Inside Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UBS AG (Incorporated with Limited Liability in Switzerland) Acting Through Its London Branch

3 June 2021 Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document, for which we accept full responsibility, includes particulars given in compliance with the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Rules”) for the purpose of giving information with regard to us. We, having made all reasonable enquiries, confirm that to the best of our knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading. This document is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for the Warrants. The Warrants are complex products. Investors should exercise caution in relation to them. Investors are warned that the price of the Warrants may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Prospective purchasers should therefore ensure that they understand the nature of the Warrants and carefully study the risk factors set out in the Base Listing Document (as defined below) and this document and, where necessary, seek professional advice, before they invest in the Warrants. -

Proposed Re-Election of Retiring Directors and Proposed Granting of General Mandates to Repurchase Shares and to Issue New Shares and Notice of Annual General Meeting

475754 \ (Sands) \ 23/03/2018 \ M51 P.1 THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult a stockbroker or other registered dealer in securities, a bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Sands China Ltd., you should at once hand this circular, together with the enclosed form of proxy, to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. SANDS CHINA LTD. 金沙中國有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1928) PROPOSED RE-ELECTION OF RETIRING DIRECTORS AND PROPOSED GRANTING OF GENERAL MANDATES TO REPURCHASE SHARES AND TO ISSUE NEW SHARES AND NOTICE OF ANNUAL GENERAL MEETING A notice convening the Annual General Meeting of Sands China Ltd. to be held at The Venetian Macao-Resort-Hotel, Florence 2201 to 2302, Level 1, Estrada da Baia de N. Senhora da Esperanca, s/n, Taipa, Macao on Friday, May 25, 2018, at 11:00 a.m. -

2020 Annual Report

Stock Code: 1928 and Note Stock Codes: 5140, 5141, 5142, 5725, 5727, 5733, 40246, 40247, 40584, 40585 www.sandschina.com From Luxury Duty Free Shopping, Exciting Entertainment and Fabulous Dining to World-Class Hotel Suites and MICE, Come and Discover Everything at Sands China. SANDS CHINA LTD. CONTENTS 1. OVERVIEW 4 1.1 Financial Results Summary 4 1.2 Highlights of 2020 5 1.3 Directors and Senior Management 11 2. BUSINESS REVIEW 18 2.1 Chairman’s Statement 18 2.2 Business Overview and Outlook 20 2.3 Our Properties 26 2.4 Management Discussion and Analysis 33 2.5 Priority Risk Factors 47 2.6 Stakeholder Information 59 3. CORPORATE GOVERNANCE 66 REPORT 3.1 Introduction 66 3.2 Corporate Governance Code Compliance 66 3.3 Board Governance Structure 67 3.4 The Board 68 3.5 Audit Committee 74 3.6 Remuneration Committee 76 3.7 Nomination Committee 78 3.8 Capex Committee 81 3.9 Risk Management and Internal Control 82 3.10 Shareholders 87 3.11 Compliance Disclosures and Other Matters 90 3.12 Directors’ Report 92 4. FINANCIAL STATEMENTS 113 4.1 Independent Auditor’s Report 113 4.2 Financial Statements 117 4.3 Notes to the Consolidated Financial Statements 123 4.4 Financial Summary 193 5. CORPORATE INFORMATION 194 6. CONTACT US 195 7. GLOSSARY 196 In case of any inconsistency between the English version and the Chinese version of this Annual Report, the English version shall prevail. SANDS CHINA LTD. 1.1 FINANCIAL HIGHLIGHTS 2 ANNUAL REPORT 2020 SANDS CHINA LTD. 1.1 FINANCIAL HIGHLIGHTS our Luxurious Hotel Rooms and Suites await you. -

