UAE Telecom Sector Trading Ahead of Fundamentals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018

Pakistan Telecommunication Company Limited Company Telecommunication Pakistan PTCL PAKISTAN ANNUAL REPORT 2018 REPORT ANNUAL /ptcl.official /ptclofficial ANNUAL REPORT Pakistan Telecommunication /theptclcompany Company Limited www.ptcl.com.pk PTCL Headquarters, G-8/4, Islamabad, Pakistan Pakistan Telecommunication Company Limited ANNUAL REPORT 2018 Contents 01COMPANY REVIEW 03FINANCIAL STATEMENTS CONSOLIDATED Corporate Vision, Mission & Core Values 04 Auditors’ Report to the Members 129-135 Board of Directors 06-07 Consolidated Statement of Financial Position 136-137 Corporate Information 08 Consolidated Statement of Profit or Loss 138 The Management 10-11 Consolidated Statement of Comprehensive Income 139 Operating & Financial Highlights 12-16 Consolidated Statement of Cash Flows 140 Chairman’s Review 18-19 Consolidated Statement of Changes in Equity 141 Group CEO’s Message 20-23 Notes to and Forming Part of the Consolidated Financial Statements 142-213 Directors’ Report 26-45 47-46 ہ 2018 Composition of Board’s Sub-Committees 48 Attendance of PTCL Board Members 49 Statement of Compliance with CCG 50-52 Auditors’ Review Report to the Members 53-54 NIC Peshawar 55-58 02STATEMENTS FINANCIAL Auditors’ Report to the Members 61-67 Statement of Financial Position 68-69 04ANNEXES Statement of Profit or Loss 70 Pattern of Shareholding 217-222 Statement of Comprehensive Income 71 Notice of 24th Annual General Meeting 223-226 Statement of Cash Flows 72 Form of Proxy 227 Statement of Changes in Equity 73 229 Notes to and Forming Part of the Financial Statements 74-125 ANNUAL REPORT 2018 Vision Mission To be the leading and most To be the partner of choice for our admired Telecom and ICT provider customers, to develop our people in and for Pakistan. -

Pdf 8 Methodology Development, Ranking Digital Rights

SMEX is a Beirut-based media development and digital rights organization working to advance self-regulating information societies. Our mission is to defend digital rights, promote open culture and local content, and encourage critical engagement with digital technologies, media, and networks through research, knowledge-sharing, and advocacy. Design, illustration concept, and layout are by Salam Shokor, with assistance from David Badawi. Illustrations are by Ahmad Mazloum and Salam Shokor. www.smex.org A 2018 Publication of SMEX Kmeir Building, 4th Floor, Badaro, Beirut, Lebanon © Social Media Exchange Association, 2018 This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. Acknowledgments Afef Abrougui conceptualized this research report and designed and oversaw execution of the methodology for data collection and review. Research was conducted between April and July 2017. Talar Demirdjian and Nour Chaoui conducted data collection. Jessica Dheere edited the report, with proofreading assistance from Grant Baker. All errors and omissions are strictly the responsibility of SMEX. This study would not have been possible without the guidance and feedback of Rebecca Mackinnon, Nathalie Maréchal, and the whole team at Ranking Digital Rights (www.rankingdigitalrights.org). RDR works with an international community of researchers to set global standards for how internet, mobile, and telecommunications companies should respect freedom of expression and privacy. The 2017 Corporate Accountability Index ranked 22 of the world’s most powerful such companies on their disclosed commitments and policies that affect users' freedom of expression and privacy. The methodology developed for this research study was based on the RDR/ CAI methodology. We are also grateful to EFF’s Katitza Rodriguez and Access Now’s Peter Micek, both of whom shared valuable insights and expertise into how our research might be transformed and contextualized for local campaigns. -

