Case Study on the Gautrain

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Our Journey to a Better Gauteng

GAUTRAIN - OUR JOURNEY TO A BETTER GAUTENG The goal of the Gautrain was not only to radically upgrade public transport in the Province, thereby making a contribution to the goals and objectives of a large range of national and provincial policy plans, but also to improve the economy of the Province and the quality of life of the people of Gauteng. Changing demographics Growing urbanisation and population numbers mean additional pressure on present transport infrastructure and future capacity. The Gautrain will continue to contribute to the future of the country and the province and through the role in can play to give impetus to national policy initiatives such as the National Development Plan and the Integrated Transport Master Plan. NDP milestones to achieve How the Gautrain can contribute to achieving these milestones South Africa’s visions for 2030 Increasing With operations of the Gautrain already supporting in excess of 6 000 jobs, future growth in employment passenger numbers and the extension of the Gautrain, as well localisation of rolling stock maintenance and building of rolling stock, can increase this number dramatically. For every R1m invested in future expansion, approximately an extra 5 jobs can be created. Increase per capita Over and above the 22% of income flowing to lower income households, expanding the income, specifically public transport network will create further opportunities for the unemployed to be able to for lower income access work opportunities. households Competitive base of Improving the quality of infrastructure, in particular the quality of public transport, could infrastructure and only improve South Africa’s competitiveness position. -

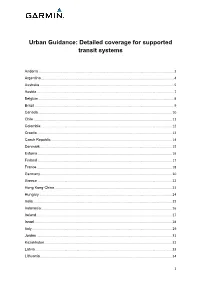

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia ................................................................................................................................................. -

Gautrain Rapid Rail Link - the Project Concept

GAUTRAIN RAPID RAIL LINK - THE PROJECT CONCEPT E. van der Merwe*, GM Negota**, OAW van Zyl** * Superintendent General and Head of Department, Gauteng Department of Transport and Public Works, Private Bag X83, MARSHALLTOWN, 2107, Tel. (011) 355 7300, Fax (011) 355 7304, e-mail: [email protected] ** Khuthele Projects, PO Box 1237, PRETORIA, 0001, Tel. (012) 430 9966, Fax (012) 342 3922, e-mail: [email protected] INTRODUCTION In February 2000 Gauteng Premier, Mbazima Shilowa, announced the new Gautrain Rapid Rail Link between Johannesburg, Pretoria and Johannesburg International Airport (JIA) as one of the ten Spatial Development Initiatives (SDIs), now called Blue IQ projects. At the end of April 2000 a consortium of consulting companies was appointed to assist the Department of Transport and Public Works with the execution of the project. Since then good progress has been made, as will be described in this paper. This project is an important project for Gauteng and South Africa, and also unique in the sense that it will be the first of such modern metropolitan or regional rail systems to be provided and operated in Southern Africa. It is however in line with a world-wide trend towards such passenger rail systems. The number of metros globally increased from 25 in 1960 to 54 in 1980 and 100 in 2000. In 1998 there were 62 major airports in the world with passenger rail access and another 116 were being planned. The latter increased to more than 140 in 2001. The above are in developed and developing countries. This paper is one of four papers at this Conference dealing with the Gautrain project. -

Train Schedule North - South Line

Train Schedule North - South Line Monday to Friday Weekend and Public Holidays South to North North to South South to North North to South Depart Depart Depart Depart Depart Depart Depart Arrive Depart Depart Depart Depart Depart Depart Depart Arrive Depart Depart Depart Depart Depart Depart Depart Arrive Depart Depart Depart Depart Depart Depart Depart Arrive Park Rosebank Sandton Marlboro Midrand Centurion Pretoria Hatfield Hatfield Pretoria Centurion Midrand Marlboro Sandton Rosebank Park Park Rosebank Sandton Marlboro Midrand Centurion Pretoria Hatfield Hatfield Pretoria Centurion Midrand Marlboro Sandton Rosebank Park 05:30 05:34 05:38 05:42 05:49 05:58 06:06 06:12 05:26 05:33 05:40 05:49 05:55 06:00 06:04 06:08 05:30 05:34 05:38 05:42 05:49 05:58 06:06 06:12 05:26 05:33 05:41 05:49 05:56 06:00 06:04 06:08 05:50 05:54 05:58 06:02 06:09 06:18 06:26 06:32 05:46 05:53 06:00 06:09 06:15 06:20 06:24 06:28 06:00 06:04 06:08 06:12 06:19 06:28 06:36 06:42 05:56 06:03 06:11 06:19 06:26 06:30 06:34 06:38 06:10 06:14 06:18 06:22 06:29 06:38 06:46 06:52 05:56 06:03 06:10 06:19 06:25 06:30 06:34 06:38 06:30 06:34 06:38 06:42 06:49 06:58 07:06 07:12 06:26 06:33 06:41 06:49 06:56 07:00 07:04 07:08 06:20 06:24 06:28 06:32 06:39 06:48 06:56 07:02 06:06 06:13 06:20 06:29 06:35 06:40 06:44 06:48 07:00 07:04 07:08 07:12 07:19 07:28 07:36 07:42 06:56 07:03 07:11 07:19 07:26 07:30 07:34 07:38 06:30 06:34 06:38 06:42 06:49 06:58 07:06 07:12 06:16 06:23 06:30 06:39 06:45 06:50 06:54 06:58 07:30 07:34 07:38 07:42 07:49 07:58 08:06 08:12 07:26 07:33 07:41 -

