July, 2009 Volume 12, Number 6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Sharjah International Airport Is All Set to Receive 200

high tech AIR CARGO UPDATE 205x292.pdf 1 11.04.2014 10:54 C M Y CM MY CY CMY K www.turkishcargo.com | +90 850 333 0 777 A4 CAS 2_Mise en page 1 05/11/13 16:13 Page1 CANNES AIRSHOW EDITORIAL 8th International Exhibition of General Aviation Editor’s Note Strongest growth of any region The GCC countries led by the UAE have been maintaining Bi-monthly: Vol 04 | Issue 05 | No. 23 their status as a safe haven for investment despite the ongoing Middle East, Africa and South Asia problems in the wider region. As other countries in the Middle East, unfortunately, continue to struggle with issues such as political and economic instability, investors both from the region and overseas prefer to setup their businesses here. Even several international corporations have relocated their headquarters to Dubai in recent years attracted by the value proposition in the city’s many free zones. The neighboring emirate, Sharjah, in the UAE is also another success story. With available land and established manufacturing businesses as well as modern air and sea ports, Sharjah is registering strong economic growth and even making headlines in international media by hosting large scale events. In this edition, we take a look at Sharjah International Airport and the region’s leading low cost carrier Air Arabia and try to highlight the reasons of the airport’s and airline’s success as several airlines in the region have failed to survive. 300 Exhibitors and represented brands Another enlightening article on transportation of pharmaceutical and temperature sensitive cargo underlines the importance PO Box: 9604, SAIF Zone, Sharjah - UAE of maintaining the right temperature throughout the journey. -

Annual Review 2014-2015

The Voice for Business Aviation in Europe Annual Review 2014-2015 Business Aviation in Europe: State of the Industry 2015 Done in collaboration with www.wingx-advance.com www.amstatcorp.com www.eurocontrol.int CONTENTS 03 Introduction 04 Overview • What is Business Aviation? • Sub-divisions of the Definition 05 The European Business Aviation Association • EBAA Representativeness of the Business Aviation Industry • EBAA Membership 1996-2014 07 State of the Industry • Economic Outlook 08 • Traffic Analysis • The European Fleet 09 • Activity Trends by Aircraft Types 10 • Business Aviation Airports 11 • Business Aviation and Safety 12 A Challenging Industry • Challenges from the Inside 1. Means of Booking a Business Aviation Flight 2. Positioning Flights 13 3. Fleet Growth Vs Traffic • Challenges from the Outside 1. Fuel Prices 14 2. Route Charges 15 3. Taxes Revenue per Flight Indicator 16 Looking Ahead: Projects for 2015 • Description of Projects 18 EBAA Members (as of 1 April 2015) 2 INTRODUCTION In our last annual review, looking back at 2013, other sub-sectors were worse off than in 2013 we concluded that 2014 would be a defining (cargo was -0.5%, and charters plummeted moment for Business Aviation. In the first half at -9%). While times remain challenging for all of the year, we saw four consecutive months of forms of transport, we shouldn’t forget that in growth – a breath of fresh air following the years many ways, Business Aviation has fared, and characterised by recession. We were hoping continues to fare, better than most of its air to see that the economic storm was over so transport peers. -

PCW 2017 Week

Air Charter Service Q&A with Mr. Stephen Fernandez, Regional Director – APAC at Air Charter Service in Hong Kong When did Air Charter Service get established and who owns the company today? Where is the head office and where are the branch offices? Week 1 (1 January - 7 January, 2017) ACS was established in 1990. Chris Leach is the founder of the company. ACS’s headquarters are in London, with a network of 20 offices spanning North America, South America, Europe, Africa, Editorial CIS, Middle East, Asia and Australia. Let me start off by wishing all of you a very happy new year. I What are the advantages of contacting your company trust you entered it well and that the subsequent hangovers for instead of an airline direct? some of you by now have subsided and that your wallets are not Every Air Charter Service client, worldwide, is allocated a dedicat- too empty from buying gifts (for those who celebrate Christmas). A new year is also the start of some new promises. I promised ed and highly experienced account manager who can provide the myself not to eat chocolate for one month. After 48 hours I was perfect charter solution quickly and effectively. For charter flights reaching for another morsel. in different regions, our international network of 20 offices work together to find the best solution (with access to 50,000 aircraft Nevertheless a New Year is a fresh start. We aim to provide you worldwide), using their expert local knowledge. All our account with interesting insights, q&a's and solid market information managers have knowledge of a huge range of different aircraft every Thursday. -