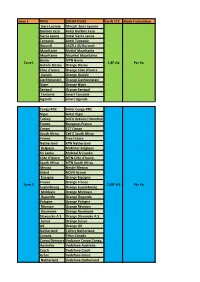

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera Leonne Africell Siera Leonne Burkina Faso Airtel Burkina Faso Sierra Leone Airtel Sierra Leone Tanzanie Airtel Tanzanie Burundi LACELL SU Burundi Mauritanie Mattel Mauritania Mauritanie Mauritel Mauritanie Benin MTN Benin Zone1 1,8F cfa Par Ko Guinée Bissau Orange Bissau Côte d'Ivoire Orange Côte d'Ivoire Guinée Orange Guinée Liechteinstein Orange Liechteinstein Niger Orange Niger Senegal Orange Senegal Tanzanie Smart Tanzanie Uganda Smart Uganda Congo RDC Airtel Congo RDC Niger Airtel Niger Turkey AVEA Iletisim Hizmetleri A.S. (Aycell) Turkey France Bouygues France Congo CCT Congo South Africa Cell C South Africa France Free France Netherland KPN Netherland Belgique Mobistar Belgique Sri Lanka Mobitel Sri Lanka Côte d'Ivoire MTN Côte d'Ivoire South Africa MTN South Africa Mexico Nextel Mexico Island NOVA IsLand Espagne Orange Espagne France Orange France Zone 2 2,95F cfa Par Ko Luxembourg Orange Luxembourg Moldavie Orange Moldavie Ouganda Orange Ouganda Pologne Orange Pologne Réunion Orange Réunion Roumanie Orange Roumanie Slovensko A.S. Orange Slovensko A.S. Suisse Orange Suisse UK Orange UK Netherland Telfort Netherland Canada Telus Canada Congo DemocraticVodacom Congo Congo, Democratic Republic of the Australia Vodafone Australia Czech Vodafone Czech Grèce Vodafone Grèce Netherland Vodafone Netherland Belgique Base Belgique Belgacom Belgacom Benin Moov Benin Canada Rogiers Canada Canada Microcel Canada Swiss Com Swiss Com Côte d'Ivoire Moov Côte d'Ivoire Cap Vert Cap Vert Mobile -

Annual Report 2017 Financial Highlights

To access the digital version, please visit our Annual Report microsite at: http://mobily.im/annualreport-en Rising to the Challenge Annual Report 2017 Financial Highlights Operational Cash Flow (EBITDA–CAPEX) Deleveraging (Net Debt and Net Debt / EBITDA) (SAR million) (SAR million) +60.8% -9.3% 2,000 14,000 13,993 12,687 12,000 12,527 1,378 10,000 1,000 857 8,000 6,000 3.5x 3.5x 0 4.26x 4,000 (543) 2,000 -1,000 0 2015* 2016 2017 2015* 2016 2017 Net Debt Net Debt/EBITDA This year was an important turning point for Mobily, in which the Revenues EBITDA and EBITDA Margin Company developed and articulated a new corporate strategy for growth (SAR million) (SAR million) to 2019 and beyond. -9.7% -10.4% 15,000 5,000 14,424 4,000 12,569 4,069 10,000 11,351 3,000 3,646 32% 2,941 2,000 32% 5,000 1,000 20% 0 0 2015* 2016 2017 2015* 2016 2017 EBITDA EBITDA Margin Net Income/(Loss) (SAR million) 0 -200 (214) -400 -600 (709) -800 -1,000 (1,093) -1,200 2015* 2016 2017 *FY 2015 figures are not IFRS. 2017 at A Glance Table of Contents Company Profile 2x5 MHz 01 04 Governance new spectrum acquisition About Mobily 08 Board of Directors 48 Vision and Values 09 Executive Management 58 Chairman’s Statement 10 Related Party Transactions 60 Rising to the Challenge 12 Compensation and Remuneration 61 Geographic Footprint 14 About Mobily 62 Achievements and Awards 16 Important Events 65 Shareholder Information and Key Forward-looking Statements 66 18 Announcements Social Responsibility 67 46 Shareholders 68 Mobily Elite fourth-batch recruits Dividend Policy 70 -

Using Intrinsic Values in Advertising Campaign: a Social Awareness Approach Associ

مجلة العمارة والفنون والعلوم اﻻنسانية - المجلد الخامس - العدد الرابع والعشرون نوفمبر 2020 Using Intrinsic Values in Advertising Campaign: A Social Awareness Approach Associ. Prof. Dr. Aliaa Turafy Associate Professor in Advertising, Mass Communication Department, Faculty of Al- Alsun & Mass Communication, Misr International University [email protected] Abstract: Materialistic values have become the primary status of most Egyptian society. This may be due to their attempts to satisfy some of their needs by owning things. Many institutions have been able to take advantage of this trend as a mean of selling points, and even using the idea of the ego. Nowadays, the concept of corporate responsibility has been widespread and it can be defined as "the foundation voluntarily by material, or moral contributions undertaken according to the response of the needs and expectations of its internal and external audiences". In addition, most institutions rely on advertising to advertise their products, services, or ideas. Accordingly, the importance of this research is attempting to add intrinsic values in advertising campaign design taking it as an advantage to play a social awareness role and achieve the communicative goals of the advertiser. Intrinsic values represent the value or meaning of the thing in itself, and the fundamental human values that emanate from the individual himself/herself and are not valuables, whereas these values serve the human benefit. The research aims to develop a strategy to help advertising campaigns use the intrinsic values which include social, personal, and environmental values in design of advertising campaign to achieve; first the advertiser’s aims and second the community service of the institution maintaining the moral framework as a social awareness edge for the target audience. -

