Impact of Globalisation on Baijiu — China's Spirits Industry: a Case

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beverages Swiggity Swag

Beverages Non-Alcoholic can/bottle/carton 1. Guava Drink ........................................................ $3 2. Grass Jelly .......................................................... $3 3. Lychee Nectar ..................................................... $3 4. Chrysanthemum Tea ........................................... $3 5. Aloe .................................................................... $3 6. Ito-en green tea .................................................. $3 7. Mr. Brown Coffee................................................ $3 8. Yakult Yogurt Probiotic Drink (6) ....................... $3 Booze 1. Golden Flower ..................................................... $10 Blended non-peated scotch, chrysanthemum tea, honey, lemon oil 2. Duck Sauce ......................................................... $10 Tequila, Sichuan peppercorn, peach, lemon EAT! MORE! MORE! EAT! 3. Taking a Bath in New York ................................. $10 Vodka, cassis, orange bitters, orange oil 4. 20th Century ....................................................... $10 Gin, cacao, Cocchi Americano, lemon shifu takeout certified professional professional certified takeout shifu 5. I’m gonna Baijiu .................................................. $10 m.d. esq. ph.d danger lucky sir sir lucky danger ph.d esq. m.d. Baijiu, bourbon, cardamom, urepan 6. Sloop Juice Bomb (IPA) ....................................... $6 open hours hours open 7. Victory Prima Pils (Pilsner) ................................. $6 served first come first -

Spirits Catalog

SPIRITS CATALOG WWW.CNSIMPORTSCA.COM [email protected] PH: 626 579 9018 | FAX: 626 579 0584 TABLE OF CONTENTS Whiskey 1 Liqueurs 10 Vodka 5 Asian Beers 13 Gin 6 Baijiu 14 Tequilla 7 Terms & Conditions 16 Mezcal 8 Return Policy 17 Rum 9 WHISKEY AMERICAN DRIFTLESS GLEN DRIFTLESS GLEN STRAIGHT RYE WHISKEY STRAIGHT BOURBON WHISKEY SINGLE BARREL SINGLE BARREL (Barrel Program Available) (Barrel Program Available) Origin: Baraboo, WI Origin: Baraboo, WI Mash: 80% Rye, 10% Malted Barley, 10% Corn Mash: 60% Corn, 20% Malted Barley, 20% Rye Nose: Cinnamon, Hints of Oak Nose: Vanilla, Honey, Light Spices Tongue: Spicy Rye, Honey Tongue: Buttered Popcorn, Raw Corn Husk, Rye Spice Finish Accolades: Silver - WSWA 2017 ABV 48% Size: 750ML ABV 48% Size: 750ML DRIFTLESS GLEN DRIFTLESS GLEN RYE WHISKEY BOURBON WHISKEY Origin: Baraboo, WI Origin: Baraboo, WI Mash: 80% Rye, 10% Malted Barley, 10% Corn Mash: 60% Corn, 20% Rye, 20% Malted Barley Nose: White pepper, Burnt Oak Nose: Vanilla, Caramel Corn Tongue: Spicy Vanilla, Honey Tongue: Light Molasses, Brown Sugar Toffee ABV 48% Size: 750ML ABV 48% Size: 750ML INDIAN RAMPUR INDIAN SINGLE VINN WHISKEY MALT WHISKY DOUBLE CASK Origin: Wilsonville, OR Origin: Rampur, India Mash: 100% Long Grain Rice Mash: 100% Indian Malted Barley Nose: Toffee, Fruit Gummies Nose: Tropical Fruit, Deep Malt, Oak Tongue: Sweet, Tapioca, Spicy Cocoa Tongue: Sherry, Rich Fruit ABV 43% Size: 375ML/750ML ABV 45% Size: 750ML 1 Spirits Catalog 2019 WHISKEY JAPANESE RAMPUR INDIAN SINGLE KUJIRA MALT WHISKY RYUKYU WHISKY 20 YEAR Origin: -

