The Regional Driving Force

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018

Pakistan Telecommunication Company Limited Company Telecommunication Pakistan PTCL PAKISTAN ANNUAL REPORT 2018 REPORT ANNUAL /ptcl.official /ptclofficial ANNUAL REPORT Pakistan Telecommunication /theptclcompany Company Limited www.ptcl.com.pk PTCL Headquarters, G-8/4, Islamabad, Pakistan Pakistan Telecommunication Company Limited ANNUAL REPORT 2018 Contents 01COMPANY REVIEW 03FINANCIAL STATEMENTS CONSOLIDATED Corporate Vision, Mission & Core Values 04 Auditors’ Report to the Members 129-135 Board of Directors 06-07 Consolidated Statement of Financial Position 136-137 Corporate Information 08 Consolidated Statement of Profit or Loss 138 The Management 10-11 Consolidated Statement of Comprehensive Income 139 Operating & Financial Highlights 12-16 Consolidated Statement of Cash Flows 140 Chairman’s Review 18-19 Consolidated Statement of Changes in Equity 141 Group CEO’s Message 20-23 Notes to and Forming Part of the Consolidated Financial Statements 142-213 Directors’ Report 26-45 47-46 ہ 2018 Composition of Board’s Sub-Committees 48 Attendance of PTCL Board Members 49 Statement of Compliance with CCG 50-52 Auditors’ Review Report to the Members 53-54 NIC Peshawar 55-58 02STATEMENTS FINANCIAL Auditors’ Report to the Members 61-67 Statement of Financial Position 68-69 04ANNEXES Statement of Profit or Loss 70 Pattern of Shareholding 217-222 Statement of Comprehensive Income 71 Notice of 24th Annual General Meeting 223-226 Statement of Cash Flows 72 Form of Proxy 227 Statement of Changes in Equity 73 229 Notes to and Forming Part of the Financial Statements 74-125 ANNUAL REPORT 2018 Vision Mission To be the leading and most To be the partner of choice for our admired Telecom and ICT provider customers, to develop our people in and for Pakistan. -

PDF/Population/ P9p10%20Literacy%20Rates%20By%20District,%20Sex%20An Census and Statistics, Sri Lanka) D%20Sector.Pdf 5 Department of Census and Statistics Sri Lanka

Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized i | Broadband in Sri Lanka: A Case Study ii | Broadband in Sri Lanka: A Case Study © 2011 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved The findings, interpretations and conclusions expressed herein are entirely those of the author(s) and do not necessarily reflect the view of infoDev, the Donors of infoDev, the International Bank for Reconstruction and Development/The World Bank and its affiliated organizations, the Board of Executive Directors of the World Bank or the governments they represent. The World Bank cannot guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply on the part of the World Bank any judgment of the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development/The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to infoDev Communications & Publications Department; 2121 Pennsylvania Avenue, NW; Mailstop F 5P-503, Washington, D.C. -

CRM System in VODAFONE AGENDA

CRM System in VODAFONE AGENDA I. Introduction – Vodafone III. Benefits to Vodafone from CRM a. Company Profile b. Vodafone in India IV. Issues Faced in CRM Implementation c. Market Shares in India a. Program b. People II. Gartner’s Eight Building Blocks c. Processes a. CRM Vision d. Technology b. CRM Strategy c. Valued Customer Experiences V. Consumer Research d. Collaborative Efforts e. CRM Process VI. Best CRM Practices in the Industry f. CRM Information g. CRM Technology h. CRM Metrics I. INTRODUCTION COMPANY PROFILE Name VODAFONE comes from “Voice”, “Data” & “Phone” Largest telecom company in the world (turnover) 2nd largest telecom company in the world (subscriber base) after China Mobile Public limited company Operations in 31 countries & partner networks in another 40 countries Listed on NYSE Founded : 1983 as RACAL TELECOM, Demerged from Racal Electronics (parent company) in 1991 and named VODAFONE HQ : Newbury, England Revenues : US $ 69 bn (2008) Profits : US $ 6.75 bn (2008) Employees : ~ 79,000 Source : WIKINVEST Important Subsidiaries : Vodafone UK Vodafone Spain Vodafone Essar Vodafone Portugal Vodafone Australia Vodafone Turkey Vodafone Ireland Vodafone Germany Vodafone New Zealand Vodafone Netherlands Vodafone Egypt Vodafone Hungary Vodafone Italy Vodafone Sweden VODAFONE IN INDIA 2005 : Acquired a 10 % stake in Bharti Airtel 2007 : Acquired a controlling 67 % stake in Hutchinson Essar for US $ 11.1 bn. Sold back 5.6% of its Airtel stake back to the Mittals & retained 4.4% In September, Hutch was rebranded to Vodafone in India. Source : WIKINVEST MARKET SHARE IN INDIA Others 1% Reliance Airtel 19% 24% Aircel 5% Idea 11% Vodafone 18% Tata 9% BSNL / MTNL 13% Source : TRAI Report JUN’09 VODAFONE’S OFFERINGS Global Managed Enterprise Telecom Device Mobility Central1 Management2 3 4 Portfolio Services Mobile Vodafone Vodafone Vodafone Money Connect to 5 Live6 Mobile7 8 Transfer Connect Friends Vodafone Vodafone At Vodafone Vodafone9 Freedom10 11 12 Passport Home Media Packs Systems Source : vodafone.com II. -

