2016Semi-Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

会议详细议程(Final Program)

会议详细议程(Final Program) 2019 International Conference on Display Technology March 26th—29th, 2019 (Tuesday - Friday) Kunshan International Convention and Exhibition Center Kunshan, Suzhou, China Plenary Session Wednesday, Mar. 27/14:00—18:00/Reception Hall Chair: Shintson Wu (吴诗聪), University of Central Florida (UCF) Title: Laser display Technology (14:00-14:30) Zuyan Xu (许祖彦), Technical Institute of Physics and Chemistry, China Academy of Engineering (CAE) Title: Thin film transistor technology and applications (14:30-15:00) Ming Liu (刘明), Institute of Microelectronics of the Chinese Academy of Sciences Title: Technology creates a win-win future (15:00-15:30) Wenbao Gao (高文宝), BOE Title: Gallium nitride micro-LEDs: a novel multi-mode, high-brightness and fast-response display technology (15:30-16:00) Martin Dawson, the University of Strathclyde’s Institute of Photonics, the Fraunhofer Centre for Applied Photonics Title: Virtual and Augmented Reality: Hope or Hype? (16:00-16:30) Achin Bhowmik, Starkey Hearing Technologies Title: Monocular Vision Impact: Monocular 3D and AR Display and Depth Detection with Monocular Camera (16:30-17:00) Haruhiko Okumura, Media AI Lab, Toshiba Title: ePaper, The Most Suitable Display Technology in AIoT (17:00-17:30) Fu-Jen (Frank) Ko, E Ink Holdings Inc. Title: Application Advantage of Laser Display in TV Market and Progress of Hisense (17:30- 18:00) Weidong Liu (刘卫东), Hisense Thursday, Mar. 28/8:30—12:30/Reception Hall Chair: Hoi S. Kwok (郭海成), Hong Kong University of Science and Technology Title: High Performance Tungsten-TADF OLED Emitters (8:30-9:00) Chi-Ming CHE (支志明), The University of Hong Kong Title: Challenges of TFT Technology for AMOLED Display (9:00-9:30) Junfeng Li (李俊峰), Nanyang Technological University, Innovation Research Institute of Visionox Technology Co., Ltd. -

Evergrande Real Estate Group (Stock Code: 3333.HK)

Evergrande Real Estate Group (Stock code: 3333.HK) 1 Table of Contents • ExecuBve Summary Page 3 • SecBon 1: Fraudulent AccounBng Masks Insolvent Balance Sheet Page 13 • SecBon 2: Bribes, Illegally Procured Land Rights and Severe Idle Land LiabiliBes Page 27 • Secon 3: Crisis Page 39 • SecBon 4: Chairman Hui Page 47 • SecBon 5: Pet Projects Page 52 • Appendix: Recent development Page 57 2 ExecuBve Summary 3 Evergrande Valuaon Evergrande has a market capitalizaon of US$ 8.9bn and trades at 1.6x book value. By market capitalizaon, Evergrande ranks among the top 5 listed Chinese properBes companies. [1] [2] RMB, HKD and USD in billions, except as noted 6/15/2012 in RMB in HKD in USD Share Price 3.80 4.60 0.59 Total Shares Outstanding 14.9 Market Capitalization 56.7 68.7 8.9 + Current Borrowing 10.2 + Non-Current Borrowing 41.5 + Income Tax Liability 11.6 + Cash Advance from Customers 31.6 Subtotal: Debt 95.0 115.0 14.8 - Unrestricted cash (20.1) (24.3) (3.1) Net debt 74.9 90.7 11.7 Enterprise value 131.6 159.4 20.6 Book Value as of 12/31/2011 34.9 Ratio of Equity Market Capitalization to Book Value 1.6x Note: Assuming RMB /USD exchange rate of 6.4 and HKD/ USD exchange rate of 7.75 1] As of June 15, 2012, Evergrande ranked 5th in market capitalizaon behind China Overseas (668 HK), Vanke (000002 SZ), Poly Real Estate (6000048 SH) and China Resources Land (1109 HK) 2] Balance sheet data as of December 31, 2011 4 PercepBon • Evergrande, which primarily operates in 2nd and 3rd Ber ciBes, has grown its assets 23 fold since 2006, becoming the largest condo/ home developer in China. -

