Manulife HSBC Chinese Equity Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Banking in an Ecosystem World

The power of many: Corporate banking in an ecosystem world August 2019 Authors and acknowledgements Akash Lal Senior Partner Mumbai Daniele Chiarella Senior Partner London Feng Han Partner Shanghai Giulio Romanelli Partner Sydney Markus Röhrig Partner Munich Vincent Zheng Associate Partner Beijing Xing Liu Consultant Beijing The authors would like to acknowledge the contributions of Roger Rudisuli, Kevin Buehler, Jacob Dahl, Joe Ngai, John Qu, Andras Havas, Istvan Rab, Fumiaki Katsuki, and Shinichiro Oda to this report. The power of many: Corporate banking in an ecosystem world Corporate banking is being transformed by digitization. From core business processes to the way that clients engage and transact, digital has become the sine qua non of almost every action. However, digitization is still in the early stages in corporate banking. As it matures, more fundamental changes will ensue, enabled by the free flow of data between banks, their clients, and third parties. The resulting “ecosystems” will catalyze new operating models and disruption on an unprecedented scale. Already, tech giants such as Alibaba, Tencent, strategies, talent, and IT to do so. They need to and Amazon operate ecosystems with multiple identify potential partners, and determine which businesses. Some already offer financial services, business models work best for them. The task is from trade finance, to payments and marketplace nuanced and complex, but in a world of increasing lending. The implication of these changes is that the competition, it represents an opportunity that traditional boundaries between corporate banks cannot be ignored. and the industries they serve can no longer be taken for granted. In an ecosystem context, information, Corporate banking’s performance resources, and expertise have coalesced; everything challenge is up for grabs. -

Bay to Bay: China's Greater Bay Area Plan and Its Synergies for US And

June 2021 Bay to Bay China’s Greater Bay Area Plan and Its Synergies for US and San Francisco Bay Area Business Acknowledgments Contents This report was prepared by the Bay Area Council Economic Institute for the Hong Kong Trade Executive Summary ...................................................1 Development Council (HKTDC). Sean Randolph, Senior Director at the Institute, led the analysis with support from Overview ...................................................................5 Niels Erich, a consultant to the Institute who co-authored Historic Significance ................................................... 6 the paper. The Economic Institute is grateful for the valuable information and insights provided by a number Cooperative Goals ..................................................... 7 of subject matter experts who shared their views: Louis CHAPTER 1 Chan (Assistant Principal Economist, Global Research, China’s Trade Portal and Laboratory for Innovation ...9 Hong Kong Trade Development Council); Gary Reischel GBA Core Cities ....................................................... 10 (Founding Managing Partner, Qiming Venture Partners); Peter Fuhrman (CEO, China First Capital); Robbie Tian GBA Key Node Cities............................................... 12 (Director, International Cooperation Group, Shanghai Regional Development Strategy .............................. 13 Institute of Science and Technology Policy); Peijun Duan (Visiting Scholar, Fairbank Center for Chinese Studies Connecting the Dots .............................................. -

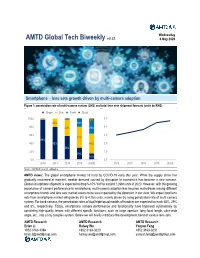

Global Tech Biweekly Vol.22 May 6, 2020 Smartphone – Lens Sets Growth Driven by Multi-Camera

Wednesday AMTD Global Tech Biweekly vol.22 6 May 2020 Smartphone – lens sets growth driven by multi-camera adoption Figure 1: penetration rate of multi-camera system (LHS) and total lens sets shipment forecast (units bn/RHS) - Single - Dual - Triple - Quad 100% 5.0 2% 2% 1% 8% 20% 19% 80% 40% 29% 4.0 60% 3.0 51% 98% 40% 80% 48% 2.0 58% 20% 1.0 29% 16% 0% 0.0 2016 2017 2018 2019 2020E 2016 2017 2018 2019 2020E Source: AMTD Research estimates AMTD views: The global smartphone market hit hard by COVID-19 early this year. While the supply chain has gradually recovered at moment, weaker demand caused by disruption to economics has become a new concern. Global smartphone shipment is expected to drop 5-10% YoY to around 1.26bn units in 2020. However, with the growing importance of camera performance to smartphone, multi-camera adoption has become mainstream among different smartphone brands and lens sets market seems to be less impacted by the downturn in our view. We expect total lens sets from smartphone market will grow by 5% to 4.7bn units, mainly driven by rising penetration rate of multi-camera system. For back camera, the penetration rates of dual/triple/quad models of handset are expected to reach 48%, 29% and 8%, respectively. Today, smartphone camera performance and functionality have improved substantially by combining high-quality lenses with different specific functions, such as large aperture, long focal length, ultra-wide angle, etc., into a tiny complex system. Below we will briefly introduce the development trend of various lens sets. -

