The Danish Brewery Group A/S ANNUAL REPORT 2003

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competitive Analysis & Two-Firm Comparison Paper Carlsberg Group

Competitive Analysis & Two-Firm Comparison Paper Carlsberg Group | Sapporo Holdings Brandon Altman Professor Geraldine Wu International Studies Program: Europe Spring 2019 Word Count: 2393 – Excluding Titles 2 Table of Contents Part 1: Industry Analysis Pg. 3 Part 2: Firm Analysis Pg. 6 Part 3: Location Matters Pg. 9 References Pg. 12 ___________ Competitive Analysis & Two-Firm Comparison Paper 3 Part 1 Industry Analysis ______________________________________________________________________________ Competitive Analysis & Two-Firm Comparison Paper 4 Nature of Danish Beer Industry: The Danish beer market has proven to be an extremely attractive industry, as evidenced by the shocking increase in beer-firm numbers over the past two decades. According to Draft Mag, “at the end of the 20th century, Denmark had around a dozen breweries to its name, most conspicuously Carlsberg, one of the world’s largest brewers of industrial lager. A decade into the 21st century, the nation boasted almost 150 breweries.” This microbrewery boom brought in a large variety of craft beers that have tended to do especially well given that “the notoriously unstable Danish weather [caused] an increase in sales of craft beer due to people being driven away from the beaches and into bars or their own homes, where the consumption of craft and specialty beers is higher” (Euromonitor). On a competitive level, Denmark is a somewhat difficult market to compete in on a large scale. As stated by Euromonitor, “beer in Denmark continued to be highly consolidated with the two -

Carlsberg Annual Report Market Overview

Carlsberg Annual Report Market overview 2 1 Our markets Denmark Norway Sweden Finland Poland Germany The Baltic StatesUnited KingdomFrance Switzerland Italy Greece Population (millions) 5.5 5.0 9.4 5.4 38.1 81.4 6.9 62.6 63.2 7.8 60.6 11.2 10.7 19.3 142.4 45.6 16.5 28.6 9.4 9.1 28.7 5.3 7. 2 1,348.1 89.3 6.6 14.4 28.5 1,206.9 Est. GDP/capita PPP (USD) 37,742 53,376 40,614 36,723 20,137 37,936 17,95 8 4 35,974 35,049 43,509 30,166 27,6 24 23,204 13,740 4 16,687 7,19 9 13,060 3,294 14,948 10,217 15,579 59,937 49,342 8,394 3,355 2,659 2,286 1,328 3,703 Est. real GDP growth (%) 1.5 1.7 4.4 3.5 3.8 2.7 4-6.6 1.1 1.7 2.2 0.6 -5.0 -2.2 0.8-2.5 4.3 4.7 6.5 7.1 5.0 0.2 5.2 5.3 6.0 9.5 5.8 8.3 6.7 3.5 7.8 Inflation, avg. consumer prices (%) 3.2 1.7 3.0 3.1 4.0 2.2 4.2-5.1 4.5 2.1 0.7 2.6 2.9 3.4 3.2-11.3 8.9 9.3 8.9 13.1 41.0 9.3 3.2 3.7 5.5 5.5 18.8 8.7 6.4 9.5 10.6 Est. -

If Auto Strike Persists Ber and Now a City Commissioner

Coho-ho to you* too Here's a (true!) fishing tale to top all fishing tales Up Frankfort way they're known as "The Lake Michigan. The Big Lake was sporting afternoon in the quiet of the channel. against my leg?" Britten said. "It was the who owned the gas station that sent the wrecker. Submarine Boys from St, Johns." 10-foot waves, and with small craft warnings "We had just the one day to fish," Britten station wagon pushing me in," The Peacocks provided the*1 two men with a It all happened . and happened, and in effect, the Frankfort dock area was con said. "It was either go out in those waves or The brakes had let go on the station wagon, and change of clothes,socks and shoes, gave them happened the weekend, of Sept, 9 when Don gested with about 530 other boats and trailers, come on home without any fish. We stuck Ryan's car rolled down the ramp and into supper and sleeping quarters Saturday night. Britten of 501 N. Clinton Avenue and Roy around until about 4:30 in the afternoon before Betsy River's 20 feet of water. The boat Ryan of 2719 W. Steel Road drove up to RYAN'S BOAT WAS NOT classed as a small we got up enough nerve to go out. popped off and floated away. It was retrieved. SUNDAY DAWNED BUSY at the station. Frankfort to do their first fishing for the craft, so he and Brittan decided to try their . "A lot of other boats our size were going out, The car floated for awhile, Britten said, with Britten and Ryan volunteered their assistance, mighty cblio salmon. -

