Currency Design in the United States and Abroad: Counterfeit Deterrence and Visual Accessibility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Currency Symbol for Indian Rupee Design Philosophy

Currency Symbol for Indian Rupee Design Philosophy The design philosophy of the symbol is derived from the Devanagari script, a traditional script deeply rooted in our Indian culture. The symbol also seamlessly integrates the Latin script which is widely used around the world. This amalgamation traverses boundaries across cultures giving it a universal identity, at the same time symbolizing our cultural values and ethos at a global platform. Simplicity of the visual form and imagery creates a deep impact on the minds of the people. And makes it easy to recognize, recall and represent by all age groups, societies, religions and cultures. Direct communication The symbol is designed using the Devanagari letter ‘Ra’ and Roman capital letter ‘R’. The letters are derived from the word Rupiah in Hindi and Rupees in English both denote the currency of India. The derivation of letters from these words conveys the association of the symbol with currency rupee. The symbol straightforwardly communicates the message of currency for both Indian and foreign nationals. In other words, a direct relationship is established between the symbol and the rupee. Shiro Rekha The use of Shiro Rekha (the horizontal top line) in Devanagari script is unique to India. Devanagari script is the only script where letters hang from the top line and does not sit on a baseline. The symbol preserves this unique and essential feature of our Indian script which is not seen in any other scripts in the world. It also clearly distinguishes itself from other symbols and establishes a sign of Indian origin. It explicitly states the Indianess of the symbol. -

Report – Made in PRD: the Changing Face of HK Manufacturers – Released in 2003

MADE IN Challenges & Opportunities for HK Industry Made in PRD Study is a Federation of Hong Kong Industries project. The Hong Kong Centre for Economic Research was commissioned to carry out this two-year Study. Published and printed in Hong Kong. HK$500 Published by Federation of Hong Kong Industries. Copyright © 2007 Federation of Hong Kong Industries. All rights reserved. No part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the Federation of Hong Kong Industries. Website : http://www.industryhk.org Contents 2 Foreword 8 Chapter 1 : Hong Kong and the Pearl and Yangtze River Deltas 28 Chapter 2 : Industrial Performance in Gunagdong and the Role of Hong Kong 42 Chapter 3 : Hong Kong-Funded Enterprises and Enterprises in Other Contractual Forms 56 Chapter 4 : The Characteristics of Product Sales 66 Chapter 5 : Guangdong and Hong Kong in Parternership 80 Chapter 6 : Business Environment of the PRD 94 Chapter 7 : Research & Development 110 Chapter 8 : Policy Recommendations 126 Glossary 128 Acknowledgements 1 Since China embarked on the historic economic reform Foreword programmes in late 1970s, the Pearl River Delta (PRD) has developed by leaps and bounds from a predominately rural region into one of the fastest growing, export- oriented industrial centres in the world. This spectacular transformation and the contributions that Hong Kong manufacturers had made to the process have been lucidly depicted in our study report – Made in PRD: The Changing Face of HK Manufacturers – released in 2003. -

Annual Report 2014 • Hong Kong Monetary Authority Page 5

2014 Annual Report Page 2 Hong Kong Monetary Authority The Hong Kong Monetary Authority (HKMA) is the government authority in Hong Kong responsible for maintaining monetary and banking stability. The HKMA’s policy objectives are • to maintain currency stability within the framework of the Linked Exchange Rate system • to promote the stability and integrity of the financial system, including the banking system • to help maintain Hong Kong’s status as an international financial centre, including the maintenance and development of Hong Kong’s financial infrastructure • to manage the Exchange Fund. The HKMA is an integral part of the Hong Kong Special Administrative Region Government but operates with a high degree of autonomy, complemented by a high degree of accountability and transparency. The HKMA is accountable to the people of Hong Kong through the Financial Secretary and through the laws passed by the Legislative Council that set out the Monetary Authority’s powers and responsibilities. In his control of the Exchange Fund, the Financial Secretary is advised by the Exchange Fund Advisory Committee. The HKMA’s offices are at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong Telephone : (852) 2878 8196 Facsimile : (852) 2878 8197 E-mail : [email protected] The HKMA Information Centre is located at 55/F, Two International Finance Centre, 8 Finance Street, Central, Hong Kong and is open from 10:00 a.m. to 6:00 p.m. Monday to Friday and 10:00 a.m. to 1:00 p.m. on Saturday (except public holidays). The Centre consists of an Exhibition Area and a Library containing materials on Hong Kong’s monetary, banking and financial affairs and central banking topics. -