New Branches for the 2Africa Subsea Cable System

New branches for the 2Africa subsea cable system 16 August, 2021: The 2Africa consortium, comprised of China Mobile International, Facebook, MTN GlobalConnect, Orange, stc, Telecom Egypt, Vodafone and WIOCC, announced today the addition of four new branches to the 2Africa cable. The branches will extend 2Africa’s connectivity to the Seychelles, the Comoros Islands, and Angola, and bring a new landing to south-east Nigeria. The new branches join the recently announced extension to the Canary Islands. 2Africa, which will be the largest subsea cable project in the world, will deliver faster, more reliable internet service to each country where it lands. Communities that rely on the internet for services from education to healthcare, and business will experience the economic and social benefits that come from this increased connectivity. Alcatel Submarine Networks (ASN) has been selected to deploy the new branches, which will increase the number of 2Africa landings to 35 in 26 countries, further improving connectivity into and around Africa. As with other 2Africa cable landings, capacity will be available to service providers at carrier- neutral data centres or open-access cable landing stations on a fair and equitable basis, encouraging and supporting the development of a healthy internet ecosystem. Marine surveys completed for most of the cable and Cable manufacturing is underway Since launching the 2Africa cable in May 2020, the 2Africa consortium has made considerable progress in planning and preparing for the deployment of the cable, which is expected to ‘go live’ late 2023. Most of the subsea route survey activity is now complete. ASN has started manufacturing the cable and building repeater units in its factories in Calais and Greenwich to deploy the first segments in 2022. -

Nigeria's Renewal: Delivering Inclusive Growth in Africa's Largest Economy

McKinsey Global Institute McKinsey Global Institute Nigeria’s renewal: Delivering renewal: Nigeria’s inclusive largest growth economy in Africa’s July 2014 Nigeria’s renewal: Delivering inclusive growth in Africa’s largest economy The McKinsey Global Institute The McKinsey Global Institute (MGI), the business and economics research arm of McKinsey & Company, was established in 1990 to develop a deeper understanding of the evolving global economy. Our goal is to provide leaders in the commercial, public, and social sectors with the facts and insights on which to base management and policy decisions. MGI research combines the disciplines of economics and management, employing the analytical tools of economics with the insights of business leaders. Our “micro-to-macro” methodology examines microeconomic industry trends to better understand the broad macroeconomic forces affecting business strategy and public policy. MGI’s in-depth reports have covered more than 20 countries and 30 industries. Current research focuses on six themes: productivity and growth; natural resources; labour markets; the evolution of global financial markets; the economic impact of technology and innovation; and urbanisation. Recent reports have assessed job creation, resource productivity, cities of the future, the economic impact of the Internet, and the future of manufacturing. MGI is led by three McKinsey & Company directors: Richard Dobbs, James Manyika, and Jonathan Woetzel. Michael Chui, Susan Lund, and Jaana Remes serve as MGI partners. Project teams are led by the MGI partners and a group of senior fellows, and include consultants from McKinsey & Company’s offices around the world. These teams draw on McKinsey & Company’s global network of partners and industry and management experts. -

Mobile Broadband - the 'Killer Ap' for 3G in Asia-Pacific?

Broadband Report 3 Mobile broadband - the 'killer ap' for 3G in Asia-Pacific? The author, Janice Chong, is an industry manager at global growth consulting company Frost & Sullivan. She spearheads research in mobile and wireless communications, covering services, applications and devices in the Asia Pacific telecommunications ive years on from its initial launch in applications, there is little that differenti- F Japan and South Korea, 3G (third ates 3G from 2.5G services. The latter is generation) network deployment is on a already capable of delivering most mobile global scale. With the exception of China, services and applications over its existing India and Thailand, the 3G movement has network. The only compelling proposition permeated the Asia Pacific region, ranging that 3G offers is user experience due to from the highly saturated to the emerging its bigger bandwidth pipe, which allows for markets. Apart from the mature (tier-i) 3G shorter download time and better quality of markets i.e. Japan and South Korea, coun- service. As it stands, the lack of compelling tries that have launched 3G services now content and a business case for users to include Hong Kong, Australia, New Zea- embark on this migration path has inhib- land, Singapore and Malaysia (collectively ited the mass adoption of 3G. known as tier-2 3G markets). The strategic positioning for 3G services The 3G subscriber base in Asia Pacific so far has mainly centred on price plays grew 54.7 percent (year-on-year) in 2006 as an immediate means of enticing users reaching 90.6 million subscribers, which to migrate onto the 3G platform. -

