Fixed Income Investor Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

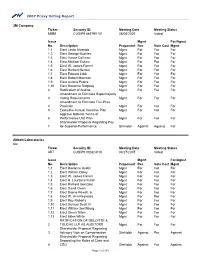

2007 Proxy Voting Report 3M Company Ticker Security ID: MMM

2007 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/08/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Rozanne Ridgway Mgmt For For For 2 Ratification of Auditor Mgmt For For For Amendment to Eliminate Supermajority 3 Voting Requirements Mgmt For For For Amendment to Eliminate Fair-Price 4 Provision Mgmt For For For 5 Executive Annual Incentive Plan Mgmt For For For Approve Material Terms of 6 Performance Unit Plan Mgmt For For For Shareholder Proposal Regarding Pay- 7 for-Superior-Performance ShrHoldr Against Against For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/27/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect Richard Gonzalez Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. -

Report of Investigation

REPORT OF INVESTIGATION UNITED STATES SECURITIES AND EXCHANGE COMMISSION OFFICE OF INSPECTOR GENERAL Investigation into Allegations of Improper Preferential Treatment and Special Access in Connection with the Division of Enforcement's Investigation of Citigroup, Inc. Case No. OIG-559 September 27,2011 This document is subjed to the provisions of th e Privacy Act of 1974, and may require redadion before disdosure to third parties. No redaction has betn performed by the Office of Inspedor Gmeral. Recipients of this report should not disseminate or copy it without the Inspector General's approval. " Report of Investigation Cas. No. OIG-559 Investigation into Allegations of Improper Preferential Treatment and Speeial Access in Connection with the Division of Enforcement's Investigation ofCitigroup, Inc. Table of Contents Introduction and Summary of Results ofthe Investigation ......................................... ..... .. I Scope of the Investigation................................................................................................... 2 Relevant Statutes, Regulations and Pol icies ....................................................................... 4 Results of the Investigation................................................. .. .............................................. 5 I. The Enforcement Staff Investigated Citigroup and Considered Various Charges and Settlement Options ........................................................................................... 5 A. The Enforcement Staff Opened an Investigation -

The TJX Companies, Inc. (Name of Registrant As Specified in Its Charter)

Table of Contents SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant o Check the appropriate box: x Preliminary Proxy Statement o Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) The TJX Companies, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement) Payment of Filing Fee (Check the appropriate box): x No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: Table of Contents 770 Cochituate Road Framingham, Massachusetts 01701 April , 2005 Dear Stockholder: We cordially invite you to attend our 2005 Annual Meeting on Tuesday, June 7, 2005, at 11:00 a.m., to be held in The Ben Cammarata Auditorium, located at our offices, 770 Cochituate Road, Framingham, Massachusetts. -

Lbex-Am 008597

CITIGROUP AGENDA Meeting Bank Participants Address Lehman's operating performance and risk management practices. • Introduce Brian Leach, CRO, who is new at Citi and in his role, to Ian and Paolo, as well as to the Firm. LBEX-AM 008597 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. Lehman Agenda NETWORK MANAGEMENT • Citi is ranked #1 in Asia, #2 in the US, and #3 in Europe in total operating fees paid by LEH. Fees exceed $30 MM p.a. Citi has been# 1 on the short list to be awarded new operating business due to to the substantial credit support provided until its action of June 12. Most recently, Citi was awarded our Brazilian outsourcing. Brian R. Leach Chief Risk Officer Citi Brian Leach assumed the role of Chief Risk Officer in March 2008, reporting to Citi's Chief Executive Officer, Vikram Pandit. Brian is also the acting Chief Risk Officer for the Institutional Clients Group. Citi is a leading global financial services company and has a presence in more than 100 countries, representing 90% of the world's GOP. The Citi brand is the most recognized in the financial services industry. Citi is known around the world for market leadership, global product excellence, outstanding talent, strong regional and product franchises, and commitment to providing the highest-quality service to its clients. Prior to becoming Citi's Chief Risk Officer, Brian was the co-COO of Old Lane. Brian, along with several former colleagues from Morgan Stanley, founded Old Lane LP in 2005. Earlier, he had worked for his LBEX-AM 008598 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. -