Video on Showcase of Awarded Websites and Mobile Applications

Video on Showcase of Awarded Websites and Mobile Applications Most Favourite Websites 1. The Kowloon Motor Bus Company (1933) Limited [www.kmb.hk] 2. The University of Hong Kong [www.hku.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] Most Favourite Mobile App 4. MTR Corporation Limited [MTR Mobile , iOS / Android] 5. Airport Authority Hong Kong [HKG My Flight , iOS / Android] 6. Hong Kong Blind Union [Searching & Exploring with Speech Augmented Map Information (SESAMI) , iOS] Designer Award 1. TheOrigo Ltd. 2. Palmary Solutions Company Limited 3. KanHan Technologies Limited Triple Gold Award 1. Arcotect Limited [www.arcotect.com] 2. Automated Systems Holdings Limited [www.asl.com.hk] 3. The Chinese University of Hong Kong [www.cuhk.edu.hk] 4. City University of Hong Kong [www.cityu.edu.hk/cityu] 5. City University of Hong Kong [www.cityu.edu.hk/cio] 6. Fish Marketing Organization [www.fmo.org.hk] 7. Freedom Communications Limited [www.freecomm.com/entxt_index.php] 8. The Hong Kong Council of Social Service [dsf.org.hk] 9. HKCSS - HSBC Social Enterprise Business Centre [www.sobiz.hk] 10. Information Technology Resource Centre Limited [itrc.hkcss.org.hk] 11. Hong Kong Council on Smoking and Health [www.smokefree.hk] 12. Hong Kong Cyberport Management Company Limited [www.cyberport.hk] 13. Hong Kong Institute of Vocational Education [it.vtc.edu.hk] 14. Hong Kong Lutheran Social, LC-HKS - Shek Kip Mei Lutheran Centre for the Blind [smartlink.hklcb.org/index2.php] 15. Hong Kong Note Printing Limited [www.hknpl.com.hk] 16. Health, Safety and Environment Office, The Hong Kong Polytechnic University [www.polyu.edu.hk/hseo] 17. -

Notice of Listing of Products by Icap Sef (Us) Llc for Trading by Certification 1

NOTICE OF LISTING OF PRODUCTS BY ICAP SEF (US) LLC FOR TRADING BY CERTIFICATION 1. This submission is made pursuant to CFTC Reg. 40.2 by ICAP SEF (US) LLC (the “SEF”). 2. The products certified by this submission are the following: Fixed for Floating Interest Rate Swaps in CNY (the “Contract”). Renminbi (“RMB”) is the official currency of the Peoples Republic of China (“PRC”) and trades under the currency symbol CNY when traded in the PRC and trades under the currency symbol CNH when traded in off-shore markets. 3. Attached as Attachment A is a copy of the Contract’s rules. The SEF is listing the Contracts by virtue of updating the terms and conditions of the Fixed for Floating Interest Rate Swaps submitted to the Commission for self-certification pursuant to Commission Regulation 40.2 on September 29, 2013. A copy of the Contract’s rules marked to show changes from the version previously submitted is attached as Attachment B. 4. The SEF intends to make this submission of the certification of the Contract effective on the day following submission pursuant to CFTC Reg. 40.2(a)(2). 5. Attached as Attachment C is a certification from the SEF that the Contract complies with the Commodity Exchange Act and CFTC Regulations, and that the SEF has posted a notice of pending product certification and a copy of this submission on its website concurrent with the filing of this submission with the Commission. 6. As required by Commission Regulation 40.2(a), the following concise explanation and analysis demonstrates that the Contract complies with the core principles of the Commodity Exchange Act for swap execution facilities, and in particular Core Principle 3, which provides that a swap execution facility shall permit trading only in swaps that are not readily susceptible to manipulation, in accordance with the applicable guidelines in Appendix B to Part 37 and Appendix C to Part 38 of the Commission’s Regulations for contracts settled by cash settlement and options thereon. -