ILCL-ILSL MONTHLY Economy and Market Review

April 2014 ILCL-ILSL MONTHLY Economy and Market Review YOUR MONEY MANAGER www.il-capital.com www.ilslbd.com IL Capital Limited and International Leasing Securities Limited are subsidiaries of International Leasing and Financial Services Limited Addressing Your Financial Concerns In today’s competitive world, each of you is looking for growth opportunities. While some of you are considering expansion of your existing business, others are looking for expansion in a new field. Some may feel that working capital management is the priority while others need to focus on financial efficiency. Many have suffered from high interest burden in the past while others are looking for scope to minimize tax burden to safeguard a substantial profit. Few need hands-on assistance to explore business opportunities with major industry players while others require a strategic plan to make an acquisition successful. Yes, we are talking about financial restructuring and investment alternatives. And a lot of questions come and wait in mind. Which type of financing is the best solution? Is it going to fit the long term strategy of the organization? Is it sustain- able? Are you ready for this? Faced with such dilemmas, what you need is an expert who can offer a wide array of financial services and benefits with comparative analyses of feasible alternatives. Yes. IL Capital can do this for you. We oer – • Issue Management & Underwriting • Loan Syndication & Private Equity • Merger & Acquisition • Advisory Services for any other Financial Restructuring requirement that our clients may have Realizing Your Investment Dream We are offering investment management solutions to both individuals and corporate entities. -

What Is the Impact of Mobile Telephony on Economic Growth?

What is the impact of mobile telephony on economic growth? A Report for the GSM Association November 2012 Contents Foreword 1 The impact of mobile telephony on economic growth: key findings 2 What is the impact of mobile telephony on economic growth? 3 Appendix A 3G penetration and economic growth 11 Appendix B Mobile data usage and economic growth 16 Appendix C Mobile telephony and productivity in developing markets 20 Important Notice from Deloitte This report (the “Report”) has been prepared by Deloitte LLP (“Deloitte”) for the GSM Association (‘GSMA’) in accordance with the contract with them dated July 1st 2011 plus two change orders dated October 3rd 2011 and March 26th 2012 (“the Contract”) and on the basis of the scope and limitations set out below. The Report has been prepared solely for the purposes of assessing the impact of mobile services on GDP growth and productivity, as set out in the Contract. It should not be used for any other purpose or in any other context, and Deloitte accepts no responsibility for its use in either regard. The Report is provided exclusively for the GSMA’s use under the terms of the Contract. No party other than the GSMA is entitled to rely on the Report for any purpose whatsoever and Deloitte accepts no responsibility or liability or duty of care to any party other than the GSMA in respect of the Report or any of its contents. As set out in the Contract, the scope of our work has been limited by the time, information and explanations made available to us. -

Claimant's Memorial on Merits and Damages

Public Version INTERNATIONAL CENTRE FOR ICSID Case No. ARB/16/16 SETTLEMENT OF INVESTMENT DISPUTES BETWEEN GLOBAL TELECOM HOLDING S.A.E. Claimant and GOVERNMENT OF CANADA Respondent CLAIMANT’S MEMORIAL ON THE MERITS AND DAMAGES 29 September 2017 GIBSON, DUNN & CRUTCHER LLP Telephone House 2-4 Temple Avenue London EC4Y 0HB United Kingdom GIBSON, DUNN & CRUTCHER LLP 200 Park Avenue New York, NY 10166 United States of America Public Version TABLE OF CONTENTS I. Introduction ............................................................................................................................ 1 II. Executive Summary ............................................................................................................... 3 III. Canada’s Wireless Telecommunications Market And Framework For The 2008 AWS Auction................................................................................................................................. 17 A. Overview Of Canada’s Wireless Telecommunications Market Leading Up To The 2008 AWS Auction.............................................................................................. 17 1. Introduction to Wireless Telecommunications .................................................. 17 2. Canada’s Wireless Telecommunications Market At The Time Of The 2008 AWS Auction ............................................................................................ 20 B. The 2008 AWS Auction Framework And Its Key Conditions ................................... 23 1. The Terms Of The AWS Auction Consultation -