IN the UNITED STATES DISTRICT COURT for the EASTERN DISTRICT of TEXAS MARSHALL DIVISION VISTA PEAK VENTURES, LLC, Plaintiff, V

Case 2:18-cv-00433 Document 1 Filed 10/18/18 Page 1 of 21 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION VISTA PEAK VENTURES, LLC, § § Plaintiff, § § v. § JURY TRIAL DEMANDED § BOE TECHNOLOGY GROUP CO., LTD., § § CIVIL ACTION NO. 2:18-cv-433 Defendant. § § § § § § PLAINTIFF’S COMPLAINT FOR PATENT INFRINGEMENT Plaintiff Vista Peak Ventures, LLC (“VPV”) files this Complaint against BOE Technology Group Co., Ltd. (“BOE”) for infringement of U.S. Patent No. 7,046,327 (“the ’327 patent”), U.S. Patent No. 6,870,593 (“the ’593 patent”), and U.S. Patent No. 6,812,528 (“the ’528 patent”), collectively, the “Asserted Patents.” THE PARTIES 1. Vista Peak Ventures, LLC is a Texas limited liability company, located at 1400 Preston Rd, Suite 472, Plano, TX 75093. 2. Upon information and belief, BOE was founded in April 1993 and provides “intelligent interface products and professional services for information interaction and human health.” See BOE Company Profile, (available at https://www.boe.com/en/about/gsjs/). BOE first issued “B shares” in foreign currency on the Shenzhen Stock Exchange in 1997, and later issued “A shares” in the same exchange in 2001. See BOE Course of Development (available at https://www.boe.com/en/about/gsjs/). In its Company Profile, BOE lists its core businesses as PLAINTIFF’S COMPLAINT FOR PATENT INFRINGEMENT 1 Case 2:18-cv-00433 Document 1 Filed 10/18/18 Page 2 of 21 PageID #: 2 “Display and Sensor Devices, Smart Systems and Healthcare Services.” See BOE Company Profile. -

Annual Report 2015

CSG HOLDING CO., LTD. ANNUAL REPORT 2015 Chairman of the Board: ZENG NAN March 2016 CSG Annual Report 2015 Section I Important Notice, Content and Paraphrase Board of Directors and the Supervisory Committee of CSG Holding Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives hereby confirm that there are no any fictitious statements, misleading statements, or important omissions carried in this report, and shall take all responsibilities, individual and/or joint, for the facticity, accuracy and completeness of the whole contents. Mr. Zeng Nan, Chairman of the Board, CFO Mr. Luo Youming and principal of the financial department Mr. Ding Jiuru confirm that the Financial Report enclosed in this 2015 Annual Report is true, accurate and complete. All directors were present the meeting of the Board for deliberating the annual report of the Company in person. This report involves futures plans and some other forward-looking statements, which shall not be considered as virtual promises to investors. Investors are kindly reminded to pay attention to possible risks. The deliberated and approved profit distribution plan in the Board Meeting is: taking total shares of 31 December 2015 as the radix, sending cash dividends of RMB 3.0 (tax included) per 10 shares to all shareholders, neither bonus shares being sent, nor converting capital reserve into share capital. Existing industry risk, market risk and exchange rate risk have been well-described in this report, please found details of the risk factors and countermeasures of future development described in Section IV Discussion and Analysis of the Management. -

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

Innovation and Upgrading Pathways in the Chinese Smartphone Production GVC Jiong How Lua National University of Singapore

