Citigroup Q2 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

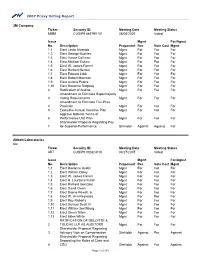

2007 Proxy Voting Report 3M Company Ticker Security ID: MMM

2007 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/08/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Rozanne Ridgway Mgmt For For For 2 Ratification of Auditor Mgmt For For For Amendment to Eliminate Supermajority 3 Voting Requirements Mgmt For For For Amendment to Eliminate Fair-Price 4 Provision Mgmt For For For 5 Executive Annual Incentive Plan Mgmt For For For Approve Material Terms of 6 Performance Unit Plan Mgmt For For For Shareholder Proposal Regarding Pay- 7 for-Superior-Performance ShrHoldr Against Against For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/27/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect Richard Gonzalez Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. -

Report of Investigation

REPORT OF INVESTIGATION UNITED STATES SECURITIES AND EXCHANGE COMMISSION OFFICE OF INSPECTOR GENERAL Investigation into Allegations of Improper Preferential Treatment and Special Access in Connection with the Division of Enforcement's Investigation of Citigroup, Inc. Case No. OIG-559 September 27,2011 This document is subjed to the provisions of th e Privacy Act of 1974, and may require redadion before disdosure to third parties. No redaction has betn performed by the Office of Inspedor Gmeral. Recipients of this report should not disseminate or copy it without the Inspector General's approval. " Report of Investigation Cas. No. OIG-559 Investigation into Allegations of Improper Preferential Treatment and Speeial Access in Connection with the Division of Enforcement's Investigation ofCitigroup, Inc. Table of Contents Introduction and Summary of Results ofthe Investigation ......................................... ..... .. I Scope of the Investigation................................................................................................... 2 Relevant Statutes, Regulations and Pol icies ....................................................................... 4 Results of the Investigation................................................. .. .............................................. 5 I. The Enforcement Staff Investigated Citigroup and Considered Various Charges and Settlement Options ........................................................................................... 5 A. The Enforcement Staff Opened an Investigation -

Final Consent Judgment As to Defendant Bank of America Corporation

EXHIBIT A UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, Plaintiff, 09 Civ. 6829 (JSR) 10 Civ. 0215 (JSR) -against- . ECF Cases BANK OF AMERICA CORPORATION, Defendant. FINAL CONSENT JUDGMENT AS TO DEFENDANT BANK OF AMERICA CORPORATION WHEREAS the Securities and Exchange Commission ("Commission") filed an Amended Complaint on October 19. 2009 in the civil action 09 Civ. 6829 (JSR) alleging that defendant Bank of America Corporation ("BAC") violated Section 14 of the Securities Exchange Act of 1934 ("Exchange Act"), and Rules 14a-3 and 1l4a-9 promulgated thereunder, as a result of its failure adequately to disclose, in connection with the proxy solicitation for the acquisition of Merrill Lynch & Co., Inc. ("Merrill"), information concerning Merri'll's payment of year-end bonuses (the "Bonus Case"); WHEREAS the Commission subsequently filed a Complaint on January 12, 2010 in the civil action 10 Civ. 0215 (JSR) alleging that BAC violated Section 14 of the Exchange Act and Rule 1l4a-9 thereunder as a result of its failure adequately to disclose, in connection with the proxy solicitation for the acquisition of Merrill, information concerning Merrill's losses in the fourth quarter of 2008 (the "Q4 Loss Case") (together with the Bonus Case, the "Actions"); WHEREAS BAC has executed the Consent annexed hereto and incorporated herein for the purpose of settling the Actions before the Court; and I WHEMREAS BAG has entered a general appearance in the Actions, consented to the Court's jurisdiction over it and the subject matter of the Actions, consented to the entry of this Final Consent Judgment as to Defendant Bank of America Corporation ("Final Judgment"), and waived any right to appeal from this Final Judgment in the Actions: I. -

The TJX Companies, Inc. (Name of Registrant As Specified in Its Charter)

