JPM Greater China Fund Portfolio As on Aug 31, 2020 Base Currency: USD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Contract Settlement Prices Summary: Hong Kong

HK Index Daily Preview 21 October 2020 Contract Settlement Prices Contract Settlement Change (Nominal) Change (Percentage) Mini-Hang Seng Index OCT 20 24,502 -47 -0.19% Mini-Hang Seng China Enterprises Index OCT 20 9,961 -6.00 -0.06% Summary: Hong Kong stocks struggled for fresh catalysts on Tuesday to sustain a three-week rally as a government report showed further weakness in the local employment market. Most equity markets in Asia-Pacific region retreated after a sell-off in US stocks overnight. The Hang Seng Index laboured to a 0.1 per cent gain at 24,569.54, having traded between gains and losses. Alibaba Group Holding climbed 0.7 per cent after breaching the HK$300 mark for the first time since its November debut, as its affiliate Ant Group won approval for its stock offering from the bourse operator. Major stock gauges in mainland China rose. The CSI300 index, which tracks the biggest companies on Shanghai and Shenzhen bourses, closed 0.8 per cent higher to 4,793.47, arresting a 1.7 per cent slide in the past four trading days. The Shanghai Composite Index added 0.5 per cent, and the Shenzhen tech board ChiNext jumped more than 1 per cent. Benchmarks in Japan and Australia declined by 0.4 per cent and 0.7 per cent respectively, while South Korea’s Kospi rose by 0.5 per cent. A deadlock in US stimulus talks pummeled US equities overnight, with the S&P 500 Index losing 1.6 per cent, the most since September 23, according to Bloomberg data. -

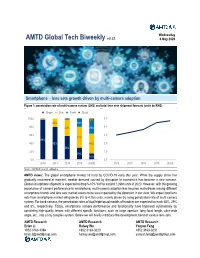

Global Tech Biweekly Vol.22 May 6, 2020 Smartphone – Lens Sets Growth Driven by Multi-Camera

Wednesday AMTD Global Tech Biweekly vol.22 6 May 2020 Smartphone – lens sets growth driven by multi-camera adoption Figure 1: penetration rate of multi-camera system (LHS) and total lens sets shipment forecast (units bn/RHS) - Single - Dual - Triple - Quad 100% 5.0 2% 2% 1% 8% 20% 19% 80% 40% 29% 4.0 60% 3.0 51% 98% 40% 80% 48% 2.0 58% 20% 1.0 29% 16% 0% 0.0 2016 2017 2018 2019 2020E 2016 2017 2018 2019 2020E Source: AMTD Research estimates AMTD views: The global smartphone market hit hard by COVID-19 early this year. While the supply chain has gradually recovered at moment, weaker demand caused by disruption to economics has become a new concern. Global smartphone shipment is expected to drop 5-10% YoY to around 1.26bn units in 2020. However, with the growing importance of camera performance to smartphone, multi-camera adoption has become mainstream among different smartphone brands and lens sets market seems to be less impacted by the downturn in our view. We expect total lens sets from smartphone market will grow by 5% to 4.7bn units, mainly driven by rising penetration rate of multi-camera system. For back camera, the penetration rates of dual/triple/quad models of handset are expected to reach 48%, 29% and 8%, respectively. Today, smartphone camera performance and functionality have improved substantially by combining high-quality lenses with different specific functions, such as large aperture, long focal length, ultra-wide angle, etc., into a tiny complex system. Below we will briefly introduce the development trend of various lens sets. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Hang Seng Indexes Announces Index Review Results

10 November 2017 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 September 2017. All changes will be effective on 4 December 2017 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company 2007 Country Garden Holdings Co. Ltd. 2382 Sunny Optical Technology (Group) Co. Ltd. Removal: Code Company 135 Kunlun Energy Co. Ltd. 293 Cathay Pacific Airways Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. Inclusion: Code Company 2238 Guangzhou Automobile Group Co., Ltd. - H Shares Removal: Code Company 916 China Longyuan Power Group Corporation Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results/ 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 289 to 291. Inclusion: Code Company Size Industry ZhongAn Online P & C Insurance 6060 MidCap Financials Co., Ltd. – H Shares 6088 FIT Hong Teng Ltd. MidCap Information Technology Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 491 to 493. -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd

Page 1 of 4 Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd. - Class A 9,230 $ 120,977 Wens Foodstuffs Group Co Ltd. - Class A 4,660 15,857 136,834 Auto Manufacturers - 0.7% SAIC Motor Corp Ltd. - Class A 24,600 64,077 Banks - 23.7% Agricultural Bank of China Ltd. - Class H 352,300 163,039 Bank of China Ltd. - Class H 193,900 92,512 Bank of Communications Co Ltd. - Class A 184,100 125,556 China CITIC Bank Corp Ltd. - Class H 24,700 18,261 China Construction Bank Corp. - Class H 81,500 71,464 China Everbright Bank Co Ltd. - Class H 126,400 68,456 China Merchants Bank Co Ltd. - Class A 108,200 539,489 China Minsheng Banking Corp Ltd. - Class A 254,300 201,851 Industrial & Commercial Bank of China Ltd. - Class A 198,400 140,993 Industrial Bank Co Ltd. - Class A 127,400 285,849 Ping An Bank Co Ltd. - Class A 75,000 143,348 Shanghai Pudong Development Bank Co Ltd. - Class A 132,300 196,379 2,047,197 Beverages - 17.9% Jiangsu Yanghe Brewery Joint-Stock Co Ltd. - Class A 4,000 77,398 Kweichow Moutai Co Ltd. - Class A 4,000 961,777 Wuliangye Yibin Co Ltd. - Class A 16,200 504,835 1,544,010 Building Materials - 1.6% Anhui Conch Cement Co Ltd. - Class H 15,900 139,921 Coal - 0.5% China Shenhua Energy Co Ltd. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Hang Seng Indexes Announces Index Review Results

10 May 2019 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 March 2019. All changes will be effective on 17 June 2019 (Monday). 1. Hang Seng Index There is no change to the constituents of the Hang Seng Index. The total number of constituents is fixed at 50. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 50. Inclusion: Code Company 291 China Resources Beer (Holdings) Co. Ltd. 960 Longfor Group Holdings Ltd. 2007 Country Garden Holdings Co. Ltd. 2020 ANTA Sports Products Ltd. 2688 ENN Energy Holdings Ltd. Removal: Code Company 753 Air China Ltd. - H Shares 902 Huaneng Power International, Inc. - H Shares 1776 GF Securities Co., Ltd. - H Shares 1816 CGN Power Co., Ltd. - H Shares 2333 Great Wall Motor Co. Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results / 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 303 to 304. Inclusion: Code Company Size Industry 1896 Maoyan Entertainment MidCap Consumer Services Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 485 to 486. -

MTR Corporation at a Glance

MTR Corporation at a Glance The size, scale and geographic coverage of the business activities of the Company have been significantly expanded as a result of the Rail Merger completed on 2 December 2007. Our share of the Hong Kong franchised public transport market has increased to 41.6% and our property land bank and rental portfolio have both been increased with the Rail Merger. Railway Operations Station Commercial and Rail Related Businesses Business Description Business Description We operate a pre-dominantly rail based transportation system We leverage our railway assets and expertise into additional in Hong Kong, comprising Domestic and Cross-boundary businesses, including rental of station retail units (including services, a dedicated high-speed Airport Express and a light Duty Free shops), advertising in trains and stations, rail system, which in total stretches 211.6 kilometres with 82 telecommunications, rail consulting and freight services. stations and 68 stops. The Integrated MTR System is one of the most intensively used systems in the world, known for its reliability, safety and efficiency. We also provide intercity services to the Mainland of China as well as a bus operation in Hong Kong providing convenient feeder services. 2007 Highlights 2007 Highlights • Successfully completed the integration of two railway • Renovations to commercial areas at nine stations were networks on the Appointed Day of 2 December, together completed with fare reductions with effect from that day • Replacement of seatback TV with new multimedia -

Kweichow Moutai Growth Declines on Slow Deliveries

CHINA DAILY Tuesday, October 30, 2018 BUSINESS 17 Kweichow Moutai growth Execs optimistic on import expo By WANG YING in Shanghai products, their know-how, “Shanghai has become a [email protected] and how interesting they are vital center for advanced as a company,” said Brian technology leadership — for Top multinational corpora- Duperreault, president, CEO ABB and the world ... We will tions’ executives have and director of finance cor- make full use of the city’s declines on slow deliveries expressed their enthusiasm poration American Interna- existing advantages and for the first China Internation- tional Group Inc. make clear the main challen- al Import Expo set to launch According to Severin ges facing Shanghai, focus Share price of on Nov 5, as part of the nation’s Schwan, CEO of Roche Group, support policies on measures efforts to expand opening-up. the pharmaceuticals giant that can address the challen- liquor maker slips While attending the 30th will showcase its cutting-edge ges, and develop specific but consumption International Business Lead- technology at the import plans and solutions,” Spies- ers’ Advisory Council, held expo, covering early research shofer said, explaining the upgrades to buoy annually in Shanghai, busi- and development, integrated company’s rationale. ness leaders said they are diagnosis and treatment solu- “We are not only seeing future prospects optimistic about China’s tions, and personalised progress in Shanghai’s reform opening-up policy and new healthcare offerings. and opening-up, but we at By ZHU WENQIAN in Beijing opportunities. Roche are taking an active role and YANG JUN in Guiyang “The import expo is in the development of China’s unprecedented in China for biomedical industry. -

