Sunny Optical Technology Version 1 | Bloomberg: 2382 HK Equity | Reuters: 2382.HK Refer to Important Disclosures at the End of This Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Tech Biweekly Vol.22 May 6, 2020 Smartphone – Lens Sets Growth Driven by Multi-Camera

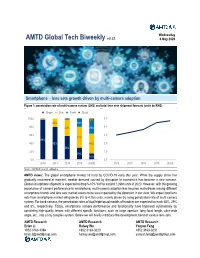

Wednesday AMTD Global Tech Biweekly vol.22 6 May 2020 Smartphone – lens sets growth driven by multi-camera adoption Figure 1: penetration rate of multi-camera system (LHS) and total lens sets shipment forecast (units bn/RHS) - Single - Dual - Triple - Quad 100% 5.0 2% 2% 1% 8% 20% 19% 80% 40% 29% 4.0 60% 3.0 51% 98% 40% 80% 48% 2.0 58% 20% 1.0 29% 16% 0% 0.0 2016 2017 2018 2019 2020E 2016 2017 2018 2019 2020E Source: AMTD Research estimates AMTD views: The global smartphone market hit hard by COVID-19 early this year. While the supply chain has gradually recovered at moment, weaker demand caused by disruption to economics has become a new concern. Global smartphone shipment is expected to drop 5-10% YoY to around 1.26bn units in 2020. However, with the growing importance of camera performance to smartphone, multi-camera adoption has become mainstream among different smartphone brands and lens sets market seems to be less impacted by the downturn in our view. We expect total lens sets from smartphone market will grow by 5% to 4.7bn units, mainly driven by rising penetration rate of multi-camera system. For back camera, the penetration rates of dual/triple/quad models of handset are expected to reach 48%, 29% and 8%, respectively. Today, smartphone camera performance and functionality have improved substantially by combining high-quality lenses with different specific functions, such as large aperture, long focal length, ultra-wide angle, etc., into a tiny complex system. Below we will briefly introduce the development trend of various lens sets. -

Hang Seng Indexes Announces Index Review Results

10 November 2017 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 September 2017. All changes will be effective on 4 December 2017 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company 2007 Country Garden Holdings Co. Ltd. 2382 Sunny Optical Technology (Group) Co. Ltd. Removal: Code Company 135 Kunlun Energy Co. Ltd. 293 Cathay Pacific Airways Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. Inclusion: Code Company 2238 Guangzhou Automobile Group Co., Ltd. - H Shares Removal: Code Company 916 China Longyuan Power Group Corporation Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results/ 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 289 to 291. Inclusion: Code Company Size Industry ZhongAn Online P & C Insurance 6060 MidCap Financials Co., Ltd. – H Shares 6088 FIT Hong Teng Ltd. MidCap Information Technology Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 491 to 493. -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

2016Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2016 REPORT For the six months ended 30 June 2016 Value Partners Limited 9th Floor, Nexxus Building 41 Connaught Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartners-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-9 Statement of financial position (unaudited) 10 Investment portfolio (unaudited) 11-15 Investment portfolio movements (unaudited) 16 SEMI-ANNUAL REPORT 2016 For the six months ended 30 June 2016 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law 9th Floor, Nexxus Building Maples and Calder 41 Connaught Road Central 53rd Floor, The Center Hong Kong 99 Queen’s Road Central Hong Kong Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law Mr. Ho Man Kei, Norman King & Wood Mallesons Mr. So Chun Ki Louis 13th Floor, Gloucester Tower The Landmark Trustee, Registrar, Administrator and 15 Queen’s Road Central Principal Office Hong Kong Bank of Bermuda (Cayman) Limited P.O. -

SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 2382.HK)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 2382.HK) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2019 RESULT HIGHLIGHTS The Group’s unaudited consolidated revenue for the six months ended 30 June 2019 was approximately RMB15,574.9 million, representing an increase of approximately 30.0% as compared with the corresponding period of last year. The increase in revenue was mainly benefited from the Group’s further development in smartphone related businesses and rapid growth in the vehicle imaging and sensing fields. The gross profit for the six months ended 30 June 2019 was approximately RMB2,864.0 million, representing an increase of approximately 23.4% as compared with the corresponding period of last year. The gross profit margin was approximately 18.4%. The net profit for the six months ended 30 June 2019 increased by approximately 20.4% to approximately RMB1,432.4 million as compared with the corresponding period of last year. The net profit margin was approximately 9.2%. FINANCIAL RESULTS The board (the “Board”) of directors (the “Directors”, each a “Director”) -

