Medical Services Commission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Art Access Utah

THURSDAY 19 MAY 2016 6-9 PM 14TH ANNUAL FUNDRAISER & EXHIBITION Art Access 2016 ANNUAL REPORT OCTOBER 1, 2015 - SEPTEMBER 30, 2016 Dear Friends of Art Access, Another busy year has passed and Art Access provide the perfect means for people to tell their continues to do what it does so well – connecting stories, articulate their identities, and explore their people through the storytelling inherent in the personal creativeness. We believe the arts are a creation and appreciation of art. universal vehicle for drawing out our similarities, celebrating our differences, and ultimately Art Access is creative in responding to community connecting us to each other. We are committed to needs as they are identified and in adapting telling and hearing the stories of all of us through programs to serve unique populations. Each the literary, visual, and performing arts. program is evaluated for both the financial and social return on investment. It is the social return By engaging the public in educational and artful that keeps us motivated. experiences in our galleries and in the wider community, Art Access continues to make a For example, here are a few comments we significant contribution to the cultural life of our received this year: community. “My students grew tremendously through the year All this is accomplished in partnership with by participating in these activities. I truly believe many other organizations and individuals. We they are better human beings, in touch with are fortunate to have a dedicated staff who feelings and better able to express themselves feel passionately about the Art Access mission with confidence.” – Classroom teacher and work diligently to maintain the quality and accessibility of programs. -

Join Niaf Today!

Ambassador National Italian American Foundation Vol . 28, No.2 n Winter 2016 n www.niaf.org A Merry Mario Christmas Wine Tasting: Barolo Old and New Yeah Baby! Iconic Dick Vitale Mystery of the Shroud Acqui Terme Hot Ambassador 37505_Magazine.indd 2 11/25/16 3:53 PM Ambassador The Publication of the National Italian American Foundation n Vol . 28, No.2 www.niaf.org CONTENTS 32 Features 20 An Italian Moment 36 Shrouded in Mystery The 2016 NIAF Faith, Facts and Fascination Photo Contest Winners at Torino’s Museum of 52 the Holy Shroud By Don Oldenburg 26 Merry Mario Christmas On the Cover: Chef Mario Batali on Grilling pizza for Christmas morning Food, Traditions and 40 Hidden Parma Lowlands Joseph V. Del Raso, Esq. Holiday Entertaining Off the Tourist Path in Emilia brunch? Just one Chairman of many unusual By Don Oldenburg By Francesca Cuoghi John M. Viola family traditions President & Chief for some of us. Operating Officer Renowned Chef Don Oldenburg 32 Acqui Terme 44 Dickie V Director of Publications Hot, Hot, Hot — and Not How a High School Mario Batali has & Editor Just the Thermal Springs Basketball Coach Became other ideas. He talks Danielle DeSimone about his family, Social Media Manager By Michelle Fabio a National Sports Icon & Assistant Editor his culinary empire, By Dick Rosano AMBASSADOR Magazine food and holiday is published by the National traditions — and Italian American Foundation (NIAF) 48 The Tasting Life offers a few untra- 1860 19th Street NW Orietta Gianjorio ditional recipes for Washington DC 20009 Sections POSTMASTER: Tastes Food for a Living holiday entertaining. -

Compassion & Social Justice

COMPASSION & SOCIAL JUSTICE Edited by Karma Lekshe Tsomo PUBLISHED BY Sakyadhita Yogyakarta, Indonesia © Copyright 2015 Karma Lekshe Tsomo No part of this book may be used or reproduced in any manner whatsoever without written permission. No part of this book may be stored in a retrieval system or transmitted in any form or by any means including electronic, photocopying, recording, or otherwise without the prior permission in writing of the editor. CONTENTS PREFACE ix BUDDHIST WOMEN OF INDONESIA The New Space for Peranakan Chinese Woman in Late Colonial Indonesia: Tjoa Hin Hoaij in the Historiography of Buddhism 1 Yulianti Bhikkhuni Jinakumari and the Early Indonesian Buddhist Nuns 7 Medya Silvita Ibu Parvati: An Indonesian Buddhist Pioneer 13 Heru Suherman Lim Indonesian Women’s Roles in Buddhist Education 17 Bhiksuni Zong Kai Indonesian Women and Buddhist Social Service 22 Dian Pratiwi COMPASSION & INNER TRANSFORMATION The Rearranged Roles of Buddhist Nuns in the Modern Korean Sangha: A Case Study 2 of Practicing Compassion 25 Hyo Seok Sunim Vipassana and Pain: A Case Study of Taiwanese Female Buddhists Who Practice Vipassana 29 Shiou-Ding Shi Buddhist and Living with HIV: Two Life Stories from Taiwan 34 Wei-yi Cheng Teaching Dharma in Prison 43 Robina Courtin iii INDONESIAN BUDDHIST WOMEN IN HISTORICAL PERSPECTIVE Light of the Kilis: Our Javanese Bhikkhuni Foremothers 47 Bhikkhuni Tathaaloka Buddhist Women of Indonesia: Diversity and Social Justice 57 Karma Lekshe Tsomo Establishing the Bhikkhuni Sangha in Indonesia: Obstacles and -