La RATP Expérimente, À Partir De Mai 2012, Une Station De Bus Du Futur

DOSSIER DE PRESSE 22 mai 2012 www.ebsf.eu La RATP expérimente, à partir de mai 2012, une station de bus du futur dans le cadre du projet européen EBSF, coordonné par l’UITP et dans la continuité de sa démarche de recherche Osmose Engagée dans une démarche ambitieuse de recherche sur les espaces de transport du futur, appelée Osmose, la RATP expérimente, à partir du 22 mai, une station de bus pilote, boulevard Diderot à Paris, dans le cadre du projet européen EBSF (European Bus System of the Future). Cette réalisation concrète traduit la vision de la RATP sur la place qu’une station de bus conséquente peut occuper dans l’espace urbain, en tant que lieu multifonc- tionnel assurant une meilleure qualité de service aux voyageurs, aux passants et aux riverains. Son objectif volontariste est de contribuer à nourrir les réflexions des acteurs impliqués dans les problématiques des espaces de transport de surface, notamment les municipalités en charge de l’espace public, et les fournis- seurs de mobilier urbain. 1 1. La démarche Osmose de la RATP Pour rendre visible sa conception des futurs espaces de transport, et leur synergie avec les espaces urbains, la RATP s’est engagée dès 2009 dans une démarche baptisée Osmose. Cette action de recherche vise à promouvoir des aménagements urbains durables, une amélioration des fonctionnalités et des services rendus aux voyageurs, une qualité d’architecture, de design et de paysage urbain. Dans un premier temps, la RATP s’est consacrée aux stations de métro dans la perspective du Grand Paris, et a présenté en mai 2010 les résultats de ses travaux, fruits d’une collaboration avec trois agences d’architectes. -

Casablanca Tramway Opens Its Doors to Optimization

GOAL SYSTEMS — SEPTEMBER 2012 — The Most Advanced Software for the Optimization of the Transport Operations Casablanca Tramway opens its doors to Optimization CasaTram, operated by the RATP Group, is ready to begin operation of Casablanca's light rail using the GoalRail® metro planning system SEPTEMBER 2012 — Casablanca, MOROCCO. This sys- tem's first 30-kilometer long tram route is expected to begin operation on 12/12/12. It will connect the city's main neighborhoods located east and southwest of the downtown district, and will have 49 stations. It is estimated that 250,000 passengers will take ad- vantage of this new service each day. The goal is to re- duce accidents and delays while offering rapid, on-time, and accessible light rail transport, at an affordable price. To achieve these objectives, GOAL SYSTEMS will be in charge of carrying out the best planning and opti- mizing all operations using GoalRail® metro and GoalStaff® software. Casablanca's transit authority, Casa Transports, has awarded a five-year contract to RATP's subsidiary com- pany RATP Développement, for operation and maintenance of the city's first Light Rail line, as well as for overseeing the preparation phases for operations and personnel. From the very beginning, RAPT Développement chose GOAL SYSTEMS to work jointly in providing optimized scheduling for the Casablanca light rail operations, once again relying upon the mutual trust and confidence developed during earlier projects such as the Algiers light rail system in Algeria and the Gautrain system that con- nects Pretoria and Johannesburg in South Africa. Goes to Page 02 Optimal planning for the 2700 buses of Consorcio Express MiBus obtains the best scheduling in Panamá Consorcio Express is now using GoalBus® and GoalDriver® to schedule its operations for Bogotá's SITP system Panama's Metrobus achieves substantial SEPTEMBER 2012 — Bogota, COLOMBIA. -

FINANCIAL and CSR REPORT Attestation of the Persons Responsible for the Annual Report

