Margin Under Pressure but Positive on Top-Line Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Esports – Who Are the Big Players and the Likely

Esports – Who are the big players and the likely winners Millennial driven esports continues to grow rapidly. The number of esports enthusiasts worldwide was estimated to be ~165 million in 2018, and for total global viewers, the forecast is ~453 million in 2019. Esports global revenue is forecast to pass US$1b in 2019 and by 2022 the global eSports market revenue is forecast to reach US$1.79 billion growing at a CAGR of 22.3%. The big players in esports Activision Blizzard Inc. (NASDAQ: ATVI) Activision Blizzard owns the popular Overwatch League as well as World of Warcraft, StarCraft, Diablo, and Hearthstone. In 2018 Activision Blizzard signed a multiyear deal with Walt Disney to broadcast the Overwatch League. As of March 2018, it was the largest game company in the Americas and Europe in terms of revenue and market capitalization. Activision Blizzard has several business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming,and Activision Blizzard Studios. Alphabet Inc. (NASDAQ: GOOGL) Alphabet (Google) has a new cloud gaming platform called Stadia. It operates games hosted on remote servers and then streams video content to connected devices, including smartphones, tablets, computers and TVs. Other competitors in the streaming space include Amazon (Twitch), Facebook, Twitter, Microsoft, Tencent, and Alibaba. Amazon (NASDAQ: AMZN) Amazon’s Twitch leads the online USA streaming market. Amazon acquired Twitch for nearly $1 billion in 2014. Twitch is only a very small percentage of Amazon’s massive revenue. Electronic Arts Inc. (NASDAQ: EA) Electronic Arts is an American video game company headquartered in California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. -

Final Study Report on CEF Automated Translation Value Proposition in the Context of the European LT Market/Ecosystem

Final study report on CEF Automated Translation value proposition in the context of the European LT market/ecosystem FINAL REPORT A study prepared for the European Commission DG Communications Networks, Content & Technology by: Digital Single Market CEF AT value proposition in the context of the European LT market/ecosystem Final Study Report This study was carried out for the European Commission by Luc MEERTENS 2 Khalid CHOUKRI Stefania AGUZZI Andrejs VASILJEVS Internal identification Contract number: 2017/S 108-216374 SMART number: 2016/0103 DISCLAIMER By the European Commission, Directorate-General of Communications Networks, Content & Technology. The information and views set out in this publication are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. ISBN 978-92-76-00783-8 doi: 10.2759/142151 © European Union, 2019. All rights reserved. Certain parts are licensed under conditions to the EU. Reproduction is authorised provided the source is acknowledged. 2 CEF AT value proposition in the context of the European LT market/ecosystem Final Study Report CONTENTS Table of figures ................................................................................................................................................ 7 List of tables .................................................................................................................................................. -

Social Media Contracts in the US and China

DESTINED TO COLLIDE? SOCIAL MEDIA CONTRACTS IN THE U.S. AND CHINA* MICHAEL L. RUSTAD** WENZHUO LIU*** THOMAS H. KOENIG**** * We greatly appreciate the editorial and research aid of Suffolk University Law School research assistants: Melissa Y. Chen, Jeremy Kennelly, Christina Kim, Nicole A. Maruzzi, and Elmira Cancan Zenger. We would also like to thank the editors at the University of Pennsylvania Journal of International Law. ** Michael Rustad is the Thomas F. Lambert Jr. Professor of Law, which was the first endowed chair at Suffolk University Law School. He is the Co-Director of Suffolk’s Intellectual Property Law Concentration and was the 2011 chair of the American Association of Law Schools Torts & Compensation Systems Section. Pro- fessor Rustad has more than 1100 citations on Westlaw. His most recent books are SOFTWARE LICENSING: PRINCIPLES AND PRACTICAL STRATEGIES (Lexis/Nexis, 3rd ed. forthcoming 2016), GLOBAL INTERNET LAW IN A NUTSHELL (3rd ed., West Academic Publishers, 2015), and GLOBAL INTERNET LAW (HORNBOOK SERIES) (West Academic Publishers, 2d ed. 2015). Professor Rustad is editor of COMPUTER CONTRACTS (2015 release), a five volume treatise published by Matthew Bender. *** Wenzhuo Liu, LL.B., LL.M, J.D., obtained China’s Legal Professional Qual- ification Certificate in 2011. In 2014, she became a member of the New York state bar. She earned an LL.M degree from the University of Wisconsin Law School in Madison, Wisconsin in 2012 and a J.D. degree from Suffolk University Law School in Boston. She was associated with Hunan Haichuan Law Firm in Changsha, China. Ms. Liu wrote a practice pointer on Software Licensing and Doing Business in China in the second and third editions of MICHAEL L. -

