Marriott Alumni Magazine

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

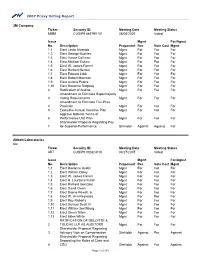

2007 Proxy Voting Report 3M Company Ticker Security ID: MMM

2007 Proxy Voting Report 3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/08/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Rozanne Ridgway Mgmt For For For 2 Ratification of Auditor Mgmt For For For Amendment to Eliminate Supermajority 3 Voting Requirements Mgmt For For For Amendment to Eliminate Fair-Price 4 Provision Mgmt For For For 5 Executive Annual Incentive Plan Mgmt For For For Approve Material Terms of 6 Performance Unit Plan Mgmt For For For Shareholder Proposal Regarding Pay- 7 for-Superior-Performance ShrHoldr Against Against For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/27/2007 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect Richard Gonzalez Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. -

OUTSULATION® Exterior Insulation and Finish System DUK202

OUTSULATION® Exterior Insulation and Finish System DUK202 The Facts: Dryvit Outsulation is unequaled for proven integrity and quality. • Structural Testing – Page 2 • MIL Standards Testing – Page 2 • ASTM Testing – other than fire – Page 2 • Federal Test Method Standard 141A – Page 3 • Insulation Board Analysis – Page 3 • Fire Testing: - Summary – Page 3 - Test Descriptions – Pages 4-5 - Conclusion – Page 5 • Building Code Listings and Approvals – Page 6 • National Accounts – Page 7 • Services – Page 8 - Research & Technology - Field & Technical - Prefabrication OUTSULATION THE FACTS: Testing As the pioneer and acknowledged leader of the EIFS industry, Dryvit UK Ltd. has always considered stringent testing of key importance to quality performance. Outsulation has been subjected to testing well beyond code minimums at national testing laboratories as well as at Dryvit’s own research, technology and manufacturing facilities – unparalleled in the industry. The data provided on the following pages will convince you that Dryvit demonstrates a full commitment to excellence in both product and performance. Such a commitment offers extraordinary peace of mind to the architect and developer specifying Outsulation. And only Dryvit Outsulation can show over 30 years of proven application results in North America – over 350,000 buildings, both new and retrofit construction. Dryvit products are designed to minimize upkeep. However, as with all building products, normal maintenance and cleaning are required. TEST METHOD RESULTS STRUCTURAL TESTING Positive and Negative ASTM E330 Tested to pressures in excess of Windloads 180 psf without loss of bond to the substrate. ASTM Salt Spray Resistance ASTM B117 300 hours. No deleterious effects. Freeze/Thaw ASTM C67 60 cycles. -

Report of Investigation

REPORT OF INVESTIGATION UNITED STATES SECURITIES AND EXCHANGE COMMISSION OFFICE OF INSPECTOR GENERAL Investigation into Allegations of Improper Preferential Treatment and Special Access in Connection with the Division of Enforcement's Investigation of Citigroup, Inc. Case No. OIG-559 September 27,2011 This document is subjed to the provisions of th e Privacy Act of 1974, and may require redadion before disdosure to third parties. No redaction has betn performed by the Office of Inspedor Gmeral. Recipients of this report should not disseminate or copy it without the Inspector General's approval. " Report of Investigation Cas. No. OIG-559 Investigation into Allegations of Improper Preferential Treatment and Speeial Access in Connection with the Division of Enforcement's Investigation ofCitigroup, Inc. Table of Contents Introduction and Summary of Results ofthe Investigation ......................................... ..... .. I Scope of the Investigation................................................................................................... 2 Relevant Statutes, Regulations and Pol icies ....................................................................... 4 Results of the Investigation................................................. .. .............................................. 5 I. The Enforcement Staff Investigated Citigroup and Considered Various Charges and Settlement Options ........................................................................................... 5 A. The Enforcement Staff Opened an Investigation -

The TJX Companies, Inc. (Name of Registrant As Specified in Its Charter)

