Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SWOT Analysis of Ufone

Ufone Ufone GSM is a Pakistani GSM cellular service provider, It's one of five GSM Mobile companies in Pakistan, and is a subsidiary ofPakistan Telecommunication Company. After the privatization of PTCL, Ufone is now owned by Etisalat. Ufone has a subscriber base of 20.23 million as of September 2010. Ufone Cellular Company INTRODUCTION TO UFONE Ufone is a newly cellular company as compared to others like Mobilink, Zong(Paktel), Instaphone operating inPakistan, providing cellular services for Eight years now. Ufone services are offered by Pak Telecom Mobile Limited (PTML), a 100% owned subsidiary of Pakistan Telecommunication Company Limited (PTCL). Established to operate cellular telephony. The company commenced its operations, under the brand name of Ufone, from Islamabad on January 29, 2001. and subsequently extended its coverage to other cities i.e. Lahore, Karachi, Kohat, Jehlum,Gujranwala, Faisalabad, Sheikhopura. In addition to the road coverage on Peshawar-Islamabad-Lahore section. Till now its coverage has been extended to more than 750 cities. In Peshawar its operation were started on 7th of May, 2001. Ufone, the brand name of the service, has been a highly successful venture touching 120000 subscribers in less than four months of its operations. SWOT analysis of Ufone INTRODUCTION Ufone GSM is a Pakistani GSM cellular service provider. It is one of six GSM Mobile companies in Pakistan and is a subsidiary of Pakistan Telecommunication Company. The company commenced its operations under the brand name of Ufone from Islamabad on January 29 2001. U fone expanded its coverage and has added new cities and highways to its coverage network. -

Posted Issuer

Central Depository Company of Pakistan Limited Element Report Page# : 1 of 267 User : XKYFSI2 Report Selection : Posted Date : 04/11/2020 Element Type : Issuer Time : 06:02:58 Element ID : ALL Location : ALL Status : Active From Date : 01/01/1996 To Date : 04/11/2020 Element Id Element Code Element Name Phone / Fax Contact Name CDC Loc Role Code Maximum User Status Main A/c Address eMail Address Designation Client A/c CM Option No. Date -------- -------- ------------------------ ---------------------- --------------- --------- -------- ----------- -------- 00002 EFU GENERAL 2313471-90 ALTAF QAMRUDDIN KHI Active INSURANCE LIMITED GOKAL 3RD FLOOR, 2314288 CFO AND 08/06/1998 QAMAR HOUSE, CORPORATE M. A. JINNAH ROAD, SECRETARY KARACHI. 00003 HABIB INSURANCE 111-030303 SHABBIR A. KHI Active COMPANY LIMITED GULAMALI 1ST FLOOR, STATE 32421600 CHIEF 01/09/1997 LIFE BLDG. NO. 6, EXECUTIVE HABIB SQUARE, M. A. JINNAH ROAD, [email protected] KARACHI. et 00004 HAYDARI 2411247 ALI ASGHAR KHI Active CONSTRUCTION RAJANI COMPANY LIMITED MEZZANINE FLOOR, 2637965 CHIEF 10/03/2004 UBL BUILDING, EXECUTIVE OPP. POLICE HEAD OFFICER OFFICE, I.I CHUNDRIGAR ROAD, KARACHI. 00005 K-ELECTRIC LIMITED 38709132 EXT:9403 AMJAD MUSTAFA KHI Active Central Depository Company of Pakistan Limited Element Report Page# : 2 of 267 User : XKYFSI2 Report Selection : Posted Date : 04/11/2020 Element Type : Issuer Time : 06:02:58 Element ID : ALL Location : ALL Status : Active From Date : 01/01/1996 To Date : 04/11/2020 Element Id Element Code Element Name Phone / Fax Contact Name CDC Loc Role Code Maximum User Status Main A/c Address eMail Address Designation Client A/c CM Option No. Date -------- -------- ------------------------ ---------------------- --------------- --------- -------- ----------- -------- 1ST FLOOR, 32647159 MANAGER, 01/09/1997 BLOCK-A, CORPORATE AFFAIRS POWER HOUSE, [email protected] ELANDER ROAD, KARACHI 00006 MURREE BREWERY 5567041-7 CH. -