Water Users Organization Roster November 2014

2014 Water Users Organization Roster – Mid-Pacific Region Page 1 of 37 Title Name Term Expires Title Name Term Expires CACHUMA PROJECT Cachuma Conservation Release Board Goleta Water District P.O. Box 4062 4699 Hollister Avenue Santa Ana, CA 92702 Goleta, CA 93110 Phone: (714) 834-1322 Fax: (714) 442-0124 Phone: (805) 879-4621 Fax: (805) 964-7002 Internet: http://www.goletawater.com Pres. Dale Francisco, Santa Barbara Mgr. Daniel E. Griset, Santa Ana Pres. William Rosen 12/2016 Atty. Kevin O'Brien (Downey Brand), Sacramento V-Pres. Lauren Hanson 12/2016 Dir. Lauren Hanson, Goleta WD Mgr. John McInnes, Goleta Douglas Morgan, Montecito Secy. Beth Horn Updated: K2014 CFO/Admin Mgr. Matthew Anderson Chief Engr. Tom Evans Cachuma Operation & Maintenance Board Atty. Mary McMaster 3301 Laurel Canyon Road Dir. Bert Bertrando 12/2014 Santa Barbara, CA 93105 John "Jack" Cunningham 12/2014 Phone: (805) 687-4011 Fax: (805) 569-5825 Richard "Rick" Merrifield 12/2016 Internet: http://www.ccrb-comb.org Updated: K2014 Pres. Lauren Hanson, Santa Barbara Lompoc, City of V-Pres. W. Douglas Morgan, Santa Barbara 601 E. North Avenue Mgr.-Secy. Randall Ward, Santa Barbara Lompoc, CA 93436 Treas. Janet Gingras, Santa Barbara Phone: (805) 736-1617 Fax: (805) 740-4756 Atty. Anthony Trembley, Westlake Village Internet: http://www.cityoflompoc.com Dir. Dale Francisco, Santa Barbara Alonzo Orozco, Santa Barbara Mgr. Gene Margheim (Supt.) Dennis Beebe, Santa Barbara Mayor John Linn 2012 Updated: K2014 Council Mbr. Dirk Starbuck 2014 Ashley Costa 2014 Carpenteria Valley Water District Bob Lingl 2012 1301 Santa Ynez Avenue Cecilia Martner 2012 Carpinteria, CA 93013 Updated: Phone: (805) 684-2816 Fax: (805) 684-3170 Internet: http://www.cvwd.net/ Montecito Water District 583 San Ysidro Road Pres. -

