Driving Returns and Profitable Growth in European Aviation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Accounts 2010 Annual Report and Accounts 2010 Accounts and Report Annual Annual Report and Accounts 2010 Welcome Aboard!

Annual report and accounts 2010 Annual report and accounts 2010 Annual report and accounts 2010 Welcome aboard! Navigating your way around this report... 01 Overview 54 Accounts 2010 Business highlights 01 Independent auditors’ report to the members easyJet at a glance 02 of easyJet plc 54 15 years of continued success 04 Consolidated income statement 55 Chairman’s statement 06 Consolidated statement of comprehensive income 56 Consolidated statement of financial position 57 Consolidated statement of changes in equity 58 Consolidated statement of cash flows 59 Notes to the accounts 60 Company statement of financial position 90 Company statement of changes in equity 91 Company statement of cash flows 92 Notes to the Company accounts 93 08 Business review 95 Other information Chief Executive’s statement 08 Five year summary 95 Strategy and KPIs 14 Glossary 96 Financial review 16 Corporate responsibility 28 34 Governance Directors’ report easyJet plc is incorporated as a public limited company and is registered in Directors’ profiles 34 England with the registered number 3959649. easyJet plc’s registered office Corporate governance 36 is Hangar 89, London Luton Airport, Bedfordshire LU2 9PF. The Directors Shareholder information 40 present the Annual report and accounts for the year ended 30 September Report on Directors’ remuneration 41 2010. References to ‘easyJet’, the ‘Group’, the ‘Company’, ‘we’, or ‘our’ are to Statement of Directors’ responsibilities 53 easyJet plc or to easyJet plc and its subsidiary companies where appropriate. Pages 01 to 53, inclusive, of this Annual report comprise the Directors’ report that has been drawn up and presented in accordance with English company law and the liabilities of the Directors in connection with that report shall be subject to the limitations and restrictions provided by such law. -

The Female FTSE Board Report 2014 Crossing the Finish Line

The Female FTSE Board Report 2014 Crossing the Finish Line Professor Susan Vinnicombe OBE, Dr Elena Doldor, Caroline Turner CRANFIELD INTERNATIONAL CENTRE FOR WOMEN LEADERS The Female FTSE Board Report 2014 Supporting Sponsors: Foreword FEMALE FTSE BOARD REPORT 2014 It has been exactly 3 years since Lord Davies challenged the UK’s top performing companies to recognise the benefits of gender equality in the boardroom and to take action to increase the number of women on British boards. Since then we have been encouraged to see chairmen and their businesses take ownership of this agenda. The figures speak for themselves. FTSE 100 companies have increased the number of women on their board from 12.5% in 2011 to 20.7% today, with the FTSE 250 similarly improving from 7.8% to 15.6%. We have also seen considerable efforts and a significant change of mindset from other key players such as investors, executive search firms and business leaders – all working together to bring about real change. We are also pleased to see that within the FTSE 100, 98% of boards now include women. Glencore Xstrata and Antofagasta – are now the outliers. This is a considerable turnaround from where 1 in 5 boards were all male in 2011. The FTSE 250 also continues in the same vein with around 50 all male boards today, down by well over half on 3 years ago. In addition, this report highlights the many strong women candidates capable of filling board positions. Cranfield have identified 100 of their top Women to Watch, which is included here. -

Executive Pay in the FTSE 100: Is Everyone Getting a Fair Slice of the Cake? London: Chartered Institute of Personnel and Development, P19

in association with RESEARCH REPORT | August 2020 FTSE 100 CEO pay in 2019 and during the pandemic The CIPD is the professional body for HR and people development. The registered charity champions better work and working lives and has been setting the benchmark for excellence in people and organisation development for more than 100 years. It has more than 150,000 members across the world, provides thought leadership through independent research on the world of work, and offers professional training and accreditation for those working in HR and learning and development. The High Pay Centre is an independent, non-partisan think tank focused on the causes and consequences of economic inequality, with a particular interest in top pay. It runs a programme of research, events and policy analysis involving business, trade unions, investors and civil society focused on achieving an approach to pay practices that enjoys the confidence of all stakeholders. FTSE 100 CEO pay in 2019 and during the pandemic Research report FTSE 100 CEO pay in 2019 and during the pandemic Contents Foreword 2 Our recommendations 3 Key findings 3 What happened to CEO pay during COVID-19? 7 What happened to CEO pay in 2019? 8 What makes up CEO pay packages? 12 Ethnic diversity 15 Conclusion 16 Our methodology 17 Appendix 19 Notes 22 Acknowledgements This report was written by Louisa Shand, Governance and Risk Adviser, CIPD, and Rachel Kay and Luke Hildyard from the High Pay Centre. We would like to thank the CIPD team who contributed to this research – Charles Cotton, Ben Willmott and Edward Houghton. -