2012 Catalogue of Results Proudly Conducted By

2012 Catalogue of Results Proudly conducted by 2012 Catalogue of Results The Royal Agricultural Society of Victoria Limited ABN 66 006 728 785 ACN 006 728 785 Melbourne Showgrounds Epsom Road Ascot Vale Victoria 3032 Telephone +61 3 9281 7444 Facsimile +61 3 9281 7592 www.rasv.com.au List of Office Bearers As at 01/05/2012 Board of Directors S. C. Spargo (Chair) D. Pollett Hodgson (VIce Chair) I. I. Bucknall D. S. Chapman M. J. Coleman A. J. Hawkes N.E. King OAM G. J. Phillips J. A. Potter P. J. B. Ronald OAM President S. C. Spargo Vice President D. Pollett Hodgson Chief Executive Officer M. O’Sullivan Industry Advisory Group P. Manders ( Chief Judge) B. Taylor B. Rogers C Badenoch L. Ryan P. Aldred Competition Manager Michael Conolly T: +61 3 9281 7473 E: [email protected] University Of Ballarat PO Box 663 Ballarat Victoria 3353 Australia Telephone 1300 225 527 Facsimile +61 3 5327 9855 www.ballarat.edu.au Vice Chancellor Professor David Battersby Contents Report on Entries 4 2012 Judging Panel 4 2012 Trophy Winners 6 2012 Sections and Classes of Entry 9 Exhibitors List 54 2 20 Years Celebrated with AUSTRALIAN INTER NATIO AIBA’s Collaborator NAL B EER AW ARDS In celebration of the AIBA’s 20th Anniversary a commemorative beer was produced, ‘Collaborator.’ AIBA 20 TH 2011 AIBA champion trophy brewers, Brendan Varis ANNIVERS ARY BREW from Feral Brewing and Andrew Ong from 2 Brothers Brewery came together to create this limited edition brew, the brewers have termed an Australian Brown Ale. -

Edited Copy of Consumers Collective Action April 27

University of Southern Denmark Consumers' Collective Action in Market System Dynamics A Case of Beer Kjeldgaard, Dannie; Askegaard, Søren; Rasmussen, Jannick Ørnstedt; Østergaard, Per Published in: Marketing Theory DOI: 10.1177/1470593116658197 Publication date: 2017 Document version: Accepted manuscript Citation for pulished version (APA): Kjeldgaard, D., Askegaard, S., Rasmussen, J. Ø., & Østergaard, P. (2017). Consumers' Collective Action in Market System Dynamics: A Case of Beer. Marketing Theory, 17(1), 51-70. https://doi.org/10.1177/1470593116658197 Go to publication entry in University of Southern Denmark's Research Portal Terms of use This work is brought to you by the University of Southern Denmark. Unless otherwise specified it has been shared according to the terms for self-archiving. If no other license is stated, these terms apply: • You may download this work for personal use only. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying this open access version If you believe that this document breaches copyright please contact us providing details and we will investigate your claim. Please direct all enquiries to [email protected] Download date: 01. Oct. 2021 Consumers’ Collective Action in Market System Dynamics: A Case of Beer Dannie Kjeldgaard*, Søren Askegaard, Jannick Ørnstedt Rasmussen, Per Østergaard University of Southern Denmark FORTHCOMING IN MARKETING THEORY, vol.17, issue 1 Dannie Kjeldgaard, Ph.D., is a Professor of Marketing in the Consumption, Culture and Commerce group at the University of Southern Denmark. Dannie’s work analyzes change processes of market- based glocalization in domains such as place branding, branding, media and identity construction, global consumer segments, ethnicity, and qualitative methodology. -

