQUELON ITALY HERZEGOVINA BULGARIA GEORGIA UZBEKISTAN NORTH UNITED MONACO KYRGYZSTAN NORTH SPAIN VATICAN AZERBAIJAN PORTUGAL MACEDONIA KOREA CITY ALBANIA TURKEY TURKMENISTAN TAJIKISTAN PACIFIC GREECE ARMENIA STATES GIBRALTAR SOUTH BERMUDA MALTA CYPRUS SYRIA CHINA KOREA TUNISIA LEBANON AFGHANISTAN JAPAN OCEAN MOROCCO WEST BANK IRAQ IRAN PACIFIC GAZA STRIP JORDAN 30° N 30° N ISRAEL PAKISTAN NEPAL ATLANTIC ALGERIA KUWAIT BHUTAN LIBYA EGYPT BAHRAIN OCEAN TURKS & PUERTO RICO WESTERN UNITED ARAB MIDWAY IS. TROPIC OF CANCER SAUDI TROPIC OF CANCER MEXICO THE BAHAMAS CAICOS IS. SAHARA EMIRATES BANGLADESH BRITISH VIRGIN IS. QATAR INDIA CUBA DOMINICAN WAKE I. ANGUILLA ST. KITTS & NEVIS OCEAN ARABIA CAYMAN IS. REPUBLIC MYANMAR MONTSERRAT OMAN CAPE MAURITANIA LAOS NORTHERN BELIZE ANTIGUA & VERDE MALI MARIANA HAITI VIRGIN IS. BARBUDA NIGER ISLANDS JAMAICA GUADELOUPE CHAD ERITREA HONDURAS NETHERLANDS MARTINIQUE YEMEN THAILAND VIETNAM ANTILLES DOMINICA SENEGAL JOHNSTON ATOLL ST. -

True Strengthstrength

Fall 2017 TRUETRUE STRENGTHSTRENGTH Mike Nichols’ life was upended after he shattered a vertebra during a hockey game in 2014. But with an incredible positive attitude, the MCC student has bounced back. He’s studying com- municatons and has started the Mikey Strong Foundation to fund treatment. See page 6. CAMPUS NEWS Terri Orosz Honored with Community College Spirit Award The New Jersey Council of County Colleges (NJCCC) Guided Pathways and Middle States accreditation. presented the 2017 Community College Spirit Award to Dr. Orosz is a community college graduate herself. Theresa Orosz, assistant dean in the Division of Arts She received an A.A.S. in Accounting from MCC; a B.S. and Sciences at MCC, for her exemplary support of New in Management Science and an M.A. in Liberal Studies Jersey’s community colleges. from Kean University; and a Doctorate in Educational The award was presented in June during its annual New Leadership from Rowan University. Jersey Community College Awards Ceremony, which also honored Raritan Valley Community College Assistant Professor Kathryn Suk with a Spirit Award. “Since its inauguration in 1993, the Community College Spirit Award has been an honor bestowed to those who embody the community college spirit – perseverance, dedication and excellence,” said NJCCC Chair Helen Albright. Dr. Orosz was recognized for working with the New Jersey Center for Student Success, specifically for helping develop the Center’s two-year strategic plan and serving as a co-presenter at several national community college student success conferences. She has 25 years of experience working with From left: MCC President Joann La Perla-Morales; Helen Albright, chair community colleges, including in Academic and Student of the New Jersey Council of County Colleges; Student Success Executive Affairs, Academic Advising, Career Services, and Director Christine Harrington, who accepted the award on behalf of Kath- Continuing Education. -

HIP HOP and SCHOOLING and the IMPACT on AFRICAN AMERICAN IDENTITY and ACADEMIC ACHIEVEMENT By

A TALE OF TWO CULTURES: HIP HOP AND SCHOOLING AND THE IMPACT ON AFRICAN AMERICAN IDENTITY AND ACADEMIC ACHIEVEMENT by BARBARA S. WISNIEWSKI DISSERTATION submitted to the Graduate School of Wayne State University, Detroit, Michigan In partial fulfillment of the requirements For the degree of DOCTOR OF PHILOSOPHY 2011 MAJOR: EDUCATIONAL EVALUATION AND RESEARCH Approved by: Advisor Date UMI Number: 3456076 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent on the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. UMI 3456076 Copyright 2011 by ProQuest LLC. All rights reserved. This edition of the work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC. 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, MI 48106 - 1346 © COPYRIGHT BY BARBARA S. WISNIEWSKI 2011 All Rights Reserved ACKNOWLEDGMENTS At the end of the long road to this dissertation, nothing is more deserving of acknowledgement than the people who supported and championed me along the way. First, and foremost, I give thanks to the Lord for giving me the strength and determination to get through this endeavor and for being the foundation of all that I do. I am indebted to my amazing advisor and committee Chair, Dr. Karen L. Tonso, who was an advocate for me from the launching of my doctoral thesis and whose support and astuteness steered me around the most problematical corners. -

Kingsborough Community College Annual Report

KINGSBOROUGH COMMUNITY 2017COLLEGE ANNUAL REPORT KINGSBOROUGH COMMUNITY COLLEGE | ANNUAL REPORT 2017 1 2 KINGSBOROUGH COMMUNITY COLLEGE | ANNUAL REPORT 2017 by distinguished and award-winning faculty, who also conduct research and publish. And our dedicated staff never waver in their commitment to enhancing student success. All of this hard work, progressive thinking, and dynamic innovation continue to attract national attention. Kingsborough has once again been identified as one of the top 50 community colleges in the nation by the Aspen Institute College Excellence Program, allowing us to compete for a top prize of one million dollars. We have also been named a Leader College by the national nonprofit Achieving the Dream. Some of the most exciting conversations on campus are about our relaunch of this initiative with a critical new focus on equity. As we take pride in our achievements, we also honor the generosity of the many individuals and institutions who have invested in the future of our students. Last year more than 1,500 students received scholarships totaling over $798,000. A LETTER FROM THE PRESIDENT Students who considered dropping out due to sudden crises at home were able to stay in school, thanks to student emergency grants underwritten Dear Friends by the Carroll and Milton Petrie Foundation. Other students struggling with chronic personal, financial of Kingsborough: or legal hardships were able to stay on track to graduate thanks to programs like Single Stop and I am very proud to share our 2016-2017 Annual SPARK, both funded by the Heckscher Foundation. Report with you. Many of the initiatives Our work doesn’t begin and end on campus. -