Hang Seng Indexes Announces Index Review Results

10 November 2017 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 September 2017. All changes will be effective on 4 December 2017 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company 2007 Country Garden Holdings Co. Ltd. 2382 Sunny Optical Technology (Group) Co. Ltd. Removal: Code Company 135 Kunlun Energy Co. Ltd. 293 Cathay Pacific Airways Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. Inclusion: Code Company 2238 Guangzhou Automobile Group Co., Ltd. - H Shares Removal: Code Company 916 China Longyuan Power Group Corporation Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results/ 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 289 to 291. Inclusion: Code Company Size Industry ZhongAn Online P & C Insurance 6060 MidCap Financials Co., Ltd. – H Shares 6088 FIT Hong Teng Ltd. MidCap Information Technology Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 491 to 493. -

Ping an Insurance

Investment Daily 23 April 2021 Major Market Indicators Market Overview 22 Apr 21 Apr 20 Apr Mkt. Turn.(mn) 154,500 154,400 195,700 Focus on individual company performance; Eye on Golden Week Stock Advances 905 591 842 Concept Stock Stock Declines 756 1,075 796 Overnight US equities rose. Hong Kong stock market rose 133 points to 28,755. H-share HSI 28,755 28,622 29,136 Index rose 50 points to 10,939. Tech Index rose 94 points to 8,279. Market turnover was Change +133 -514 +30 HK$154.5 billion. Commodity stocks grew. Angang(347) and Maanshan Iron(323) gained HSI Turn.($bn) 55.63 75.47 113.52 5.2-9.8%. Healthcare sector rose. Innovent Bio(1801) and Ocumension-B(1477) gained HSCEI 10,939 10,889 11,086 4.7-13.6%. China Gas(384) announced share placement at discount. Share price failed to Change +51 -197 -7 keep above placement price HK$29.75. Share price plunged 11.3% and closed at HK$29. HSCEI Turn.($bn) 68.19 76.42 112.87 US initial weekly jobless claim fell further to 547,000, better than expectation, but it failed to provide much support to the US stock market on Thursday. Investors remained concerns HSI Technical Indicators on the surge of COVID 19 new cases in lots of countries including India. Media reports saying that US President Biden plans to propose nearly doubling the capital gains tax rate 10-days MA 28,793 50-days MA 29,178 for wealthy individuals, triggered a sell off on the US stock market in late session. -

Ng Keng Hooi to Retire As AIA Group Chief Executive and President to Be Succeeded by Lee Yuan Siong from 1 June 2020

This announcement is for information purposes only and does not constitute an invitation or offer by any person to acquire, purchase or subscribe for securities. This announcement is not, and is not intended to be, an offer of securities of the Company for sale in the United States. The securities of the Company have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under the U.S. Securities Act. There is not, and is not intended to be, any public offering of the securities of the Company in the United States. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Ng Keng Hooi to retire as AIA Group Chief Executive and President To be succeeded by Lee Yuan Siong from 1 June 2020 HONG KONG, 22 November 2019 – AIA Group Limited (“AIA” or the “Company”) announces today that its Group Chief Executive and President, Ng Keng Hooi, has informed the Board of Directors of the Company (the “Board”) of his intention to retire from his executive positions with the Company and its subsidiaries (the “Group”) effective 31 May 2020. -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

Qdiis(June02,2021)

Qualified Domestic Institutional Investors(QDIIs) with Investment Quotas Granted by the SAFE By June 2, 2021 Unit: 100 million USD No. Name of QDII Latest Approval Date Investment 1 Bank of China, Ltd. (BOC Wealth Management Co.,Ltd) 2021.03.18 Quota30.00 Industrial and Commercial Bank of China Limited (ICBC 2 2021.03.18 28.00 Wealth Management Co.,Ltd) 3 Bank of East Asia (China), Ltd. 2020.11.04 3.00 Bank of Communications Co., Ltd.(BOCOM Wealth 4 2020.04.10 5.00 Management Co.,Ltd) China Construction Bank Corporation (CCB Wealth 5 2020.06.01 5.00 Management Co.,Ltd) 6 HSBC Bank (China) Company, Ltd. 2021.06.01 44.00 China Merchants Bank Co., Ltd. (CMB Wealth Management 7 2021.03.18 23.00 Co.,Ltd) 8 China Citic Bank 2006.09.18 1.00 9 Hang Seng Bank (China) Company, Ltd. 2021.06.01 2.50 10 Citibank (China) Co., Ltd. 2021.01.06 35.00 11 Industrial Bank (IB Wealth Management Co.,Ltd) 2021.05.18 6.00 12 Standard Chartered Bank (China), Ltd. 2021.06.01 28.00 13 Minsheng Bank 2006.11.08 1.00 China Everbright Bank (China Everbright Wealth 14 2021.01.06 2.00 Management Co.,Ltd) 15 Bank of Beijing 2006.12.11 0.50 16 Bank of China (Hong Kong), Ltd. Branches in Mainland 2007.01.11 0.30 17 Credit Suisse Shanghai Branch 2007.01.30 0.30 18 Agricultural Bank of China(ABC Wealth Management Co.,Ltd) 2020.10.09 2.00 19 Nanyang Commercial Bank (China) Co., Ltd. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