Xiaomi Sews up Deals for Smart Homes

16 BUSINESS Thursday, November 29, 2018 CHINA DAILY HONG KONG EDITION Xiaomi sews Shenzhen firms hike investment up deals for in R&D sector By ZHOU MO in Shenzhen, Guangdong smart homes [email protected] 20 percent of Shenzhenregistered list Tech tieups with Ikea, Microsoft and Nearly 20 percent of ed companies devoted more Shenzhenregistered listed than 10 percent of their iKongjian ‘to create better life for people’ companies devoted more operating revenue to R&D than 10 percent of their oper By OUYANG SHIJIA shortly after Ikea, the world’s ating revenue to research ouyangshijia@ largest furniture retailer, said and development last year, a chinadaily.com.cn last week that it would acceler level on par with globally ate its transformation to fully leading hightech enterpris the sector that took the lead. Chinese technology giant embrace new technologies and es like Google and Apple, Of the 10 listed companies Xiaomi Corp announced on offer better user experiences. according to a report. with the biggest R&D invest Wednesday it has teamed up Bjorn Block, business leader In all, 256 companies cov ment, eight were IT compa with Sweden’s furniture titan for Ikea’s Home Smart divi Lei Jun, founder and CEO of Xiaomi Corp, delivers a speech on Wednesday during the MIDC Xiaomi ered in the Shenzhenregis nies. Ikea to offer smart home prod sion, told during the confer AIoT Developer Conference in Beijing. PROVIDED TO CHINA DAILY tered Listed Companies The R&D investment of ucts. ence that the new partnership Development Report dis Tencent Holdings Ltd, the The tieup is part of its larg marked a key step in creating a closed their R&D spending world’s largest game maker er efforts to expand into the seamless experience for cus partnership would benefit home renovation service plat in their 2017 annual reports. -

Investment Daily

Investment Daily 12 August 2020 Major Market Indicators Market Overview 11 Aug 10 Aug 7 Aug Mkt. Turn.(mn) 141,400 135,300 177,800 HK stock will retreat today, resistance at 25,000; Eye on Tencent Stock Advances 1,015 741 577 Result Stock Declines 857 1,054 1,242 Overnight US equities performed well. Hang Seng Index significantly rebounded 513 points to 24,890 HSI 24,891 24,377 24,532 after dropping two days in a row. H-share Index rose 162 points to 10,153. Market turnover was Change +531 -154 -399 HK$141.4 billion. Heavyweight blue chips boosted market. Tencent(700) rose 2.3% before result announcement. AIA(1299) also rose 2.5%. Macau will resume issuing tourist visas. Gaming stocks HSI Turn.($bn) 41.50 44.96 56.02 HSCEI 10,153 9,991 10,063 rose. Sands(1928)surged 9.8% while Galaxy Entertainment(27) advanced 5.5%. Change +163 -73 -139 President Trump said he was considered a capital gain tax cut, together with newly daily confirmed HSCEI Turn.($bn) 34.63 41.20 54.31 COVID 19 cases decline in US, support the US stock market to rise on early Tuesday, the Dow once rose 360 points on Tuesday. However, Senate Majority Leader Mitch McConnell confirmed that talks between the Democrats and the White House were at a stalemate, triggered late selling pressure. US HSI Technical Indicators stock finished lower. 10-days MA 24,743 The three major US stock index fell 0.4-1.7% respectively on Tuesday, of which, the Nasdaq index fell 50-days MA 24,885 the most and closed below the 10 Day SMA. -

