November 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

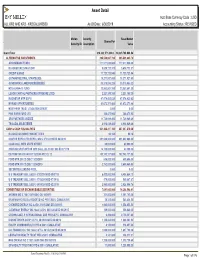

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 6/30/2019 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 6/30/2019 Accounting Status : REVISED Mellon Security Base Market . Shares/Par Security ID Description Value Grand Total 214,322,571,803.0.. 18,225,768,088.54 ALTERNATIVE INVESTMENTS 395,539,667.780 395,539,665.78 ARROWMARK FUND I 177,577,920.000 177,577,920.00 BLACKSTONE STRAT OPP 5,629,722.370 5,629,722.37 CREDIT SUISSE 11,723,723.940 11,723,723.94 GOTHAM NEUTRAL STRATEGIES 18,271,927.600 18,271,927.60 GOVERNORS LANE FUNDÉÉÉÉÉÉÉÉ 30,370,085.220 30,370,085.22 H2O ALPHA-10 FUND 23,983,801.350 23,983,801.35 LUXOR CAPITAL PARTNERS OFFSHORE LTDD 2,221,195.350 2,221,195.35 MAGNETAR MTP EOF II 47,074,425.620 47,074,425.62 MYRIAD OPPORTUNITIES 61,672,371.480 61,672,371.48 NORTHERN TRUST LITIGATION CREDIT 2.000 0.00 PINE RIVER FUND LTD 366,473.900 366,473.90 SRS PARTNERS USÉÉÉÉ 11,729,989.490 11,729,989.49 TRICADIA SELECTÉÉÉÉ 4,918,029.460 4,918,029.46 CASH & CASH EQUIVALENTS 901,268,217.160 887,047,810.08 BLACKROCK MONEY MARKET FD B 90.160 90.16 CANTOR REPO A TRI REPO 2.450% 07/01/2019 DD 06/28/19 691,600,000.000 691,600,000.00 CASH COLL WITH STATE STREET 60,000.000 60,000.00 CNH/USD SPOT OPTION 2019 CALL JUL 19 007.000 ED 071119 14,130,000.000 42,390.00 EB TEMP IVN FD VAR RT 12/31/49 FEE CL 12 182,143,127.000 182,143,127.00 FORD MTR CR CO DISC 11/25/2019 636,000.000 609,606.00 FORD MTR CR CO DISC 12/04/2019 2,762,000.000 2,685,469.58 SECURITIES LENDING POOL 0.000 0.00 U S TREASURY BILL 0.000% 07/02/2019 DD 05/07/19 6,422,000.000 6,408,684.73 U S TREASURY -

Sihvonenjaakko.Pdf

Jaakko Sihvonen TALOUDELLISEN VÄÄRINKÄYTÖSKOLMION JA TALOUDELLISTEN VÄÄRINKÄYTÖSTEN VÄLINEN YHTEYS Havainnot Yhdysvalloista ajanjaksolta 2006−2016 Johtamisen ja talouden tiedekunta Pro gradu -tutkielma Marraskuu 2020 TIIVISTELMÄ Jaakko Sihvonen: Taloudellisen väärinkäytöskolmion ja taloudellisten väärinkäytösten välinen yhteys Pro gradu -tutkielma Tampereen yliopisto Kauppatieteiden tutkinto-ohjelma, yrityksen laskentatoimi Marraskuu 2020 Globaalien markkinoiden kiihtyvä kasvu ja yhdysvaltalaisten julkisten osakeyhtiöiden hallintorakenteiden monimuotoisuus ovat tarjonneet mahdollisuuksia petolliselle liiketoiminnalle. Vaikka lainsäädäntöä on pyritty uudistamaan ja hallintorakenteita implementoimaan kohti läpinäkyvämpää toimintaa, taloudelliset väärinkäytökset ovat kasvaneet finanssikriisin aikana ja sen jälkeen uusiin mittakaavoihin. Tämän tutkimuksen tavoitteena on selvittää taloudellisen väärinkäytöskolmion elementtien yhteys taloudellisiin väärinkäytöksiin sekä päivittää aikaisemmin 2000- luvulla tehtyjä tutkimuksia. Tässä tutkimuksessa selvitetään, voidaanko Cresseyn 1950- luvulla luoman taloudellisen väärinkäytöskolmion avulla havaita ja ennustaa taloudellisia väärinkäytöksiä. Tutkimusasetelma luotiin siten, että Yhdysvaltojen arvopaperimarkkinoita valvovan elimen, Securities and Exchange Commissionin, verkkosivuilta etsittiin vuosina 2015−2019 julkaistut mediatiedotteet taloudellisista väärinkäytöksistä ja niitä tehneistä yhtiöistä. Havaituille väärinkäytösyhtiöille etsittiin satunaisesti vertailuyhtiö yhtiön kokoon perustuen. Tutkimus -