All Web Holdings 092018.Xlsx

Percent of Total Holdings VanEck – Emerging Markets Equity UCITS 30/9/2018 U.S. Dollar Security Name Port. Weight Total 100.00 Alibaba Group Holding Ltd. 6.75 Tencent Holdings Ltd. 6.48 Ping An Insurance (Group) Company of China, Ltd. 5.08 Samsung Electronics Co., Ltd. 4.72 HDFC Bank Limited 4.40 Naspers Limited 3.80 CIE Automotive, S.A. 2.57 Galaxy Entertainment Group Limited 2.04 Kweichow Moutai Co., Ltd. 1.85 Huazhu Group Ltd. 1.68 Malaysia Airports Holdings Bhd. 1.65 CP All Public Co. Ltd. 1.63 Ayala Land Inc. 1.56 Sberbank Russia OJSC 1.51 Focus Media Information Technology Co., Ltd. 1.45 Samsung SDI Co., Ltd 1.44 PT Bank Rakyat Indonesia (Persero) Tbk 1.44 Beijing Enterprises Water Group Limited 1.42 Fleury SA 1.28 Unifin Financiera SAB de CV SOFOM ENR 1.27 Transaction Capital Ltd. 1.27 Srisawad Corporation Public Company Limited 1.25 Baozun, Inc. 1.24 A-Living Services Co., Ltd. 1.24 China Maple Leaf Educational Systems Ltd. 1.22 Chroma Ate Inc. 1.20 Itau Unibanco Holding S.A. 1.19 International Container Terminal Services, Inc. 1.15 Cholamandalam Investment & Finance Co. Ltd. 1.15 Sunny Optical Technology (Group) Co., Ltd. 1.12 Fu Shou Yuan International Group Ltd. 1.11 Regional, S.A.B. de C.V. 1.11 China Zhengtong Auto Services Holdings Limited 1.09 Bloomberry Resorts Corporation 1.06 Beijing Capital International Airport Co., Ltd. 1.04 Yandex NV 1.00 Bank of Georgia Group Plc 0.99 POYA International Co., Ltd. -

SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 2382.HK)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (incorporated in the Cayman Islands with limited liability) (Stock code: 2382.HK) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2017 RESULT HIGHLIGHTS The Group’s unaudited consolidated revenue for the six months ended 30 June 2017 was approximately RMB10,031.7 million, representing an increase of approximately 69.8% as compared with the corresponding period of last year. The increase in revenue was mainly benefited from the Group’s development in the smartphone related business and vehicle imaging field. The gross profit for the six months ended 30 June 2017 was approximately RMB2,069.7 million, representing an increase of approximately 109.5% as compared with the corresponding period of last year. The gross profit margin for the six months ended 30 June 2017 was approximately 20.6%. The net profit for the six months ended 30 June 2017 increased by approximately 149.7% to approximately RMB1,161.0 million as compared with the corresponding period of last year. The increase in net profit was mainly due to the increased gross profit and the effective control over operating expenses. The net profit margin for the six months ended 30 June 2017 was approximately 11.6%. -

Sunny Optical (2382 HK) ELECTRICAL EQUIPMENT

9 March 2017 EQUITIES Sunny Optical (2382 HK) ELECTRICAL EQUIPMENT Hold: Strong February shipments mostly priced-in Hong Kong Jan-Feb handset camera module and vehicle lens shipments HOLD tracking slightly ahead But growth momentum has started to slow down TARGET PRICE (HKD) PREVIOUS TARGET (HKD) 55.00 Maintain Hold with TP of HKD55 SHARE PRICE (HKD) UPSIDE/DOWNSIDE Strong February handset camera module and vehicle lens shipments. Sunny 51.60 +6.6% Optical reported February shipment data for its three major product lines (handset (as of 09 Mar 2017) camera modules (HCM), handset camera lens (HCL), and vehicle lens) today after MARKET DATA market close. February HCM shipments were 29.4m (down 8% MoM but up 144% Market cap (HKDm) 56,605 Free float 55% YoY) on fewer working days in February. January and February total shipments were Market cap (USDm) 7,286 BBG 2382 HK 3m ADTV (USDm) 38 RIC 2382.HK 61.2mn (up 121% YoY). This accounted for17%/19% of our (up 34% YoY) and consensus (up 20% YoY) 2017 shipment estimates, tracking ahead, thanks to FINANCIALS AND RATIOS (CNY) Year to 12/2015a 12/2016e 12/2017e 12/2018e continuous market share gains from its peers. February handset camera lens (HCL) HSBC EPS 0.70 1.16 1.67 2.11 shipments came in at 41.4m (down 4% MoM, up 98% YoY). January to February HSBC EPS (prev) - - - - Change (%) - - - - accumulated HCL shipments were 84.3mn (up 93% YoY), in-line with what we are Consensus EPS 0.69 1.12 1.62 2.14 expecting in terms of the full year, or 17%/17% of our 2017 shipment forecasts (up PE (x) 65.3 39.7 27.6 21.7 Dividend yield (%) 0.3 0.5 0.7 0.9 31% YoY) and consensus (up 28% YoY), respectively. -