Mount Yale Market Outlook Fourth Quarter 2019 Contents

Mount Yale Market Outlook Fourth Quarter 2019 Contents Pg. 1. Summary 3 2. Growth, Inflation & Policy 8 3. Equities 18 4. Fixed Income & Credit 26 5. Real Assets 34 6. Opportunistic 38 7. Asset Allocation 42 Cartoon: The Gloves Are Off 4Q, 2019 4th Quarter 2019 Market Outlook, Page 3 Q3, 2019 Market Review QTD & YTD TOTAL RETURNS 26.8 20.6 19.2 15.7 16.1 14.2 13.3 12.6 12.5 13.0 11.4 11.1 8.5 7.7 6.2 6.8 5.4 4.7 4.5 3.4 3.1 2.3 1.9 1.7 1.5 1.3 1.8 0.3 1.0 0.8 0.6 -0.4 -1.0 -0.7 -2.4 -1.8 -4.1 -5.0 QTD YTD 4th Quarter 2019 Market Outlook, Page 4 Source: Bloomberg. SEE IMPORTANT DISCLOSURES AT THE END OF THIS PRESENTATION. Market Returns from Key Events Date TOTAL RETURNS, AS OF 10/18/19 3/10/00 10/9/02 10/9/07 (Tech (Tech (Housing 11/8/16 3/22/18 7/31/19 Bubble Bubble Bubble 3/9/09 (Trump 1/26/18 (start of 9/20/18 12/24/18 7/26/19 (Trade War Asset Class Benchmark peak) low) high) (GFC low) election) (Jan high) Trade War) (Sep high) (Dec low) (SPX ATH) escalation) ■ US REITs MSCI US REIT GR 11.6 11.5 6.2 20.0 10.5 14.9 21.0 18.3 33.4 8.0 7.5 ■ Municipal High Yield Bonds Bloomberg US Muni HY 6.1 6.3 5.3 8.8 6.5 8.7 9.4 10.4 9.7 2.2 2.1 ■ Global Real Estate Sec's S&P Global Property 9.9 10.2 3.5 16.5 9.9 6.0 10.8 14.1 24.6 5.1 5.6 ■ Gold LBMA Gold Price PM Fix 8.7 9.5 6.0 4.6 5.2 5.7 7.9 23.3 18.4 4.9 4.4 ■ US Interm-Term Bonds Bloomberg U.S. -