Investigating the Relationship Between Kadazandusun Beliefs About Paddy Spirits, Riddling in Harvest-Time and Paddy-Related Sundait

VOL. 13 ISSN 1511-8393 JULAI/JULY 2012 http://www.ukm.my/jmalim/ Investigating the Relationship between Kadazandusun Beliefs about Paddy Spirits, Riddling in Harvest-time and Paddy-Related Sundait (Perkaitan antara Kepercayaan terhadap Semangat Padi, Berteka-teki pada Musim Menuai dan Sundait Kadazandusun yang Berunsurkan Padi: Satu Penelitian) LOW KOK ON Sekolah Pengajian Seni, Universiti Malaysia Sabah Jalan UMS, 88400 Kota Kinabalu, Sabah [email protected] LEE YOK FEE Jabatan Pengajian Kenegaraan dan Ketamadunan Fakulti Ekologi Manusia, Universiti Putra Malaysia 43400 UPM Serdang, Selangor [email protected] ABSTRACT During recent field trips to collect sundait (riddles) from Kadazandusun communities in Sabah, it was noted that many of the riddle answers relate to paddy farming: for example, rice planting activities and related paraphernalia are often mentioned. This paper analyzes collected Kadazandusun “paddy- related” sundait based on their social context and background. In addition, it also examines traditional beliefs in paddy spirits and the origin of riddling at harvest-time. Some unique aspects of paddy-related sundait are highlighted and the relationship between the belief in paddy spirits and the ritual of harvest riddling is further explored. Keywords: Kadazandusun sundait, paddy-related riddles, paddy spirits, harvest- time riddling 72 | MALIM – SEA Journal of General Studies 13 • 2012 ABSTRAK Dalam beberapa kerja lapangan mengumpul sundait (teka-teki) Kadazandusun di Sabah yang telah pengkaji lakukan baru-baru ini, banyak sundait Kadazandusun yang jawapannya berkait dengan unsur padi, aktiviti penanaman padi dan alatan padi telah dikenal pasti. Fokus tulisan ini adalah menganalisis koleksi sundait Kadazandusun yang berunsurkan padi berasaskan konteks dan latar sosial orang Kadazandusun. -

Asd Menu Web-6-8 01.Pdf

WELCOME TO ~ AH SING DEN ~ Named after the world’s most famous opium den from Victorian times in East London where Charles Dickens, Arthur Conan Doyle and other creative people derived inspiration. We hope by bringing you the most delicious tipples and morsels your imagination will flourish as well! SPECIALS SIGNATURE COCKTAILS A LOVE LETTER FOR MICKIE ~ 16 Lalo Tequila, St. George Green Chile, Prickly Pear, Guava, Jalapeno, Citrus, Sambal, Honey, Ancho Chiles Verde DETOXICATED ~ 16 Woodinville Bourbon, Pimm’s No.1, All your Fruits & Vegetables, Tullia Rose #DICKPICK ~ 14 Hendrick’s Gin, Togarashi Pickle Syrup, Cucumber, Basil, Grapefruit, Velvet Falernum Thyme Foam YOU WANNA PEACH OF ME ~ 13 Still Austin Gin, Tarragon, Grapefruit, Lemon, Honey, Amaro Nonino, Giffard Peche, Egg White UME AND YOU ~ 16 Iwai-Mars Japanese Whisky, Umeshu, House Umami Bitters NOTHING MORE TOULOUSE ~ 15 Lucid Absinthe, Du Peyrat Cognac, Dolin Dry Vermouth, Creme de Peche, Burlesque Bitters LET’S HAVE A KIKI ~ 13 Kikori Japanese Whisky, Green Grape & Plum Soju, Averna, Lemon, Cardamon Bitters COAL MINER’S DAUGHTER ~ 15 Del Maguey Vida Mezcal, Fresno Chile Syrup, Nola Coffe Liqueur, Activated Charcoal, Lime WET YOUR WILLIE......NELSON ~ 16 Mizu Green Tea Shochu, Dank Terpene, Jasmine Tea, Matcha, Lavender Honey Bitters, Lemon, Egg White THE MOTHER OF PEARL ~ 28 Kinmen Kaoliang Baijiu, Rihei Ginger, Yuzuri, Lemongrass, Zephyr Gin, Saline, Baby Pearls ROTATING FROZEN ~ MP SAKE KIKU-MASAMUNE DRY SAKE CUP, FUTSUSHU 8 18OML Casual table sake, dry & sharp HOT JUNMAI SAKE (Small/Large) 6/12 70% filtered, full flavor SUIGEI TOKUBETSU JUNMAI “DRUNKEN WHALE”, 27 30OML SO-SHU Clean crisp texture, bright flavor dry finish NAGARAGAWA JG TENKAWA “MILKY WAY”, 54 72OML KUN-SHU “Music enhanced”, delicate balance between sweetness & acidity, vanilla and green apple KIKU-MASAMUNE JUNMAI TARU, JUN-SHU 42 72OML Samurai Favorite. -

