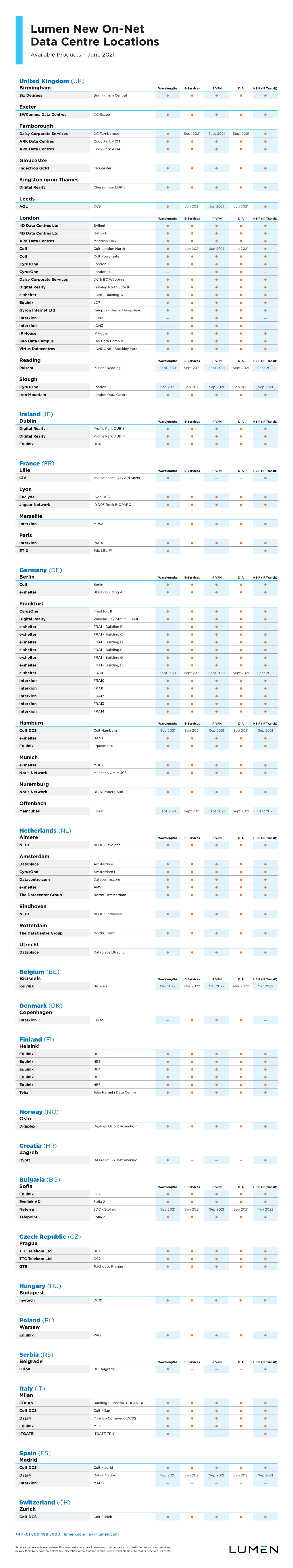

Lumen New On-Net Data Centre Locations Available Products – June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Equinix Inc (Eqix) 10-Q

EQUINIX INC (EQIX) 10-Q Quarterly report pursuant to sections 13 or 15(d) Filed on 04/27/2012 Filed Period 03/31/2012 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2012 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 000-31293 EQUINIX, INC. (Exact name of registrant as specified in its charter) Delaware 77-0487526 (State of incorporation) (I.R.S. Employer Identification No.) One Lagoon Drive, Fourth Floor, Redwood City, California 94065 (Address of principal executive offices, including ZIP code) (650) 598-6000 (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) Yes x No ¨ and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

Interconnection

Interconnection 101 As cloud usage takes off, data production grows exponentially, content pushes closer to the edge, and end users demand data and applications at all hours from all locations, the ability to connect with a wide variety of players becomes ever more important. This report introduces interconnection, its key players and busi- ness models, and trends that could affect interconnection going forward. KEY FINDINGS Network-dense, interconnection-oriented facilities are not easy to replicate and are typically able to charge higher prices for colocation, as well as charging for cross-connects and, in some cases, access to public Internet exchange platforms and cloud platforms. Competition is increasing, however, and competitors are starting the long process of creating network-dense sites. At the same time, these sites are valuable and are being acquired, so the sector is consolidating. Having facili- ties in multiple markets does seem to provide some competitive advantage, particularly if the facilities are similar in look and feel and customers can monitor them all from a single portal and have them on the same contract. Mobility, the Internet of Things, services such as SaaS and IaaS (cloud), and content delivery all depend on net- work performance. In many cases, a key way to improve network performance is to push content, processing and peering closer to the edge of the Internet. This is likely to drive demand for facilities in smaller markets that offer interconnection options. We also see these trends continuing to drive demand for interconnection facilities in the larger markets as well. © 2015 451 RESEARCH, LLC AND/OR ITS AFFILIATES. -