Aviation Week & Space Technology

UK-Japan Should the USAF Quebec’s Drive Fighter Proposal Lead in Space? To Digital $14.95 APRIL 3-16, 2017 RICH MEDIA A320neo EXCLUSIVE Report Card Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Penton. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Penton Privacy Policy and the Penton Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Penton. -

ITV Diversity Acceleration Plan

DIVERSITY ACCELERATION PLAN REPORT 2021 WELCOME CAROLYN MCCALL, CEO ITV Welcome to our report. A year ago, we committed to increasing investment, including appointing a new Diversity & Inclusion team, in order to accelerate the speed of change and increase representation on-screen, in our production teams and within our own workforce. Attracting the best talent from a wide range of backgrounds, creating an inclusive culture where all colleagues can flourish, and making programmes that appeal to wide and diverse audiences are all hugely important priorities to our business. I feel incredibly proud to work for ITV and this has been an extraordinary year. I would like to acknowledge the passion and commitment ITV colleagues have displayed to drive this agenda forward and particularly the hard work of and the important role that our colleague Network Groups have played. Lockdown made things harder to deliver on many fronts including some elements of this plan and there are further steps to reach all our targets. There is no doubting our commitment – we are also committed to measuring our progress and reporting publicly each year because we know that we will rightly be judged by actions rather than words. 2 INTRODUCTION ADE RAWCLIFFE, GROUP DIRECTOR DIVERSITY AND INCLUSION, ITV As a senior leader at ITV I know how essential it is for us to use our position in society to shape Britain’s culture whilst reflecting who we are; it’s a position of privilege and responsibility. ITV has a duty to remain relevant, successful and profitable. As custodians of an organisation which millions of British people have a close relationship and affinity with, we understand the importance of ensuring that ITV consistently lives up to their expectations. -

Diversity: the 20-Year Journey on Gender

THE ODGERS BERNDTSON CORPORATE LEADERSHIP BAROMETER The 20-year Journey on Gender Personal Perspectives From Leaders In Executive Search CORPORATE LEADERSHIP BAROMETER Virginia Bottomley, Chair, Board Practice It’s 20 years since the first woman became chief executive of a FTSE 100 company. After Marjorie Scardino took over as CEO of Pearson others followed and now there are six female chief executives and six female chairs of FTSE 100 companies. It’s still not enough, but things are changing. This 20-year mark, ushering in the most comprehensive measures yet to help women progress their careers, seems a good moment to take stock. Progress has been measured and analysed, paving the way for a new and more ambitious approach led by Hampton-Alexander, soon to report after its first year. The new requirements force companies to look not just at the composition of their boards, welcome though that is, but also women rising through the ranks. This is welcome because it focuses attention on organisations and how they foster and develop all talent. Taken together with new requirements enforcing greater transparency on male and female pay, these changes promise to accelerate progress on gender and, hopefully, also other aspects of diversity and inclusion. As the leading executive search firm in the UK, and one of the largest globally, Odgers Berndtson has a role to play. We are one of the lead firms behind a voluntary code of conduct to promote best practice on diversity in recruitment, and proud of our record, but societal change is complex and our industry is one of many pieces in the jigsaw. -

Guardian Media Group Plc Annual Report and Accounts 2009 Securing the Long-Term Future of the Guardian GMG Annual Report 2009