The Shape of the Carlsberg Group

Contents A Brief Presentation 2 Supervisory Board and Executive Board 4 The Shape of the Carlsberg Group 5 Highlights and Key Figures 7 Report for 1998/99 8 The Danish Brewing Operations 15 Carlsberg and the Environment 17 The International Brewing Operations 19 Nordic Region 19 UK 20 Central, Eastern and Southern Europe 21 Western Europe and Exports 25 Asia, Africa, North and Latin America 29 Carlsberg's Alcohol Policy 32 Carlsberg's Policy on Gene Technology 33 Soft Drinks, Coca-Cola Nordic Beverages 35 Group Staff Functions 37 Accounts for 1998/99 43 Financial Review 44 Accounting Policies 49 Turnover etc. in Major Subsidiaries 51 Group Companies 52 Profit and Loss Account 53 Balance Sheet 54 Cash Flow Statement 56 Notes to the Accounts 57 Auditors' Report 65 Subsidiaries and Associated Companies 67 Shares and Shareholders 71 Announcements to the Stock Exchange, Financial Calendar, Annual General Meeting 72 1 A Brief Presentation The Carlsberg Group is one of the world’s major interna- Ever since Carlsberg’s foundation, the Company has tional brewing groups, with Carlsberg and Tuborg being operated its own research departments. In 1875, the two of the most widely-sold beer brands on a global scale. Carlsberg Laboratory was established. It has now been integrated into the Carlsberg Research Center which has The Group comprises the Parent Company - the Carlsberg 80 laboratories equipped with the latest technology and a Breweries founded in 1847 and Tuborg Breweries founded staff of about 150. In addition to extensive basic research, in 1873 - and about 100 subsidiaries and associated com- brewing related research is conducted into enzyme chem- panies, the majority of which are situated outside istry, protein chemistry, carbohydrate chemistry, plant Denmark. -

BEER in DENMARK 08 Aug 2013 HEADLINES

BEER IN DENMARK 08 Aug 2013 HEADLINES Total volume sales decline by 2% to 366 million litres in 2012 New beer tax and economic downturn delays recovery for the struggling beer category Domestic premium lager is the fastest growing category, with total volume sales up by 2% in 2012 Unit prices grow by 1% in both the on-trade and off-trade in 2012 Carlsberg leads with a 57% total volume share in 2012 Volume sales forecast to post a negative CAGR of 1% over 2012 to 2017 COMPETITIVE LANDSCAPE The leading beer players were Danish multinationals Carlsberg, with a 57% total volume share and Royal Unibrew, with a 21% share in 2012. Both companies are heavily present in domestic standard lager and both invested great efforts over the review period into better addressing the under 30 year old consumer group, which is proportionally more female and less beer-friendly. Royal Unibrew recorded volume share growth in 2012, and has since 2007 gained one percentage point on its key competitor Carlsberg. Both companies nonetheless grew in share in 2012 as Carlsberg offered price discounts on its most popular brands; Tuborg Grøn and Carlsberg Pilsner. However, Royal Unibrew has so far been more successful than Carlsberg in addressing the changing consumer preference among younger Danes. Carlsberg has in recent years focused on introductions of product types with new USPs and these have mainly failed, such as the domestic premium lager Copenhagen, launched in 2011, whereas Royal Unibrew has focused more on updating the brand image of its leading well-known products, namely Royal. -

Training in the Food and Beverages Sector in Denmark. Report for the FORCE Programme