Apigee X Migration Offering

Apigee X Migration Offering Overview Today, enterprises on their digital transformation journeys are striving for “Digital Excellence” to meet new digital demands. To achieve this, they are looking to accelerate their journeys to the cloud and revamp their API strategies. Businesses are looking to build APIs that can operate anywhere to provide new and seamless cus- tomer experiences quickly and securely. In February 2021, Google announced the launch of the new version of the cloud API management platform Apigee called Apigee X. It will provide enterprises with a high performing, reliable, and global digital transformation platform that drives success with digital excellence. Apigee X inte- grates deeply with Google Cloud Platform offerings to provide improved performance, scalability, controls and AI powered automation & security that clients need to provide un-parallel customer experiences. Partnerships Fresh Gravity is an official partner of Google Cloud and has deep experience in implementing GCP products like Apigee/Hybrid, Anthos, GKE, Cloud Run, Cloud CDN, Appsheet, BigQuery, Cloud Armor and others. Apigee X Value Proposition Apigee X provides several benefits to clients for them to consider migrating from their existing Apigee Edge platform, whether on-premise or on the cloud, to better manage their APIs. Enhanced customer experience through global reach, better performance, scalability and predictability • Global reach for multi-region setup, distributed caching, scaling, and peak traffic support • Managed autoscaling for runtime instance ingress as well as environments independently based on API traffic • AI-powered automation and ML capabilities help to autonomously identify anomalies, predict traffic for peak seasons, and ensure APIs adhere to compliance requirements. -

Pakistan Telecommunication Company Limited

VIS Credit Rating Company Limited www.vis.com.pk RATING REPORT Pakistan Telecommunication Company Limited REPORT DATE: RATING DETAILS October 05, 2020 Latest Rating Previous Rating Long- Short- Long- Short- Rating Category term term term term RATING ANALYSTS: Entity AAA A-1+ AAA A-1+ Talha Iqbal Rating Date October 05, 2020 October 11, 2019 [email protected] Rating Outlook Stable Stable Rating Action Reaffirm Reaffirm Asfia Aziz [email protected] COMPANY INFORMATION Incorporated in 1995 External auditors: KPMG Taseer & Hadi Co., Chartered Accountants. Public Listed Company Chief Executive Officer: Rashid Naseer Khan Board of Directors: - Mr. Shoaib Ahmad Siddiqui - Mr. Abdulrahim A. Al Nooryani - Mr. Rizwan Malik - Mr. Hatem Dowidar - Mr. Hesham Al Qassim - Mr. Khalifa Al Shamsi - Mr. Naveed Kamran Baloch - Syed Shabahat Ali Shah - Dr. Mohamed Karim Bennis APPLICABLE METHODOLOGY(IES) VIS Entity Rating Criteria: Corporates (May 2019) https://www.vis.com.pk/kc-meth.aspx VIS Credit Rating Company Limited www.vis.com.pk Pakistan Telecommunication Company Limited OVERVIEW OF THE INSTITUTION RATING RATIONALE Pakistan Pakistan Telecommunication Company Limited (PTCL) is the leading Integrated Information Telecommunication Communication Technology (ICT) Company in Pakistan, having the largest fixed-line network Company Limited in the country. The company’s products and services include voice services, high-speed (PTCL) was broadband internet, Fiber to the Home (FTTH) services, CharJi wireless internet, Smart TV incorporated in 1995 (IPTV) service, , Smart TV App and Touch App, digital-content streaming services like Netflix, and provides , and enterprise-grade platforms like Smart Cloud, Tier-3 Certified Data Centers, Managed and telecommunication Satellite Services. -

(July 2011 to June 2012) – Part 2 of 2 Pakistan: Karachi Electric Supply Co

Annual Environment & Social Monitoring Report (July 2011 to June 2012) – Part 2 of 2 Environmental and Social Performance Report November 2012 Pakistan: Karachi Electric Supply Company Post Privatization Rehabilitation, Upgrade and Expansion Prepared by Karachi Electric Supply Company Karachi, Pakistan The Environmental and Social Performance Report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff, and may be preliminary in nature. Your attention is directed to the “Terms of Use” section of this website. ASIAN DEVELOPMENT BANK QUERIES KESC 2013 KESC RESPONSE AGAINST ANNUAL MONITORING REPORT 2011-12 AUGUST - 2013 KESC authorized representative to be contacted on the AMR: Name : Chander Perkash Title : General Manager (Corporate Compliance) Tel : +9221-32647048 Cell : +92300- 2910106 Email : [email protected] ADDRESS: 12th Floor, Technology Park Shahra-e-Faisal, Karachi - Pakistan. Phone: +9221-32647048 Page Section Description/Title Comments / Remarks KESC response No. No. of Section 20 3.2.2 On public Please provide (i) schedule As a part of SEIA, area stakeholder consultation of consultations with are consulted and a general public various stakeholders, (ii) hearing which is open for all is summary of issues raised by organized before each project to respective stakeholder ensure maximum input from public. groups, and (iii) how these issues were resolved. Does the "open door" policy Whistle Blower Policy is in place for for community consultation both internal and External refer to KESC's grievance stakeholders. mechanism? Who or what unit can an aggrieved party AZM Speakup – Whistle Blower approach? Where is this Policy: person or unit located? Please discuss what Communication Platforms through a issues/complaints were dedicated helpline number, email raised, and how these issues address and text messaging option is were resolved. -