Van+ May 2014 Aw Layout 1

ISSN 1745-1736 April / May 2014 Will CSPs maximise Volume 16 Issue 2 their potential in the cloud? How to win by playing to your strengths BIG DATA ANALYTICS CEM POLICY BILL & CHARGE 5G Can CSP data transform Does quality awareness Does it deliver business Why CSPs alone can Why it’s here and what performance? set CSPs apart? model flexibility? keep control of billing. it means for CSPs. VanillaPlus Insight VanillaPlus Insight VanillaPlus Insight VanillaPlus Insight VanillaPlus Insight out June 2014 out July 2014 out October 2014 out December 2014 out February 2015 PLUS: Astellia buys Ingenia Telecom • Cerillion survey heralds cloud billing • Openet and OpenCloud launch joint service definition system • Amdocs announces policy control for LTE • Hadoop can cut licencing costs by 70%, says cVidya • TeliaSonera chooses Ericsson for customer experience assurance • CSG International launches convergent billing into space with Inmarsat • Inside Vodacom’s Digital Route deployment • Read the latest news at www.vanillaplus.com technological enabler OF DEUTSCHE BÖRSE CLOUD EXCHANGE CONTENTS IN THIS ISSUE TALKING HEADS Thomas Vasen explains Will CSPs maximise why software in the cloud, 4 EDITOR’S COMMENT their potential in the for the cloud and enabling George Malim wonders when moving too slowly means you’ve reached the cloud? the cloud opens up end of the line opportunities for CSPs 5 INDUSTRY NEWS Astellia acquires Ingenia Telecom, Bytesphere element polling assets 22 bought by Exfo 6 MARKET NEWS Cerillion survey heralds cloud billing, Syniverse -

Year in Review 2013

SM_Dec_2013 cover Worldwide Satellite Magazine December 2013 SatMagazine 2013 YEAR IN REVIEW SatMagazine December 2013—Year In Review Publishing Operations Senior Contributors This Issue’s Authors Silvano Payne, Publisher + Writer Mike Antonovich, ATEME Mike Antonovich Robert Kubbernus Hartley G. Lesser, Editorial Director Tony Bardo, Hughes Eran Avni Dr. Ajey Lele Richard Dutchik Dave Bettinger Tom Leech Pattie Waldt, Executive Editor Chris Forrester, Broadgate Publications Don Buchman Hartley Lesser Jill Durfee, Sales Director, Editorial Assistant Karl Fuchs, iDirect Government Services Eyal Copitt Timothy Logue Simon Payne, Development Director Bob Gough, 21 Carrick Communications Rich Currier Jay Monroe Jos Heyman, TIROS Space Information Tommy Konkol Dybvad Tore Morten Olsen Donald McGee, Production Manager David Leichner, Gilat Satellite Networks Chris Forrester Kurt Peterhans Dan Makinster, Technical Advisor Giles Peeters, Track24 Defence Sima Fishman Jorge Potti Bert Sadtler, Boxwood Executive Search Simen K. Frostad Sally-Anne Ray David Gelerman Susan Sadaat Samer Halawi Bert Sadtler Jos Heyman Patrick Shay Jack Jacobs Mike Towner Casper Jensen Serge Van Herck Alexandre Joint Pattie Waldt Pradman Kaul Ali Zarkesh Published 11 times a year by SatNews Publishers 800 Siesta Way Sonoma, CA 95476 USA Phone: (707) 939-9306 Fax: (707) 838-9235 © 2013 SatNews Publishers We reserve the right to edit all submitted materials to meet our content guidelines, as well as for grammar or to move articles to an alternative issue to accommodate publication space requirements, or removed due to space restrictions. Submission of content does not constitute acceptance of said material by SatNews Publishers. Edited materials may, or may not, be returned to author and/or company for review prior to publication. -

Neterra Contract W Logo BG Ver.3

Бул. Андрей Сахаров 20 А, гр. София 1784, България тел.: +359 2 975 16 16, факс: +359 2 975 34 36 www.neterra.net Tender for supply of Optica cable Ref.№20087/07.08.2020 I. Introduction 1. About Neterra Neterra is an independent telecom operator for standard and complex services and projects in Europe for more than 20 years – www.neterra.net 2. Project Name: "Construction of Passive fiber-optic telecommunication infrastructure on the territory of Sofia" 3. A contract for Supply of optical cable for Stage 1 of the project - Construction of core network layer will be signed with the selected contractor. 4. Contacts: 4.1. Technical contact – Dimitar Kesov, dkesov @neterra.net , +359 887 57 54 26 4.2. Commercial contact – Daniel Genchev, [email protected], + 359 886 407 388 4.3. Version Version Date Description 1.0 07-08-2020 Valid version II. General information for the project 5. Neterra is building a passive fiber-optic infrastructure on the territory of the city of Sofia in order to expand its current coverage. The network consists of the following main elements: 5.1. Core layer - main / trunk routes of optical cables, serving as the backbone of the network and connecting all primary points. 5.2. Distribution layer - optical cables, providing coverage from the core network to all areas with concentration of Subscribers. 5.3. Access layer – last mile optical cables providing connectivity between the distribution layer and the Subscribers. III. Optical cable and delivery requirements 6. Application: underground, duct 7. Cable type – please provide two options: 7.1. -