INTRODUCTION Indian Currency Rate Fluctuations and Comparison With

INTRODUCTION Indian currency rate fluctuations and comparison with Japanese yen, Chinese Yuan, British Pound and Euro, are the central issues of this thesis. The study will follow the United State Dollar as a base currency and will find out that which currency is more volatile and which currency is more stable within these more popular currencies which are mostly traded in the currency market. Currencies which we are referring over here are as follows: USD EURO JAPANESE YEN GREAT BRITAIN POUND CHINESE YAUN INDIAN RUPPE Most of the presently empirical literature on foreign exchange market follows either the stock market fluctuations or the export –import market analysis. But this thesis directly focused on the currency market volatility in the foreign exchange market, in particular these three key areas for the present research that are-price fluctuation in Indian currency market, Theoretical Economic equilibrium of currency market, INR we will compare with other four currency market volatility that are Japan, British, China and Europe, and lastly find out that which currency market is more stable out of these five markets. 1.1 Indian Foreign Exchange Market- Sam Y. Gross (1998, Federal Reserve Bank of New York), “Foreign exchange” refers to money denominated in the currency of another nation or group of nations. Any person who exchanges money denominated in his own nation‟s currency for money denominated in another nation‟s currency acquires foreign exchange.” Indian currency is the key part of the Indian Foreign Exchange Market and directly or indirectly the currency market affected to the other part of the foreign exchange market that are stock market and export – import market of India. -

Graduates Subsidy Programme 2021

Guidance Notes on Application for Green Employment Scheme: Graduates Subsidy Programme 2021 Preamble The purpose of Green Employment Scheme: Graduates Subsidy Programme 2021 (the Programme) is to provide subsidies to prospective employers of graduates of environment- related disciplines with a view to sustaining the provision of job opportunities for fresh graduates to work in environment-related areas as well as nurturing young people with environmental knowledge, talents and passion to meet the environmental needs of Hong Kong. Responsible Government Department 2. Environmental Protection Department (EPD) is responsible for the implementation of the Programme. Eligibility for the Programme 3. An applicant must be a holder of a valid business registration certificate and (a) has recently recruited an Eligible Graduate employee (see para.5 below) who reported duty on or after 1 April 2021; or (b) is in the process of recruiting; or (c) is planning to recruit at least one Eligible Graduate employee, to work on a full-time basis in an Eligible Job Place (see para.6 below). 4. An applicant without a valid business registration certificate and under the following circumstances will also be considered on a case-by-case basis: (a) Applicant registered in Company Registry with valid Company Registration Certificate; or (b) Applicant being a charitable institution under Section 88 of the Inland Revenue Ordinance; or (c) Applicant being an organization registered under the Societies Ordinance (Cap. 151). 5. An Eligible Graduate employee under the Programme must be: (a) a fresh graduate who has completed a Bachelor’s degree programme in a relevant environment-related subjectNote 1 from a Hong Kong higher education institution, or equivalent, in 2020 or 2021; (b) a Hong Kong Special Administrative Region (HKSAR) resident with a valid Hong Kong Identity Card; and Note 1 Environmental conservation, environmental science, environmental management, sustainable development or other subjects relevant to the duties of the Eligible Job Places. -

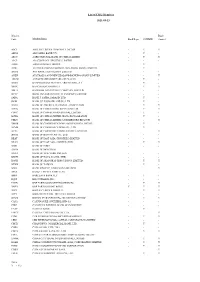

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

The Unicode Standard, Version 6.3

Currency Symbols Range: 20A0–20CF This file contains an excerpt from the character code tables and list of character names for The Unicode Standard, Version 6.3 This file may be changed at any time without notice to reflect errata or other updates to the Unicode Standard. See http://www.unicode.org/errata/ for an up-to-date list of errata. See http://www.unicode.org/charts/ for access to a complete list of the latest character code charts. See http://www.unicode.org/charts/PDF/Unicode-6.3/ for charts showing only the characters added in Unicode 6.3. See http://www.unicode.org/Public/6.3.0/charts/ for a complete archived file of character code charts for Unicode 6.3. Disclaimer These charts are provided as the online reference to the character contents of the Unicode Standard, Version 6.3 but do not provide all the information needed to fully support individual scripts using the Unicode Standard. For a complete understanding of the use of the characters contained in this file, please consult the appropriate sections of The Unicode Standard, Version 6.3, online at http://www.unicode.org/versions/Unicode6.3.0/, as well as Unicode Standard Annexes #9, #11, #14, #15, #24, #29, #31, #34, #38, #41, #42, #44, and #45, the other Unicode Technical Reports and Standards, and the Unicode Character Database, which are available online. See http://www.unicode.org/ucd/ and http://www.unicode.org/reports/ A thorough understanding of the information contained in these additional sources is required for a successful implementation. -