Ptcl Bandwidth Tariffs

PAKISTAN TELECOMMUNICATION AUTHORITY HEAD QUARTERS, F-5/1, ISLAMABAD Tel:051-2878138 Fax:051-9225334 www.pta.gov.pk PTCL BANDWIDTH TARIFFS Date of hearings : 22.09.2006 05.10.2006 Venue of hearings : Auditorium, PTA HQs, Islamabad Date of issuance of the instant Determination : 06.10.2006 The Authority present: Maj. Gen. (R) Shahzada Alam Malik: Chairman S. Nasrul Karim Ghaznavi: Member Dr. Muhammad Yaseen: Member The Issue: “Reviewing and removing afresh the anomalies that exist in the tariffs of Domestic Private Leased Circuit (DPLC), International Private Leased Circuit (IPLC) and Internet Protocol (IP) of PTCL” Revised/afresh decision/Determination of the Authority 1. PRELUDE: 1.1 Being mindful of its statutory obligations under the Pakistan Telecommunication (Re-organization) Act, 1996 (the “Act”), the Pakistan Telecommunication Authority (the “Authority”), keeping in view the worldwide trend of tariffs, decided to regulate Pakistan Telecommunication Company Limited’s (“PTCL”) bandwidth tariffs in order to bring it in line with the international benchmarks for promoting proliferation of ICT related services which depend on the same. 1 1.2 Through this determination the Authority desires to set and determine afresh the tariffs of Domestic Private Leased Circuit (DPLC), International Private Leased Circuits (IPLC) and Internet Protocol (IP) of PTCL. 2. BACKGROUND/FACTS THAT NECESSITATED ISSUANCE OF THE INSTANT DETERMINATION: 2.1 Succinctly, relevant facts that constrained the Authority to settle the captioned issue through the instant determination is that PTCL being the bulk provider of bandwidth in the country is likely to maintain its dominance in the market for the next few years. During the past few years, there has been noticed a major decline in the cost of building submarine cables. -

Pdf 8 Methodology Development, Ranking Digital Rights

SMEX is a Beirut-based media development and digital rights organization working to advance self-regulating information societies. Our mission is to defend digital rights, promote open culture and local content, and encourage critical engagement with digital technologies, media, and networks through research, knowledge-sharing, and advocacy. Design, illustration concept, and layout are by Salam Shokor, with assistance from David Badawi. Illustrations are by Ahmad Mazloum and Salam Shokor. www.smex.org A 2018 Publication of SMEX Kmeir Building, 4th Floor, Badaro, Beirut, Lebanon © Social Media Exchange Association, 2018 This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. Acknowledgments Afef Abrougui conceptualized this research report and designed and oversaw execution of the methodology for data collection and review. Research was conducted between April and July 2017. Talar Demirdjian and Nour Chaoui conducted data collection. Jessica Dheere edited the report, with proofreading assistance from Grant Baker. All errors and omissions are strictly the responsibility of SMEX. This study would not have been possible without the guidance and feedback of Rebecca Mackinnon, Nathalie Maréchal, and the whole team at Ranking Digital Rights (www.rankingdigitalrights.org). RDR works with an international community of researchers to set global standards for how internet, mobile, and telecommunications companies should respect freedom of expression and privacy. The 2017 Corporate Accountability Index ranked 22 of the world’s most powerful such companies on their disclosed commitments and policies that affect users' freedom of expression and privacy. The methodology developed for this research study was based on the RDR/ CAI methodology. We are also grateful to EFF’s Katitza Rodriguez and Access Now’s Peter Micek, both of whom shared valuable insights and expertise into how our research might be transformed and contextualized for local campaigns. -

