Yoshinoya HD / 9861

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Learning How to Espresso Yourself

WP6 nationalpost.com NATIONAL POST, SATURDAY, JANUARY 27, 2018 KOPI LUWAK IS THE MOST EXPENSIVE COFFEE IN THE WORLD DUE TO ITS UNORTHODOX ORIGINS. IT’S PRODUCED FROM THE COFFEE BEANS DIGESTED AND EXCRETED BY AN INDONESIAN CAT CALLED A CIVET CAT. ITS HEFTY PRICE TAG CAN RUN FROM $100 TO $600 A POUND, ACCORDING TO CNN. rom Tokyo’s classic Press), coffee has been con- spiralling out of the drip. The Café de l’Ambre, where sidered an ordinary, every- pinching of the water kettle Learning how F centenarian master day Japanese beverage since spout so it exudes just the tini- Sekiguchi Ichiro still roasts the early 1900s. Unlike other est stream of water. At a good the beans, to sleek specialty imports – such as the dining shop it’s like a ballet. It’s just coffee shops and retro-cool room table or men’s dress suit beautiful to watch,” she adds. to espresso kissaten (traditional coffee- – that retained their Western Kissaten offer a unique cof- houses), Japan is home to one “scent,” she says that coffee fee experience, says Michie of the world’s most exciting became naturalized quickly. Yamamoto, owner of Tandem yourself coffee cultures. It evolved from being used Coffee in Toronto. Originally This may come as a sur- as a medicine in its early days from Shizuoka (a city between prise to the uninitiated, who (the late 1500s) to “a drink for Tokyo and Nagoya), Yama- Confessions of a coffee-hating assume green tea is the chief pleasure” roughly 70 years moto visits family in Japan caffeinated beverage, but later when the Dutch, Japan’s regularly. -

About HCJ Visitors Information

About HCJ What is HCJ? Visitors information With its history of over 40 years, HCJ is highly recognized by all business Show Information persons in Japanese hospitality industry. 850 exhibitors and 60,000 visitors makes the event most energetic. This is a "must-visit" show for the professionals, especially for those involved Business process is speedy and effective. (expected) Date February 20(Tue.) -23(Fri.), 2018 Scale in newly opening hotels, restaurants and commercial facilities. 10:00 - 17:00 (16:30 on the last day) 850 companies / 2,100 booths / 18,900 sq.m. (HCJ2017 results) ● HOTERES JAPAN: International hotels & restaurant trade show for hotels, "ryokan"s, travel, and facilities. HCJ Brings Powerful Visitors! Number of Visitors (expected) Venue Tokyo Big Sight ● CATEREX JAPAN: Food and catering trade show for catering and food services. (Tokyo International Exhibition Center, Japan) 60,000 professionals ● JAPAN FOOD SERVICE EQUIPMENT SHOW: Equipment for commercial kitchens and food services trade show. By Sector Number of Visitors 56,367 What are the purposes of your visit? Three events are held simultaneously, providing the largest business matching opportunity for hospitality & food service industry in Japan! (multiple answers) Organized by Restaurants, Food Services 11,048 19.6% To gather information on new products/services 49.4% Japan Management Association Japan Hotel Association Manufacturing 10,333 17.8% To gather information for product purchasing 26.3% Japan Ryokan & Hotel Association Japan Restaurant Association Target Exhibits / Zoning To purchase ( or examine ) products 25.6% Japan Tourism Facilities Association Hotels,Inns 9,639 17.1% To ascertain current trends in related markets 22.8% Organized by Renewal Continuation & Expansion Please choose from the four zones. -

Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1St Section 9936 Industry: Food Service, Retail Gold Medalist in Chinese Cuisine

MITA SECURITIES Equity Research June 22, 2021 MITA SECURITIES Co., Ltd. Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1st Section 9936 Industry: Food service, retail Gold medalist in Chinese cuisine. Enjoy Initiation of coverage dumplings in store or at home; initiating coverage with a Buy rating Rating Initiating coverage with a TP of 7,250 yen and a Buy rating We initiate coverage of Ohsho Food Service Corporation (9936, Ohsho Food Service, the Buy company) with a target price of 7,250 yen and a Buy rating. Target price (JPY) 7,250 The company operates “Gyoza no Ohsho,” the largest Chinese restaurant chain, both Stock price (JPY) (Jun 21) 5,610 directly and through franchisees nationwide. The company’s earnings have been robust Market cap (JPYbn) 130.6 since pre-COVID-19 pandemic. Although sales of in-store dining declined as it was forced Key changes to shorten business hours in the wake of the COVID-19, sales of take-out and delivery have Rating New been strong. The company posted an OP of 6.1bn yen (OPM 7.5%) in FY3/21 while many of Target price New its competitors posted losses. With the withdrawal of underperforming restaurants, the Earnings forecast New potential locations for new openings have been increasing. The company appears to be the Stock price (JPY) only major Chinese restaurant chain that can continue to make positive investments. In our 10,000 view, the company’s competitive advantage will continue to strengthen. 9,000 8,000 7,000 The catalysts we envision for an upturn in the stock price include strong monthly same- 6,000 5,000 store sales, recovery in quarterly profits, easing of requests by local governments to 4,000 3,000 shorten business hours, and progress in vaccination against the COVID-19. -