Q4 2007 Citigroup Inc. Earnings Conference Call on Jan. 15. 2008

FINAL TRANSCRIPT C - Q4 2007 Citigroup Inc. Earnings Conference Call Event Date/Time: Jan. 15. 2008 / 8:30AM ET www.streetevents.com Contact Us © 2008 Thomson Financial. Republished with permission. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written consent of Thomson Financial. FINAL TRANSCRIPT Jan. 15. 2008 / 8:30AM, C - Q4 2007 Citigroup Inc. Earnings Conference Call CORPORATE PARTICIPANTS Art Tildesley Citigroup Inc. - IR Vikram Pandit Citigroup Inc. - CEO Gary Crittenden Citigroup Inc. - CFO CONFERENCE CALL PARTICIPANTS Guy Moszkowski Merrill Lynch - Analyst Betsy Graseck Morgan Stanley - Analyst William Tanona Goldman Sachs - Analyst Mike Mayo Deutsche Bank - Analyst Meredith Whitney Oppenheimer - Analyst Glenn Schorr UBS - Analyst Richard Bove Punk, Ziegel - Analyst David Hilder Bear Stearns - Analyst PRESENTATION Operator Good morning, ladies and gentlemen and welcome to Citi©s fourth-quarter and full-year 2007 earnings review featuring Citi Chief Executive Officer, Vikram Pandit and Chief Financial Officer, Gary Crittenden. Today©s call will be hosted by Art Tildesley. We ask that you hold all questions until the completion of the formal remarks at which time you will be given instructions for the question and answer session. Also, as a reminder, this conference is being recorded today. If you have any objections, please disconnect at this time. Mr. Tildesley, you may begin. Art Tildesley - Citigroup Inc. - IR Thank you very much, operator and thank you all for joining us this morning. Welcome to our fourth-quarter 2007 earnings presentation. The presentation that we will be walking through is available on our website, so you will want to download that now if you haven©t already done so. -

Printmgr File

Citigroup Inc. 399 Park Avenue New York, NY 10043 March 13, 2007 Dear Stockholder: We cordially invite you to attend Citigroup’s annual stockholders’ meeting. The meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached proxy statement. Thank you for your support of Citigroup. Sincerely, Charles Prince Chairman of the Board and Chief Executive Officer This proxy statement and the accompanying proxy card are being mailed to Citigroup stockholders beginning about March 13, 2007. Citigroup Inc. 399 Park Avenue New York, NY 10043 Notice of Annual Meeting of Stockholders Dear Stockholder: Citigroup’s annual stockholders’ meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. You will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting. At the meeting, stockholders will be asked to ➢ elect directors, ➢ ratify the selection of Citigroup’s independent registered public accounting firm for 2007, ➢ act on certain stockholder proposals, and ➢ consider any other business properly brought before the meeting. The close of business on February 21, 2007 is the record date for determining stockholders entitled to vote at the annual meeting. -

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23 Citigroup Q3 2007 Earnings Call Transcript Citigroup, Inc. (C) Q3 2007 Earnings Call October 15, 20078:30 am ET Executives Art Tildesley - IR Charles Prince - Chairman, CEO Gary Crittenden - CFO Analysts Jason Goldberg - Lehman Brothers Betsy Graseck - Morgan Stanley Guy Moszkowski - Merrill Lynch Glenn Schorr - UBS John McDonald - Banc of AmericaSecurities Ron Mandle - GIC Mike Mayo - Deutsche Bank Meredith Whitney - CIBC World Markets Jeff Harte - Sandler O'Neill Vivek Juneja – JP Morgan Diane Merdian - KBW Operator Welcome to Citi's third quarter 2007 earnings reviewfeaturing Citi Chairman and Chief Executive Officer Charles Prince and ChiefFinancial Officer Gary Crittenden. Today's call will be hosted by ArtTildesley, Director of Investor Relations. (Operator Instructions) Mr.Tildesley, you may begin. Art Tildesley Thank you very much, operator and thank you all for joiningus today for our third quarter 2007 earnings presentation. We are going to walkyou through a presentation, that presentation is available on our website now,so if you haven't downloaded that, you want to do that now. The format we will follow will be Chuck will start the call,Gary will take you through our presentationand then we would be happy to answer any questions you may have. Before we get started, I would like to remind you thattoday's presentation may contain forward-looking statements. Citigroup'sfinancial results may differ materially from these statements, so please referto our SEC filings for a description of the factors that could cause our actualresults to differ from expectations. With that said, let me turn it over to Chuck. -