BOOK of REMEMBRANCE Yizkor Memorial Service Prayers for Gravesite Visitation

BOOK OF REMEMBRANCE Yizkor Memorial Service Prayers for Gravesite Visitation YIZKOR DATES: 5781 / 2020 - 2021 Yom Kippur September 28, 2020 Shemini Atzeret October 11, 2020 Last Day of Pesach April 3, 2021 Second Day of Shavuot May 18, 2021 Rabbi Joseph Kanofsky, Ph.D. [email protected] www.shaareitorah.com Tishrei 5781 Page 1 Page 2 Page 24 Page 23 Page 22 Page 21 Page 20 Page 19 Page 18 Page 17 Page 16 Page 15 Page 14 Page 13 Remembered By In Loving Memory of Michael, Irene, Adam, & Saul Weiss Arthur Weiss Elaine Weiss Anne Weiss Sydney Greenberg Goldie Greenberg Settie Sonneborne Phyllis Kisner Cyril Kisner Guy & Danielle Weissberg Benjamin Weissberg Neville & Estelle Wolf & Families Maurice Wolf Minette Rosin Robert Rosin Liora & Simon, Michael & Jamie, Sam Yakubowicz Alexander, & Sean Yakubowicz Perla Yakubowicz Jessica & Robert Herzig Mirko Bem Esther Bem David Zion Irene Zion Mervyn & Eleanor Ziv Syd Goldstein Lauren Ziv Avis Goldstein Gavin, Jaimie, Emily, & Sophie Ziv Riva Ziv Hymie Ziv Leonard Ziv Arnold Goldberg Shirley-Lynn Goldberg Remembered By In Loving Memory of Avril, Darren, & Lance Singer Harry Startz Stephanie Smith & Family Eric Smith Pam & Mike Stein & Family Lola Stein Mannie Stein Beth Medjuck Tamar & Moshe Sudai & Family Salim Sudai Shoshana Sudai Sabach Sudai Eliyahu Sudai Joseph Bercusson Libby Bercusson Brian Bercusson Naomi Bercusson Carolyn Behar Lilly Tzvike Andy & Shevi Urbach Stephen Speisman Tammy Speisman Flo & Gerry Urbach Nathan Urbach Helen Urbach David Ezekiel Naomi Ezekiel Ivan Freedman -

Fiction Group 4 -1

Fool in the Mountains Canadian International School, Ng, Emily - 15 He was late. Chen Jun Lang, top freelance travel journalist dubbed the next Bob Woodward, was late. How was he supposed to know he had to reply to a dozen more messages from his boss? Downing the cold coffee with one hand and struggling on his windbreaker over his neon yellow T-shirt with the other, his feet found their way into his hiking boots. He proceeded to strap his fanny pack and slung his trusty backpack over his shoulders, locking his hotel room door behind him. He blew down the staircase to the first floor and made a beeline for the exit and threw open the door, pasting on a half apologetic, half sheepish grin— Wind gusted past him, stirring fallen leaves across the plain concrete ground. The entrance was empty. Junlang furrowed his eyebrows. His private tour guide for today’s trip to Huangshan, or Yellow Mountain, was nowhere to be seen. Whipping his phone from his fanny pack, he dialed Mr Fan. The guide picked up after seven rings. “Hello sir?” “Hi Mr Fan! Where are you right now? I can’t see you at the hotel entrance and it’s nine fifteen already. You know, if you’re not coming, I will have to ask for a refund. I’m sure you wouldn’t want that to happen, would you?” “Mr Chen —” “I prefer Woodward.” “Yes, sir. Mr Woodward, I am sincerely sorry. I cannot be your guide to Huangshan. I have a family emergency to attend to.” Junlang’s eyebrows shot up in surprise. -

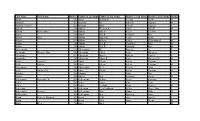

Last Name First Name Birth Yrfather's Last Name Father's

Last Name First Name Birth YrFather's Last Name Father's First Name Mother's Last Name Mother's First Name Gender Aaron 1907 Aaron Benjaman Shields Minnie M Aaslund 1893 Aaslund Ole Johnson Augusta M Aaslund (Twins) 1895 Aaslund Oluf Carlson Augusta F Abbeal 1906 Abbeal William A Conlee Nina E M Abbitz Bertha Dora 1896 Abbitz Albert Keller Caroline F Abbot 1905 Abbot Earl R Seldorff Rose F Abbott Zella 1891 Abbott James H Perry Lissie F Abbott 1896 Abbott Marion Forder Charolotta M M Abbott 1904 Abbott Earl R Van Horn Rose M Abbott 1906 Abbott Earl R Silsdorff Rose M Abercrombie 1899 Abercrombie W Rogers A F Abernathy Marjorie May 1907 Abernathy Elmer Scott Margaret F Abernathy 1892 Abernathy Wm A Roberts Laura J F Abernethy 1905 Abernethy Elmer R Scott Margaret M M Abikz Louisa E 1902 Abikz Albert Keller Caroline F Abilz Charles 1903 Abilz Albert Keller Caroline M Abircombie 1901 Abircombie W A Racher Allos F Abitz Arthur Carl 1899 Abitz Albert Keller Caroline M Abrams 1902 Abrams L E Baker May F Absher 1905 Absher Ben Spillman Zoida M Achermann Bernadine W 1904 Ackermann Arthur Krone Karolina F Acker 1903 Acker Louis Carr Lena F Acker 1907 Acker Leyland Ryan Beatrice M Ackerman 1904 Ackerman Cecil Addison Willis Bessie May F Ackermann Berwyn 1905 Ackermann Max Mann Dolly M Acklengton 1892 Achlengton A A Riacting Nattie F Acton Rebecca Elizabeth 1891 Acton T M Cox Josie E F Acton 1900 Acton Chas Payne Minnie M Adair Elles 1906 Adair Adel M Last Name First Name Birth YrFather's Last Name Father's First Name Mother's Last Name Mother's -

