Equinix Inc (Eqix) 10-Q

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interconnection

Interconnection 101 As cloud usage takes off, data production grows exponentially, content pushes closer to the edge, and end users demand data and applications at all hours from all locations, the ability to connect with a wide variety of players becomes ever more important. This report introduces interconnection, its key players and busi- ness models, and trends that could affect interconnection going forward. KEY FINDINGS Network-dense, interconnection-oriented facilities are not easy to replicate and are typically able to charge higher prices for colocation, as well as charging for cross-connects and, in some cases, access to public Internet exchange platforms and cloud platforms. Competition is increasing, however, and competitors are starting the long process of creating network-dense sites. At the same time, these sites are valuable and are being acquired, so the sector is consolidating. Having facili- ties in multiple markets does seem to provide some competitive advantage, particularly if the facilities are similar in look and feel and customers can monitor them all from a single portal and have them on the same contract. Mobility, the Internet of Things, services such as SaaS and IaaS (cloud), and content delivery all depend on net- work performance. In many cases, a key way to improve network performance is to push content, processing and peering closer to the edge of the Internet. This is likely to drive demand for facilities in smaller markets that offer interconnection options. We also see these trends continuing to drive demand for interconnection facilities in the larger markets as well. © 2015 451 RESEARCH, LLC AND/OR ITS AFFILIATES. -

Executive Report

Executive Report Using the CyrusOne IX for Active-Active, Active-Passive and Active-DR Interconnection A better use of time and money is to use large Web-scale carrier-neutral data centers containing the resiliency required for power, cooling, seismic stability, and most importantly, connectivity. Establishing the Right DR Strategy Most enterprises today are required to operate at least a simple disaster recovery (DR) data center strategy to maintain business continuity due to regulations and other factors Single consolidated including uptime resiliency. Compliance, regulations and due diligence often necessitate data center the active synching of IT environments to each other (active-active) or asymmetrical • With all of the eggs in one basket, synching to each other (active-passive). harden the basket. These enhanced DR strategies require highly connected data centers within specific latency parameters, and also require careful site selection. Factors for site selection include power-grid resiliency (there are three grids in North America: East, West and Electric Reliability Council of Texas (ERCOT)), seismic mitigation and network availability. These three factors can create a daunting task for an enterprise, especially when needing to hire dedicated staff to select, build and operate these facilities. Two data centers Using in-place optical waves, multiprotocol label switching (MPLS) and Internet Protocol • Active – passive (IP) transit greatly reduces costs and removes the need for expensive telecom hardware • Active – active and the staff to operate that hardware. How a National IX Works The CyrusOne National Internet Exchange (IX) meets many requirements for connectivity by delivering carrier-class infrastructure to data centers. This neutral platform has dedicated high-speed multiple carrier waves and MPLS between sites already in place. -

4Q20 Baron Real Estate Fund Letter

December 31, 2020 Baron Real Estate Fund Dear Baron Real Estate Fund Shareholder: The Baron Real Estate Fund (the “Fund”) generated exceptionally strong performance in 2020, gaining 44.28% (Institutional Shares) for the year ended December 31, 2020. The Fund’s 44.28% gain in 2020 substantially outperformed both its primary benchmark index, the MSCI USA IMI Extended Real Estate Index (the “MSCI Real Estate Index”), that rose only 4.21%, and the MSCI US REIT Index, that declined by 8.70%. For the most recent three-month period ended December 31, 2020, the Baron Real Estate Fund increased 16.79%, exceeding the returns of 10.35% by the MSCI Real Estate Index and 11.16% by the MSCI US REIT Index. Baron Real Estate Fund Cumulative Return Since Inception (December 31, 2009 through December 31, 2020) • Baron Real Estate Fund: 446.66% • MSCI Real Estate Index: 239.73% • MSCI U.S. REIT Index: 149.50% JEFFREY KOLITCH Retail Shares: BREFX The Fund has received special recognition from Morningstar for its Institutional Shares: BREIX achievements: PORTFOLIO MANAGER R6 Shares: BREUX Morningstar Real Estate Category Ratings (as of December 31, 2020) • Morningstar Overall Rating™: • Morningstar 5-Year Ranking: - Baron Real Estate Fund received a 5-star Morningstar Overall - Baron Real Estate Fund ranked in the top 2% of all real estate Morningstar Rating™ funds • Morningstar 10-Year, 5-Year, 3-Year Ratings: We will address the following topics in this letter: - Baron Real Estate Fund received a 5-star Morningstar Rating™ for each of its full 10-year, 5-year, -