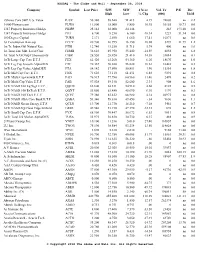

Ishares Core S&P U.S. Value 1-800-Flowers.Com 1347 Property

NASDAQ - The Globe and Mail - September 28, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield iShares Core S&P U.S. Value IUSV 56.380 58.640 51.413 4.19 74603 na 2.2 1-800-Flowers.com FLWS 11.800 15.000 8.850 10.95 36155 18.73 0.0 1347 Property Insurance Holdgs PIHPP 25.142 28.000 24.148 - 263 193.40 8.0 1347 Property Insurance Holdgs PIH 6.700 8.250 6.100 -18.14 1221 51.54 0.0 180 Degree Capital TURN 2.171 2.500 1.660 17.41 16071 na 0.0 1st Constitution Bancorp FCCY 20.700 26.995 16.150 10.08 3239 21.79 1.2 1st Tr. Indxx Gbl Natural Res. FTRI 12.740 13.250 11.715 3.74 400 na 3.6 1st Trust Em. Mkt. Local Curr. FEMB 36.610 45.950 35.440 -14.59 4858 na 6.8 1st Trust NASDAQ Cybersecurity CIBR 28.520 28.920 21.410 14.58 35014 na 0.1 1stTr Large Cap Core E.T.F. FEX 62.420 63.260 54.360 6.20 18670 na 1.0 1stTr Lrg Cap Growth AlphaDEX FTC 70.367 70.880 56.820 10.61 10422 na 0.3 1stTr Lrg Cap Value AlphaDEX FTA 54.142 57.690 50.851 1.90 15316 na 1.8 1stTr Mid Cap Core E.T.F. FNX 71.620 73.110 61.431 6.48 9091 na 0.8 1stTr Multi Cap Growth E.T.F. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) (X) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarter ended October 31, 1999 ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 000-23262 CMGI, INC. ------------------------------------------------------ (Exact name of registrant as specified in its charter) DELAWARE 04-2921333 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 100 BRICKSTONE SQUARE 01810 ANDOVER, MASSACHUSETTS (Zip Code) (Address of principal executive offices) (978) 684-3600 (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes X No --------- --------- Number of shares outstanding of the issuer's common stock, as of December 10, 1999 Common Stock, par value $0.01 per share 122,970,601 ---------------------------------------- ----------- Class Number of shares outstanding CMGI, INC. FORM 10-Q INDEX Page Number ----------- Part I. FINANCIAL INFORMATION Item 1. Consolidated Financial Statements Consolidated Balance Sheets October 31, 1999 and July 31, 1999 3 Consolidated Statements of Operations Three months ended October 31, 1999 and 1998 4 Consolidated Statements of Cash Flows Three months ended October 31, 1999 and 1998 5 Notes to Interim Consolidated Financial Statements 6-12 Item 2. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) (X) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarter ended October 31, 2000 ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 000-23262 CMGI, INC. ---------- (Exact name of registrant as specified in its charter) DELAWARE 04-2921333 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 100 Brickstone Square 01810 Andover, Massachusetts (Zip Code) (Address of principal executive offices) (978) 684-3600 (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No _____ ----- Number of shares outstanding of the issuer's common stock, as of December 11, 2000 Common Stock, par value $.01 per share 319,311,017 --------------------------------------- ----------- Class Number of shares outstanding CMGI, INC. FORM 10-Q INDEX Page Number ----------- Part I. FINANCIAL INFORMATION Item 1. Consolidated Financial Statements Consolidated Balance Sheets October 31, 2000 (unaudited) and July 31, 2000 3 Consolidated Statements of Operations Three months ended October 31, 2000 and 1999 (unaudited) 4 Consolidated Statements of Cash Flows Three months ended October 31, 2000 and 1999 (unaudited) 5 Notes to Interim Unaudited Consolidated Financial Statements 6-13 Item 2. -

