Investment Daily

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UBS AG (Incorporated with Limited Liability in Switzerland) Acting Through Its London Branch

3 June 2021 Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document, for which we accept full responsibility, includes particulars given in compliance with the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Rules”) for the purpose of giving information with regard to us. We, having made all reasonable enquiries, confirm that to the best of our knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading. This document is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for the Warrants. The Warrants are complex products. Investors should exercise caution in relation to them. Investors are warned that the price of the Warrants may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Prospective purchasers should therefore ensure that they understand the nature of the Warrants and carefully study the risk factors set out in the Base Listing Document (as defined below) and this document and, where necessary, seek professional advice, before they invest in the Warrants. -

Proposed Re-Election of Retiring Directors and Proposed Granting of General Mandates to Repurchase Shares and to Issue New Shares and Notice of Annual General Meeting

475754 \ (Sands) \ 23/03/2018 \ M51 P.1 THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult a stockbroker or other registered dealer in securities, a bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Sands China Ltd., you should at once hand this circular, together with the enclosed form of proxy, to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. SANDS CHINA LTD. 金沙中國有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1928) PROPOSED RE-ELECTION OF RETIRING DIRECTORS AND PROPOSED GRANTING OF GENERAL MANDATES TO REPURCHASE SHARES AND TO ISSUE NEW SHARES AND NOTICE OF ANNUAL GENERAL MEETING A notice convening the Annual General Meeting of Sands China Ltd. to be held at The Venetian Macao-Resort-Hotel, Florence 2201 to 2302, Level 1, Estrada da Baia de N. Senhora da Esperanca, s/n, Taipa, Macao on Friday, May 25, 2018, at 11:00 a.m. -

2020 Annual Report

Stock Code: 1928 and Note Stock Codes: 5140, 5141, 5142, 5725, 5727, 5733, 40246, 40247, 40584, 40585 www.sandschina.com From Luxury Duty Free Shopping, Exciting Entertainment and Fabulous Dining to World-Class Hotel Suites and MICE, Come and Discover Everything at Sands China. SANDS CHINA LTD. CONTENTS 1. OVERVIEW 4 1.1 Financial Results Summary 4 1.2 Highlights of 2020 5 1.3 Directors and Senior Management 11 2. BUSINESS REVIEW 18 2.1 Chairman’s Statement 18 2.2 Business Overview and Outlook 20 2.3 Our Properties 26 2.4 Management Discussion and Analysis 33 2.5 Priority Risk Factors 47 2.6 Stakeholder Information 59 3. CORPORATE GOVERNANCE 66 REPORT 3.1 Introduction 66 3.2 Corporate Governance Code Compliance 66 3.3 Board Governance Structure 67 3.4 The Board 68 3.5 Audit Committee 74 3.6 Remuneration Committee 76 3.7 Nomination Committee 78 3.8 Capex Committee 81 3.9 Risk Management and Internal Control 82 3.10 Shareholders 87 3.11 Compliance Disclosures and Other Matters 90 3.12 Directors’ Report 92 4. FINANCIAL STATEMENTS 113 4.1 Independent Auditor’s Report 113 4.2 Financial Statements 117 4.3 Notes to the Consolidated Financial Statements 123 4.4 Financial Summary 193 5. CORPORATE INFORMATION 194 6. CONTACT US 195 7. GLOSSARY 196 In case of any inconsistency between the English version and the Chinese version of this Annual Report, the English version shall prevail. SANDS CHINA LTD. 1.1 FINANCIAL HIGHLIGHTS 2 ANNUAL REPORT 2020 SANDS CHINA LTD. 1.1 FINANCIAL HIGHLIGHTS our Luxurious Hotel Rooms and Suites await you. -