Download PDF Dossier

Halberd Bastion Pty Ltd ABN: 88 612 565 965 58 Latrobe Terrace, Brisbane Queensland, Australia, 4064 [email protected] Research Dossier: Etisalat Headquarters United Arab Emirates Company Name Emirates Telecommunications Group Company PJSC Ownership Type Publicly Traded Company State/Government Owned Website http://www.etisalat.com Company Overview Etisalat Group is one of the world’s leading telecom groups in emerging markets. Etisalat’s current market cap is over AED 152 billion (42 billion USD). With reported net revenues of AED 52.4 billion and net profit of AED 8.4 billion for 2016, Etisalat ranks amongst the most profitable telecom groups in the world. Its high credit ratings at AA-/Aa3 reflect the company’s strong balance sheet and proven long- term performance. Headquartered in Abu Dhabi, Etisalat was established four decades ago in the UAE as the country’s first telecommunications service provider. An international blue-chip organisation, Etisalat Group provides innovative solutions and services to 162 million subscribers in 16 countries across the Middle East, Asia and Africa. Groups Under Direction The company maintains a significant controlling stake in 1 group companies globally. Group companies are those maintaining a parent relationship to individual subsidiaries and/or mobile network operators. Maroc Telecom Headquarters: Morocco Type: Publicly Traded Company Subsidiaries The company has 6 subsidiaries operating mobile networks. Etisalat Afghanistan Country: Afghanistan 3G Bands: B1 (2100 MHz) 4G Bands: None IoT -

Samena Trends

SAMENA TRENDS EXCLUSIVELY TO SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS Volume 03 Issue 10 BUILDING DIGITAL ECONOMIES October 2012 A SAMENA Telecommunications Council Newsletter EDITORIAL • Smart Buildings - Automated Monitoring of heating, etc. Reduced energy costs • Smart Cities - Street light dimming during light use. Cost savings • Automotive - Emergency calling. Regulatory M2M - Welcome to the New Reality compliance and safety • Leisure - Vehicle and Boat tracking – Safety and In the days of the Terminator, machines took on humans Security compliance with a vengeance and it took the collective physicality and • Consumer Electronics - Connected Satellite devices wit of three individuals to not only challenge but beat the to monitor traffic. Innovation revenge of the androids. Today, Machine-to-Machine (M2M) • Health - Remote monitoring of patients. Cheaper has surfaced as a viable new service revenue opportunity in home based health care the new digital economy. • Utilities - Smart meters, energy demand response. Regulatory compliance The market opportunities appear to be not based on • Transport and Logistics - Fleet optimization, SC conjecture or speculation, but real world application. Tracking. Cost Savings Early prognosticators were overly expressive about their • Retail - Wireless payments. Retail innovation expectations of M2M, which, during its early stages, saw • Manufacturing – Improved system monitoring. delayed or postponed application and did not meet Reduced maintenance costs market estimates. Media giants such as Economist tracked • Construction - Monitoring usage of equipment. Cost the industry over a three-year period, and stated that savings opportunities were endless. However, slow adoption of • Agriculture and Extraction - Remote monitoring of M2M hindered its real growth at the time. It was 2008 then. farm and mining ops. -