Guardian Media Group plc Annual Report and Accounts 2009 Securing the long-term future of the Guardian GMG Annual Report 2009 Contents 01 Introduction 32 Corporate responsibility 02 Group structure 36 Financial review 03 Financial highlights 42 Corporate governance 04 Statement from the chair 47 Report of the directors 07 Chief executive’s review of operations 49 Directors’ remuneration report 08 Introduction 53 Independent auditors’ report 09 Guardian News & Media 54 Profit and loss account 12 GMG Regional Media 54 Statement of recognised income 15 GMG Radio and expense 17 GMG Property Services 55 Balance sheet 19 Trader Media Group 56 Cash flow statement 22 Emap 57 Notes relating to the financial statements 25 Outlook 87 Group five year review 26 Board of directors 89 Company financial statements of Guardian 28 Statement from the chair of the Scott Trust Media Group plc 30 The Scott Trust directors 99 Advisers GMG Annual Report 2009 Securing the long-term future of the Guardian Guardian Media Group (GMG) is one of the UK’s leading multimedia businesses. The diverse portfolio includes national and regional newspapers, websites, magazines, radio stations and business-to-business media. Our flagship is the Guardian newspaper and website. The Group is wholly owned by the Scott Trust, which exists to secure the ongoing editorial independence of the Guardian. Under this unique form of media ownership the Group is able to take a long-term view as it invests in the future and security of the Guardian’s independent, liberal journalism. www.gmgplc.co.uk -

Executive Pay in the FTSE 100: Is Everyone Getting a Fair Slice of the Cake?

in association with Executive pay in the FTSE 100 Is everyone getting a fair slice of the cake? RESEARCH REPORT August 2019 The CIPD is the professional body for HR and people development. The not-for-profit organisation champions better work and working lives and has been setting the benchmark for excellence in people and organisation development for more than 100 years. It has 150,000 members across the world, provides thought leadership through independent research on the world of work, and offers professional training and accreditation for those working in HR and learning and development. The High Pay Centre is an independent, non-partisan think tank focused on the causes and consequences of economic inequality, with a particular interest in top pay. It runs a programme of research, events and policy analysis involving business, trade unions, investors and civil society focused on achieving an approach to pay practices that enjoys the confidence of all stakeholders. Executive pay in the FTSE 100: is everyone getting a fair slice of the cake? Research report Executive pay in the FTSE 100 Is everyone getting a fair slice of the cake? Contents Foreword 2 Summary of key findings 3 Our recommendations 6 In-depth analysis of executive pay CEO pay trends 8 The disconnect between CEO pay and employee pay 11 The disconnect between CEO pay and performance 16 The effects of shareholder dissent on CEO pay 19 Exposing the layer of other top earners 22 What makes up CEO pay packages? 25 Gender diversity 31 Individual remuneration packages 33 Our methodology 35 Appendix 37 Notes 41 Acknowledgements This report was written by Elena Kalinina, Database Marketing Analyst, Louisa Shand, Governance and Risk Adviser at the CIPD, and Ashley Walsh, Head of Policy and Research, at the High Pay Centre. -

Easyjet Europe, in Austria

ANNUAL REPORT AND ACCOUNTS 2017 PURPOSEFUL AND DISCIPLINED Annual report and accounts 2017 and accounts Annual report GROWTH 2017 at 2017 has been a year of purposeful and disciplined growth to develop our market positions at slot-constrained airports. We have grown our share in a number of key airports, with our fleet up-gauging process also allowing us to add capacity where our competitors cannot. Our sustained focus on cost control and lean initiatives is supported by our fleet development and increased use of digital to improve our customers’ experience. We moved quickly in response to the UK’s referendum vote to leave the European Union by establishing a new airline, easyJet Europe, in Austria. easyJet Europe is now operational and will enable easyJet to continue to operate flights both across and domestically within all European countries after the UK has left the EU, regardless of the outcome of talks on a future UK-EU aviation agreement. We continue investing in innovation, which has already revolutionised our customer offer and we expect to continue to harness technology to deliver cost and reliability benefits as well as exciting improvements in customer experiences that will keep easyJet a structural winner at the forefront of the aviation industry. easyJet’s customer proposition continues its positive development and, backed by a strong balance sheet, will deliver long-term shareholder value. STRATEGIC REPORT Investment case 2 Gatwick North Chairman’s letter 3 easyJet at a glance 4 Terminal Our business model 8 Chief Executive’s -