2015 FINANCIAL AND CSR REPORT Attestation of the persons responsible for the annual report We, the undersigned, hereby attest that to the best of our knowledge the financial statements have been prepared in accordance with generally accepted accounting principles and give a true and fair view of the assets, liabilities, financial position and results of operations of the Company and of all consolidated companies, and that the management report attached here to presents a true and fair picture of the financial position of the Company and of all consolidated companies as well as a description of the main risks and contingencies facing them. Chairwoman and Chief Executive Officer Élisabeth Borne Chief Financial Officer Alain Le Duc CONSOLIDATED CONTENTS FINANCIAL STATEMENTS • Statutory Auditors’ report 63 MANAGEMENT Consolidated statements of REPORT comprehensive income 64 • Consolidated balance sheets 65 Financial results 4 Consolidated statements of cash flows66 Workforce, environmental and social information 11 Consolidated statements of changes in equity 67 Note on extra-financial reporting methodology Notes to the consolidated Financial year 2015 34 financial statements 68 Report by one of the Statutory Auditors 36 FINANCIAL STATEMENTS REPORT BY THE • PRESIDENT Statutory Auditors’ report 121 • Balance sheet 122 The Board of Directors 39 Income statement 124 Risk management and internal control and audit functions 43 Notes to the financial statements 126 Appendices 55 Statutory Auditors’ report 61 MANAGEMENT REPORT Financial results 4 Workforce, environmental and social information 11 Note on extra-financial reporting methodology Financial year 2015 34 Report by one of the Statutory Auditors 36 ORGANIZATIONAL CHART OF THE RATP GROUP – DECEMBER 31, 2015 TELCITÉ 100% TELCITÉ NAO 100% ReAl PROPeRT. -

2017 Financial and CSR Report Attestation of the Persons Responsible for the Annual Report

2017 Financial and CSR Report Attestation of the persons responsible for the annual report We, the undersigned, hereby attest that to the best of our knowledge the financial statements have been prepared in accordance with generally-accepted accounting principles and give a true and fair view of the assets, liabilities, financial position and results of the company and of all consolidated companies, and that the management report attached hereto presents a true and fair picture of changes to the business, the results and the financial position of the company and of all consolidated companies as well as a description of the main risks and contingencies facing them. Paris, 23 March 2018. Chairwoman and CEO Catherine Guillouard Chief Financial Officer Alain Le Duc CONTENTS Management Consolidated report fi nancial statements RATP group organisation chart 5 2017 financial results 6 Statutory Auditors’ report on the consolidated financial Social, environmental statements 89 and societal information 17 Consolidated statements Note on methodology of comprehensive income 93 for the extra-financial report 50 Consolidated balance sheets 95 Report by one of the Statutory Auditors 54 Consolidated statements of cash flows 96 Internal control relating to the preparation and treatment Consolidated statements of accounting and financial of changes in equity 97 reporting 57 Notes to the consolidated Risk management and internal financial statements 98 control and audit functions 63 Corporate Financial governance statements report Statutory Auditors’ report on the financial statements 153 Composition of the Board of Directors EPIC balance sheet 156 and terms of office 77 EPIC income statement 157 Role of the Board of Directors 77 Notes to the financial Compensation and benefits 78 statements 158 Appendices 78 ƙƗƘƞ FINANCIAL AND CSR REPORT ş ƚ 2017 management report RATP group organisation chart p. -

Transport Dossier De Presse RATP

Le transport public, notre métier Édition : février 2011 Édition Le transport public RATP Dev partenaire 29 filiales des collectivités en France et une présence dans notre 12 pays à l’international métierRATP Dev assure l’exploitation et la maintenance Une offre adaptée aux besoins des collectivités Nous intervenons dans les situations les plus variées, avec des offres systématiquement de réseaux de transport urbains et interurbains adaptées à vos environnements et problématiques locales. (bus, cars, tramways, réseaux ferrés et métro). Un savoir-faire et une expertise prouvés Nous sommes présents dans plus de 30 villes, Nous maîtrisons toutes les composantes de notre métier : conception et exploitation agglomérations et départements, en France de réseaux multimodaux (Bus, Métro, RER, Tramway), maintenance, sécurité, information des voyageurs, billettique, tarification, marketing client, etc. et dans de nombreux pays sur 4 continents. Forts de l’expérience et de l’expertise sans égales Des services aux coûts maîtrisés Nos spécialistes sont en mesure de vous proposer des choix techniques, économiques du groupe RATP, nous vous proposons des solutions et socialement responsables. La richesse et la diversité de nos expériences sont autant performantes, fiables et innovantes. de gages de notre efficacité et d’un service de qualité pour nos voyageurs. Efficaces, réactives et à l’écoute des besoins Une équipe à taille humaine de leurs clients, nos équipes de terrain déploient Nous vous apportons le dynamisme, la flexibilité et la culture entrepreneuriale de filiales de terrain dont les équipes peuvent en retour compter sur l’appui, les compétences quotidiennement leur savoir-faire pour développer, et la stabilité d’un leader mondial du transport public. -