Innovation and Upgrading pathways in the Chinese smartphone production GVC Lua Innovation and Upgrading pathways in the Chinese smartphone production GVC Jiong How Lua National University of Singapore Innovation and Upgrading pathways in the Chinese smartphone production GVC Lua Abstract This paper attends to the recent upgrading developments demonstrated by Chinese smartphone firms. Adopting a comparative approach of tearing down retail-accessible smartphones to their components, this paper traces the upgrading activities across global value chains (GVCs) that Chinese firms partake in during the production process. Upgrading is thus discovered to be diverse and complicated rather than a linear process, carrying significant implications for the production networks and supply chains in Chinese smartphone firms. Innovation and Upgrading pathways in the Chinese smartphone production GVC Lua Introduction China today is not only the world’s largest exporter of labor-intensive goods but also remains as the largest producer of personal electronics devices, surpassing the output of the US (West & Lansang, 2018). Contrary to popular belief, Chinese smartphone producers do not merely mimic their competitors, instead, innovate to “catch-up” with international competitors by upgrading across Global Value Chains (GVCs). Utilizing Liu et al. ’s (2015) illustration as a starting point, I open the dossier for both acknowledgement and critique. Figure 1. Two different expectations, two sources of mobile phone manufacturing Source: Liu et al. (2015, p. 273) This paper primarily take issue with the linear depiction of technological improvements in leading smartphone firms in Figure 1 because upgrading is a complicated process involving different strategies and forms of innovation. Instead, it argues that leading Chinese smartphone firms subscribe to a non-linear upgrading process. -

In the United States District Court for the Eastern District of Texas Marshall Division Fundamental Innovation Systems Internati

Case 2:20-cv-00117 Document 1 Filed 04/23/20 Page 1 of 24 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION FUNDAMENTAL INNOVATION SYSTEMS INTERNATIONAL LLC, Plaintiff, Civil Action No. 2:20-cv-00117 vs. COOLPAD GROUP LIMITED, COOLPAD JURY TRIAL DEMANDED TECHNOLOGIES, INC., and YULONG COMPUTER TELECOMMUNICATION SCIENTIFIC (SHENZHEN) CO. LTD., Defendants. COMPLAINT FOR PATENT INFRINGEMENT AND JURY DEMAND Plaintiff Fundamental Innovation Systems International LLC (“Plaintiff” or “Fundamental”), by and through its undersigned counsel, brings this action against Defendants Coolpad Group Limited, Coolpad Technologies, Inc., and Yulong Computer Telecommunication Scientific (Shenzhen) Co. Ltd. (collectively “Defendants” or “Coolpad”) to prevent Defendants’ continued infringement of Plaintiff’s patents without authorization and to recover damages resulting from such infringement. PARTIES 1. Plaintiff is a Delaware limited liability company with a place of business located at 2990 Long Prairie Road, Suite B, Flower Mound, Texas 75022. 2. Plaintiff is the owner by assignment of all right, title, and interest in U.S. Patent Nos. 7,239,111 (the “’111 Patent”), 8,624,550 (the “’550 Patent”), 7,834,586 (the “’586 Patent”), 8,232,766 (the “’766 Patent”), and 7,986,127 (the “’127 Patent”) (collectively, the “Patents-in- Suit”). 06904-00001/12059581.3 Case 2:20-cv-00117 Document 1 Filed 04/23/20 Page 2 of 24 PageID #: 2 3. On information and belief, Defendant Coolpad Group Limited is a company duly organized and existing under the laws of the Cayman Islands, with a place of business located at Coolpad Information Harbor, No. -

A Relatively Cautious View for 2019, Reiterate "Accumulate"