Netease to Report Second Quarter 2021 Financial Results on August 31

NetEase to Report Second Quarter 2021 Financial Results on August 31 August 17, 2021 BEIJING, Aug. 17, 2021 /PRNewswire/ -- NetEase, Inc. (NASDAQ: NTES and HKEX: 9999, "NetEase" or the "Company"), one of China's leading internet and online game services providers, today announced that it will report financial results for the 2021 second quarter on Tuesday, August 31, 2021, before the open of the U.S. markets. The earnings teleconference call with simultaneous webcast will take place at 8:00 a.m. Eastern Time on Tuesday, August 31, 2021 (Beijing/Hong Kong Time: 8:00 p.m., Tuesday, August 31, 2021). NetEase's management will be on the call to discuss the quarterly results and answer questions. Interested parties may participate in the conference call by dialing 1-646-828-8193 and providing conference ID: 7055363, 15 minutes prior to the initiation of the call. A replay of the call will be available by dialing 1-719-457-0820 and entering passcode 7055363#. The replay will be available through September 13, 2021. This call will be webcast live and the replay will be available for 12 months. Both will be available on NetEase's Investor Relations website at http://ir.netease.com/. About NetEase, Inc. As a leading internet technology company based in China, NetEase, Inc. (NASDAQ: NTES; HKEX: 9999) is dedicated to providing premium online services centered around innovative and diverse content, community, communication and commerce. NetEase develops and operates some of China's most popular mobile and PC-client games. In more recent years, NetEase has expanded into international markets including Japan and North America. -

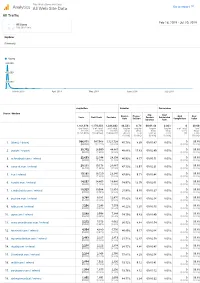

Thiswaifudoesnotexist.Net: Google Analytics: All Traffic 20190218-20190720

This Waifu Does Not Exist Analytics All Web Site Data Go to report All Traffic Feb 18, 2019 - Jul 20, 2019 All Users 100.00% Users Explorer Summary Users 600,000 400,000 200,000 March 2019 April 2019 May 2019 June 2019 July 2019 Acquisition Behavior Conversions Source / Medium Avg. Goal Bounce Pages / Goal Goal Users New Users Sessions Session Conversion Rate Session Completions Value Duration Rate 1,161,978 1,170,333 1,384,602 46.58% 8.74 00:01:48 0.00% 0 $0.00 % of Total: % of Total: % of Total: Avg for Avg for Avg for Avg for % of Total: % of 100.00% 100.07% 100.00% View: View: View: View: 0.00% Total: (1,161,978) (1,169,566) (1,384,602) 46.58% 8.74 00:01:48 0.00% (0) 0.00% (0.00%) (0.00%) (0.00%) (0.00%) ($0.00) 1. (direct) / (none) 966,071 967,968 1,121,738 45.78% 8.39 00:01:47 0.00% 0 $0.00 (82.06%) (82.71%) (81.02%) (0.00%) (0.00%) 2. google / organic 30,702 28,990 44,887 48.86% 15.63 00:02:49 0.00% 0 $0.00 (2.61%) (2.48%) (3.24%) (0.00%) (0.00%) 3. m.facebook.com / referral 22,693 22,544 24,304 46.93% 4.77 00:00:51 0.00% 0 $0.00 (1.93%) (1.93%) (1.76%) (0.00%) (0.00%) 4. away.vk.com / referral 20,111 19,178 26,667 47.13% 13.97 00:02:31 0.00% 0 $0.00 (1.71%) (1.64%) (1.93%) (0.00%) (0.00%) 5. -