Securities and Exchange Commission Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ------------- FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): September 23, 1999 CMGI, Inc. ------------------------------------------------ (Exact name of registrant as specified in charter) Delaware 000-22846 04-2921333 - --------------------------- ----------- ------------------ (State or other juris- (Commission (IRS Employer diction of incorporation) File Number) Identification No.) 100 Brickstone Square, Andover, MA 01810 - ---------------------------------- ------------ (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (978) 684-3600 N/A ------------------------------------------------------------ (Former name or former address, if changed since last report) Item 5. Other Events. ------------ AdKnowledge Inc. - ---------------- On September 23, 1999, CMGI, Inc. ("CMGI" or the "Company") entered into an Agreement and Plan of Merger and Contribution with Engage Technologies, Inc., a majority owned subsidiary of CMGI ("Engage"), a wholly owned subsidiary of CMGI and AdKnowledge Inc. ("AdKnowledge"), a provider of Web marketing management services focused on the needs of online marketers and agencies. Under the terms of the agreement, CMGI will initially acquire control of AdKnowledge through the issuance of approximately $170 million of CMGI common stock, followed by a contribution of AdKnowledge shares held by CMGI and AdKnowledge -

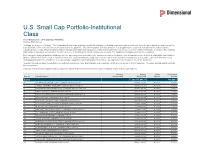

U.S. Small Cap Portfolio-Institutional Class As of October 31, 2018 (Updated Monthly) Source: State Street Holdings Are Subject to Change

U.S. Small Cap Portfolio-Institutional Class As of October 31, 2018 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

EGAN-JONES PROXY 2019 COVERAGE Ticker Company FCCY 1St Constitution Bancorp SRCE 1St Source Corporation XXII 22Nd Century Group, Inc

EGAN-JONES PROXY 2019 COVERAGE Ticker Company FCCY 1st Constitution Bancorp SRCE 1st Source Corporation XXII 22nd Century Group, Inc. TWOU 2U, Inc. DDD 3D Systems Corporation III 3i Group plc MMM 3M Company AOS A. O. Smith Corporation AHC A.H. Belo Corporation Class A AAON AAON, Inc. AAN Aaron's, Inc. ABB ABB Ltd. Sponsored ADR ABT Abbott Laboratories ABBV AbbVie, Inc. ABEO Abeona Therapeutics, Inc. ANF Abercrombie & Fitch Co. Class A ABMD ABIOMED, Inc. ABM ABM Industries Incorporated AXAS Abraxas Petroleum Corporation ACIA Acacia Communications, Inc. ACHC Acadia Healthcare Company, Inc. ACAD ACADIA Pharmaceuticals Inc. AKR Acadia Realty Trust AXDX Accelerate Diagnostics, Inc. XLRN Acceleron Pharma Inc ACN Accenture Plc Class A ACCO ACCO Brands Corporation ARAY Accuray Incorporated ACRX AcelRx Pharmaceuticals, Inc. ACER Acer Therapeutics Inc. ACHV Achieve Life Sciences Inc. ACHN Achillion Pharmaceuticals, Inc. ACIW ACI Worldwide, Inc. ACU Acme United Corporation ACNB ACNB Corporation ACOR Acorda Therapeutics, Inc. ACRGF ACREAGE HOLDINGS INC. ACSAF Actividades de Construccion y Servicios SA ATVI Activision Blizzard, Inc. ATU Actuant Corporation Class A AYI Acuity Brands, Inc. GOLF Acushnet Holdings Corp. ADMS Adamas Pharmaceuticals, Inc. ADUS Addus HomeCare Corporation IOTS Adesto Technologies Corporation ADDYY adidas AG Sponsored ADR ADNT Adient plc ADMA ADMA Biologics, Inc. ADML ADMIRAL GROUP PLC ADBE Adobe Inc. ADT ADT, Inc. ATGE Adtalem Global Education Inc. ADTN ADTRAN, Inc. ADRO Aduro BioTech, Inc. AAP Advance Auto Parts, Inc. ADSW Advanced Disposal Services Inc. ADES Advanced Emissions Solutions, Inc. AEIS Advanced Energy Industries, Inc. AMD Advanced Micro Devices, Inc. ASIX AdvanSix, Inc. AAVVF Advantage Oil & Gas Ltd. -