Spare the Air Employer Program Members

Spare the Air Employer Program Members 511 Affymetrix Inc. 1000 Journals Project Agilent Technologies ‐ Sonoma County 3Com Corporation Public Affairs 511 Contra Costa Agnews Developmental Center 511 Regional Rideshare Program AHDD Architecture 7‐Flags Car Wash Air Products and Chemicals, Inc. A&D Christopher Ranch Air Systems Inc. A9.com Akeena Solar AB & I Akira ABA Staffing, Inc. Akraya Inc. ABB Systems Control Alameda Co. Health Care for the Homeless Abgenix, Inc. Program ABM Industries, Inc Alameda County Waste Management Auth. Above Telecommunications, Inc. Alameda Free Library Absolute Center Alameda Hospital AC Transit Alameda Unified School District Academy of Art University Alder & Colvin Academy of Chinese Culture & Health Alexa Internet Acclaim Print & Copy Centers Allergy Medical Group Of S F A Accolo Alliance Credit Union Accretive Solutions Alliance Occupational Medicine ACF Components Allied Waste Services/Republic Services Acologix Inc. Allison & Partners ACRT, Inc Alta Bates/Summit Medical Center ACS State & Local Solutions Alter Eco Act Now Alter Eco Americas Acterra ALTRANS TMA, Inc Actify, Inc. Alum Rock Library Adaptive Planning Alza Corporation Addis Creson American Century Investment Adina for Life, Inc. American International (Group) Companies Adler & Colvin American Lithographers ADP ‐ Automatic Data Processing American Lung Association Advance Design Consultants, Inc. American Musical Theatre of San Jose Advance Health Center American President Lines Ltd Advance Orthopaedics Amgen, Inc Advanced Fibre Communications Amtrak Advanced Hyperbaric Recovery of Marin Amy’s Kitchen Advanced Micro Devices, Inc. Ananda Skin Spa Advantage Sales & Marketing Anderson Zeigler Disharoon Gallagher & Advent Software, Inc Gray Aerofund Financial Svcs.,Inc. Anixter Inc. Affordable Housing Associates Anomaly Design Affymax Research Institute Anritsu Corporation Anshen + Allen, Architects BabyCenter.com Antenna Group Inc BACE Geotechnical Anza Library BackFlip APEX Wellness Bacon's Applied Biosystems BAE Systems Applied Materials, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Spare the Air Employer Program Members List Last Updated: April

Spare the Air Employer Program Members 1000 Journals Project Affymax Research Institute 511 Contra Costa - Pleasant Hill Affymetrix Inc. 511 Contra Costa - San Pablo Agilent 511 Regional Rideshare Program Agilent Technologies - Sonoma County 7 Flags Car Wash Public Affairs A Nobel Smile Air Products and Chemicals, Inc. A&D Christopher Ranch Air Systems Inc. A. Maciel Printing Airtreks A9.com Akira AB & I Akraya Inc. ABA Staffing, Inc. Alameda Co. Health Care for the Homeless ABB Systems Control Program Abbott Alameda County Waste Management Auth. Abgenix, Inc. Alameda Free Library Able Services Alameda Hospital ABM Industries, Inc Alameda Publishing Group Above Telecommunications, Inc. Alexa Internet Absolute Center All Covered AC Transit Allergy Medical Group Of S F A Academy of Chinese Culture & Health Alliance Credit Union Acclaim Print & Copy Centers Alliance Occupational Medicine Accolo Allied Waste Services Accretive Solutions Allied Waste Services -- SCCO Division ACF Components 4915 ACRT, Inc Allied Waste Services/Republic Services ACS State & Local Solutions Allison & Partners Act Now Alta Bates/Summit Medical Center Acterra Alter Eco Actify, Inc. Alter Eco Americas Actiontec Electronics ALTRANS TMA, Inc Adaptive Planning Alum Rock Library Addis Creson AMC Entertainment, Inc Adina for Life, Inc. Amelias Antics Adler & Colvin American Century Investment Adobe Lumber American International (Group) Companies ADP - Automatic Data Processing American Lung Association in California Adura Technologies American President Lines Ltd Advance Design Consultants, Inc. Amgen, Inc Advance Health Center Amtrak Advance Orthopaedics Amy’s Kitchen Advanced Hyperbaric Recovery of Marin Anderson Zeigler Disharoon Gallagher & Advantage Sales & Marketing Gray Advent Software, Inc Andrades Automotive Aerofund Financial Svcs.,Inc. Angela Klein, Architect Affinture Anixter Inc. -