Executive Report

Executive Report Using the CyrusOne IX for Active-Active, Active-Passive and Active-DR Interconnection A better use of time and money is to use large Web-scale carrier-neutral data centers containing the resiliency required for power, cooling, seismic stability, and most importantly, connectivity. Establishing the Right DR Strategy Most enterprises today are required to operate at least a simple disaster recovery (DR) data center strategy to maintain business continuity due to regulations and other factors Single consolidated including uptime resiliency. Compliance, regulations and due diligence often necessitate data center the active synching of IT environments to each other (active-active) or asymmetrical • With all of the eggs in one basket, synching to each other (active-passive). harden the basket. These enhanced DR strategies require highly connected data centers within specific latency parameters, and also require careful site selection. Factors for site selection include power-grid resiliency (there are three grids in North America: East, West and Electric Reliability Council of Texas (ERCOT)), seismic mitigation and network availability. These three factors can create a daunting task for an enterprise, especially when needing to hire dedicated staff to select, build and operate these facilities. Two data centers Using in-place optical waves, multiprotocol label switching (MPLS) and Internet Protocol • Active – passive (IP) transit greatly reduces costs and removes the need for expensive telecom hardware • Active – active and the staff to operate that hardware. How a National IX Works The CyrusOne National Internet Exchange (IX) meets many requirements for connectivity by delivering carrier-class infrastructure to data centers. This neutral platform has dedicated high-speed multiple carrier waves and MPLS between sites already in place. -

Middle East 2019 Post Event Report .Pdf

MIDDLE EAST 2019 Save the date: Capacity Middle East will return on 3 - 5 March 2020! POST-EVENT REPORT THANK YOU TO THE SPONSORS Host sponsor Diamond sponsor Platinum sponsors Gold sponsors Silver sponsors Associate sponsors To Serve and to Connect Subsea Middle East sponsors Host sponsor Associate sponsors MIDDLE EAST 2019 THANK YOU Capacity Middle East welcomed 1,683 industry leaders and decision makers from over 500 companies for four days packed with networking, market discussions and lively debates. Our exhibition showcased companies from across the global telecoms community and our conference engaged thought leaders and showcased key market developments. It was the perfect opportunity to reinforce partnerships and explore new business opportunities. The Capacity Media team would like to thank all of our sponsors, speakers and delegates for making this event possible, and look forward to seeing you next year for Capacity Middle East 2020. CONTENTS View the highlights from Capacity Middle East 2019 Who attended? Who spoke at Capacity Middle East 2019 Agenda highlights Key market developments from the Middle East Subsea Middle East Who spoke at Subsea Middle East Testimonials Social media highlights All the networking that happened MIDDLE EAST 2019 1683 519 80 ATTENDEES COMPANIES COUNTRIES VIEW THE HIGHLIGHTS FROM CAPACITY MIDDLE EAST 2019 VIEW THE 2019 HIGHLIGHTS HERE We are delighted to be the Host Sponsor of Capacity Middle East . The event brings together all the stakeholders and it is the ideal platform for us to meet all of our customers, suppliers and members of our entire ecosystem. Ananda Bose, Chief Wholesale & Corporate Affairs Officer, DATAMENA We are a regular participant in Capacity Middle East. -