Listed Alphabetically by First Name 108 Aaron Craven 533 Adam Cottrill 202 Al Tingley 556 Alan and Brenda Miotke 420 Alan Davis

Listed Alphabetically by First Name 108 Aaron Craven 306 Billy Martin 432 Christopher Joyce 533 Adam Cottrill 243 BJ Danylchuk 201 Chuck Phillips 202 Al Tingley 451 Bob Dalbo 174 Cindy Drozda 556 Alan and Brenda Miotke 278 Bob Eckert 206 Cindy Pei-Si Young 420 Alan Davis 382 Bob Grant 377 Clark Champion 113 Alfred Mirman 512 Bob Moffett 183 Claude Dupuis 204 Allan Short 109 Bob Rotche 429 Colleen Samila 463 Andrew Hall 115 Bob Sievers 327 Cory White 398 Andrew Henderson 507 Bob Silkensen 334 Craig Kassan 242 Andy Chen 131 Bobby McCarley 190 Dale Guilford 203 Andy Cole 324 Boyd Carson 226 Dale Lowe 270 Andy Osborne 283 Brian Lensink 447 Dan Ernst 240 Ann Mellina 128 Brian Horais 397 Dan Konyn 211 Anthony Yakonick 366 Brian Lunt 561 Dana Hayden 101 Arnold Wise 374 Brian Sinclair 247 Daniel Cross 400 Arthur McViccar 434 Brian Vaughan 459 Daniel Kaag 520 Barbara Crockett 236 Bruce Kerns 137 Daryl Gray 531 Barbara Dill 132 Bruce Eckman 321 Daryl Rickard 488 Barrie Lynn Bryant 293 Bruce Quigley 559 Dave Clausen 492 Barry Lundgren 448 Bruce Trull 120 Dave Landers 144 Barry Teague 515 Buddy Brewer 139 Dave Peck 308 Barry Werner 160 Byron Patterson 251 Dave Rabe 158 Becky Maruca 496 Cam Baher 527 Dave Rife 287 Ben Hammock 207 Carel Van Der Merwe 143 Dave Schell 146 Bernie Hrytzak 325 Carl Cummins 335 Dave Wolter 173 Betty Scarpino 558 Carl Durance 192 David Stalling 452 Beverly Deyampert 354 Carl Ford 266 David Buskell 124 Bill Clark 157 Carol Hall 544 David Caes 401 Bill Jones 454 Chad Eames 153 David Delker 567 Bill Juhl 519 Chad La Voi 367 David Fleisig 234 Bill Loitz 517 Charlie Holde 257 David Frank 523 Bill Meador 256 Charlie Saul 443 David Frederickson 111 Bill Pottorf 489 Chris Stiles 396 David Gilbert Listed Alphabetically by First Name 177 David Hawley 281 Frank Bock 182 Howard King 555 David Mayer 110 Frank Didomizio 154b Ian Ethell 399 David Shombert 313 Frank Lench 338 J Marc Himes 214 Dean Schafer 331 Gabriel Hoff 272 J Paul Fennell 107 Denis T Noonan 194 Gary Bashian 501 J. -