NASDAQ Stock Market LLC (“Nasdaq Exchange”), a Subsidiary of the Nasdaq Stock Market, Inc

July 31, 2006 Nancy M. Morris, Esq. Secretary US Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 RE: Request for Relief from § 12 of the Securities Exchange Act of 1934 Dear Ms. Morris: On January 13, 2006, the Securities and Exchange Commission (“SEC” or “Commission”) approved the application of The NASDAQ Stock Market LLC (“Nasdaq Exchange”), a subsidiary of The Nasdaq Stock Market, Inc. (“Nasdaq”), to register under Section 6 of the Securities Exchange Act of 1934 (“Act” or “Exchange Act”) as a national securities exchange.1 Nasdaq’s transition of its listing and trading activities to the Nasdaq Exchange will further Congress’s instruction to promote “fair competition . between exchange markets.”2 Absent the relief requested herein, however, Nasdaq’s transition to a national securities exchange would require approximately 3,200 Nasdaq Global Market3 and Capital Market issuers with securities registered pursuant to the Act, or exempt from registration under Section 12(g) of the Act,4 to file registration statements5 to register those securities under Section 12(b) of the Act.6 1 Securities Exchange Act Release No. 53128 (January 13, 2006), 71 FR 3550 (January 23, 2006) (the “Exchange Approval Order”). 2 Exchange Act Section 11A(a)(1)(C)(ii). 3 Effective July 1, 2006, Nasdaq renamed the Nasdaq National Market as the Nasdaq Global Market and created a new segment within the Global Market called the Global Select Market. References to the Nasdaq Global Market include those securities listed on the Nasdaq Global Market and the Nasdaq Global Select Market. See Securities Exchange Act Release No. -

US Vegan Climate

US Vegan Climate ETF Schedule of Investments April 30, 2021 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.4% Administrative and Support and Waste Management and Remediation Services - 13.4% 1,675 Accenture plc - Class A $ 485,700 233 Allegion plc 31,311 107 Booking Holdings, Inc. (a) 263,870 293 Broadridge Financial Solutions, Inc. 46,479 317 Equifax, Inc. 72,666 352 Expedia Group, Inc. 62,033 70 Fair Isaac Corporation (a) 36,499 729 Fidelity National Financial, Inc. 33,257 214 FleetCor Technologies, Inc. (a) 61,572 782 Global Payments, Inc. 167,841 961 IHS Markit, Ltd. 103,384 5,607 Mastercard, Inc. - Class A 2,142,210 425 Moody's Corporation 138,852 212 MSCI, Inc. 102,983 3,091 PayPal Holdings, Inc. (a) 810,738 491 TransUnion 51,354 8,745 Visa, Inc. - Class A 2,042,482 6,653,231 Construction - 0.9% 890 DR Horton, Inc. 87,478 1,956 Johnson Controls International plc 121,937 705 Lennar Corporation - Class A 73,038 19 NVR, Inc. (a) 95,344 682 PulteGroup, Inc. 40,320 396 Sunrun, Inc. (a) 19,404 437,521 Finance and Insurance - 14.1% 1,735 Aflac, Inc. 93,222 40 Alleghany Corporation (a) 27,159 797 Allstate Corporation 101,060 969 Ally Financial, Inc. 49,855 1,588 American Express Company 243,520 2,276 American International Group, Inc. 110,272 314 Ameriprise Financial, Inc. 81,138 657 Anthem, Inc. 249,259 596 Aon plc - Class A 149,858 1,025 Arch Capital Group, Ltd. (a) 40,703 496 Arthur J. -