Pakistan Telecommunication Company Limited (PTCL) Is the Largest Telecommunication Company in Pakistan

Pakistan Telecommunication Company Limited (PTCL) is the largest telecommunication company in Pakistan. This company provides telephony services to the nation and still holds the status of backbone for country's telecommunication infrastructure, despite arrival of a dozen other telecoms including telecom giants like Telenor and China Mobile. The company consists of around 2000 telephone exchanges across country providing largest fixed line network. GSM, CDMA and Internet are other resources of PTCL, making it a gigantic organization. The Government of Pakistan sold 26% shares and control of the company to Etisalat in 2006. The Government of Pakistan retained 62% of the shares while the remaining 12% are held by the general public. HISTORICAL BACKGROUND 1947 Posts & Telegraph Dept established 1961 Pakistan Telegraph & Telephone Dep¶t. 1990-91 Pakistan Telecom Corporation. 1995 about 5% of PTC assets transferred to PTA, FAB & NTC. 1996 PTCL Formed listed on all Stock Exchanges of Pakistan. 1998 Mobile (Ufone)& Internet(PakNet)subsidiaries established. 2000 Telecom Policy Finalized. 2003 Telecom Deregulation Policy Announced. 2006 Etisalat Takes Over PTCL's management. FIRMS CUSTOMERS 1. SERVICES FOR CONSUMERS These customers are households, and the nature of connection that installed at home according to it and charges are charged from them according to domestic level. 2. SERVICES FOR CORPORATE CUSTOMERS These are business customers such as organization, firms, institution, public call office, etc. different package are given according to the nature and size of organization. 1. PRODUCTS AND SERVICERS Pakistan Telecommunication Company Limited not only Provides Conventional telephone facilities, it also offers optical fiber services to the private sector. We will briefly discuss below the product lines being offered by the PTCL. -

Mapreduce: Simplified Data Processing On

MapReduce: Simplified Data Processing on Large Clusters Jeffrey Dean and Sanjay Ghemawat [email protected], [email protected] Google, Inc. Abstract given day, etc. Most such computations are conceptu- ally straightforward. However, the input data is usually MapReduce is a programming model and an associ- large and the computations have to be distributed across ated implementation for processing and generating large hundreds or thousands of machines in order to finish in data sets. Users specify a map function that processes a a reasonable amount of time. The issues of how to par- key/value pair to generate a set of intermediate key/value allelize the computation, distribute the data, and handle pairs, and a reduce function that merges all intermediate failures conspire to obscure the original simple compu- values associated with the same intermediate key. Many tation with large amounts of complex code to deal with real world tasks are expressible in this model, as shown these issues. in the paper. As a reaction to this complexity, we designed a new Programs written in this functional style are automati- abstraction that allows us to express the simple computa- cally parallelized and executed on a large cluster of com- tions we were trying to perform but hides the messy de- modity machines. The run-time system takes care of the tails of parallelization, fault-tolerance, data distribution details of partitioning the input data, scheduling the pro- and load balancing in a library. Our abstraction is in- gram's execution across a set of machines, handling ma- spired by the map and reduce primitives present in Lisp chine failures, and managing the required inter-machine and many other functional languages. -