Table of Contents SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant o Check the appropriate box: x Preliminary Proxy Statement o Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) The TJX Companies, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement) Payment of Filing Fee (Check the appropriate box): x No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: Table of Contents 770 Cochituate Road Framingham, Massachusetts 01701 April , 2005 Dear Stockholder: We cordially invite you to attend our 2005 Annual Meeting on Tuesday, June 7, 2005, at 11:00 a.m., to be held in The Ben Cammarata Auditorium, located at our offices, 770 Cochituate Road, Framingham, Massachusetts. -

Lbex-Am 008597

CITIGROUP AGENDA Meeting Bank Participants Address Lehman's operating performance and risk management practices. • Introduce Brian Leach, CRO, who is new at Citi and in his role, to Ian and Paolo, as well as to the Firm. LBEX-AM 008597 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. Lehman Agenda NETWORK MANAGEMENT • Citi is ranked #1 in Asia, #2 in the US, and #3 in Europe in total operating fees paid by LEH. Fees exceed $30 MM p.a. Citi has been# 1 on the short list to be awarded new operating business due to to the substantial credit support provided until its action of June 12. Most recently, Citi was awarded our Brazilian outsourcing. Brian R. Leach Chief Risk Officer Citi Brian Leach assumed the role of Chief Risk Officer in March 2008, reporting to Citi's Chief Executive Officer, Vikram Pandit. Brian is also the acting Chief Risk Officer for the Institutional Clients Group. Citi is a leading global financial services company and has a presence in more than 100 countries, representing 90% of the world's GOP. The Citi brand is the most recognized in the financial services industry. Citi is known around the world for market leadership, global product excellence, outstanding talent, strong regional and product franchises, and commitment to providing the highest-quality service to its clients. Prior to becoming Citi's Chief Risk Officer, Brian was the co-COO of Old Lane. Brian, along with several former colleagues from Morgan Stanley, founded Old Lane LP in 2005. Earlier, he had worked for his LBEX-AM 008598 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. -

The Big Short Author: Michael Lewis Extract

The Big Short Author: Michael Lewis Extract Prologue Poltergeist The willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grown-ups remains a mystery to me to this day. I was twenty-four years old, with no experience of, or particular interest in, guessing which stocks and bonds would rise and which would fall. Wall Street's essential function was to allocate capital: to decide who should get it and who should not. Believe me when I tell you that I hadn't the first clue. I'd never taken an accounting course, never run a business, never even had savings of my own to manage. I'd stumbled into a job at Salomon Brothers in 1985, and stumbled out, richer, in 1988, and even though I wrote a book about the experience, the whole thing still strikes me as totally preposterous - which is one reason the money was so easy to walk away from. I figured the situation was unsustainable. Sooner rather than later, someone was going to identify me, along with a lot of people more or less like me, as a fraud. Sooner rather than later would come a Great Reckoning, when Wall Street would wake up and hundreds, if not thousands, of young people like me, who had no business making huge bets with other people's money or persuading other people to make those bets, would be expelled from finance. When I sat down to write my account of the experience - Liar's Poker, it was called - it was in the spirit of a young man who thought he was getting out while the getting was good. -

Q4 2007 Citigroup Inc. Earnings Conference Call on Jan. 15. 2008

FINAL TRANSCRIPT C - Q4 2007 Citigroup Inc. Earnings Conference Call Event Date/Time: Jan. 15. 2008 / 8:30AM ET www.streetevents.com Contact Us © 2008 Thomson Financial. Republished with permission. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written consent of Thomson Financial. FINAL TRANSCRIPT Jan. 15. 2008 / 8:30AM, C - Q4 2007 Citigroup Inc. Earnings Conference Call CORPORATE PARTICIPANTS Art Tildesley Citigroup Inc. - IR Vikram Pandit Citigroup Inc. - CEO Gary Crittenden Citigroup Inc. - CFO CONFERENCE CALL PARTICIPANTS Guy Moszkowski Merrill Lynch - Analyst Betsy Graseck Morgan Stanley - Analyst William Tanona Goldman Sachs - Analyst Mike Mayo Deutsche Bank - Analyst Meredith Whitney Oppenheimer - Analyst Glenn Schorr UBS - Analyst Richard Bove Punk, Ziegel - Analyst David Hilder Bear Stearns - Analyst PRESENTATION Operator Good morning, ladies and gentlemen and welcome to Citi©s fourth-quarter and full-year 2007 earnings review featuring Citi Chief Executive Officer, Vikram Pandit and Chief Financial Officer, Gary Crittenden. Today©s call will be hosted by Art Tildesley. We ask that you hold all questions until the completion of the formal remarks at which time you will be given instructions for the question and answer session. Also, as a reminder, this conference is being recorded today. If you have any objections, please disconnect at this time. Mr. Tildesley, you may begin. Art Tildesley - Citigroup Inc. - IR Thank you very much, operator and thank you all for joining us this morning. Welcome to our fourth-quarter 2007 earnings presentation. The presentation that we will be walking through is available on our website, so you will want to download that now if you haven©t already done so. -