Pearl Harbor, December 7, 1941 3

DAYS OF DECEPTION: GROUND ZERO AND BEYOND WILLIAM THOMAS Days of Deception: Ground Zero and Beyond Copyright © 2006 All rights reserved. Printed in the United States of America. No part of this book, either in part or in whole, may be reproduced, transmitted or utilized in any form or by any means, electronic, photographic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the author, except for brief quotations embodied in literary articles and reviews. ISBN: 1-893157-18-0 13 digit: 978-1-893157-18-7 Cover Design by Michelle Easterly and William Thomas Cover photos: 1. WTC, September 11, 2001 Civil Engineering Magazine www.pubs.asce.org 2. USS Arizona, Pearl Harbor, December 7, 1941 www.history.navy.mil 3. Budapest Hero’s Square, Bela Szandelsky Published by: Bridger House Publishers P.O. Box 2208, Carson City, NV 89702, USA 1-800-729-4131 Printed in the United States of America 10 9 8 7 6 5 4 3 2 1 DEDICATION For the victims of September 11, 2001. Then and now. Days of Deception: Ground Zero and Beyond “The bigger the lie, therefore, the likelier it is to be believed.” — Adolf Hitler TABLE OF CONTENTS PART I Pearl Harbor Prelude.............................................................................1 Chapter 1: NORDO .........................................................................13 Chapter 2: We Have A Problem Here..............................................41 Chapter 3: “I See Buildings” ...........................................................63 -

As Filed with the Securities and Exchange Commission on December 6, 1999 Registration No

As filed with the Securities and Exchange Commission on December 6, 1999 Registration No. 333- - -------------------------------------------------------------------------------- - -------------------------------------------------------------------------------- SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 --------------- FORM S-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 --------------- CMGI, INC. (Exact name of registrant as specified in its charter) --------------- Delaware 7331 04-2921333 (State or other jurisdiction (Primary Standard Industrial (I.R.S. Employer of incorporation or organization) Classification Code Number) Identification Number) --------------- 100 Brickstone Square, Andover, Massachusetts 01810, (978) 684-3600 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) --------------- David S. Wetherell Chairman of the Board, President and Chief Executive Officer CMGI, Inc. 100 Brickstone Square Andover, Massachusetts 01810 (978) 684-3600 (Name, address, including zip code, and telephone number, including area code, of agent for service) --------------- Copies to: Mark G. Borden, Esq. Gordon K. Davidson, Esq. Hale and Dorr LLP Mark A. Leahy, Esq. 60 State Street Fenwick & West LLP Boston, Massachusetts 02109 Two Palo Alto Square Telephone: (617) 526-6000 Palo Alto, California 94306 Telecopy: (617) 526-5000 Telephone: (650) 494-0600 Telecopy: (650) 494-1417 --------------- Approximate date of commencement of proposed sale to the public: -

DFA INVESTMENT DIMENSIONS GROUP INC Form NPORT-EX Filed

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-EX Filing Date: 2019-09-30 | Period of Report: 2019-07-31 SEC Accession No. 0001752724-19-129464 (HTML Version on secdatabase.com) FILER DFA INVESTMENT DIMENSIONS GROUP INC Mailing Address Business Address 6300 BEE CAVE ROAD 6300 BEE CAVE ROAD CIK:355437| IRS No.: 363129984 | State of Incorp.:MD | Fiscal Year End: 1031 BUILDING ONE BUILDING ONE Type: NPORT-EX | Act: 40 | File No.: 811-03258 | Film No.: 191125085 AUSTIN TX 78746 AUSTIN TX 78746 (512) 306-7400 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document DFA INVESTMENT DIMENSIONS GROUP INC. FORM N-Q REPORT July 31, 2019 (UNAUDITED) Table of Contents DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES SCHEDULES OF INVESTMENTS Enhanced U.S. Large Company Portfolio U.S. Large Cap Value Portfolio U.S. Targeted Value Portfolio U.S. Small Cap Value Portfolio U.S. Core Equity 1 Portfolio U.S. Core Equity 2 Portfolio U.S. Vector Equity Portfolio U.S. Small Cap Portfolio U.S. Micro Cap Portfolio DFA Real Estate Securities Portfolio Large Cap International Portfolio International Core Equity Portfolio International Small Company Portfolio Global Small Company Portfolio Japanese Small Company Portfolio Asia Pacific Small Company Portfolio United Kingdom Small Company Portfolio Continental Small Company Portfolio DFA International Real Estate Securities Portfolio DFA Global Real Estate Securities Portfolio DFA International Small Cap Value Portfolio International Vector Equity Portfolio World ex U.S. Value Portfolio World ex U.S. Targeted Value Portfolio World ex U.S. Core Equity Portfolio NOTES TO FINANCIAL STATEMENTS Organization Security Valuation Financial Instruments Federal Tax Cost Recently Issued Accounting Standards Other Subsequent Event Evaluations Table of Contents TABLE OF CONTENTS CONTINUED THE DFA INVESTMENT TRUST COMPANY SCHEDULES OF INVESTMENTS The U.S.