Quarterly Portfolio Disclosure

Schroders 29/05/2020 ASX Limited Schroders Investment Management Australia Limited ASX Market Announcements Office ABN:22 000 443 274 Exchange Centre Australian Financial Services Licence: 226473 20 Bridge Street Sydney NSW 2000 Level 20 Angel Place 123 Pitt Street Sydney NSW 2000 P: 1300 180 103 E: [email protected] W: www.schroders.com.au/GROW Schroder Real Return Fund (Managed Fund) Quarterly holdings disclosure for quarter ending 31 March 2020 Holdings on a full look through basis as at 31 March 2020 Weight Asset Name (%) 1&1 DRILLISCH AG 0.000% 1011778 BC / NEW RED FIN 4.25 15-MAY-2024 144a (SECURED) 0.002% 1011778 BC UNLIMITED LIABILITY CO 3.875 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 4.375 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 5.0 15-OCT-2025 144a (SECURED) 0.004% 1MDB GLOBAL INVESTMENTS LTD 4.4 09-MAR-2023 Reg-S (SENIOR) 0.011% 1ST SOURCE CORP 0.000% 21VIANET GROUP ADR REPRESENTING SI ADR 0.000% 2I RETE GAS SPA 1.608 31-OCT-2027 Reg-S (SENIOR) 0.001% 2I RETE GAS SPA 2.195 11-SEP-2025 Reg-S (SENIOR) 0.001% 2U INC 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 361 DEGREES INTERNATIONAL LTD 0.000% 3D SYSTEMS CORP 0.000% 3I GROUP PLC 0.002% 3M 0.020% 3M CO 1.625 19-SEP-2021 (SENIOR) 0.001% 3M CO 1.75 14-FEB-2023 (SENIOR) 0.001% 3M CO 2.0 14-FEB-2025 (SENIOR) 0.001% 3M CO 2.0 26-JUN-2022 (SENIOR) 0.001% 3M CO 2.25 15-MAR-2023 (SENIOR) 0.001% 3M CO 2.75 01-MAR-2022 (SENIOR) 0.001% 3M CO 3.25 14-FEB-2024 (SENIOR) 0.002% -

Boba Tea: Blending Drinks and Cultures

This material is exclusively prepared for Ringle Customers Ringle material written by Tutor Angela Kim Boba Tea: Blending Drinks and Cultures [source: http://theboola.com/a-comprehensive-non-scientific-ranking-of-boba-tea-at-yale/] 0 본 자료는 저작권 법에 의해 보호되는 저작물로, Ringle 사에 저작권이 존재합니다. 해당 자료에 대한 무단 복제/배포를 금하며, 해당 자료로 수익을 얻거나 이에 상응하는 혜택을 누릴 시 Ringle 과 사전 협의가 없는 경우 고소/고발 조치 될 수 있습니다. This material is exclusively prepared for Ringle Customers [Summary in English] I. Origins Within the past decade, boba tea, also known as “bubble tea,” has gained enormous popularity around the world. • Boba tea was created in Taiwan in the 1980s. Although the exact origin story is unknown, most people believe it was developed by Lin Hsiu Hui who added some tapioca pudding to her drink at a teahouse in Taichung, Taiwan. It became immediately popular and many street vendors began to serve boba at night markets. • The word “boba” can refer to both the broad category of drinks with chunky toppings or the black tapioca pearls themselves. • Boba pearls are made from tapioca that comes from the cassava root. The cassava plant is native to South America but came to Taiwan from Brazil during Japanese rule between 1895 to 1945. While “bubble tea” refers to the milk froth from shaking the cup, “boba” refers to the Taiwanese tapioca pearls. Often, the drink is called “bubble tea” on the East Coast while it is called “boba” on the West Coast more often. • In its most basic form, the drink includes black tea, milk, ice, and tapioca pearls. -