The Big Short: Inside the Doomsday Machine

The Big Short Inside the doomsday machine Also by Michael Lewis Home Game Liar's Poker The Money Culture Pacific Rift Losers The New New Thing Next Moneyball Coach The Blind Side EDITED BY MICHAEL LEWIS Panic The Big Short INSIDE THE DOOMSDAY MACHINE Michael Lewis W. W. NORTON & COMPANY NEW YORK LONDON Copyright (c) 2010 by Michael Lewis All rights reserved For information about permission to reproduce selections from this book, write to Permissions, W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, NY 10110 ISBN: 978-0-393-07819-0 W. W. Norton & Company, Inc. 500 Fifth Avenue, New York, N.Y. 10110 www.wwnorton.com W. W. Norton & Company Ltd. Castle House, 75/76 Wells Street, London W1T 3QT For Michael Kinsley To whom I still owe an article The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he knows already, without a shadow of doubt, what is laid before him.--Leo Tolstoy, 1897 Contents Prologue Poltergeist Chapter 1 A Secret Origin Story Chapter 2 In the Land of the Blind Chapter 3 "How Can a Guy Who Can't Speak English Lie?" Chapter 4 How to Harvest a Migrant Worker Chapter 5 Accidental Capitalists Chapter 6 Spider-Man at The Venetian Chapter 7 The Great Treasure Hunt Chapter 8 The Long Quiet Chapter 9 A Death of Interest Chapter 10 Two Men in a Boat Epilogue Everything Is Correlated Acknowledgments PROLOGUE Poltergeist The willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grown-ups remains a mystery to me to this day. -

Understanding the Financial Crisis Eamonn K

NORTH CAROLINA BANKING INSTITUTE Volume 13 | Issue 1 Article 3 2009 Wall Street Meets Main Street: Understanding the Financial Crisis Eamonn K. Moran Follow this and additional works at: http://scholarship.law.unc.edu/ncbi Part of the Banking and Finance Law Commons Recommended Citation Eamonn K. Moran, Wall Street Meets Main Street: Understanding the Financial Crisis, 13 N.C. Banking Inst. 5 (2009). Available at: http://scholarship.law.unc.edu/ncbi/vol13/iss1/3 This Article is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Banking Institute by an authorized administrator of Carolina Law Scholarship Repository. For more information, please contact [email protected]. WALL STREET MEETS MAIN STREET: UNDERSTANDING THE FINANCIAL CRISIS EAMONN K. MORAN* TABLE OF CONTENTS I. INTRODUCTION .............................................................................. 7 II. THE ORIGINS OF THE CREDIT CRISIS ...................................... 13 A. Federal Reserve Interest Rate Reductions ................. 13 B. The Nature of the Lender - Borrower Relationship ..... 15 C. Overextended Homeowners ........................................ 16 D. The Rise of Subprime Lending - The Essentials ..... 20 E. The Politics of Homeownership ................................... 25 F. The Current Housing Crisis: Reverberating Effects of Subprim e Lending ................................................... 30 III. FINANCIAL INNOVATION: THE GROWTH OF COMPLEX FINANCIAL INSTRUMENTS -