The China Analyst: Online and Mobile Games Gaining Popularity

Industry Note September 13, 2004 Safa Rashtchy, Senior Research Analyst Technology 650 838-1347, [email protected] The China Analyst: Online And Mobile Games Aaron M. Kessler, Sr Research Analyst 650 838-1434, [email protected] Gaining Popularity Reason for Report: KEY POINTS: Industry Overview The China Analyst is our weekly report on the Chinese Internet and technology market. Our commentaries are based on data we collect daily in China using our Related Companies: staff and consultants as well as industry contacts in Mainland China and Hong CTRP 31.52 Kong. Our goal is not to summarize news, but to analyze the most important CHINA 6.73 developments in Internet, online games, wireless services, economy, technology, NTES 35.51 SINA 22.23 consumer behavior, corporate activities, and government regulations, and to SOHU 15.13 discuss how these trends impact both our existing coverage companies in China as SNDA 24.19 well as the broader, long-term development of the Chinese Internet market. Summary of Internet Activity in China (MM) Jun-04 Jan-04 Jun-03 Y/Y % Total active users 87 80 68 28% Dial-up subscribers 52 49 47 11% ISDN subscribers 6 6 5 20% ADSL subscribers 31 17 10 210% Source: China Internet Network Information Center, Piper Jaffray China Research Summary of Telecom Activity in China (MM) Jul-04 Jun-04 Jul-03 M/M % Y/Y % Fixed line subscribers 299 295 241 1.4% 24% Penetration rate 24% 24% 19% - - Mobile users 310 305 239 1.6% 30% Penetration rate 24% 24% 18% - - Source: Ministry of Information Industry of China, Piper Jaffray China Research Industry Commentary – Online and Mobile Games Gaining Popularity as more companies are focusing on this fast growing, and relatively safe, segment. -

List of Search Engines

A blog network is a group of blogs that are connected to each other in a network. A blog network can either be a group of loosely connected blogs, or a group of blogs that are owned by the same company. The purpose of such a network is usually to promote the other blogs in the same network and therefore increase the advertising revenue generated from online advertising on the blogs.[1] List of search engines From Wikipedia, the free encyclopedia For knowing popular web search engines see, see Most popular Internet search engines. This is a list of search engines, including web search engines, selection-based search engines, metasearch engines, desktop search tools, and web portals and vertical market websites that have a search facility for online databases. Contents 1 By content/topic o 1.1 General o 1.2 P2P search engines o 1.3 Metasearch engines o 1.4 Geographically limited scope o 1.5 Semantic o 1.6 Accountancy o 1.7 Business o 1.8 Computers o 1.9 Enterprise o 1.10 Fashion o 1.11 Food/Recipes o 1.12 Genealogy o 1.13 Mobile/Handheld o 1.14 Job o 1.15 Legal o 1.16 Medical o 1.17 News o 1.18 People o 1.19 Real estate / property o 1.20 Television o 1.21 Video Games 2 By information type o 2.1 Forum o 2.2 Blog o 2.3 Multimedia o 2.4 Source code o 2.5 BitTorrent o 2.6 Email o 2.7 Maps o 2.8 Price o 2.9 Question and answer . -

Information Rereival, Part 1

11/4/2019 Information Retrieval Deepak Kumar Information Retrieval Searching within a document collection for a particular needed information. 1 11/4/2019 Query Search Engines… Altavista Entireweb Leapfish Spezify Ask Excite Lycos Stinky Teddy Baidu Faroo Maktoob Stumpdedia Bing Info.com Miner.hu Swisscows Blekko Fireball Monster Crawler Teoma ChaCha Gigablast Naver Walla Dogpile Google Omgili WebCrawler Daum Go Rediff Yahoo! Dmoz Goo Scrub The Web Yandex Du Hakia Seznam Yippy Egerin HotBot Sogou Youdao ckDuckGo Soso 2 11/4/2019 Search Engine Marketshare 2019 3 11/4/2019 Search Engine Marketshare 2017 Matching & Ranking matched pages ranked pages 1. 2. query 3. muddy waters matching ranking “hits” 4 11/4/2019 Index Inverted Index • A mapping from content (words) to location. • Example: the cat sat on the dog stood on the cat stood 1 2 3 the mat the mat while a dog sat 5 11/4/2019 Inverted Index the cat sat on the dog stood on the cat stood 1 2 3 the mat the mat while a dog sat a 3 cat 1 3 dog 2 3 mat 1 2 on 1 2 sat 1 3 stood 2 3 the 1 2 3 while 3 Inverted Index the cat sat on the dog stood on the cat stood 1 2 3 the mat the mat while a dog sat a 3 cat 1 3 dog 2 3 mat 1 2 Every word in every on 1 2 web page is indexed! sat 1 3 stood 2 3 the 1 2 3 while 3 6 11/4/2019 Searching the cat sat on the dog stood on the cat stood 1 2 3 the mat the mat while a dog sat a 3 cat 1 3 query dog 2 3 mat 1 2 cat on 1 2 sat 1 3 stood 2 3 the 1 2 3 while 3 Searching the cat sat on the dog stood on the cat stood 1 2 3 the mat the mat while a dog sat a 3 cat -