Winter 2020 Colocation Services

2020 WINTER CUSTOMER SUCCESS REPORT COLOCATION SERVICES CATEGORY COLOCATION SERVICES OVERVIEW Colocation services allow businesses to host their data in a third-party data center that has privately-owned networking equipment and servers. Instead of maintaining servers in-house, at a private data center, or in offices, enterprises can elect to co-locate their infrastructure by renting space in a colocation center. Unlike other types of hosting where clients can rent server space owned by a hosting vendor, with colocation, the client owns the server and rents the physical space needed to house it in a data center. The colocation service rents out data center space where clients can install their equipment. It also provides the cooling, IP address, bandwidth, and power systems that the customer needs to deploy their servers. 2 Customer Success Report Ranking Methodology The FeaturedCustomers Customer Success ranking is based on data from our customer reference Customer Success Report platform, market presence, web presence, & social Award Levels presence as well as additional data aggregated from online sources and media properties. Our ranking engine applies an algorithm to all data collected to calculate the final Customer Success Report rankings. The overall Customer Success ranking is a weighted average based on 3 parts: Market Leader Content Score is affected by: Vendor on FeaturedCustomers.com with 1. Total # of vendor generated customer substantial customer base & market share. references (case studies, success stories, Leaders have the highest ratio of customer testimonials, and customer videos) success content, content quality score, and social media presence relative to company size. 2. Customer reference rating score 3. -

TRADE EUROPE NOW! the Why and How of Electronic Execution in the EU and Beyond

TRADE EUROPE NOW! The Why and How of Electronic Execution in the EU and Beyond Commissioned by: Interxion Researched and Written by: A-Team Group TRADE EUROPE NOW! EXECUTIVE SUMMARY 01 European financial markets are poised for major change as institutions prepare for the EU’s Markets for Financial Instruments Directive (MiFID) II regulation, which comes into effect in January 2017. 02 In the absence of a centralised pan-European order book, trading firms will need to consolidate orders from multiple trading venues to construct their own views of European Best Bid/Offer (EBBO). 03 The emerging picture of the European market structure presents US traders with opportunities to source significant liquidity and diversify their trading activities. 04 Practitioners also need access to independent service providers for key capabilities required under MiFID II, including time-stamping, time synchronisation and risk management gateways. 05 MiFID II’s focus on transparency across a broad range of asset types brings Europe more closely into line with US markets, making it relatively straightforward for US participants to take advantage of Europe’s sophisticated market centres. 06 To succeed, it’s essential that new entrants and current firms secure fast access to key trading venues in the London area, including the London Stock Exchange, BATS Chi-X, the Euronext markets, ICE Futures Europe (the former Liffe), and Frankfurt-based Eurex, a key leading indicator of European market direction. 07 London is the gateway to Europe and selecting the right colocation data centre from which to execute from is an important first step towards successful trading in Europe.Interxion’s City of London data centre campus is situated equidistant from key liquidity venues, Slough in the West, Basildon in the East and right next to the London Stock Exchange. -

4Q20 Baron Real Estate Fund Letter

December 31, 2020 Baron Real Estate Fund Dear Baron Real Estate Fund Shareholder: The Baron Real Estate Fund (the “Fund”) generated exceptionally strong performance in 2020, gaining 44.28% (Institutional Shares) for the year ended December 31, 2020. The Fund’s 44.28% gain in 2020 substantially outperformed both its primary benchmark index, the MSCI USA IMI Extended Real Estate Index (the “MSCI Real Estate Index”), that rose only 4.21%, and the MSCI US REIT Index, that declined by 8.70%. For the most recent three-month period ended December 31, 2020, the Baron Real Estate Fund increased 16.79%, exceeding the returns of 10.35% by the MSCI Real Estate Index and 11.16% by the MSCI US REIT Index. Baron Real Estate Fund Cumulative Return Since Inception (December 31, 2009 through December 31, 2020) • Baron Real Estate Fund: 446.66% • MSCI Real Estate Index: 239.73% • MSCI U.S. REIT Index: 149.50% JEFFREY KOLITCH Retail Shares: BREFX The Fund has received special recognition from Morningstar for its Institutional Shares: BREIX achievements: PORTFOLIO MANAGER R6 Shares: BREUX Morningstar Real Estate Category Ratings (as of December 31, 2020) • Morningstar Overall Rating™: • Morningstar 5-Year Ranking: - Baron Real Estate Fund received a 5-star Morningstar Overall - Baron Real Estate Fund ranked in the top 2% of all real estate Morningstar Rating™ funds • Morningstar 10-Year, 5-Year, 3-Year Ratings: We will address the following topics in this letter: - Baron Real Estate Fund received a 5-star Morningstar Rating™ for each of its full 10-year, 5-year, -