HSBC Saudi Arabia

HSBC Saudi Arabia HSBC China & India Equity Freestyle Fund - IAF Fund Details Monthly Factsheet Fund Manager HSBC Saudi Arabia as of 31 December 2017 Inception Date 12 December 2005 Profile Inception Price USD 10 To provide capital appreciation through investing in a well-diversified portfolio comprising of shares in Indian and Chinese companies over a long period of five years and above . Fund Type Open ended Investment Policy Freestyle Management Top Holdings (as of 1st valuation day of 4th Quarter 2017) Base Currency US Dollar Stock Weight % of the Fund Alibaba Group Holding Ltd. 10 Risk/Return Profile High Tencent Holdings Ltd. 10 Bloomberg Code SABCHIN AB Infosys Ltd. 6 Baidu Inc. Sponsored ADR 5 Zawya Code HSBCIEF.MF Sunny Optical Tech Group 4 Fund Size (USD) 43 Million Maruti Suzuki India Ltd 4 Minimum Initial USD 2,000 HCL Technologies Ltd. 4 Investment China Mobile Ltd. 3 Briilliance China Auto 3 Minimum Additional USD 1,000 Investment TAL Education Group 3 Valuation Day Monday & Thursday Fund Composition (as end of December 2017) Cut off Time Before close of business; On Sunday for Monday valuation, and on Wednesday for Thursday valuation. Redeemed Funds Four business days Payment after valuation day Annual Management Fee 2.3% Subscription Fee Up to 2% 4thQuarter 2017 Financial Indicators Percentage of Management fees and 0.58% charges of 4Qtr17 to the average of the Fund’s Net Asset Value Amount & percentage of profits NA Contact Details distributed in the 4th Quarter HSBC Saudi Arabia Limited Fund manager’s investment and NA percentage to the AUM of the Fund as end of December2017 Local and International Investors Amount & percentage of 4Qtr17 547,121 Toll Free Number: 920022688 dealing expenses to the Fund’s (1.41%) average NAV Website www.hsbcsaudi.com Percentage of borrowings to Fund’s NA NAV as end of December 2017 Email: [email protected] Issued by HSBC Saudi Arabia Authorized and regulated by Capital Market Authority License No. -

Manulife HSBC Chinese Equity Fund

SPECIALTY Code 8921 / HSBCC Volatility meter Low High Manulife HSBC Chinese Equity Fund Fund (18) Benchmark (19) Based on 3 year standard deviation How the underlying fund is invested UNDERLYING FUND -> HSBC Chinese Equity Fund - Institutional Series Objective The fundamental investment objective of the Fund is to provide long-term capital Composition growth by investing primarily in a diversified portfolio of equity and equity-related securities of Foreign Equity 94.10% publicly traded companies registered, or with an official listing, on a stock exchange in the Peoples Cash & Equivalents 5.90% Republic of China (China), as well as investing in securities of public companies that have a significant business or investment link with China. Managed by HSBC Global Asset Management (HK) Ltd Fund managers Team Managed: HSBC Global Asset Management (Canada) Inception date May 2004 Manulife inception date May 2017 Equity Industry Total assets $186.7 million Information Technology 31.90% Financials 19.87% Consumer Discretionary 14.97% Real Estate 5.96% Energy 5.26% Materials 4.73% Telecommunication Services 3.61% Other 13.70% Overall past performance This graph shows how a $10,000 investment in this fund would have changed in value over time, Geographic split based on gross returns. Gross rates of return are shown before investment management China 76.60% fees have been deducted. The shaded returns represent the underlying fund returns prior to the Hong Kong 16.51% Manulife Fund’s inception date. Canada 1.48% Cyprus 0.52% Australia -

Investment Daily

Investment Daily 23 March 2021 Major Market Indicators Market Overview 22 Mar 19 Mar 18 Mar Mkt. Turn.(mn) 134,200 206,200 174,600 Resistance Continued at 50 Day SMA; Low Market Turnover Stock Advances 991 550 898 reflected cautious sentiment Stock Declines 778 1,168 821 Hang Seng index opened down 189 points and then rebounded sharply afterwards, rising as HSI 28,885 28,991 29,406 much as 121 points. The index then gradually consolidated and closed down 106 points at Change -106 -415 +372 28,885. H-shares index rose 23 points to 11,307, and Hang Seng Tech index fell 42 points to HSI Turn.($bn) 51.06 90.99 75.59 8,509. Market turnover amounted to HK$134.2bn, with fund inflow from the stock connect HSCEI 11,307 11,284 11,470 amounted at HK441mn. Xiaomi (1810) announced this morning that a product presentation Change +23 -187 +112 will be held next Monday, triggering share price up 1.9%. BOCOM (3328), CKH (0001) HSCEI Turn.($bn) 50.01 83.79 72.30 and China Overseas (0688) rose 3.1%, 3.6% and 2.9% respectively; and Sunny Optical (2382), Bud APAC (1876) and Meituan (3690) dropped 5.0%, 3.9% and 3.7%. HSI Technical Indicators US 10 Year Yield fell 5 basis points to 1.68% on Monday, support investor to rotate some of the funds back to major technology stocks. Of which, major tech stocks such as Apple, 10-days MA 28,998 50-days MA 29,317 Microsoft and Tesla rose more than 2%.