股 票 研 [Table_Title] Company Report: China Merchants Port (00144 HK) Spencer Fan 范明 究 (86755) 2397 6686 Equity Research 公司报告: 招商局港口 (00144 HK) [email protected] 10 May 2019 A[Table_S Relativelyummary ]Cautious View for 2019, Reiterate "Accumulate" 对2019年维持相对谨慎,重申“收集” The Company's management guided low single-digit growth in 2019. On [Table_Rank] the other hand, the management predicts that the Company's main driving Rating: Accumulate Maintained force in 2019 will come from the overseas segment, and it expects overseas 公 container volume to record medium-to-high single-digit YoY growth in 2019. 评级: 收集 (维持) 司 Domestic port container loading and unloading operation fee might not be 报 greatly adjusted in 2019, while handling fees of some overseas ports might increase. Overall, we expect CMP's port business to generate low single-digit [Table_Price] 告 6-18m TP 目标价: HK$16.80 YoY revenue growth in 2019. Revised from 原目标价: HK$17.00 Company Report Qianhai land ready to release value; the disposal of land interests is Share price 股价: HK$15.120 expected to bring about HK$3.58 billion in after-tax income. We believe that China Merchants Port will benefit indirectly from the long-term development of Shenzhen’s Qianhai Shekou Free Trade Zone. It is Stock performance understood that Qianhai Land will still be developed in accordance with the 股价表现 mature development model of the "Port-Zone-City" of China Merchants [Table_QuotePic] Group. % of return 10.0 Reiterate "Accumulate" rating and adjust TP to HK$16.80. CMP’s port 5.0 resources are still balanced, and we still favor CMP's overseas development 0.0 capability. -

GC Influencers Have Been Chosen Following Research Among Private Practice Lawyers and Other In-House Counsel

v GC Influencers CHINA 2019 Friday, 11th January 2019 JW Marriott Hotel, Hong Kong Programme Engaging content, networking and celebration with leading General Counsel and top ranked lawyers globally. GC Influencers For more informationCHINA visit 2019 chambers.com A5-Advert-Forums.idml 1 22/10/2018 12:17 Welcome SARAH KOGAN Editor Chambers Asia-Pacific Meet the most influential General Counsel in China today. Chambers has provided insight into the legal profession for over 30 years. During this time, in-house lawyers and third-party experts have shared their views on the value and importance placed on the role of the General Counsel. No longer just the ethical and legal heart of a business, these professionals now sit as influential participants at board level. Effective managers, industry pioneers, diversity and CSR champions: these Influencers show the way. Research Methodology: Our GC Influencers have been chosen following research among private practice lawyers and other in-house counsel. We identified the key areas in which GCs have displayed substantial influence: Engaging content, • Effective management and development of an in-house team • Navigation of substantial business projects such as M&A or strategic networking and business change. • Development of litigation strategy and understanding the pressures faced celebration with leading within industry General Counsel and top • Bringing diversity & inclusion and CSR to the forefront of industry. ranked lawyers globally. • Ability to influence and respond to regulatory change Our aim is to celebrate excellence within the legal profession. This dynamic hall of fame encourages collaboration among the in-house legal community. Our GC Influencers have created best practice pathways endorsed by both private practice and other in-house lawyers. -

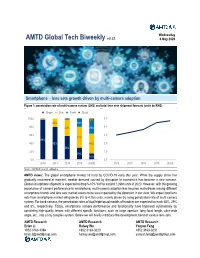

Global Tech Biweekly Vol.22 May 6, 2020 Smartphone – Lens Sets Growth Driven by Multi-Camera

Wednesday AMTD Global Tech Biweekly vol.22 6 May 2020 Smartphone – lens sets growth driven by multi-camera adoption Figure 1: penetration rate of multi-camera system (LHS) and total lens sets shipment forecast (units bn/RHS) - Single - Dual - Triple - Quad 100% 5.0 2% 2% 1% 8% 20% 19% 80% 40% 29% 4.0 60% 3.0 51% 98% 40% 80% 48% 2.0 58% 20% 1.0 29% 16% 0% 0.0 2016 2017 2018 2019 2020E 2016 2017 2018 2019 2020E Source: AMTD Research estimates AMTD views: The global smartphone market hit hard by COVID-19 early this year. While the supply chain has gradually recovered at moment, weaker demand caused by disruption to economics has become a new concern. Global smartphone shipment is expected to drop 5-10% YoY to around 1.26bn units in 2020. However, with the growing importance of camera performance to smartphone, multi-camera adoption has become mainstream among different smartphone brands and lens sets market seems to be less impacted by the downturn in our view. We expect total lens sets from smartphone market will grow by 5% to 4.7bn units, mainly driven by rising penetration rate of multi-camera system. For back camera, the penetration rates of dual/triple/quad models of handset are expected to reach 48%, 29% and 8%, respectively. Today, smartphone camera performance and functionality have improved substantially by combining high-quality lenses with different specific functions, such as large aperture, long focal length, ultra-wide angle, etc., into a tiny complex system. Below we will briefly introduce the development trend of various lens sets. -