Table of Contents SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant o Check the appropriate box: x Preliminary Proxy Statement o Definitive Proxy Statement o Definitive Additional Materials o Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) The TJX Companies, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement) Payment of Filing Fee (Check the appropriate box): x No fee required. o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: o Fee paid previously with preliminary materials. o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. 1) Amount Previously Paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: Table of Contents 770 Cochituate Road Framingham, Massachusetts 01701 April , 2005 Dear Stockholder: We cordially invite you to attend our 2005 Annual Meeting on Tuesday, June 7, 2005, at 11:00 a.m., to be held in The Ben Cammarata Auditorium, located at our offices, 770 Cochituate Road, Framingham, Massachusetts. -

Lbex-Am 008597

CITIGROUP AGENDA Meeting Bank Participants Address Lehman's operating performance and risk management practices. • Introduce Brian Leach, CRO, who is new at Citi and in his role, to Ian and Paolo, as well as to the Firm. LBEX-AM 008597 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. Lehman Agenda NETWORK MANAGEMENT • Citi is ranked #1 in Asia, #2 in the US, and #3 in Europe in total operating fees paid by LEH. Fees exceed $30 MM p.a. Citi has been# 1 on the short list to be awarded new operating business due to to the substantial credit support provided until its action of June 12. Most recently, Citi was awarded our Brazilian outsourcing. Brian R. Leach Chief Risk Officer Citi Brian Leach assumed the role of Chief Risk Officer in March 2008, reporting to Citi's Chief Executive Officer, Vikram Pandit. Brian is also the acting Chief Risk Officer for the Institutional Clients Group. Citi is a leading global financial services company and has a presence in more than 100 countries, representing 90% of the world's GOP. The Citi brand is the most recognized in the financial services industry. Citi is known around the world for market leadership, global product excellence, outstanding talent, strong regional and product franchises, and commitment to providing the highest-quality service to its clients. Prior to becoming Citi's Chief Risk Officer, Brian was the co-COO of Old Lane. Brian, along with several former colleagues from Morgan Stanley, founded Old Lane LP in 2005. Earlier, he had worked for his LBEX-AM 008598 CONFIDENTIAL TREATMENT REQUESTED BY LEHMAN BROTHERS HOLDINGS, INC. -

Q4 2007 Citigroup Inc. Earnings Conference Call on Jan. 15. 2008

FINAL TRANSCRIPT C - Q4 2007 Citigroup Inc. Earnings Conference Call Event Date/Time: Jan. 15. 2008 / 8:30AM ET www.streetevents.com Contact Us © 2008 Thomson Financial. Republished with permission. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written consent of Thomson Financial. FINAL TRANSCRIPT Jan. 15. 2008 / 8:30AM, C - Q4 2007 Citigroup Inc. Earnings Conference Call CORPORATE PARTICIPANTS Art Tildesley Citigroup Inc. - IR Vikram Pandit Citigroup Inc. - CEO Gary Crittenden Citigroup Inc. - CFO CONFERENCE CALL PARTICIPANTS Guy Moszkowski Merrill Lynch - Analyst Betsy Graseck Morgan Stanley - Analyst William Tanona Goldman Sachs - Analyst Mike Mayo Deutsche Bank - Analyst Meredith Whitney Oppenheimer - Analyst Glenn Schorr UBS - Analyst Richard Bove Punk, Ziegel - Analyst David Hilder Bear Stearns - Analyst PRESENTATION Operator Good morning, ladies and gentlemen and welcome to Citi©s fourth-quarter and full-year 2007 earnings review featuring Citi Chief Executive Officer, Vikram Pandit and Chief Financial Officer, Gary Crittenden. Today©s call will be hosted by Art Tildesley. We ask that you hold all questions until the completion of the formal remarks at which time you will be given instructions for the question and answer session. Also, as a reminder, this conference is being recorded today. If you have any objections, please disconnect at this time. Mr. Tildesley, you may begin. Art Tildesley - Citigroup Inc. - IR Thank you very much, operator and thank you all for joining us this morning. Welcome to our fourth-quarter 2007 earnings presentation. The presentation that we will be walking through is available on our website, so you will want to download that now if you haven©t already done so. -