Tree Planting by Businesses

REPORT 2020 TREE PLANTING BY BUSINESSES in France, Switzerland and the UK A study to inspire corporate commitments © Adobe Stock / lovelyday12 Stephanie Mansourian and Daniel Vallauri What a friend we have in a tree, the tree is the symbol of hope, self improvement and what people can do for themselves. Professor Wangari Maathai Winner of the 2004 Nobel Peace Prize Acknowledgements: We would like to thank all interviewees for this study: Marine d’Allancé, Benjamin de Poncheville and James Rawles from WWF France, Claude Fromageot (Groupe Rocher), Jonathan Guyot (all4trees), Valentin Hervouet and Thierry Rabenandro (Planète Urgence), Jan Heusser (Coop), Owen Keogh (Sainsbury’s), Sarah Megahed (Livelihoods Carbon Funds) and Naomi Rosenthal (South Pole). We would also like to thank the following WWF staff: Rina Andrianarivony (WWF Madagascar), Anna Kitulagoda (WWF-UK), Stuart Dainton (WWF-UK & Trillion Trees), Christopher Eves (WWF-UK), Katrin Oswald (WWF-Switzerland) and Anita Diederichsen (WWF International) for their valuable inputs to earlier drafts. Thanks are also extended to Sarah Blanford, Celia Cole and Harriette Roberts from Sainsbury’s, Emily Sharples from South Pole and Marion Daras from Livelihoods Carbon Funds who provided additional inputs. Disclaimer: Any errors or misinterpretations associated with the interviews are entirely those of the authors. Published in 2020 by WWF-France. © Text 2020 WWF All rights reserved Any reproduction in full or in part must mention the title and credit the abovementioned publisher as the copyright owner. Layout by Sambou-Dubois WWF is one of the world’s largest and most experienced independent conservation organizations, with over 5 million supporters and a global Network active in more than 100 countries. -

Global Powers of Luxury Goods 2020 the New Age of Fashion and Luxury Contents

Global Powers of Luxury Goods 2020 The new age of fashion and luxury Contents Foreword 3 Quick statistics 4 The new age of fashion and luxury 5 Top 10 highlights 17 Top 100 24 Geographic analysis 31 Product sector analysis 37 New entrants 42 Fastest 20 43 Study methodology and data sources 45 Endnotes 47 Contacts 50 Foreword Welcome to the seventh edition of Global Powers of Luxury Goods. At the time of writing, the COVID-19 pandemic has inflicted many losses: human, social and economic. What we are now experiencing is an unprecedented moment of crisis in modern history. However, it is during uncertain times that companies often come up with new ideas, converting the crisis into an opportunity, and adopting a long-term vision of future challenges. This prolonged disruptive situation is creating profound changes in consumer behavior and how companies are responding to these changes—prompting a debate about the future of the fashion and luxury industry. There is a general feeling of rethinking luxury and driving it in new directions, considering which business models will be feasible and more relevant in the new normal. Tradition and responsiveness, two elements that have always characterized luxury companies, will both be required to face great challenges in the post-COVID environment. We see the pandemic acting as a divider between the old way of doing business and the new scenario that is taking shape, characterized by changing consumer behavior. Hence, in this report, we talk about a new age for fashion and luxury and will explore the main trends that will drive the industry in the coming months. -

Catalog-2012-2013.Pdf

22/10/2018 https://www.course-catalog.com/mcc/admin/includes/catalogs/Catalog-2012-2013-1540189586.html General Information Address, Foreword and Leadership MAIN CAMPUS 2600 Woodbridge Avenue P.O. Box 3050 Edison, New Jersey 08818-3050 732.548.6000 NEW BRUNSWICK CENTER 140 New Street New Brunswick, NJ 08901 732.745.8866 PERTH AMBOY CENTER 60 Washington Street Perth Amboy, NJ 08861 732.324.0700 FOREWORD The catalog is the contract between the College and the student. This catalog provides information for students, faculty, and administrators regarding the College’s policies. Requirements, course offerings, schedules, activities, tuition and fees in this catalog are subject to change without notice at any time at the sole discretion of the administration. Such changes may be of content of any of the foregoing; and the cancellation of a schedule of classes or other academic activities. Payment of tuition or attendance in any class shall constitute a student's acceptance of the administratio n's rights as set forth above. The office of the Registrar prepares the catalog. Any questions about its contents should be directed to the Registrar in Chambers Hall. The most current information can be found on the MCC website: www.middlesexcc.edu MIDDLESEX COUNTY BOARD OF CHOSEN FREEHOLDERS Christopher D. Rafano, Freeholder Director Ronald G. Rios, Deputy Director Carol Barrett Bellante Stephen J. Dalina H. James Polos Charles E. Tomaro Blanquita Valenti MIDDLESEX COUNTY COLLEGE BOARD OF TRUSTEES Dorothy K. Power, Chairman Thomas Tighe, Vice Chairman Mark J. Finkelstein, Treasurer Robert Sica, Secretary Frank T. Antisell Charles Hahn ’12 George J.