Groupe Ratp Fi Rse 2020.Pdf

Attestation des personnes assumant la responsabilité du rapport financier annuel Nous attestons que, à notre connaissance, les comptes sont établis conformément aux normes comptables applicables et donnent une image fidèle du patrimoine, de la situation financière et du résultat de la société et de l’ensemble des entreprises comprises dans le périmètre de consolidation, et que le rapport de gestion ci-joint présente un tableau fidèle de l’évolution des affaires, des résultats et de la situation financière de la société et de l’ensemble des entreprises comprises dans le périmètre de consolidation ainsi qu’une description des principaux risques et incertitudes auxquels elles sont confrontées. Paris, le 12 mars 2021 La présidente-directrice générale Catherine Guillouard Le directeur financier Jean-Yves Leclercq Édito 4 La raison d’être du groupe RATP 6 Le groupe RATP aujourd’hui 8 Nos cinq expertises 10 Notre modèle de création Comptes de valeur 12 111 Organigramme du Groupe 14 consolidés Rapport des commissaires aux comptes sur les comptes consolidés 112 Rapport État du résultat global 116 Bilan consolidé 118 de gestion 15 Tableau des flux de trésorerie consolidés 119 Résultats financiers 16 Tableau de variation Contrôle interne des capitaux propres 120 et gestion des risques 32 Annexe aux comptes consolidés 121 Déclaration de performance extra-financière 51 Comptes sociaux 169 Rapport des commissaires aux comptes sur les comptes annuels 170 Rapport Bilan Epic 173 de gouvernement Compte de résultat Epic 174 d’entreprise 101 Annexe aux comptes -

Our Mobility Solutions for the Future of Your Regions

Our mobility solutions for the future of your regions 2 As a major player in all forms of mobility, we want to work with you to transform cities and take on an unprecedented challenge: provide a growing population with innovative mobility solutions, while respecting major economic, social and environmental balances. RATP Group has been a partner to elected representatives and transport authorities in France and around the world for numerous years, its teams attuned to their requirements and providing their skills. We are convinced that we are moving towards a better city. And we are so convinced of this that it has become our signature. We believe in the future of the smart city because we trust its ability to constantly reinvent itself. Its density, complexity and continuous transformation are our natural element. What is our job? To take up the challenges of mass transit while applying the highest possible level of safety and reliability. To develop tailor-made mobility solutions for the benefit of all, using the full range of multimodal transport services. And, finally, to use an inclusive, responsible and sustainable approach to incrust our activities into the urban fabric. Cities all over the world are moving forward and we will always be there to support them. Today, RATP Group at a glance… GLOBAL 16 million Present in journeys every 14 countries day, including across 12 million in the 4 continents Île-de-France region MULTIMODAL 8 modes Metro Tram Urban and Rail Sightseeing Demand- Cable Maritime interurban responsive cars shuttles buses transport 4 partnerships Scooters Carpooling Car sharing Autonomous vehicles BROAD-BASED EXPERTISE Builder of the smart, sustainable city 2 OUR EXPERTISE Urban mobility Infrastructure RATP Group has developed unique management time-honoured expertise as a multimodal French authorities have selected RATP as operator and is a world leader in urban the infrastructure manager for the Metro Urban services mobility. -

Global Mass Transit Report Information and Analysis on the Global Mass Transit Industry

NOVEMBER 2009 VOLUME I, ISSUE 1 Global Mass Transit Report Information and analysis on the global mass transit industry Contactless Ticketing in Mass Transit Mass Transit in South Africa A win-win solution for all stakeholders Governments invest heavily in transport infrastructure ith its myriad of advantages such as lower transaction costs, faster transaction speeds and multi-functionality, W s governments around the world acknowledge the contactless smart ticketing is the future of the global mass- important role that public transport plays in improving the transportation industry. Already operational in key metropolitan A quality of life, there is a global trend for increased investment in areas such as Hong Kong, London, Seoul, Washington D.C. and this important infrastructure sector. A commitment to upgrade Shanghai, contactless smart ticketing offers a win-win solution and expand mass transit systems has risen across the Americas, for transit operators and users, contactless technology developers Europe, Asia, and now in Africa as well. Taking the lead in Africa and financial institutions. is its biggest economy South Africa. Today, virtually all transit-fare payment systems in the For many years, South Africa boasted of the best transport delivery and procurement stages are opting for contactless infrastructure in the African continent. However, over the last ticketing as the primary medium. India’s Mumbai metro, which few years the transport infrastructure has been deteriorating. This is expected to become operational in 2011, will be equipped with is essentially owing to short sightedness and lack of continued a system based on contactless technology with reusable smart investment. It is only now that the transport sector has begun tickets.