Selected Prior Participants CEO/President Nikesh Arora, CEO

Selected Prior Participants CEO/President Nikesh Arora, CEO, Palo Alto Networks Kevin Mandia, CEO, FireEye Scott Johnston, CEO, Docker Jonathan Roberts, COO, CVS Tom Hanenburg, COO, Northern California, Kaiser Permanente Rohit Ghai, President, RSA Tony Werner, President, Technology, Product, and Xperience, Comcast Jan Geldmacher, President, Sprint Business Lane Bess, Former CEO, Palo Alto Networks Chris Anderson, CEO, 3D Robotics Jamie Iannone, CEO, eBay Gwen Morrison, CEO, The Americas, The Store, WPP Sailesh Chittipeddi, CEO, Integrated Device Technology, Renesas Pedro Pablo Perez, CEO, Business Security Unit, Telefonica John Petrie, CEO, NTT Security Elena Kvochko, COO, Cybersecurity, Bank of America Anand Chandrasekher, Former President, Qualcomm Datacenter CIO Mary Gendron, CIO, Qualcomm Michael Smith, CIO, Estee Lauder Matt Minetola, CIO, E*TRADE Marco Trecroce, CIO, Four Seasons Pete Kelso, CITO, Aflac Doug Rousso, CITO, MGM Dennis Howard, CIO, Charles Schwab Nancy Flores, CIO and CTO, McKesson Abhi Dhar, CIO and CTO, TransUnion Mark Murphy, Global CIO, Abbott Laboratories Yves Caseau, Group CIO, Michelin Bill Graff, CIO, Cerner Mike Anderson, CIO, Schneider Electric Sally Gilligan, CIO, Gap Eileen Mahoney, CIO, PVH Patrick Browning, CIO, E.W. Scripps Charles Brooks, CIO, Kemper Vijay Sankaran, CIO, TD Ameritrade Harry Moseley, CIO, Zoom Sangy Vatsa, CIO, Comerica Dilip Venkatachari, CIO, Digital, U.S. Bank Steve Mills, Global CIO, iHeartMedia David Shive, CIO, US General Services Administration Missy Young, CIO, Switch Kristin -

CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents

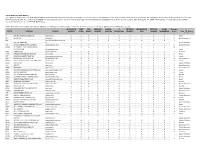

Rating Corporate Workplaces on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality NEWS CEI 2021 Corporate Equality Index © 2021 by the Human Rights Campaign Foundation. The Human Rights Campaign Foundation owns all right, title and interest in and to this publication and all derivative works thereof. Permission for reproduction and redistribution is granted if the publication is (1) reproduced in its entirety and (2) distributed free of charge. The Human Rights Campaign name and the Equality logo are trademarks of the Human Rights Campaign. The Human Rights Campaign Foundation and design incorporating the Equality logo are trademarks of the Human Rights Campaign Foundation. ISBN-13 978-1-934765-58-6 CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents Rating Workplaces Corporate on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality 2 Message from the HRC Foundation President NEWS 3 EXECUTIVE SUMMARY 5 Key Findings 7 Equality at the Fortune-Ranked Companies 8 Accelerating Global Equality 10 Spotlight: HRC’s Equidad Programs 13 FINDINGS 14 Criteria 1: Workforce Protections 16 Criteria 2: Inclusive Benefits 17 Continued Need for Partner Benefits 18 Understanding Transgender-Inclusive Healthcare Coverage 19 Criteria 3: Supporting an Inclusive Culture & Corporate Social Responsibility 19 Internal Education and Training Best Practices 20 LGBTQ Employee Resource Group or Diversity Council 22 Outreach or Engagement with the LGBTQ Community 24 Corporate Social Responsibility 25 Spotlight: Equality -