Jpmorgan Funds - China A-Share Opportunities Fund

Fund House of the Year Fund Selector Asia Awards - Singapore3) Singapore 2021 - Greater China/China Equity - Platinum4) FOR SINGAPORE INVESTORS ONLY SINGAPORE RECOGNISED SCHEME FACT SHEET | July 31, 2021 JPMorgan Funds - China A-Share Opportunities Fund INVESTMENT OBJECTIVE PERFORMANCE To provide long-term capital growth by investing primarily inCUMULATIVE PERFORMANCE (%) companies of the People's Republic of China (PRC). JPM China A-Share Opportunities A (acc) - USD CSI 300 (Net)1) EXPERTISE 300 200 Fund Manager Howard Wang, Rebecca Jiang 250 150 % CHANGE FUND INFORMATION (JPMorgan Funds - China A-Share Opportunities Fund) 200 100 Fund base currency Launch Date REBASED 150 50 CNH 11/09/15 Total fund size (m) Inception NAV 100 0 USD 8,051.8 USD 15.61 50 -50 ISIN code 08/15 08/16 08/17 08/18 08/19 08/20 08/21 LU1255011170 Since 11/09/15 Current charge Since 1 month 3months 1 year 3 years 5 years Initial : Up to 5.0% of NAV launch Redemption : Currently 0% (Up to 0.5% of NAV) A (acc) - USD (NAV to NAV) -7.9 -4.4 20.8 98.6 143.2 149.4 Management fee : 1.5% p.a. A (acc) - USD (Charges applied)* -12.3 -9.0 15.0 89.2 131.5 137.4 Subscription Channel Benchmark (in USD)1) -6.7 -4.9 12.3 52.4 69.1 59.2 Cash A (acc) - RMB (NAV to NAV) -8.0 -4.5 11.8 88.4 136.4 151.7 SRS(for platforms only) A (acc) - RMB (Charges applied)* -12.4 -9.0 6.4 79.4 125.1 139.7 RATINGS A (acc) - SGD (NAV to NAV) -7.3 -2.6 19.0 97.4 - 105.5 A (acc) - SGD (Charges applied)* -11.8 -7.2 13.3 88.0 - 95.7 Morningstar Analyst Rating Silver Morningstar Rating™ ★★★★★ ANNUALISED -

Premium China Funds Management

Premium China Fund Top 10 Portfolio Holdings as at 31 July 2020 Tencent (Media & Entertainment) Market Cap: USD 660.2 Billion • Tencent, a world leader in the internet-related services space, provides services across instant messaging, social media, email, web-portals, e-commerce, advertising, online payment as well as multiplayer games. • With offerings including QQ Instant Messenger and WeChat, Tencent is providing similar services to the likes of Facebook, Twitter and WhatsApp. By the end of Q2 2018, QQ had 803 million monthly active user accounts, whilst WeChat, since its launch in 2011, accommodates for over 1 Billion monthly active users. • In November 2017, Tencent's market value reached US$528 billion, surpassing Facebook’s market value at the time, which resulted in it being recognised as one of the world's top 5 most valuable public companies. Alibaba Group (Retailing) Market Cap: USD 681.2 Billion • Alibaba, an e-commerce giant, provides services ranging from web portals connecting businesses and consumers, electronic payment services and internet infrastructure. • Its flagship site Alibaba.com is the world’s largest online business-to-business trading platform for small businesses, handling sales between importers and exporters from over 240 countries. whilst its consumer-to-consumer portal—Taobao functions similar to eBay featuring nearly a billion products. Currently, it is amongst one of the 20 most visited websites globally on a consistent basis. • Global brands such as Nike, Uniqlo and Burberry, use Alibaba’s Tmall platform to market to an estimated 300 million shoppers. The companies online payment platform—Alipay is larger than PayPal and accounts for roughly half of all online payment transactions within China.