“Tics Para La Mejora De La Competitividad Energética”

Guía de referencia “TICs para la mejora de la competitividad energética” Tendencias, Soluciones y 100 proveedores fundamentales M2M Tele pre se er nc t ia en C ta a D artCities Sm A M u orac o t b ió v o IT la n i o li m n C d - E a e d a e t n i i d z e f ó r a i i t c G c s i i o n ó e S s n ó g i m e I l c n o e a a c t T i e z r i r t l l t G i g a c i r e r é i l n e d t E t e s a V s m o s l e D i rt u c u í C h l a o e g u V d li n i z r a e t c i e ó n M t r a m S R e a l i d a a d d a A t u n e m Plataforma de empresas TIC para la mejora de la Eficiencia Energética Eficiencia la de mejora la para TIC empresas de Plataforma “TICs para la mejora de la competitividad energética” competitividad la de mejora la para “TICs Guía de referencia de Guía índice Prólogo 4 Perspectiva general: Eficiencia Energética 6 Impulso de las Admnistraciones Públicas 15 10 Principales tendencias en SmartEnergy 21 Soluciones Tecnológicas en 4 áreas 37 Empresas asociadas 49 Otros proveedores fundamentales 73 Red de colaboración institucional 75 Organismos y Enlaces de referencia 79 10 documentos de referencia 85 Misión, objetivos e iniciativas de enerTIC 87 > Ir a Indice Prólogo Inmersos en unos tiempos de grandes cambios y oportunidades, la Plataforma enerTIC, surge como un proyecto para generar sinergias, colaborar con otras organizaciones nacionales e internacionales, y contribuir al desarrollo del potencial de transformación de las Tecnologías de la Información y Comunicaciones en el ámbito de la eficiencia energética en España. -

Comodo Threat Intelligence

Comodo Threat Intelligence Lab SPECIAL REPORT: AUGUST 2017 – IKARUSdilapidated Locky Part II: 2nd Wave of Ransomware Attacks Uses Your Scanner/Printer, Post Office Billing Inquiry THREAT RESEARCH LABS Locky Ransomware August 2017 Special Report Part II A second wave of new but related IKARUSdilapidated Locky ransomware attacks has occurred, building on the attacks discovered by the Comodo Threat Intelligence Lab (part of Comodo Threat Research Labs) earlier in the month of August 2017. This late August campaign also uses a botnet of “zombie computers” to coordinate a phishing attack which sends emails appearing to be from your organization’s scanner/printer (or other legitimate source) and ultimately encrypts the victims’ computers and demands a bitcoin ransom. SPECIAL REPORT 2 THREAT RESEARCH LABS The larger of the two attacks in this wave presents as a scanned image emailed to you from your organization’s scanner/printer. As many employees today scan original documents at the company scanner/printer and email them to themselves and others, this malware-laden email will look very innocent. The sophistication here includes even matching the scanner/printer model number to make it look more common as the Sharp MX2600N is one of the most popular models of business scanner/printers in the market. This second wave August 2017 phishing campaign carrying IKARUSdilapidated Locky ransomware is, in fact, two different campaigns launched 3 days apart. The first (featuring the subject “Scanned image from MX-2600N”) was discovered by the Lab to have commenced primarily over 17 hours on August 18th and the second (a French language email purportedly from the French post office featuring a subject including “FACTURE”) was executed over a 15-hour period on August 21st, 2017.