Trends and Correlates of High-Risk Alcohol

Advance Publication by J-STAGE Journal of Epidemiology Original Article J Epidemiol 2019 Trends and Correlates of High-Risk Alcohol Consumption and Types of Alcoholic Beverages in Middle-Aged Korean Adults: Results From the HEXA-G Study Jaesung Choi1, Ji-Yeob Choi1,2,3, Aesun Shin2,3, Sang-Ah Lee4, Kyoung-Mu Lee5, Juhwan Oh6, Joo Yong Park1, Jong-koo Lee6,7, and Daehee Kang1,2,3,8 1Department of Biomedical Sciences, Seoul National University Graduate School, Seoul, Korea 2Department of Preventive Medicine, Seoul National University College of Medicine, Seoul, Korea 3Cancer Research Institute, Seoul National University, Seoul, Korea 4Department of Preventive Medicine, Kangwon National University School of Medicine, Kangwon, Korea 5Department of Environmental Health, College of Natural Science, Korea National Open University, Seoul, Korea 6JW Lee Center for Global Medicine, Seoul National University College of Medicine, Seoul, Korea 7Department of Family Medicine, Seoul National University College of Medicine, Seoul, Korea 8Institute of Environmental Medicine, Seoul National University Medical Research Center, Seoul, Korea Received November 30, 2017; accepted February 28, 2018; released online August 25, 2018 ABSTRACT Background: We aimed to report the prevalence and correlates of high-risk alcohol consumption and types of alcoholic beverages. Methods: The baseline data of the Health Examinees-Gem (HEXA-G) study participants, including 43,927 men and 85,897 women enrolled from 2005 through 2013, were used for analysis. Joinpoint regression was performed to estimate trends in the age-standardized prevalence of alcohol consumption. Associations of demographic and behavioral factors, perceived health- related effects, social relationships, and the diagnostic history of diseases with alcohol consumption were assessed using multinomial logistic regression. -

Visiting Beijing? Be Sure to Get a Taste of China's True Spirit!

For Immediate Release Contact: Simon Dang Company: Capital Spirits Bar and Distillery 首都酒坊 Phone: +86 186 11509831 Email: [email protected] Twitter: @capitalspirits Address: 3 DaJuHutong Beijing 大菊胡同 3 号 北京 Website www.capitalspiritsbj.com Photos & Media: https://www.flickr.com/photos/capitalspirits Visiting Beijing? Be sure to get a taste of China’s true spirit! Beijing, June 2015 – Tourists seeking famous cultural experiences in Beijing will no doubt have Tiananmen Square, the Forbidden City, the Great Wall, and/or the Summer Palace at the top of their lists. And while no trip would be complete without a plate of Peking Duck 烤鸭 and Beijing dumplings 饺子 now for the first time, tourists can also taste and learn all about Baijiu, China’s national liquor, in a recently opened specialist baijiu bar in Beijing aptly named Capital Spirits. Touted as the world’s first bar dedicated to Baijiu, Capital Spirits Bar & Distillery is quickly becoming a de-facto cultural institution for enjoying China’s most popular homegrown liquor. What is Baijiu? Roughly translated as “white spirit”, many scholars believe Baijiu (白酒) origins date back to the Xia Dynasty between 2100 BC and 1600 BC. Today Baijiu is the most commonly consumed spirit in the world according to recent reports from the International Wine & Spirit Research and among the over 11,000 distilleries nationwide its taste can vary greatly in flavor and alcohol content depending on choice of grain and production methods. As the national spirit of China, Baijiu has become more popular to foreigners as a cultural icon to sample while visiting China. -