DOCUMENT RESUME ED 398 435 CE 072 312 AUTHOR Hoist, Ole TITLE Training in the Food and Beverages Sector in Denmark. Report for the FORCE Programme. INSTITUTION European Centre for the Development ofVocational Training, Thessaloniki (Greece). REPORT NO ISBN-92-827-6730-2 PUB DATE 95 NOTE 87p. AVAILABLE FROMUNIPUB, 4611-F Assembly Drive, Lanham, MD20706-4391; 800-274-4888; fax: 301-459-0056 (Catalogue No. HX-93-96-839-EN-C: 8 European Currency Units). PUB TYPE Reports Research/Technical (143) EDRS PRICE MF01/PC04 Plus Postage. DESCRIPTORS Case Studies; *Continuing Education; DairyFarmers; Educational Needs; *Food Processing Occupations; Foreign Countries; Job Skills; 'Job Training;Labor Needs; *Meat Packing Industry; Postsecondary Education; Program Effectiveness; ProgramEvaluation; Secondary Education; Vocational Education IDENTIFIERS *Denmark ABSTRACT A study of the food sector in Denmark waslimited to the slaughterhouse, dairy, beverages sectors.The food sector was the most important single industry in theDanish economy. It was the largest manufacturing sector, generatedone-third of total manufacturing, and comprised approximately 8 percent ofthe total Danish gross domestic product. It was a veryheterogeneous sector predominantly made up of large companies. With no legalrequirement for continuing training under Danish law, atradition developed over the years with regard to initial andcontinuing training that was based solely on voluntary agreements betweenmanagement and work force. The main principle of all vocationaltraining was that the state made resources available in its budget.The chosen strategic course that aims to establish acustomer-supplier relationship with foreign food companies by providing a high levelof market readiness regarding quality, taste, appearance, and packagingof primary products would require the Danish food sector'sproduct development efforts to be strengthened. -

The Rise of Mikkeller

The Rise of Mikkeller Roskilde University 3rd Semester Project Fall 2018 Group No. 4 Students: Students no.: Supervisor: Emil Lykke Weile 63654 Henrik Reinicke Jensen Heidi Ejdesgaard Møller 63650 Kirstin Maria Ocampo 63647 Levent Kurtis 63600 Emil Weile The Rise of Mikkeller 18/12-2018 Heidi Møller Kirstin Maria Ocampo Levent Kurtis Abstract Mikkeller is a young craft beer company which has been on the rise since its start-up in the early 2000s. With the current 21st century trends, other beer companies have evolved their products, in order to remain competitive towards the fast-rising craft beer company Mikkeller. The purpose of this study is to investigate where Mikkeller is currently positioned in the beer market and to study whether the position has changed or not over the last five years. With the study of the relationship between business and trends and the fundamental understanding of the way Mikkeller is able to challenge the larger beer companies, the position of Mikkeller in the beer market is achieved. With the current trends in society, Mikkeller is both able to influence their consumer behaviour, by strengthening their customer relationship and strategically challenge the industrial beer companies. Thereby the marketing and production strategies of the industrial beer companies such as Carlsberg and Royal Unibrew, are changing accordingly to the trends, causing them to produce products similar to Mikkeller. Conclusively, the position of Mikkeller has changed drastically over the five years, wherein they have a more significant role in the beer market, yet they are in a more challenging position than ever. 2 Emil Weile The Rise of Mikkeller 18/12-2018 Heidi Møller Kirstin Maria Ocampo Levent Kurtis Table of Contents 1. -

Development of Beer Industry and Craft Beer Expansion

Journal of Food and Nutrition Research (ISSN 1336-8672) Vol. 58, 2019, No. 1, pp. 63–74 Development of beer industry and craft beer expansion Ján Pokrivčák – Soňa Chovanová SuPeková – DrahoSlav lančarič – raDovan Savov – Marián TóTh – raDoSlav vašina Summary The objective of this paper is to evaluate how globalization of Slovak economy and its economic growth affected not only the structure of the traditional beer market in Slovakia but also the rise and expansion of craft breweries. The theory is focused on examining an interplay between the standardized and globalized traditional beer industry, develop- ment and dissemination of craft brewing technologies and changing of life styles. Results and main outcomes are based on a survey where 20 owners of craft breweries in Slovakia were interviewed using a focus group approach. We identi- fied main factors affecting expansion of craft breweries as well as barriers to craft breweries expansion. The expansion is positively affected by increasing demand for diversified beer, different beer styles and the increase of income. The main barriers are the increasing consumption of substitutes, lack of qualified brewers and taxation policy. Main motivation factors to start a craft brewery are lack of diversified beer and good business opportunity. Keywords craft beer; globalization; product diversity; demand; quality; Slovakia Global trends in brewing Industry country, China (489.9 million hectolitres) is the The beer industry in Europe and in the world largest beer-consuming country in the world, has been going through significant changes recent- followed by USA (241.7 million hectolitres), Brazil ly. On the one hand, the process of consolidation (131.5 million hectolitres), Russia (100.1 million is going on, which has been reflected in a series hectolitres) and Germany (84.4 million hectoli- of mergers and acquisitions of large commercial tres). -

