Mks/Eqd/43/20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Tech Biweekly Vol.22 May 6, 2020 Smartphone – Lens Sets Growth Driven by Multi-Camera

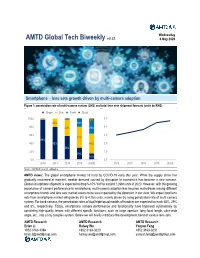

Wednesday AMTD Global Tech Biweekly vol.22 6 May 2020 Smartphone – lens sets growth driven by multi-camera adoption Figure 1: penetration rate of multi-camera system (LHS) and total lens sets shipment forecast (units bn/RHS) - Single - Dual - Triple - Quad 100% 5.0 2% 2% 1% 8% 20% 19% 80% 40% 29% 4.0 60% 3.0 51% 98% 40% 80% 48% 2.0 58% 20% 1.0 29% 16% 0% 0.0 2016 2017 2018 2019 2020E 2016 2017 2018 2019 2020E Source: AMTD Research estimates AMTD views: The global smartphone market hit hard by COVID-19 early this year. While the supply chain has gradually recovered at moment, weaker demand caused by disruption to economics has become a new concern. Global smartphone shipment is expected to drop 5-10% YoY to around 1.26bn units in 2020. However, with the growing importance of camera performance to smartphone, multi-camera adoption has become mainstream among different smartphone brands and lens sets market seems to be less impacted by the downturn in our view. We expect total lens sets from smartphone market will grow by 5% to 4.7bn units, mainly driven by rising penetration rate of multi-camera system. For back camera, the penetration rates of dual/triple/quad models of handset are expected to reach 48%, 29% and 8%, respectively. Today, smartphone camera performance and functionality have improved substantially by combining high-quality lenses with different specific functions, such as large aperture, long focal length, ultra-wide angle, etc., into a tiny complex system. Below we will briefly introduce the development trend of various lens sets. -

Hang Seng Indexes Announces Index Review Results

10 November 2017 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 29 September 2017. All changes will be effective on 4 December 2017 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents is fixed at 50. Inclusion: Code Company 2007 Country Garden Holdings Co. Ltd. 2382 Sunny Optical Technology (Group) Co. Ltd. Removal: Code Company 135 Kunlun Energy Co. Ltd. 293 Cathay Pacific Airways Ltd. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 40. Inclusion: Code Company 2238 Guangzhou Automobile Group Co., Ltd. - H Shares Removal: Code Company 916 China Longyuan Power Group Corporation Ltd. - H Shares The list of constituents is provided in Appendix 2. Changes in constituent companies of the HSCEI will also be applied to the Hang Seng China Enterprises Smart Index. more… Hang Seng Indexes Announces Index Review Results/ 2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will increase from 289 to 291. Inclusion: Code Company Size Industry ZhongAn Online P & C Insurance 6060 MidCap Financials Co., Ltd. – H Shares 6088 FIT Hong Teng Ltd. MidCap Information Technology Following the constituent changes above, the number of constituents in the Hang Seng Composite Index will increase from 491 to 493. -

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights Yingqi Tan July 2020 M-RCBG Associate Working Paper Series | No. 153 The views expressed in the M-RCBG Associate Working Paper Series are those of the author(s) and do not necessarily reflect those of the Mossavar-Rahmani Center for Business & Government or of Harvard University. The papers in this series have not undergone formal review and approval; they are presented to elicit feedback and to encourage debate on important public policy challenges. Copyright belongs to the author(s). Papers may be downloaded for personal use only. Mossavar-Rahmani Center for Business & Government Weil Hall | Harvard Kennedy School | www.hks.harvard.edu/mrcbg 1 REFORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS MAY 2020 Yingqi Tan MPP Class of 2020 | Harvard Kennedy School MBA Class of 2020 | Harvard Business School J.D. Candidate Class of 2023 | Harvard Law School RERORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS 2 Contents Table of Contents Contents .................................................................................................. 2 Acknowledgements ................................................................................ 7 Abbreviations ......................................................................................... 8 Introduction ......................................................................................... -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