Senior Men's Club Newsletter

SENIOR MEN’S CLUB NEWSLETTER Vol . 33, No. 1 Website: SMCNC.ORG January, 2008 We’re Not Getting Old (with thanks to Walt Bork) Morris, an 82 year-old man, went to the doctor to get a physical. A few days later, the doctor saw Morris walking down the street with a gorgeous young woman on his arm. A couple of days later, the doctor spoke to Morris and said, “You’re really doing great, aren’t you?” Morris replied, “Just doing what you said, Doc, “Get a hot momma and be cheerful.’” The doctor said, “I didn’t say that. I said, ‘You’ve got a heart murmur. Be careful.’” ***************** Three old guys are out walking. First one says, “Windy, isn’t it?” Second one says, “No, it’s Thursday!” Third one says, “So am I. Let’s go get a beer.” ***************** A man was telling his neighbor, “I just bought a new hearing aid. It cost me four thousand dollars, but it’s state of the art. It’s perfect.” “Really,” answered the neighbor. “What kind is it?” “Twelve-thirty.” JANUARY SPEAKERS (Meetings are at 10:00 a.m. in Morrill Hall, St, Mark’s Church) Jan 4 Frederick Afragola, CEO of both The Bank of New Canaan and The Bank of Fairfield (In Organization), will address such issues as what happened to electronic banking, why we have more banks in our stable town, and what affect housing problems have on local banks. A resident of New Canaan for 37 years, Mr. Afragola was formerly Chairman and President of The Bank of New Canaan for five years. -

Marriott Alumni Magazine | Summer 2003

MARRIOTT ALUMNI MAGAZINE it’s all in the presentation Tolerance, Faith, & Politics 2002 Annual Report MARRIOTT SCHOOL OF MANAGEMENT | BRIGHAM YOUNG UNIVERSITY | SUMMER 2003 The 2003 Marriott School Hawes Scholars are (back row, left to right) Trent Bingham, Rob Ludlow, Russell Hardy, Paul Garver, Dave Coltrin, David Peterson, Steve Arner, (front row, left to right) Heather Bryce, Marissa Hatch, and Karen Peterson. Ten MBA candidates were named Hawes Scholars in January. The honor, which carries a cash award of $10,000, is the highest distinction given to MBA students at the school. Nominations for the Hawes Scholars are made by students and faculty and voted on by both groups. Final selection is made by the Hawes Scholar Committee. Selection is based on academic performance, leadership, maturity, and a commitment to high ethi- cal standards. CONTENTS alumni exchange trends at work speeches special feature What’s the best way to initiate and sustain a mentoring relationship? responses from where have all it’s all in the tolerance, 2002 annual 34alumni the ethics gone? 8 presentation 14 faith, & politics 29 report By Dean Ned C. Hill By Donald S. Smurthwaite Remarks from Oregon’s U.S. and Associate Deans Senator Gordon H. Smith W. Steve Albrecht and Lee T. Perry NEWS 2 dean’s message 24 alumni news The Strength of Our Alumni Network Alum and brother team up in business, and an alumna gets By Assistant Dean Joseph D. Ogden, External Relations acquainted with the southern lifestyle. Marriott School administrators visit Management Society chapters in Chile, 19 school news Argentina, and Brazil. -

Tinitrd ~Rates ~Rnatr

ELIZABETH WARREN UNITED STATES SENATE MASSACHUSETTS WASHINGTON, DC 20510-2105 P: 202-224-4543 COMMITIEES: 2400 JFK FEDERAL BUILDING BANKING, HOUSING, AND URBAN AFFAIRS 15 NEW SUDBURY STREET tinitrd ~rates ~rnatr BOSTON, MA 02203 HEALTH, EDUCATION, LABOR, AND PENS IONS P: 617- 565- 3170 ENERGY AND NATURAL RESOURCES 1500 MAIN STREET SUITE 406 SPECIAL COMMITTEE ON AGING SPRINGFIELD, MA 01103 September 15, 2016 P: 413- 788- 2690 www.warren.senate.gov The Honorable Michael E. Horowitz Department of Justice Inspector General 950 Pennsylvania Ave. NW, Suite 4706 Washington, DC 20530-0001 Dear Mr. Horowitz: I am writing to request an Inspector General review of the Department of Justice (DOJ) response to referrals made by the Financial Crisis Inquiry Commission (FCIC) for potential violations of securities laws identified during the FCIC's investigation of the causes of the 2008 financial and economic crisis in the United States. Thousands of FCIC documents were made public for the first time in March 2016. These documents reflect months of work by the FCIC, including hearings and testimony taken under oath, transcribed witness interviews, and thousands of documents collected voluntarily or under subpoena. A review of these documents conducted by my staff has identified 11 separate FCIC referrals of individuals or corporations to DOJ in cases where the FCIC found "serious indications of violation[ s]" of federal securities or other laws. 1 Nine individuals were implicated in these referrals (two were implicated twice). The DOJ has not filed any criminal prosecutions against any of the nine individuals. Not one of the nine has gone to prison or been convicted of a criminal offense. -