Exchange Rate Statistics

Exchange rate statistics Updated issue Statistical Series Deutsche Bundesbank Exchange rate statistics 2 This Statistical Series is released once a month and pub- Deutsche Bundesbank lished on the basis of Section 18 of the Bundesbank Act Wilhelm-Epstein-Straße 14 (Gesetz über die Deutsche Bundesbank). 60431 Frankfurt am Main Germany To be informed when new issues of this Statistical Series are published, subscribe to the newsletter at: Postfach 10 06 02 www.bundesbank.de/statistik-newsletter_en 60006 Frankfurt am Main Germany Compared with the regular issue, which you may subscribe to as a newsletter, this issue contains data, which have Tel.: +49 (0)69 9566 3512 been updated in the meantime. Email: www.bundesbank.de/contact Up-to-date information and time series are also available Information pursuant to Section 5 of the German Tele- online at: media Act (Telemediengesetz) can be found at: www.bundesbank.de/content/821976 www.bundesbank.de/imprint www.bundesbank.de/timeseries Reproduction permitted only if source is stated. Further statistics compiled by the Deutsche Bundesbank can also be accessed at the Bundesbank web pages. ISSN 2699–9188 A publication schedule for selected statistics can be viewed Please consult the relevant table for the date of the last on the following page: update. www.bundesbank.de/statisticalcalender Deutsche Bundesbank Exchange rate statistics 3 Contents I. Euro area and exchange rate stability convergence criterion 1. Euro area countries and irrevoc able euro conversion rates in the third stage of Economic and Monetary Union .................................................................. 7 2. Central rates and intervention rates in Exchange Rate Mechanism II ............................... 7 II. -

Growing with Stronger Foundations

BOC Hong Kong (Holdings) Limited Summary Financial Report 2003 Growing with Stronger Foundations This Summary Financial Report only gives a summary of the information and particulars contained in the “2003 Annual Report” (“annual report”) of the Company from which this Summary Financial Report is derived. Both the annual report and this Summary Financial Report are available (in both English and Chinese) on the Company’s website at www.bochkholdings.com. You may obtain, free of charge, 52/F Bank of China Tower, 1 Garden Road, Hong Kong a copy of the annual report (English or Chinese or both) from the Website: www.bochkholdings.com Company’s Share Registrar, Computershare Hong Kong Investor Services Limited, details of which are set out in Shareholder Information of this Summary Financial Report. Summary Financial Report 2003 Contents BOC Hong Kong (Holdings) Limited (“the Company”) was incorporated in Hong Kong 1 Financial Highlights on September 12, 2001 to hold the entire equity interest in Bank of China (Hong Kong) 2 Five-Year Financial Summary Limited (“BOCHK”), its principal operating 5 Chairman’s Statement subsidiary. Bank of China holds a substantial part of its interests in the shares of the 7 Chief Executive’s Report Company through BOC Hong Kong (BVI) Limited, an indirect wholly owned subsidiary 13 Management’s Discussion of Bank of China. and Analysis BOCHK is a leading commercial banking group in Hong Kong. With approximately 300 37 Corporate Information branches and about 450 ATMs and other 39 Board of Directors and delivery channels in Hong Kong, it offers a comprehensive range of financial products Senior Management and services to retail and corporate customers. -

MONEY in HONG KONG Money in Hong Kong

HONG KONG MONETARY AUTHORITY 55th Floor, Two International Finance Centre, 8 Finance Street, Central, Hong Kong Telephone: (852) 2878 8196 Facsimile: (852) 2878 8197 E-mail: [email protected] www.hkma.gov.hk MONEY IN HONG KONG Money in Hong Kong Hong Kong’s currency notes are issued by three commercial banks, except for the $10 notes which are issued by the Hong Kong SAR Government. Coins are also issued by the Government. All Hong Kong’s notes and coins are fully backed by US dollar reserves held in the Exchange Fund. Notes in Hong Kong Notes in everyday circulation in Hong Kong are in $10, $20, $50, $100, $500 and $1,000 denominations. The Government, through the Hong Kong Monetary Authority, has authorised three commercial banks, The Hongkong and Shanghai Banking Corporation Limited, the Standard Chartered Bank (Hong Kong) Limited, and the Bank of China (Hong Kong) Limited, to issue notes in Hong Kong other than the $10 notes. The Government began issuing a paper $10 note in 2002 to meet continuing demand from the public for a note in addition to the $10 coin. In 2007, the Government issued a polymer $10 note alongside the paper one. The $10 notes issued by two note-issuing banks in the 1990s remain legal tender, but are no longer printed. Coins in Hong Kong The Government issues $10, $5, $2, $1, 50-cent, 20-cent and 10- cent coins. There are two series of coins in circulation: the bauhinia series and the Queen’s Head series. The bauhinia series was introduced in 1993 to gradually replace the Queen’s Head series.