2016Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2016 REPORT For the six months ended 30 June 2016 Value Partners Limited 9th Floor, Nexxus Building 41 Connaught Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartners-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-9 Statement of financial position (unaudited) 10 Investment portfolio (unaudited) 11-15 Investment portfolio movements (unaudited) 16 SEMI-ANNUAL REPORT 2016 For the six months ended 30 June 2016 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law 9th Floor, Nexxus Building Maples and Calder 41 Connaught Road Central 53rd Floor, The Center Hong Kong 99 Queen’s Road Central Hong Kong Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law Mr. Ho Man Kei, Norman King & Wood Mallesons Mr. So Chun Ki Louis 13th Floor, Gloucester Tower The Landmark Trustee, Registrar, Administrator and 15 Queen’s Road Central Principal Office Hong Kong Bank of Bermuda (Cayman) Limited P.O. -

Greater China 2019

IR Magazine Awards – Greater China 2019 Winners and nominees AWARDS BY RESEARCH Best overall investor relations (large cap) ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best overall investor relations (small to mid-cap) Alibaba Pictures Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Li-Ning NetDragon Websoft Holdings Best investor relations officer (large cap) ANTA Sports Products Suki Wong Cathay Financial Holdings Yajou Chang & Sophia Cheng China Resources Beer Vincent Tse WINNER China Telecom Lisa Lai China Unicom Jacky Yung Best investor relations officer (small to mid-cap) Agile Group Holdings Samson Chan BizLink Holding Tom Huang Far East Consortium International Venus Zhao WINNER Li-Ning Rebecca Zhang Yue Yuen Industrial (Holdings) Olivia Wang Best IR by a senior management team Maggie Wu, CFO & Daniel Zhang, Alibaba Group CEO Tomakin Lai Po-sing, CFO & China Resources Beer Xiaohai Hou, CEO Xiaochu Wang, CEO & Zhu WINNER China Unicom Kebing, CFO Wai Hung Boswell Cheung, CFO & Far East Consortium International David Chiu, Chairman & CEO Ma Jianrong, CEO & Cun Bo Wang, Shenzhou International Group Holdings CFO AWARDS BY REGION Best in region: China Alibaba Pictures Group ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best in region: Hong Kong AIA Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Yue Yuen -

China Vanke (A-1)

9-314-104 REV: MAY 9, 2014 L Y N N S . P A I N E JOHN MACOMBER K E I T H C H I - H O W O N G China Vanke (A-1) For me, long term is five to ten years. For Wang Shi it’s way out there—beyond imagination. Twenty years ago when Vanke was still a very small company, he already had a very grand vision that I thought was impossible to achieve. Twelve years ago when I became the general manager, we were only a two billion RMB company. He was thinking what Vanke might look like if it's a 100 billion company. I couldn’t have imagined that we’d achieve that goal in less than 10 years. — Yu Liang, President, China Vanke China Vanke president Yu Liang surveyed the densely developed expanse of land below as his plane touched down in the southern city of Shenzhen in November 2011. Yu was eager to get back to the company’s headquarters in the suburbs of Shenzhen after several days on the road meeting with subsidiary heads, construction partners, and government officials across China. Under the leadership of its founder Wang Shi, China Vanke Co. Ltd. (Vanke) had grown from a small trading firm to China’s largest homebuilder, successfully navigating the tumultuous mix of volatile markets and ever-changing government policies that characterized China’s real estate market. For 2011, Vanke expected to sell some 10.7 million square meters of floor area, or more than 120,000 homes valued at over 120 billion RMB (about US $20 billion).1 Nonetheless, the year had been a slow one for the industry, as the central government introduced successive waves of austerity measures to bring down skyrocketing prices.