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights Yingqi Tan July 2020 M-RCBG Associate Working Paper Series | No. 153 The views expressed in the M-RCBG Associate Working Paper Series are those of the author(s) and do not necessarily reflect those of the Mossavar-Rahmani Center for Business & Government or of Harvard University. The papers in this series have not undergone formal review and approval; they are presented to elicit feedback and to encourage debate on important public policy challenges. Copyright belongs to the author(s). Papers may be downloaded for personal use only. Mossavar-Rahmani Center for Business & Government Weil Hall | Harvard Kennedy School | www.hks.harvard.edu/mrcbg 1 REFORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS MAY 2020 Yingqi Tan MPP Class of 2020 | Harvard Kennedy School MBA Class of 2020 | Harvard Business School J.D. Candidate Class of 2023 | Harvard Law School RERORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS 2 Contents Table of Contents Contents .................................................................................................. 2 Acknowledgements ................................................................................ 7 Abbreviations ......................................................................................... 8 Introduction ......................................................................................... -

Annual Report 2019 001 2019 MILESTONES

CORPORATE CULTURE About China Telecom China Telecom Corporation Limited (“China Telecom” or the “Company”, a joint stock Corporate Mission limited company incorporated in the People’s Republic of China with limited liability, together with its subsidiaries, collectively the “Group”) is a large-scale and leading Let the customers fully enjoy a new information life integrated intelligent information services operator in the world, providing wireline & mobile telecommunications services, Internet access services, information services and other value-added telecommunications services primarily in the PRC. As at the end of 2019, the Strategic Goal Company had mobile subscribers of about 336 million, wireline broadband subscribers of about 153 million and access lines in service of about 111 million. The Company’s H shares Be a leading integrated intelligent information services operator and American Depositary Shares (“ADSs”) are listed on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange” or ”HKSE”) and the New York Stock Exchange respectively. Core Value Comprehensive innovation, pursuing truth and pragmatism, respecting people and creating value all together Operation Philosophy Pursue mutual growth of corporate value and customer value Service Philosophy Customer First Service Foremost Code of Corporate Practice Keep promise and provide excellent service for customers Cooperate honestly and seek win-win result in joint innovation Operate prudently and enhance corporate value continuously Manage precisely and allocate resources scientifically Care the staff and tap their potential to the full Reward the society and be a responsible corporate citizen Corporate Slogan Connecting the World Forward-Looking Statements Certain statements contained in this report may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. -

2020 Annual Report 9668

渤海銀行股份有限公司 CHINA BOHAI BANK CO., LTD. (A joint stock company incorporated in the People’s Republic of China with limited liability) Stock Code : 9668 CHINA BOHAI BANK CO., LTD. CO., CHINA BOHAI BANK 2020 ANNUAL REPORT 2020 ANNUAL REPORT Annual Report 2020 Contents 1 Contents Definitions 2 Important Notice 4 Chairman’s Statement 5 President’s Statement 6 Statement of the Chairman of the Board of Supervisors 7 Corporate Profile 8 Awards and Ranking 10 Summary of Accounting Data and Business Data 11 Management Discussion and Analysis 15 Changes in Share Capital and Information on Shareholders 65 Directors, Supervisors, Members of Senior Management, Employees and Branches 71 Corporate Governance 86 Report of the Board of Directors 108 Report of the Board of Supervisors 117 Important Events 124 Audit Report and Financial Report 129 Organizational Structure Chart 280 CHINA BOHAI BANK CO., LTD. Annual Report 2020 2 Denitions Definitions Articles of Association the Articles of Association of CHINA BOHAI BANK CO., LTD. Bank, our Bank, Company, CHINA BOHAI BANK CO., LTD. (渤海銀行股份有限公司), a joint stock company our Company established on December 30, 2005 in the PRC with limited liability pursuant to the relevant PRC laws and regulations, and its H Shares were listed on the Hong Kong Stock Exchange (Stock Code: 9668) CBIRC China Banking and Insurance Regulatory Commission (中國銀行保險監督管理委員會) CBRC the former China Banking Regulatory Commission (中國銀行業監督管理委員會) Central Bank, PBoC the People’s Bank of China China Accounting Standards Accounting Standards for -