Netease Provides Update on Financing for Netease Cloud Music

NetEase Provides Update on Financing for NetEase Cloud Music Capital Infusion Aids Strategy to Create Largest Interactive Community for Music Lovers in China Beijing, China - November 12, 2018 NetEase, Inc. (NASDAQ: NTES) (“NetEase”), one of China’s leading internet and online game services providers, today announced that its music streaming platform NetEase Cloud Music has completed its previously announced round of financing with investors, including strategic partner Baidu, General Atlantic, Boyu Capital and several other investors. The total amount invested was over $600 million, and NetEase remains the controlling shareholder of the NetEase Cloud Music business. With a population of 1.4 billion and upward trends in consumption, China’s recorded music market is expected to expand considerably. China’s recorded music market was 45 times smaller than that in the U.S. in 2017, and China’s per capita spending on recorded music is projected to quadruple from 2017 to 2023, according to iResearch. Revenue from the music industry in China is projected to reach RMB376 billion in 2018[1], affording China’s digital music market tremendous potential for continued growth as younger generations embrace the convenience of streaming music services and online music becomes a way of life. This round of financing aids NetEase’s efforts to further penetrate the market and leverage its strong industry position. Launched in April 2013, NetEase Cloud Music is now widely recognized as one of the industry’s largest players, with more than 600 million registered users, adding 200 million alone over the last twelve months. With a focus on delivering a differentiated and premium user experience, NetEase Cloud Music has been praised for providing precise, personalized recommendations and promoting user interaction. -

Daily Global Market Report 29 July 2021

Daily Global Market Report 29 July 2021 Global Capital Markets US DJIA DJIA declined 0.36% to end at 34,930.93 points on Wednesday, pulled down Dow Jones Industrial Average -0.36% by losses in the Telecoms, Utilities, and Financials sectors. S&P 500 Index slipped 0.02% to close at 4,400.64 points on Wednesday. S&P 500 Affiliated Managers Group Inc and Humana Inc were the top losers. Standard & Poor's 500 Index -0.02% The tech-heavy NASDAQ Composite Index rose 0.41% to settle at 15,018.10 points on Wednesday, with Pinduoduo Inc and NetEase Inc being the top NASDAQ performers. NASDAQ Composite Index 0.41% Germany DAX Index ended 0.33% higher at 15,570.36 points on Wednesday, driven DAX by gains in the Software, Technology, and Transportation & Logistics sectors. Deutscher Aktien Index 0.33% UK The FTSE 100 Index increased 0.29% and closed at 7,016.63 points on FTSE 100 Wednesday, as gains were recorded in the Precious and Base Metal Miners. Financial Times Stock Exchange 100 Index 0.29% France CAC 40 Index ended 1.18% higher at 6,609.31 points on Wednesday, led by CAC 40 gains in the General Financial, Foods & Drugs, and Gas & Water sectors. Cotation Assistée en Continu 40 Index 1.18% Commodities Sovereign Yields Last Trade 1D% YTD% Current Yield Brent Crude ($/bbl) 74.74 0.3% 43.8% US Treasuries 10Y 1.263% WTI Crude ($/bbl) 72.37 1.0% 49.1% US Treasuries 30Y 1.911% Natural Gas ($/mbtu) 4.04 1.8% 59.5% German Treasuries 10Y -0.447% Gold ($/t oz) 1,804.60 0.03% -4.8% UK Treasury 10Y 0.576% Silver ($/t oz) 24.88 0.9% -5.9% France