China Consumer Close-Up

January 13, 2015 The Asian Consumer: A new series Equity Research China Consumer Close-up The who, what and why of China’s true consumer class Few investing challenges have proven more elusive than understanding the Chinese consumer. Efforts to translate the promise of an emerging middle class into steady corporate earnings have been uneven. In the first of a new series on the Asian consumer, we seek to strip the problem back to the basics: Who are the consumers with spending power, what drives their consumption and how will that shift over time? The result is a new approach that yields surprising results. Joshua Lu Goldman Sachs does and seeks to do business with +852-2978-1024 [email protected] companies covered in its research reports. As a result, Goldman Sachs (Asia) L.L.C. investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Sho Kawano Investors should consider this report as only a single factor +81(3)6437-9905 [email protected] Goldman Sachs Japan Co., Ltd. in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Becky Lu Appendix, or go to www.gs.com/research/hedge.html. +852-2978-0953 [email protected] Analysts employed by non- US affiliates are not registered/ Goldman Sachs (Asia) L.L.C. qualified as research analysts with FINRA in the U.S. January 13, 2015 Asia Pacific: Retail Table of contents PM Summary: A holistic view of the Asian consumer 3 China’s cohort in a regional context (a preview of India and Indonesia) 8 What they are buying and what they will buy next: Tracking 7 consumption desires 11 Seven consumption desires in focus 14 1. -

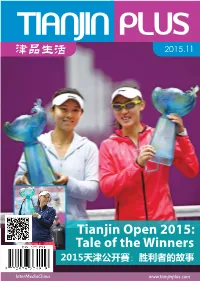

Tianjin Open 2015: Tale of the Winners 2015天津公开赛:胜利者的故事

2015.082015.082015.08 Tianjin Open 2015: Tale of the Winners 2015天津公开赛:胜利者的故事 InterMediaChina www.tianjinplus.com IST offers your children a welcoming, inclusive international school experience, where skilled and committed teachers deliver an outstanding IB education in an environment of quality learning resources and world-class facilities. IST is... fully accredited by the Council of International Schools (CIS) IST is... fully authorized as an International Baccalaureate World School (IB) IST is... fully accredited by the Western Association of Schools and Colleges (WASC) IST is... a full member of the following China and Asia wide international school associations: ACAMIS, ISAC, ISCOT, EARCOS and ACMIBS 汪正影像艺术 VISUAL ARTS Wang Zheng International Children Photography Agency 汪 正·天 津 旗下天津品牌店 ■婴有爱婴幼儿童摄影 ■韩童街拍工作室 ■顽童儿童摄影会馆 ■汪叔叔专业儿童摄影 ■素摄儿童摄影会馆 转 Website: www.istianjin.org Email: [email protected] Tel: 86 22 2859 2003/5/6 ■ Prince&Princess 摄影会馆 ■韩爱儿童摄影会馆 ■本真儿童摄影会馆 4006-024-521 5 NO.22 Weishan South Road, Shuanggang, Jinnan District, Tianjin 300350, P.R.China 14 2015 2015 CONTENTS 11 CONTENTS 11 Calendar 06 Beauty 38 46 Luscious Skin Sport & Fitness 40 Partner Promotions 09 Tianjin Open 2015: A Tale of Upsets, Close Calls and Heroic Performances Art & Culture 14 How to 44 Eat me. Tianjin style. How to Cope with Missing Home Feature Story 16 Beijing Beat 46 16 The Rise of Craft Beer in China Off the Tourist Trail: Perfect Family Days Out Cover Story 20 Special Days 48 Tianjin Open 2015: Tale of the Winners Special Days in November 2015 Restaurant -