Alcoholic and Non-Alcoholic Drinks Aarhus, Denmark, 31 August - 1 September 2017 Index (In Alphabetical Order)

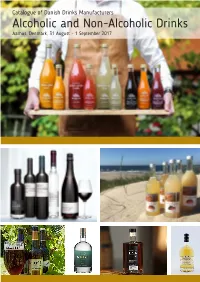

Catalogue of Danish Drinks Manufacturers Alcoholic and Non-Alcoholic Drinks Aarhus, Denmark, 31 August - 1 September 2017 Index (In alphabetical order) Sector Company Website Spirits Fary Lochan Distillery www.farylochan.dk Herbie Gin www.herbiegin.com Njord Gin www.spiritofnjord.com Nohrlund ApS www.nohrlund.com Nordisk Brænderi ApS www.nordiskbraenderi.dk NORLIQ I/S www.norliq.dk Pure Shots A/S www.pureshots.com Schirripa® ApS www.schirripa.dk Skotlander Rum www.skotlander.com Spirits and wine Dyrehøj Vingaard www.dyrehoj-vingaard.dk Frederiksdal Kirsebærvin A/S www.frederiksdal.com Wine Andersen Winery ApS www.andersenwinery.dk Cold Hand Winery www.coldhandwinery.dk Easy Wine2go www.easywine2go.com Guldbæk Vingård www.guldbaekvingaard.dk HORN CIDER www.horncider.dk Skærsøgaard www.dansk-vin.dk Winemaker of Jutland www.denjyskevinmager.dk Beer A/S Bryggeriet Vestfyen www.vestfyen.dk Bryghuset i Randers A/S www.randersbryghus.dk Coisbo ApS www.coisbo.com Hornbeer www.hornbeer.dk Klosterbryggeriet www.klosterbryggeriet.dk Midtfyns Bryghus A/S www.midtfyns-bryghus.dk Munkebo Mikrobryg www.munkebo-mikrobryg.dk Mead Malling Mjød www.mallingmjod.dk Snoremark www.snoremark.dk Sparkling Tea Copenhagen Sparkling Tea Company www.sparklingtea.co Juice Bornholms Mosteri A/S www.bornholmsmosteri.com Klosterbryggeriet www.klosterbryggeriet.dk Mariendal Mosteri Djursland www.mariendalmosteri.dk Me&Ginger www.meandginger.com SEiMEi ApS www.seimei.dk Søbogaard www.snn.dk Vesterhavsmost® www.vesterhavsmost.dk Other Non-Alcoholic Drinks Fine Nordic ApS -

To Hop Or Not to Hop Early Medieval Beer Brewing in Scandinavia and Continental Europe

To hop or not to hop Early medieval beer brewing in Scandinavia and continental Europe 1 Version 1.4 20170616 Martin Forest 1 Cover photo is from the book HUMLE, deg gröna guldet, Page 117 To hop or not to hop Table of Content Table of Content 1 Introduction 3 Scope 3 Editorial note 3 Geographical clarification 3 What are hops? 4 What do hops contain? 4 Usage of Hops 5 Fibre 5 Hops in Food 6 Cooking 6 Brewing 6 Medicine 6 Hops in the middle ages 8 Timeline details 8 Stepping through time. 13 Pre 800 13 9th century 13 11-12th century 13 13th century 13 14th century 14 15th century 15 16th century 15 What about other sources? 16 Vikings 16 Hop types and varieties 16 Hop history in Sweden 18 Genetics 18 How wild are the swedish hops? 19 Taxation 19 Diversity of hops 21 Did hops kill the gruit? 21 What’s the most historically accurate brew? 22 What kind of hops to use? 23 Hop volume and quantity 23 What hops should I use? 24 Conclusion 25 1 To hop or not to hop Who am I then 25 Appendix A 26 Alpha acids 26 Beta acids 27 Essential oils 28 Bibliography 29 2 To hop or not to hop Introduction The purpose of this document is to explore the use of hops in beer brewing between 400 and 1600 in Scandinavia and continental Europe. Collecting and summarising a large number of primary sources I have attempted to map out the evidence of hop use in beer brewing.