INTERIM REPORT 中期報告 2017 深圳國際控股有限公司 Interim Report 2017 中期報告

Shenzhen International Holdings Limited INTERIM REPORT 中期報告 2017 深圳國際控股有限公司 Interim Report 2017 中期報告 (Incorporated in Bermuda with limited liability) (於百慕達註冊成立之有限公司) Stock Code 股份代號:00152 CONTENTS Corporate Profile 2 Independent Review Report 25 Corporate Information 4 Interim Consolidated Balance Sheet 26 Financial Highlights 5 Interim Consolidated Income Statement 28 Management Discussion and Analysis Interim Consolidated Statement Overall Review 6 of Comprehensive Income 29 Logistic Business 8 Interim Consolidated Statement of Changes in Equity 30 Toll Road Business 15 Interim Condensed Consolidated Other Investments 19 Statement of Cash Flows 32 Financial Position 20 Notes to the Unaudited Interim Financial Information 33 Outlook for the Second Half of 2017 23 Supplementary Information 62 Human Resources 24 CORPORATE PROFILE Shenzhen International Holdings Limited is a company incorporated in Bermuda with limited liability and is listed on the main board of the Stock Exchange of Hong Kong. The Group is principally engaged in the investment, construction and operation of logistic infrastructure facilities, as well as providing various value-added logistic services to customers leveraging its infrastructure facilities and information services platform. Shenzhen Investment Holdings Company Limited, the controlling shareholder of the Company, is a corporation wholly-owned by State-owned Assets Supervision and Administration Commission of the People’s Government of Shenzhen Municipal and, as at the date of this report, holds approximately -

Home Appliance Cautious Buy

Sector Research | China Home Appliance THIS IS THE TRANSLATION OF A REPORT ORIGINALLY PUBLISHED IN CHINESE BY GUOSEN SECURITIES CO., LTD ON SEPTEMBER 24, 2012 October 16, 2012 Home Appliance Cautious Buy Cherry pick home-appliance names amid the price corrections Investment highlights Analyst Wang Nianchun We expect home-appliance y-o-y sales volume growth to rebound moderately +755-82130407 in 4Q 2012. Based on our channel checks and data already released for Jul-Aug [email protected] S0980510120027 2012, 3Q sales volume of various sub-sectors was in line with expectations, and the profitability of the TV sub-sector slightly beat expectations. The subsidies for energy efficient home-appliance products introduced in June are unlikely to materially boost sales until three to six months after their launch. We expect the 4Q y-o-y sales Sales Contact volume growth of air conditioners, refrigerators, washing machines and LCD TVs will be 7.5%, 5.8%, 5.0% and 0.8% respectively, representing a modest rebound from the Roger Chiman Managing Director first three quarters. +852 2248 3598 [email protected] Divergence within the sector intensifies, and we suggest waiting for buying Chris Berney opportunities amid price pullbacks. The overall industry sentiment has been tepid Managing Director +852 2248 3568 since the beginning of 2012, but product-mix upgrade and lower material costs could lead [email protected] to an improvement in profitability this year. Based on our estimates, subsidy policies for Andrew Collier energy efficient home-appliance products will have more significant effects in 2013 than Director +852 2248 3528 this year.