Briefing : Easyjet

10 The Sunday Times February 4, 2018 BUSINESS BRIEFING EASYJET MARKET WATCH IAN COWIE Goldman Sachs gave global than they are today. But both were about to fall. This THE ISSUE THE ANALYST stock markets a bit of a shock will they? technique, sadly similar to EASY STREET WILL HEFFERNAN Hang on last week when the world’s Switching into cash is the many retail investors in best-known investment bank easy part of market timing practice, meant he retired EasyJet reported quarterly results This was a strong set of results and warned share prices were because the individual can last month with a fund worth last month that showed the airline management raised its revenue per in there, due a “rather painful . congratulate him or herself £150,890. taking advantage of recent carrier seat growth guidance for the first half sharp correction”. Nor was on standing back from Good Timing Gary also bankruptcies. Overall sales rose 14.1% of this financial year from mid to high Goldman the first institution excessive exuberance initially kept his savings in to £1.1bn (€1.25bn). Total revenue per single-digit. Yields were impressive to express fears about lofty elsewhere. Buying back into cash but, unlike Bob, only seat was £55.99, an uptick of 8.4%. and lead to earnings per share and your valuations. A few days earlier, shares after prices have ever invested in the stock Overall passenger numbers grew by upgrades across the board. EasyJet Bank of America Merrill plunged and confidence has market when confidence and 8% to 18.8m. -

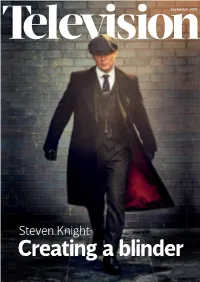

Steven Knight Creating a Blinder CAPTURE the ESSENCE of a NATION

September 2019 Steven Knight Creating a blinder CAPTURE THE ESSENCE OF A NATION A collection of music inspired by Japan, from traditional instruments to modern J-Pop AVAILABLE FOR LICENCE AT AUDIONETWORK.COM/DISCOVER/SOUNDSOFJAPAN FIND OUT MORE: Rebecca Hodges [email protected] (0)207 566 1441 Journal of The Royal Television Society September 2019 l Volume 56/8 From the CEO The man who wrote ITV Chief Executive Carolyn McCall, over licence fees for the over-75s, Britain’s answer to the convention’s chair, outlines her which provides a lot of context. HBO’s Boardwalk thinking for the RTS conference in an Mathew Horsman’s piece on the con- Empire, the brilliant interview with Television. She explains, test to own the on-demand market is crime drama Peaky among other things, how a panel of typically well-informed and incisive. Blinders, is the subject consumers will be a key part of this In keeping with the accent on Cam- of this month’s cover year’s Cambridge agenda. bridge, this month’s Our Friend column story. Andrew Billen interviewed We also profile one of the conven- has an East Anglian flavour. Chris Page Steven Knight and found that his life tion’s US speakers, Linda Yaccarino, will need no introduction to viewers in story really is stranger than fiction. head of advertising and partnerships the ITV Anglia region. His sometimes Don’t miss this riveting read. In my at NBCUniversal. Linda is less well maverick approach to weather fore- opinion, it is one of Andrew’s best known in the UK than she is across casting is often a talking point in his ever interviews for Television. -

EXCLUSIVE INTERVIEW with the CEO of ITV, DAME CAROLYN MCCALL Tuesday 19 March 2019

EXCLUSIVE INTERVIEW WITH THE CEO OF ITV, DAME CAROLYN MCCALL Tuesday 19 March 2019 Caroline Binham, Financial Regulation Correspondent, Financial Times In conversation with Dame Carolyn McCall, Chief Executive, ITV Carolyn McCall joined The Guardian newspaper in 1986 as a planner in the marketing department and worked her way up until in 2006 she became chief executive of Guardian Media Group, the parent company. She oversaw the paper’s move from broadsheet to Berliner format as well as the launch of The Guardian website. In 2010, she became chief executive of easyJet. During her eight years in the post the airline achieved record passenger numbers and record profits. Last year Dame Carolyn became chief executive of ITV and is guiding the broadcaster through a time of rapid change in the media industry. In this exclusive interview for the FT 125 Women’s Forum, Dame Carolyn spoke to Caroline Binham about her career. This report highlights some of the key themes that came out of the discussion. In the middle One of Dame Carolyn’s first management job at The Guardian was running an advertising team. It was valuable experience: she reported to two boards and had to juggle different tasks as well as manage the expectations of those around her. “I learnt more from being in middle management than at many other phases of my career,” she said. “I learnt how to manage people well, to listen, to empathise.” She said middle management could be great fun if you had the right team and environment. “The first thing is to get the right team.