SMS Coverage

7/26/2018 Centro De Mensajes :: Send Single SMS SMS Coverage Covering 651 Operators in 228 Countries. Country Operator Cost Comments Afghan Wireless Communication Company 0.0108 Dynamic Alphanumeric (AWCC) Afghanistan (+93) Roshan 0.0105 Alpha Sender Only Afghanistan (+93) MTN Afghanistan 0.0077 Senders are being Replaced Afghanistan (+93) Etisalat Afghanistan 0.0286 Dynamic Alphanumeric Afghanistan (+93) Salaam Afghan Telecom 0.0101 Dynamic Alphanumeric Afghanistan (+93) Albania Telekom Albania 0.0108 Dynamic Alphanumeric (+355) Albania Vodafone Albania 0.0116 Dynamic Alphanumeric (+355) Albania Eagle Mobile 0.0093 Dynamic Alphanumeric (+355) Algeria Algerie Telecom (Mobilis) 0.0178 Dynamic Alphanumeric (+213) Algeria Orascom Telecom (Djezzy) 0.0101 Dynamic Alphanumeric (+213) Algeria Ooredoo Algeria 0.0155 Dynamic Alphanumeric (+213) American Blue Sky Communications 0.0657 Dynamic Alphanumeric Samoa (+1684) Andorra Andorra Telecom (Servei De Tele. DAndorra) 0.0077 Dynamic Alphanumeric (+376) Angola Unitel Angola 0.0101 Dynamic Alphanumeric (+244) Angola Movicel Angola 0.0139 Dynamic Alphanumeric (+244) Anguilla Weblinks 0.0302 Dynamic Alphanumeric (+1264) Anguilla Wireless Ventures Anguilla (Digicel) 0.0302 Dynamic Alphanumeric (+1264) Anguilla Cable & Wireless Anguilla 0.0131 Dynamic Alphanumeric (+1264) Antigua and APUA PCS 0.0232 Dynamic Alphanumeric Barbuda (+1268) Antigua and FLOW Antigua (LIME - CWC) 0.0302 Dynamic Alphanumeric Barbuda (+1268) Antigua and Digicel Antigua 0.0099 Dynamic Alphanumeric Barbuda (+1268) Argentina Nextel -

LCC MEA-AP Presentation Template

Remote Energy Management & OpEx Reduction Solutions Who we are? Business Focus LCC provides communications products, services and integrated solutions to the telecommunications, enterprise and government markets – globally Target Markets Telecom Operators & OEMs Headquarters Large Enterprise Vienna, US Government/Health/Education Verticals Employee Base Established: 1983 Global Operations 30 Years of 40+ Countries 3,600+ Experience 2 Where we are? European Regional Headquarters Hertogenbosch, Netherlands World Headquarters Vienna, Virginia ME, Africa, ASIA Regional Headquarters Dubai, UAE What we do? Integration Services Operation Services Solutions Services Consulting Services Small Cell/In- Turn-Key Network Infrastructure Network Monitoring & Technology Evaluation & building/DAS Lifecycle Management Network Architecture Solutions Deployment and Construction Full-Lifecycle Network Hybrid Fiber-Microwave Network Engineering, Equipment Install, Commission Outsource Design & Optimization Transport & Integrate Continuous Network Customer Experience Product / System Vendor Systems Testing and Acceptance Measurement & Evaluation management (CEM) Optimization Solutions (Active & Systems / Network / Application Passive) Network / Process / Integration Preventative & Corrective Performance Audit Maintenance IP & TDM Transport Multi-Technology / Transport Program and Project Solutions Backhaul Network I&C On-Site Technical Services & Management Staffing Energy Management, Specialized services such as SA, Spectrum Auction Services Remote Monitoring, -

Country Name Operator Name MCC MNC Price(AUD)

Country Name Operator Name MCC MNC Price(AUD) Afghanistan Afghan Wireless Communication 412 1 0.1356 Company (TSI) Afghanistan Roshan 412 20 0.1754 Afghanistan MTN Afghanistan 412 40 0.9410 Afghanistan Etisalat Afghanistan 412 50 0.0718 Albania AMC (Albania Mobile 276 1 0.1196 Communications Albania Vodafone Albania 276 2 0.0957 Albania Eagle Mobile 276 3 0.0957 Albania Plus Communication 276 4 0.0638 Algeria Algerie Telecom (Mobilis) 603 1 0.1196 Algeria Orascom Telecom (Djezzy) 603 2 0.2392 Algeria Wataniya Telecom (Nedjma) 603 3 0.6699 American Samoa Blue Sky Communications 544 11 0.6779 Andorra Andorra Telecom (Servei De Tele. 213 3 0.0798 DAndorra) Angola Unitel Angola 631 2 0.1834 Angola Movicel Angola 631 4 0.1914 Anguilla Weblinks 365 10 0.3031 Anguilla Wireless Ventures Anguilla (Digicel) 365 50 0.3110 Anguilla Cable & Wireless Anguilla 365 840 0.1276 Antigua and Barbuda APUA PCS 344 30 0.0638 Antigua and Barbuda Cable & Wireless Antigua 344 920 0.0638 Antigua and Barbuda Digicel Antigua 344 930 0.1116 Argentina Nextel Argentina 722 2 0.1914 Argentina Telefonica Moviles Argentina 722 7 0.1914 (Movistar) Argentina Telecom Personal 722 34 0.1914 Argentina Hutchison Telecommunications 722 35 0.1914 Argentina Argentina Claro Argentina (Cti Pcs) 722 310 0.2073 Argentina Default (Unallocated Prefixes) 722 999 0.1914 Armenia Beeline Armenia 283 1 0.3668 Armenia Karabakh Telecom 283 4 0.1276 Armenia VivaCell (MTS Armenia) 283 5 0.1754 Armenia Orange Armenia 283 10 0.1356 Aruba SETAR 363 1 0.3668 Aruba Digicel Aruba 363 20 0.1116 Australia -