Xiaomi Sews up Deals for Smart Homes

16 BUSINESS Thursday, November 29, 2018 CHINA DAILY HONG KONG EDITION Xiaomi sews Shenzhen firms hike investment up deals for in R&D sector By ZHOU MO in Shenzhen, Guangdong smart homes [email protected] 20 percent of Shenzhenregistered list Tech tieups with Ikea, Microsoft and Nearly 20 percent of ed companies devoted more Shenzhenregistered listed than 10 percent of their iKongjian ‘to create better life for people’ companies devoted more operating revenue to R&D than 10 percent of their oper By OUYANG SHIJIA shortly after Ikea, the world’s ating revenue to research ouyangshijia@ largest furniture retailer, said and development last year, a chinadaily.com.cn last week that it would acceler level on par with globally ate its transformation to fully leading hightech enterpris the sector that took the lead. Chinese technology giant embrace new technologies and es like Google and Apple, Of the 10 listed companies Xiaomi Corp announced on offer better user experiences. according to a report. with the biggest R&D invest Wednesday it has teamed up Bjorn Block, business leader In all, 256 companies cov ment, eight were IT compa with Sweden’s furniture titan for Ikea’s Home Smart divi Lei Jun, founder and CEO of Xiaomi Corp, delivers a speech on Wednesday during the MIDC Xiaomi ered in the Shenzhenregis nies. Ikea to offer smart home prod sion, told during the confer AIoT Developer Conference in Beijing. PROVIDED TO CHINA DAILY tered Listed Companies The R&D investment of ucts. ence that the new partnership Development Report dis Tencent Holdings Ltd, the The tieup is part of its larg marked a key step in creating a closed their R&D spending world’s largest game maker er efforts to expand into the seamless experience for cus partnership would benefit home renovation service plat in their 2017 annual reports. -

CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2202)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2202) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Vanke Co., Ltd.* (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2019 Annual Report will be delivered to the H-Share Holders of the Company and available for viewing on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and of the Company (www.vanke.com) in April 2020. Both the Chinese and English versions of this results announcement are available on the websites of the Company (www.vanke.com) and The Stock Exchange of Hong Kong Limited (www.hkexnews.hk). In the event of any discrepancies in interpretations between the English version and Chinese version, the Chinese version shall prevail, except for the financial report prepared in accordance with International Financial Reporting Standards, of which the English version shall prevail. -

UNO Template

04 December 2013 Asia Pacific/Australia Equity Research Casinos & Gaming (Casino & Gaming (AU)) Crown (CWN.AX / CWN AU) Rating (from Outperform) UNDERPERFORM* DOWNGRADE RATING Price (04 Dec 13, A$) 16.65 Target price (A$) 16.40¹ Market cap. (A$mn) 12,127.76 Pause in the rally Yr avg. mthly trading (A$mn) 433 Last month's trading (A$mn) 448 Projected return: ■ We believe Crown will UNDERPERFORM in the short-term as Macau Capital gain (%) -1.5 gaming stocks have become expensive. We lower our rating from Dividend yield (net %) 2.2 Outperform. We upgrade our FY14 NPAT 8% on a strong MPEL 3Q. Our Total return (%) 0.72 DCF-based target price remains unchanged as the uplift in our MPEL 52-week price range 17.2 - 10.1 * Stock ratings are relative to the relevant country benchmark. valuation was offset by weakness in the domestic casinos as reported at ¹Target price is for 12 months. CWN’s AGM. CWN reported that main floor gaming across its Australia casinos was in-line with the prior year for the 17 weeks ending October 27. It Research Analysts was implied from the AGM language that VIP was running below the pcp. Larry Gandler 61 3 9280 1855 ■ For calendar 2014 we factor 6% gaming revenue growth for MPEL – a [email protected] somewhat slower pace than the 22% for 2013E. Our US$32.50 MPEL DCF Kenny Lau, CFA equates to 12.1x 2014E EBITDA. Currently, MPEL is trading at 13.1x 2014E 852 2101 7914 EBITDA. Also, the margin expansion phase may be slowing as mass market [email protected] table hold rates rose from the low-20s to the low-30s by 2013E. -