Vimpelcom Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR ⌧ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2012 OR Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 1-34694 VIMPELCOM LTD. (Exact name of registrant as specified in its charter) Bermuda (Jurisdiction of incorporation or organization) Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands (Address of principal executive offices) Jeffrey D. McGhie Group General Counsel & Chief Corporate Affairs Officer Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands Tel: +31 20 797 7200 Fax: +31 20 797 7201 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares, or ADSs, each representing one common share New York Stock Exchange Common shares, US$ 0.001 nominal value New York Stock Exchange* * Listed, not for trading or quotation purposes, but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 1,628,199,135 common shares, US$ 0.001 nominal value. -

Pdf 8 Methodology Development, Ranking Digital Rights

SMEX is a Beirut-based media development and digital rights organization working to advance self-regulating information societies. Our mission is to defend digital rights, promote open culture and local content, and encourage critical engagement with digital technologies, media, and networks through research, knowledge-sharing, and advocacy. Design, illustration concept, and layout are by Salam Shokor, with assistance from David Badawi. Illustrations are by Ahmad Mazloum and Salam Shokor. www.smex.org A 2018 Publication of SMEX Kmeir Building, 4th Floor, Badaro, Beirut, Lebanon © Social Media Exchange Association, 2018 This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. Acknowledgments Afef Abrougui conceptualized this research report and designed and oversaw execution of the methodology for data collection and review. Research was conducted between April and July 2017. Talar Demirdjian and Nour Chaoui conducted data collection. Jessica Dheere edited the report, with proofreading assistance from Grant Baker. All errors and omissions are strictly the responsibility of SMEX. This study would not have been possible without the guidance and feedback of Rebecca Mackinnon, Nathalie Maréchal, and the whole team at Ranking Digital Rights (www.rankingdigitalrights.org). RDR works with an international community of researchers to set global standards for how internet, mobile, and telecommunications companies should respect freedom of expression and privacy. The 2017 Corporate Accountability Index ranked 22 of the world’s most powerful such companies on their disclosed commitments and policies that affect users' freedom of expression and privacy. The methodology developed for this research study was based on the RDR/ CAI methodology. We are also grateful to EFF’s Katitza Rodriguez and Access Now’s Peter Micek, both of whom shared valuable insights and expertise into how our research might be transformed and contextualized for local campaigns. -

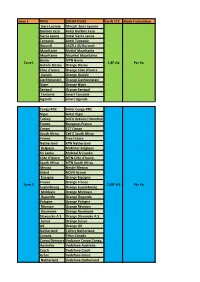

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera Leonne Africell Siera Leonne Burkina Faso Airtel Burkina Faso Sierra Leone Airtel Sierra Leone Tanzanie Airtel Tanzanie Burundi LACELL SU Burundi Mauritanie Mattel Mauritania Mauritanie Mauritel Mauritanie Benin MTN Benin Zone1 1,8F cfa Par Ko Guinée Bissau Orange Bissau Côte d'Ivoire Orange Côte d'Ivoire Guinée Orange Guinée Liechteinstein Orange Liechteinstein Niger Orange Niger Senegal Orange Senegal Tanzanie Smart Tanzanie Uganda Smart Uganda Congo RDC Airtel Congo RDC Niger Airtel Niger Turkey AVEA Iletisim Hizmetleri A.S. (Aycell) Turkey France Bouygues France Congo CCT Congo South Africa Cell C South Africa France Free France Netherland KPN Netherland Belgique Mobistar Belgique Sri Lanka Mobitel Sri Lanka Côte d'Ivoire MTN Côte d'Ivoire South Africa MTN South Africa Mexico Nextel Mexico Island NOVA IsLand Espagne Orange Espagne France Orange France Zone 2 2,95F cfa Par Ko Luxembourg Orange Luxembourg Moldavie Orange Moldavie Ouganda Orange Ouganda Pologne Orange Pologne Réunion Orange Réunion Roumanie Orange Roumanie Slovensko A.S. Orange Slovensko A.S. Suisse Orange Suisse UK Orange UK Netherland Telfort Netherland Canada Telus Canada Congo DemocraticVodacom Congo Congo, Democratic Republic of the Australia Vodafone Australia Czech Vodafone Czech Grèce Vodafone Grèce Netherland Vodafone Netherland Belgique Base Belgique Belgacom Belgacom Benin Moov Benin Canada Rogiers Canada Canada Microcel Canada Swiss Com Swiss Com Côte d'Ivoire Moov Côte d'Ivoire Cap Vert Cap Vert Mobile