Printmgr File

Citigroup Inc. 399 Park Avenue New York, NY 10043 March 13, 2007 Dear Stockholder: We cordially invite you to attend Citigroup’s annual stockholders’ meeting. The meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached proxy statement. Thank you for your support of Citigroup. Sincerely, Charles Prince Chairman of the Board and Chief Executive Officer This proxy statement and the accompanying proxy card are being mailed to Citigroup stockholders beginning about March 13, 2007. Citigroup Inc. 399 Park Avenue New York, NY 10043 Notice of Annual Meeting of Stockholders Dear Stockholder: Citigroup’s annual stockholders’ meeting will be held on Tuesday, April 17, 2007, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. You will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting. At the meeting, stockholders will be asked to ➢ elect directors, ➢ ratify the selection of Citigroup’s independent registered public accounting firm for 2007, ➢ act on certain stockholder proposals, and ➢ consider any other business properly brought before the meeting. The close of business on February 21, 2007 is the record date for determining stockholders entitled to vote at the annual meeting. -

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23

Citigroup Q3 2007 Earnings Call Transcript - Seeking Alpha Page 1 of 23 Citigroup Q3 2007 Earnings Call Transcript Citigroup, Inc. (C) Q3 2007 Earnings Call October 15, 20078:30 am ET Executives Art Tildesley - IR Charles Prince - Chairman, CEO Gary Crittenden - CFO Analysts Jason Goldberg - Lehman Brothers Betsy Graseck - Morgan Stanley Guy Moszkowski - Merrill Lynch Glenn Schorr - UBS John McDonald - Banc of AmericaSecurities Ron Mandle - GIC Mike Mayo - Deutsche Bank Meredith Whitney - CIBC World Markets Jeff Harte - Sandler O'Neill Vivek Juneja – JP Morgan Diane Merdian - KBW Operator Welcome to Citi's third quarter 2007 earnings reviewfeaturing Citi Chairman and Chief Executive Officer Charles Prince and ChiefFinancial Officer Gary Crittenden. Today's call will be hosted by ArtTildesley, Director of Investor Relations. (Operator Instructions) Mr.Tildesley, you may begin. Art Tildesley Thank you very much, operator and thank you all for joiningus today for our third quarter 2007 earnings presentation. We are going to walkyou through a presentation, that presentation is available on our website now,so if you haven't downloaded that, you want to do that now. The format we will follow will be Chuck will start the call,Gary will take you through our presentationand then we would be happy to answer any questions you may have. Before we get started, I would like to remind you thattoday's presentation may contain forward-looking statements. Citigroup'sfinancial results may differ materially from these statements, so please referto our SEC filings for a description of the factors that could cause our actualresults to differ from expectations. With that said, let me turn it over to Chuck. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C

Table of Contents SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the quarterly period ended September 9, 2005. OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-14625 HOST MARRIOTT CORPORATION (Exact Name of Registrant as Specified in Its Charter) Maryland 53-0085950 (State of Incorporation) (I.R.S. Employer Identification No.) 6903 Rockledge Drive, Suite 1500, Bethesda, Maryland 20817 (Address of Principal Executive Offices) (Zip Code) (240) 744-1000 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). x Yes ¨ No Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No The registrant had 353,459,131 shares of its $0.01 par value common stock outstanding as of October 13, 2005. Table of Contents INDEX PART I. FINANCIAL INFORMATION Page No. Item 1. Financial Statements (unaudited): Condensed Consolidated Balance Sheets- September 9, 2005 and December 31, 2004 3 Condensed Consolidated Statements of Operations- Quarter Ended and Year-to-Date Ended September 9, 2005 and September 10, 2004 4 Condensed Consolidated Statements of Cash Flows- Year-to-Date Ended September 9, 2005 and September 10, 2004 5 Notes to Condensed Consolidated Financial Statements 7 Item 2. -