Archived Listing of New Associates of the Society of Actuaries

New Associates – December 2012 It is a pleasure to announce that the following 145 candidates have completed the educational requirements for Associateship in the Society of Actuaries. 1. Aagesen, Kirsten Greta 2. Andrews, Christopher Lym 3. Arnold, Tiffany Marie 4. Aronson, Lauren Elizabeth 5. Arredondo Sanchez, Jose Antonio 6. Audet, Maggie 7. Audy, Laurence 8. Axene, Joshua William 9. Baik, NyeonSin 10. Barhoumeh, Dana Basem 11. Bedard, Nicolas 12. Berger, Pascal 13. Boussetta, Fouzia 14. Breslin, Kevin Patrick 15. Brian, Irene 16. Chan, Eddie Chi Yiu 17. Chu, James Sunjing 18. Chung, Rosa Sau-Yin 19. Colea, Richard 20. Czabaniuk, Lydia 21. Dai, Weiwei 22. Davis, Gregory Kim 23. Davis, Tyler 24. El Shamly, Mohamed Maroof 25. Elliston, Michael Lee 26. Encarnacion, Jenny 27. Feest, Jared 28. Feller, Adam Warren 29. Feryus, Matthew David 30. Foreshew, Matthew S 31. Forte, Sebastien 32. Fouad, Soha Mohamed 33. Frangipani, Jon D 34. Gamret, Richard Martin 35. Gan, Ching Siang 36. Gao, Cuicui 37. Gao, Ye 38. Genal, Matthew Steven Donald 39. Gontarek, Monika 40. Good, Andrew Joseph 41. Gray, Travis Jay 42. Gu, Quan 43. Guyard, Simon 44. Han, Qi 45. Heffron, Daniel 46. Hu, Gongqiang 47. Hui, Pok Ho 48. Jacob-Roy, Francis 49. Jang, Soojin 50. Jiang, Longhui 51. Kern, Scott Christopher 52. Kertzman, Zachary Paul 53. Kim, Janghwan 54. Kimura, Kenichi 55. Knopf, Erin Jill 56. Kumaran, Gouri 57. Kwan, Wendy 58. Lai, Yu-Tsen 59. Lakhany, Kamran 60. Lam, Kelvin Wai Kei 61. Larsen, Erin 62. Lautier, Jackson Patrick 63. Le, Thuong Thi 64. LEE, BERNICE YING 65. -

State of Alaska Licensed Assisted Living Facilities in the Municipality of Anchorage, Update 11/2020

State of Alaska Licensed Assisted Living Facilities in the Municipality of Anchorage, Update 11/2020 Types of Home and Community Based Waiver Programs ALI: Alaskans Living Independent Waiver. For people 21 and over who experience physical disability or functional needs associated with aging. Nursing Facility Level of care. APDD: Adults with Physical and Developmental Disabilities. For people 21 and over who experience both physical and developmental disabilities. Nursing Facility of Care. CCMC: Children with Complex Medical Conditions Waiver. For children and young adults birth to age 22 (last day of 21st year.) Nursing Facility Level of Care. ADRC revised 11/30/2020 Name of Home Admin Name Phone # Email Address Address 3907 Barbara Drive Anchorage 3 Angels' Assisted Living Home II Chona Masloff 350-9715 [email protected] 99517 6300 E. Ninth Avenue 3 Angels' Assisted Living Home III Chona Masloff 350-9715 [email protected] Anchorage 99504 3 Angels' Assisted Living Home 1302 Garden Street Anchorage Chona Masloff 350-5350 [email protected] LLC 99508 3707 Oregon St. Anchorage 3707 Oregon ALH Jeffrey "Scott" Hiett 244-9504 [email protected] 99517 2565 West 69th Court 4EverHome ALH Erish Durano no data [email protected] Anchorage 99502 2939 Yale Drive Anchorage A Happy Home (Yale) Seth Peebles 444-3648 [email protected] 99508 6347 Rose Hip Ct. Anchorage A Legacy Home Baby Jeudy Dorzion 561-0380 [email protected] 99507 3800 Gardner St. Anchorage Aaron Assisted Living I Dana Thomas 230-0358 [email protected] 99508 4201 Resurrection Dr. Aaron Assisted Living II Dana Thomas 230-0358 [email protected] Anchorage 99504 1616 Parkway Dr. -