UNO Template

04 December 2013 Asia Pacific/Australia Equity Research Casinos & Gaming (Casino & Gaming (AU)) Crown (CWN.AX / CWN AU) Rating (from Outperform) UNDERPERFORM* DOWNGRADE RATING Price (04 Dec 13, A$) 16.65 Target price (A$) 16.40¹ Market cap. (A$mn) 12,127.76 Pause in the rally Yr avg. mthly trading (A$mn) 433 Last month's trading (A$mn) 448 Projected return: ■ We believe Crown will UNDERPERFORM in the short-term as Macau Capital gain (%) -1.5 gaming stocks have become expensive. We lower our rating from Dividend yield (net %) 2.2 Outperform. We upgrade our FY14 NPAT 8% on a strong MPEL 3Q. Our Total return (%) 0.72 DCF-based target price remains unchanged as the uplift in our MPEL 52-week price range 17.2 - 10.1 * Stock ratings are relative to the relevant country benchmark. valuation was offset by weakness in the domestic casinos as reported at ¹Target price is for 12 months. CWN’s AGM. CWN reported that main floor gaming across its Australia casinos was in-line with the prior year for the 17 weeks ending October 27. It Research Analysts was implied from the AGM language that VIP was running below the pcp. Larry Gandler 61 3 9280 1855 ■ For calendar 2014 we factor 6% gaming revenue growth for MPEL – a [email protected] somewhat slower pace than the 22% for 2013E. Our US$32.50 MPEL DCF Kenny Lau, CFA equates to 12.1x 2014E EBITDA. Currently, MPEL is trading at 13.1x 2014E 852 2101 7914 EBITDA. Also, the margin expansion phase may be slowing as mass market [email protected] table hold rates rose from the low-20s to the low-30s by 2013E. -

3Q18 Earnings Call Presentation October 24, 2018

The Venetian Macao Sands Cotai Central, Macao Marina Bay Sands, Singapore The Parisian Macao 3Q18 Earnings Call Presentation October 24, 2018 Sands Macao Four Seasons Macao Sands Bethlehem The Venetian Las Vegas The Palazzo, Las Vegas Forward Looking Statements This presentation contains forward‐looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements involve a number of risks, uncertainties or other factors beyond the company’s control, which may cause material differences in actual results, performance or other expectations. These factors include, but are not limited to, general economic conditions, competition, new development, construction and ventures, substantial leverage and debt service, fluctuations in currency exchange rates and interest rates, government regulation, tax law changes and the impact of U.S. tax reform, legalization of gaming, natural or man‐made disasters, terrorist acts or war, outbreaks of infectious diseases, insurance, gaming promoters, risks relating to our gaming licenses, certificate and subconcession, infrastructure in Macao, our subsidiaries’ ability to make distribution payments to us, and other factors detailed in the reports filed by Las Vegas Sands with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date thereof. Las Vegas Sands assumes no obligation to update such information. Within this presentation, the -

Issue of Senior Notes

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy securities in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Neither this announcement nor anything herein forms the basis for any contract or commitment whatsoever. Neither this announcement nor any copy hereof may be taken into or distributed in the United States. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration. No public offer of securities is to be made by the Company in the United States. SANDS CHINA LTD. 金沙中國有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1928 and Note Stock Codes: 5140, 5141, 5142, 5725, 5727, 5733) INSIDE INFORMATION ISSUE OF SENIOR NOTES This announcement is issued pursuant to Part XIVA of the SFO and Rule 13.09(2)(a) of the Listing Rules. INTRODUCTION Reference is made to the announcement of the Company dated June 2, 2020 in relation to the proposed issuance of senior notes. -

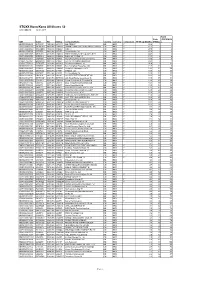

STOXX Hong Kong All Shares 50 Last Updated: 02.01.2018

STOXX Hong Kong All Shares 50 Last Updated: 02.01.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 85.6 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 65.7 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 47.5 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 47.2 4 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 44.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.1 6 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 29.6 7 8 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 29.1 8 7 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 26.9 9 12 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 21.8 10 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 19.5 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 12 13 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.9 13 11 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 18.0 14 15 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 17.0 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 15.6 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