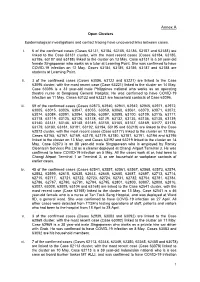

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Hotel Restaurant Institutional Japan

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/26/2013 GAIN Report Number: JA 3526 Japan Food Service - Hotel Restaurant Institutional Japan HRI Food Service Sector Report 2014 Approved By: Steve Shnitzler, Director, ATO Japan Prepared By: Masayuki (Alex) Otsuka, Marketing Specialist, ATO Tokyo Report Highlights: The $361 billion food service industry has finally recovered from the negative impacts affected by the Great Earthquake in 2011. Per capita spending (including company spending) for HRI spending has made a significant contribution to the food service industry’s step by step growth. In addition, increased tourism has also contributed to the re-invigoration of the industry as HRI outlets are offering more international cuisines throughout the market place. Competition remains intense and the sophisticated Japanese consumer continues to demand high quality food products. U.S. suppliers are well positioned to compete in many products categories provided they are willing to adjust to changing market demand. - Table of Contents - I. MARKET SUMMARY A. Market Volume and Trends B. Sectors C. Value of Total Imported Food vs. Domestic Products D. Advantages and Challenges II. ROAD MAP FOR MARKET ENTRY A. Entry Strategy 1. Market Access 2. Competitive Analysis 3. Comparative Advantage of the Products 4. Receptivity of the Distribution Trade 5. Ability of Willingness to Meet Market Requirements B. Market Structure 1. Distribution 2. Segmentation i. Large Increase of Foreign Travelers to Japan ii. Spending More Time at Roadside Rest Areas and Airport Terminals iii. -

Resolving Labour Shortage? the Digital Transformation of Working Practices in the Japanese Service Sector

This is an open source publication by LeidenAsiaCentre, July 2019. LEIDENASIACENTRE Resolving Labour Shortage? The Digital Transformation of Working Practices in the Japanese Service Sector Saori Shibata LeidenAsiaCentre is an independent research centre affiliated with Leiden University and made possible by a grant from the Vaes Elias Fund. The centre focuses on academic research with direct application to society. All research projects are conducted in close cooperation with a wide variety of partners from Dutch society. More information can be found on our website : www.leidenasiacentre.nl For contact or orders: [email protected] M. de Vrieshof 3, 2311 BZ Leiden, The Netherlands 0 1. Introduction Many advanced democracies, including Japan, face a shift toward an ageing society and a labour shortage. The Japanese Ministry of Labour, Health and Welfare (MHLW) reports in its Labour Economy Survey that on average roughly 55 % of firms in the hospitality industry (hotels, restaurants and cafes) face a labour shortage of part-time workers in 2018 (MHLW 2018:7). Many restaurants in Japan were already forced to end 24-hour opening due to labour shortages (Harding 2017). It has progressed automation in restaurants. For instance, an increasing number of restaurants and cafes started introducing automation and robotisation, increasing labour productivity, improving advertisement, requiring a smaller number of workers and reducing labour costs. Some restaurants integrated registered customers’ smartphones and send advertising messages to their smartphones when they are near to restaurants. This can contribute to the reduction of advertisement costs and effectively increase customers. IBM Japan invented a system named “Chef Watson”, which creates a large number of menus for restaurants with just a little input of some food ingredients (Nakata 2014). -

Cafe, Sweets Cafe Sweet Sales

Cafe, Sweets The sales of cafe are going well with their strategy of store remodeling, and many of them earn high profit due to the low cost. The companies operating cafes mainly compete in suburb area, Sweet Cafe while companies operating sweets are opening restaurants at Shopping malls. Duskin Co., Ltd. Komeda’s Coffee Doutor Coffee Co., Ltd. Starbucks Coffee Japan, Ltd. Mister Donut Dotour, Execior The main business of Duskin Starbucks Coffee It has been operating food division. Most shops The leading company Komeda Coffee shop franchise café in Japan are franchise. It frequently of cafe industry. It has Originated in Nagoya and it is opening for long time. It releases new menu. been merged into franchise shops, including in Kyushu and proceeds remodeling Starbucks U.S. in 2015. Chain Tohoku area. restaurants. 102 Billion yen Sales Chain Sales of Cafe 47.9 Billion yen Sales of business 75.2 Billion yen Sales 137.8 Billion yen 48.2 Billion yen Sales business Profit of Cafe Sales 19.4 Billion yen Profit Profit of business 4.5 Billion yen 13.4 Billion yen -0.2 Billion yen business Profit 3.9 Billion yen Stores 1,359 stores Stores 588 stores 1,170 stores Stores Store 614 stores Pronto Corporation Saintmarc Holdings Co., Ltd. B-R 31 Ice Cream Co., Ltd. Tully’s Coffee Japan Co., Ltd. St. Marc Cafe Tully ‘s Coffee Originated in Okayama. Seatle styled cafe. Thirty-one Ice cream It serves freshly baked It has been merged The leading company of ice cream shops. bakery. It has good in Ito En Ltd. -