Printmgr File

Citigroup Inc. 399 Park Avenue New York, NY 10043 March 13, 2007 Dear Stockholder: We cordially invite you to attend Citigroup’s annual stockholders’ meeting. The meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached proxy statement. Thank you for your support of Citigroup. Sincerely, Charles Prince Chairman of the Board and Chief Executive Officer This proxy statement and the accompanying proxy card are being mailed to Citigroup stockholders beginning about March 13, 2007. Citigroup Inc. 399 Park Avenue New York, NY 10043 Notice of Annual Meeting of Stockholders Dear Stockholder: Citigroup’s annual stockholders’ meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. You will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting. At the meeting, stockholders will be asked to ➢ elect directors, ➢ ratify the selection of Citigroup’s independent registered public accounting firm for 2007, ➢ act on certain stockholder proposals, and ➢ consider any other business properly brought before the meeting. The close of business on February 21, 2007 is the record date for determining stockholders entitled to vote at the annual meeting. -

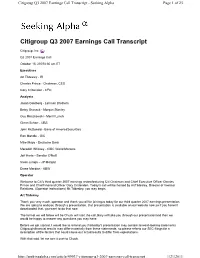

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23 Citigroup Q3 2007 Earnings Call Transcript Citigroup, Inc. (C) Q3 2007 Earnings Call October 15, 20078:30 am ET Executives Art Tildesley - IR Charles Prince - Chairman, CEO Gary Crittenden - CFO Analysts Jason Goldberg - Lehman Brothers Betsy Graseck - Morgan Stanley Guy Moszkowski - Merrill Lynch Glenn Schorr - UBS John McDonald - Banc of AmericaSecurities Ron Mandle - GIC Mike Mayo - Deutsche Bank Meredith Whitney - CIBC World Markets Jeff Harte - Sandler O'Neill Vivek Juneja – JP Morgan Diane Merdian - KBW Operator Welcome to Citi's third quarter 2007 earnings reviewfeaturing Citi Chairman and Chief Executive Officer Charles Prince and ChiefFinancial Officer Gary Crittenden. Today's call will be hosted by ArtTildesley, Director of Investor Relations. (Operator Instructions) Mr.Tildesley, you may begin. Art Tildesley Thank you very much, operator and thank you all for joiningus today for our third quarter 2007 earnings presentation. We are going to walkyou through a presentation, that presentation is available on our website now,so if you haven't downloaded that, you want to do that now. The format we will follow will be Chuck will start the call,Gary will take you through our presentationand then we would be happy to answer any questions you may have. Before we get started, I would like to remind you thattoday's presentation may contain forward-looking statements. Citigroup'sfinancial results may differ materially from these statements, so please referto our SEC filings for a description of the factors that could cause our actualresults to differ from expectations. With that said, let me turn it over to Chuck. -

Meredith Whitney CATCHING up with Al Visits

Meredith Whitney CATCHING UP WITH al visits. She and her husband, former Meredith Whitney WWE champion and now commen- tator and Fox News contributor, John The Wall Street superstar discusses her career and love of Bermuda. Layfield, have called it home for the past four years. MY PHILOSOPHY: I LOVE YOU, OR I DON’T KNOW YOU “Both John and I commute often “As a Brown University graduate, working on Wall Street wasn’t considered cool. to New York City,” said Whitney. My career has been a whirlwind. What I enjoy most about the industry is you are “Access from the East Coast is con- paid to learn. Since you are responsible for funding growing businesses, you venient. We can fly from JFK and be need knowledge on all industries and trends. It is a never-ending process. sitting on our front porch in Hamilton “Wall Street attracts some of the brightest minds, but it can bring bad behavior. I don’t know why. Sometimes it’s an act of desperation. within a couple of hours.” “When you start out, you don’t know who to trust and who the stand-outs are. You must be careful. Integrity counts. I have never wanted something so GO AHEAD, DITCH YOUR badly to change myself and break my principals. HUSBAND FOR THE DAY “Since the credit crisis, our financial system has been gummed-up. At some Known around the world for its pink point, the media [and public] will stop hating banks. We need them. sand beach, turquoise water, and “My muni bond call was controversial and required a lot of work.