Baijiu (ルᄑ←ナメ), Chinese Liquor: History, Classification and Manufacture

J Ethn Foods 3 (2016) 19e25 Contents lists available at ScienceDirect Journal of Ethnic Foods journal homepage: http://journalofethnicfoods.net Review article Baijiu (白酒), Chinese liquor: History, classification and manufacture * Xiao-Wei Zheng a, Bei-Zhong Han b, a Biotechnology Center, Nutrition & Health Research Institute, COFCO Corporation, Beijing, China b College of Food Science and Nutritional Engineering, China Agricultural University, Beijing, China article info abstract Article history: Baijiu (白酒) is a traditional fermented alcoholic drink originating in China, which is typically obtained by Received 13 January 2016 natural fermentation. It has a high reputation and constitutes an important part of Chinese dietary Received in revised form profile. The production of baijiu involves five major steps, materials preparation, daqu (大曲) making, 20 February 2016 alcoholic fermentation, distillation, and aging. There is a range of baijiu with different flavors and cor- Accepted 22 February 2016 responding names. Baijiu can be categorized according to the production techniques (solid state and Available online 15 March 2016 semi-solid state), types of starter [daqu, xiaoqu (小曲), and fuqu (麸曲)] and product flavor (strong, light, sauce, etc.). different types of baijiu have their home microbiota and flavor because of their distinct Keywords: alcoholic production techniques. In this review, we discuss the critical steps and the microorganisms involved in baijiu(白酒) the production of different types of baijiu. Although baijiu contains alcohol, it has been proven that it flavor plays a significant role in the heath and quality of peoples' lives. history Copyright © 2016, Korea Food Research Institute, Published by Elsevier. This is an open access article microorganisms under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). -

High Quality Development Path of Chinese Sauce-Flavor Baijiu Industry—Analysis Based on Consumption Data

E3S Web of Conferences 251, 01099 (2021) https://doi.org/10.1051/e3sconf/202125101099 TEES 2021 High quality development path of Chinese sauce-flavor Baijiu industry—Analysis based on consumption data Cong Peng1,*, and Xu Guo1 1 School of Economics and Finance, Guizhou University of Commerce, Guiyang, Guizhou, China, 550014 Abstract:As an important part of Baijiu industry in China, Chinese sauce-flavor Baijiu is sought after by the consumer market for its unique taste. However, in recent years, there are still many challenges in the process of industrial development. Based on the analysis of three characteristics of Chinese sauce- flavor Baijiu market and the internal and external environments of industrial development, the internal and external factors of high quality and sustainable development of Chinese sauce-flavor Baijiu industry were discussed from three aspects - concentrated development, green development and diversified development. profits and taxes, the sauce-flavor Baijiu industry has made steady development[1]. In 2019, with the 1 Introduction production of 400,000 kilo-litre (about 5.1% of total Baijiu brewing in China has a long time history dated China’s production), the such type of enterprises back to ancient times. In the course of evolution, kinds accomplished the production value of 134.1 billion yuan, of brewing technology have been created and a unique 2% of the total China’s Baijiu industry value, among liquor culture was formed. The custom of raising a cup which the sauce-flavor Baijiu enterprises of Guizhou of liquor has rooted in Chinese culture for hundreds of province produced 80% of the total China’s amount, years. -

Classification of Multiple Chinese Liquors by Means of a QCM-Based E-Nose and MDS-SVM Classifier