Review of the Fees Payable to Non-Executive

REVIEW OF THE FEES PAYABLE TO NON-EXECUTIVE DIRECTORS OF CLP HOLDINGS LIMITED 25 February 2019 - 1 - Contents Page Executive Summary 2 Introduction 4 General Principles 4 CLP’s Approach 6 CLP’s Methodology 7 Application of CLP’s methodology 10 Review Outcome for 2019 10 Benchmarking 14 Conclusion 18 Appendices Appendix A: Opinion of J.S. Gale & Co Appendix B: Current level of fees payable to CLP’s Non-executive Directors Appendix C: Breakdown of Calculation of Hours Spent by Directors Appendix D: List of 49 Hang Seng Index Constituent Stocks (excluding CLP Holdings); List of 34 Hang Seng HK 35 Index Constituent Stocks (excluding CLP Holdings); List of 30 largest companies by capitalisation; and List of Sample Major Utility Companies Listed in Hong Kong, U.K., Australia and New Zealand - 2 - Executive Summary I. CLP Code on Corporate Governance issued on 28 February 2005 and most recently updated in January 2019 (the CLP Code) provides that Non-executive Directors (NEDs) of CLP Holdings Limited (CLP Holdings) are paid fees in line with market practice based on a formal independent review undertaken no less frequently than every three years. The previous such reviews took place in 2004, 2007, 2010, 2013 and 2016, and, therefore, in 2019, a review (2019 Review) was due of the level of fees to be paid to NEDs for the three years commencing on the day following the 2019 Annual General Meeting (2019 AGM). II. The CLP Code explained the methodology which is used by CLP Holdings in calculating NEDs’ remuneration. In this regard, no distinction is made between those NEDs who are categorised as independent and those who are not. -

4Q19 Earnings Call Presentation January 29, 2020 Forward Looking Statements

4Q19 Earnings Call Presentation January 29, 2020 Forward Looking Statements This presentation contains forward-looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve a number of risks, uncertainties or other factors beyond the company’s control, which may cause material differences in actual results, performance or other expectations. These factors include, but are not limited to, general economic conditions, disruptions or reductions in travel, as well as in our operations, due to natural or man-made disasters, pandemics, epidemics, or outbreaks of infectious or contagious diseases such as the coronavirus originating in Wuhan, China, new development, construction and ventures, government regulation, risks relating to our gaming licenses and subconcession, fluctuations in currency exchange rates and interest rates, substantial leverage and debt service, gaming promoters, competition, tax law changes, infrastructure in Macao, political instability, civil unrest, terrorist acts or war, legalization of gaming, insurance, our subsidiaries’ ability to make distribution payments to us, and other factors detailed in the reports filed by Las Vegas Sands with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date thereof. Las Vegas Sands assumes no obligation to update such information. Within this presentation, the company may make reference -

Permitted, Subject to the Approval of the Government of Macau, to Each Grant One Subconcession to Other Gaming Operators

W y n n R e s o R t s , L i m i t e d permitted, subject to the approval of the government of Macau, to each grant one subconcession to other gaming operators. There is no limit to the number of casinos each concessionaire is permitted to operate, but each facility is subject to government approval. Currently, there are 33 operating casinos in Macau. In 2002, the other two concessions were granted to Sociedade de Jogos de Macau (“SJM”) and Galaxy Entertainment Group Limited (“Galaxy”). SJM, which is controlled by the family of Stanley Ho, operates 20 of the 33 existing casinos, including the Hotel Lisboa and The Grand Lisboa. SJM is a Hong Kong Stock Exchange listed company. In September 2009, SJM opened L’ Arc Macau Casino/Hotel which is adjacent to Wynn Macau. In December 2009, SJM opened the Casino Oceanus which is adjacent to the Macau ferry terminal. In addition, an affiliate of SJM owns one of three water ferry services and the helicopter shuttle service that links Macau to Hong Kong. Galaxy, a Hong Kong Stock Exchange listed company, was also awarded a casino concession in June 2002. Galaxy opened the Waldo Hotel/Casino on the Macau peninsula in 2004, the Grand Waldo Cotai in the summer of 2006, and Galaxy Star World hotel casino immediately adjacent to Wynn Macau in October 2006. In addition, Galaxy is currently constructing a resort on Cotai, which is expected to open in 2011. Las Vegas Sands Corp., the owner and operator of The Venetian and The Palazzo resorts in Las Vegas and a former partner of Galaxy, entered into a subconcession agreement with Galaxy in 2002 which allows it to independently develop and operate casinos in Macau.