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera

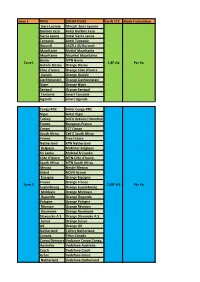

Zone 1 PAYS OPERATEURS Tarifs TTC Mode Facturation Siera Leonne Africell Siera Leonne Burkina Faso Airtel Burkina Faso Sierra Leone Airtel Sierra Leone Tanzanie Airtel Tanzanie Burundi LACELL SU Burundi Mauritanie Mattel Mauritania Mauritanie Mauritel Mauritanie Benin MTN Benin Zone1 1,8F cfa Par Ko Guinée Bissau Orange Bissau Côte d'Ivoire Orange Côte d'Ivoire Guinée Orange Guinée Liechteinstein Orange Liechteinstein Niger Orange Niger Senegal Orange Senegal Tanzanie Smart Tanzanie Uganda Smart Uganda Congo RDC Airtel Congo RDC Niger Airtel Niger Turkey AVEA Iletisim Hizmetleri A.S. (Aycell) Turkey France Bouygues France Congo CCT Congo South Africa Cell C South Africa France Free France Netherland KPN Netherland Belgique Mobistar Belgique Sri Lanka Mobitel Sri Lanka Côte d'Ivoire MTN Côte d'Ivoire South Africa MTN South Africa Mexico Nextel Mexico Island NOVA IsLand Espagne Orange Espagne France Orange France Zone 2 2,95F cfa Par Ko Luxembourg Orange Luxembourg Moldavie Orange Moldavie Ouganda Orange Ouganda Pologne Orange Pologne Réunion Orange Réunion Roumanie Orange Roumanie Slovensko A.S. Orange Slovensko A.S. Suisse Orange Suisse UK Orange UK Netherland Telfort Netherland Canada Telus Canada Congo DemocraticVodacom Congo Congo, Democratic Republic of the Australia Vodafone Australia Czech Vodafone Czech Grèce Vodafone Grèce Netherland Vodafone Netherland Belgique Base Belgique Belgacom Belgacom Benin Moov Benin Canada Rogiers Canada Canada Microcel Canada Swiss Com Swiss Com Côte d'Ivoire Moov Côte d'Ivoire Cap Vert Cap Vert Mobile -

Apache Hadoop Goes Realtime at Facebook

Apache Hadoop Goes Realtime at Facebook Dhruba Borthakur Joydeep Sen Sarma Jonathan Gray Kannan Muthukkaruppan Nicolas Spiegelberg Hairong Kuang Karthik Ranganathan Dmytro Molkov Aravind Menon Samuel Rash Rodrigo Schmidt Amitanand Aiyer Facebook {dhruba,jssarma,jgray,kannan, nicolas,hairong,kranganathan,dms, aravind.menon,rash,rodrigo, amitanand.s}@fb.com ABSTRACT 1. INTRODUCTION Facebook recently deployed Facebook Messages, its first ever Apache Hadoop [1] is a top-level Apache project that includes user-facing application built on the Apache Hadoop platform. open source implementations of a distributed file system [2] and Apache HBase is a database-like layer built on Hadoop designed MapReduce that were inspired by Googles GFS [5] and to support billions of messages per day. This paper describes the MapReduce [6] projects. The Hadoop ecosystem also includes reasons why Facebook chose Hadoop and HBase over other projects like Apache HBase [4] which is inspired by Googles systems such as Apache Cassandra and Voldemort and discusses BigTable, Apache Hive [3], a data warehouse built on top of the applications requirements for consistency, availability, Hadoop, and Apache ZooKeeper [8], a coordination service for partition tolerance, data model and scalability. We explore the distributed systems. enhancements made to Hadoop to make it a more effective realtime system, the tradeoffs we made while configuring the At Facebook, Hadoop has traditionally been used in conjunction system, and how this solution has significant advantages over the with Hive for storage and analysis of large data sets. Most of this sharded MySQL database scheme used in other applications at analysis occurs in offline batch jobs and the emphasis has been on Facebook and many other web-scale companies. -

New Zealand Reseller Update: June 2021 JUNE

New Zealand Reseller Update: June 2021 JUNE All the stock, all the updates, all you need. Always speak to your Synnex rep before quoting customer If you have colleagues not receiving this monthly Google deck but would like to, please have them sign up here Follow Chrome Enterprise on LinkedIn Channel news June update Questions about Switching to Chrome Promotions Marketing Case Studies Training Product Launches & Stock updates Channel news Chrome OS in Action: Chrome Enterprise has announced new solutions Chrome Demo Tool is live and open for partner sign ups! to accelerate businesses move to Chrome OS On October 20, Chrome OS announced new solutions to help businesses deploy Chromebooks Demo Tool Guide and Chrome OS devices faster, while keeping their employees focused on what matters most. Each solution solves a real-world challenge we know businesses are facing right now and will help them support their distributed workforce. The Chrome Demo Tool is a new tool for Google for Education ● Chrome OS Readiness Tool: Helps businesses segment their workforce and identify and Chrome Enterprise partners with numerous pre-configured which Windows devices are ready to adopt Chrome OS (available 2021). options to demo top Chrome features including single sign-on ● Chrome Enterprise Recommended: Program that identifies verified apps for the Chrome OS environment. (SSO), parallels, zero touch enrollment (ZTE), and many more ● Zero-touch enrollment: Allow businesses to order devices that are already corporate that are coming soon. enrolled so they can drop ship directly to employees. ● Parallels Desktop: Gives businesses access to full-featured Windows and legacy apps locally on Chrome OS.