3Q18 Earnings Call Presentation October 24, 2018

The Venetian Macao Sands Cotai Central, Macao Marina Bay Sands, Singapore The Parisian Macao 3Q18 Earnings Call Presentation October 24, 2018 Sands Macao Four Seasons Macao Sands Bethlehem The Venetian Las Vegas The Palazzo, Las Vegas Forward Looking Statements This presentation contains forward‐looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements involve a number of risks, uncertainties or other factors beyond the company’s control, which may cause material differences in actual results, performance or other expectations. These factors include, but are not limited to, general economic conditions, competition, new development, construction and ventures, substantial leverage and debt service, fluctuations in currency exchange rates and interest rates, government regulation, tax law changes and the impact of U.S. tax reform, legalization of gaming, natural or man‐made disasters, terrorist acts or war, outbreaks of infectious diseases, insurance, gaming promoters, risks relating to our gaming licenses, certificate and subconcession, infrastructure in Macao, our subsidiaries’ ability to make distribution payments to us, and other factors detailed in the reports filed by Las Vegas Sands with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date thereof. Las Vegas Sands assumes no obligation to update such information. Within this presentation, the -

Issue of Senior Notes

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy securities in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Neither this announcement nor anything herein forms the basis for any contract or commitment whatsoever. Neither this announcement nor any copy hereof may be taken into or distributed in the United States. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration. No public offer of securities is to be made by the Company in the United States. SANDS CHINA LTD. 金沙中國有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1928 and Note Stock Codes: 5140, 5141, 5142, 5725, 5727, 5733) INSIDE INFORMATION ISSUE OF SENIOR NOTES This announcement is issued pursuant to Part XIVA of the SFO and Rule 13.09(2)(a) of the Listing Rules. INTRODUCTION Reference is made to the announcement of the Company dated June 2, 2020 in relation to the proposed issuance of senior notes. -

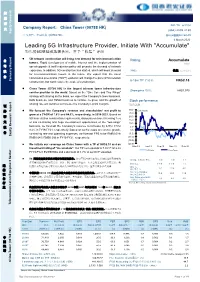

Leading 5G Infrastructure Provider, Initiate with "Accumulate"

股 票 研 [Table_Title] Gin Yu 余劲同 Company Report: China Tower (00788 HK) 究 (852) 2509 2130 Equity Research 公司报告: 中国铁塔 (00788 HK) [email protected] 6 March 2020 Leading[Table_Summary 5G] Infrastructure Provider, Initiate With "Accumulate" 领先的5G基础设施提供商,首予“收集”评级 5G network construction will bring new demand for telecommunication 公 Rating:[Table_Rank] Accumulate towers. Rapid development of mobile Internet and the implementation of Initial 司 speed upgrade & tariff reduction policy will promote the demand of network 报 expansion. In addition, 5G construction has started, which will boost demand 评级: 收集 (首次覆盖) for telecommunication towers in the future. We expect that the novel 告 coronavirus pneumonia ("NCP") epidemic will change the pace of 5G network Company Report 6[Table_Price]-18m TP 目标价 : construction, but won't reduce the scale of construction. HK$2.18 China Tower (00788 HK) is the largest telecom tower infrastructure Share price 股价: HK$1.970 service provider in the world. Based on the "One Core and Two Wings" strategy with sharing as the basis, we expect the Company's tower business, DAS business, and TSSAI business to continue to grow, and the growth of 告 Stock performance sharing rate will continue to increase the Company's profit margins. 证 股价表现 报 [Table_QuotePic] 券 We forecast the Company's revenue and shareholders' net profit to 30.0 % of return 究 grow at a CAGR of 7.6% and 54.9%, respectively, in 2018-2021. Based on 25.0 研 20.0 5G base station construction requirements, discounts on tower licensing fees 研 15.0 究 of site co-sharing and huge development opportunities of the "two-wings" 10.0 券 business, we forecast the Company's revenue to increase by 6.9%/ 7.5%/ 5.0 报 8.4% in FY19-FY21, respectively.