MIDRMA Board/13-WP/6 3/03/2014 International Civil Aviation

MIDRMA Board/13-WP/6 3/03/2014 International Civil Aviation Organization Middle East Regional Monitoring Agency Board Thirteenth Meeting (MIDRMA Board/13) (Bahrain, 9 –12 March 2014) Agenda Item 4: RVSM Monitoring and Related Technical Issues MID STATES MINIMUM MONITORING REQUIREMENTS (Presented by MIDRMA) SUMMARY The aim of this working paper is to address the RVSM Minimum Monitoring Requirements (MMR) applicable for each MIDRMA Member State. Action by the meeting is at paragraph 3. REFERENCES − ATM/AIM/SAR SG/13 Report − ICAO Doc 9547 − ICAO doc 9937 − ICAO Annex 6 Part I − MIDANPIRG/14 Report − MID RVSM SMR 2012-2013 1. INTRODUCTION 1.1 The height-keeping performance of aircraft is a key element in ensuring the safe operations of RVSM airspace. The RVSM height monitoring standards are considered the minimum requirement needed to maintain the safety of operations in the RVSM designated airspace. 1.2 Upon changes to ICAO Annex 6, Operation of Aircraft, Parts I & II, applicable on 18 November 2010, the following standard was adopted by the International Civil Aviation Organization (ICAO): 7.2.7 The State of the Operator that has issued an RVSM approval to an operator shall establish a requirement which ensures that a minimum of two aeroplanes of each aircraft type grouping of the operator have their height-keeping performance monitored, at least once every two years or within intervals of 1000 flight hours per aeroplane, whichever period is longer. If an operator aircraft type grouping consists of a single aeroplane, monitoring of that aeroplane shall be accomplished within the specified period. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Nantucket Memorial Airport Page 32

OFFICIAL PUBLICATION OF THE NATIONAL AIR TRANSPORTATION ASSOCIATION 2nd Quarter 2011 Nantucket Memorial Airport page 32 Also Inside: • A Workers Compensation Controversy • Swift Justice: DOT Enforcement • Benefits of Airport Minimum Standards GET IT ALL AT AVFUEL All Aviation Fuels / Contract Fuel / Pilot Incentive Programs Fuel Quality Assurance / Refueling Equipment / Aviation Insurance Fuel Storage Systems / Flight Planning and Trip Support Global Supplier of Aviation Fuel and Services 800.521.4106 • www.avfuel.com • facebook.com/avfuel • twitter.com/AVFUELtweeter NetJets Ad - FIRST, BEST, ONLY – AVIATION BUSINESS JOURNAL – Q2 2011 First. Best. Only. NetJets® pioneered the concept of fractional jet ownership in 1986 and became a Berkshire Hathaway company in 1998. And to this day, we are driven to be the best in the business without compromise. It’s why our safety standards are so exacting, our global infrastructure is so extensive, and our service is so sophisticated. When it comes to the best in private aviation, discerning fl iers know there’s Only NetJets®. SHARE | LEASE | CARD | ON ACCOUNT | MANAGEMENT 1.877.JET.0139 | NETJETS.COM A Berkshire Hathaway company All fractional aircraft offered by NetJets® in the United States are managed and operated by NetJets Aviation, Inc. Executive Jet® Management, Inc. provides management services for customers with aircraft that are not fractionally owned, and provides charter air transportation services using select aircraft from its managed fleet. Marquis Jet® Partners, Inc. sells the Marquis Jet Card®. Marquis Jet Card flights are operated by NetJets Aviation under its 14 CFR Part 135 Air Carrier Certificate. Each of these companies is a wholly owned subsidiary of NetJets Inc. -

Dubai Airshow Aspires to Be the Biggest International Event

11-15th Nov. 2007, Airport Expo. Dubai United Arab Emirates The SHOW DAILY is Published by SAP MEDIA WORLDWIDE LTD. DAY ONE SUNDAY, 11th NOV. 2007 FROM THE PUBLISHERS OF INTERNATIONAL AEROSPACE TODAy’s pro- GRAMME Dubai Airshow Aspires To Be Sunday, 11th November 2007 The Biggest International Event Room A 09.00am Dubai 2007 official opening he 10th edition of the at Royal Pavilion Dubai Airshow, is com- 10.00am Press conference Lockheed Tpletely sold out, and has Martin at Press Conf. Room broken all the international Mezzanine Floor East Hall event’s previous records of 11.00am Press conference DAE Press size, exhibitor and aircraft Conf. Room at Mezzanine numbers and aircraft displayed Floor East Hall as it readies for its final show- 12.00nn Press conference BOEING ing at the Airport Expo Dubai. at Press Conf. Room Mez The largest ever Dubai Airshow zanine Floor East Hall is a barometer for huge Middle 01.00pm Press conference Lockheed East Aviation growth, says HH Martin at Press Conf. Room Sheikh Ahmed. The growth is in Mezzanine Floor East Hall tandem with its 2009 move to 02.00pm Press conference BOEING a new, purpose-built facility at at Press Conf. Room Mez Dubai World Central, the huge His Highness Sheikh Ahmed Bin Saeed Al Maktoum, President, Dubai Civil Aviation zanine Floor East Hall urban aviation community being Authority (DCAA), and Chairman of Dubai Airports at the press conference. 03.00pm Press conference Airbus at built in Jebel Ali, 30 kilometres Press Conf. Room Mezzanine north of Dubai city centre. -