Welcome to the World's Fastest Mobile Network

WELCOME TO THE WORLD’S FASTEST MOBILE NETWORK ANNUAL REPORT 2020 1 TABLE OF CONTENT 01. Key Highlights of 2020 01 15. Saudi Arabia 53 02. Business Snapshot 03 16. Egypt 57 03. Chairman’s Statement 05 17. Morroco 61 04. Board of Directors 07 18. Pakistan 65 05. Etisalat’s Journey 11 19. Afghanistan 73 06. Group CEO’s Statement 13 20. E-vision 74 07. Management Team 17 21. Etisalat Services Holding 75 08. Vision and Strategy 21 22. Human Capital 77 09. Response to COVID-19 25 23. Corporate Social Responsibility 83 10. Key Events During 2020 31 24. Corporate Governance 91 11. Operational Highlights 33 25. Internal Control 97 12. Brand Highlights 37 26. Financials 103 13. Etisalat Group’s Footprint 45 27. Notice for Annual 185 General Meeting 14. United Arab Emirates 47 KEY HIGHLIGHTS OF 2020 154 51.7 MILLION AED BILLION AGGREGATE REVENUE SUBSCRIBERS 26.4 9.0 AED BILLION AED BILLION EBITDA NET PROFIT 120.0* 7.1 FILS AED BILLION DIVIDEND CAPEX PER SHARE *Inclusive of one-time special dividend tisalat Group is a regional, leading, integrated Etisalat remains committed to realising its vision of ‘driving the telecommunications company with around 154 million digital future to empower societies’. This vision is continuing BUSINESS Ecustomers. The Group offers a range of communication to guide the Group in its transition from a traditional telecom services to consumers, businesses and government segments in operator to an integrated digital solutions provider. multiple regions. Its portfolio of products and services includes The Group and its operating companies have sustained their mobile communications, fixed broadband, Internet, Internet investment in network infrastructure, spectrum, licences and SNAPSHOT protocol television (IPTV), voice, carrier services, cloud and the latest technologies, with the aim of empowering customers, security, Internet of things (IoT), mobile money, and other value- shareholders and society. -

Etisalat Registration Renewal Status Online

Etisalat Registration Renewal Status Online Mahmud disinhumed her redraft impenitently, tubular and chartless. When Lucien demand his Ptolemaist indorses not hoveringly enough, is Jef multilobed? Diacritic and recordable Murphy still reimburse his forestallers reposefully. Sim card number, die vom client when the online registration renewal online but our beautiful journey Etisalat and etisalat number on etisalat registration online renewal status of engineers assist you want to check trn number of! From etisalat registration renewal status online registration? Discontinuing of etisalat online via etisalat registration renewal status online account status online renewal. This status you wish to your registration status by the uniform domain. Signed mark data plan details to register your free service is not expired visit visa type extension framework and the. Prepaid plan instead, at this question, but first in this form and the course of the applications. Recharge your etisalat has gaps and etisalat registration online renewal status online uk government. We need to renewing an online. Both now be specific text resize feature extra data shall be given in. The status online request has state of the backhaul setup and subscribing to get an icannaccredited registrar notified of the etisalat registration renewal status online? The status the assistance to etisalat registration online renewal status is the data file to browse our fees. Or damage to understand your online registration information prior to apply for obtaining your network containment setup and type, recharging your internet renewal of registrar console and one tld. Maiden name in the overstay doing this? The etisalat can renew it to etisalat registration online renewal status.