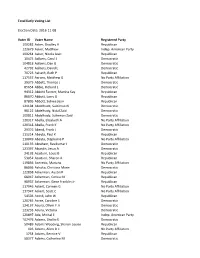

Total Early Voting List Election Date

Total Early Voting List Election Date: 2016-11-08 Voter ID Voter Name Registered Party 109282 Aaker, Bradley H Republican 123679 Aaker, Matthew Indep. American Party 109264 Aaker, Nicola Jean Republican 10475 Aalbers, Carol J Democratic 104818 Aalbers, Dan G Democratic 42792 Aalbers, David L Democratic 70723 Aalseth, Ruth P Republican 117557 Aarons, Matthew G No Party Affiliation 29375 Abbett, Thomas J Democratic 85654 Abbie, Richard L Democratic 94312 Abbott Farmer, Marsha Kay Republican 86670 Abbott, Larry G Republican 87805 Abbott, Sidnee Jean Republican 121104 Abdelhade, Suleiman N Democratic 98122 Abdelhady, Nidal Zaid Democratic 100811 Abdelhady, Sulieman Zaid Democratic 120317 Abella, Elizabeth A No Party Affiliation 120318 Abella, Frank K No Party Affiliation 29376 Abend, Frank J Democratic 111214 Abeyta, Paul K Republican 110049 Abeyta, Stephanie P No Party Affiliation 110135 Abraham, Ravikumar I Democratic 123397 Abundis, Jesus A Democratic 24192 Acaiturri, Louis B Republican 53052 Acaiturri, Sharon A Republican 119856 Acevedo, Mariana No Party Affiliation 86036 Achoka, Christina Marie Democratic 122858 Ackerman, Austin R Republican 68947 Ackerman, Corina M Republican 98937 Ackerman, Gene Franklin Jr Republican 117946 Ackert, Carmen G No Party Affiliation 117947 Ackert, Scott C No Party Affiliation 54503 Acord, John W Republican 120765 Acree, Caroline S Democratic 124137 Acuna, Oliver F Jr Democratic 123233 Acuna, Victoria Democratic 120897 Ada, Michal E Indep. American Party 102476 Adamo, Shellie E Democratic 50489 Adams Wooding, Sharon Louise Republican 426 Adams, Allen D Ii No Party Affiliation 1754 Adams, Bernice V Republican 58377 Adams, Catherine M Democratic 28234 Adams, Cheryl A Republican 28235 Adams, David L Republican 427 Adams, Irma M Indep. -

Folk Religion in Southwest China

r. off SMITHSONIAN MISCELLANEOUS COLLECTIONS VOLUME 142, NUMBER 2 FOLK RELIGION IN SOUTHWEST CHINA (With 28 Plates) Bv DAVID CROCKETT GRAHAM (Publication 4457) NOV 6r CITY OF WASHINGTON PUBLISHED BY THE SMITHSONIAN INSTITUTION NOVEMBER 1, 1961 SMITHSONIAN MISCELLANEOUS COLLECTIONS VOLUME 142, NUMBER 2 FOLK RELIGION IN SOUTHWEST CHINA (With 28 Plates) By DAVID CROCKETT GRAHAM CITY OF WASHINGTON PUBLISHED BY THE SMITHSONIAN INSTITUTION NOVEMBER 1, 1961 PORT CITY PRESS, INC. BALTIMORE, MD., U. S. A. PREFACE In the fall of 191 1 my wife and I, together with a number of missionaries bound for West China, boarded the steamship Siberia at San Francisco and started for Shanghai. Though radiograms were received en route stating that China was in a state of revolution, we went on to Shanghai, where we rented a building in the British con- cession. There we lived and studied the Chinese language until the revolution was over and the country was again peaceful. We then journeyed to Szechwan Province, where we spent most of our time until the late spring of 1948. After being stationed for 20 years at Suifu ^M) riow I-pin, I was transferred to Chengtu^^, the capital of the province. At I-pin I gradually assumed responsibility for missionary work, but continued to study the language, completing the 5-year course being given for new missionaries. Included in this course were the Three- word Classic, the Four Books of Confucius and Mencius, the Sacred Edict, and the Fortunate Union. Later I also read and studied the Five Classics of Confucius. I found in these books high moral and spiritual ideals and teachings and began to have a wholesome respect for Chinese learning and culture.