Change 3, FAA Order 7340.2A Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.2A CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2A, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to the interested aviation public. 3. EFFECTIVE DATE. July 29, 2010. 4. EXPLANATION OF CHANGES. Changes, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. Y[fa\.Uj-Koef p^/2, Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: k/^///V/<+///0 Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 7/29/10 JO 7340.2A CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−2 . 4/8/10 CAM−1−1 through CAM−1−2 . 7/29/10 1−1−1 . 8/27/09 1−1−1 . 7/29/10 2−1−23 through 2−1−27 . 4/8/10 2−1−23 through 2−1−27 . 7/29/10 2−2−28 . 4/8/10 2−2−28 . 4/8/10 2−2−23 . -

Office of International Aviation (X-40) Foreign and U.S

OFFICE OF INTERNATIONAL AVIATION (X-40) FOREIGN AND U.S. CARRIER LICENSING DIVISIONS Page 1 of 4 FOREIGN AIR CARRIER FIFTH FREEDOM CHARTER APPLICATIONS ON HAND DURING WEEK ENDING MAY 21, 2021 (Prior Approval Required By DOT Regulations (Part 212) and Orders) Points to be Served and Charterer and Applicant Number of Flights Period Requested Action Taken Volga-Dnepr Manila-New York (JFK) DF Young Approved Airlines 1 o w CARGO 5/21-25/21 5/20/21 Everett-Taranto Boeing Approved 1 o w CARGO 5/24-26/21 5/20/21 Prestwick-Bangor or Portsmouth, NH Boeing Pending 1 o w CARGO 5/24-25/21 Tulsa-Palembang, Indonesia PT Kurhanz Trans Pending 1 r t CARGO 6/3-7/21 Frankfurt-Philadelphia Fracht FWO AG Pending 1 o w CARGO 6/4-8/21 AirBridgeCargo Hong Kong or Leipzig-Cincinnati DHL Aviation Americas, Inc. Pending Airlines 14 o w CARGO 6/1/21-7/1/21 Cincinnati-Brussels or Leipzig DHL Aviation Americas, Inc. Pending 14 o w CARGO 6/1/21-7/1/21 Shenzhen-Cincinnati DHL Aviation Americas, Inc. Approved 2 o w CARGO 5/20-28/21 5/20/2021 Flexjet Operations Newark-London-Bodrum PrivateFly Approved 1 o w PAX 5/19-20/21 5/19/21 MHS Aviation London-Latrobe, PA Hunt & Palmer PLC Approved 1 o w PAX 5/20/21 5/19/21 Atlanta-Barbados-Saint-Gilles, France Lunajets SA Approved 1 o w PAX 5/22/21 5/19/21 Page 2 of 4 FOREIGN AIR CARRIER FIFTH FREEDOM CHARTER APPLICATIONS ON HAND DURING WEEK ENDING MAY 21, 2021 (Prior Approval Required By DOT Regulations (Part 212) and Orders) Points to be Served and Charterer and Applicant Number of Flights Period Requested Action Taken VistaJet Limited Los Angeles-Providenciales Jet Edge Cancelled 1 o w PAX 5/16/21 5/17/21 Abu Dhabi-Cleveland UAC Approved 1 o w PAX 5/16/21 5/16/21 Anguilla-Teterboro Flipt LLC. -