Ticker Company Domain Application Security Cubit

Cyber Security Risk Rating The Egan-Jones Cyber Security Risk Ratings helps stakeholders assess the security posture (health) of covered entities. EJPS analysts use the SecuritiesScorecard platform to ascertain the company’s Score, which is incorporated into the EJPS Proxy Research Report. The methodology utilized for determining the Score can be found at http://ejproxy.com/media/documents/Egan-Jones_Proxy_Services_Cyber_Risk_Rating.pdf. For additional questions or comments, please contact [email protected] or +1-844-495-5244 x1102. Please be aware scores posted here may be delayed. For subscription questions about the direct live feed or the full SSC report please contact [email protected]. APPLICATION CUBIT DNS ENDPOINT HACKER IP NETWORK INFORMATION PATCHING SOCIAL Minimum TICKER COMPANY DOMAIN SECURITY SCORE HEALTH SECURITY CHATTER REPUTATION SECURITY LEAK CADENCE ENGINEERING Grade Final_EJP_Rating A AGILENT TECHNOLOGIES, INC. agilent.com B A B A A A B A A A B Good AA ALCOA INC. alcoa.com D A D B A B A A A A D Some Concerns AAC americanaddictioncenters.o F B D A A A A A B A F AAC HOLDINGS INC rg Needs Attention AAL ANGLO AMERICAN PLC, LONDON angloamerican.com C A D A A A A A A A D Some Concerns AAMC ALTISOURCE ASSET MANAGEMENT B A A A A A A A A A B CORPORATION altisourceamc.com Good AAN AARON'S INC. aaronrents.com A A A A A A A A A A A Superior AAOI APPLIED OPTOELECTRONICS INC. ao-inc.com B A B A A A B A A A B Good AAT AMERICAN ASSETS TRUST INC americanassetstrust.com B A A A A A A A A A B Good AAV ADVANTAGE OIL & GAS LTD. -

Impact Shares YWCA Women’S Empowerment ETF Schedule of Investments March 31, 2020 (Unaudited)

Impact Shares YWCA Women’s Empowerment ETF Schedule of Investments March 31, 2020 (Unaudited) Description Shares Fair Value Description Shares Fair Value Discover Financial Services .. 169 $ 6,028 COMMON STOCK†† — 96.6% Fifth Third Bancorp ....... 391 5,806 First Republic Bank ....... 91 7,488 Communication Services— 11.4% Hartford Financial Services Alphabet, Cl A* .......... 100 $ 116,195 Group .............. 193 6,801 Alphabet, Cl C* .......... 99 115,118 Huntington Bancshares ..... 571 4,688 AT&T ................ 3,880 113,102 KeyCorp .............. 539 5,589 CenturyLink ............ 114 1,078 M&T Bank ............. 69 7,137 Comcast, Cl A ........... 2,309 79,384 MetLife ............... 402 12,289 Interpublic Group ......... 201 3,254 Moody's .............. 84 17,766 Sprint* ................ 351 3,026 Northern Trust .......... 111 8,376 Verizon Communications .... 2,239 120,302 PNC Financial Services Group 393 37,618 Walt Disney ............ 957 92,446 Primerica .............. 22 1,947 Principal Financial Group .... 134 4,200 643,905 Progressive ............ 294 21,709 Consumer Discretionary— 10.4% Prudential Financial ....... 211 11,002 Amazon.com* ........... 141 274,911 S&P Global ............ 121 29,651 Autoliv ................ 45 2,071 State Street ............ 321 17,100 Best Buy .............. 117 6,669 T Rowe Price Group ....... 118 11,523 Dunkin' Brands Group ...... 41 2,177 US Bancorp ............ 793 27,319 eBay ................. 415 12,475 Voya Financial .......... 71 2,879 Wells Fargo ............ 2,072 59,466 Expedia Group .......... 72 4,051 Gap ................. 115 810 490,109 General Motors .......... 709 14,733 Hasbro ............... 68 4,865 Health Care— 19.0% Hilton Worldwide Holdings ... 150 10,236 AbbVie ............... 777 59,199 Kohl's ................ 89 1,298 Agilent Technologies .....