The Hot Shoppes History

THE MONTGOMERY COUNTY SUMMER 2018 VOL. 61 STORY NO. 1 MONTGOMERY COUNTY’S PERIODICAL FOR HISTORICAL RESEARCH Mighty Mos in Montgomery County: ƋäDĩő ĂĩłłäʼnDĆʼnőĩŅű By Katie Dishman MONTGOMERY Administrative Office: 301-340-2825 /0:;69@ Library: 301-340-2974 465;.64,9@*6<5;@/0:;690*(3:6*0,;@ [email protected] • MontgomeryHistory.org Montgomery History envisions an active intellectual life rooted in an understanding and appreciation of our individual and collective histories. Its mission is to collect, preserve, interpret, and share the histories of all of Montgomery County’s residents and communities. The Montgomery County Story, in publication since 1957, features scholarly articles on topics of local interest. It is the only journal solely devoted to research on Montgomery County, Maryland’s rich and colorful past. Montgomery County Story Editorial Board Eileen McGuckian, Editor Janine Boyce Linda Kennedy Robert Plumb Jane Burgess 1EƃLI[0SKER Cara Seitchek Montgomery History Board of Directors Larry Giammo, President (ERMIP([]IV, Vice President Barbara Kramer, Treasurer Marylin Pierre, Counsel Robert Bachman Fred Evans Steve Roberts Karla Silvestre Barbara Boggs Sue Reeb Cara Seitchek Staff 1EƃLI[0SKER, Executive Director Sarah Hedlund$DaZjYjaYf9j[`anakl Clarence Hickey, Speakers Bureau Coordinator Elizabeth Lay, Collections Manager Kurt Logsdon, Weekend Coordinator Anna Nielsen, Outreach & Communications Manager Laura Riese$GŸ[]Emk]meK`ghEYfY_]j /EXLEVMRI7XI[EVX, Director of Development PHOTO CREDITS: All photos courtesy of the -

Filed by Host Marriott Corporation Pursuant To

Filed by Host Marriott Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Starwood Hotels & Resorts Commission File No.: 333-130249 Information about the Proposed Transactions and Where to Find It In connection with the proposed transactions, Host Marriott Corporation filed a proxy statement/prospectus as part of a registration statement on Form S-4 on March 2, 2006 and other documents regarding the proposed transactions with the Securities and Exchange Commission (“SEC”). Investors and security holders are urged to read the proxy statement/prospectus (and all amendments and supplements to it) because it contains important information about Host Marriott Corporation, Starwood Hotels & Resorts and the proposed transactions. The definitive proxy statement/prospectus was first mailed to stockholders of Host Marriott Corporation on or about March 6, 2006 seeking their approval of the issuance of shares of Host Marriott Corporation common stock in the transactions contemplated by the master agreement. Investors and security holders may obtain a free copy of the proxy statement/prospectus and other documents filed by Host Marriott Corporation with the SEC at the SEC’s web site at www.sec.gov. The definitive proxy statement/prospectus and other relevant documents may also be obtained free of cost by directing a request to Host Marriott Corporation, 6903 Rockledge Drive, Suite 1500, Bethesda, MD 20817, Attention Investor Relations, (telephone 240-744-1000). Investors and security holders are urged to read the proxy statement/prospectus and other relevant material before making any voting or investment decisions with respect to the proposed transactions. -

Marriott 2015 Annual Report

Marriott International, Inc. 2015 Annual Report Tour our interactive Annual Report at Marriott.com/investor. Letter to Shareholders J.W. Marriott, Jr. Arne M. Sorenson Executive Chairman and Chairman of the Board President and Chief Executive Officer Dear Shareholders, 2015 was a great year for Marriott International. Diluted earnings per share totaled $3.15, an increase of 24 percent over the prior year. Adjusted earnings before interest, taxes, depreciation and amortiza- tion (Adjusted EBITDA) rose 13 percent to $1.7 billion. In 2015, adjusted operating income margin increased to 47 percent, a 5 percentage point improvement over 2014, and return on invested capital reached a record 49 percent.1 Revenue Per Available Room (RevPAR) for the More than 28 percent of our worldwide gross room company’s comparable systemwide properties nights booked in 2015 came through our digital increased just over 5 percent in 2015 on a constant platforms Marriott.com and Marriott Mobile. These dollar basis, and average daily rates rose 4 percent. platforms not only deliver the finest service to our In North America, systemwide RevPAR also grew guests, they are also our most cost-effective book- more than 5 percent while occupancy reached a ing channels. Our new Marriott Mobile app alone record 74 percent. exceeded $1 billion in gross bookings in 2015. 1 Adjusted EBITDA, adjusted operating income margin, and return on invested capital are “non-GAAP financial measures.” See pages 30-31 and 97-98 for an explanation of why we believe these financial measures are meaningful and reconciliations of these measures to the most directly comparable measures under generally accepted accounting principles.