Exhibition for Hospitality, Food Service and Catering Industries!

Exhibition for Hospitality, Food Service and Catering Industries! 44th Japan Management Association Japan Hotel Association Japan Ryokan & Hotel Association Japan Restaurant Association Japan Tourism Facilities Association 37th Japan Contract Food Service Association Japan Lunch Food Service Association Japan Food Service for Patients Association Japan Management Association Japan Food Service Equipment Association Japan Japan ManagementManagement AssociAssociationation Date February 16(Tue.) ~ 19(Fri.), 2016 10:00~17:00(Last day 10:00~16:30) Venue Tokyo Big Sight (Tokyo International Exhibition Center, Ariake) 811 companies / 1,947 booths / 17,523sq.m. scale Japan’s largest trade show for hospitality, food service and catering! HCJ represents the three trade shows: ● HOTERES JAPAN: International hotels & restaurant trade show for hotels, "ryokan"s, travel, and facilities. ● CATEREX JAPAN: Food and catering trade show for catering and food services. ● JAPAN FOOD SERVICE EQUIPMENT SHOW: Equipment for commercial kitchens and food services trade show. Three events are held simultaneously, H for HOTERES JAPAN, providing the largest business matching for CATEREX JAPAN, and opportunity for hospitality & food C service industry in Japan! J for JAPAN FOOD SERVICE EQUIPMENT SHOW. (The 44th International Hotel & Restaurant Show) * & ' ( ! ) $)% "# $"% (The 37th Exhibition for the Catering Industries) + * ! -(* ! * ! &, * & ' ( & ('-/ & &" '+ '* * ( ! ( -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

List of Employment for Undergraduate Students in 2014-2016

List of employment for Undergraduate stduents in 2014-2016 As of May 1st, 2017 Construction/Real estate business ITOCHU Urban Community/AIBLE INC./Okuraya homes/Okumura corporation/Kinoshita Group/Kyoritsu maintenance/ Kyowanissei/Kudo corporation/Shonan Station Building, Shonan Misawa Homes/Starts Corporation/ Sumitomo Real Estate/Sumitomo forestry home service/Sekisui House/Sekiwa Real Estate/Daikin Air Techno/ Taiseioncho/Takara Leben/ Tokyu Livable/Tokyo Building, Tokyo Reiki Inc./Nishimatsu Construction/Nihon Housing, Housecom/PanaHome/Misawa Homes Shizuoka/ Misawa Homes Tokyo/Mitsui Fudosan Realty/LUMINE Manufacture ADVANEX/Alps Electric/ITO EN/FDK/Kanebo Cosmetics/kawamura Electric/Kewpie/Kyowa Hakko Kirin/Cross Company/Koike sanso Kogyo/ Korg, Sanwa Tekki/JFE Shoji Coil Center/Shindengen Electric Manufacturing/SUZUKI Motor/ThreeBond Group/Daiwa Industries Takara Standard/Tachikawa Corporation/tanico/Chugai Mining/THK/DNP Multi Print/DISCO/ACCRETECH/Torii Pharmaceutical Triumph International Japan/NAKAMURAYA/Niigata Power Systems/Nifco/Nihon Pharmaceutical/NIWAKA/NOEVIR/Punch Industry P&G Maxfactor/Hitachi Construction Machinery Japan/Beyonz/fabrica communications/Furukawa Battery/HOYA/MEIKO/Meidensha HIROTA/RENOWN/YKKAP/Wacol Holdings Transportation ITOCHU Logistics/AIRDO/Odakyu Electric Railway/Kanagawa Chuo Kotsu/K.R.S./Kokusai motorcars/Sakai Moving Service/ Sagawa Global Logistics/SANKYU/J-AIR/JAL Express/JAL Cargo Service/JAL Ground Service/JAL SKY/All Nippon Airways/DNP logistics/ Nippon Konpo Unyu Soko/Nippon Express/Japan