1.4.2021 Display.Indd

OUR TH YEAR www.slenterprise.com January 4, 2021 Volume , Number 24 $1.50 5O OF NOTE Jobless rate up a little, but job creation strong As the pandemic rages in Utah, the state’s unemployment rate responded with a slight uptick in November. The jobless rate went up to 4.3 percent from October’s 4.1 percent, according to numbers released Just holding it in by the Utah Department of Workforce Ser- Half of Utahns say they suf- vices (DWS). A quiet railroad spur sits near where offi cials envision the Utah Inland Port will be developed. The national unemployment rate fered from “quiet stress” in dropped from 6.9 percent in October to 6.7 2020, according to a survey by Although Salt Lake City's Northwest Quadrant will be the port's base of operations, developers expect a system of satellite ports throughout the state. percent in November. American Addiction Centers. “Utah’s job market continues to incre- Some widely known symptoms mentally improve with thousands of job of stress are visible outbursts, openings in multiple industries,” said Mark shouting, swearing and anger. By Excitement growing over rural Knold, chief economist at DWS. “Utah’s comparison, “quiet stress” can economy has shown itself to be one of cause an individual to underreact the nation’s best in re-employing workers. and not speak up about how they Utah's inclusion in Inland Port While the pace of job improvement has tem for moving goods through, into and out feel. Wyoming and Hawaii had slowed in the last few months, we antici- Brice Wallace of Utah. -

FINANCIAL CRISIS INQUIRY COMMISSION Interview of CHARLES O. PRINCE March 17, 2010 1285 Avenue of the Americas 9:30 A.M. C O

1 1 2 FINANCIAL CRISIS INQUIRY COMMISSION 3 4 Interview of CHARLES O. PRINCE 5 6 March 17, 2010 7 1285 Avenue of the Americas 8 9 9:30 a.m. 10 11 12 C O N F I D E N T I A L 13 14 15 16 17 18 19 20 21 22 23 24 25 Veritext National Deposition & Litigation Services 866 299-5127 2 1 A P P E A R A N C E S: 2 FINANCIAL CRISIS INQUIRY COMMISSION 3 1717 Pennsylvania Avenue NW, Suite 800 Washington, DC 20006 4 BY: BRADLEY J. BONDI, Assistant Director 5 and Deputy General Counsel KAREN DUBAS, paralegal 6 7 PAUL, WEISS, RIFKIND, WHARTON & GARRISON, 8 LLP On behalf of the Witness 9 1285 Avenue of the Americas New York, New York 10019 10 BY: BRUCE BIRENBOIM, ESQ. 11 BRAD S. KARP, ESQ. SUSANNA BUERGEL, ESQ. 12 JANE O'BRIEN, ESQ. 13 SKADDEN, ARPS, SLATE, MEAGHER & FLOM, LLP 14 On behalf of the Witness Four Times Square 15 New York, New York 10036 16 BY: JONATHAN J. LERNER, ESQ 17 18 19 20 21 22 23 24 25 Veritext National Deposition & Litigation Services 866 299-5127 3 1 Interview - CHARLES PRINCE 2 BY MR. BONDI: 3 Q Good morning, Mr. Prince. How 4 are you? 5 A Good morning. Well, thank you. 6 Q My name is a Brad Bondi. I am 7 with the Financial Crisis Inquiry Commission 8 in Washington. We were formed by Congress 9 to investigate the causes of the financial 10 crisis, both domestic and globally, and to 11 report on those causes in a report due 12 December 15, 2010, this year.