Article Classification of Multiple Chinese Liquors by Means of a QCM-based E-Nose and MDS-SVM Classifier Qiang Li, Yu Gu * and Jing Jia School of Automation and Electrical Engineering, University of Science and Technology Beijing, Beijing 100083, China; [email protected] (Q.L.); [email protected] (J.J.) * Correspondence: [email protected]; Tel.: +86-10-8237-7825 Academic Editor: Ki-Hyun Kim Received: 8 November 2016; Accepted: 25 January 2017; Published: 30 January 2017 Abstract: Chinese liquors are internationally well-known fermentative alcoholic beverages. They have unique flavors attributable to the use of various bacteria and fungi, raw materials, and production processes. Developing a novel, rapid, and reliable method to identify multiple Chinese liquors is of positive significance. This paper presents a pattern recognition system for classifying ten brands of Chinese liquors based on multidimensional scaling (MDS) and support vector machine (SVM) algorithms in a quartz crystal microbalance (QCM)-based electronic nose (e-nose) we designed. We evaluated the comprehensive performance of the MDS-SVM classifier that predicted all ten brands of Chinese liquors individually. The prediction accuracy (98.3%) showed superior performance of the MDS-SVM classifier over the back-propagation artificial neural network (BP-ANN) classifier (93.3%) and moving average-linear discriminant analysis (MA-LDA) classifier (87.6%). The MDS-SVM classifier has reasonable reliability, good fitting and prediction (generalization) performance in classification of the Chinese liquors. Taking both application of the e-nose and validation of the MDS-SVM classifier into account, we have thus created a useful method for the classification of multiple Chinese liquors. -

View the Herbs We Stock, Many Of

BASTYR CENTER FOR NATURAL HEALTH Chinese and Ayurvedic Herbal Dispensary Ayurvedic Herb List Retail price Retail price Ayurvedic Herb Name Ayurvedic Herb Name per gram per gram Amalaki $0.15 Tagar/Valerian $0.15 Arjuna $0.15 Talisadi $0.30 Ashoka $0.15 Trikatu $0.15 Ashwagandha $0.15 Triphala $0.15 Avipattikar $0.15 Triphala Guggulu $0.50 Bacopa $0.15 Tulsi $0.15 Bala $0.15 Vacha $0.15 Bibhitaki $0.15 Vidanga $0.15 Bilva $0.15 Vidari Kanda $0.15 Brahmi/Gotu Kola $0.15 Yashtimadhu/Licorice root $0.15 Bhumyamalaki $0.15 Yogaraj Guggulu $0.50 Calamus Root $0.15 Chandana/Red Sandalwood $0.30 Chitrak $0.15 Dashamula $0.15 Gokshura $0.15 Guduchi $0.15 Haridra/Turmeric $0.15 Haritaki $0.15 Hingvastak Churna $0.15 Kaishore Guggulu $0.50 Kalmegh $0.15 Kapikacchu $0.15 Kumari $0.15 Kutaja $0.15 Kutki $0.30 Manjishtha $0.15 Musta $0.15 Neem $0.15 Pippali $0.15 Punarnava $0.15 Punarnava Guggulu $0.50 Sat isapgul $0.15 Shankpushpi $0.15 Shardunika $0.15 Shatavari $0.15 Shilajit $0.50 Shunti/Ginger Root $0.15 Sitopaladi $0.30 Prices subject to change without notice Updated: 10/2018 BASTYR CENTER FOR NATURAL HEALTH Chinese and Ayurvedic Herbal Dispensary Chinese Raw Herb List Retail price Retail price Chinese Raw Herb Name Chinese Raw Herb Name per gram per gram Ai Ye $0.05 Cao Guo $0.10 Ba Ji Tian $0.10 Cao Wu (Zhi) $0.05 Ba Yue Zha $0.05 Ce Bai Ye $0.05 Bai Bian Dou $0.05 Chai Hu $0.15 Bai Bu $0.05 Chan Tui $0.25 Bai Dou Kou $0.10 Che Qian Zi $0.05 Bai Fu Zi (Zhi) $0.10 Chen Pi $0.05 Bai Guo (Granule) $0.27 Chi Shao Yao $0.10 Bai He $0.10 Chi Shi