Bibliography

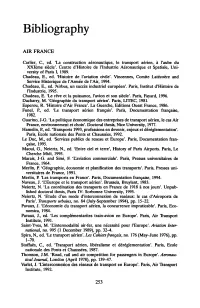

Bibliography AIR FRANCE Carlier, c., ed. 'La construction aeronautique, Ie transport aenen, a I'aube du XXIeme siecle'. Centre d'Histoire de l'Industrie Aeronautique et Spatiale, Uni versity of Paris I, 1989. Chadeau, E., ed. 'Histoire de I'aviation civile'. Vincennes, Comite Latecoere and Service Historique de l'Annee de l'Air, 1994. Chadeau, E., ed. 'Airbus, un succes industriel europeen'. Paris, Institut d'Histoire de l'Industrie, 1995. Chadeau, E. 'Le reve et la puissance, I'avion et son siecle'. Paris, Fayard, 1996. Dacharry, M. 'Geographie du transport aerien'. Paris, LITEC, 1981. Esperou, R. 'Histoire d'Air France'. La Guerche, Editions Ouest France, 1986. Funel, P., ed. 'Le transport aerien fran~ais'. Paris, Documentation fran~aise, 1982. Guarino, J-G. 'La politique economique des entreprises de transport aerien, Ie cas Air France, environnement et choix'. Doctoral thesis, Nice University, 1977. Hamelin, P., ed. 'Transports 1993, professions en devenir, enjeux et dereglementation'. Paris, Ecole nationale des Ponts et Chaussees, 1992. Le Due, M., ed. 'Services publics de reseau et Europe'. Paris, Documentation fran ~ise, 1995. Maoui, G., Neiertz, N., ed. 'Entre ciel et terre', History of Paris Airports. Paris, Le Cherche Midi, 1995. Marais, J-G. and Simi, R 'Caviation commerciale'. Paris, Presses universitaires de France, 1964. Merlin, P. 'Geographie, economie et planification des transports'. Paris, Presses uni- versitaires de France, 1991. Merlin, P. 'Les transports en France'. Paris, Documentation fran~aise, 1994. Naveau, J. 'CEurope et Ie transport aerien'. Brussels, Bruylant, 1983. Neiertz, N. 'La coordination des transports en France de 1918 a nos jours'. Unpub lished doctoral thesis, Paris IV- Sorbonne University, 1995. -

16325/09 ADD 1 GW/Ay 1 DG C III COUNCIL of the EUROPEAN

COUNCIL OF Brussels, 19 November 2009 THE EUROPEAN UNION 16325/09 ADD 1 AVIATION 191 COVER NOTE from: Secretary-General of the European Commission, signed by Mr Jordi AYET PUIGARNAU, Director date of receipt: 18 November 2009 to: Mr Javier SOLANA, Secretary-General/High Representative Subject: Commission staff working document accompanying the report from the Commission to the European Parliament and the Council European Community SAFA Programme Aggregated information report (01 january 2008 to 31 december 2008) Delegations will find attached Commission document SEC(2009) 1576 final. ________________________ Encl.: SEC(2009) 1576 final 16325/09 ADD 1 GW/ay 1 DG C III EN COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 18.11.2009 SEC(2009) 1576 final COMMISSION STAFF WORKING DOCUMENT accompanying the REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL EUROPEAN COMMUNITY SAFA PROGRAMME AGGREGATED INFORMATION REPORT (01 January 2008 to 31 December 2008) [COM(2009) 627 final] EN EN COMMISSION STAFF WORKING DOCUMENT AGGREGATED INFORMATION REPORT (01 January 2008 to 31 December 2008) Appendix A – Data Collection by SAFA Programme Participating States (January-December 2008) EU Member States No. No. Average no. of inspected No. Member State Inspections Findings items/inspection 1 Austria 310 429 41.37 2 Belgium 113 125 28.25 29.60 3 Bulgaria 10 18 4 Cyprus 20 11 42.50 5 Czech Republic 29 19 32.00 6 Denmark 60 16 39.60 7 Estonia 0 0 0 8 Finland 120 95 41.93 9 France 2,594 3,572 33.61 10 Germany 1,152 1,012 40.80 11 Greece 974 103 18.85 12 Hungary 7 9 26.57 13 Ireland 25 10 48.80 14 Italy 873 820 31.42 15 Latvia 30 34 30.20 16 Lithuania 12 9 48.08 17 Luxembourg 26 24 29.08 18 Malta 13 6 36.54 19 Netherlands 258 819 36.91 EN 2 EN 20 Poland 227 34 39.59 21 Portugal 53 98 46.51 22 Romania 171 80 28.37 23 Slovak Republic 13 5 23.69 24 Slovenia 19 8 27.00 25 Spain 1,230 2,227 39.51 26 Sweden 91 120 44.81 27 United Kingdom 610 445 39.65 Total 9,040 10,148 34.63 Non-EU ECAC SAFA Participating States No.