2016Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2016 REPORT For the six months ended 30 June 2016 Value Partners Limited 9th Floor, Nexxus Building 41 Connaught Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartners-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-9 Statement of financial position (unaudited) 10 Investment portfolio (unaudited) 11-15 Investment portfolio movements (unaudited) 16 SEMI-ANNUAL REPORT 2016 For the six months ended 30 June 2016 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law 9th Floor, Nexxus Building Maples and Calder 41 Connaught Road Central 53rd Floor, The Center Hong Kong 99 Queen’s Road Central Hong Kong Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law Mr. Ho Man Kei, Norman King & Wood Mallesons Mr. So Chun Ki Louis 13th Floor, Gloucester Tower The Landmark Trustee, Registrar, Administrator and 15 Queen’s Road Central Principal Office Hong Kong Bank of Bermuda (Cayman) Limited P.O. -

Annual Report 2019 001 2019 MILESTONES

CORPORATE CULTURE About China Telecom China Telecom Corporation Limited (“China Telecom” or the “Company”, a joint stock Corporate Mission limited company incorporated in the People’s Republic of China with limited liability, together with its subsidiaries, collectively the “Group”) is a large-scale and leading Let the customers fully enjoy a new information life integrated intelligent information services operator in the world, providing wireline & mobile telecommunications services, Internet access services, information services and other value-added telecommunications services primarily in the PRC. As at the end of 2019, the Strategic Goal Company had mobile subscribers of about 336 million, wireline broadband subscribers of about 153 million and access lines in service of about 111 million. The Company’s H shares Be a leading integrated intelligent information services operator and American Depositary Shares (“ADSs”) are listed on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange” or ”HKSE”) and the New York Stock Exchange respectively. Core Value Comprehensive innovation, pursuing truth and pragmatism, respecting people and creating value all together Operation Philosophy Pursue mutual growth of corporate value and customer value Service Philosophy Customer First Service Foremost Code of Corporate Practice Keep promise and provide excellent service for customers Cooperate honestly and seek win-win result in joint innovation Operate prudently and enhance corporate value continuously Manage precisely and allocate resources scientifically Care the staff and tap their potential to the full Reward the society and be a responsible corporate citizen Corporate Slogan Connecting the World Forward-Looking Statements Certain statements contained in this report may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. -

2020 Annual Report 9668

渤海銀行股份有限公司 CHINA BOHAI BANK CO., LTD. (A joint stock company incorporated in the People’s Republic of China with limited liability) Stock Code : 9668 CHINA BOHAI BANK CO., LTD. CO., CHINA BOHAI BANK 2020 ANNUAL REPORT 2020 ANNUAL REPORT Annual Report 2020 Contents 1 Contents Definitions 2 Important Notice 4 Chairman’s Statement 5 President’s Statement 6 Statement of the Chairman of the Board of Supervisors 7 Corporate Profile 8 Awards and Ranking 10 Summary of Accounting Data and Business Data 11 Management Discussion and Analysis 15 Changes in Share Capital and Information on Shareholders 65 Directors, Supervisors, Members of Senior Management, Employees and Branches 71 Corporate Governance 86 Report of the Board of Directors 108 Report of the Board of Supervisors 117 Important Events 124 Audit Report and Financial Report 129 Organizational Structure Chart 280 CHINA BOHAI BANK CO., LTD. Annual Report 2020 2 Denitions Definitions Articles of Association the Articles of Association of CHINA BOHAI BANK CO., LTD. Bank, our Bank, Company, CHINA BOHAI BANK CO., LTD. (渤海銀行股份有限公司), a joint stock company our Company established on December 30, 2005 in the PRC with limited liability pursuant to the relevant PRC laws and regulations, and its H Shares were listed on the Hong Kong Stock Exchange (Stock Code: 9668) CBIRC China Banking and Insurance Regulatory Commission (中國銀行保險監督管理委員會) CBRC the former China Banking Regulatory Commission (中國銀行業監督管理委員會) Central Bank, PBoC the People’s Bank of China China Accounting Standards Accounting Standards for -

SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 2382.HK)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 2382.HK) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2019 RESULT HIGHLIGHTS The Group’s unaudited consolidated revenue for the six months ended 30 June 2019 was approximately RMB15,574.9 million, representing an increase of approximately 30.0% as compared with the corresponding period of last year. The increase in revenue was mainly benefited from the Group’s further development in smartphone related businesses and rapid growth in the vehicle imaging and sensing fields. The gross profit for the six months ended 30 June 2019 was approximately RMB2,864.0 million, representing an increase of approximately 23.4% as compared with the corresponding period of last year. The gross profit margin was approximately 18.4%. The net profit for the six months ended 30 June 2019 increased by approximately 20.4% to approximately RMB1,432.4 million as compared with the corresponding period of last year. The net profit margin was approximately 9.2%. FINANCIAL RESULTS The board (the “Board”) of directors (the “Directors”, each a “Director”) -

All Web Holdings 092018.Xlsx

Percent of Total Holdings VanEck – Emerging Markets Equity UCITS 30/9/2018 U.S. Dollar Security Name Port. Weight Total 100.00 Alibaba Group Holding Ltd. 6.75 Tencent Holdings Ltd. 6.48 Ping An Insurance (Group) Company of China, Ltd. 5.08 Samsung Electronics Co., Ltd. 4.72 HDFC Bank Limited 4.40 Naspers Limited 3.80 CIE Automotive, S.A. 2.57 Galaxy Entertainment Group Limited 2.04 Kweichow Moutai Co., Ltd. 1.85 Huazhu Group Ltd. 1.68 Malaysia Airports Holdings Bhd. 1.65 CP All Public Co. Ltd. 1.63 Ayala Land Inc. 1.56 Sberbank Russia OJSC 1.51 Focus Media Information Technology Co., Ltd. 1.45 Samsung SDI Co., Ltd 1.44 PT Bank Rakyat Indonesia (Persero) Tbk 1.44 Beijing Enterprises Water Group Limited 1.42 Fleury SA 1.28 Unifin Financiera SAB de CV SOFOM ENR 1.27 Transaction Capital Ltd. 1.27 Srisawad Corporation Public Company Limited 1.25 Baozun, Inc. 1.24 A-Living Services Co., Ltd. 1.24 China Maple Leaf Educational Systems Ltd. 1.22 Chroma Ate Inc. 1.20 Itau Unibanco Holding S.A. 1.19 International Container Terminal Services, Inc. 1.15 Cholamandalam Investment & Finance Co. Ltd. 1.15 Sunny Optical Technology (Group) Co., Ltd. 1.12 Fu Shou Yuan International Group Ltd. 1.11 Regional, S.A.B. de C.V. 1.11 China Zhengtong Auto Services Holdings Limited 1.09 Bloomberry Resorts Corporation 1.06 Beijing Capital International Airport Co., Ltd. 1.04 Yandex NV 1.00 Bank of Georgia Group Plc 0.99 POYA International Co., Ltd. -

CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2202)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2202) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Vanke Co., Ltd.* (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2019 Annual Report will be delivered to the H-Share Holders of the Company and available for viewing on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and of the Company (www.vanke.com) in April 2020. Both the Chinese and English versions of this results announcement are available on the websites of the Company (www.vanke.com) and The Stock Exchange of Hong Kong Limited (www.hkexnews.hk). In the event of any discrepancies in interpretations between the English version and Chinese version, the Chinese version shall prevail, except for the financial report prepared in accordance with International Financial Reporting Standards, of which the English version shall prevail. -

SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 2382.HK)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED 舜宇光學科技(集團)有限公司 (incorporated in the Cayman Islands with limited liability) (Stock code: 2382.HK) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2017 RESULT HIGHLIGHTS The Group’s unaudited consolidated revenue for the six months ended 30 June 2017 was approximately RMB10,031.7 million, representing an increase of approximately 69.8% as compared with the corresponding period of last year. The increase in revenue was mainly benefited from the Group’s development in the smartphone related business and vehicle imaging field. The gross profit for the six months ended 30 June 2017 was approximately RMB2,069.7 million, representing an increase of approximately 109.5% as compared with the corresponding period of last year. The gross profit margin for the six months ended 30 June 2017 was approximately 20.6%. The net profit for the six months ended 30 June 2017 increased by approximately 149.7% to approximately RMB1,161.0 million as compared with the corresponding period of last year. The increase in net profit was mainly due to the increased gross profit and the effective control over operating expenses. The net profit margin for the six months ended 30 June 2017 was approximately 11.6%.